Financial Advisor Software: Ah, the digital Swiss Army knife for the financially astute! No longer are spreadsheets and frantic calculations the norm. This exploration delves into the wonderful world of software designed to streamline client management, boost efficiency, and (dare we say it) even make financial planning a little less… terrifying. Prepare for a journey into a realm where algorithms replace late nights and insightful data replaces gut feelings.

This guide will dissect the core functionalities of various financial advisor software options, from CRM systems to sophisticated portfolio management tools. We’ll examine the key features that set them apart, explore the benefits for both advisors and clients, and navigate the sometimes-treacherous waters of cost, integration, and security. Buckle up, it’s going to be a wild ride (a financially responsible one, of course).

Defining Financial Advisor Software

Let’s face it, managing finances isn’t exactly a barrel of laughs. Unless you’re a numbers whiz with a penchant for spreadsheets (and who is?), financial advisor software can be a lifesaver, a digital Swiss Army knife for your wealth-building endeavors. It streamlines the often-chaotic world of personal finance, transforming it into something… dare we say… manageable?

Financial advisor software encompasses a range of tools designed to help financial professionals – and increasingly, savvy individuals – organize, analyze, and manage financial data. Think of it as the ultimate financial sidekick, offering a blend of efficiency and insight to navigate the complexities of investments, planning, and client relationships.

Core Functionalities of Financial Advisor Software

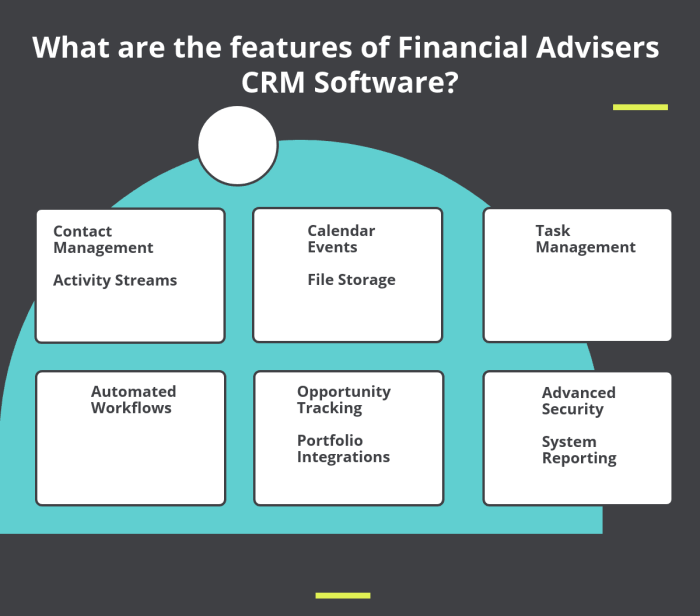

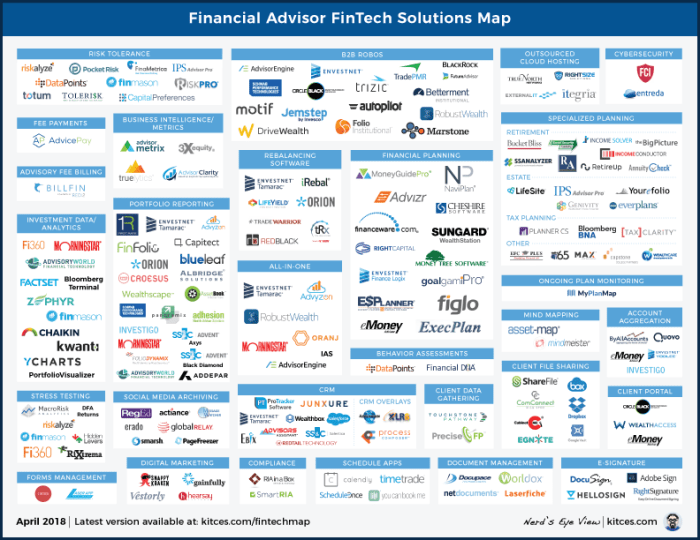

Typical financial advisor software offers a suite of features designed to tackle the multifaceted nature of financial management. These functionalities often include client relationship management (CRM), portfolio management tools, financial planning capabilities, and reporting features. Some software also integrates with other financial platforms, allowing for a seamless workflow. Imagine a well-oiled machine, humming along smoothly, effortlessly churning out reports and projections – that’s the promise of good financial software.

Types of Financial Advisor Software

The market offers a variety of specialized software catering to different needs. Client Relationship Management (CRM) software focuses on organizing and interacting with clients, keeping track of everything from birthdays to investment preferences. Portfolio management software is geared towards tracking investment performance, analyzing risk, and generating reports. Finally, financial planning software allows advisors to create comprehensive financial plans for clients, projecting future scenarios and suggesting strategies for achieving financial goals. Each type brings a unique set of advantages to the table, allowing advisors to tailor their technology to their specific practices. Think of it as choosing the right tool for the job – a hammer for nails, a screwdriver for screws, and a really fancy, high-powered laser for… well, maybe not that last one.

Key Differentiating Features of Financial Advisor Software

Choosing the right software can feel like navigating a minefield of features and specifications. Key differentiators include the level of integration with other platforms, the sophistication of reporting capabilities, the user-friendliness of the interface, and the overall cost. Some software packages boast robust automation features, saving advisors valuable time and reducing the risk of human error. Others excel in their analytical capabilities, offering advanced modelling and forecasting tools. The best software will depend on the specific needs and preferences of the advisor or individual user, making careful consideration crucial for a successful implementation. Selecting the right software is akin to choosing the perfect pair of shoes – comfort, style, and functionality all matter.

Benefits and Use Cases

Let’s face it, managing finances is about as thrilling as watching paint dry. Unless, of course, you’re using financial advisor software. Then, it’s more like watching paint dry… but with significantly less paperwork. This software offers a plethora of benefits, transforming the often-tedious world of financial advising into something approaching… manageable.

Financial advisor software streamlines various aspects of the financial advisory process, boosting efficiency and improving client relationships. The advantages are numerous, impacting both the advisor and the client in profound (and surprisingly enjoyable) ways. Imagine a world where you don’t spend your weekends wrestling with spreadsheets – it’s within reach!

Client Management Enhancements

Efficient client management is the cornerstone of any successful financial advisory practice. Financial advisor software significantly enhances this process by centralizing client information, automating tasks, and providing tools for better communication. This leads to improved accuracy, reduced errors, and ultimately, happier clients. For example, imagine effortlessly tracking all client assets, liabilities, and transactions in one secure location, accessible from anywhere with an internet connection. No more frantic searches through filing cabinets! This software also facilitates automated reporting, eliminating the manual effort and reducing the risk of human error.

Efficiency Improvements

The time saved by using financial advisor software is nothing short of miraculous. Imagine the hours reclaimed from manually inputting data, generating reports, and chasing down missing information. This newfound efficiency allows advisors to focus on higher-value activities, such as strategic planning and client interaction. Specific examples include automated portfolio rebalancing, streamlined tax preparation processes, and the instant generation of personalized client reports. This increased efficiency translates directly to increased profitability and a better work-life balance for advisors.

Impact on Client Relationship Management (CRM)

Financial advisor software dramatically improves client relationships. The software provides tools for personalized communication, allowing advisors to tailor their interactions to each client’s specific needs and preferences. Features such as automated email reminders for upcoming meetings or personalized financial updates foster stronger client relationships and improve client retention. Imagine the impact of proactive communication – sending clients personalized reports outlining their progress towards their financial goals, making them feel valued and informed. This enhanced communication leads to increased client satisfaction and loyalty.

Advisor vs. Client Benefits

| Advisors | Clients |

|---|---|

| Increased efficiency and productivity | Improved understanding of their financial situation |

| Reduced administrative burden | Personalized financial advice tailored to their needs |

| Improved client relationship management | Increased transparency and access to their financial information |

| Better data security and compliance | Proactive communication and timely updates |

| Enhanced decision-making capabilities | Greater confidence in their financial future |

Key Features and Functionality

Choosing the right financial advisor software is like picking the perfect pair of shoes – you need something comfortable, supportive, and stylish enough to impress your clients (and maybe even yourself!). A robust system goes beyond simple spreadsheets; it’s your digital command center for managing client portfolios, generating reports, and ensuring compliance. Let’s delve into the essential features that transform data into actionable insights and make your life (significantly) easier.

The core functionality of effective portfolio management software revolves around its ability to efficiently track, analyze, and manage investments. This includes features that streamline client onboarding, consolidate data from multiple sources, and provide a clear, concise overview of each client’s financial picture. Think of it as a highly organized, always-up-to-date filing cabinet, but with significantly more pizzazz (and less paper cuts).

Portfolio Management Capabilities

A robust system allows for the seamless input and tracking of various asset classes, including stocks, bonds, mutual funds, real estate, and even alternative investments like cryptocurrencies (if you’re feeling adventurous!). It should also facilitate the creation and management of personalized portfolios tailored to individual client needs and risk tolerance. Imagine effortlessly rebalancing portfolios based on market fluctuations, all within a single, user-friendly interface. This eliminates the tedious manual calculations and spreadsheet juggling that can lead to errors and headaches. Furthermore, sophisticated features like tax-loss harvesting optimization can further enhance portfolio performance. For example, the software might automatically identify and suggest tax-loss harvesting opportunities, maximizing your clients’ after-tax returns.

Reporting and Analytics

Reporting and analytics are the heart and soul of effective financial planning. These features allow you to not only track performance but also to visualize trends and identify potential areas for improvement. Comprehensive reports, easily customizable to meet specific client needs and regulatory requirements, are essential. Imagine generating client-ready reports with a single click, complete with personalized charts and graphs illustrating portfolio performance, asset allocation, and projected future growth. Advanced analytics might include risk assessment models, scenario planning tools, and even predictive analytics to anticipate market shifts and adjust strategies accordingly. For instance, a sophisticated system could forecast the potential impact of rising interest rates on a client’s bond portfolio, allowing for proactive adjustments.

Hypothetical Workflow Example

Let’s imagine a scenario: A new client, let’s call him Barry, comes to you seeking financial advice. First, you would use the software to onboard Barry, securely inputting his personal information and financial data. Then, based on Barry’s goals (early retirement, a new yacht, funding his children’s education), the software helps you construct a suitable portfolio. The software then automatically tracks Barry’s investments, generating regular performance reports that you can easily share with him. If the market takes a downturn, the software might suggest rebalancing strategies to mitigate risk, and you can use the built-in reporting tools to explain these adjustments clearly to Barry, maintaining transparency and trust.

Compliance and Security Features, Financial Advisor Software

Security and compliance are paramount in the financial industry. The software should offer robust security measures, including encryption, multi-factor authentication, and audit trails, ensuring the confidentiality and integrity of client data. Compliance features should streamline the process of meeting regulatory requirements, such as maintaining accurate records and generating compliant reports. These features might include automated data backups, secure document storage, and integration with compliance databases. For example, the software might automatically flag any transactions that trigger regulatory reporting requirements, ensuring you stay ahead of the curve and avoid potential penalties.

Integration and Compatibility

Choosing financial advisor software is like choosing a financial instrument – you need it to play nicely with your existing portfolio! Successful implementation hinges not just on the software’s intrinsic capabilities, but also on its ability to seamlessly integrate with your current tech ecosystem. A poorly integrated system can quickly become a frustrating, time-consuming, and frankly, money-losing proposition.

Software integration ensures data flows smoothly between different applications, preventing the dreaded data silos that can lead to inaccurate reporting, missed opportunities, and a general sense of mild financial chaos. Imagine trying to balance your checkbook with information scattered across five different spreadsheets – it’s a recipe for disaster! A well-integrated system, on the other hand, presents a unified view of your client data, allowing for efficient workflow and informed decision-making. Compatibility, in this context, refers to the software’s ability to interact effectively with various operating systems, browsers, and other technologies used in your practice.

Software Integration with Other Financial Tools

The importance of seamless data exchange between your financial advisor software and other crucial tools cannot be overstated. Think of it as the circulatory system of your financial practice; if the blood (data) doesn’t flow freely, the whole organism suffers. Poor integration leads to duplicated efforts, increased risk of errors, and a significant drain on your valuable time. Efficient integration, conversely, streamlines processes, reduces manual data entry, and enhances overall productivity. This allows you to focus on what truly matters: providing exceptional service to your clients and growing your business. A smoothly functioning system allows for the automated transfer of client data, eliminating manual entry and reducing the risk of human error. This translates directly to cost savings and improved accuracy.

Compatibility Across Platforms

Different financial advisor software options boast varying levels of compatibility with various platforms. Some might seamlessly integrate with Windows, macOS, and iOS devices, while others may struggle to communicate even across different browsers. Consider the needs of your team and clients; if your team primarily uses Macs, choosing software with robust macOS compatibility is essential. Similarly, if your clients primarily access information through mobile devices, ensuring compatibility with iOS and Android is crucial. Compatibility issues can manifest in various ways, from simple display problems to complete system malfunctions. Careful research into a software’s compatibility profile before committing is a critical step in preventing future headaches. For instance, a software lacking compatibility with a widely used CRM could lead to significant workflow inefficiencies.

Integration Challenges and Solutions

Integration isn’t always a walk in the park. Challenges can range from simple incompatibility between APIs (Application Programming Interfaces) to more complex data format differences. For example, one common issue is the mismatch between the data formats used by different applications. This can lead to data loss or corruption during the transfer process. Solutions typically involve employing data transformation tools to convert data into compatible formats. Another challenge is ensuring data security during the integration process. Sensitive client information must be protected at all times. Solutions include implementing robust security protocols and using encrypted data transfer methods. A well-designed integration strategy addresses these challenges proactively, minimizing disruptions and ensuring data integrity.

Essential Integrations

A robust financial advisor software should integrate smoothly with several essential tools to maximize efficiency and effectiveness.

- CRM (Customer Relationship Management): A seamless CRM integration allows for efficient client management, tracking interactions, and managing client portfolios effectively.

- Accounting Software: Integration with accounting software streamlines financial reporting and ensures accurate tracking of income and expenses.

- Portfolio Management Systems: Direct integration with portfolio management systems allows for real-time portfolio updates and performance analysis.

- Document Management Systems: Integration with secure document management systems facilitates efficient storage and retrieval of client documents.

- Compliance Software: Integration with compliance software helps ensure adherence to regulatory requirements and minimizes the risk of non-compliance.

Cost and Pricing Models

Choosing the right financial advisor software isn’t just about finding the shiniest bells and whistles; it’s about finding the perfect fit for your budget, too. Navigating the world of pricing models can feel like deciphering a cryptic financial document, but fear not! We’ll break down the common approaches and help you avoid those sneaky hidden costs that can spring up like unwelcome weeds in your perfectly manicured financial garden.

Software pricing models are as diverse as the financial instruments they help manage. Understanding these models is crucial for making an informed decision that aligns with your firm’s size, needs, and, of course, your bottom line. A mismatch between software capabilities and your budget can lead to either underutilized features (a costly oversight) or a system that strains your resources.

Subscription-Based Pricing

Subscription models, often billed monthly or annually, are the most prevalent. They typically offer tiered pricing, with higher tiers unlocking more advanced features and greater user capacity. This approach provides predictable budgeting and allows for easy scaling as your business grows. Think of it as a gym membership – you pay regularly for access to the equipment (software features) and can adjust your membership level as needed. For example, a small advisory firm might start with a basic plan, while a larger firm would opt for a premium package with features like advanced reporting and client portal integrations. The flexibility is a key advantage.

One-Time Purchase Pricing

This model involves a single upfront payment for the software license. While seemingly appealing for its simplicity, it often lacks the ongoing support, updates, and feature enhancements that subscription models provide. Imagine buying a powerful but outdated computer – it might work for a while, but you’ll quickly miss out on new technologies and security patches. One-time purchase models are usually a less flexible option, particularly if your needs evolve. This model might suit smaller firms with very specific, unchanging needs.

Cost-Effectiveness Comparison

Comparing the cost-effectiveness of different software options requires a careful assessment of several factors. A lower upfront cost for a one-time purchase might seem attractive, but factor in the potential for increased long-term maintenance costs, the lack of updates, and the risk of incompatibility with future technologies. Conversely, a subscription model, while involving recurring payments, offers continuous support, regular updates, and often access to new features, potentially boosting efficiency and reducing long-term operational costs. Ultimately, the most cost-effective solution depends on your firm’s specific needs and growth trajectory.

Hidden Costs of Software Implementation and Maintenance

Ah, the hidden costs – the mischievous gremlins that can derail even the most meticulously planned budget. These often-overlooked expenses include data migration (transferring your existing client data to the new system), customization (tailoring the software to your specific workflows), training (educating your staff on how to use the software effectively), ongoing technical support (troubleshooting issues and receiving assistance), and potential integration costs (connecting the software with other systems you use). These can significantly add to the total cost of ownership, so careful planning and budgeting are essential. For instance, migrating a large database of client information can be unexpectedly time-consuming and costly, requiring specialized expertise. Underestimating these hidden costs can lead to unpleasant budget surprises.

Selecting the Right Software

Choosing the perfect financial advisor software is like finding the ideal Swiss Army knife – it needs to be versatile, reliable, and not leave you with a paper cut every time you use it. The wrong software can lead to more headaches than a tax audit, so careful consideration is crucial. This process, while potentially daunting, can be broken down into manageable steps to ensure you find the perfect fit for your practice.

The selection process isn’t a sprint; it’s a strategic marathon. Think of it as building a finely tuned engine – each component plays a vital role in the overall performance. Rushing the process can lead to costly mistakes and inefficient workflows, impacting your bottom line and client satisfaction.

Factors to Consider When Evaluating Software Options

Several key factors demand careful scrutiny. Ignoring these could lead to a software selection that’s less than ideal, akin to buying a sports car with bicycle tires – fast, but ultimately impractical.

- Scalability: Will the software grow with your business? Consider your projected growth rate and ensure the software can handle increasing client numbers and data volume without significant performance degradation. Imagine a software that struggles when you acquire just a few more clients; that’s a recipe for disaster.

- Security: Protecting client data is paramount. Look for robust security features, including encryption, access controls, and compliance with relevant regulations (e.g., GDPR, CCPA). A breach can be devastating, both financially and reputationally – far more expensive than a slightly higher software subscription fee.

- Ease of Use: Intuition is key. The software should be user-friendly for both you and your staff. Complex interfaces can lead to errors and wasted time. Think of it as choosing a car – you wouldn’t want one with a control panel that looks like a NASA mission control.

- Integration Capabilities: Seamless integration with other tools (CRM, accounting software, etc.) is essential for efficient workflows. A disjointed system is like trying to build a house with mismatched bricks – it’s possible, but incredibly inefficient and prone to collapse.

- Reporting and Analytics: The software should provide comprehensive reporting and analytical capabilities to track key performance indicators (KPIs) and make data-driven decisions. Imagine navigating without a GPS – you might eventually arrive, but it’ll be a much longer and more frustrating journey.

A Step-by-Step Guide for Choosing Appropriate Financial Advisor Software

Following a structured approach will ensure a thorough evaluation and a well-informed decision. This methodical approach will help you avoid the pitfalls of impulsive choices and ensure a smooth transition.

- Define your needs: Clearly articulate your requirements. What specific functionalities do you need? How many clients do you currently have, and how many do you anticipate having in the future? What are your budget constraints?

- Research and shortlist potential options: Explore different software providers and compare their features, pricing, and reviews. Don’t be afraid to ask for demos or free trials.

- Conduct thorough evaluations: Test the shortlisted options and assess their usability, functionality, and integration capabilities. Involve your staff in the testing process to get their feedback.

- Compare and contrast: Create a comparison table to evaluate the different software options based on your prioritized criteria. This will help you identify the best fit for your needs and budget.

- Make your decision: Choose the software that best meets your requirements and aligns with your budget. Remember, the best software is the one that seamlessly integrates into your workflow and empowers you to better serve your clients.

Decision-Making Process Based on Specific Needs

Let’s illustrate with a hypothetical scenario. Imagine a small financial advisory firm with 50 clients, aiming for 100 within two years, needing strong security and reporting features, and a budget of $500 per month. They would prioritize scalability, security, reporting, and ease of use, potentially foregoing some niche features to stay within budget. A larger firm with hundreds of clients and a larger budget might prioritize different features and integrations, perhaps even opting for a more bespoke solution.

Security and Data Protection

Protecting your clients’ financial data is not just a good idea; it’s the bedrock of trust, the cornerstone of your reputation, and frankly, the only way to avoid a very expensive and embarrassing trip to the legal equivalent of the principal’s office. Financial advisor software must prioritize airtight security to maintain client confidentiality and comply with stringent regulations. A breach isn’t just a headache; it’s a potential career-ender.

Data security and privacy are paramount in financial advisor software because clients entrust their most sensitive information – their financial well-being – to you. A single data breach can result in significant financial losses, legal repercussions, and irreparable damage to your professional reputation. Think of it as guarding Fort Knox, except instead of gold, you’re protecting people’s futures. And let’s face it, a disgruntled bear with a penchant for spreadsheets is far less dangerous than a sophisticated cyberattack.

Encryption Methods

Robust encryption is the first line of defense. This involves converting sensitive data into an unreadable format, rendering it useless to unauthorized individuals. Think of it as scrambling a top-secret recipe – only those with the right decoder ring (your software’s decryption key) can understand it. Common methods include AES (Advanced Encryption Standard) with a key length of at least 256 bits, providing a highly secure level of protection. This is like having a combination lock with billions upon billions of possible combinations – good luck cracking that, hackers!

Access Controls and Authentication

Multi-factor authentication (MFA) should be mandatory. This requires users to provide multiple forms of identification, such as a password and a code sent to their phone, before gaining access. It’s like having a double-locked vault door – even if someone gets past the first lock, they’ll still need to overcome the second. Role-based access control (RBAC) further limits access based on job responsibilities, preventing unauthorized users from viewing sensitive client data. This ensures that only authorized personnel can access specific information, creating a digital equivalent of a well-guarded VIP area.

Data Backup and Disaster Recovery

Regular data backups are essential to ensure business continuity in the event of a system failure or cyberattack. Think of this as having a comprehensive insurance policy for your digital assets. These backups should be stored securely offsite, ideally in a geographically separate location, to protect against physical damage or theft. A robust disaster recovery plan should be in place, outlining the steps to restore data and systems in the event of a catastrophic event. It’s like having a detailed escape plan for your digital fortress, ensuring you can get everyone out safely and get back up and running quickly.

Future Trends and Innovations

The world of financial advice is undergoing a thrilling metamorphosis, fueled by technological advancements that would make even the most seasoned soothsayer raise an eyebrow. Forget dusty ledgers and tedious calculations; the future of financial advisor software is bright, bold, and brimming with possibilities that promise to revolutionize how advisors serve their clients and, dare we say, make their lives a little easier (and a lot more profitable).

The convergence of artificial intelligence, automation, and enhanced data analytics is poised to reshape the financial advisory landscape in ways we’re only beginning to comprehend. Imagine a world where personalized financial plans are generated in seconds, risk assessments are performed with superhuman accuracy, and client portfolios are optimized with the precision of a Swiss watchmaker. Sounds like a dream? It’s rapidly becoming reality.

Artificial Intelligence and Machine Learning in Financial Advisory

AI and machine learning are no longer futuristic fantasies; they are actively transforming the way financial advisors operate. These technologies are being integrated into software to automate tasks like data entry, portfolio rebalancing, and even client communication. Sophisticated algorithms can analyze vast datasets to identify market trends, predict investment performance, and provide personalized recommendations with unprecedented speed and accuracy. For instance, robo-advisors, powered by AI, are already providing automated investment advice to a growing number of clients, offering a cost-effective alternative to traditional human advisors. While some fear job displacement, the reality is more nuanced; AI is freeing up advisors to focus on higher-value tasks like building client relationships and providing strategic financial planning.

Enhanced Data Analytics and Predictive Modeling

The sheer volume of data available today is overwhelming, but it’s also incredibly valuable. Advanced data analytics tools, coupled with predictive modeling capabilities, allow financial advisors to gain deeper insights into client behavior, market trends, and investment performance. This enables them to make more informed decisions, proactively identify and mitigate risks, and develop more effective financial strategies. Imagine software that can predict a client’s potential need for long-term care based on their age, health history, and lifestyle – that’s the power of predictive modeling at play. This level of foresight allows advisors to proactively tailor their services and build stronger, more trusting relationships with their clients.

Blockchain Technology and Enhanced Security

Blockchain technology, the backbone of cryptocurrencies, offers significant potential for enhancing security and transparency in the financial advisory industry. Its decentralized and immutable nature can help protect sensitive client data from breaches and fraud. Imagine a system where all financial transactions and documents are securely recorded on a blockchain, accessible only to authorized parties – a fortress of financial information impenetrable to cybercriminals. This enhanced security will not only protect client assets but also build greater trust and confidence in the financial advisory profession.

Hyper-Personalization and Client Experience

The future of financial advisory software is hyper-personalization. Imagine software that learns each client’s unique financial goals, risk tolerance, and preferences, tailoring its advice and communications accordingly. This level of customization will lead to more engaged clients, improved outcomes, and stronger advisor-client relationships. It’s a shift from a one-size-fits-all approach to a truly personalized experience, designed to meet the specific needs of each individual. This could involve AI-powered chatbots that answer client queries instantly, or personalized financial dashboards that provide real-time insights into their portfolio performance.

Wrap-Up: Financial Advisor Software

So, there you have it – a whirlwind tour through the exciting landscape of financial advisor software. From choosing the right software to mastering its features and navigating the complexities of data security, we’ve covered the essentials. Remember, selecting the perfect software is a journey, not a destination. Embrace the process, choose wisely, and watch your efficiency (and perhaps your sanity) soar. May your spreadsheets be ever-organized, your clients ever-satisfied, and your profits ever-growing. Happy advising!

FAQ Resource

What are the legal implications of using financial advisor software?

Using financial advisor software doesn’t negate your legal responsibilities. Ensure the software complies with relevant regulations and that you maintain proper documentation and client confidentiality.

How can I ensure my data is secure in the cloud?

Choose reputable software providers with robust security features like encryption, multi-factor authentication, and regular security audits. Also, establish strong internal security protocols.

What’s the best way to train my staff on new financial advisor software?

Provide comprehensive training materials, hands-on sessions, and ongoing support. Consider phased implementation to minimize disruption and allow for continuous learning.

Can I integrate my existing accounting software with financial advisor software?

Many financial advisor software options offer integrations with popular accounting platforms. Check for compatibility before purchasing to avoid costly headaches later.