Expense Tracking Software Review: Let’s face it, nobody *loves* tracking expenses. It’s about as exciting as watching paint dry, unless you’re a paint-drying enthusiast (we don’t judge). But mastering your finances is crucial, whether you’re a penny-pinching individual or a multi-million dollar business. This review dives into the wild world of expense tracking software, exploring the features, benefits, and occasional hilarious mishaps that come with taming those unruly receipts.

From mobile apps that fit snugly in your pocket to desktop behemoths that demand their own desk space, we’ll cover the gamut of options. We’ll also navigate the treacherous waters of pricing models, security concerns, and the all-important question: Can this software actually make budgeting less of a headache? (Spoiler alert: maybe.) Prepare for a journey into the often-chaotic, sometimes-rewarding world of personal and business finance management.

Introduction to Expense Tracking Software

In today’s fast-paced world, where even the most meticulous among us can lose track of a stray coffee purchase or two (or twenty-two), expense tracking software emerges as a beacon of financial sanity. It’s the digital equivalent of a well-organized filing cabinet, but infinitely more charming and less likely to attract dust bunnies. Essentially, it’s software designed to help individuals and businesses record, categorize, and analyze their financial transactions, preventing the dreaded “Where did all my money go?” existential crisis.

Expense tracking software offers a plethora of benefits, transforming the often-dreaded task of budgeting into something almost… enjoyable. For individuals, it’s a lifeline for staying on top of personal finances, aiding in saving for goals (like that dream vacation or finally paying off student loans), and spotting areas where spending could be curbed (we’re looking at you, daily latte habit). Businesses, on the other hand, can leverage this technology to streamline accounting processes, improve cash flow management, identify cost-saving opportunities, and simplify tax preparation—all leading to increased profitability and a healthier bottom line. Think of it as a financial Sherpa, guiding you through the sometimes treacherous terrain of personal or business finances.

Types of Expense Tracking Software

Expense tracking software comes in various flavors to suit different preferences and needs. The choice largely depends on your technological comfort level, the complexity of your financial life, and whether you prefer working on a desktop or on the go.

- Mobile Apps: These user-friendly applications are designed for smartphones and tablets, offering convenience and accessibility. Many popular apps, such as Mint or Personal Capital, provide features like automatic transaction categorization, budgeting tools, and insightful spending reports, all available at your fingertips. Imagine effortlessly tracking expenses while waiting for your morning coffee – pure bliss!

- Desktop Software: For those who prefer a more comprehensive and detailed approach, desktop software provides a more robust set of features. Programs like Quicken or Microsoft Money (though the latter is no longer actively developed) offer advanced functionalities, including investment tracking, tax reporting, and sophisticated budgeting tools. Think of it as having a dedicated financial assistant residing on your computer, ready to answer your every financial query.

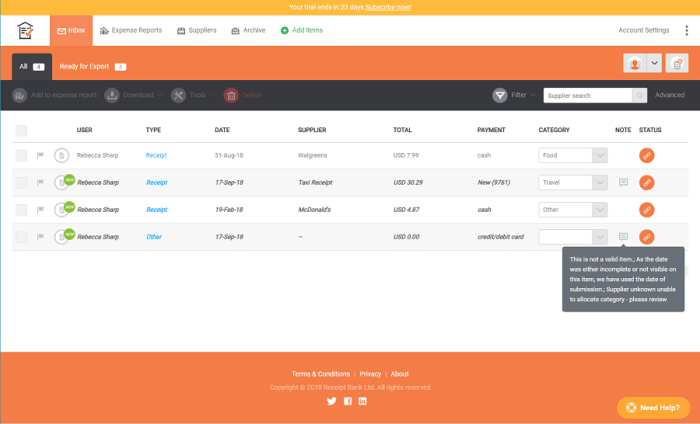

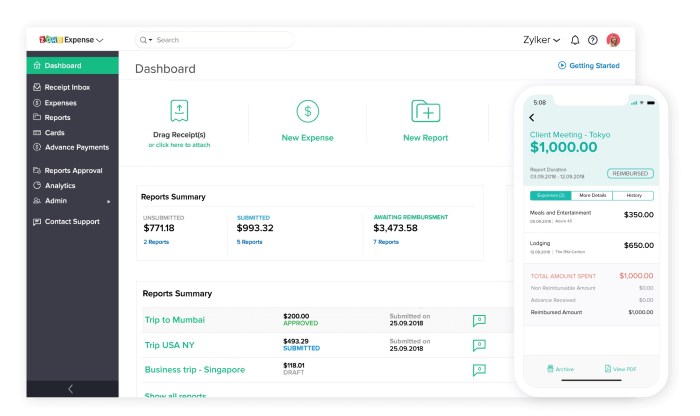

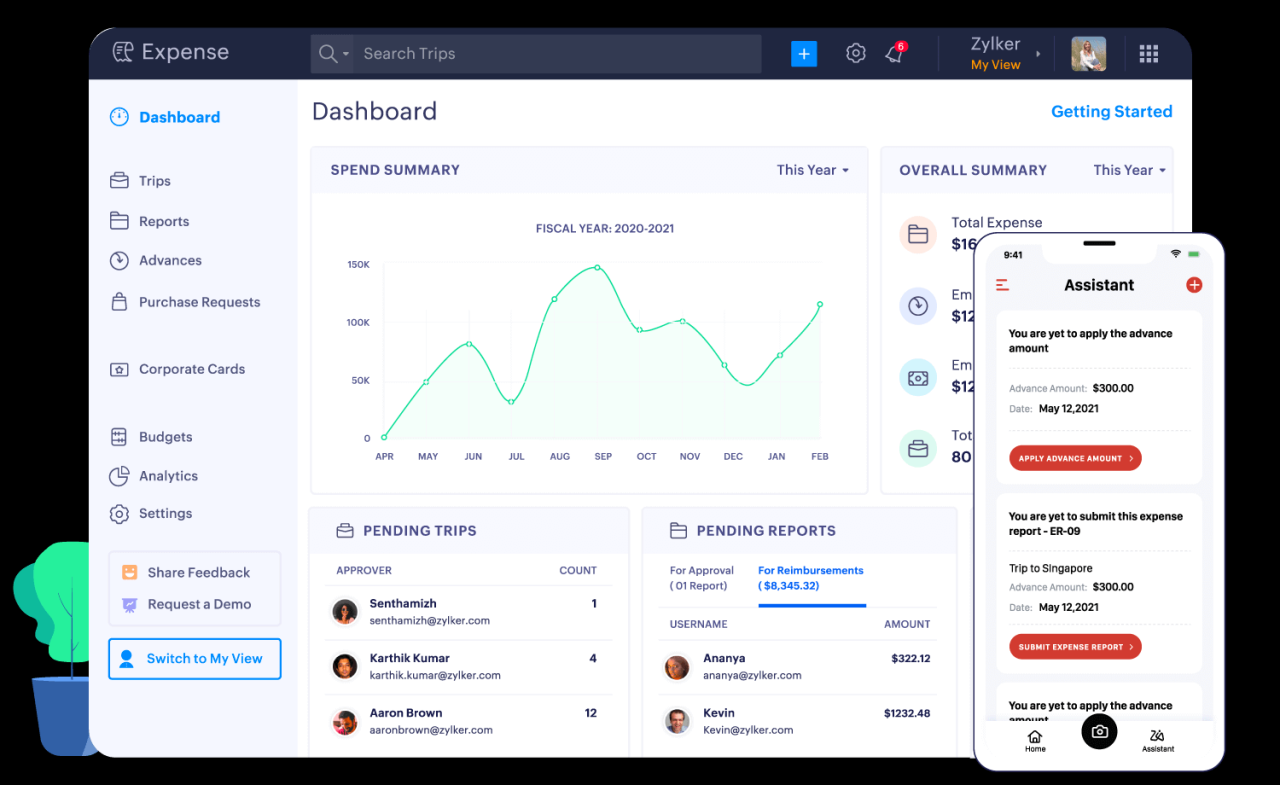

- Cloud-Based Solutions: Cloud-based solutions offer the best of both worlds, combining the accessibility of mobile apps with the power of desktop software. These solutions, such as Xero or Zoho Expense, often include features like real-time collaboration, multi-user access, and secure data storage, making them particularly useful for businesses or individuals who need to share financial information.

Key Features of Expense Tracking Software

Choosing the right expense tracking software can feel like navigating a minefield of spreadsheets and confusing jargon. But fear not, intrepid budgeter! This section will illuminate the essential features that will transform your financial chaos into organized glory. We’ll explore what makes these tools tick, and help you pick the perfect match for your needs, whether you’re a freelancer meticulously tracking deductions or a small business owner wrestling with invoices.

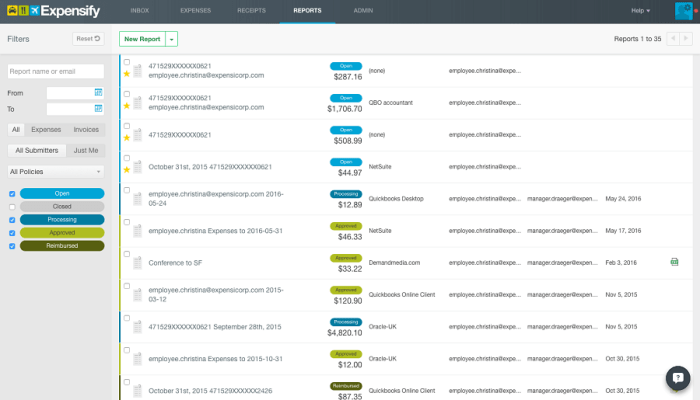

Expense tracking software offers a range of features designed to simplify financial management. These features vary in complexity and availability depending on the specific software, but some core functionalities remain consistent across different platforms. The effectiveness of these tools lies in their ability to automate data entry, provide insightful reports, and integrate seamlessly with other financial applications.

Essential Features of Expense Tracking Software

Let’s delve into the core features you’ll find in most expense tracking software. Think of these as the “must-have” ingredients in your recipe for financial success. Without them, your budgeting efforts might be as tasty as a bowl of lukewarm oatmeal.

| Feature | Mobile App Example (Mint) | Desktop Software Example (Quicken) | Cloud-Based Example (Xero) |

|---|---|---|---|

| Receipt Scanning | Uses phone camera to capture and digitize receipts; automatically extracts key data. | Requires manual data entry or potentially uses a scanner; often integrates with accounting software. | Offers receipt capture via mobile app and uploads; integrates with other Xero services for streamlined accounting. |

| Budgeting Tools | Allows users to set budgets for various categories; provides visual representations of spending versus budget. | Provides detailed budgeting tools, allowing for sophisticated budgeting strategies and forecasting. | Offers budgeting features integrated with accounting, allowing for real-time budget tracking and reporting. |

| Reporting Capabilities | Generates simple reports such as spending by category and monthly summaries. | Produces detailed reports including customizable charts and graphs, profit & loss statements, and balance sheets. | Provides comprehensive reporting, including customizable reports, financial statements, and tax reporting capabilities. |

| Integration with Other Financial Tools | Connects with bank accounts and credit cards for automatic transaction import. | Integrates with various financial institutions and accounting software for comprehensive financial management. | Seamlessly integrates with other Xero services and third-party applications, creating a unified financial ecosystem. |

Advanced Features of Expense Tracking Software

While the essential features are crucial, some advanced functionalities can significantly enhance your financial organization. These features often cater to specific needs and can elevate your expense tracking experience from “good” to “exceptional.” Think of these as the gourmet garnishes that take your financial dish from simple to sublime.

Expense categorization automatically sorts transactions into predefined categories (e.g., food, rent, entertainment), saving you valuable time and effort. Mileage tracking simplifies the process of recording business-related travel expenses, automatically calculating reimbursements based on IRS mileage rates. Subscription management provides a centralized view of all your recurring subscriptions, allowing you to identify and eliminate unnecessary expenses, helping prevent those sneaky “subscription creep” surprises.

Software Selection Criteria: Expense Tracking Software Review

Choosing the right expense tracking software is like choosing the perfect pair of shoes – you need something comfortable, stylish (yes, even software can be stylish!), and that won’t give you blisters (aka, frustration). This section will guide you through the process, ensuring you make a decision that won’t leave you weeping into your spreadsheets.

Selecting the ideal expense tracking software requires careful consideration of several key factors. A poorly chosen program can quickly morph from a helpful tool into a time-consuming headache, leaving you longing for the simplicity of a pen and paper (though, let’s be honest, that’s even more tedious). Let’s navigate this crucial decision-making process with the grace of a seasoned financial ninja.

Decision-Making Flowchart for Expense Tracking Software Selection, Expense Tracking Software Review

The following flowchart provides a visual representation of the decision-making process. Imagine it as a treasure map leading you to the perfect software.

[Imagine a flowchart here. The flowchart would begin with a “Start” box, leading to a decision diamond: “Need Free or Paid Software?”. From there, branches would lead to further decision diamonds considering factors like ease of use, platform compatibility, security features, and customer support. Finally, the flowchart would end with a “Software Selected” box.]

The flowchart illustrates the sequential steps involved in choosing expense tracking software. Each decision point requires careful evaluation based on individual needs and priorities. For instance, the choice between free and paid software directly impacts features and support. Similarly, ease of use is crucial for maximizing efficiency, while security is paramount for protecting sensitive financial data.

Factors to Consider When Selecting Software

Several critical factors influence the suitability of expense tracking software. Ignoring these could lead to regret – and potentially, an audit.

- Ease of Use: Intuitive navigation and user-friendly interfaces are essential. Look for software with clear instructions, minimal jargon, and a streamlined workflow. Imagine wrestling with a complex program – it’s not a fun way to spend your evenings.

- Cost: Expense tracking software comes in various pricing models. Consider your budget and the features offered at each price point. Don’t be afraid to explore free options, but be aware of limitations.

- Platform Compatibility: Ensure compatibility with your devices (desktop, mobile, tablet). Seamless syncing across platforms is a huge time-saver, preventing data silos and frantic data entry.

- Security: Your financial data is sensitive. Choose software with robust security features, including encryption and secure data storage. A breach could be a financial and reputational nightmare.

- Customer Support: Excellent customer support is crucial, especially if you encounter issues. Look for software with responsive and helpful support channels (email, phone, chat).

Comparison of Pricing Models for Expense Tracking Software

Different pricing models cater to various needs and budgets. Understanding these models is crucial for making an informed decision.

- Freemium: Offers basic features for free, with premium features available through a paid subscription. This is like a buffet – you get a taste of what’s on offer, but you pay extra for the main course.

- Subscription-Based: Requires a recurring payment for access to all features. This is similar to a gym membership – you pay regularly, but you get consistent access to all the equipment.

The choice between freemium and subscription-based models depends on your needs and budget. A freemium model might suffice for basic tracking, while a subscription might be necessary for advanced features and extensive support. Consider the long-term cost and value proposition of each model. For example, if you are a freelancer needing robust invoicing features, a subscription-based model might be a better value than a free model with limited features.

User Reviews and Comparisons

Navigating the world of expense tracking software can feel like trying to balance a checkbook on a unicycle – exhilarating, potentially disastrous, and definitely requiring a steady hand. To help you avoid a financial wipeout, we’ve delved into the bustling marketplace of user reviews to bring you a clear-eyed comparison of popular options. Remember, the “best” software is subjective and depends on your individual needs, but user feedback provides invaluable insights.

User reviews offer a candid, unvarnished look at the real-world experience of using these apps. They reveal hidden glitches, highlight unexpected delights, and ultimately, paint a more accurate picture than any marketing brochure ever could. This section dissects common praises and complaints, offering a realistic perspective on the strengths and weaknesses of various programs.

Popular Expense Tracking Software: A Comparative Analysis

Before diving into specific examples, it’s crucial to understand that user experiences are varied. Factors such as technical proficiency, accounting background, and the complexity of individual financial situations significantly influence satisfaction levels. This analysis aims to present a balanced perspective gleaned from a wide range of user feedback.

- Mint: Mint, a free service, boasts a large user base and generally positive reviews for its ease of use and attractive interface. Pros include automatic transaction importing and a clear visual representation of spending habits. Cons often cite limitations in customization options and occasional syncing issues. One user commented, “It’s great for a quick overview, but lacks the depth I need for detailed budgeting.” Another praised its “intuitive design and helpful visualizations.”

- Personal Capital: This software offers more advanced features than Mint, including investment tracking and retirement planning tools. Pros include its comprehensive features and robust reporting capabilities. However, cons often center around the learning curve for its more advanced functions and the requirement for a higher level of financial literacy to fully utilize its potential. One user described it as “powerful but overwhelming,” while another stated, “Once I learned how to use it, it became invaluable.”

- YNAB (You Need A Budget): YNAB, while not free, is lauded by many users for its unique zero-based budgeting approach. Pros include its emphasis on mindful spending and its ability to help users gain control of their finances. Cons often revolve around the time commitment required to set up and maintain the budget, as well as the subscription cost. One user described it as “life-changing,” while another complained, “It’s too much work for me.”

Common User Praises and Complaints

The chorus of user voices reveals recurring themes. Positive feedback frequently highlights ease of use, intuitive interfaces, and helpful features like automatic import and insightful reporting. Conversely, common complaints include syncing problems, limitations in customization, inadequate customer support, and, of course, the dreaded bug.

- Ease of Use: Many users praise intuitive interfaces and straightforward navigation, making expense tracking less of a chore and more of a manageable task.

- Data Visualization: The ability to visually represent spending habits through charts and graphs is a frequently cited benefit, offering a clear picture of financial health.

- Automatic Imports: The automatic import of transactions from bank accounts and credit cards is a significant time-saver, freeing up users from manual data entry.

- Syncing Issues: Problems with syncing data across devices are a common complaint, leading to frustration and data inconsistencies.

- Customer Support: Inadequate or unresponsive customer support is a frequent source of user dissatisfaction.

- Limited Customization: The lack of customization options can restrict users from tailoring the software to their specific needs.

Illustrative User Testimonials

To further illuminate the user experience, here are a couple of examples pulled directly from online reviews (names have been omitted to protect the innocent, or at least, their privacy):

“Mint is fantastic for a quick overview of my finances, but it’s missing the advanced features I need for serious budgeting. It’s like having a cute puppy that can’t fetch the newspaper – adorable, but not entirely useful.”

“YNAB changed my relationship with money. It’s not just an app; it’s a financial philosophy. Yes, it takes time, but the results are worth it.”

Integration with Other Tools

The ability of your expense tracking software to play nicely with other financial tools is crucial; it’s the difference between a mildly helpful app and a financial superhero sidekick. Think of it like this: a lone ranger might be effective, but a well-coordinated team conquers the Wild West (or, in this case, your finances). Seamless integration eliminates the tedious task of manual data entry, freeing you up for more important things, like counting your savings (or planning your next vacation).

Seamless integration with other financial tools significantly improves the efficiency and accuracy of financial management. This reduces the likelihood of errors caused by manual data transfer and provides a holistic view of your financial situation. Different integration methods offer various levels of automation and complexity.

API Integration

API (Application Programming Interface) integration allows for direct, real-time data exchange between the expense tracker and other applications. This is generally the most robust and efficient method. Imagine a well-oiled machine: data flows effortlessly between your banking app, accounting software, and expense tracker, updating automatically. This eliminates manual data entry and ensures that all your financial information is consistently up-to-date. For example, a well-integrated system might automatically import transactions from your bank account into your expense tracker, categorizing them based on pre-defined rules or machine learning algorithms. The benefits include increased accuracy, reduced manual effort, and a more comprehensive financial overview. However, API integration requires technical expertise for setup and may not be available for all software combinations.

File Import/Export

File import/export methods, such as CSV or Excel files, offer a simpler alternative to API integration. This method involves manually exporting data from one application and importing it into another. While less sophisticated than API integration, it is generally more widely compatible and easier to set up. Think of it as a slightly more manual, but still effective, way of transferring data. For instance, you could export your bank statement as a CSV file and then import it into your expense tracking software. However, this method is prone to errors due to manual intervention and can be time-consuming, especially for large datasets. The lack of real-time updates also means your financial overview may not always reflect the most current information.

Streamlining Financial Management Through Integration

Effective integration streamlines financial management by providing a centralized platform for all financial data. This eliminates the need to juggle multiple applications and spreadsheets, saving you time and reducing the risk of errors. Consider the scenario of a small business owner who uses separate software for accounting, banking, and expense tracking. With seamless integration, they can easily track expenses, reconcile bank statements, and generate financial reports all within a unified system. This unified view provides a clearer understanding of their financial health and facilitates better decision-making. Furthermore, this holistic approach reduces the time spent on administrative tasks, allowing them to focus on the core aspects of their business.

Security and Privacy Considerations

Protecting your financial data is paramount when using expense tracking software. After all, you wouldn’t want your meticulously documented latte purchases to fall into the wrong hands – unless, of course, those hands belong to a particularly generous benefactor. Let’s delve into the security aspects of these handy applications, ensuring your financial secrets remain, well, secret.

Expense tracking software, while incredibly convenient, presents several potential security risks. These range from the relatively mundane (a forgotten password) to the more sinister (data breaches and malicious software). The sensitive nature of financial information demands a rigorous approach to security, and a little bit of healthy paranoia never hurt anyone (except maybe the paranoia itself).

Data Breaches and Unauthorized Access

Data breaches are a significant concern for any software handling sensitive information. Imagine the chaos if a hacker gained access to your expense records, potentially revealing far more than just your penchant for overpriced artisanal cheeses. Robust security measures, such as multi-factor authentication (requiring more than just a password for login), encryption both in transit and at rest, and regular security audits, are crucial to mitigating this risk. Reputable providers invest heavily in these safeguards, but it’s always wise to check their security certifications and publicly available security reports. For example, a provider boasting SOC 2 Type II compliance demonstrates a commitment to robust security practices.

Malware and Phishing Attacks

Malicious software (malware) can compromise your system and potentially steal your financial data. Phishing attempts, disguised as legitimate emails or messages from your expense tracking provider, can trick you into revealing your login credentials. Best practices include using strong, unique passwords, regularly updating your software, and being wary of suspicious emails or links. Think twice before clicking that email promising a free upgrade – it might be a Trojan horse in disguise.

Privacy Policies and Data Handling

Understanding the provider’s privacy policy is crucial. Reputable providers will clearly Artikel how they collect, use, and protect your data. Look for transparency regarding data storage location, data retention policies, and how they handle data requests. Some providers might offer more granular control over data sharing than others, allowing you to choose which data points are synced with other applications. Consider whether the level of data protection aligns with your comfort level and risk tolerance. A provider’s commitment to GDPR or CCPA compliance is a positive sign.

Comparison of Security Features

Different expense tracking software providers offer varying levels of security. Some might utilize end-to-end encryption, while others might rely on less secure methods. Features such as two-factor authentication, password managers integration, and regular security updates are key indicators of a provider’s commitment to security. A thorough comparison of the security features offered by different providers should be a key component of your selection process. For example, one provider might offer biometric authentication, adding an extra layer of protection compared to a provider relying solely on passwords.

Illustrative Examples of Software Use Cases

Expense tracking software isn’t just for accountants; it’s a versatile tool that can tame the wild beast of personal and business finances. Let’s explore how different individuals and businesses can harness its power to achieve financial clarity and, dare we say, even a touch of joy (yes, joy!). We’ll delve into three distinct scenarios, showcasing the software’s adaptability and demonstrating the significant benefits it offers.

The following examples illustrate how various features of expense tracking software can be tailored to meet the unique demands of different financial contexts. We’ll see how seemingly simple tools can transform financial management from a tedious chore into a streamlined and insightful process.

Personal Finance Management: The “Accidental Millionaire”

Imagine Amelia, a freelance graphic designer with a penchant for artisanal cheese and vintage vinyl. Her income fluctuates, making budgeting a chaotic game of guesswork. Enter expense tracking software.

- Feature Utilized: Categorization and budgeting tools. Amelia meticulously categorizes every expense – from client invoices to that surprisingly expensive block of cheddar. The software automatically generates reports, revealing spending patterns she never noticed before.

- Outcome: Amelia discovers her vinyl habit is a significant drain on her savings. Using the software’s budgeting features, she sets realistic spending limits for each category, achieving a healthier financial balance. She’s even started a small emergency fund!

- Benefits Realized: Increased financial awareness, improved budgeting, reduced impulsive spending, and a growing sense of control over her finances. She’s well on her way to becoming an “accidental millionaire” (or at least, a more financially secure graphic designer).

Small Business Expense Tracking: The “Organized Entrepreneur”

Meet Ben, the owner of “Ben’s Books,” a charming independent bookstore. He’s great at selling books, but bookkeeping? Not so much. He needs a system that simplifies expense tracking and generates reports for tax season.

- Feature Utilized: Receipt scanning, automated expense categorization, and report generation. Ben uses the software’s mobile app to scan receipts instantly. The software automatically categorizes expenses, saving him hours of manual data entry. At tax time, generating reports is a breeze.

- Outcome: Ben gains a clear overview of his business’s financial health. He identifies areas where he can cut costs and optimize pricing. He submits accurate tax returns without the usual last-minute panic.

- Benefits Realized: Streamlined bookkeeping, accurate financial reporting, improved cost management, and reduced stress during tax season. Ben is now the envy of other bookstore owners, known as the “Organized Entrepreneur.”

Freelance Work Expense Management: The “Globally Mobile Freelancer”

Consider Chloe, a software developer who works remotely for clients worldwide. Tracking expenses across different currencies and projects is a logistical nightmare without the right tools.

- Feature Utilized: Multi-currency support, project-based expense tracking, and invoicing features. Chloe tracks expenses for each client project separately, using the software’s multi-currency capabilities to manage international transactions. She seamlessly integrates invoicing features to streamline her billing process.

- Outcome: Chloe accurately tracks her income and expenses for each project, simplifying her tax preparation and client billing. She can easily demonstrate the value she provides to her clients, leading to increased client satisfaction and repeat business.

- Benefits Realized: Accurate project costing, simplified invoicing, improved client communication, and stress-free tax preparation. She’s now a celebrated “Globally Mobile Freelancer,” jet-setting around the world while maintaining impeccable financial records.

Last Recap

So, there you have it – a whirlwind tour of the expense tracking software landscape. While the process might not be the most thrilling, the right software can transform your financial life from a chaotic mess into something resembling…order. Remember, choosing the right tool is key. Consider your needs, your budget (ironic, we know), and your tolerance for mildly annoying software glitches. And above all, remember to celebrate those small victories – like successfully scanning that crumpled receipt from last Tuesday’s questionable taco truck.

Query Resolution

What if I don’t have many expenses to track?

Even minimal tracking can offer valuable insights. Many free options exist for basic needs.

Can I use expense tracking software for tax purposes?

Yes, many programs help organize receipts and generate reports suitable for tax preparation. Consult a tax professional for specific advice.

What about data security? Is my financial information safe?

Reputable software providers prioritize data security with encryption and other safeguards. Read reviews and privacy policies carefully.

Is there a free option that’s actually good?

Many offer free versions with limited features. Consider your needs to determine if a free or paid option better suits you. “Free” often comes with limitations.