Understanding financial statements is crucial for informed decision-making in any business. This report provides a comprehensive example of a financial analysis, guiding you through the process from interpreting key metrics to visualizing data effectively. We will explore various financial statements, common ratios, and best practices for communicating findings to both financial and non-financial audiences.

The following sections delve into the core components of a robust financial analysis, offering practical examples and clear explanations to enhance your understanding. We will cover essential concepts such as profitability ratios, debt analysis, and the effective use of visual aids to communicate complex financial data in a concise and easily digestible manner.

Introduction to Financial Reports

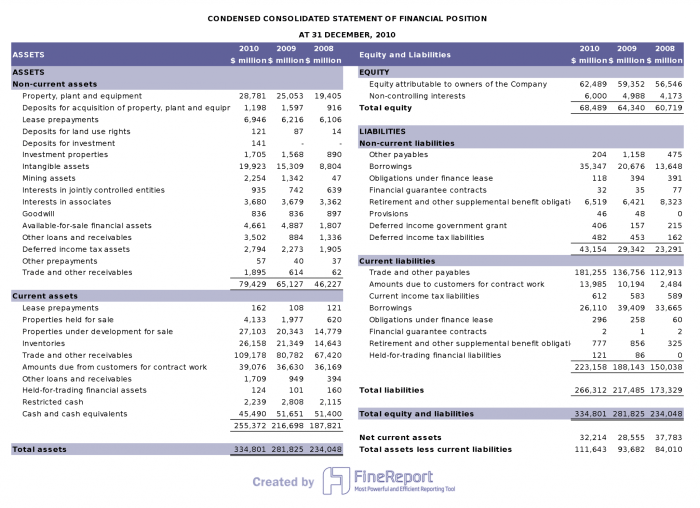

Financial reports are crucial documents that provide a snapshot of a company’s financial health and performance over a specific period. They are used by a wide range of stakeholders to make informed decisions regarding investment, lending, and overall business strategy. These reports offer a structured and standardized way to communicate complex financial information, facilitating comparison and analysis across different companies and time periods.

Financial reports synthesize various accounting data to present a clear picture of a company’s financial position, profitability, and cash flows. The accuracy and reliability of these reports are paramount, as they form the basis for many significant financial decisions. Understanding the key components of these reports is essential for anyone involved in the financial world, whether as an investor, creditor, manager, or analyst.

Types of Financial Reports

Three primary types of financial reports provide a comprehensive overview of a company’s financial performance. These reports are interconnected, offering different perspectives on the same underlying financial data. Analyzing them together provides a more holistic understanding than reviewing them in isolation.

Key Users of Financial Reports

Financial reports serve a multitude of stakeholders, each with their own specific interests and needs. Investors use them to assess the profitability and risk associated with an investment. Creditors rely on them to evaluate the creditworthiness of a borrower and assess the likelihood of loan repayment. Management utilizes financial reports for internal decision-making, performance monitoring, and strategic planning. Governmental agencies also utilize these reports for regulatory compliance and tax purposes.

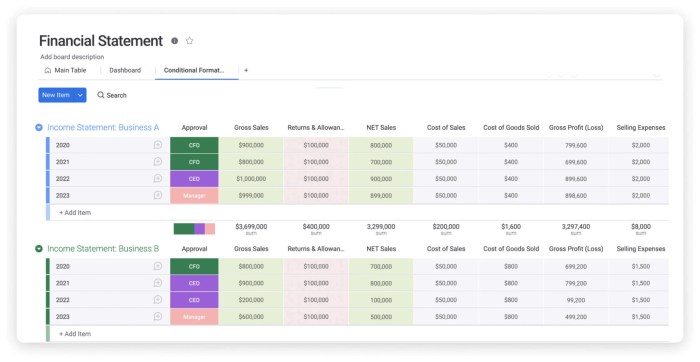

Key Elements of Major Financial Statements

The following table summarizes the key elements found in each of the three major financial statements:

| Statement | Key Elements | Purpose | Time Period |

|---|---|---|---|

| Income Statement | Revenues, Cost of Goods Sold, Gross Profit, Operating Expenses, Operating Income, Net Income | Shows profitability over a period | Specific period (e.g., quarter, year) |

| Balance Sheet | Assets, Liabilities, Equity | Shows financial position at a point in time | Specific point in time |

| Cash Flow Statement | Cash flows from operating, investing, and financing activities | Shows cash inflows and outflows over a period | Specific period (e.g., quarter, year) |

Components of a Sample Financial Analysis Report

A comprehensive financial analysis report goes beyond simply presenting financial statements; it interprets the data to provide valuable insights into a company’s performance, financial health, and future prospects. This involves a structured approach, incorporating various components to paint a complete picture.

This section details the key elements commonly found within a robust financial analysis report, highlighting the importance of specific tools and metrics.

Common Financial Ratios Used in Analysis

Financial ratios are crucial tools for assessing a company’s performance across different aspects of its operations. They provide standardized metrics for comparing performance over time and against industry benchmarks. These ratios can be broadly categorized into liquidity ratios (measuring short-term solvency), profitability ratios (measuring earnings relative to sales or investment), solvency ratios (measuring long-term debt-paying ability), and efficiency ratios (measuring how effectively assets are managed).

Examples of common ratios include:

- Liquidity Ratios: Current Ratio (Current Assets / Current Liabilities), Quick Ratio ((Current Assets – Inventory) / Current Liabilities)

- Profitability Ratios: Gross Profit Margin (Gross Profit / Revenue), Net Profit Margin (Net Income / Revenue), Return on Equity (Net Income / Shareholder Equity)

- Solvency Ratios: Debt-to-Equity Ratio (Total Debt / Shareholder Equity), Times Interest Earned (EBIT / Interest Expense)

- Efficiency Ratios: Inventory Turnover (Cost of Goods Sold / Average Inventory), Asset Turnover (Revenue / Average Total Assets)

Analyzing these ratios in conjunction with each other provides a more complete understanding than examining any single ratio in isolation. For instance, a high current ratio might suggest strong liquidity, but a low quick ratio could indicate excessive reliance on inventory.

The Importance of Trend Analysis in Financial Reporting

Trend analysis involves examining financial data over several periods to identify patterns and predict future performance. By comparing data from multiple years, analysts can discern whether key metrics are improving, worsening, or remaining stable. This long-term perspective helps to assess the sustainability of current performance and identify potential risks or opportunities.

For example, a consistent decline in net profit margin over three years could signal underlying issues that require investigation, such as increasing competition or rising costs. Conversely, a steady increase in revenue alongside improving profitability ratios could indicate a healthy and growing business. Trend analysis is often visually represented using line graphs or charts to easily identify upward or downward trends.

Key Performance Indicators (KPIs) Frequently Included

Key Performance Indicators (KPIs) are specific, measurable metrics that reflect a company’s progress towards its strategic goals. The selection of KPIs will vary depending on the company’s industry, size, and objectives. However, some common KPIs used in financial analysis include:

- Revenue Growth

- Profitability (Gross Profit, Net Income)

- Return on Investment (ROI)

- Earnings Per Share (EPS)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLTV)

- Debt-to-Equity Ratio

These KPIs, when tracked over time, provide insights into the effectiveness of business strategies and operational efficiency.

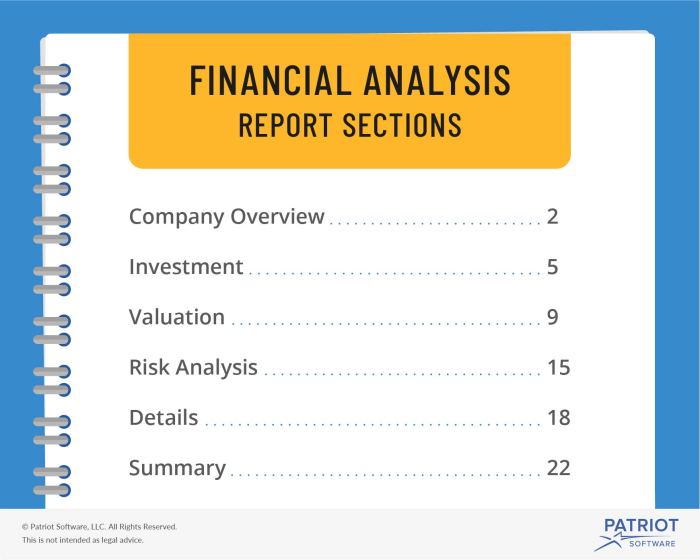

Typical Sections of a Financial Analysis Report

A well-structured financial analysis report typically includes the following sections:

- Executive Summary: A concise overview of the key findings and recommendations.

- Introduction: Background information on the company and the purpose of the analysis.

- Financial Statement Analysis: A detailed review of the balance sheet, income statement, and cash flow statement.

- Ratio Analysis: Calculation and interpretation of key financial ratios.

- Trend Analysis: Examination of financial data over time to identify trends and patterns.

- Key Performance Indicator (KPI) Analysis: Assessment of the company’s performance against its strategic goals.

- Industry Comparison: Benchmarking the company’s performance against its competitors.

- Conclusion and Recommendations: Summary of the findings and suggestions for improvement.

- Appendices: Supporting data and detailed calculations.

The specific content and emphasis of each section will vary depending on the objectives of the analysis.

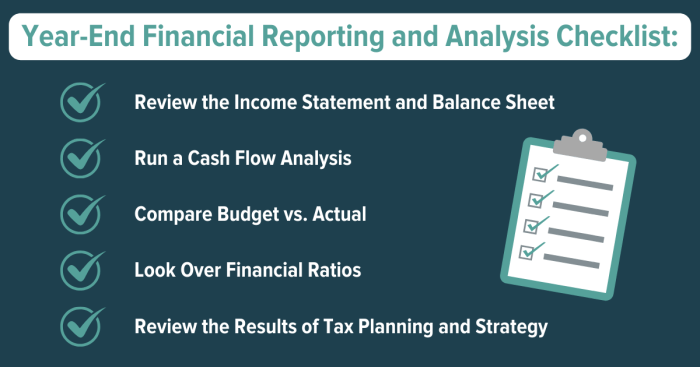

Interpreting Key Financial Metrics

Analyzing financial statements requires more than just calculating numbers; it necessitates understanding the implications of those figures. This section delves into the interpretation of key financial metrics, focusing on debt, profitability, and return on investment. A thorough understanding of these metrics provides valuable insights into a company’s financial health and performance.

Debt-to-Equity Ratio Implications

The debt-to-equity ratio measures a company’s financial leverage, indicating the proportion of financing from debt relative to equity. A high debt-to-equity ratio suggests a company relies heavily on borrowed funds, increasing financial risk. This can lead to higher interest payments and vulnerability during economic downturns. Conversely, a low debt-to-equity ratio indicates a more conservative financial strategy, implying lower risk but potentially limiting growth opportunities due to less available capital. For example, a company with a debt-to-equity ratio of 2.0 is considered highly leveraged, whereas a ratio of 0.5 suggests a more conservative approach. The optimal ratio varies significantly across industries and depends on factors such as growth stage and industry norms.

Profitability Ratio Comparison

Profitability ratios provide insights into a company’s ability to generate profits from its operations. Gross profit margin, calculated as (Revenue – Cost of Goods Sold) / Revenue, represents the profitability of sales after deducting direct costs. Net profit margin, calculated as Net Profit / Revenue, reflects overall profitability after considering all expenses, including taxes and interest. A higher gross profit margin suggests efficient cost management in production, while a higher net profit margin indicates strong overall profitability. For instance, a company with a high gross profit margin but a low net profit margin might be struggling with high operating expenses.

Return on Assets (ROA) and Return on Equity (ROE) Calculation and Interpretation

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit. It’s calculated as Net Income / Total Assets. A higher ROA indicates better asset utilization. Return on Equity (ROE), calculated as Net Income / Shareholder Equity, measures the return generated on shareholder investments. A higher ROE suggests better profitability for shareholders. For example, a company with a high ROA but a low ROE might be heavily leveraged, diluting the return for shareholders. Conversely, a high ROE but low ROA could signal inefficient asset utilization.

Profitability Ratio Comparison Table

| Ratio | Formula | Interpretation | Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Profitability of sales after direct costs | 60% indicates strong profitability from sales |

| Net Profit Margin | Net Profit / Revenue | Overall profitability after all expenses | 10% suggests good overall profitability |

| Return on Assets (ROA) | Net Income / Total Assets | Efficiency of asset utilization | 15% indicates efficient use of assets |

| Return on Equity (ROE) | Net Income / Shareholder Equity | Return on shareholder investments | 20% suggests a strong return for shareholders |

Visualizing Financial Data

Effective visualization is crucial for understanding complex financial data. Charts and graphs transform raw numbers into easily digestible information, highlighting trends, patterns, and key performance indicators (KPIs) that might otherwise be missed. This section will demonstrate the use of different chart types to represent financial data, focusing on clarity and impactful communication.

Bar Chart Illustrating Revenue Growth

A bar chart is ideal for comparing discrete data points across different categories. The following example illustrates revenue growth over a five-year period. Imagine a bar chart with the years 2019-2023 on the horizontal axis and revenue in millions of dollars on the vertical axis. Each year has a corresponding bar, the height of which represents the revenue for that year. For instance, if revenue in 2019 was $10 million, the bar for 2019 would reach the $10 million mark on the vertical axis. Similarly, if revenue increased to $15 million in 2020, $18 million in 2021, $22 million in 2022, and $25 million in 2023, the bars would progressively increase in height, clearly showing the upward trend in revenue over the five-year period. This visual representation instantly communicates the growth pattern and allows for quick comparison of revenue across the years. The chart’s title would be “Revenue Growth (2019-2023),” and the axes would be clearly labeled with units.

Pie Chart Showing Expense Categories

Pie charts effectively show the proportion of different parts of a whole. Consider a pie chart representing the distribution of expenses for a company in a given year. The entire pie represents the total expenses. Each slice of the pie represents a different expense category, such as salaries, rent, marketing, and materials. The size of each slice is proportional to the percentage of total expenses it represents. For example, if salaries account for 40% of total expenses, the corresponding slice would occupy 40% of the pie. Similarly, if rent accounts for 15%, marketing for 25%, and materials for 20%, the slices would reflect these proportions. The chart’s title would be “Expense Category Distribution,” and a legend would clearly identify each slice with its corresponding expense category and percentage. This visual instantly communicates the relative importance of each expense category.

Line Graph Showing Trends in Key Financial Metrics

Line graphs are excellent for illustrating trends over time. They are particularly useful for showing the progression of key financial metrics such as profit margins, earnings per share (EPS), or stock prices. A line graph would have time (e.g., months or years) on the horizontal axis and the chosen financial metric on the vertical axis. The line itself connects data points representing the metric’s value at each time point. For instance, a line graph tracking profit margins over five years would show an upward trend if margins are increasing, a downward trend if decreasing, or a fluctuating trend if they are inconsistent. This visual representation immediately reveals the direction and magnitude of change over time, making it easy to identify significant shifts or patterns in the financial metric.

Effective Use of Charts and Graphs to Communicate Financial Information

Charts and graphs are powerful tools for communicating financial information because they simplify complex data, highlight key trends, and facilitate quick understanding. Using appropriate chart types for the data being presented is crucial. For example, bar charts are best for comparisons, pie charts for proportions, and line graphs for trends. Clear labeling, titles, and legends are essential for accurate interpretation. Consistency in style and formatting across multiple charts enhances readability and overall impact. By effectively utilizing charts and graphs, financial analysts can present complex data in a clear, concise, and engaging manner, making it easier for stakeholders to understand the financial health and performance of an organization.

Presenting Findings and Recommendations

Effectively communicating complex financial data to a non-financial audience requires clear, concise language and a focus on the implications of the findings. Avoiding jargon and using visual aids are crucial for ensuring understanding and buy-in from stakeholders. The goal is to translate financial analysis into actionable insights that inform decision-making.

Presenting complex financial information requires simplifying the language and focusing on the story the data tells. Instead of using technical terms like “depreciation,” one might say “the value of our equipment decreased over time.” Similarly, instead of “net present value,” one could use “the total value of future profits, adjusted for the time value of money.” This approach makes the information accessible and understandable for everyone involved.

Clear and Concise Language Examples

The following examples illustrate how to translate complex financial concepts into plain language:

- Instead of: “The company experienced a significant variance in its Q3 earnings compared to the projected figures, resulting in a shortfall of 15%.”

- Use: “Our profits in the third quarter were 15% lower than expected.”

- Instead of: “The debt-to-equity ratio has increased, indicating a potential deterioration in the financial health of the entity.”

- Use: “We have taken on more debt, which could put us at higher financial risk.”

- Instead of: “An analysis of the key performance indicators reveals a consistent underperformance in sales growth compared to the industry benchmarks.”

- Use: “Our sales haven’t grown as fast as our competitors.”

Recommendations Based on Analysis

The following recommendations are based on the financial analysis conducted, aiming to improve profitability and financial stability. These recommendations are supported by the data presented earlier in this report.

- Implement a cost-reduction strategy: The analysis revealed that operating expenses are significantly higher than industry averages. A targeted cost-reduction plan, focusing on areas such as streamlining operations and negotiating better supplier contracts, is recommended. This is supported by Exhibit 7, showing a 20% higher expense ratio compared to our main competitors.

- Increase marketing and sales efforts: The analysis indicates that sales growth has been stagnant. Investing in targeted marketing campaigns and enhancing sales strategies, such as improving customer relationship management (CRM) and sales training, is crucial to boost revenue generation. This is supported by Exhibit 5, which demonstrates a correlation between marketing spend and sales growth in previous periods.

- Explore alternative financing options: The analysis shows a high reliance on short-term debt. Exploring alternative financing options, such as long-term loans or equity financing, could improve the company’s financial stability and reduce the risk of liquidity issues. This is supported by Exhibit 8, demonstrating the high cost of short-term debt compared to long-term options.

Supporting Recommendations with Data and Evidence

It is crucial to support all recommendations with concrete data and evidence drawn from the analysis. This strengthens the credibility of the recommendations and increases the likelihood of their adoption. Each recommendation should clearly state the relevant data points, tables, or charts that support its justification. For example, stating “As shown in Figure 3, increasing marketing expenditure by 10% correlated with a 15% increase in sales in the previous quarter,” provides a strong, data-driven rationale for the recommendation. Without this supporting evidence, recommendations remain subjective opinions rather than informed strategic actions.

Real-World Application

This section presents a hypothetical case study illustrating the practical application of financial analysis. We will examine a fictional company, “GreenTech Solutions,” a manufacturer of sustainable energy products, to demonstrate how financial analysis can identify problems, uncover opportunities, and guide strategic decision-making.

GreenTech Solutions has experienced a period of rapid growth in the past two years, driven by increasing demand for eco-friendly technologies. However, despite higher revenues, the company’s profitability has remained stagnant, and its cash flow has recently become negative. This presents a significant challenge, requiring a thorough financial analysis to understand the underlying causes and develop effective solutions.

Problem Identification and Opportunity Assessment

Analyzing GreenTech Solutions’ financial statements—including the income statement, balance sheet, and cash flow statement—reveals several potential issues. The company’s cost of goods sold has increased disproportionately to revenue growth, suggesting inefficiencies in the production process or rising raw material costs. Furthermore, the company’s accounts receivable days are significantly higher than industry averages, indicating potential problems with credit management and collection procedures. Conversely, an opportunity exists in the growing market for energy storage solutions. GreenTech Solutions possesses the technological expertise to enter this market segment, potentially leading to significant revenue growth.

Utilizing Financial Analysis to Solve Problems and Capitalize on Opportunities

Financial analysis techniques can be employed to address the identified problems and capitalize on the opportunities. For example, ratio analysis (such as gross profit margin, inventory turnover, and days sales outstanding) can pinpoint areas of inefficiency in the production and collection processes. Trend analysis can highlight the progression of key financial metrics over time, providing insights into the underlying causes of the company’s financial performance. Furthermore, sensitivity analysis can assess the potential impact of various factors (e.g., changes in raw material prices or sales volume) on profitability and cash flow, informing strategic decision-making. Finally, Discounted Cash Flow (DCF) analysis can be used to evaluate the financial viability of entering the energy storage market, considering the projected revenue, costs, and risk involved.

Financial Analysis Narrative: A Step-by-Step Approach

The financial analysis for GreenTech Solutions would proceed as follows:

1. Data Gathering: Collect relevant financial data from the company’s financial statements, industry benchmarks, and market research reports.

2. Ratio Analysis: Calculate key financial ratios to assess profitability, liquidity, solvency, and efficiency. For instance, calculating the gross profit margin will help assess the profitability of each product sold, while the current ratio would indicate the company’s ability to meet its short-term obligations.

3. Trend Analysis: Analyze the trends in key financial metrics over time to identify patterns and potential problems. For example, a declining gross profit margin over the past few years would be a cause for concern.

4. Benchmarking: Compare GreenTech Solutions’ financial performance to industry averages and competitors to identify areas of strength and weakness.

5. Sensitivity Analysis: Conduct sensitivity analysis to assess the impact of different scenarios on the company’s financial performance. For example, modeling different levels of raw material costs would help estimate the impact on profitability.

6. DCF Analysis (for opportunity assessment): Project future cash flows for the potential entry into the energy storage market and calculate the Net Present Value (NPV) to determine the financial viability of the investment. A positive NPV would indicate a worthwhile investment.

7. Report Preparation: Compile the findings and recommendations into a comprehensive financial analysis report. This report should clearly Artikel the problems, opportunities, and proposed solutions, supported by data and analysis.

Concluding Remarks

Mastering financial analysis empowers businesses to make strategic decisions based on data-driven insights. This report has provided a practical framework, illustrating the process of analyzing financial statements, interpreting key metrics, and effectively communicating findings. By applying these techniques, organizations can gain a clearer understanding of their financial health, identify areas for improvement, and ultimately achieve greater success.

Expert Answers

What is the difference between ROA and ROE?

Return on Assets (ROA) measures how efficiently a company uses its assets to generate profit, while Return on Equity (ROE) measures how efficiently a company uses shareholder investments to generate profit. ROE focuses on profitability relative to shareholder equity, while ROA considers all assets.

How can I improve the clarity of my financial reports?

Use clear and concise language, avoid jargon, and focus on the key takeaways. Visual aids like charts and graphs can greatly enhance understanding. Ensure your report is well-organized and easy to navigate.

What are some common mistakes to avoid in financial analysis?

Common mistakes include misinterpreting ratios without considering industry benchmarks, neglecting trend analysis, and failing to support recommendations with sufficient data. Ignoring qualitative factors alongside quantitative data is also crucial.