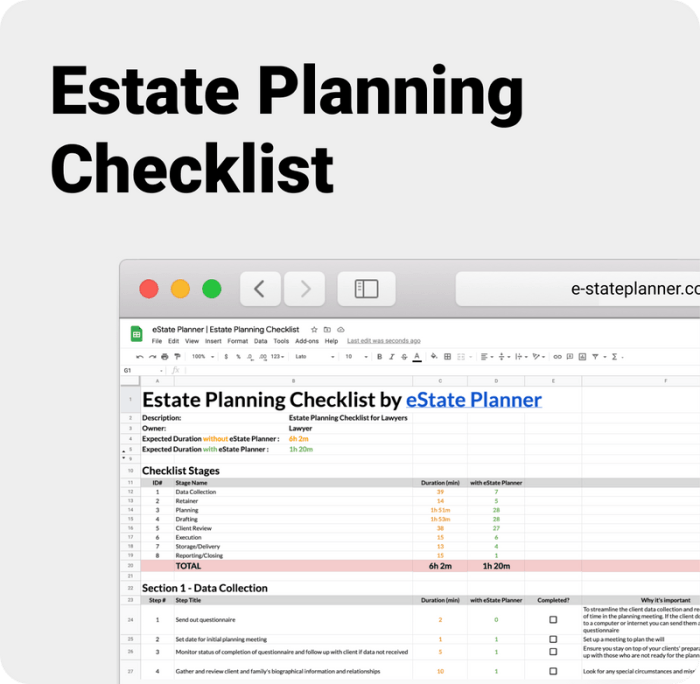

Estate Planning Checklist Update: Let’s face it, nobody *wants* to think about their own mortality, but avoiding estate planning is like leaving a cryptic crossword puzzle for your loved ones to solve after you’re gone – and nobody wants *that* kind of legacy. This guide tackles the often-dreaded topic of estate planning with a blend of practical advice and enough humor to keep you from succumbing to existential dread. We’ll navigate the complexities of wills, taxes, digital assets, and more, ensuring your affairs are in order – and maybe even a little bit funny.

This updated checklist covers crucial areas like tax law changes, beneficiary designations, will revisions, digital asset management, and planning for blended families. We’ll provide clear steps, helpful examples, and even a few witty asides to make the process less daunting. Prepare to be informed, entertained, and maybe even slightly amused by the prospect of your own meticulously planned demise (in the best possible way, of course!).

Will Changes in Tax Laws Impact Estate Planning?

Ah, taxes – the one thing guaranteed to bring a smile to the face of… well, no one, really. But their impact on estate planning is undeniably significant, and recent changes have thrown a rather large (and potentially expensive) wrench into the works. Understanding these shifts is crucial for ensuring your carefully crafted plans don’t end up looking more like a game of financial Jenga than a secure legacy.

The potential impact of recent tax law alterations on estate planning strategies is multifaceted and, dare we say, delightfully complex. Changes to estate tax exemptions, gift tax limits, and capital gains taxes can all significantly alter the optimal approach to transferring wealth. For example, a decrease in the estate tax exemption means more estates are subject to this levy, prompting a need for proactive strategies to minimize the tax burden. Conversely, an increase in the gift tax exclusion might allow for more generous lifetime gifting, potentially reducing the size of the taxable estate.

Impact on Different Asset Types

The effect of tax law changes varies considerably depending on the type of asset being transferred. Real estate, for instance, may face different capital gains tax implications under revised legislation. Similarly, the taxation of closely held businesses or valuable collections of, say, vintage rubber ducks, can be substantially altered. A comprehensive estate plan must carefully consider these nuances to optimize tax efficiency. Imagine, for example, a family business passed down through generations. New tax laws might incentivize certain restructuring strategies to minimize future tax liabilities, perhaps through strategic gifting or the establishment of trusts. Conversely, a collection of rare stamps might require a different approach, possibly involving careful consideration of gifting strategies within the annual gift tax exclusion.

Strategies for Mitigating Tax Implications

Mitigating the tax implications of estate transfers requires a proactive and strategic approach. One common strategy is the use of trusts, which can help to manage the distribution of assets and minimize tax liabilities. Irrevocable life insurance trusts (ILITs), for instance, can be incredibly effective in keeping death benefit proceeds out of the taxable estate. Furthermore, careful estate planning can involve the strategic use of charitable giving to reduce the taxable estate. Donating appreciated assets to charity can provide a tax deduction while simultaneously benefiting a worthy cause. This is particularly advantageous if the asset’s value has increased significantly, allowing you to minimize your tax burden while also making a positive impact. Let’s say you own a piece of land that has appreciated substantially. Donating it to a conservation charity could generate a significant tax deduction while preserving a natural area. It’s a win-win, unless you really loved that land. Then it’s more of a “win-and-a-slightly-sad-goodbye.”

Updating Beneficiary Designations on Accounts

Let’s face it, estate planning isn’t exactly a barrel of laughs. But ensuring your assets end up in the right hands after you’re gone? That’s a comedy goldmine…if you don’t mess it up. Regularly reviewing and updating your beneficiary designations is crucial to avoid a hilarious (and heartbreaking) family feud over your prized collection of rubber ducks.

Beneficiary designations determine who receives your assets upon your death, overriding your will in many cases. Outdated designations can lead to unintended consequences, leaving loved ones scrambling for a slice of the pie – a pie that might end up in the hands of your ex-spouse, or worse, a long-lost childhood friend who owes you five dollars from a lemonade stand. Let’s avoid such comedic catastrophes.

Consequences of Outdated Beneficiary Designations

Failing to update beneficiary designations can lead to significant complications and unintended distributions of assets. For instance, if you name an ex-spouse as a beneficiary on a retirement account and then forget to change it after your divorce, that ex-spouse could receive a significant portion of your retirement savings, even if you have remarried and intended for your new spouse or children to inherit. Similarly, if a beneficiary predeceases you, and you haven’t updated the designation, the assets may pass to their estate, potentially triggering unexpected tax implications and further complicating the distribution process. The resulting legal battles could be more entertaining than a three-ring circus, but far less desirable.

A Step-by-Step Guide to Updating Beneficiary Information

Updating beneficiary information is surprisingly straightforward. The specific process might vary slightly depending on the institution, but the general steps remain the same. Remember, it’s always best to contact the institution directly if you have any questions. Procrastination is a comedic villain in this scenario; don’t let it win.

| Account Type | Current Beneficiary | Updated Beneficiary | Date Updated |

|---|---|---|---|

| Retirement Account (401k) | Jane Doe (Ex-Spouse) | John Smith (Spouse) | October 26, 2024 |

| Bank Account (Savings) | John Smith (Spouse) | John Smith (Spouse), Mary Smith (Daughter) | October 26, 2024 |

| Life Insurance Policy | None | John Smith (Spouse), Trust Fund | October 26, 2024 |

| Investment Account (Brokerage) | Jane Doe (Ex-Spouse) | John Smith (Spouse) | October 26, 2024 |

Reviewing and Revising Your Will

Your will, that testament to your brilliant life choices (and perhaps a few questionable ones), shouldn’t be a dusty relic gathering cobwebs in a drawer. Just like a fine wine (or a particularly stubborn stain), it needs occasional attention to ensure it remains relevant and reflects your current wishes – and avoids any potential familial feuds over your prized collection of rubber ducks. Regular review is crucial to keep your estate plan aligned with your ever-evolving life.

Life, as we all know, is a chaotic symphony of unexpected events and occasionally questionable decisions. Your will, therefore, should be treated as a dynamic document, adaptable to the changes life throws your way. Failing to update your will can lead to unintended consequences, potentially leaving your loved ones in a legal and emotional muddle, far from the harmonious distribution of your earthly possessions you envisioned. Think of it as preventative legal maintenance – far better than dealing with the fallout later.

Situations Requiring Will Changes

Several life events necessitate a thorough review and potential revision of your will. These significant milestones often dramatically alter your financial landscape and family dynamics, rendering your previous wishes obsolete. Ignoring these changes can lead to unforeseen complications, potentially causing distress for your heirs and a significant headache for your executors.

- Marriage: “Til death do us part” is a beautiful sentiment, but it significantly impacts your estate plan. Marriage often necessitates updating beneficiaries and considering spousal rights, preventing unintended consequences. For example, failing to update your will after marriage could leave your spouse with nothing, a situation that would likely cause more drama than a reality TV show.

- Divorce: The dissolution of a marriage requires a complete overhaul of your will. Beneficiary designations should be carefully revised, and any provisions made for your ex-spouse should be removed to avoid unwanted distributions. Imagine the awkward family dinners that could result from an oversight here!

- Birth or Adoption of a Child: The arrival of a new family member is joyous, but it also demands an update to your will. Failing to include your new child as a beneficiary could result in them being unintentionally excluded from inheriting, leading to potential family disputes and a significant legal battle.

- Significant Asset Changes: A substantial increase or decrease in assets, such as the purchase of a home, inheritance, or a major business transaction, necessitates a will review. This ensures your assets are distributed according to your current wishes, and prevents your estate from being divided in a manner inconsistent with your intentions.

Will Review Checklist

Before you embark on this crucial task, consider the following points for a comprehensive review of your existing will. This checklist acts as a guide, ensuring you cover all the necessary bases and avoid any nasty surprises down the line. Think of it as your legal spring cleaning, but far less tedious (hopefully).

- Beneficiary Designations: Verify that all beneficiaries are accurately listed and reflect your current wishes. Consider any changes in relationships or circumstances that might warrant alterations.

- Executor and Trustee Appointments: Ensure that the individuals you’ve chosen as executors and trustees are still willing and able to fulfill these roles. Consider appointing alternate individuals in case your primary choices are unavailable.

- Guardianship Provisions: If you have minor children, review the guardianship provisions to ensure they align with your current preferences. Consider any changes in relationships or circumstances that might affect your choice of guardian.

- Asset Distribution: Review the distribution of your assets to ensure it reflects your current intentions. Consider any significant changes in your financial situation or family dynamics.

- Legal Compliance: Ensure that your will complies with all current laws and regulations in your jurisdiction. Laws change, and what was perfectly legal yesterday might not be today.

Digital Asset Management in Estate Planning

In today’s digital age, neglecting your online footprint in your estate plan is like leaving a treasure chest unlocked on a pirate ship – incredibly unwise! Your digital assets, from online banking accounts to cherished social media profiles and even valuable intellectual property, represent a significant part of your overall estate. Failing to plan for their distribution could lead to frustrating legal battles, lost memories, and potentially significant financial losses for your loved ones. Properly managing these digital assets ensures a smooth transition and honors your wishes after you’re gone.

Digital assets are increasingly valuable and require specific planning. These aren’t physical items easily handled by a traditional will; they require a different approach. Think of it as a digital will, a parallel plan to your traditional estate plan, ensuring your digital legacy is as secure as your financial one. This involves not only identifying your digital assets but also outlining how access and control should be transferred after your passing. Without a clear plan, these assets could become inaccessible, lost, or even misused.

Methods for Managing and Transferring Digital Assets

Managing and transferring digital assets involves several key steps. First, you need a comprehensive inventory of your online accounts and digital property. Then, you’ll need to determine how access will be granted to your designated beneficiaries. Finally, you should consider updating account settings and utilizing legal documents to solidify your wishes. This process, while potentially complex, is crucial for protecting your digital legacy.

Creating a Digital Asset Inventory

A well-organized inventory is the cornerstone of effective digital asset management. This inventory acts as a roadmap for your beneficiaries, guiding them through the process of accessing and managing your digital accounts and intellectual property. Without this document, your loved ones could be left fumbling in the digital dark, potentially facing significant challenges in accessing important information or valuable assets.

Sample Digital Asset Inventory Template

Consider using a spreadsheet or a dedicated digital asset management software to create your inventory. Here’s a simple template to get you started:

| Asset Type | Account Name | Username/Email | Password (or Password Manager Information) | Beneficiary | Instructions for Access |

|---|---|---|---|---|---|

| Email Account | [email protected] | [email protected] | [Password Manager Name and Note] | John Doe | Contact Email Provider for Account Transfer |

| Social Media Account (Facebook) | John Smith | johnsmith123 | [Password Manager Name and Note] | Jane Smith | Instructions for Memorialization/Account Deletion |

| Online Banking Account | Acme Bank | johnsmith456 | [Password Manager Name and Note] | Financial Advisor | Contact Bank for Account Transfer |

| Intellectual Property (Copyright) | Novel Manuscript | N/A | N/A | Literary Agent | Copy of Copyright Registration Certificate |

Remember, storing passwords directly in the document is generally discouraged. Instead, utilize a secure password manager and note the manager’s name and any relevant information in the password field. This approach offers a more secure method of managing sensitive information.

Power of Attorney and Healthcare Directives

Let’s face it, nobody wants to think about losing the ability to manage their own affairs. However, life throws curveballs, and having a plan in place is far more sensible than hoping for the best. Power of Attorney and Healthcare Directives are your legal safety nets, ensuring your wishes are respected even if you become incapacitated. Think of them as your legal sidekicks, ready to step in when you can’t.

Power of Attorney and healthcare directives are essential legal documents that allow you to appoint trusted individuals to make decisions on your behalf should you become unable to do so yourself. These documents are particularly crucial for protecting your assets and ensuring your medical care aligns with your preferences during periods of incapacity, providing peace of mind for both you and your loved ones. Without them, the legal process can be lengthy and potentially lead to decisions that don’t reflect your wishes.

Durable Power of Attorney

A Durable Power of Attorney (POA) grants someone you trust (your “agent”) the authority to manage your financial and legal affairs. This power remains in effect even if you become incapacitated. This means your agent can pay bills, manage your bank accounts, handle real estate transactions, and even make important legal decisions on your behalf. Choosing the right agent is paramount; consider someone with strong financial acumen and your best interests at heart. Think of them as your financial superhero, ready to swoop in and handle things when you can’t. Imagine a scenario where you’re unexpectedly hospitalized – a durable POA ensures your bills are paid and your affairs are in order without lengthy legal battles.

Healthcare Power of Attorney (Healthcare Directive)

A Healthcare Power of Attorney (also known as a healthcare directive or advance directive) focuses specifically on your medical care. It designates a person (your “healthcare agent”) to make healthcare decisions for you if you become unable to communicate your wishes. This includes decisions about medical treatment, hospitalization, and end-of-life care. This document is particularly important in ensuring your medical care aligns with your values and preferences. For instance, if you strongly oppose life support, a healthcare directive ensures your wishes are followed, preventing unwanted medical interventions. A well-drafted healthcare directive provides clarity and comfort, preventing potential conflicts and ensuring your medical care reflects your personal beliefs and values. It’s your voice, even when you can’t speak for yourself.

Comparison of Durable Power of Attorney and Healthcare Power of Attorney, Estate Planning Checklist Update

While both documents grant authority to an agent, their scope differs significantly. A Durable POA covers financial and legal matters, while a Healthcare POA focuses solely on medical decisions. It’s entirely possible, and often advisable, to have separate agents for each document, allowing you to select individuals with the appropriate skills and understanding of your needs in each area. For example, you might choose a financially savvy family member for your Durable POA and a trusted healthcare professional for your Healthcare POA. This ensures that each aspect of your life is managed by someone well-equipped to handle the specific responsibilities. It’s a matter of assigning the right person to the right job, ensuring the best possible outcome in any situation.

Long-Term Care Planning

Planning for long-term care is less about anticipating a comfortable retirement and more about preparing for the unexpected – a sudden illness, a debilitating injury, or the slow creep of age-related decline. It’s a topic most people would rather avoid, like that slightly-too-enthusiastic relative who insists on sharing their questionable life advice, but ignoring it can lead to financial ruin and emotional distress for you and your loved ones. Let’s face it, nobody wants to become a burden, especially a financially burdensome one.

Long-term care refers to the ongoing assistance needed when someone can no longer fully care for themselves. This can range from help with bathing and dressing to 24/7 skilled nursing care. The financial and legal aspects are intertwined, demanding careful consideration of various options and their potential impact on your assets. Failing to plan effectively can leave you or your family scrambling to cover exorbitant costs, potentially depleting your savings and jeopardizing your legacy. It’s a bit like forgetting to pack a parachute before skydiving – it might seem fine initially, but the landing is going to be rough.

Types of Long-Term Care and Associated Costs

The cost of long-term care varies dramatically depending on the level of care required and geographic location. A basic home health aide might cost a few hundred dollars a week, while a private room in a skilled nursing facility can easily exceed $10,000 per month. The variations are significant and unpredictable, making careful planning essential.

- Home Healthcare: This involves receiving care in your own home, ranging from occasional visits by a nurse or aide to full-time, around-the-clock assistance. Costs vary widely based on the frequency and intensity of care needed.

- Assisted Living Facilities: These facilities offer a supportive environment with assistance with daily living activities, but residents typically maintain a degree of independence. Monthly costs range significantly depending on location and amenities, but generally fall between $3,000 and $8,000 per month.

- Skilled Nursing Facilities: These facilities provide a higher level of medical care, often necessary for individuals recovering from surgery or managing chronic conditions. Expect to pay considerably more, often exceeding $10,000 per month for a private room in many areas.

- Adult Day Care: Provides daytime supervision and care for individuals who need assistance but live at home. This option is generally less expensive than other forms of long-term care, often costing between $50 and $150 per day.

Strategies for Funding Long-Term Care

Securing sufficient funds for long-term care requires a multi-pronged approach, and it’s not just about having a fat savings account.

- Long-Term Care Insurance: This type of insurance helps cover the costs of long-term care services, but it’s crucial to understand the policy’s details, including benefit levels, waiting periods, and exclusions. Purchasing a policy when you’re younger and healthier usually results in lower premiums.

- Medicaid Planning: Medicaid is a government program that provides financial assistance for long-term care. However, eligibility requirements are strict, and asset limits are relatively low. Careful planning, often involving the use of trusts and other strategies, may be necessary to qualify for Medicaid assistance without unduly depleting assets beforehand. This often requires the help of an estate planning attorney well-versed in Medicaid rules and regulations.

- Personal Savings and Investments: While relying solely on personal savings can be risky, having a substantial nest egg significantly improves your ability to manage long-term care expenses. Diversifying investments and maintaining an emergency fund are crucial.

- Reverse Mortgages: A reverse mortgage allows homeowners to access the equity in their home without selling it. This can provide funds for long-term care expenses, but it’s important to carefully weigh the potential risks and implications before proceeding. The interest accumulates, potentially reducing the equity available to heirs.

Estate Planning for Blended Families

Ah, blended families – the modern masterpiece of love, laughter, and the occasional logistical nightmare. Estate planning in these situations can feel like navigating a minefield blindfolded, but with a little careful planning, you can create a legacy that’s both fair and avoids familial fireworks. The key is proactive communication and a well-structured plan that addresses the unique complexities of multiple families merging their assets and affections.

Blended families introduce a unique set of challenges to estate planning. Unlike traditional families with a single nuclear unit, blended families often involve multiple sets of children, previous spouses, and potentially complex relationships between step-parents and step-children. This complexity necessitates a carefully crafted estate plan that accounts for everyone’s interests and avoids potential disputes over inheritance. Failure to do so can lead to protracted legal battles and lasting family rifts, turning a time of reflection and closure into a protracted and expensive soap opera.

Potential Conflicts in Blended Family Estate Planning

Potential conflicts often stem from a lack of clarity regarding inheritance distribution. Step-children may feel excluded from the inheritance, leading to resentment and legal challenges. Similarly, conflicts may arise between the surviving spouse and the children from a previous marriage regarding the control and distribution of assets. These conflicts can be exacerbated if the estate plan lacks transparency or fails to adequately address the emotional and financial needs of all involved parties. A poorly planned estate can turn a grieving family into warring factions.

Strategies for Mitigating Conflicts

Open communication is paramount. Honest discussions about expectations, desires, and concerns among all family members, ideally facilitated by a qualified estate planning attorney, are crucial to prevent misunderstandings. Transparency in the estate planning process allows everyone to understand the plan and address any concerns proactively. This prevents nasty surprises after the death of the primary breadwinner. A well-drafted estate plan should clearly Artikel the distribution of assets, ensuring fairness and minimizing the potential for conflict. Consideration should be given to all parties involved, including children from previous relationships.

Sample Estate Plan for Blended Families

A sample plan could include a trust to manage assets and provide for the surviving spouse and children from both marriages. The trust could stipulate that a certain portion of the assets be distributed to the surviving spouse for their lifetime, with the remainder distributed to the children upon the spouse’s death. Specific provisions can be made to ensure that step-children are not unfairly excluded, perhaps by creating separate trusts for each child or allocating assets based on specific needs or circumstances. Life insurance policies can also play a vital role in providing financial security for the surviving spouse and children. For example, a policy specifically benefiting the children from the first marriage can address their needs and mitigate potential conflict with the surviving spouse.

Remember: This is a simplified example. A personalized estate plan should be tailored to the specific circumstances of each blended family, considering the size of the estate, the number of children, and the specific needs and desires of each family member. Consulting with an estate planning attorney is crucial to ensure the plan is legally sound and meets the unique needs of your family.

Choosing the Right Estate Planning Professional

Navigating the sometimes-murky waters of estate planning can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially leading to a wobbly end result. Fortunately, you don’t have to go it alone. A skilled professional can guide you through the process, ensuring your wishes are clearly documented and your loved ones are protected. But choosing the *right* professional is crucial. The wrong choice could leave you with more problems than you started with.

The landscape of estate planning professionals is surprisingly diverse, offering a range of expertise and services. Understanding the nuances of each type of professional will help you make an informed decision.

Types of Estate Planning Professionals

Estate planning isn’t a one-size-fits-all affair, and neither are the professionals who assist with it. Attorneys specializing in estate planning possess in-depth legal knowledge and can draft legally sound documents, such as wills and trusts. Financial advisors, on the other hand, often focus on the financial aspects of estate planning, helping clients manage assets and investments to minimize tax liabilities. Certified Financial Planners (CFPs) hold a more rigorous certification and can provide comprehensive financial planning, including estate planning strategies. Some professionals may even offer a combination of these services. Choosing the right type depends on your individual needs and the complexity of your estate. For instance, a simple will might only require an attorney, while a complex estate with significant assets might benefit from a collaborative approach involving both an attorney and a financial advisor.

Selecting a Qualified and Trustworthy Professional

Finding a trustworthy estate planning professional requires diligence. Start by asking for referrals from trusted sources, such as friends, family, or other professionals. Check online reviews and ratings, but remember that these can be subjective. Verify the professional’s credentials and licenses to ensure they are qualified to provide the services you need. Look for professionals who belong to reputable professional organizations, signifying a commitment to ethical practices and continuing education. Consider scheduling consultations with several professionals before making a decision. This allows you to compare their approaches, fees, and communication styles to ensure a good fit. Remember, choosing an estate planning professional is a significant decision; taking your time and conducting thorough research is essential.

Questions to Ask Potential Estate Planning Professionals

Before committing to a professional, it’s vital to ask pertinent questions to assess their suitability and expertise. The answers you receive will help you make an informed decision that aligns with your specific needs and expectations.

| Question | Reason for Asking |

|---|---|

| What are your fees and how are they structured? | Understanding the cost upfront prevents unexpected expenses and allows for budget comparison. |

| What is your experience with cases similar to mine? | Ensures the professional has the necessary expertise to handle your specific situation. |

| What is your approach to estate planning and how do you work with clients? | Understanding their methodology and communication style helps determine compatibility. |

| Can you provide references from past clients? | Allows you to gather independent feedback on the professional’s work and client experience. |

| What are your qualifications and certifications? | Verifies the professional’s credentials and expertise in estate planning. |

| What is your process for updating estate plans as laws change? | Ensures ongoing support and adaptation to legal changes. |

| How do you handle conflicts of interest? | Ensures transparency and ethical practices. |

| What is your availability and response time? | Guarantees accessibility and responsiveness throughout the process. |

Illustrating the Importance of Proactive Estate Planning

Failing to proactively plan for the distribution of your assets can lead to unforeseen complications and significant distress for your loved ones. An outdated or nonexistent estate plan can create a legal and emotional minefield, leaving your family grappling with complex issues at a time when they are already grieving. Proper estate planning isn’t just about money; it’s about ensuring your wishes are respected and your legacy is protected.

The consequences of neglecting estate planning can be far-reaching and deeply impactful. Without a clear plan, the distribution of your assets may be governed by default state laws, which might not align with your intentions. This can result in unintended beneficiaries inheriting your property, leading to family disputes and protracted legal battles. Furthermore, the lack of clear instructions regarding healthcare and financial decisions can leave your family struggling to make crucial choices on your behalf during a time of vulnerability.

Unintended Outcomes from Outdated Estate Plans

An outdated estate plan can lead to several unintended consequences, causing significant financial and emotional hardship for your heirs. For instance, if you’ve had children or experienced a major life change like marriage or divorce since your last will, the document may no longer reflect your current wishes. This could lead to assets being distributed to individuals you no longer wish to benefit, potentially creating conflict among family members. Similarly, changes in tax laws can significantly alter the tax implications of your estate, making an older plan inefficient and potentially costly for your heirs. Ignoring these changes can result in unnecessary tax burdens and reduce the inheritance your loved ones receive.

Hypothetical Scenario: The Case of the Forgotten Will

Imagine Amelia, a successful entrepreneur, who drafted her will twenty years ago. Over the years, she married, had two children, and built a substantial business. However, she never updated her will to reflect these significant life changes. Tragically, Amelia passed away unexpectedly. Her outdated will, which predated her marriage and children, left her entire estate to her parents, who had already passed away. This meant her children, the intended beneficiaries, inherited nothing, and her assets were distributed according to state intestacy laws, resulting in a protracted and emotionally draining legal battle among distant relatives. The lack of a clear power of attorney also meant her business was left in limbo, potentially impacting its value and jeopardizing its future. This scenario illustrates the devastating consequences of failing to update one’s estate plan to reflect life’s changes. The emotional toll on her children, compounded by the significant financial loss, highlights the crucial need for proactive estate planning. This situation could have been easily avoided with regular reviews and updates to her estate plan.

Conclusive Thoughts: Estate Planning Checklist Update

So, there you have it: a slightly less terrifying (and hopefully more amusing) look at estate planning. Remember, proactive planning isn’t just about avoiding family feuds over your prized collection of rubber ducks; it’s about ensuring your wishes are respected and your loved ones are taken care of. While the process might seem overwhelming, breaking it down into manageable steps, as Artikeld above, makes it far less daunting. Now go forth and conquer… your estate planning to-do list! You’ve got this (and maybe a good estate planning lawyer on speed dial).

Q&A

What if I don’t have a will?

Dying intestate (without a will) means the state dictates how your assets are distributed, potentially leading to unintended consequences and family disputes. It’s akin to letting a mischievous gremlin decide your legacy.

How often should I review my estate plan?

Ideally, annually, or whenever significant life changes occur (marriage, divorce, birth, death, major asset purchases/sales). Think of it as a yearly tune-up for your afterlife arrangements.

What are digital assets?

Digital assets encompass online accounts (banking, social media, email), intellectual property, and digital photos. Failing to plan for these can leave your digital footprint in limbo, a sort of digital ghost town.

Do I need a lawyer?

While some simpler estate plans can be handled independently, seeking professional advice is highly recommended, especially for complex situations. A lawyer can ensure your wishes are legally sound and your ducks are in a row (pun intended).