Estate Planning Software Review: Let’s face it, nobody *loves* thinking about their own mortality, but proper estate planning is about as much fun as a root canal without anesthesia. Thankfully, estate planning software aims to alleviate some of that existential dread (and the paperwork!). This review dives into the wild world of digital will-making, exploring everything from user-friendly interfaces to the surprisingly thrilling topic of data security. Prepare for a journey that’s both informative and, dare we say, mildly entertaining.

We’ll dissect the various types of software available – from DIY options that promise to make you the next legal eagle to professional-grade programs that whisper promises of seamless estate management. We’ll compare features, pricing, and user experiences, leaving no digital tombstone unturned. Buckle up, buttercup, it’s going to be a wild ride!

Introduction to Estate Planning Software

Estate planning: the very phrase conjures images of dusty legal tomes, hushed whispers, and the faint scent of expensive mahogany. But thankfully, the 21st century offers a less intimidating (and significantly cheaper) alternative: estate planning software. These digital tools are transforming the way individuals and families navigate the often-complex world of wills, trusts, and power of attorney, making the process more accessible and, dare we say, even enjoyable.

Estate planning software provides a multitude of benefits, ranging from the purely practical to the surprisingly cathartic. Imagine, finally getting those crucial documents in order without the hefty fees of a lawyer, the added convenience of having everything neatly organized in one place, and the peace of mind knowing your wishes are clearly documented. It’s like having a digital legal guardian angel, always ready to assist with the often-overlooked yet critically important task of safeguarding your family’s future.

Types of Estate Planning Software

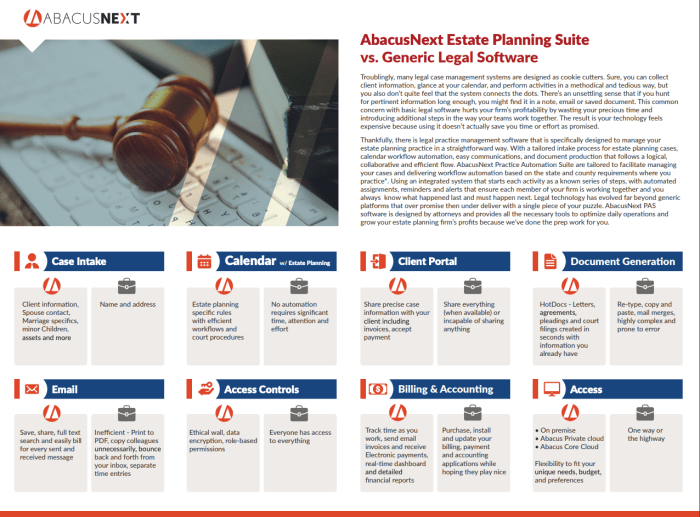

Estate planning software comes in two primary flavors: DIY and professional-grade. DIY software, often marketed towards individuals with straightforward estate needs, typically guides users through a series of questionnaires and templates to create basic wills, trusts, and other essential documents. These programs are designed for simplicity and ease of use, prioritizing accessibility over the intricate complexities of advanced estate planning. Professional-grade software, on the other hand, offers a more robust feature set, catering to individuals with more complex assets or those seeking more sophisticated estate planning strategies. These typically incorporate advanced features such as tax optimization tools and the ability to integrate with professional advisors. Think of it as the difference between assembling a flat-pack bookshelf and commissioning a bespoke mahogany masterpiece.

A Brief History of Estate Planning Software

The evolution of estate planning software mirrors the broader digital revolution. Early versions were rudimentary, often limited to simple will templates and basic guidance. However, as technology advanced, so did the capabilities of this software. The introduction of user-friendly interfaces, integrated legal databases, and sophisticated algorithms transformed these programs from simple document generators into powerful tools capable of handling increasingly complex estate planning scenarios. For example, the incorporation of tax calculation engines and interactive tutorials has made the process far more accessible to the average user. While the early days were marked by simple form filling, today’s software often boasts features that were once the exclusive domain of high-priced legal professionals. This evolution reflects a broader shift towards democratizing access to legal services, empowering individuals to take control of their financial futures.

Key Features of Estate Planning Software

Choosing the right estate planning software can feel like navigating a minefield of legal jargon and confusing features. Fear not, dear reader! We’re here to illuminate the path to digital estate planning enlightenment, armed with wit and a healthy dose of legal know-how (or at least, the semblance thereof). This section will dissect the essential features you should seek in a reputable estate planning software package, comparing and contrasting popular options to help you make an informed decision. Think of us as your trusty Sherpas guiding you through the treacherous terrain of wills, trusts, and beneficiaries.

Estate planning software, at its core, aims to simplify the often daunting process of organizing your affairs for the future. This isn’t about replacing the advice of a qualified estate attorney (that’s a whole different kettle of fish!), but rather providing a user-friendly tool to help you document your wishes and ensure a smoother transition for your loved ones. The features you need will depend on your individual circumstances, but some key functionalities are common to most reputable programs.

Will Creation Capabilities

A robust will creation feature is paramount. Look for software that guides you through the process of outlining your assets, naming beneficiaries, and appointing executors. Ideally, the software should offer various will types (simple, complex, etc.) to cater to diverse needs. Some programs might even offer the ability to generate multiple wills for different jurisdictions, a boon for those with assets spread across state lines. This feature removes the guesswork, providing clear instructions and templates to simplify the process. Poorly designed will creation tools often lead to confusion and potentially invalid documents.

Trust Creation Tools

Beyond simple wills, many sophisticated programs offer trust creation capabilities. This is particularly useful for those with complex assets or who wish to establish trusts for specific purposes (e.g., educational trusts, charitable trusts). However, the complexity of trust law requires careful consideration. While the software can assist with the documentation, it’s crucial to consult with a legal professional to ensure the trust aligns with your specific goals and complies with all relevant regulations. Features like automated trust document generation and interactive guides are highly beneficial.

Beneficiary Designation

Accurately designating beneficiaries is crucial for avoiding potential disputes and ensuring your assets are distributed according to your wishes. High-quality estate planning software facilitates this process by providing clear, organized interfaces for listing beneficiaries and specifying the assets they are to inherit. The software should allow for easy updates and modifications to beneficiary designations, as life circumstances change. Features like alerts for outdated information are valuable additions to prevent errors.

Comparison of Estate Planning Software Packages

The following table compares four popular estate planning software packages. Remember, features and pricing can change, so always verify directly with the software provider.

| Software Name | Key Features | Pricing | User Rating (Example) |

|---|---|---|---|

| EstatePlannerPro | Will & Trust Creation, Beneficiary Designation, Digital Asset Management, Secure Storage | $99 – $299 (One-time Fee) | 4.5 stars |

| LegalZoom | Will Creation, Living Will, Power of Attorney, Basic Trust Options | Variable, Subscription or One-time Fee | 4 stars |

| Quicken WillMaker & Trust | Will & Trust Creation, Asset Inventory, Beneficiary Tracking | $70 – $150 (One-time Fee) | 4.2 stars |

| Trust & Will | Will & Trust Creation, Healthcare Directives, Digital Asset Management | $149 – $349 (One-time Fee) | 4.3 stars |

User Experience and Interface

Estate planning isn’t exactly known for being a barrel of laughs, but the software designed to help navigate it certainly *can* be. A user-friendly interface is paramount; after all, you’re dealing with potentially sensitive and complex information at a stressful time. The right software can make the process significantly less daunting, while the wrong software can feel like wrestling a greased piglet blindfolded.

The importance of intuitive design cannot be overstated. Imagine trying to decipher hieroglyphics while simultaneously trying to remember your great-aunt Mildred’s maiden name – that’s what a poorly designed estate planning software can feel like. A good user experience should guide users through the process smoothly, offering clear instructions and avoiding unnecessary jargon. Think of it as a well-lit, clearly marked path through a potentially confusing jungle – not a treacherous, overgrown maze where you’re constantly battling thorny legal terms.

Guided Workflows versus Interactive Forms

Different software employs different approaches to user interaction. Guided workflows, like a helpful hand holding yours, lead users step-by-step through the process, ensuring nothing is missed. This approach is ideal for those less familiar with estate planning terminology or those who prefer a structured, linear process. Interactive forms, on the other hand, offer a more flexible approach, allowing users to jump between sections and complete tasks at their own pace. This is beneficial for users who are already familiar with estate planning and prefer a more customizable experience. Think of guided workflows as a meticulously planned road trip with a detailed itinerary, and interactive forms as a more open-ended journey with a map but plenty of room for improvisation.

Examples of User Interface Design

Let’s imagine two hypothetical software programs. “EstatePlanPro” boasts a clean, modern interface with clear visual cues, intuitive navigation, and helpful tooltips. Its guided workflow is logical and easy to follow, even for first-time users. The forms are well-organized and use plain language, avoiding legal jargon. In contrast, “Will-o’-the-Wisp” presents users with a cluttered, confusing interface filled with confusing terminology and unhelpful error messages. Navigation is cumbersome, and the forms are poorly organized, leading to a frustrating and potentially error-prone experience. One leaves you feeling empowered and confident, the other leaves you muttering darkly about the vagaries of probate law.

Security and Data Privacy

Estate planning is, let’s face it, a sensitive subject. You’re entrusting incredibly personal and valuable information to software, so the security measures employed should be as robust as Fort Knox (minus the questionable moat maintenance). Failing to prioritize security isn’t just bad business; it’s a recipe for a legal and ethical disaster of Shakespearean proportions.

The software should act as a digital vault, safeguarding your client’s most intimate details from prying eyes. This requires a multi-layered approach, combining technological safeguards with responsible data handling practices. Imagine the chaos if your meticulously crafted will ended up in the wrong hands – a situation easily avoided with proper security protocols.

Crucial Security Measures for Estate Planning Software

Protecting user data necessitates a comprehensive strategy. This isn’t just about passwords; it’s about building a fortress around sensitive information. A robust system needs multiple layers of defense, working in concert to prevent unauthorized access and data breaches.

- Data Encryption: All data, both in transit and at rest, should be encrypted using strong, industry-standard algorithms like AES-256. This ensures that even if data is intercepted, it remains unreadable without the correct decryption key. Imagine a scrambled message only decipherable by a chosen few – that’s encryption in action.

- Access Control: The software should implement granular access controls, limiting access to sensitive data based on user roles and permissions. Only authorized personnel should have access to specific information. Think of it as a sophisticated keycard system, where each user only has access to the areas they need.

- Regular Security Audits: Independent security audits should be conducted regularly to identify and address vulnerabilities. This is like a yearly checkup for your digital fortress, ensuring everything is running smoothly and securely.

- Two-Factor Authentication (2FA): Implementing 2FA adds an extra layer of security, requiring users to provide two forms of authentication before accessing their accounts. This is like having two separate keys to open your digital vault – significantly reducing the risk of unauthorized access.

- Intrusion Detection and Prevention Systems (IDPS): These systems monitor network traffic and system activity for malicious behavior, alerting administrators to potential threats in real-time. It’s like having a watchful guard constantly monitoring the perimeter for any suspicious activity.

Legal and Ethical Considerations Regarding Data Privacy, Estate Planning Software Review

The legal landscape surrounding data privacy is constantly evolving, but the ethical considerations remain steadfast. Estate planning software providers have a moral and legal obligation to protect user data and comply with relevant regulations such as GDPR and CCPA. Failure to do so can result in hefty fines and irreparable damage to reputation.

Hypothetical Security Breach Scenario and Mitigation

Let’s imagine a scenario: A malicious actor gains unauthorized access to the estate planning software database through a cleverly disguised phishing email, exploiting a vulnerability in the system’s login process. This allows them to access wills, trusts, and other sensitive financial information.

A robust estate planning software would mitigate this risk through several key measures:

- Multi-factor authentication would prevent unauthorized access even if the attacker obtained login credentials through phishing.

- Intrusion detection systems would alert administrators to suspicious login attempts, allowing for immediate intervention.

- Data encryption would render the stolen data unreadable, limiting the damage even if the attacker gained access to the database.

- Regular security audits and penetration testing would proactively identify and patch vulnerabilities, reducing the likelihood of successful attacks.

- A comprehensive incident response plan would guide the software provider’s actions in the event of a breach, minimizing further damage and ensuring compliance with legal and regulatory requirements.

Cost and Value

Estate planning software: a worthwhile investment or a frivolous expense? The answer, as with most things in life, depends on your specific circumstances and priorities. Let’s delve into the often-murky waters of pricing and explore whether the software’s value justifies the cost. We’ll weigh the pros and cons against the traditional route of hiring a legal professional, and hopefully, emerge with a clearer understanding of your financial fate.

The pricing models for estate planning software vary wildly, ranging from a one-time purchase offering a lifetime license to recurring subscription fees that could leave your wallet feeling a little… lighter. One-time purchases typically offer a complete package upfront, while subscriptions might offer more ongoing support and updates, but at a potentially higher long-term cost. Think of it like buying a car versus leasing one; each has its own set of advantages and disadvantages.

Pricing Models Comparison

Different software providers employ various pricing strategies. Some offer a simple, straightforward one-time fee for access to all features, while others use a tiered subscription model, offering different feature sets at varying price points. Consider the long-term implications of each approach. A one-time purchase might seem cheaper initially, but a subscription service could offer continuous updates and improvements, potentially justifying the ongoing cost. Choosing between these models requires careful consideration of your budget and long-term needs.

Return on Investment (ROI) Analysis

Calculating the ROI of estate planning software versus hiring a professional requires a nuanced approach. The cost of hiring a lawyer or financial advisor can range significantly depending on location, experience, and complexity of your estate. Software, on the other hand, provides a more predictable cost, although additional costs might arise from needing further professional assistance for more complex situations. The software can often handle simpler estates effectively, representing a significant cost saving compared to professional fees. However, for highly complex estates involving significant assets or intricate family dynamics, professional assistance remains essential, regardless of the software used. Think of it like using a DIY kit versus hiring a contractor for a home renovation; both can achieve a similar outcome, but the time and skill requirements differ dramatically.

Cost-Benefit Analysis

Let’s illustrate the value proposition with a hypothetical cost-benefit analysis. Keep in mind that these figures are illustrative and can vary based on the specific software and professional fees in your area.

| Software Name | Cost | Features Included | Value Proposition |

|---|---|---|---|

| EasyEstatePlan | $199 (one-time purchase) | Will creation, trust creation, beneficiary designation, digital asset management | Cost-effective solution for straightforward estate planning needs. Suitable for individuals with simpler estates. |

| LegacyPro | $9.99/month (subscription) | Will creation, trust creation, advanced tax planning tools, ongoing support | More comprehensive features and ongoing support, but potentially higher long-term cost. Suitable for individuals who value ongoing access to updates and assistance. |

| EstateWise | $499 (one-time purchase) | Will creation, trust creation, advanced asset allocation tools, legal document review | High upfront cost but potentially significant value for individuals with complex estates needing comprehensive planning. |

| Hiring a Lawyer | $3,000 – $10,000+ | Personalized estate plan, legal advice, representation in legal matters | High cost but provides personalized legal expertise and representation, essential for complex estates or high-value assets. |

Note that the figures presented are illustrative and should not be taken as definitive pricing. Actual costs will vary significantly depending on the specific software chosen, the complexity of the estate, and the fees charged by legal professionals in your region. Always conduct thorough research before making any decisions.

Integration with Other Services: Estate Planning Software Review

Estate planning isn’t a solitary activity; it’s a complex financial ecosystem. Therefore, the best estate planning software doesn’t exist in a vacuum. Seamless integration with other crucial financial and legal tools is paramount, transforming a potentially daunting task into a surprisingly streamlined experience. Think of it as assembling a well-oiled financial machine, rather than wrestling with a temperamental jalopy.

The benefits of integration extend beyond mere convenience. A well-integrated system allows for a holistic view of your financial situation, facilitating more informed and accurate estate planning decisions. It reduces the risk of errors caused by manual data entry and reconciliation, saving you time, money, and potential headaches down the line. Essentially, it’s the difference between meticulously hand-drawing a complex blueprint and using sophisticated CAD software.

Tax Software Integration

Integrating estate planning software with tax preparation software offers a significant advantage. The seamless transfer of relevant financial data, such as asset values and beneficiary designations, minimizes the risk of inconsistencies and omissions in tax filings. This integration streamlines the process of calculating estate taxes, gift taxes, and other relevant tax implications, allowing for proactive tax planning and potentially significant tax savings. Imagine having your estate plan automatically update your tax projections – a true marvel of modern technology. This minimizes the chance of unpleasant surprises during tax season, ensuring that your estate plan aligns perfectly with your tax obligations.

Financial Account Aggregation

The ability to aggregate data from various financial accounts, such as bank accounts, investment portfolios, and retirement accounts, directly within the estate planning software is a game-changer. This eliminates the tedious task of manually compiling this information, reducing the likelihood of errors and ensuring that your estate plan reflects your complete financial picture. This feature simplifies the process of identifying and categorizing assets, providing a clear and concise overview of your net worth and facilitating more accurate estate valuation. This is akin to having a single, unified dashboard for all your financial assets, instead of juggling multiple logins and spreadsheets.

Support and Customer Service

Navigating the often-murky waters of estate planning can be daunting, even with the best software. Therefore, reliable and responsive customer support is not merely a desirable feature; it’s an absolute necessity. A well-designed estate planning software program is only as good as the assistance available when you inevitably encounter a snag, a question, or a moment of utter bewilderment (we’ve all been there).

The availability and quality of customer support can significantly impact your overall experience and the success of your estate planning efforts. Imagine, for instance, wrestling with a complex tax calculation within the software, only to find yourself stranded without a lifeline to a helpful human being. The potential for errors, frustration, and even legal complications is substantial. Therefore, choosing a software provider with robust support mechanisms is crucial.

Customer Support Channels

The methods of contacting customer support vary widely among estate planning software providers. Some offer a comprehensive suite of options, while others might limit themselves to a single channel. This section will examine the common channels and their relative merits. A holistic approach usually proves most effective.

- Phone Support: A direct phone line provides immediate access to a knowledgeable representative. This is particularly valuable when dealing with urgent issues or complex problems requiring real-time guidance. However, phone support can sometimes lead to longer wait times, especially during peak hours.

- Email Support: Email allows for a more detailed explanation of your problem, and the opportunity to provide supporting documentation. This is ideal for non-urgent inquiries or situations requiring careful consideration. However, email responses can be slower than other methods.

- Online Chat Support: Live chat offers a convenient and relatively quick way to get assistance. It’s often the best option for simple questions or troubleshooting minor issues. The immediate nature of chat is beneficial, but the interaction is usually less detailed than email or phone support.

Characteristics of Excellent Estate Planning Software Support

Exceptional customer support goes beyond simply answering questions; it’s about providing a positive and helpful experience. Several key characteristics define excellent support in this context.

- Responsiveness: Prompt responses to inquiries are paramount. A provider that consistently replies within a reasonable timeframe demonstrates a commitment to customer satisfaction. For example, a provider aiming for excellence might aim for a response time of under 24 hours for emails and immediate availability for chat.

- Expertise: Support representatives should possess a deep understanding of both the software and the complexities of estate planning. They should be able to provide accurate and helpful guidance, not just generic troubleshooting advice. Imagine a representative who can explain the intricacies of a specific tax form within the software, rather than just stating that the software is “working as intended.”

- Accessibility: Multiple support channels should be available to cater to different preferences and urgency levels. A combination of phone, email, and online chat support provides a flexible and accessible solution for users.

- Proactive Support: Some providers offer proactive support, such as tutorials, FAQs, and knowledge bases, to anticipate and address common issues before they arise. This demonstrates a commitment to customer success beyond simply reacting to problems.

Illustrative Examples of Software Use Cases

Estate planning—a topic as thrilling as watching paint dry, some might say—becomes significantly less daunting with the right software. Let’s explore how these digital wizards can transform the often-overwhelming process into something more manageable, even…dare we say…enjoyable? We’ll examine three diverse scenarios to illustrate the software’s versatility and benefits.

Young Couple Establishing a Will

Imagine a young couple, brimming with optimism and perhaps a slightly less optimistic view of their potential future tax liabilities. They’ve just bought their first home, a charming fixer-upper that requires more elbow grease than their combined salaries can afford. They need a will, but the thought of navigating legal jargon and potential inheritance disputes fills them with the same dread they feel when facing another weekend of DIY projects. Estate planning software simplifies the process. The software guides them through the creation of a straightforward will, clearly outlining options for beneficiaries and asset distribution. It also helps them understand the legal implications of their choices, potentially saving them from expensive consultations with a lawyer. The software’s user-friendly interface allows them to complete the process efficiently, avoiding the stress and time commitment of traditional methods. The resulting will is a legally sound document, ensuring their wishes are carried out even in the unlikely event of a premature demise (knock on wood!). This simple act, facilitated by the software, provides peace of mind, allowing them to focus on more pressing matters, such as choosing the perfect shade of paint for their living room.

Elderly Person Updating Their Estate Plan

Now, let’s consider an elderly individual, perhaps a retired professor with a penchant for collecting rare first editions and an even rarer ability to remember where they put their reading glasses. Their current estate plan, created decades ago, is outdated and no longer reflects their current assets or family situation. The software empowers them to update their will, trust, or power of attorney documents easily and efficiently. The software’s intuitive design and step-by-step guidance ensures the process is accessible, regardless of their technological proficiency. The ability to easily modify existing documents saves them time and the potential frustration of starting from scratch. Features like secure document storage offer peace of mind, knowing their important documents are safe and accessible when needed. This ensures their assets are distributed according to their wishes, even if their memory is less than perfect (we’ve all been there).

Family with Complex Assets

Finally, let’s picture a family with a more intricate estate—think multiple properties, investments, a thriving small business, and perhaps a collection of vintage cars that would make Jay Leno jealous. Traditional estate planning for such complexity can be a logistical nightmare, often involving multiple lawyers and accountants. Estate planning software provides a centralized platform to manage all aspects of their estate plan. The software allows them to meticulously document all their assets, define beneficiaries, and establish clear instructions for the distribution of their wealth. Integration with other financial services can streamline the process further. The software’s robust reporting features provide a clear overview of their financial situation, enabling informed decision-making. The secure storage and accessibility of their documents ensure continuity and prevent potential disputes amongst family members, thus preserving family harmony—a priceless asset indeed.

Concluding Remarks

So, there you have it – a whirlwind tour of the estate planning software landscape. While choosing the right software might not be as exciting as winning the lottery, it’s significantly less likely to leave you with a hefty tax bill (unless, of course, you win the lottery and forget to update your will!). Remember, the best software for you will depend on your individual needs and comfort level. Do your research, compare options, and choose wisely. Your future self (and your heirs) will thank you. Now, if you’ll excuse us, we have a sudden urge to update our own wills… just in case.

FAQ Overview

What happens if my estate planning software provider goes out of business?

This is a valid concern! Look for providers with robust data backup and transfer policies, or consider downloading your documents regularly for safekeeping.

Can I use estate planning software if I have very complex assets?

While some software handles complex situations, highly intricate estates may still require professional legal counsel. Software can be a helpful tool, but not a replacement for expert advice.

Is my data truly secure with estate planning software?

Security varies widely. Look for software with strong encryption, two-factor authentication, and transparent data privacy policies. Read the fine print!

What if I need help using the software?

Reliable customer support is crucial. Check reviews to see how responsive and helpful the provider is before committing.