Unlocking the power of data visualization, financial dashboards offer businesses of all sizes a clear, concise view of their financial health. From tracking key performance indicators (KPIs) to identifying emerging trends, these dynamic tools transform raw data into actionable insights, enabling more informed decision-making and ultimately, improved profitability. This exploration delves into the design, implementation, and interpretation of effective financial dashboards, showcasing practical examples across diverse industries.

We will examine various dashboard types, crucial metrics, effective visualization techniques, and best practices for building and utilizing these powerful tools. Understanding how to select appropriate data sources, design intuitive layouts, and interpret the resulting information is key to harnessing the full potential of financial dashboards. We will also discuss advanced features like predictive analytics and customized user access.

Introduction to Financial Dashboards

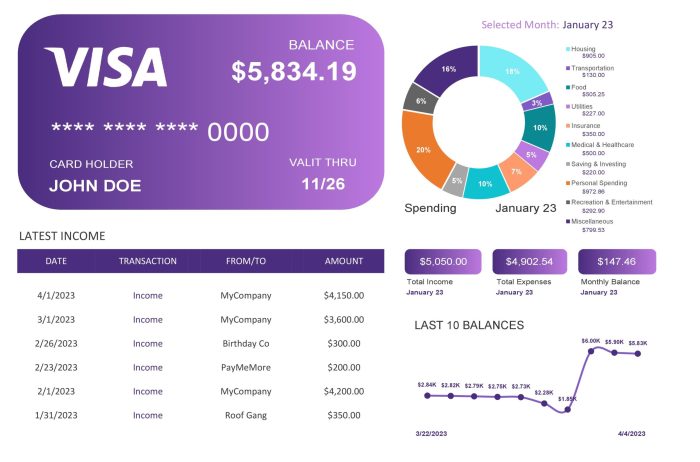

A financial dashboard is a visual representation of key financial metrics and data, designed to provide a quick and comprehensive overview of a business’s financial performance. Its purpose is to facilitate informed decision-making by presenting critical information in an easily digestible format, allowing stakeholders to quickly identify trends, potential problems, and opportunities for improvement.

Financial dashboards offer significant benefits for businesses of all sizes. For small businesses, they provide a clear picture of cash flow, profitability, and expenses, enabling proactive management of resources. Larger enterprises benefit from dashboards by gaining a holistic view of performance across multiple departments and subsidiaries, facilitating better strategic planning and resource allocation. The ability to track key performance indicators (KPIs) in real-time allows for faster responses to market changes and improved operational efficiency across the board.

Types of Financial Dashboards

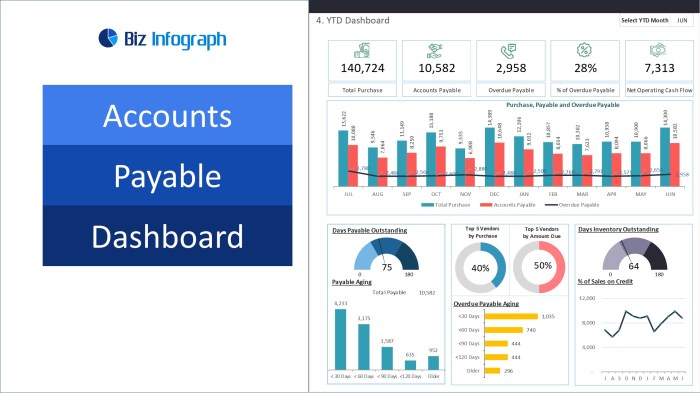

Different types of financial dashboards cater to specific needs and levels of analysis within an organization. Operational dashboards focus on day-to-day performance, tracking metrics like sales, inventory levels, and production output. Strategic dashboards, on the other hand, provide a higher-level view, focusing on long-term goals and strategic initiatives, incorporating data on market share, customer acquisition costs, and return on investment (ROI). Other types might include financial planning and analysis (FP&A) dashboards, which support the budgeting and forecasting process, and compliance dashboards, ensuring adherence to regulatory requirements.

Basic Financial Dashboard Layout

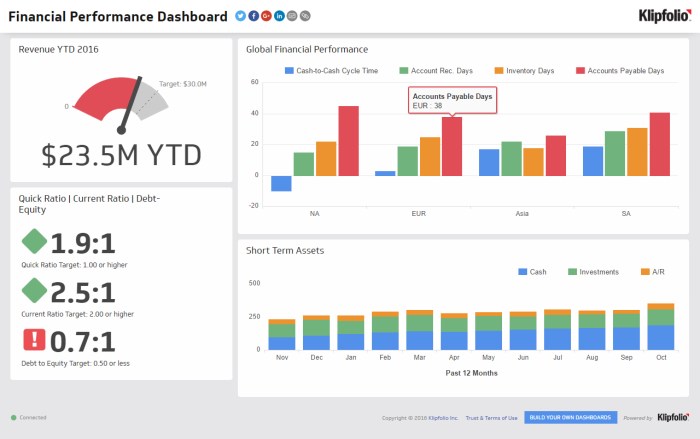

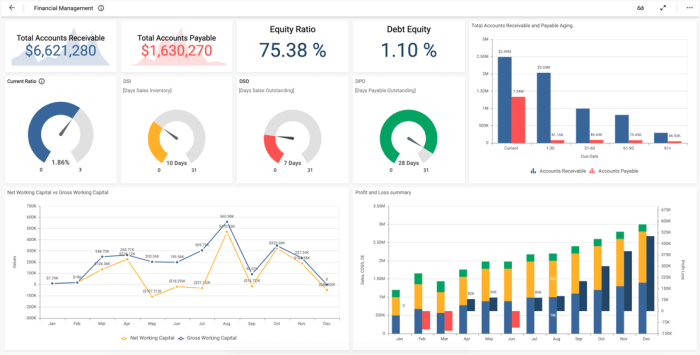

Imagine a dashboard divided into several key sections. The top section might display high-level summaries of key financial indicators, such as total revenue, net income, and cash balance, using large, easily readable numbers and perhaps color-coding to highlight positive or negative trends. Below this, individual sections could delve into more granular details. One section might focus on profitability, showing gross profit margin, operating income, and net profit margin. Another could detail cash flow, displaying cash inflows and outflows from various sources. A final section could provide a visual representation of key ratios, perhaps using charts or graphs to illustrate trends over time. The overall design should be clean, uncluttered, and intuitive, allowing for quick comprehension of the data presented. The use of clear visual cues, such as color-coding and icons, can significantly enhance the dashboard’s effectiveness. For example, green might indicate positive performance, while red could highlight areas needing attention.

Key Metrics and Indicators in Financial Dashboards

Effective financial dashboards rely on a carefully selected set of key metrics and indicators to provide a concise yet comprehensive overview of a company’s financial health. These metrics should be tailored to the specific business goals and provide actionable insights for decision-making. Understanding the nuances of different metrics and their interpretations is crucial for leveraging the full potential of a financial dashboard.

Choosing the right metrics is paramount for creating a truly valuable dashboard. An overloaded dashboard with irrelevant data can be overwhelming and counterproductive. Conversely, a dashboard lacking crucial information fails to provide a complete picture. The selection process should be driven by the specific business objectives and the questions the dashboard aims to answer.

Essential Financial Metrics

Five essential financial metrics frequently incorporated into dashboards are revenue growth, profit margins, cash flow, return on investment (ROI), and debt-to-equity ratio. Revenue growth reflects the increase in sales over a specific period, providing insights into market demand and business performance. Profit margins reveal the profitability of operations, indicating efficiency and pricing strategies. Cash flow tracks the movement of cash in and out of the business, highlighting liquidity and financial stability. ROI measures the return on investments, reflecting the effectiveness of capital allocation. Finally, the debt-to-equity ratio indicates the company’s financial leverage and risk profile. These metrics offer a holistic view of a company’s financial performance and position.

Metric Selection Based on Business Goals

The selection of appropriate metrics should align directly with the overarching business goals. A company focused on rapid expansion might prioritize revenue growth and market share, while a company emphasizing profitability would focus on profit margins and cost control. For example, a startup aiming for rapid growth would focus on metrics like customer acquisition cost (CAC) and monthly recurring revenue (MRR), while an established corporation might concentrate on metrics like return on assets (ROA) and earnings per share (EPS). This targeted approach ensures the dashboard delivers the most relevant information for informed decision-making.

Leading and Lagging Indicators

Leading indicators predict future performance, while lagging indicators reflect past performance. Leading indicators, such as marketing campaign effectiveness or sales pipeline, provide early warnings of potential issues or opportunities. Lagging indicators, such as revenue or profit, confirm past performance. A balanced dashboard incorporates both types, providing a comprehensive view of past performance and future prospects. For example, a decrease in website traffic (leading indicator) might foreshadow a decline in sales (lagging indicator). Understanding this relationship allows for proactive interventions.

Financial Metrics Table

| Metric | Interpretation | Example | Relevance |

|---|---|---|---|

| Revenue Growth | Increase in sales over time | 15% year-over-year growth | Indicates market demand and business success |

| Profit Margin | Profitability of operations | 10% net profit margin | Reflects efficiency and pricing strategies |

| Cash Flow | Movement of cash in and out of the business | Positive cash flow from operations | Highlights liquidity and financial stability |

| Return on Investment (ROI) | Return on investments | 20% ROI on a marketing campaign | Measures the effectiveness of capital allocation |

Examples of Financial Dashboards Across Industries

Financial dashboards are powerful tools, but their effectiveness hinges on tailoring them to the specific needs of each industry. A one-size-fits-all approach simply won’t work. Different industries prioritize different metrics and require unique visualizations to effectively present key performance indicators (KPIs). The following examples illustrate how dashboards adapt to the unique demands of retail, manufacturing, and healthcare.

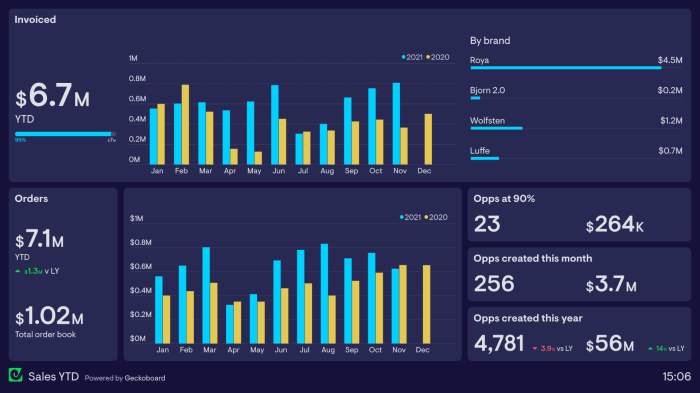

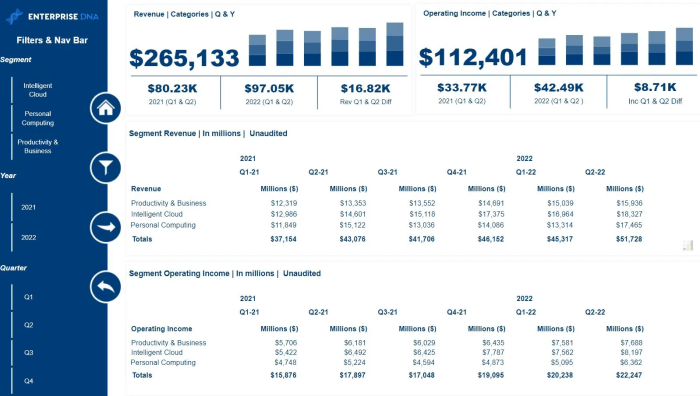

Retail Financial Dashboard Example

Retail dashboards focus heavily on sales performance, inventory management, and customer behavior. A typical dashboard might include visualizations such as geographical sales maps highlighting regional performance, line charts tracking sales trends over time, and bar charts comparing the performance of different product categories. Key metrics would include revenue, gross margin, average transaction value, customer acquisition cost, and inventory turnover rate. The design often emphasizes ease of understanding and quick identification of trends, allowing managers to react swiftly to changing market conditions. For instance, a sudden dip in sales in a specific region could trigger immediate investigation and corrective action. A heatmap visualizing sales performance across different product lines allows for swift identification of underperforming items and potential opportunities for promotional campaigns.

Manufacturing Financial Dashboard Example

Manufacturing dashboards emphasize operational efficiency and production costs. These dashboards typically utilize gauges to monitor key production metrics like output, machine uptime, and defect rates. Charts and graphs track production costs, including material costs, labor costs, and overhead. Key metrics might include production output, cost of goods sold (COGS), manufacturing cycle time, and overall equipment effectiveness (OEE). The design often incorporates real-time data feeds to provide up-to-the-minute insights into production processes. For example, a real-time visualization of the production line’s efficiency could help managers identify bottlenecks and optimize workflow. A dashboard might also include predictive maintenance indicators based on machine usage and historical data, enabling proactive maintenance scheduling to minimize downtime.

Healthcare Financial Dashboard Example

Healthcare financial dashboards focus on patient care costs, revenue cycle management, and operational efficiency. These dashboards frequently employ visualizations such as pie charts to represent the distribution of healthcare costs across different departments, bar charts comparing the performance of different service lines, and line charts showing trends in patient volume and revenue. Key metrics include patient volume, revenue per patient, length of stay, operating margin, and accounts receivable days. The design often emphasizes compliance with regulatory requirements and the ability to track key performance indicators related to patient care quality. For example, a dashboard might track metrics such as patient satisfaction scores, readmission rates, and infection rates, alongside financial metrics. This integration allows for a holistic view of the organization’s performance, balancing financial health with the quality of patient care.

Key Differences in Dashboard Design Across Industries

The following bullet points highlight the key differences in dashboard design across the three industries discussed:

- Focus: Retail dashboards prioritize sales and customer metrics; manufacturing dashboards focus on production efficiency and cost; healthcare dashboards emphasize patient care costs and revenue cycle management.

- Key Metrics: Retail uses revenue, gross margin, and customer acquisition cost; manufacturing uses production output, COGS, and OEE; healthcare uses patient volume, revenue per patient, and length of stay.

- Visualizations: Retail frequently employs geographical maps and sales trend charts; manufacturing uses gauges and real-time data feeds; healthcare utilizes pie charts to show cost distribution and line charts for patient volume trends.

- Data Sources: Each industry integrates data from different sources, reflecting their unique operational characteristics. Retail integrates POS systems and customer relationship management (CRM) data; manufacturing uses machine data and production scheduling systems; healthcare integrates electronic health records (EHR) and billing systems.

Building and Implementing a Financial Dashboard

Building and implementing a successful financial dashboard requires a systematic approach, encompassing data selection, design, development, security, and integration. This process ensures the dashboard provides accurate, timely, and actionable insights to support informed decision-making.

Selecting Appropriate Data Sources

The foundation of any effective financial dashboard lies in the quality and relevance of its data sources. Choosing appropriate sources requires careful consideration of data accuracy, reliability, and accessibility. Sources might include enterprise resource planning (ERP) systems, customer relationship management (CRM) systems, general ledgers, financial reporting tools, and external market data providers. Data should be validated and cleansed to ensure accuracy and consistency. For example, a company might integrate data from its ERP system for sales figures, its CRM for customer demographics, and a market research firm for industry benchmarks. The selection process should prioritize data sources that align with the dashboard’s specific objectives and key performance indicators (KPIs).

Designing and Developing a Financial Dashboard

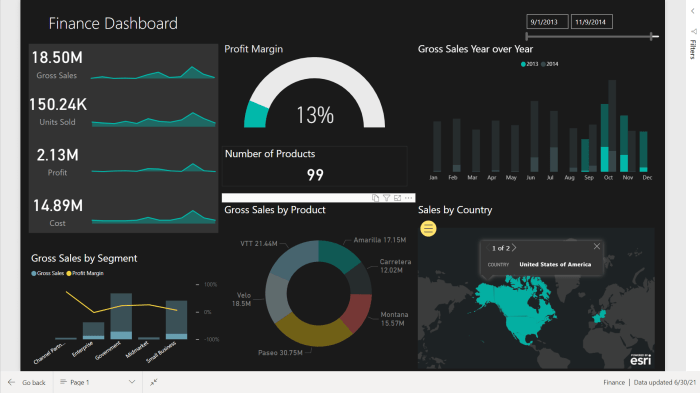

Designing and developing a financial dashboard involves several key steps. First, define the dashboard’s purpose and target audience. This clarifies the required KPIs and the desired level of detail. Next, create a wireframe outlining the dashboard’s layout and the placement of key visualizations. Popular dashboarding tools include Tableau, Power BI, and Qlik Sense, each offering diverse functionalities and visualization options. These tools allow for interactive exploration of data, enabling users to drill down into specific details or filter information based on various criteria. The development process involves connecting the chosen data sources, configuring data transformations, and creating visualizations that effectively communicate insights. For instance, a sales dashboard might use a geographical map to show sales performance by region, supplemented by bar charts comparing sales figures across product lines.

Data Security and Access Control

Data security and access control are paramount for financial dashboards, especially those containing sensitive financial information. Robust security measures are necessary to protect data from unauthorized access, modification, or disclosure. This includes implementing strong authentication mechanisms, data encryption, and regular security audits. Access control should be granular, allowing different users to access only the data and functionalities relevant to their roles and responsibilities. For example, a senior manager might have access to all dashboard data, while a department head might only see data relevant to their department. Compliance with relevant data privacy regulations, such as GDPR or CCPA, is crucial.

Integrating a Financial Dashboard with Existing Business Systems

Seamless integration with existing business systems is essential for maximizing the value of a financial dashboard. This integration allows for automated data updates, eliminating manual data entry and reducing the risk of errors. Integration methods vary depending on the systems involved and might include application programming interfaces (APIs), data extracts, and scheduled data imports. For instance, a financial dashboard might automatically pull sales data from an ERP system at the end of each business day, updating the dashboard with the latest figures. Successful integration ensures that the dashboard provides a real-time, accurate reflection of the organization’s financial performance.

Interpreting and Utilizing Dashboard Data

Financial dashboards are powerful tools, but their value lies not just in their creation, but in the effective interpretation and utilization of the data they present. Understanding how to analyze KPIs, identify trends, and translate insights into actionable strategies is crucial for leveraging the full potential of these visual representations of financial health.

Interpreting key performance indicators (KPIs) displayed on a financial dashboard involves more than just looking at the numbers. It requires understanding the context of each KPI, its relationship to other metrics, and its implications for the overall business strategy. For example, a high customer acquisition cost (CAC) might initially seem alarming, but when considered alongside a high customer lifetime value (CLTV), it could indicate a successful, albeit expensive, acquisition strategy. Similarly, a decrease in revenue might be offset by improvements in profitability, indicating a successful cost-cutting initiative. The key is to analyze KPIs holistically, considering their interdependencies and the broader business context.

KPI Interpretation and Contextual Analysis

Effective interpretation involves a multi-faceted approach. Firstly, understanding the definition and calculation of each KPI is essential. Secondly, comparing current performance to historical data, industry benchmarks, and targets provides crucial context. Finally, analyzing the relationships between different KPIs reveals deeper insights. For instance, a declining gross profit margin might be investigated further by analyzing changes in sales volume, cost of goods sold, and pricing strategies, providing a more complete picture than looking at the margin in isolation. This holistic approach allows for a nuanced understanding of performance and potential areas for improvement.

Trend and Pattern Identification in Financial Data

Financial dashboards are designed to facilitate the identification of trends and patterns. Visual representations like charts and graphs make it easier to spot upward or downward trends in revenue, expenses, profit margins, and other key metrics. These visual cues can quickly highlight areas requiring attention. For example, a consistently declining trend in sales might indicate a need for a revised marketing strategy or product development. Similarly, a sudden spike in expenses warrants investigation to identify the root cause. Furthermore, by comparing trends across different KPIs, one can identify potential correlations, such as a correlation between increased marketing spend and improved sales conversion rates. This analytical approach, aided by the visual nature of dashboards, allows for proactive identification of potential issues and opportunities.

Using Dashboard Insights for Informed Business Decisions

The ultimate goal of a financial dashboard is to inform better business decisions. By analyzing the data presented, businesses can identify areas of strength and weakness, track the effectiveness of initiatives, and make data-driven adjustments to their strategies. For example, if a dashboard reveals a consistent underperformance in a specific product line, management can decide to discontinue the product, allocate resources elsewhere, or implement a marketing campaign to revitalize its sales. Similarly, a dashboard showcasing high customer churn might prompt the company to investigate customer satisfaction issues and implement strategies to improve retention. In essence, dashboard insights empower businesses to make proactive, informed decisions based on objective data, leading to improved performance and increased profitability.

Hypothetical Scenario: Addressing Declining Profitability

Imagine a small bakery experiencing declining profitability. Their financial dashboard reveals a steady decrease in net profit margin over the past six months, despite consistent sales volume. Further analysis, aided by the dashboard, shows a significant increase in the cost of flour, a key ingredient. This insight allows the bakery to explore alternative flour suppliers, negotiate better pricing with their current supplier, or adjust their pricing strategy to offset the increased input cost. The dashboard, by quickly highlighting the problem and providing relevant data, facilitates a swift and informed response, preventing further erosion of profitability. This demonstrates the practical application of dashboard data in solving real-world business challenges.

Advanced Features and Considerations

Elevating financial dashboards beyond simple data visualization requires incorporating advanced features that enhance their analytical power, usability, and security. These features transform static reports into dynamic tools capable of supporting proactive decision-making and improved financial management.

Predictive analytics, interactive elements, customizable access controls, and real-time alerts are key components of a truly effective modern financial dashboard. These enhancements allow for deeper insights, personalized experiences, and improved operational efficiency.

Incorporating Predictive Analytics

Integrating predictive analytics significantly enhances the value of a financial dashboard. By leveraging historical data and statistical modeling, dashboards can forecast future trends, identify potential risks, and provide proactive insights. For instance, a sales forecasting model integrated into a dashboard could predict future revenue based on past performance, seasonal trends, and market indicators. This allows businesses to anticipate potential shortfalls or surpluses, enabling more effective resource allocation and strategic planning. Another example is the use of predictive models to identify potential credit risks, allowing for more informed lending decisions and reduced default rates. The improved accuracy and timeliness of predictions provided by such integration lead to better-informed decision-making.

Interactive Elements and Drill-Down Capabilities

Interactive elements transform static data visualizations into dynamic exploration tools. Drill-down capabilities allow users to investigate data at increasingly granular levels. For example, a user might start by reviewing overall company revenue, then drill down to examine performance by region, product line, or sales representative. This allows for a deeper understanding of underlying factors contributing to overall performance. Interactive charts and graphs, along with filtering and sorting options, empower users to explore data in a flexible and intuitive manner. The ability to interact directly with the data fosters a more comprehensive understanding of financial performance and identifies areas requiring further attention.

Customizable Dashboards for Different User Roles

Dashboards should be tailored to the specific needs and responsibilities of different user roles. A CEO might require a high-level overview of key performance indicators (KPIs), while a finance manager needs detailed breakdowns of specific accounts. Implementing role-based access control ensures that users only see the data relevant to their responsibilities, protecting sensitive information and improving efficiency. This can be achieved through user-specific dashboards with different levels of access, data filtering, and visualization options. For example, a sales team might only see sales data and targets, while a finance team has access to more comprehensive financial statements and analysis.

Financial Dashboard with Alerts and Notifications

Consider a financial dashboard designed for a mid-sized manufacturing company. This dashboard would display key metrics like production costs, inventory levels, and sales figures. In addition to these standard metrics, it would incorporate advanced features such as real-time alerts for critical thresholds. For instance, if inventory levels fall below a predefined reorder point, the system would send an automated notification to the purchasing department. Similarly, if production costs exceed a predetermined budget, an alert would be triggered, prompting investigation and corrective action. These alerts and notifications ensure that potential problems are identified promptly, enabling proactive intervention and preventing costly disruptions. The dashboard could also include predictive modeling to forecast future demand, allowing the company to optimize production and inventory management.

Last Word

In conclusion, mastering the art of financial dashboard design and interpretation is crucial for any organization aiming for data-driven success. By carefully selecting relevant metrics, employing effective visualization techniques, and integrating these dashboards into existing business systems, companies can gain a significant competitive edge. The examples and best practices Artikeld in this guide provide a solid foundation for creating and utilizing financial dashboards that drive informed decisions and ultimately, enhanced financial performance.

Detailed FAQs

What software can I use to create a financial dashboard?

Many tools exist, including spreadsheet software (Excel, Google Sheets), dedicated business intelligence (BI) platforms (Tableau, Power BI), and custom development options.

How often should my financial dashboard be updated?

Update frequency depends on your needs. Some dashboards require real-time updates, while others might suffice with daily, weekly, or monthly refreshes.

What are the potential risks associated with using financial dashboards?

Risks include data inaccuracies, security breaches, and misinterpretations of data leading to flawed decisions. Robust data validation and security measures are crucial.

How can I ensure my dashboard is user-friendly?

Prioritize clarity, simplicity, and intuitive navigation. Use clear labels, consistent formatting, and avoid overwhelming users with excessive data.