Emergency Fund Planning Tips: Let’s face it, life throws curveballs. One minute you’re cruising along, the next you’re staring down a surprise medical bill or a leaky roof that looks suspiciously like Niagara Falls. This isn’t a doom-and-gloom prophecy, friends, but a gentle nudge towards financial preparedness. Building an emergency fund isn’t just about avoiding debt; it’s about safeguarding your peace of mind, ensuring you can weather life’s unexpected storms without losing your cool (or your savings).

This guide will walk you through the process of creating a robust emergency fund, from determining the ideal size based on your unique financial situation to implementing practical savings strategies. We’ll explore various saving vehicles, budgeting techniques, and even the psychological benefits of watching your emergency fund grow. Prepare to be empowered, financially speaking, of course!

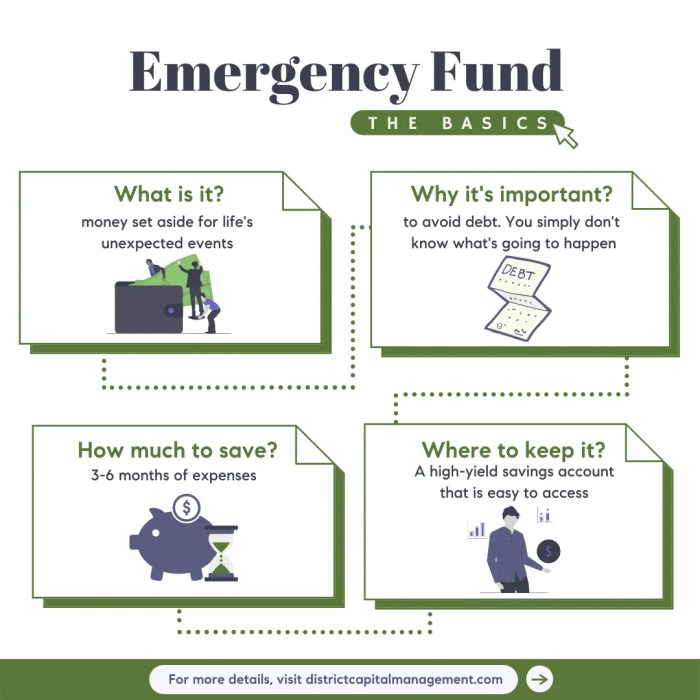

Defining Your Emergency Fund Needs

So, you want to build an emergency fund? Excellent! Think of it as your financial parachute – you hope you never need it, but when you do, you’ll be incredibly grateful it’s there. Let’s dive into figuring out just how big that parachute needs to be.

Determining the ideal size of your emergency fund is a bit like Goldilocks finding her perfect porridge: not too small, not too big, but just right. It hinges on two key factors: your monthly expenses and the potential for unexpected calamities (because life, bless its chaotic heart, loves to throw curveballs).

Emergency Fund Size Calculation, Emergency Fund Planning Tips

To determine the ideal size, we need to consider your monthly expenses. Let’s say your monthly budget looks something like this: rent ($1500), groceries ($500), utilities ($200), transportation ($300), and miscellaneous spending ($500). That totals $3000 per month. Now, consider potential unexpected costs – a sudden car repair, a medical bill, or a leaky roof. These can range from a few hundred to several thousand dollars. A reasonable emergency fund would cover at least 3-6 months of expenses. For our example, 3 months would be $9000 ($3000 x 3), and 6 months would be a more robust $18,000. The more unpredictable your income or expenses, the more months you should aim for.

Short-Term versus Long-Term Emergency Funds

Think of a short-term emergency fund as your “quick-draw” money – readily accessible cash for smaller, more immediate emergencies like a flat tire or a surprise vet bill for your beloved pet hamster, Mr. Nibbles. This fund typically covers 1-3 months of expenses. A long-term emergency fund, on the other hand, is your “big-gun” reserve, designed to handle more significant events like job loss or a major home repair. This fund aims for 3-6 months or even more, depending on your risk tolerance and financial situation. It’s your safety net for those truly unexpected life events.

Emergency Fund Sizes Based on Risk Tolerance

The perfect emergency fund size is subjective and depends on your risk tolerance. Someone with a stable job and low debt might feel comfortable with a smaller fund, while someone with a less predictable income might prefer a larger cushion.

| Risk Level | Fund Size (months of expenses) | Advantages | Disadvantages |

|---|---|---|---|

| Low | 1-3 | Easier to build, provides peace of mind for smaller emergencies. | Less protection against major unforeseen events. |

| Medium | 3-6 | Good balance between security and accessibility; covers a wider range of emergencies. | Requires more significant saving effort. |

| High | 6+ | Excellent protection against job loss or major unexpected events; provides significant financial security. | Requires substantial savings; may tie up a significant portion of available funds. |

Identifying Income Sources and Savings Strategies

Building an emergency fund is like constructing a sturdy fortress against life’s unexpected curveballs – you need a solid plan and, let’s be honest, a bit of financial wizardry. This section will delve into the exciting world of boosting your income and strategically stashing your hard-earned cash, turning your emergency fund from a distant dream into a gleaming reality. Forget ramen noodles and instant coffee – let’s build wealth!

Increasing your income and implementing effective savings strategies are two sides of the same coin, both crucial for building a robust emergency fund. The faster you can increase your income and the more efficiently you save, the quicker you’ll reach your financial safety net. Think of it as a race against unforeseen circumstances, and you want to be well-prepared to win!

Methods for Increasing Income

Let’s face it, wishing for a bigger paycheck won’t magically make it happen. However, actively seeking opportunities to boost your income can significantly accelerate your emergency fund growth. Consider these avenues, each offering a unique path to financial freedom (or at least, a more comfortable safety net).

- Freelancing or Gig Work: Embrace the gig economy! Platforms like Upwork and Fiverr offer countless opportunities to monetize your skills, whether you’re a writer, designer, programmer, or virtual assistant. Think of it as your own personal money-making empire, one client at a time.

- Part-Time Job: A classic but effective method. Even a few extra hours a week at a part-time job can make a surprising difference in your savings. Picture yourself sipping margaritas on a beach knowing your emergency fund is growing steadily – that’s the power of a part-time job.

- Selling Unused Items: Declutter your life and your bank account simultaneously! Selling gently used clothing, electronics, or furniture on platforms like eBay or Facebook Marketplace can generate unexpected cash flow. Think of it as a treasure hunt, but instead of gold, you find money.

- Investing in Yourself: Upskilling or acquiring new skills can lead to higher-paying job opportunities. Online courses, workshops, or even a degree can be a worthwhile investment in your future financial security. This is not just about money; it’s about investing in your potential.

Savings Strategies: High-Yield Savings Accounts, Money Market Accounts, and Certificates of Deposit (CDs)

Once you’ve got the extra cash flowing in, you need a strategic plan to keep it safe and growing. Different savings vehicles offer varying levels of accessibility and returns. Choosing the right one depends on your financial goals and risk tolerance. Let’s break down the most popular options.

| Account Type | Pros | Cons |

|---|---|---|

| High-Yield Savings Account | High interest rates, easy access to funds, FDIC insured | Interest rates may fluctuate |

| Money Market Account | Higher interest rates than savings accounts, check-writing capabilities | May require minimum balance, interest rates can be lower than CDs |

| Certificate of Deposit (CD) | Higher interest rates than savings accounts and MMAs, FDIC insured | Limited access to funds (penalties for early withdrawal), interest rates fixed for the term |

Practical Budgeting Techniques

Budgeting isn’t just about restricting spending; it’s about strategically allocating your resources to achieve your financial goals. Effective budgeting is the cornerstone of successful emergency fund building. Here are some practical techniques to maximize your savings.

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This simple framework provides a clear guideline for managing your finances.

- Zero-Based Budgeting: Assign every dollar a purpose, ensuring all income is accounted for. This method promotes mindful spending and helps identify areas for potential savings.

- Envelope System: Allocate cash for specific categories (groceries, entertainment, etc.) into separate envelopes. Once the cash is gone, you’re done spending in that category for the period. This method helps visualize spending habits.

- Track Your Expenses: Use budgeting apps or spreadsheets to monitor your spending habits. Identifying spending patterns helps you make informed decisions about where to cut back.

Building a Realistic Savings Plan

So, you’ve figured out how much emergency cash you need – congratulations! That’s the hardest part. Now comes the slightly less daunting, but still crucial, task of actually *building* that emergency fund. Think of it as a financial Everest – you’ll need a plan, some sturdy gear (discipline!), and maybe a Sherpa (a budgeting app).

Building an emergency fund from scratch isn’t about overnight riches; it’s a marathon, not a sprint. A realistic plan acknowledges that life throws curveballs (like unexpectedly expensive car repairs or a rogue squirrel short-circuiting your electrical system), so flexibility is key. We’ll Artikel a structured approach to make this less of a financial climb and more of a leisurely stroll (with occasional uphill battles, of course).

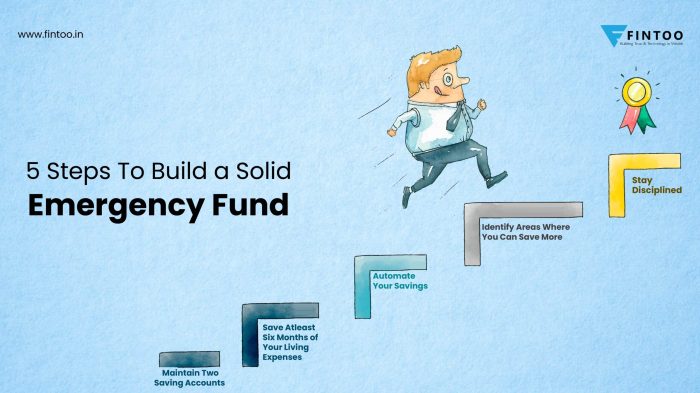

Step-by-Step Guide to Building an Emergency Fund

This step-by-step plan provides a realistic timeline and milestones for building your emergency fund. Remember, these are just guidelines; adjust them to fit your unique financial circumstances. Think of it as a personalized financial fitness program.

- Assess your current financial situation: Before you start climbing, you need to know your starting point. List all your income sources and expenses. This isn’t a beauty contest; honesty is the best policy (and the most effective!).

- Set a savings goal: Based on your needs (remember those calculations from earlier?), determine a realistic monthly savings amount. Start small if necessary – even $25 a month is a start. The key is consistency, not immediate wealth.

- Create a timeline: Divide your total emergency fund goal by your monthly savings amount to determine the number of months it will take to reach your target. Celebrate small victories along the way! Reaching the halfway point deserves a small reward (within budget, of course!).

- Identify and eliminate unnecessary expenses: Look for areas where you can cut back. Do you really need that daily latte? Could you cook at home more often? Every little bit helps, and these small savings can significantly impact your progress.

- Review and adjust your plan regularly: Life changes, and your savings plan should too. Review your progress monthly and make adjustments as needed. Perhaps your income increased, allowing for higher monthly savings, or maybe an unexpected expense requires a temporary pause. Flexibility is your friend.

Automating Savings

Automating your savings is like having a tiny, diligent financial robot working for you 24/7. It eliminates the temptation to spend money you’ve earmarked for emergencies. Think of it as pre-emptive strike against impulse purchases!

Set up automatic transfers from your checking account to your savings account each month. Most banks offer this service, making it incredibly easy to implement. Even a small automated transfer will add up over time, and you won’t even miss the money. It’s like magic, but with less glitter and more compound interest.

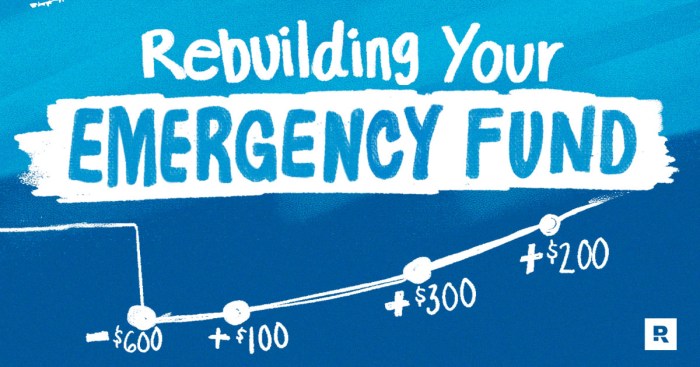

Tracking Progress

Tracking your progress is crucial to staying motivated. A simple spreadsheet or budgeting app can help visualize your progress and keep you on track. Seeing your fund grow is incredibly satisfying and reinforces your commitment.

Here’s a sample spreadsheet layout:

| Month | Starting Balance | Amount Saved | Ending Balance | Notes |

|---|---|---|---|---|

| January | $0 | $50 | $50 | Started my emergency fund! |

| February | $50 | $75 | $125 | Got a small bonus! |

| March | $125 | $50 | $175 |

Remember, consistency is key. Even small, regular contributions will eventually lead to a substantial emergency fund. So, start saving today, and watch your financial security grow!

Managing Unexpected Expenses

Ah, unexpected expenses – the uninvited guests at the party of life. They crash the festivities, drain the punch bowl (your emergency fund), and leave you wondering how you’ll pay for the cleanup. But fear not, dear saver! With a little planning and a dash of strategic thinking, you can navigate these financial curveballs with grace (and maybe even a chuckle).

The key is to understand that an emergency fund isn’t just a rainy-day fund; it’s a “tornado-hurricane-and-a-swarm-of-locusts” fund. It needs to be robust enough to handle the truly unexpected, without leaving you completely destitute. This means considering not just the probability of an event, but also its potential financial impact.

Medical Expense Management

Unexpected medical bills can be a financial knockout punch. Even with health insurance, deductibles, co-pays, and unexpected procedures can quickly deplete savings. A strong strategy involves understanding your health insurance policy inside and out. Know your coverage limits, deductibles, and out-of-pocket maximums. Consider a Health Savings Account (HSA) if eligible, as it offers tax advantages for medical savings. Furthermore, explore options like payment plans offered by hospitals or medical providers to spread out large bills over time. For example, a family facing a $10,000 unexpected medical bill might negotiate a payment plan of $500 a month for 20 months, significantly easing the burden on their emergency fund.

Job Loss Contingency Planning

Losing your job is a major life event, and it’s crucial to have a plan in place. This goes beyond simply having an emergency fund. Before the job loss happens (because, let’s face it, it’s easier to plan then!), update your resume, network with colleagues, and explore potential alternative income streams. Having three to six months of living expenses in your emergency fund is generally recommended, but having a plan beyond that is crucial. This could involve aggressively searching for a new position, tapping into professional networks, or even exploring temporary contract work. For instance, a software engineer laid off could leverage freelance platforms to maintain income while actively seeking a full-time role.

Home Repair Strategies

Home repairs can sneak up on you like a ninja wielding a leaky faucet. Regular home maintenance is key to preventing costly repairs, but sometimes, things just happen. A proactive approach includes setting aside a portion of your monthly budget specifically for home repairs. This creates a smaller, dedicated emergency fund for minor issues, preventing the need to dip into your larger emergency fund for every small hiccup. For example, a homeowner could allocate $100 a month for home maintenance, allowing them to address minor repairs promptly and prevent them from escalating into major, expensive problems. For larger repairs, exploring options like home equity loans or lines of credit can provide financial flexibility, but only after exhausting other options and careful consideration of the interest implications.

Insurance Options Comparison

Insurance acts as a financial safety net, mitigating the impact of unexpected events. Different types of insurance address different risks. Health insurance, as discussed, covers medical expenses. Homeowners or renters insurance protects against property damage or theft. Auto insurance covers accidents and vehicle damage. Unemployment insurance provides temporary income support during job loss (though the amount and duration vary widely by location). It’s important to compare policies and coverage levels to find the best fit for your needs and budget. Consider the deductible and premium amounts, and carefully read the fine print to understand what is and isn’t covered. For example, comparing a high-deductible health plan with a lower premium to a low-deductible plan with a higher premium will allow you to choose the option that best aligns with your risk tolerance and financial capabilities.

Contingency Plan Examples

Creating a detailed contingency plan for various emergency scenarios is crucial. This isn’t about predicting the future (unless you have a crystal ball, in which case, please share!), but rather about being prepared for a range of possibilities. For a job loss, the plan could include a list of potential employers, networking contacts, and alternative income sources. For a medical emergency, the plan could include information about your health insurance, preferred hospitals, and emergency contacts. For home repairs, the plan could include a list of trusted contractors, emergency repair services, and a pre-allocated fund for minor repairs. The key is to anticipate potential problems and develop a step-by-step plan to address them effectively. For example, a detailed plan for a car accident might include steps such as contacting emergency services, notifying your insurance company, and documenting the accident scene.

Maintaining and Protecting Your Emergency Fund

So, you’ve bravely built your emergency fund – congratulations, you magnificent money manager! But the journey doesn’t end with a triumphant “I’m financially secure!” Think of your emergency fund like a well-trained guard dog: it needs regular feeding (contributions), grooming (reviewing), and occasional, very serious, training (adjustments). Neglecting it could lead to some very unpleasant surprises.

Regularly reviewing and adjusting your emergency fund is crucial for maintaining its effectiveness. Life, as we all know, is a chaotic dance of unexpected events. A sudden job loss, a medical emergency, or even a burst pipe can throw your carefully constructed financial plans into a tizzy. Failing to adapt your emergency fund to your evolving needs leaves you vulnerable to these unforeseen circumstances. Think of it as regularly updating your software – you wouldn’t run on Windows 95, would you?

Emergency Fund Review and Adjustment Strategies

Regularly assessing your emergency fund involves more than just checking the balance. Consider your current expenses, income stability, and outstanding debts. Perhaps you’ve taken on a new mortgage, or your car needs replacing soon. These are all factors that could significantly impact the size of your emergency fund. A good rule of thumb is to review it at least annually, or even quarterly if your financial situation is particularly volatile. Imagine your emergency fund as a living, breathing entity that needs constant care and attention. It adapts to you, not the other way around.

Protecting Your Emergency Fund from Impulsive Spending

Let’s be honest, sometimes we all succumb to the siren song of impulse purchases. That sparkly new gadget, that weekend getaway… they look so tempting! However, dipping into your emergency fund for non-emergencies is like using your fire extinguisher to put out a candle – highly inefficient and potentially disastrous. One effective strategy is to separate your emergency fund from your everyday accounts. This creates a psychological barrier, making it harder to casually access those funds. Consider a high-yield savings account, a separate checking account, or even a certificate of deposit. The extra steps involved in accessing the money can provide the time needed to reconsider that impulse buy. Think of it as a “cooling-off” period for your spending urges.

Maintaining Financial Discipline and Avoiding Non-Emergency Withdrawals

Maintaining financial discipline requires constant vigilance and a dash of self-control (we all know how hard that can be!). One powerful technique is to visualize the consequences of depleting your emergency fund. Imagine facing a genuine emergency without the financial safety net – a truly unpleasant thought! This visualization can serve as a powerful deterrent against unnecessary withdrawals. Another helpful strategy is to set clear financial goals beyond the emergency fund, giving you something positive to save for. This shifts the focus from simply avoiding spending to actively building towards a brighter financial future. This could be anything from a down payment on a house to a dream vacation – anything that motivates you.

Visualizing Emergency Fund Growth

Charting your emergency fund’s journey isn’t just about tracking numbers; it’s about witnessing your financial resilience blossom. Think of it as a visual testament to your dedication, a graph that screams, “I’m financially prepared, and I’m not afraid to show it!” This visualization can be a powerful motivator, transforming the often-dreaded task of saving into a satisfying game of progress.

Imagine a graph, a vibrant depiction of your financial fortitude. The horizontal axis represents time, stretching from your savings’ humble beginnings to your ambitious future. Each month, a new data point appears, showcasing the triumphant rise of your emergency fund. The vertical axis, naturally, represents the dollar amount diligently saved. The line connecting these data points isn’t a perfectly smooth ascent; it’s a rollercoaster reflecting life’s unpredictable nature. Steep inclines represent months of diligent saving, perhaps fueled by a hefty bonus or a period of reduced spending. Conversely, gentle dips illustrate unexpected expenses—a surprise car repair, a slightly more extravagant holiday—perfectly normal setbacks in the grand scheme of things. Key milestones, like reaching the first $1,000, $5,000, and ultimately your target emergency fund amount, are clearly marked with celebratory flags (in your mind, of course—we’re focusing on the visualization here!). These flags are not just numerical achievements; they represent tangible progress and a significant boost to your financial confidence.

The Psychological Impact of Visualizing Progress

Visualizing your emergency fund’s growth offers significant psychological advantages, transforming a potentially tedious task into a rewarding experience. Seeing your progress charted before your eyes fosters a sense of accomplishment, reinforcing positive financial habits. This visual representation provides tangible proof of your efforts, counteracting the feeling that your savings are insignificant or growing too slowly. The graph becomes a powerful tool, motivating you to continue saving and celebrating each milestone reached. It’s a constant reminder of your commitment and a testament to your growing financial security. Consider this: A study by researchers at the University of Pennsylvania showed that individuals who tracked their progress towards a goal were significantly more likely to achieve it. This is because visualizing progress triggers the release of dopamine, a neurotransmitter associated with reward and motivation, making the entire process more engaging and less daunting. The graph, therefore, serves as more than just a record of your savings; it’s a potent psychological tool designed to fuel your financial success.

End of Discussion

So, there you have it – a comprehensive guide to building and maintaining your emergency fund. Remember, the journey may have its bumps, but the destination – financial security and a significantly reduced stress level – is well worth the effort. Think of your emergency fund as your financial superhero cape: it might not be visible all the time, but it’s there when you need it most. Now go forth and conquer those unexpected expenses! (But hopefully, not too many of them!)

Clarifying Questions: Emergency Fund Planning Tips

What if I already have some savings? Do I start from scratch?

Absolutely not! Use your existing savings as a great head start. Simply assess how much you already have, and adjust your target savings goal accordingly.

How often should I review my emergency fund?

At least annually, or whenever significant life changes occur (new job, marriage, children, etc.). Your needs will evolve, so your fund should too.

Can I use my emergency fund for a “slightly” unexpected expense?

Resist the urge! That’s the very definition of an *emergency* fund. If it’s not truly an emergency, find alternative solutions before dipping into your safety net.

What if I lose my job and my emergency fund isn’t enough?

Don’t panic! File for unemployment benefits immediately, and explore other options like temporary work, freelancing, or negotiating with creditors. This is where having a detailed contingency plan comes in handy.