ESG investing, a rapidly evolving field, integrates environmental, social, and governance (ESG) factors into investment decisions. This approach moves beyond traditional financial metrics, considering a company’s impact on the planet and society alongside its profitability. This guide delves into the core principles, frameworks, data considerations, and strategic implications of ESG investing, offering a comprehensive understanding of this increasingly important investment philosophy.

We will explore various ESG assessment frameworks, examine the challenges of data standardization and reliability, and discuss how ESG factors can be integrated into diverse investment strategies. Furthermore, we will analyze the relationship between ESG performance and financial returns, considering both the opportunities and challenges presented by this evolving landscape.

Defining ESG Investing

ESG investing, also known as sustainable investing, considers environmental, social, and governance (ESG) factors alongside financial factors when making investment decisions. It’s a strategy that aims to generate positive social and environmental impact while also achieving financial returns. This approach recognizes that a company’s long-term financial performance is intertwined with its sustainability practices and ethical conduct.

Core Principles of ESG Investing

The core principles of ESG investing center around the belief that companies that manage their ESG risks and opportunities effectively are better positioned for long-term success. This approach moves beyond traditional financial analysis to consider the broader impact of a company’s operations on society and the environment. Investors using this framework aim to identify companies that are not only financially sound but also contribute positively to the world. This involves evaluating a company’s commitment to sustainability, its treatment of employees and stakeholders, and its overall governance structure.

The Three Pillars of ESG

The three pillars—Environmental, Social, and Governance—are interconnected and influence each other. A strong performance in one area can positively impact the others, while weaknesses in one area can negatively affect the overall ESG profile of a company.

Environmental

This pillar focuses on a company’s impact on the environment. Key considerations include carbon emissions, waste management, resource consumption, and pollution. Companies demonstrating strong environmental performance often invest in renewable energy, reduce their carbon footprint, and implement sustainable practices throughout their supply chain. For example, Patagonia, known for its commitment to sustainable materials and environmental activism, exemplifies strong environmental performance. Similarly, Tesla’s focus on electric vehicles significantly contributes to reducing carbon emissions in the transportation sector.

Social

The social pillar assesses a company’s relationships with its employees, customers, suppliers, and the wider community. This includes factors like labor practices, human rights, product safety, community engagement, and diversity and inclusion. Unilever, with its focus on sustainable living and its commitment to fair labor practices across its supply chain, is a prime example of a company with strong social performance. Similarly, companies that prioritize employee well-being, offer competitive wages, and foster a diverse and inclusive workplace often demonstrate strong social performance.

Governance

The governance pillar examines a company’s leadership, executive pay, audits, internal controls, and shareholder rights. Good governance ensures transparency, accountability, and ethical conduct within the organization. Companies with strong governance structures often have independent boards of directors, robust risk management systems, and clear ethical guidelines. Microsoft, with its commitment to transparency and ethical business practices, represents a company with strong governance. Similarly, companies with diverse and inclusive boards demonstrate a commitment to good governance.

Comparison of Traditional and ESG Investing

The following table compares traditional investing approaches with ESG investing approaches:

| Asset Class | Investment Strategy | Risk Profile | Return Expectations |

|---|---|---|---|

| Equities, Bonds, Real Estate | Maximizing financial returns based on traditional financial metrics | Potentially higher risk, depending on asset allocation | Market-rate returns, potentially higher with active management |

| Equities, Bonds, Real Estate, Impact Investments | Maximizing financial returns while considering ESG factors; may include impact investing | Similar to traditional investing, potentially higher or lower depending on specific ESG criteria | Market-rate returns, potentially aligned with or exceeding traditional investments depending on market conditions and strategy |

ESG Investment Frameworks and Standards

A robust ESG investment strategy relies heavily on consistent and reliable frameworks for assessing and comparing the environmental, social, and governance performance of companies. These frameworks provide a standardized approach, enabling investors to make informed decisions and fostering greater transparency and accountability within the market. However, the landscape of ESG frameworks is complex, with various methodologies and potential limitations.

Several prominent frameworks and standards guide ESG assessments, each with its strengths and weaknesses. Understanding these differences is crucial for effective ESG investing.

ESG Reporting Frameworks: GRI, SASB, and TCFD

The Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD) represent key frameworks for ESG reporting. GRI offers a comprehensive, widely adopted standard covering a broad range of ESG issues. SASB, conversely, focuses on material ESG factors specific to different industries, aiming for greater relevance and comparability within sectors. TCFD, established by the Financial Stability Board, concentrates specifically on climate-related risks and opportunities, urging companies to disclose their climate-related strategies and financial implications. While each framework offers valuable insights, their differing scopes and methodologies can lead to inconsistencies in ESG ratings across companies.

Methodologies of ESG Rating Agencies

Numerous ESG rating agencies utilize varied methodologies to assess companies’ ESG performance. These agencies collect data from multiple sources, including company disclosures, news articles, and stakeholder feedback. However, the weighting assigned to different ESG factors, the data sources used, and the analytical techniques employed can significantly influence the final ratings. Some agencies emphasize quantitative data, while others incorporate qualitative assessments. This lack of standardization can lead to discrepancies in ratings from different agencies for the same company, creating challenges for investors trying to compare and contrast performance. For instance, one agency might prioritize carbon emissions reduction, while another might place greater weight on labor practices.

Limitations and Challenges of Current ESG Frameworks

Despite the growth and standardization efforts, current ESG frameworks face several limitations. Data availability and quality remain significant concerns, with inconsistencies in reporting practices across companies and industries. The subjectivity inherent in assessing certain ESG factors, such as corporate governance or social impact, can also lead to inconsistencies in ratings. Furthermore, the lack of universally accepted standards and the proliferation of different rating methodologies can create “greenwashing” concerns, where companies may exaggerate their ESG performance to attract investors. Finally, the lack of consistent global standards makes cross-border comparisons difficult.

Hypothetical ESG Rating System for the Renewable Energy Sector

This hypothetical system focuses on the renewable energy sector, considering its unique ESG challenges and opportunities. The rating will be based on a weighted average of three key areas: Environmental (50%), Social (30%), and Governance (20%).

| Category | Criteria | Weighting |

|---|---|---|

| Environmental | Greenhouse gas emissions reduction targets and performance; Renewable energy source diversification; Water usage efficiency; Waste management practices; Land use impact | 50% |

| Social | Employee safety and well-being; Community engagement and relations; Supply chain sustainability; Commitment to diversity and inclusion; Human rights compliance | 30% |

| Governance | Board diversity and independence; Transparency and disclosure practices; Anti-corruption measures; Stakeholder engagement; Long-term strategic planning | 20% |

The weighting reflects the sector’s primary focus on environmental sustainability, while also recognizing the importance of social and governance aspects. Specific metrics and targets would be defined for each criterion, enabling quantitative assessment.

ESG Data and Reporting

The reliability and transparency of ESG data are paramount to the success of ESG investing. Without accurate and consistently reported information, investors lack the crucial insights needed to make informed decisions and hold companies accountable for their ESG performance. The quality of ESG data directly impacts the effectiveness of ESG integration within investment strategies and the overall integrity of the ESG market.

The importance of robust ESG data reporting cannot be overstated. Inaccurate or incomplete data can lead to misallocation of capital, hindering the progress towards sustainable development goals. Furthermore, a lack of transparency erodes investor confidence and can contribute to “greenwashing,” where companies exaggerate their ESG credentials without sufficient evidence.

Best Practices in ESG Data Collection and Verification

Effective ESG data collection and verification require a multi-faceted approach. This includes employing rigorous methodologies, utilizing diverse data sources, and implementing robust verification processes. For example, companies might use a combination of internal audits, third-party assessments, and independent verification to ensure the accuracy and reliability of their reported data. Best practices also involve clearly defining the scope of ESG reporting, aligning with established standards and frameworks, and using standardized metrics for consistent measurement across reporting periods. Regular updates and revisions to data collection methodologies are also critical to adapt to evolving ESG concerns and standards.

Challenges Related to Data Standardization and Comparability

One of the major challenges facing the ESG investing landscape is the lack of standardized data and reporting methodologies across companies. Different companies may use different metrics, reporting frameworks, and data collection methods, making direct comparisons difficult and potentially misleading. This inconsistency hinders the ability to benchmark performance, assess materiality, and identify industry best practices. Furthermore, the voluntary nature of many ESG disclosures means that data availability and quality can vary significantly across companies and sectors. Addressing these inconsistencies requires a collaborative effort from companies, investors, standard-setting bodies, and regulators to promote the adoption of common standards and methodologies.

Potential Data Sources for ESG Information

Reliable ESG data is drawn from a variety of sources, each offering a unique perspective. A comprehensive approach necessitates integrating information from multiple sources to gain a holistic view of a company’s ESG performance.

- Financial Data: Annual reports, financial statements, sustainability reports, SEC filings (e.g., 10-K forms), and company websites. These sources provide financial performance data that can be correlated with ESG performance.

- Environmental Data: Environmental, Social, and Governance (ESG) rating agencies (e.g., MSCI, Sustainalytics, Refinitiv), databases such as CDP (formerly the Carbon Disclosure Project), government environmental agencies (e.g., EPA in the US), and industry-specific environmental data providers. These provide data on greenhouse gas emissions, water usage, waste generation, and other environmental impacts.

- Social Data: Surveys, employee feedback mechanisms, social media analytics, news articles, and reports from human rights organizations. This data informs assessments of labor practices, human rights, community relations, and product safety.

- Governance Data: Company charters, board composition information, executive compensation data, and proxy statements. These provide insights into corporate governance structures, risk management practices, and ethical conduct.

ESG Integration in Investment Strategies

Integrating Environmental, Social, and Governance (ESG) factors into investment strategies is no longer a niche practice; it’s becoming a mainstream approach for many investors seeking to balance financial returns with positive societal impact. This integration can significantly influence portfolio construction, risk management, and overall investment performance. Different investment approaches utilize ESG considerations in unique ways, leading to a diverse range of strategies.

ESG factors can be effectively incorporated across various investment strategies, each offering a unique approach to integrating ESG considerations into the investment process. This integration is not about sacrificing financial returns for social good; rather, it’s about identifying opportunities and mitigating risks associated with ESG performance. A robust ESG integration process can lead to more resilient and potentially more profitable portfolios.

ESG Integration in Active Investment Strategies

Active investment strategies, characterized by manager discretion in security selection, offer significant opportunities for ESG integration. Fund managers can actively research companies, evaluate their ESG performance, and incorporate this assessment into their buy/sell decisions. This allows for a deeper dive into ESG issues relevant to specific companies and sectors, leading to more targeted investment choices. For instance, an active manager might favor companies with strong environmental sustainability programs, demonstrating a commitment to reducing their carbon footprint and improving resource efficiency. This approach goes beyond simply screening out companies with poor ESG ratings; it actively seeks out companies with strong ESG profiles and positive trajectories.

ESG Integration in Passive Investment Strategies

While traditionally viewed as less flexible, passive strategies, such as index funds or exchange-traded funds (ETFs), are increasingly incorporating ESG factors. This can be achieved through the creation of ESG-focused indices, which weight companies based on their ESG performance. Investors can then choose to invest in passively managed funds tracking these indices, effectively gaining ESG exposure without requiring active management. For example, an ETF tracking an index that excludes companies involved in fossil fuels provides passive exposure to a portfolio with a lower carbon footprint. Furthermore, some passive managers are integrating ESG data into their existing index tracking methodologies, leading to improved ESG performance within traditional index funds.

ESG Integration in Thematic Investing

Thematic investing, focusing on specific trends or sectors, provides a fertile ground for ESG integration. Themes like clean energy, sustainable agriculture, or responsible water management inherently incorporate ESG considerations. Investors can target companies actively contributing to these themes, aligning their investments with their values while potentially benefiting from the growth potential of these sectors. For example, an investor focused on the renewable energy theme might invest in companies developing solar panels, wind turbines, or other clean energy technologies. This approach directly supports the transition to a more sustainable economy while offering potentially strong financial returns.

ESG Analysis and Portfolio Construction

ESG analysis informs portfolio construction by allowing investors to identify companies with strong ESG profiles and those with material ESG risks. This analysis can be used to create portfolios that are both financially sound and aligned with investors’ ESG preferences. For example, an investor might choose to overweight companies with strong governance scores, reducing exposure to corporate governance risks such as accounting scandals or executive misconduct. Conversely, companies with poor environmental performance might be underweighted or excluded entirely to mitigate environmental risks such as climate change or pollution.

ESG Analysis and Risk Management

ESG analysis plays a crucial role in risk management by identifying and assessing ESG-related risks that could negatively impact investment returns. For example, a company facing significant reputational damage due to a social controversy might experience a decline in its share price. By incorporating ESG analysis into their risk management framework, investors can better anticipate and manage these risks. This might involve adjusting portfolio weights, diversifying investments, or actively engaging with companies to mitigate identified risks.

Hypothetical Case Study: Integrating ESG into a Retirement Portfolio

Consider a hypothetical investor, Sarah, nearing retirement, aiming for a balanced portfolio. Sarah incorporates ESG factors by allocating 30% to a low-carbon equity ETF, 20% to a global bond fund with strong ESG ratings, and 15% to a renewable energy thematic fund. The remaining 35% is allocated to a diversified core equity fund, but Sarah actively screens out companies with poor ESG scores from this portion of her portfolio. By doing this, Sarah creates a portfolio that balances her financial goals with her desire to support sustainable and responsible businesses, thereby mitigating potential ESG-related risks. This approach allows her to achieve both financial security and a positive social impact.

Materiality and Impact Measurement

Understanding material ESG factors and accurately measuring their impact is crucial for effective ESG investing. Materiality refers to the significance of an ESG issue to a company’s financial performance, reputation, and long-term sustainability. Impact measurement, on the other hand, quantifies the positive or negative consequences of investments on various stakeholders and the environment. A robust framework integrating both concepts is essential for responsible and impactful ESG investing.

Defining Materiality in ESG Investing

Materiality in the context of ESG investing signifies the relevance of environmental, social, and governance factors to a company’s business model, financial performance, and long-term value creation. It’s not simply about identifying all ESG issues a company faces; rather, it’s about pinpointing those that could materially affect its ability to achieve its strategic objectives and create long-term value for investors. A material ESG issue is one that has the potential to significantly impact a company’s financial position, operational efficiency, or reputation, thereby influencing its stock price and investor returns. For example, a significant oil spill for an energy company or a major data breach for a tech firm would be considered material ESG events.

Methods for Assessing Materiality of ESG Issues

Several methods exist for assessing the materiality of ESG issues. One common approach involves a combined qualitative and quantitative analysis. Qualitative analysis focuses on identifying key ESG issues relevant to the company’s industry, operations, and strategic priorities. This might involve reviewing company disclosures, industry reports, and stakeholder feedback. Quantitative analysis uses data and metrics to assess the financial impact of those identified ESG issues. This might involve analyzing correlations between ESG performance and financial indicators, such as profitability, revenue growth, or cost of capital. Another method is stakeholder engagement. Directly engaging with stakeholders – employees, customers, suppliers, communities – can provide valuable insights into the ESG issues that are most important to them and therefore most likely to impact the company’s long-term success. Finally, materiality assessments often involve using established frameworks and standards, such as the Global Reporting Initiative (GRI) Standards or the Sustainability Accounting Standards Board (SASB) standards, which provide guidance on identifying and reporting on material ESG issues.

Metrics for Measuring Environmental and Social Impact

Measuring the environmental and social impact of investments requires a range of metrics tailored to the specific investment and its impact area. For environmental impact, common metrics include greenhouse gas emissions (Scope 1, 2, and 3), water consumption, waste generation, and energy efficiency. Examples of specific metrics might be tons of CO2e emitted per unit of production, liters of water used per product, or percentage reduction in energy consumption year-over-year. For social impact, metrics can include employee satisfaction scores, diversity and inclusion metrics (e.g., gender pay gap, representation of underrepresented groups), community engagement initiatives, and health and safety performance indicators (e.g., lost-time injury frequency rate). These metrics are often reported in accordance with recognized standards, such as the GRI Standards or SASB Standards. The selection of appropriate metrics depends on the specific investment, industry, and stakeholder concerns.

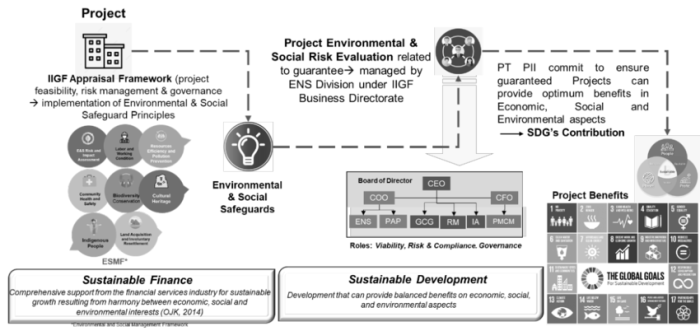

Framework for Measuring Long-Term Impact on Stakeholders

A comprehensive framework for measuring the long-term impact of ESG investments on various stakeholders should incorporate both qualitative and quantitative data, across a range of time horizons. The framework should clearly define the stakeholders (e.g., investors, employees, customers, communities, environment), the specific ESG issues being addressed, and the metrics used to measure impact. It should also include a baseline assessment of the current situation, targets for improvement, and a plan for monitoring and reporting progress over time. For example, a framework might track changes in greenhouse gas emissions, employee turnover rates, customer satisfaction scores, and community engagement levels over a five-year period. The framework should also consider both direct and indirect impacts, acknowledging that the consequences of ESG investments can ripple through various parts of the economy and society. Regular reporting and independent verification can further enhance the credibility and transparency of the impact measurement process. Consideration should also be given to using established frameworks such as the UN Sustainable Development Goals (SDGs) as a guide for identifying and tracking relevant impacts.

ESG and Financial Performance

The relationship between Environmental, Social, and Governance (ESG) performance and financial returns is a subject of ongoing research and debate. While not a guaranteed direct correlation, a growing body of evidence suggests a positive link between strong ESG practices and improved financial performance, although the strength and nature of this relationship can vary depending on the industry, the specific ESG factors considered, and the time horizon. This section explores this connection, examining studies and highlighting the potential for ESG integration to enhance investment outcomes.

ESG performance and financial returns are increasingly viewed as interconnected. Companies with robust ESG profiles often demonstrate better operational efficiency, reduced risk exposure, and enhanced long-term value creation. This is due to several factors including improved resource management, stronger stakeholder relationships, and a more resilient business model. Conversely, neglecting ESG factors can lead to increased financial risks, such as reputational damage, regulatory penalties, and stranded assets.

Studies Examining the Correlation Between ESG Scores and Financial Metrics

Numerous studies have explored the relationship between ESG scores and financial metrics. For example, a meta-analysis of studies conducted by the US SIF Foundation found a positive correlation between ESG performance and financial returns across various asset classes. Other research, such as that published by MSCI and Sustainalytics, consistently demonstrates a link between higher ESG ratings and improved financial performance indicators, including return on equity (ROE), return on assets (ROA), and profitability. These studies often employ various methodologies, including regression analysis and portfolio comparisons, to assess the relationship. It’s crucial to note that the magnitude of the correlation can vary across studies due to differences in methodologies, data sets, and time periods examined.

Potential for ESG Integration to Enhance Risk-Adjusted Returns

Integrating ESG factors into investment strategies can potentially enhance risk-adjusted returns. By identifying and mitigating ESG-related risks, investors can reduce the likelihood of negative financial outcomes. For example, companies with poor environmental practices may face increased regulatory scrutiny or higher insurance costs, impacting profitability. Similarly, companies with weak social governance may experience reputational damage or employee unrest, affecting productivity and market share. By proactively assessing and addressing these risks, ESG integration can contribute to more stable and predictable investment returns. Furthermore, identifying companies with strong ESG performance can lead to uncovering investment opportunities with superior long-term growth potential, driven by factors such as innovation in sustainable technologies or improved operational efficiency.

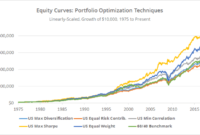

Comparison of Financial Performance: ESG-Focused Funds vs. Traditional Funds

To illustrate the potential benefits, consider a hypothetical comparison of the financial performance of ESG-focused funds versus traditional funds over a ten-year period (2013-2023). A simplified chart could be constructed with two lines representing the cumulative returns of each fund type. The ESG-focused fund line might show a slightly lower initial return in the first few years, but then demonstrate a steeper incline over the latter half of the period, eventually surpassing the cumulative return of the traditional fund. This visual representation would suggest that while ESG funds might not always outperform traditional funds in the short term, they can exhibit stronger long-term growth and potentially offer superior risk-adjusted returns. The specific numbers would need to be based on actual fund performance data, and the visual would emphasize the trend rather than precise numerical values. This hypothetical example emphasizes the potential for long-term value creation through ESG integration, highlighting that short-term underperformance doesn’t necessarily negate the potential for long-term outperformance. Important note: Past performance is not indicative of future results.

Challenges and Future Trends in ESG Investing

ESG investing, while experiencing rapid growth, faces significant hurdles and is subject to ongoing evolution. Understanding these challenges and anticipating future trends is crucial for investors, companies, and policymakers alike to navigate this dynamic landscape effectively and responsibly. This section explores key challenges, the evolving regulatory role, innovative approaches, and potential future trends shaping the future of ESG.

Key Challenges Facing ESG Investing

Several obstacles hinder the widespread adoption and effectiveness of ESG investing. Data inconsistencies and a lack of standardization pose a significant challenge. The complexity of ESG metrics, coupled with the varying methodologies used to collect and report them, makes it difficult to compare investments across different sectors and geographies. Another significant hurdle is the issue of “greenwashing,” where companies exaggerate or misrepresent their ESG performance to attract investors. This lack of transparency and accountability undermines the integrity of the entire ESG investment landscape. Furthermore, the integration of ESG factors into traditional financial analysis remains a challenge, as the long-term nature of ESG impacts often clashes with short-term market pressures. Finally, the absence of universally accepted standards and frameworks can lead to inconsistencies and difficulties in comparing ESG performance across different companies and investment strategies.

The Evolving Role of Regulators and Policymakers

Regulators and policymakers play a pivotal role in shaping the ESG landscape. Increasingly, governments worldwide are implementing regulations to enhance ESG data transparency and accountability. For instance, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) mandates disclosures on ESG risks and the integration of ESG factors into investment decisions. Similar initiatives are underway in other jurisdictions, such as the United States, where regulatory bodies are focusing on improving ESG data quality and addressing concerns about greenwashing. These regulatory efforts aim to create a more standardized and transparent ESG reporting framework, fostering greater investor confidence and driving further adoption of ESG principles. The ongoing evolution of these regulations will significantly influence how companies report and investors evaluate ESG performance in the years to come.

Innovative Approaches to ESG Investing and Impact Measurement

The field of ESG investing is witnessing the emergence of innovative approaches to both investment strategies and impact measurement. One such approach is the use of alternative data sources, such as satellite imagery and social media analytics, to gain a more comprehensive understanding of a company’s ESG performance. This complements traditional financial data and offers valuable insights into environmental and social impacts that may not be captured in conventional reporting. Another example is the increasing use of blockchain technology to enhance the transparency and traceability of ESG data. Blockchain’s immutable ledger can record ESG performance data securely and transparently, reducing the risk of manipulation and improving data reliability. Furthermore, innovative impact measurement frameworks are being developed to quantify the social and environmental benefits of investments, moving beyond simple reporting to a more holistic assessment of value creation. These advancements are transforming the way investors evaluate and engage with companies on ESG issues.

Potential Future Trends in ESG Investing

Several trends are expected to shape the future of ESG investing. Technological advancements, such as artificial intelligence (AI) and machine learning, are expected to play an increasingly important role in analyzing ESG data, identifying ESG risks and opportunities, and improving the efficiency of impact measurement. For example, AI algorithms can process vast amounts of ESG data to identify patterns and predict future trends, enabling more informed investment decisions. Furthermore, evolving investor expectations are pushing for a greater focus on the integration of ESG factors across all aspects of investment management, from portfolio construction to risk management. This includes a growing demand for transparency and accountability, driving the development of more robust ESG reporting frameworks and the adoption of more stringent standards. The increasing integration of ESG considerations into mainstream finance is a key trend to watch. We are likely to see a significant increase in the amount of ESG-related data available, a greater focus on the measurement and reporting of impact, and a more sophisticated understanding of the relationship between ESG performance and financial returns. The growth of sustainable finance initiatives, coupled with technological advancements, will further shape the ESG investment landscape, creating a more integrated and effective approach to sustainable investing.

Ending Remarks

Ultimately, ESG investing represents a shift towards a more holistic and sustainable approach to finance. By considering the broader societal and environmental impacts of investments, ESG strategies aim to generate long-term value while contributing to a more responsible and equitable future. While challenges remain in terms of data standardization and consistent measurement, the growing awareness of ESG factors and their increasing integration into mainstream investment practices suggest a promising future for this field.

Quick FAQs

What is the difference between ESG and SRI?

While often used interchangeably, Socially Responsible Investing (SRI) is a broader term encompassing various approaches to investing with ethical and social considerations. ESG investing is a more specific subset of SRI focusing on environmental, social, and governance factors.

How can I find ESG-rated companies?

Several ESG rating agencies (e.g., MSCI, Sustainalytics, Bloomberg) provide ratings and data on companies’ ESG performance. You can also access information directly from companies through their sustainability reports.

Are ESG investments more expensive?

Not necessarily. The costs associated with ESG investing can vary depending on the specific strategy and fund chosen. Some ESG funds may have higher fees than traditional funds, while others are competitively priced.

Do ESG investments always outperform traditional investments?

There’s no guarantee of superior returns with ESG investing. The relationship between ESG performance and financial returns is complex and still under research. However, many believe ESG integration can improve risk-adjusted returns over the long term by mitigating potential risks.