Navigating the treacherous waters of a financial crisis requires a proactive and multifaceted approach. This exploration delves into the crucial strategies businesses and governments employ to identify, mitigate, and recover from economic downturns. From recognizing early warning signs to implementing robust risk management frameworks, we’ll examine the essential tools for navigating uncertainty and ensuring long-term stability.

Understanding the historical context of past crises, coupled with a comprehensive risk assessment, is paramount. Effective communication with stakeholders, strategic liquidity management, and well-defined restructuring plans are all vital components of a successful crisis response. We’ll also consider the regulatory landscape and the role of international cooperation in mitigating the global impact of financial instability.

Identifying Early Warning Signs of a Financial Crisis

Predicting financial crises is a complex undertaking, but recognizing early warning signs can significantly improve preparedness and mitigation efforts. A multi-faceted approach, combining quantitative data analysis with qualitative assessments of market sentiment and regulatory frameworks, is crucial for effective crisis management. Ignoring any of these aspects can lead to a delayed or ineffective response.

Key Indicators of an Impending Financial Crisis

The following table categorizes ten key indicators that often precede a financial crisis. It’s important to note that the presence of one or two indicators doesn’t automatically signal an imminent crisis; rather, it’s the confluence of several indicators across different sectors that raises serious concerns.

| Sector | Indicator | Description | Example |

|---|---|---|---|

| Banking | Rapid Credit Growth | A sharp increase in lending, often fueled by low interest rates or lax lending standards. | The rapid expansion of subprime mortgages in the years leading up to the 2008 financial crisis. |

| Banking | Deteriorating Asset Quality | Rising levels of non-performing loans (NPLs) and increased loan defaults. | The surge in defaults on mortgages and other loans during the 2008 crisis. |

| Real Estate | Housing Price Bubbles | Significant and unsustainable increases in property values, often driven by speculation. | The rapid appreciation of housing prices in the United States prior to 2008. |

| Real Estate | High Household Debt Levels | A substantial increase in household debt relative to income, indicating potential vulnerability to economic shocks. | The high levels of mortgage debt among US households before the 2008 crisis. |

| Sovereign Debt | Large Fiscal Deficits | Government spending exceeding revenues for an extended period, leading to accumulating debt. | The large fiscal deficits experienced by several European countries during the Eurozone crisis. |

| Sovereign Debt | Rising Debt-to-GDP Ratio | The ratio of a country’s total debt to its gross domestic product increasing significantly. | Greece’s high debt-to-GDP ratio before the Eurozone crisis. |

| Financial Markets | Increased Market Volatility | Sharp fluctuations in asset prices, reflecting heightened uncertainty and risk aversion. | The increased volatility in stock markets during the 2008 crisis. |

| Financial Markets | Sharp Decline in Equity Prices | A significant and sustained drop in stock market valuations. | The sharp decline in global equity markets in 2008. |

| Global Economy | Current Account Deficits | A country importing more goods and services than it exports, leading to potential external vulnerabilities. | The large current account deficit of the United States prior to the 2008 crisis. |

| Global Economy | Capital Flight | Sudden and large-scale outflow of capital from a country, often driven by concerns about economic stability. | Capital flight from several emerging markets during the 2013 “taper tantrum”. |

Historical Context of Major Financial Crises and Early Warning Signs

Analyzing past crises provides valuable insights into the patterns and indicators that often precede such events. Three prominent examples are the Asian Financial Crisis of 1997-98, the Russian Financial Crisis of 1998, and the Global Financial Crisis of 2008-09.

The Asian Financial Crisis was characterized by rapid credit growth, large current account deficits, and fixed exchange rates that became unsustainable. The Russian crisis was marked by a large fiscal deficit, dependence on volatile capital inflows, and weak financial regulation. The 2008 Global Financial Crisis was preceded by a housing price bubble, rapid growth in subprime mortgages, and excessive risk-taking by financial institutions. In each case, a combination of quantitative indicators and qualitative factors like regulatory failures and investor sentiment contributed to the crisis.

Limitations of Quantitative Indicators and the Importance of Qualitative Assessments

While quantitative indicators are valuable tools for monitoring financial stability, relying solely on them can be misleading. Quantitative data can lag behind the underlying economic realities and fail to capture crucial qualitative aspects. For instance, the level of confidence in the banking system, regulatory effectiveness, and the overall market sentiment are vital factors that cannot be fully captured by numerical data. A comprehensive assessment necessitates a nuanced understanding of these qualitative elements, integrating them with quantitative data for a more complete and accurate picture. Ignoring qualitative factors can lead to an underestimation of systemic risks and a delayed response to potential crises.

Risk Assessment and Mitigation Strategies

Effective risk management is crucial for the long-term viability of any medium-sized manufacturing company. A proactive approach, encompassing both internal and external factors, is essential to identify potential threats and develop appropriate mitigation strategies. This allows businesses to navigate economic uncertainties and maintain operational resilience.

A Comprehensive Risk Assessment Framework for a Medium-Sized Manufacturing Company

A robust risk assessment framework should consider a wide range of factors, categorized for clarity and efficient analysis. Internal factors include operational risks (e.g., production inefficiencies, supply chain disruptions, technological failures), financial risks (e.g., cash flow issues, debt levels, interest rate fluctuations), and human capital risks (e.g., employee turnover, skill gaps, lack of training). External factors encompass market risks (e.g., competition, demand fluctuations, changing consumer preferences), economic risks (e.g., recession, inflation, exchange rate volatility), regulatory risks (e.g., environmental regulations, trade policies, labor laws), and geopolitical risks (e.g., international conflicts, political instability). The framework should utilize a standardized methodology, such as a risk matrix that considers both the likelihood and impact of each identified risk. This allows for prioritization of mitigation efforts, focusing resources on the most critical threats.

Five Risk Mitigation Strategies and Their Effectiveness Across Economic Climates

Risk mitigation strategies vary in their effectiveness depending on the prevailing economic conditions. Here are five common strategies and their comparative analysis:

- Diversification: Spreading investments and operations across multiple markets and product lines reduces dependence on any single factor. This strategy is highly effective during economic downturns, as losses in one area can be offset by gains in others. For example, a manufacturing company producing both consumer goods and industrial components will be less vulnerable to a recession affecting one sector than a company focused solely on one.

- Hedging: Using financial instruments to offset potential losses from adverse price movements (e.g., currency fluctuations, commodity price changes). This is particularly effective during periods of high volatility, like inflation or currency crises. For example, a company importing raw materials can hedge against currency fluctuations by using forward contracts.

- Insurance: Transferring specific risks to an insurance company through purchasing appropriate policies (e.g., property damage, liability, business interruption). Insurance provides a safety net during unexpected events, regardless of the economic climate, although the cost of premiums may vary.

- Contingency Planning: Developing pre-emptive plans to address potential disruptions (e.g., supply chain disruptions, natural disasters). This is valuable in all economic climates, as unexpected events can occur regardless of the overall economic health. A well-defined contingency plan helps ensure business continuity.

- Cost Reduction: Implementing measures to reduce operational expenses (e.g., streamlining processes, improving efficiency). While effective in any climate, cost reduction becomes especially crucial during recessions when demand falls and revenue is reduced. This can involve optimizing production processes, negotiating better deals with suppliers, or reducing workforce through attrition.

Best Practices for Stress Testing Financial Models

Stress testing financial models is critical for assessing resilience to unexpected shocks. Effective stress testing involves:

- Scenario Planning: Defining a range of plausible scenarios, including severe economic downturns, natural disasters, and geopolitical events. Scenarios should consider various combinations of factors and their potential impact.

- Sensitivity Analysis: Examining the impact of changes in key variables (e.g., interest rates, exchange rates, commodity prices) on financial performance. This helps identify vulnerabilities and critical thresholds.

- Monte Carlo Simulation: Using probabilistic models to simulate a large number of possible outcomes, considering the uncertainty surrounding key inputs. This provides a more comprehensive view of risk than deterministic scenarios.

- Regular Review and Updates: Models should be reviewed and updated regularly to reflect changes in the business environment and new information. This ensures the models remain relevant and accurate.

- Independent Validation: Models should be independently validated to ensure accuracy and reliability. An external review can help identify potential biases or weaknesses.

Crisis Communication and Stakeholder Management

Effective crisis communication is paramount in navigating a financial downturn. A well-defined strategy, encompassing proactive measures and swift responses, can significantly mitigate reputational damage and maintain stakeholder confidence. This involves not only disseminating timely information but also fostering open dialogue and demonstrating empathy.

A robust communication plan is essential for navigating the complexities of a financial crisis. Failure to communicate effectively can exacerbate the situation, leading to heightened uncertainty and eroding trust among stakeholders. Transparency, honesty, and consistent messaging are crucial for maintaining confidence during periods of volatility.

Sample Crisis Communication Plan: Sudden Market Downturn

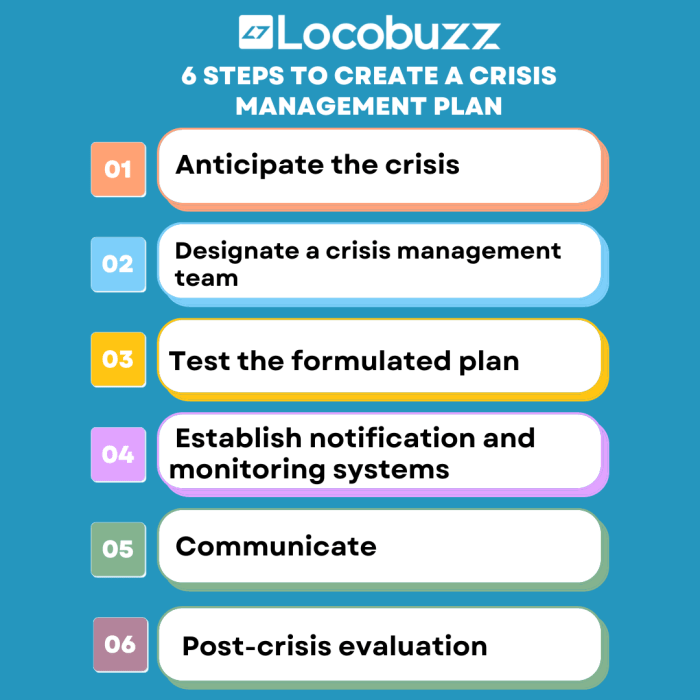

This plan Artikels steps to take in response to a sudden, significant market downturn. It prioritizes swift, coordinated communication across various channels to reach key stakeholder groups.

- Phase 1: Immediate Response (within 24 hours): Activate the crisis communication team. Issue a brief, factual statement acknowledging the market downturn and assuring stakeholders of the company’s stability and ongoing commitment. This statement will be disseminated via press release, website update, and social media. Internal communication will focus on reassuring employees and addressing immediate concerns.

- Phase 2: Ongoing Communication (days 2-7): Provide regular updates on the company’s financial position and strategic response to the downturn. This will include more detailed financial information for investors and updates on operational changes for employees and customers. Webinars and conference calls will be scheduled to address stakeholder questions.

- Phase 3: Long-Term Strategy (weeks 7+): Focus on rebuilding confidence and outlining the company’s long-term recovery plan. This will involve consistent communication highlighting progress, successes, and future outlook. Regular reporting and investor meetings will be crucial.

Importance of Transparency and Proactive Communication

Transparency and proactive communication are vital for maintaining stakeholder confidence during a financial crisis. Openly addressing concerns, acknowledging challenges, and providing regular updates, even when the situation is uncertain, builds trust and prevents the spread of misinformation. Proactive communication allows the company to shape the narrative and demonstrate its commitment to its stakeholders. Conversely, a lack of transparency can lead to speculation, rumors, and ultimately, a loss of confidence. For example, the 2008 financial crisis highlighted the detrimental effects of a lack of transparency, with the delayed disclosure of information exacerbating the crisis.

Tailored Communication Messages for Stakeholder Groups

Effective crisis communication requires tailoring messages to resonate with specific stakeholder groups. The following examples illustrate this approach.

- Investors: “We acknowledge the current market volatility and its impact on investor sentiment. We are taking decisive action to mitigate the risks and maintain the long-term value of your investment. We will provide a detailed financial update next week, outlining our revised strategies and projections.” This message focuses on financial performance and future outlook.

- Employees: “We understand that the current market situation may cause concern. Our priority is to ensure the stability of the company and the security of our employees. We are committed to open communication and will provide regular updates on the company’s performance and any potential impacts on employment. We will also hold town hall meetings to answer questions.” This message prioritizes job security and open communication.

- Customers: “We are aware of the current economic challenges. We remain fully committed to providing our customers with the same high level of service and product quality they have come to expect. We are confident that we will navigate this period and continue to serve our customers effectively.” This message emphasizes continued service and quality.

Liquidity Management and Funding Strategies

Maintaining adequate liquidity and securing diverse funding sources are paramount for businesses navigating financial crises. A robust liquidity management strategy, coupled with a well-defined funding plan, can significantly improve a company’s resilience and chances of survival during periods of economic uncertainty. This section will explore various short-term and long-term funding options and strategies for optimizing cash flow.

Sources of Short-Term and Long-Term Funding

Access to diverse funding sources is crucial for weathering financial storms. Short-term funding provides immediate liquidity needs, while long-term funding supports sustained operations and investments. A balanced approach to both is essential.

- Short-Term Funding Sources: These options provide immediate capital for bridging short-term cash flow gaps. Examples include:

- Lines of Credit: Pre-approved loans allowing businesses to borrow funds as needed, up to a pre-set limit. These offer flexibility but typically come with higher interest rates than longer-term loans.

- Commercial Paper: Short-term unsecured promissory notes issued by corporations to raise capital. This is a cost-effective option for creditworthy companies.

- Trade Credit: Delayed payment terms offered by suppliers, providing a short-term, interest-free loan. Negotiating favorable terms with suppliers is crucial during crises.

- Factoring: Selling accounts receivable to a third party at a discount to receive immediate cash. This can be beneficial for businesses with significant outstanding invoices.

- Long-Term Funding Sources: These provide sustained capital for investments and long-term growth, crucial for navigating prolonged economic downturns. Examples include:

- Term Loans: Loans with fixed repayment schedules and interest rates, providing predictable cash flow management. These are suitable for major capital expenditures or acquisitions.

- Bonds: Debt securities issued by corporations to raise capital. They offer a fixed income stream to investors, and can be a significant source of funding for larger organizations.

- Equity Financing: Raising capital by selling ownership stakes in the company. This dilutes ownership but can provide substantial funding, particularly during times when debt financing is difficult to secure. This could involve venture capital, private equity, or an initial public offering (IPO).

- Government-backed loans: During economic crises, governments often offer loan programs with favorable terms to support businesses. These programs can be vital for businesses struggling to secure conventional financing.

Maintaining Adequate Liquidity Reserves and Optimizing Cash Flow

Maintaining sufficient liquidity reserves acts as a buffer against unexpected financial shocks. Strategies for optimizing cash flow during uncertain times are crucial for survival.

Adequate liquidity reserves are typically defined as sufficient cash and easily convertible assets to cover short-term liabilities and operating expenses for a specific period, often three to six months. This allows businesses to meet obligations and maintain operations even during periods of reduced revenue. Strategies for optimizing cash flow include rigorous expense management, efficient inventory control, accelerating collections of receivables, and exploring opportunities for cost reduction and revenue generation. For example, a company might renegotiate payment terms with suppliers, implement stricter credit policies for customers, or explore cost-cutting measures such as reducing staffing levels or outsourcing certain functions. These actions are often difficult but necessary to navigate challenging economic environments.

Diversification of Funding Sources to Mitigate Crisis Impact

Relying on a single funding source exposes a business to significant risk during a financial crisis. Diversifying funding sources reduces reliance on any one lender or funding mechanism, thus mitigating the impact of potential disruptions. For instance, a business that relies solely on bank loans may face severe difficulties if the bank experiences financial distress or tightens lending standards. In contrast, a business with a diversified funding strategy, incorporating a mix of bank loans, commercial paper, and trade credit, is better positioned to withstand such shocks. This diversified approach reduces the overall risk and enhances the resilience of the business during periods of economic uncertainty. This approach provides flexibility and options when one funding source becomes unavailable or too expensive.

Restructuring and Recovery Planning

A comprehensive restructuring and recovery plan is crucial for businesses facing significant financial setbacks. It provides a roadmap for navigating the crisis, stabilizing operations, and ultimately returning to profitability. A well-defined plan allows for proactive decision-making, resource allocation, and stakeholder communication, significantly improving the chances of survival and long-term success.

Developing a robust restructuring plan requires a methodical approach, combining financial analysis with strategic planning. The process should involve a thorough assessment of the current financial situation, identifying areas needing immediate attention, and developing strategies to address them. This also involves engaging with stakeholders and developing a clear communication strategy to maintain trust and confidence.

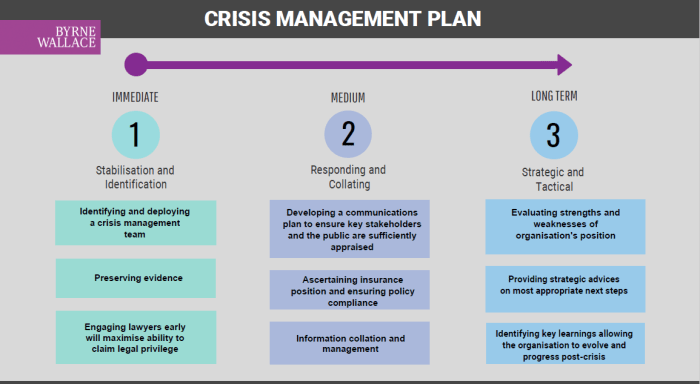

Developing a Comprehensive Business Restructuring Plan

A step-by-step approach to developing a comprehensive business restructuring plan involves several key phases. First, a thorough assessment of the company’s financial health is conducted, identifying the root causes of the financial distress. This involves analyzing financial statements, cash flow projections, and key performance indicators (KPIs). Next, a detailed restructuring strategy is formulated, encompassing cost reduction measures, asset sales, debt restructuring negotiations, and potentially, operational changes. The plan must clearly Artikel the objectives, timelines, and responsibilities involved. Implementation involves executing the planned actions, monitoring progress, and making necessary adjustments along the way. Finally, ongoing monitoring and evaluation of the restructuring plan’s effectiveness are vital to ensure the company stays on track and makes any necessary corrections.

Examples of Successful Corporate Restructuring Strategies

Several companies have successfully navigated financial crises through effective restructuring. For example, General Motors (GM) during the 2008-2009 financial crisis underwent a government-backed bankruptcy reorganization. This involved significant cost-cutting measures, streamlining operations, and a reduction in its product line. The restructuring enabled GM to shed unprofitable assets, restructure its debt, and emerge as a more competitive and financially sound company. Similarly, Chrysler’s restructuring involved a similar process of bankruptcy, debt reduction, and operational changes, allowing it to eventually merge with Fiat. These examples highlight the importance of decisive action, strategic partnerships, and a willingness to make difficult choices in order to achieve a successful restructuring.

Designing a Recovery Plan with Key Performance Indicators (KPIs)

A recovery plan needs clearly defined KPIs to track progress and ensure long-term viability. These KPIs should reflect the company’s key objectives, such as improved profitability, reduced debt, and increased market share. Examples of relevant KPIs include: Net Profit Margin (measuring profitability), Debt-to-Equity Ratio (measuring financial leverage), Customer Acquisition Cost (measuring marketing efficiency), and Return on Investment (ROI) on restructuring initiatives. Regular monitoring of these KPIs allows for early detection of any deviations from the plan, enabling timely corrective actions. A comprehensive dashboard visualizing these KPIs provides a clear overview of the recovery process, facilitating better decision-making and communication with stakeholders. The selection of KPIs should be tailored to the specific circumstances of the business and the objectives of the restructuring plan. For instance, a company focused on growth might prioritize KPIs like revenue growth and market share, while a company prioritizing profitability might focus on KPIs like net profit margin and operating income.

Regulatory and Legal Considerations

Navigating the complex landscape of financial regulations is crucial for preventing and mitigating financial crises. Robust regulatory frameworks are designed to promote stability within the financial system, protecting both businesses and consumers. However, these regulations also carry significant legal implications for businesses that fail to comply. Understanding these frameworks and their consequences is vital for effective crisis management.

Effective financial crisis management necessitates a thorough understanding of the regulatory and legal environment. This includes awareness of the key frameworks designed to prevent and mitigate crises, as well as the legal repercussions for non-compliance. Furthermore, the role of government intervention in resolving crises and its impact on businesses must be considered.

Key Regulatory Frameworks

Several international and national regulatory frameworks aim to prevent and mitigate financial crises. These frameworks often overlap and complement each other, creating a multi-layered approach to financial stability.

| Framework | Focus | Key Features | Example |

|---|---|---|---|

| Basel Accords | Banking Supervision | Capital adequacy requirements, risk management guidelines, supervisory review process. | Basel III introduced stricter capital requirements for banks to improve their resilience to shocks. |

| Dodd-Frank Act (US) | Financial Regulation Reform | Increased oversight of financial institutions, consumer protection measures, establishment of the Consumer Financial Protection Bureau (CFPB). | Created the Financial Stability Oversight Council (FSOC) to identify and address systemic risk. |

| European Union’s Capital Requirements Regulation (CRR) | Banking Regulation | Harmonized capital requirements for banks across the EU, strengthening the EU banking sector’s stability. | Sets minimum capital requirements for banks based on risk assessments. |

| International Monetary Fund (IMF) | Global Financial Stability | Surveillance of global financial systems, lending to countries facing balance of payments crises, technical assistance to improve financial regulation. | Provides financial assistance and policy advice to countries facing economic crises. |

Legal Implications of Inadequate Risk Management

Businesses that fail to adequately manage financial risks face a range of legal implications. These consequences can be severe, potentially leading to significant financial penalties, reputational damage, and even criminal charges.

Failure to comply with relevant regulations can result in fines, sanctions, and legal action from regulatory bodies. For instance, a company failing to meet capital adequacy requirements could face penalties and restrictions on its operations. Furthermore, inadequate risk management can lead to litigation from investors or creditors who suffer losses due to the company’s negligence. In extreme cases, directors and officers can face personal liability for corporate failures resulting from inadequate risk management.

Government Intervention in Resolving Financial Crises

Government intervention plays a critical role in resolving financial crises. The nature and extent of intervention vary depending on the severity and nature of the crisis, but it often involves measures to restore confidence in the financial system and prevent a wider economic collapse. These interventions can have significant impacts on businesses, both positive and negative.

Examples of government interventions include bailouts of failing financial institutions, liquidity injections into the money market, and fiscal stimulus packages to boost economic activity. While such interventions can prevent a complete collapse of the financial system, they can also lead to increased government debt, moral hazard (where institutions take on excessive risk expecting a bailout), and distortions in market mechanisms. Businesses may benefit from government support during a crisis, but they may also face increased regulatory scrutiny and potential nationalization or restructuring as a consequence.

International Implications of Financial Crises

Financial crises, regardless of their origin, rarely remain confined to national borders. Their impact reverberates globally, creating interconnected challenges and requiring international cooperation for effective management. The severity and nature of this impact, however, differ significantly depending on whether the affected economy is developed or developing.

The transmission of financial crises across borders occurs through various channels, including trade, capital flows, and global financial markets. A crisis in one country can quickly destabilize others through reduced demand for exports, capital flight, and contagion effects in interconnected financial institutions. Understanding these international implications is crucial for developing effective preventative and mitigation strategies.

Impact on Developed versus Developing Economies

Developed and developing economies experience distinct impacts during financial crises. Developed economies, with generally more robust financial systems and regulatory frameworks, often experience sharper, albeit shorter, declines in economic activity. They possess greater access to international financial markets and resources to manage the crisis. However, the interconnectedness of their financial systems means that a crisis in one major economy can trigger a domino effect, impacting global stability. The 2008 global financial crisis, originating in the US subprime mortgage market, serves as a prime example, demonstrating how a crisis in a developed economy can swiftly impact the global financial system.

Developing economies, conversely, often face longer-lasting and more severe consequences. Their financial systems are typically more vulnerable, lacking the depth and resilience of developed economies. They are often heavily reliant on foreign capital inflows, making them particularly susceptible to capital flight during a global crisis. Furthermore, limited access to international financial safety nets and weaker regulatory frameworks exacerbate their vulnerabilities. The 1997-98 Asian financial crisis illustrated the devastating impact of a crisis on developing economies, highlighting the need for robust domestic policies and international support.

Role of International Organizations

International organizations like the International Monetary Fund (IMF) and the World Bank play pivotal roles in mitigating the global spread of financial crises and providing financial assistance to affected countries. The IMF offers financial assistance through loan programs, conditional upon the implementation of specific economic reforms aimed at addressing the root causes of the crisis. These reforms often involve fiscal consolidation, structural adjustments, and exchange rate adjustments. The World Bank, meanwhile, focuses on longer-term development goals, providing financial and technical assistance to help countries rebuild their economies and strengthen their financial sectors after a crisis. Both organizations also play crucial roles in monitoring global financial stability and providing early warning signals of potential crises.

International Cooperation Strategies

Effective international cooperation is essential in preventing and managing the global spread of financial instability. Strategies include enhanced regulatory frameworks, coordinated monetary policies, and improved information sharing among countries. The Basel Accords, for instance, represent a significant effort to harmonize banking regulations globally, aiming to improve the stability of the international financial system. Similarly, international cooperation through forums like the G20 has been crucial in coordinating responses to global financial crises, facilitating the sharing of best practices and ensuring a coordinated approach to policy responses. The coordinated response to the 2008 global financial crisis, while imperfect, demonstrated the potential of international cooperation in mitigating the severity of a global crisis.

Epilogue

Successfully managing financial crises hinges on preparedness, foresight, and decisive action. By understanding the early warning signals, implementing robust risk mitigation strategies, and maintaining open communication with stakeholders, organizations can significantly improve their chances of weathering economic storms. A proactive approach, coupled with a well-defined recovery plan, empowers businesses to not only survive but also emerge stronger from periods of financial uncertainty.

Detailed FAQs

What is the role of insurance in financial crisis management?

Insurance can provide a crucial safety net by covering potential losses from unforeseen events exacerbating a crisis. However, it’s not a standalone solution and should be part of a broader risk management strategy.

How can technology help in crisis management?

Technology plays a significant role, enabling real-time data analysis for early warning detection, facilitating rapid communication with stakeholders, and streamlining crisis response operations.

What is the importance of ethical considerations during a financial crisis?

Maintaining ethical standards is paramount. Transparency, fairness, and responsible decision-making are crucial for preserving stakeholder trust and mitigating reputational damage.

How can small businesses prepare for financial crises?

Small businesses should focus on building strong financial foundations, diversifying income streams, and establishing emergency funds. They should also develop simple, yet effective, crisis communication plans.