Crafting effective financial dashboards is crucial for making sense of complex financial data. Whether you’re managing personal finances or overseeing a large corporation, a well-designed dashboard can transform raw numbers into actionable insights. This guide explores the process of building such dashboards, from defining the scope and designing the user interface to integrating data sources and ensuring security.

We’ll cover key aspects such as selecting appropriate data visualization techniques, implementing robust security measures, and deploying and maintaining your dashboard effectively. Through practical examples and best practices, we aim to equip you with the knowledge needed to create a financial dashboard that meets your specific needs and delivers clear, concise financial information.

Defining the Scope of a Financial Dashboard

A financial dashboard is a visual representation of key financial data, designed to provide a quick and comprehensive overview of an individual’s or organization’s financial health. It consolidates information from various sources into a single, easily digestible format, allowing for efficient monitoring and informed decision-making. The specific components and KPIs will vary significantly depending on the intended user and their financial goals.

Core Components of a Typical Financial Dashboard

Effective financial dashboards typically include several core components to ensure a holistic view of financial performance. These components work together to provide a clear picture of current financial standing and trends. A well-designed dashboard presents data in a visually appealing and easily understandable manner, avoiding information overload. This is achieved through the strategic use of charts, graphs, and key performance indicators. For example, a common component is a summary section displaying key metrics like total assets, liabilities, and net worth (for personal finance) or revenue, expenses, and profit margin (for business finance).

Differences Between Dashboards for Personal Finance and Business Finance

Personal finance dashboards focus on individual financial well-being, tracking assets, liabilities, income, expenses, and net worth. They might include features for budgeting, debt management, and investment tracking. In contrast, business finance dashboards are geared toward monitoring the financial performance of a company. They emphasize key performance indicators like revenue, profit margins, cash flow, and return on investment (ROI). Business dashboards often integrate data from various departments and utilize more sophisticated analytics to identify trends and potential risks. A key distinction lies in the scale and complexity of the data involved, with business dashboards generally handling significantly larger datasets and more complex calculations.

Key Performance Indicators (KPIs) Commonly Included in Financial Dashboards

The specific KPIs included in a financial dashboard depend heavily on the user’s goals and the type of finance being monitored. However, some common examples include:

- Personal Finance: Net worth, debt-to-income ratio, savings rate, investment returns, monthly expenses, and budget variance.

- Business Finance: Revenue, gross profit margin, net profit margin, return on assets (ROA), return on equity (ROE), cash flow from operations, customer acquisition cost (CAC), and customer lifetime value (CLTV).

These KPIs provide a concise summary of financial performance, enabling quick identification of areas needing attention or celebration of successes. Careful selection of KPIs is crucial to ensure the dashboard effectively addresses the user’s needs and objectives.

Data Sources Used to Populate a Financial Dashboard

Financial dashboards draw data from a variety of sources, depending on the context. Data integration is a critical aspect of dashboard creation, ensuring accuracy and consistency. The sources can range from simple spreadsheets to complex enterprise resource planning (ERP) systems.

- Personal Finance: Bank statements, credit card statements, investment account statements, budgeting apps, and expense tracking software.

- Business Finance: Accounting software (e.g., QuickBooks, Xero), enterprise resource planning (ERP) systems, customer relationship management (CRM) systems, sales data, and financial reporting databases.

The accuracy and reliability of the dashboard are directly dependent on the quality and consistency of data from these sources. Regular updates and data validation are essential to maintain the dashboard’s integrity and usefulness.

Designing the User Interface (UI) and User Experience (UX)

A well-designed financial dashboard is crucial for effective data analysis and decision-making. The user interface (UI) and user experience (UX) are paramount; a poorly designed dashboard can lead to confusion, misinterpretations, and ultimately, poor financial outcomes. The goal is to create a visually appealing and intuitive interface that facilitates efficient data exploration and understanding.

Wireframe Design for a Financial Dashboard

A wireframe provides a skeletal structure for the dashboard’s layout, outlining the placement of key elements and the user’s navigation flow. This helps visualize the information hierarchy and ensures a logical and intuitive user experience. The following table represents a sample wireframe:

| Column 1: Key Metrics | Column 2: Charts & Graphs | Column 3: Data Tables | Column 4: Interactive Elements |

|---|---|---|---|

| Revenue | Line chart showing revenue trends over time | Detailed revenue breakdown by product/service | Date selector for customized time range |

| Profit Margin | Bar chart comparing profit margins across different segments | Table displaying profit margin data with key performance indicators (KPIs) | Drill-down functionality for deeper analysis |

| Expenses | Pie chart illustrating expense distribution across categories | Table with detailed expense breakdown by category and time period | Filtering options for specific expense categories |

| Cash Flow | Area chart depicting cash inflow and outflow | Table summarizing cash flow statements | Downloadable reports in various formats (CSV, PDF, etc.) |

This wireframe is a simplified example and can be adapted based on specific needs and data points. Responsive design principles should be applied to ensure optimal viewing across different screen sizes.

Visual Clarity and Data Representation

Visual clarity and effective data representation are critical for a financial dashboard’s success. Information should be presented concisely and without clutter, using appropriate visual cues to highlight key trends and insights. Ambiguity should be avoided, and the dashboard should be easily understandable even for users with limited financial expertise. For example, using clear labels, consistent units, and avoiding unnecessary visual noise significantly improves comprehension.

Color Palettes and Chart Types

The choice of color palettes and chart types directly impacts the dashboard’s readability and effectiveness. A well-chosen color palette enhances visual appeal and helps distinguish different data points. Consistent use of color coding is crucial to maintain clarity. For instance, using a consistent color for revenue across all charts aids in immediate comprehension. Different chart types are suitable for different data representations; line charts show trends, bar charts compare values, and pie charts illustrate proportions. Selecting the appropriate chart type for the specific data being presented is vital for effective communication.

Best Practices for Intuitive Interface Design

Designing an intuitive and user-friendly interface requires careful consideration of several factors. Prioritizing key metrics, using clear and concise labels, providing interactive elements like filters and drill-downs, and ensuring responsive design across devices are crucial for a positive user experience. Moreover, incorporating user feedback throughout the design process and conducting usability testing are invaluable for identifying and addressing potential usability issues before the dashboard’s launch. A well-designed dashboard should seamlessly guide users through the data, allowing them to quickly identify key insights and make informed decisions.

Selecting Appropriate Data Visualization Techniques

Choosing the right chart type is crucial for effectively communicating financial insights within a dashboard. The goal is to present complex data in a clear, concise, and easily digestible manner, enabling users to quickly grasp key trends and patterns. The selection process depends heavily on the specific data being visualized and the insights you aim to highlight.

Different chart types excel at showcasing different aspects of financial data. For example, bar charts are ideal for comparing discrete values across categories, while line graphs are better suited for illustrating trends over time. Pie charts effectively show the proportion of parts to a whole, but become less useful with many segments. Understanding these strengths and weaknesses allows for the creation of a dashboard that is both informative and visually appealing.

Chart Type Comparisons and Applications in Financial Dashboards

| Chart Type | Description | Suitable for | Example in Financial Dashboard |

|---|---|---|---|

| Bar Chart | Compares discrete values across different categories. Can be horizontal or vertical. | Comparing sales figures across different regions, comparing revenue streams, displaying budget vs. actual spending. | A vertical bar chart comparing monthly revenue for the past year, with each month represented by a bar. |

| Line Graph | Shows trends and changes in data over time. | Illustrating revenue growth over several years, visualizing stock prices, tracking key performance indicators (KPIs) over time. | A line graph showing the company’s stock price over the past quarter, highlighting any significant fluctuations. |

| Pie Chart | Represents the proportion of parts to a whole. | Showing the breakdown of revenue sources, visualizing the allocation of budget across different departments (when the number of departments is relatively small). | A pie chart illustrating the percentage of revenue generated from different product lines. |

| Scatter Plot | Shows the relationship between two variables. | Analyzing the correlation between marketing spend and sales revenue, identifying outliers in financial data. | A scatter plot illustrating the relationship between advertising expenditure and sales figures for different product categories. |

Sample Dashboard Section with Diverse Chart Types

Imagine a section of a financial dashboard focused on sales performance. This section could incorporate several chart types to offer a holistic view.

A bar chart could compare sales figures across different regions for the current month. A line graph could show the trend of overall sales revenue over the past year, highlighting seasonal variations. Finally, a smaller pie chart could display the percentage contribution of each product line to the total sales revenue for the month.

This combination provides a comprehensive overview, allowing users to quickly compare regional performance, understand sales trends over time, and identify the key revenue-generating products. The visual representation makes it easier to spot potential issues or areas for improvement than simply looking at raw numerical data.

Utilizing Interactive Elements for Enhanced Data Exploration

Interactive elements significantly improve data exploration within a financial dashboard. Drill-down capabilities allow users to investigate data at different levels of detail. For example, clicking on a bar representing a specific region in a bar chart could reveal a more granular breakdown of sales by product within that region. Similarly, hovering over a point on a line graph could display the exact value for that data point. These interactive features empower users to delve deeper into the data and uncover hidden insights, fostering a more thorough understanding of the financial landscape. Such interactivity transforms a static report into a dynamic exploration tool.

Simplifying Complex Financial Data Presentation

Presenting complex financial data in a simplified and easily understandable manner is paramount. This requires careful consideration of the audience and their level of financial literacy. Avoid technical jargon and opt for clear, concise labels and titles. Use consistent color schemes and visual cues to enhance readability. Prioritize the most important metrics and avoid overwhelming the user with excessive information. The goal is to create a dashboard that is intuitive and easy to navigate, even for users without a strong financial background. Consider using clear annotations and tooltips to explain any potentially confusing data points or trends. A well-designed dashboard translates complex financial information into actionable insights that are readily understood by all stakeholders.

Data Integration and Connectivity

Building a truly effective financial dashboard hinges on seamlessly integrating data from diverse sources. This section explores the common data sources, integration methods, data cleaning processes, and a step-by-step guide to connecting your dashboard to a specific data source. The accuracy and reliability of your dashboard are directly tied to the quality of your data integration process.

Data sources for financial dashboards are incredibly varied, reflecting the multifaceted nature of modern finance.

Common Data Sources for Financial Dashboards

Financial dashboards draw data from a wide range of sources. These sources often include accounting software packages (like Xero, QuickBooks, or SAP), Customer Relationship Management (CRM) systems (such as Salesforce or HubSpot), and various databases (SQL, NoSQL, or cloud-based solutions). Other potential sources include spreadsheet programs (Excel, Google Sheets), dedicated financial reporting tools, and even data extracted directly from transactional systems. The specific sources will depend heavily on the organization’s size, structure, and the information required for the dashboard.

Data Integration Methods

Several methods exist for integrating data from disparate sources into a unified dashboard. The choice depends on factors like data volume, data structure, technical expertise, and the desired level of real-time data updates.

Common approaches include:

- ETL (Extract, Transform, Load): This traditional method involves extracting data from various sources, transforming it into a consistent format, and loading it into a central data warehouse or data lake. This is particularly useful for large datasets and complex transformations.

- API Integration: Many software applications offer Application Programming Interfaces (APIs) that allow direct access to their data. This method provides real-time or near real-time data updates, streamlining the process significantly.

- Data Connectors/Import Tools: Many dashboarding tools offer built-in connectors or import functions that simplify the process of importing data from various sources. These often handle much of the data transformation automatically.

- Data Replication: This method involves creating a copy of the data in a central location. This is useful when real-time data is not crucial, and the volume of data is relatively small.

Data Cleaning and Transformation

Before data can be used effectively in a dashboard, it must undergo a thorough cleaning and transformation process. This involves handling missing values, correcting inconsistencies, standardizing formats, and ensuring data accuracy.

Key steps include:

- Identifying and Handling Missing Values: Missing data can significantly skew results. Strategies include imputation (filling in missing values based on existing data) or removal of incomplete records.

- Data Standardization: Ensuring consistency in data formats (e.g., date formats, currency symbols) is crucial for accurate analysis and reporting.

- Data Validation: Checking for outliers and anomalies that might indicate errors in the data. This often involves using statistical methods or data quality rules.

- Data Transformation: Converting data into a format suitable for analysis and visualization. This might involve aggregation, calculation of new variables, or data normalization.

Connecting a Dashboard to a Spreadsheet

Let’s illustrate a simplified step-by-step process for connecting a dashboard to a spreadsheet (e.g., an Excel file):

- Import the Spreadsheet: Most dashboarding software allows direct import of spreadsheet files via a file upload function or a dedicated connector.

- Data Cleaning (if necessary): Inspect the data for errors, inconsistencies, or missing values. Address these issues before proceeding.

- Data Transformation (if necessary): If needed, transform the data to suit the dashboard’s requirements. This might involve creating calculated fields or renaming columns.

- Establish Connections: The dashboard software will guide you through the process of linking the cleaned and transformed data to the visualization components of your dashboard.

- Data Visualization: Once the connection is established, you can use the data to create charts, graphs, and other visualizations within the dashboard.

Security and Data Privacy Considerations

Protecting sensitive financial data within a dashboard requires a multi-layered approach encompassing robust security measures and adherence to relevant data privacy regulations. Neglecting these aspects can lead to significant financial losses, reputational damage, and legal repercussions. This section Artikels key considerations for building a secure and privacy-compliant financial dashboard.

Data Encryption

Protecting data at rest and in transit is paramount. Data encryption transforms sensitive information into an unreadable format, rendering it useless to unauthorized individuals. For data at rest, database encryption and file-level encryption are crucial. Data in transit should be secured using HTTPS protocols and VPNs for all communication between the dashboard and data sources. Strong encryption algorithms, such as AES-256, should be employed.

Access Control and User Authentication

Implementing robust access control mechanisms is essential to limit access to sensitive data based on user roles and permissions. This involves using role-based access control (RBAC) to define granular permissions for different user groups. For instance, a finance manager might have full access, while a sales representative may only view sales-related data. Multi-factor authentication (MFA) should be mandatory, adding an extra layer of security beyond passwords. This could involve using one-time passwords (OTPs), biometric authentication, or security tokens.

Data Privacy Compliance

Compliance with regulations such as GDPR, CCPA, and HIPAA is crucial, depending on the type of data handled and the geographic location of users. This involves implementing data minimization principles, ensuring data is only collected and processed for specified, explicit, and legitimate purposes. Data subjects should have the right to access, rectify, erase, and restrict the processing of their personal data. Regular data privacy impact assessments (DPIAs) should be conducted to identify and mitigate potential risks. Examples of non-compliance could result in substantial fines and legal action. For example, a company failing to properly secure customer financial data under GDPR could face fines up to €20 million or 4% of annual global turnover.

Security Threats and Mitigation Strategies

Several security threats exist, including unauthorized access, data breaches, and denial-of-service (DoS) attacks. Mitigation strategies involve implementing firewalls, intrusion detection and prevention systems (IDS/IPS), and regular security audits. Vulnerability scanning and penetration testing can identify and address weaknesses in the system. Robust logging and monitoring are essential for detecting suspicious activities and responding promptly to incidents. For example, a distributed denial-of-service (DDoS) attack could be mitigated using cloud-based DDoS protection services that absorb malicious traffic, preventing the dashboard from becoming unavailable. Similarly, regular security audits can uncover vulnerabilities and help maintain the overall security posture.

Dashboard Deployment and Maintenance

Deploying and maintaining a financial dashboard is crucial for ensuring its continued effectiveness and providing reliable access to key financial information. The chosen deployment method significantly impacts accessibility, security, and ongoing maintenance requirements. Regular updates and performance monitoring are essential to guarantee the dashboard remains accurate, relevant, and efficient.

Deployment Methods for Financial Dashboards

Cloud-Based Deployment

Cloud-based solutions offer several advantages, including scalability, accessibility, and reduced infrastructure costs. Platforms like AWS, Azure, or Google Cloud provide pre-built services for hosting and managing dashboards, eliminating the need for on-site server maintenance. Dashboards can be accessed from anywhere with an internet connection, enhancing collaboration and real-time data access. Security features offered by cloud providers generally exceed those available with on-premise solutions, although careful configuration and adherence to best practices are still necessary. For example, a company might choose to deploy their financial dashboard on AWS, leveraging its robust security infrastructure and scalability to handle fluctuating user demand.

On-Premise Deployment

On-premise deployment involves installing the dashboard on servers within the organization’s own data center. This approach offers greater control over data security and compliance, particularly beneficial for highly sensitive financial data. However, it requires significant upfront investment in hardware and IT personnel for ongoing maintenance and support. This method might be preferred by organizations with stringent regulatory requirements or concerns about data sovereignty. A large financial institution, for example, might opt for an on-premise solution to maintain complete control over its sensitive financial data and comply with strict regulatory guidelines.

Hybrid Deployment

A hybrid approach combines elements of both cloud-based and on-premise deployments. This strategy can provide a balance between cost-effectiveness, scalability, and security. For instance, a company might host less sensitive data in the cloud for accessibility and cost savings, while maintaining highly sensitive data on its own servers. This allows for a flexible and customized solution tailored to specific needs and risk tolerance.

Importance of Regular Dashboard Maintenance and Updates

Regular maintenance and updates are paramount to ensuring the dashboard’s accuracy, reliability, and relevance. Outdated data, broken links, or inefficient code can lead to inaccurate insights and poor decision-making. Updates should include not only data refreshes but also improvements to the user interface, functionality, and security features. Neglecting maintenance can result in increased downtime, security vulnerabilities, and a loss of user confidence. For example, failing to update a dashboard’s underlying data sources could lead to reporting inaccurate financial figures, impacting strategic planning and investment decisions.

Dashboard Performance Monitoring and Issue Identification

Monitoring dashboard performance involves tracking key metrics such as loading times, error rates, and user engagement. This helps identify potential issues early on, preventing them from escalating into major problems. Tools like Google Analytics or dedicated dashboard monitoring platforms can provide valuable insights into user behavior and system performance. Regularly reviewing these metrics allows for proactive adjustments to improve the dashboard’s efficiency and user experience. For example, monitoring loading times can reveal bottlenecks in data retrieval, allowing for optimization of queries or database design.

Maintaining and Updating a Financial Dashboard: A Checklist

A comprehensive maintenance plan should incorporate the following tasks:

- Regular data source verification and updates

- Scheduled data backups and disaster recovery planning

- Periodic security audits and vulnerability assessments

- User feedback collection and UI/UX improvements

- Performance monitoring and optimization

- Documentation updates and knowledge base maintenance

- Software updates and patching

- Regular testing of functionality and data accuracy

Illustrative Examples of Financial Dashboards

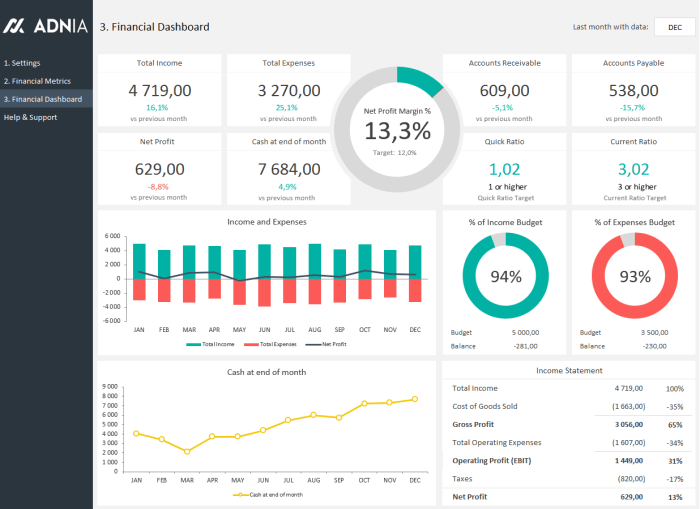

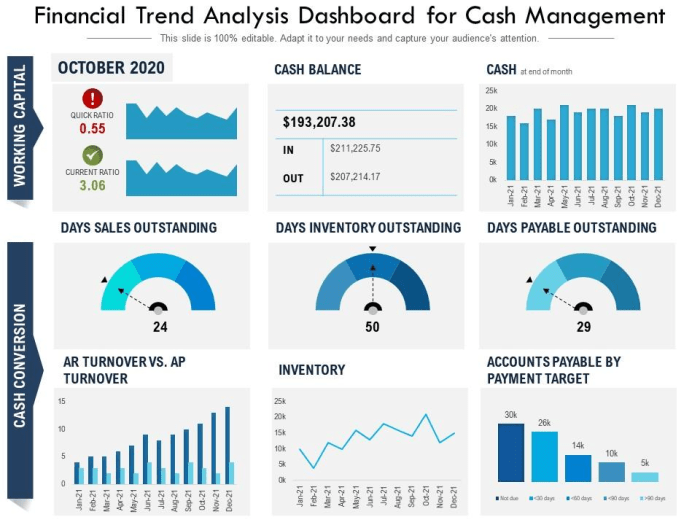

Financial dashboards are powerful tools that provide a visual representation of key financial data, allowing users to quickly understand their financial position and make informed decisions. The design and functionality of a dashboard vary greatly depending on the user’s needs and the complexity of the financial data involved. Below are examples showcasing the diverse applications of financial dashboards across different contexts.

Financial Dashboard for a Small Business

A well-designed financial dashboard for a small business should provide a concise overview of key performance indicators (KPIs) and operational metrics. This allows owners to monitor their business’s health and make data-driven decisions.

This type of dashboard needs to be easily understandable and actionable, prioritizing key metrics over overwhelming detail. The design should focus on clarity and simplicity, making it easy for the business owner to quickly assess the financial status of their company.

- Revenue and Expenses: A clear display of total revenue, cost of goods sold, operating expenses, and net profit, ideally presented over time (e.g., monthly or quarterly). A simple bar chart or line graph would suffice.

- Cash Flow: Real-time tracking of cash inflows and outflows, showing current cash balance and projected cash flow for the next few weeks or months. A simple table with color-coding for positive and negative cash flows would be helpful.

- Key Performance Indicators (KPIs): Tracking of crucial metrics such as customer acquisition cost (CAC), customer lifetime value (CLTV), average order value (AOV), and gross profit margin. These KPIs can be displayed using gauges or bar charts for easy comparison against targets.

- Sales Performance: Visualization of sales data, broken down by product, customer, or sales channel. A combination of charts and tables would offer a comprehensive view.

- Inventory Management: For businesses with inventory, tracking of stock levels, turnover rates, and potential stockouts. A simple table with color-coded alerts for low stock levels would be beneficial.

Financial Dashboard for Personal Finance Management

A personal finance dashboard should offer a comprehensive yet easy-to-understand overview of an individual’s financial health. It should empower users to track their spending, savings, and investments, ultimately leading to better financial planning and decision-making. The design should prioritize user-friendliness and intuitive navigation, making it accessible to individuals with varying levels of financial literacy.

- Net Worth: A clear display of total assets (e.g., savings, investments, property) minus total liabilities (e.g., loans, credit card debt). This can be presented as a single number, updated in real-time.

- Budgeting and Spending Tracking: Categorization of spending and comparison against a pre-defined budget. Pie charts or bar charts would effectively visualize spending patterns across different categories (e.g., housing, food, transportation).

- Investment Portfolio: Overview of investment holdings, including asset allocation, performance, and overall portfolio value. A table displaying the holdings, their current value, and performance over time would be appropriate.

- Debt Management: Tracking of outstanding debt, including interest rates and minimum payments. A table summarizing outstanding debts with clear visualization of remaining balances and payment schedules would be helpful.

- Savings Goals: Tracking progress towards savings goals, visualizing the amount saved against the target amount. A progress bar would be a visually appealing way to track progress.

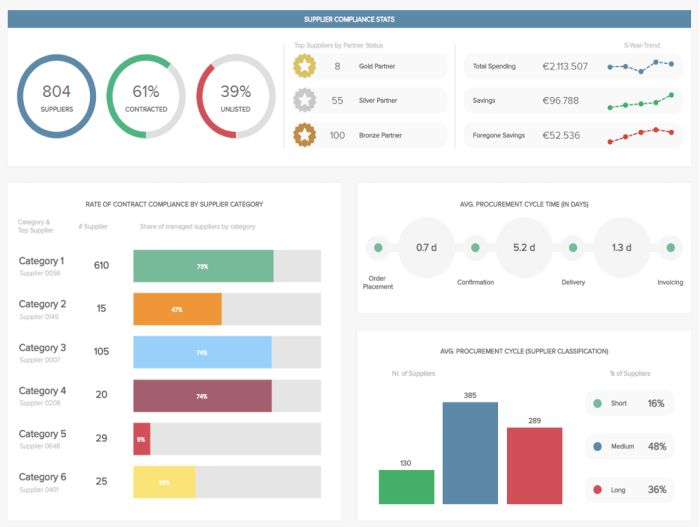

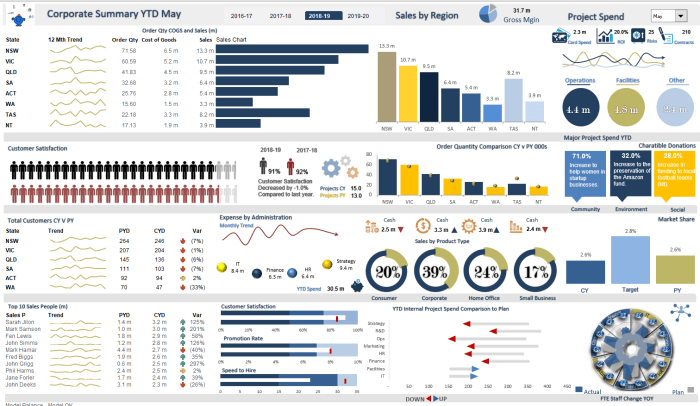

Financial Dashboard for a Large Corporation

Financial dashboards for large corporations are significantly more complex, incorporating a wide range of data sources and sophisticated analytical capabilities. These dashboards are designed to provide executives and other stakeholders with a holistic view of the company’s financial performance, identify trends, and support strategic decision-making. The design should emphasize data accuracy, security, and the ability to drill down into detailed information.

- Consolidated Financial Statements: Real-time display of key financial statements, including the balance sheet, income statement, and cash flow statement, aggregated across different business units and subsidiaries. This requires sophisticated data integration and aggregation capabilities.

- Key Performance Indicators (KPIs): Tracking of a large number of KPIs, potentially customized for different departments or business units. These KPIs may include metrics related to profitability, efficiency, market share, and customer satisfaction.

- Predictive Analytics: Integration of forecasting models and predictive analytics to anticipate future trends and risks. This could involve machine learning algorithms to predict future revenue, expenses, or cash flow.

- Risk Management: Monitoring of key financial risks, including credit risk, market risk, and operational risk. This often involves the integration of risk management systems and data sources.

- Regulatory Compliance: Ensuring compliance with relevant financial regulations and reporting requirements. The dashboard might include features for automated report generation and compliance checks.

Concluding Remarks

Building a successful financial dashboard involves careful planning, thoughtful design, and a commitment to data security. By understanding the core components, selecting appropriate visualization techniques, and implementing robust security measures, you can create a powerful tool for financial analysis and decision-making. This guide has provided a framework for this process, emphasizing the importance of user experience, data integrity, and ongoing maintenance. Remember that the ultimate goal is to transform complex financial data into readily understandable insights, enabling informed and effective decision-making.

FAQ Compilation

What software is best for creating financial dashboards?

The best software depends on your needs and technical skills. Options range from spreadsheet software like Excel to dedicated business intelligence tools like Tableau or Power BI, and even custom solutions using programming languages.

How often should I update my financial dashboard?

The frequency depends on your data sources and reporting needs. Daily updates might be necessary for real-time monitoring, while weekly or monthly updates may suffice for less time-sensitive information.

What are the common pitfalls to avoid when creating a financial dashboard?

Common pitfalls include overly complex designs, inaccurate data, insufficient security measures, and a lack of user-friendly navigation. Prioritizing clarity, accuracy, and user experience is crucial.