ESG Investing Strategies Review: Embark on a surprisingly hilarious journey into the world of sustainable finance! We’ll delve into the often-serious (but secretly giggle-inducing) world of Environmental, Social, and Governance investing, exploring everything from ethically sourced coffee beans to the surprisingly dramatic world of corporate boardroom battles. Prepare for a rollercoaster ride of responsible investing, complete with unexpected twists and turns that will leave you both enlightened and entertained.

This review covers the core principles of ESG investing, comparing various investment approaches (think: a financial choose-your-own-adventure!), analyzing materiality and risk assessment (with fewer spreadsheets than you’d expect!), and navigating the sometimes-bewildering landscape of ESG data and reporting. We’ll even tackle the challenges and opportunities of ESG investing – because even in the world of sustainable finance, there’s always a good story (and maybe a few unexpected accounting scandals) to be found.

Defining ESG Investing

ESG investing, or Environmental, Social, and Governance investing, isn’t just a trendy buzzword whispered in hushed tones at exclusive cocktail parties (though it might be). It’s a rapidly growing investment strategy that considers a company’s impact on the planet, its people, and its overall governance structure, alongside its financial performance. Think of it as investing with your conscience – and hopefully, a healthy return. It’s a win-win, if you do it right (and let’s be honest, doing it right is half the fun).

ESG investing acknowledges that a company’s long-term success isn’t solely determined by its profit margins. Factors like environmental sustainability, employee treatment, and ethical business practices play a significant role in shaping a company’s reputation, resilience, and ultimately, its profitability. Ignoring these factors is like building a house on a foundation of sand – it might look good initially, but the first gust of wind (or scandal) will send it tumbling.

Core Principles of ESG Investing

The core principles revolve around three interconnected pillars: Environmental, Social, and Governance. Environmental factors assess a company’s impact on the environment, considering its carbon footprint, waste management, and resource consumption. Social factors examine a company’s relationships with its employees, customers, suppliers, and the wider community, looking at things like labor practices, diversity, and community engagement. Governance factors evaluate a company’s leadership, ethics, and transparency, focusing on areas like board diversity, executive compensation, and anti-corruption measures. These three pillars aren’t independent; they are intricately interwoven, influencing and reinforcing each other. A company with strong governance is more likely to prioritize environmental sustainability and social responsibility, and vice versa. It’s a beautiful, albeit sometimes messy, ecosystem.

Dimensions of ESG Criteria and Their Relative Importance

The relative importance of each ESG criterion varies depending on the investor’s priorities and the specific industry. For example, a renewable energy company will likely face more stringent environmental scrutiny than a traditional retail business. However, some criteria consistently hold significant weight across various sectors. For instance, a company’s commitment to reducing its carbon emissions (Environmental) is increasingly crucial, given the global focus on climate change. Similarly, fair labor practices (Social) and transparent governance structures (Governance) are becoming non-negotiable for many investors. The weight given to each criterion often depends on industry benchmarks, regulatory requirements, and the investor’s individual risk tolerance. It’s a delicate balancing act, like juggling chainsaws while riding a unicycle – challenging, but potentially very rewarding.

Examples of Companies with Strong and Weak ESG Profiles

Let’s look at some real-world examples. Companies like Patagonia, known for its commitment to environmental sustainability and ethical labor practices, often score highly on ESG ratings. Their dedication to using recycled materials and supporting environmental causes enhances their brand reputation and attracts environmentally conscious consumers. On the other hand, companies facing numerous controversies related to environmental damage or unethical labor practices, might have significantly lower ESG scores. These scores are not static; they fluctuate based on a company’s performance and actions. It’s a dynamic landscape, constantly shifting like a sand dune in a desert windstorm. It’s a reminder that even the strongest ESG performers can stumble, and companies with initially weak profiles can improve. Continuous monitoring and assessment are vital.

ESG Investment Strategies: ESG Investing Strategies Review

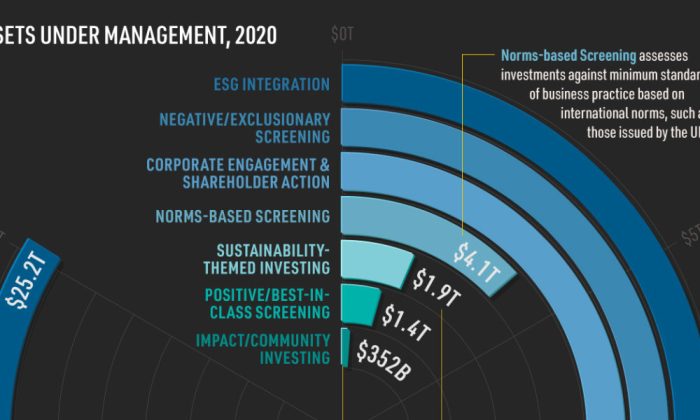

Investing responsibly is no longer a niche pursuit; it’s become a mainstream movement, albeit one with more twists and turns than a particularly ambitious rollercoaster. Let’s unravel the complexities of various ESG investment strategies, examining their approaches and practical applications with the seriousness they deserve, but also with a healthy dose of amusement – after all, even saving the planet can be a bit of a laugh.

Different ESG investment approaches offer various pathways to aligning financial returns with environmental and social goals. Choosing the right approach depends on an investor’s risk tolerance, time horizon, and specific ethical priorities. Think of it like choosing a flavor of ethically-sourced ice cream – lots of delicious options, but some are definitely more adventurous than others.

ESG Integration, ESG Investing Strategies Review

ESG integration involves systematically incorporating ESG factors into traditional financial analysis. It’s not about abandoning financial metrics; rather, it’s about enhancing them with a conscience. Imagine a financial analyst, but instead of just crunching numbers, they also consider the company’s carbon footprint and labor practices. This holistic approach aims to identify companies with strong ESG profiles that are also financially sound, reducing risk and potentially enhancing returns. The practical implementation involves screening companies based on ESG ratings and incorporating ESG data into financial models. Asset allocation might favor companies with high ESG scores across various sectors, creating a diversified portfolio with a built-in ethical component.

Thematic ESG Investing

Thematic investing focuses on specific ESG themes, such as renewable energy, sustainable agriculture, or green technology. This strategy zeroes in on companies actively contributing to positive environmental and social change within a particular area. Think of it as a highly specialized, ethically-driven approach. Implementation involves identifying companies directly involved in the chosen theme, potentially leading to a concentrated portfolio with higher risk but also higher potential returns if the theme gains traction. Asset allocation would be heavily weighted towards companies within the selected theme.

Exclusionary ESG Investing

Exclusionary screening, also known as negative screening, involves avoiding investments in companies involved in controversial activities, such as tobacco, fossil fuels, or weapons manufacturing. This approach is straightforward: if a company’s activities clash with your ethical compass, you simply avoid investing in it. This is the “don’t do bad things” approach. Practical implementation is relatively simple, relying on readily available ESG data and exclusion lists to build a portfolio. Asset allocation might be more broadly diversified, but with specific sectors or companies excluded based on predefined criteria.

Impact Investing

Impact investing aims to generate measurable positive social and environmental impact alongside a financial return. It’s not just about avoiding harm; it’s about actively doing good. This approach requires careful due diligence to ensure investments are genuinely contributing to positive change, often involving direct engagement with investee companies. Implementation necessitates a rigorous impact measurement framework to track and evaluate the social and environmental outcomes of investments. Asset allocation will likely be diverse, but the selection process prioritizes investments with demonstrable positive impact.

Hypothetical ESG Portfolio for a Risk-Averse Investor

For a risk-averse investor, a diversified portfolio with a blend of ESG integration and exclusionary screening would be suitable. This approach balances ethical considerations with risk mitigation. A sample portfolio might include:

- Large-cap, low-volatility stocks with strong ESG ratings across various sectors (e.g., consumer staples, healthcare, utilities).

- Investment-grade corporate bonds issued by companies with robust ESG performance and low credit risk.

- ESG-focused mutual funds or ETFs that utilize integration and exclusionary strategies, providing broad diversification.

- A small allocation to a renewable energy ETF, representing a carefully managed exposure to a growth-oriented sector.

This portfolio prioritizes stability and income while aligning investments with ESG principles. The exclusion of high-risk sectors like fossil fuels and controversial industries helps mitigate potential reputational and financial risks. The inclusion of ESG-focused funds simplifies the process of identifying and vetting companies with strong ESG profiles.

Materiality and ESG Risk Assessment

Let’s face it, investing isn’t just about chasing the highest returns anymore; it’s about understanding the bigger picture – or, as we like to call it, the “planet-sized” picture. Materiality and ESG risk assessment are the magnifying glasses we use to examine a company’s impact, both positive and negative, on the world and its bottom line. Ignoring these factors is like driving a car blindfolded – thrilling, perhaps, but ultimately disastrous.

ESG factors, when truly material, significantly impact a company’s financial performance. Think of it as a delicate ecosystem: damage one part, and the whole thing suffers. For instance, a company with a poor environmental record might face hefty fines, reputational damage leading to decreased sales, or even difficulty securing financing. Conversely, a company prioritizing social responsibility might attract top talent, enhance its brand image, and ultimately, boost its profitability. It’s a win-win, provided you’re playing the game correctly.

Key ESG Factors Impacting Financial Performance

Identifying material ESG factors requires a thorough analysis of a company’s operations and industry. This isn’t just about ticking boxes; it’s about digging deep to uncover the truly significant issues. Some key factors to consider include carbon emissions (for climate change), water usage (for resource scarcity), labor practices (for social risk), and supply chain transparency (for ethical sourcing). A company’s governance structure, including board diversity and executive compensation, also plays a vital role in its overall ESG performance and subsequent financial health.

Methods for Assessing ESG Risks and Opportunities

Several methods exist for evaluating ESG risks and opportunities. These range from simple questionnaires and scoring systems to sophisticated data analytics and scenario planning. Many companies use a combination of these approaches to gain a comprehensive understanding of their ESG profile. Qualitative assessments, such as stakeholder engagement and expert interviews, are also incredibly valuable in providing context and nuance to quantitative data. Remember, numbers only tell part of the story; human input is essential.

Potential Financial Impacts of ESG Performance

The following table illustrates the potential financial implications of both positive and negative ESG performance. While specific figures vary greatly depending on the industry and company, the overall trend is clear: strong ESG performance can translate into increased profitability and reduced risk, while poor ESG performance can lead to significant financial losses.

| ESG Factor | Positive Performance (Financial Impact) | Negative Performance (Financial Impact) | Example |

|---|---|---|---|

| Climate Change Mitigation | Reduced carbon tax liabilities, increased investor interest, enhanced brand reputation | Increased fines and penalties, decreased investor confidence, reputational damage | A renewable energy company vs. a coal-fired power plant |

| Supply Chain Transparency | Improved supplier relationships, reduced risk of ethical violations, enhanced consumer trust | Supply chain disruptions, reputational damage due to unethical practices, legal liabilities | A company with robust ethical sourcing vs. one with questionable labor practices in its supply chain |

| Employee Relations | Increased employee productivity, reduced turnover, improved brand reputation | High turnover costs, labor disputes, decreased productivity | A company known for its fair labor practices vs. one facing frequent strikes and lawsuits |

| Governance | Increased investor confidence, improved corporate efficiency, reduced risk of scandals | Decreased investor confidence, increased risk of fraud and corruption, reputational damage | A company with a diverse and independent board vs. one with weak corporate governance |

ESG Data and Reporting

Navigating the world of ESG data can feel like trying to assemble IKEA furniture without the instructions – a frustrating, potentially chaotic, yet ultimately rewarding experience (if you don’t end up with extra parts). The sheer volume and variety of data available can be overwhelming, but understanding its sources and limitations is crucial for effective ESG investing. Let’s delve into the fascinating, if slightly bewildering, world of ESG data and reporting.

The accuracy and reliability of ESG data are paramount, yet the landscape is far from standardized. Different providers employ varying methodologies, leading to discrepancies in ratings and scores. This, however, doesn’t render the data useless; rather, it necessitates a discerning and critical approach. Understanding the strengths and weaknesses of each provider is key to interpreting the data effectively and making informed investment decisions.

Reputable Sources for ESG Data and Ratings

Several reputable organizations provide ESG data and ratings, each with its own strengths and weaknesses. These providers often use different methodologies, resulting in varying scores for the same company. Understanding these differences is crucial for a comprehensive assessment.

- MSCI: Known for its comprehensive coverage and sophisticated methodologies, MSCI is a widely respected provider, although its reliance on publicly available data can limit its granularity.

- Sustainalytics: This firm focuses on material ESG risks, offering in-depth analysis and a robust methodology. However, its data may not be as readily available as some competitors.

- Bloomberg: Bloomberg integrates ESG data into its broader financial data platform, offering convenient access for investors already using its services. Its data, however, might be less specialized than other providers.

- Refinitiv: Similar to Bloomberg, Refinitiv provides a comprehensive platform integrating ESG data with financial information. Its strengths lie in its broad coverage and ease of access within its existing ecosystem.

Comparison of ESG Data Providers

The following table summarizes some key differences between the aforementioned providers. Remember, the “best” provider depends entirely on your specific needs and investment strategy. Choosing the right provider is like choosing the right tool for the job – a hammer won’t help you screw in a screw, and vice versa.

| Provider | Strengths | Limitations |

|---|---|---|

| MSCI | Broad coverage, sophisticated methodologies | Reliance on publicly available data |

| Sustainalytics | Focus on material ESG risks, in-depth analysis | Data accessibility |

| Bloomberg | Integration with broader financial data | Less specialized ESG data |

| Refinitiv | Broad coverage, ease of access | Similar to Bloomberg in limitations |

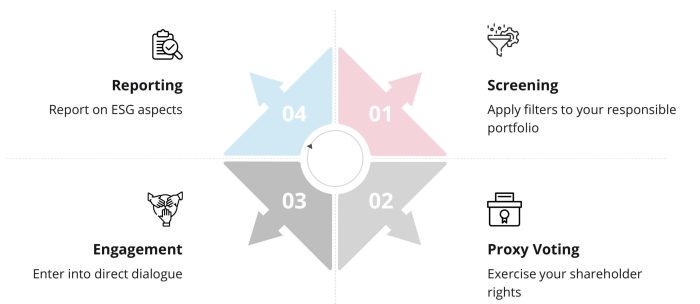

Best Practices for ESG Reporting and Disclosure

Effective ESG reporting is crucial for transparency and accountability. A well-structured report allows stakeholders to understand a company’s ESG performance and identify potential risks and opportunities. Think of it as a company’s ESG “report card,” showing its progress (or lack thereof) in various areas.

The following bullet points Artikel some best practices for ESG reporting and disclosure:

- Materiality Assessment: Identify the ESG issues most relevant to the company’s business and stakeholders.

- Data Quality and Assurance: Ensure the accuracy, completeness, and consistency of reported data. This is not optional; it’s the foundation upon which everything else is built.

- Standardized Frameworks: Align reporting with established frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) standards for consistency and comparability.

- Transparency and Disclosure: Clearly articulate the company’s ESG strategy, performance, and future goals. Openness is key – hiding things only breeds suspicion.

- Stakeholder Engagement: Actively engage with stakeholders to understand their expectations and incorporate their feedback into the reporting process. After all, it’s their money (or their planet) at stake.

ESG Performance Measurement and Benchmarking

Measuring the ESG performance of an investment portfolio isn’t just about counting butterflies (though that *could* be a surprisingly relevant metric for biodiversity initiatives). It’s about quantifying the impact of your investments on environmental, social, and governance factors, allowing for informed decision-making and – let’s be honest – bragging rights amongst your equally ethically-minded colleagues. This involves a blend of quantitative data and qualitative assessments, a delightful cocktail of numbers and nuanced judgment.

ESG performance measurement is a multifaceted process, requiring a robust methodology to ensure accuracy and comparability. It necessitates the selection of appropriate metrics, the collection of reliable data, and the application of suitable analytical techniques. Ignoring these steps is akin to navigating a labyrinth blindfolded – you might stumble upon the cheese (profit!), but it’s unlikely to be efficient.

ESG Metrics and Data Sources

A multitude of ESG metrics exist, each providing a unique perspective on a company’s sustainability performance. These range from carbon emissions and water usage (environmental) to employee diversity and human rights records (social), to board diversity and executive compensation (governance). Data sources for these metrics are equally diverse, including company disclosures (sustainability reports, annual reports), third-party ESG rating agencies (MSCI, Sustainalytics, Refinitiv), and independent research organizations. The key is selecting metrics relevant to your investment strategy and using data from reliable, consistent sources. Inconsistent data is like a wobbly table – it undermines the entire structure of your analysis.

ESG Benchmarks and Indices

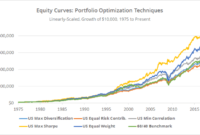

Benchmarking your ESG portfolio against traditional indices allows you to assess its relative performance while considering ESG factors. Several ESG benchmarks and indices are available, each with its own methodology and weighting scheme. For example, the MSCI KLD 400 Social Index focuses on companies with strong ESG profiles, while the Dow Jones Sustainability World Index includes companies demonstrating a commitment to sustainability across various aspects of their operations. These indices provide a standardized framework for comparing ESG performance, but it’s crucial to understand the specific methodologies used to construct each index to ensure accurate comparisons. Choosing the right benchmark is like selecting the right golf club – the wrong one will significantly impact your score.

Performance Comparison: ESG vs. Traditional Portfolio

Let’s compare a hypothetical ESG-focused portfolio against a traditional S&P 500 portfolio over a five-year period (2018-2022). This comparison is for illustrative purposes and does not represent actual investment performance. Remember, past performance is not indicative of future results, and ESG investing involves inherent risks.

| Year | ESG Portfolio Return (%) | S&P 500 Return (%) | ESG Outperformance (%) |

|---|---|---|---|

| 2018 | -4.0 | -4.4 | 0.4 |

| 2019 | 28.0 | 31.5 | -3.5 |

| 2020 | 18.5 | 18.4 | 0.1 |

| 2021 | 22.0 | 28.7 | -6.7 |

| 2022 | -15.0 | -18.1 | 3.1 |

ESG and Regulatory Landscape

The world of ESG investing isn’t just about doing good; it’s increasingly about navigating a complex and rapidly evolving regulatory landscape. Governments globally are scrambling to keep up with the burgeoning ESG movement, resulting in a patchwork quilt of regulations that can leave even seasoned investors feeling slightly bewildered (and possibly a little seasick). Let’s chart a course through this regulatory archipelago.

The implications of these regulations are far-reaching, affecting everything from investment strategies to reporting requirements. Imagine trying to build a house without building codes – it would be chaotic, potentially unsafe, and certainly not very efficient. Similarly, a clear and consistent regulatory framework is crucial for the long-term health and sustainability of the ESG investment market.

Global Regulatory Trends in ESG Investing

The global regulatory landscape for ESG investing is a dynamic mix of established frameworks and emerging standards. The European Union, for example, has been a pioneer with its Sustainable Finance Disclosure Regulation (SFDR), which aims to increase transparency and prevent “greenwashing” – essentially, companies falsely claiming to be environmentally friendly. Meanwhile, other jurisdictions, such as the United States, are developing their own frameworks, often with a slightly different emphasis and approach. This divergence creates both challenges and opportunities for global investors, necessitating a nuanced understanding of the specific requirements in each market. The lack of complete harmonization globally means that investors need to be agile and adaptable, carefully navigating the complexities of different regulatory regimes. One could even say it’s a bit of a regulatory obstacle course, but with potentially high rewards for those who successfully complete it.

Impact of ESG Regulations on Investment Strategies

ESG regulations are fundamentally reshaping investment strategies. For instance, the increased emphasis on disclosure means investors need to incorporate ESG factors more deeply into their due diligence processes. This requires not only analyzing financial data but also assessing a company’s environmental impact, social responsibility initiatives, and governance structures. Failure to do so could lead to significant financial and reputational risks, as investors increasingly demand transparency and accountability. Moreover, the rise of sustainable and impact investing strategies is directly linked to the regulatory push towards ESG integration. This shift is driving innovation in areas such as green bonds, sustainable infrastructure projects, and impact measurement, opening up exciting new investment opportunities for those who can effectively navigate the regulatory maze.

Future Trends in ESG Regulation and Their Impact

Predicting the future is always a risky business, but some clear trends are emerging in the ESG regulatory landscape. We can anticipate a continued push towards greater standardization and harmonization of ESG reporting requirements globally. This could involve the adoption of common metrics and frameworks, making it easier for investors to compare companies across different jurisdictions. Further, we might see a greater focus on enforcement and penalties for greenwashing, ensuring that companies are held accountable for their ESG claims. The increasing sophistication of ESG data analytics will also play a significant role, enabling more robust and reliable assessments of ESG performance. This evolution could lead to a more efficient and transparent ESG investment market, attracting greater capital flows towards sustainable and responsible investments. For instance, the increased use of AI and machine learning in ESG data analysis could lead to more accurate and timely identification of ESG risks and opportunities, potentially reshaping investment portfolios and strategies significantly. This might even lead to the development of new, specialized investment products designed to exploit these insights.

Challenges and Opportunities in ESG Investing

The world of ESG investing, while brimming with the promise of a more sustainable future, isn’t exactly a walk in the park. It’s a landscape dotted with both thrilling opportunities and treacherous pitfalls, a bit like a financial jungle gym built from recycled materials. Let’s explore the exciting climbs and perilous drops.

ESG investing presents a unique blend of compelling prospects and significant hurdles. While the potential for positive impact and financial returns is undeniable, navigating the complexities of data quality, standardization, and the ever-present threat of greenwashing requires careful consideration. This section will delve into the key challenges and opportunities, illustrating them with real-world examples to help paint a clearer picture.

Key Challenges in ESG Investing

The challenges in ESG investing are multifaceted, ranging from the practical difficulties of data collection to the ethical concerns surrounding corporate transparency. Overcoming these obstacles is crucial for the continued growth and credibility of this important investment strategy.

- Data Quality and Comparability: ESG data is often inconsistent, incomplete, and lacks standardization across different companies and reporting frameworks. This makes it difficult to compare the ESG performance of different companies and to make informed investment decisions. Imagine trying to compare apples and oranges, but the apples are bruised and the oranges are half-rotten. A truly frustrating situation for any investor.

- Greenwashing: Some companies engage in “greenwashing,” which is the practice of making misleading or unsubstantiated claims about their environmental or social performance. This can mislead investors and undermine the credibility of ESG investing. Think of it as the equivalent of a used car salesman promising a lemon is a prize-winning racecar. Buyer beware!

- Lack of Standardization: The absence of universally accepted ESG standards and metrics makes it difficult to assess the true ESG performance of companies. Different rating agencies use different methodologies, leading to inconsistencies and confusion. It’s like having a dozen different recipes for a cake, all claiming to be the best – which one do you choose?

Opportunities in ESG Investing

Despite the challenges, ESG investing presents significant opportunities for both investors and companies. The potential for both financial returns and positive societal impact is considerable, driving increasing interest from a wider range of stakeholders.

- Financial Returns: Studies have shown that companies with strong ESG performance tend to outperform their peers in the long run. This is because ESG factors can be important drivers of financial performance, such as improved risk management, innovation, and brand reputation. Think of it as a virtuous cycle: good ESG practices lead to better financial results, which in turn reinforces the commitment to ESG.

- Positive Societal Impact: ESG investing allows investors to align their investments with their values and contribute to a more sustainable and equitable future. This can lead to a sense of purpose and satisfaction beyond simply maximizing financial returns. It’s about making money while making the world a better place – a win-win situation.

- Risk Mitigation: By incorporating ESG factors into their investment decisions, investors can identify and mitigate potential risks associated with environmental, social, and governance issues. This can lead to more resilient and stable portfolios. It’s a matter of foreseeing potential problems and avoiding them before they cause significant damage.

Case Studies: Successful and Unsuccessful ESG Strategies

Analyzing both successful and unsuccessful ESG investment strategies provides valuable lessons for investors and companies alike.

Successful ESG Investment Strategy: Unilever’s Sustainable Living Plan

Unilever’s Sustainable Living Plan, launched in 2010, aimed to decouple the company’s growth from its environmental footprint. The plan focused on improving the health and well-being of consumers, reducing the environmental impact of its operations, and enhancing its social responsibility. The strategy has been linked to improved financial performance and increased brand reputation, demonstrating the potential for ESG to create both social and economic value. The plan wasn’t without its critics, but the overall results speak for themselves.

Unsuccessful ESG Investment Strategy: Volkswagen’s Emissions Scandal

Volkswagen’s emissions scandal, which came to light in 2015, serves as a stark reminder of the risks associated with failing to address ESG concerns. The company’s deliberate deception regarding its vehicle emissions led to significant financial losses, reputational damage, and legal repercussions. This case highlights the importance of transparency and accountability in ESG reporting and the severe consequences of greenwashing. It’s a cautionary tale about the potential downsides of neglecting ESG considerations.

The Future of ESG Investing

Predicting the future is a fool’s errand, especially in the rapidly evolving world of finance. However, observing current trends and technological advancements allows us to paint a reasonably accurate, albeit slightly whimsical, picture of ESG investing’s future. Expect twists, turns, and perhaps even a few unexpected pirouettes as the market adapts to the ever-changing landscape of sustainability and responsible investing.

The next few years will likely witness a significant expansion of ESG investing, driven by increasing regulatory pressure, growing investor demand, and a heightened awareness of environmental and social issues. We can expect to see a more nuanced approach to ESG, moving beyond simple checklists to a more holistic and integrated assessment of companies’ sustainability performance. This shift will require a more sophisticated understanding of materiality and the interconnectedness of environmental, social, and governance factors. Think of it as moving from a simple “yes” or “no” to a detailed, multi-dimensional analysis, rather like upgrading from a rotary phone to a smartphone.

Technological Advancements Shaping ESG Investing

The future of ESG investing is inextricably linked to technological progress. Artificial intelligence (AI) and machine learning (ML) will play a crucial role in improving data collection, analysis, and reporting. AI-powered platforms can analyze vast datasets to identify ESG risks and opportunities, improving the accuracy and efficiency of ESG assessments. Imagine AI sifting through terabytes of data to identify companies genuinely committed to sustainability, separating the wheat from the chaff, so to speak. Blockchain technology could enhance transparency and traceability in supply chains, helping investors verify ESG claims and track the impact of their investments. This could be the key to unlocking a level of transparency previously thought impossible, providing a truly auditable trail of ESG performance. Furthermore, advancements in satellite imagery and remote sensing can provide real-time data on environmental impacts, such as deforestation or pollution, allowing for more timely and accurate ESG assessments. Picture this: satellites acting as ESG auditors, constantly monitoring and reporting on environmental impacts worldwide.

ESG’s Role in a Sustainable and Responsible Investment Landscape

ESG will increasingly become a core component of mainstream investment strategies, not a niche area. We anticipate a future where ESG considerations are fully integrated into investment decision-making processes, from portfolio construction to risk management. The concept of “impact investing,” which focuses on generating both financial returns and positive social and environmental impact, will continue to grow in popularity. Think of it as a win-win scenario, where investments generate profits while simultaneously contributing to a more sustainable world. Furthermore, the demand for transparency and accountability in ESG reporting will increase, leading to the development of standardized and robust reporting frameworks. This will allow investors to compare companies’ ESG performance more easily and make informed decisions. It’s a bit like having a universal translator for ESG data, ensuring everyone speaks the same language. Ultimately, the future of ESG investing is a future where financial success and environmental and social responsibility are inextricably linked, creating a more sustainable and equitable world.

Epilogue

So, there you have it – a whirlwind tour through the surprisingly captivating world of ESG investing. While the quest for a sustainable future might seem daunting, this review hopefully demonstrates that navigating the complexities of ESG can be both rewarding and, dare we say, fun. Remember, even the most serious financial decisions can have a touch of humor – especially when you’re making a positive impact on the world. Now go forth and invest responsibly (and maybe chuckle along the way!).

Essential FAQs

What is greenwashing, and how can I avoid it?

Greenwashing is when companies exaggerate or misrepresent their environmental or social credentials. To avoid it, look for independent verification of ESG claims, examine a company’s overall sustainability practices, and be wary of overly optimistic or vague statements.

How do I find reputable ESG data providers?

Reputable providers undergo rigorous audits and adhere to established standards. Look for providers with transparent methodologies and a strong track record. However, remember that even reputable sources have limitations; always perform your own due diligence.

Is ESG investing more expensive than traditional investing?

Not necessarily. While some ESG funds might have higher fees, many offer comparable costs to traditional investments. The real cost comparison should be based on long-term performance and alignment with your values.