Financial Dashboard Software: Imagine a world where your financial data doesn’t just sit there, lifeless and unloved, like a forgotten tax return. Instead, picture it dancing a jig of profitability, a tango of triumph, a waltz of wealth (well, maybe not a waltz, that’s a bit slow). Financial dashboards bring your financial data to life, transforming confusing spreadsheets into vibrant, insightful visualizations that even your accountant will find captivating. This deep dive explores the power of financial dashboard software, revealing its secrets and showcasing its surprisingly delightful capabilities.

From understanding core functionalities and user benefits to navigating the treacherous waters of data security and compliance, we’ll uncover the essential elements of effective financial dashboard implementation. We’ll explore the various types of users who can benefit from this technology, from small business owners to multinational corporations, and even those who just enjoy watching numbers do their thing. We’ll also delve into the key features and benefits, including real-time data visualization, customizable dashboards, and the surprisingly fun process of integrating with existing accounting systems. Get ready to be amazed (and possibly slightly entertained).

Defining Financial Dashboard Software

Financial dashboard software: it’s not just a pretty face (although, let’s be honest, a well-designed dashboard *is* pretty). It’s the Swiss Army knife of financial management, providing a single, easily digestible view of your organization’s financial health. Think of it as your financial crystal ball, but instead of murky predictions, it delivers clear, concise data, empowering you to make smarter, faster decisions.

Financial dashboard software consolidates data from various sources – accounting systems, CRM, sales platforms, you name it – into a centralized, interactive display. This allows users to monitor key performance indicators (KPIs), identify trends, and ultimately, steer their finances towards success (or, at the very least, avoid a complete financial meltdown).

Core Functionalities of Financial Dashboard Software

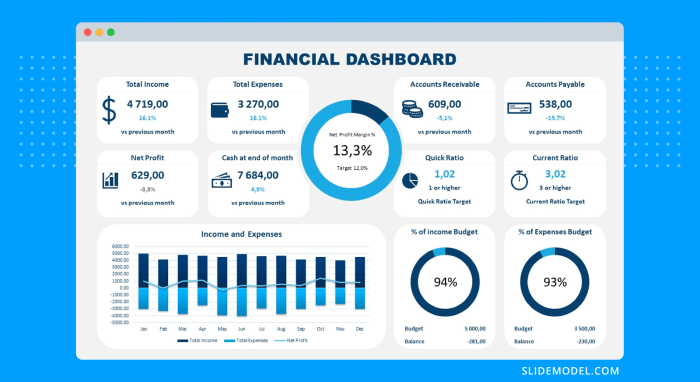

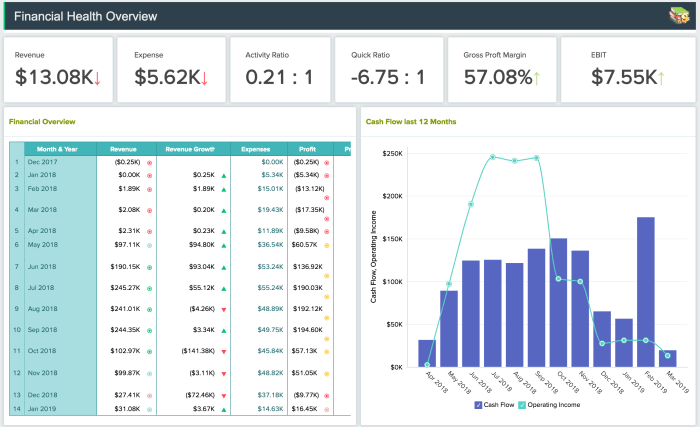

At its heart, financial dashboard software offers a suite of functionalities designed to streamline financial analysis and reporting. These include data aggregation and visualization, real-time monitoring of KPIs, customizable dashboards tailored to specific user needs, and often, the ability to generate insightful reports with just a few clicks. Imagine the time saved! No more endless spreadsheet wrangling; just clear, actionable insights at your fingertips.

Types of Users Who Benefit from Financial Dashboard Software

A wide array of users can benefit from the power of financial dashboards. From C-suite executives needing a high-level overview to departmental managers requiring granular detail, the versatility of this software is impressive. Accountants gain efficiency in reporting, financial analysts can delve into deeper insights, and even sales teams can track their contribution to the bottom line. In short, anyone who needs to understand and act upon financial data will find a dashboard invaluable.

Key Performance Indicators (KPIs) Typically Visualized

KPIs are the lifeblood of any financial dashboard. These metrics provide a snapshot of performance across various aspects of the business. Commonly visualized KPIs include revenue growth, profit margins, cash flow, customer acquisition cost (CAC), return on investment (ROI), and debt levels. Think of them as the vital signs of your business, constantly monitored to ensure everything is running smoothly (or to quickly identify any potential emergencies requiring immediate attention).

On-Premise vs. Cloud-Based Solutions

Choosing between on-premise and cloud-based solutions often comes down to budget, IT infrastructure, and security preferences. Here’s a quick comparison:

| Feature | On-Premise | Cloud-Based |

|---|---|---|

| Cost | Higher initial investment, lower ongoing costs | Lower initial investment, recurring subscription fees |

| Security | Greater control over security, but requires robust internal security measures | Relies on the vendor’s security infrastructure, but often benefits from advanced security features |

| Scalability | Scaling can be complex and expensive | Easily scalable to meet changing needs |

| Maintenance | Requires dedicated IT staff for maintenance and updates | Vendor handles maintenance and updates |

Key Features and Benefits

Unlocking the secrets to financial success doesn’t require a crystal ball; it requires the right tools. Our financial dashboard software provides the clarity and insight you need to navigate the sometimes-murky waters of finance, transforming complex data into actionable strategies. Forget endless spreadsheets and confusing reports – let’s dive into the features that will make your financial life significantly less stressful (and maybe even a little fun).

Data integration is the unsung hero of efficient financial management. Imagine trying to build a house with mismatched bricks and wonky foundations – chaos ensues! Similarly, disparate financial data sources lead to inaccurate reporting and flawed decision-making. Our software seamlessly integrates data from various sources, including accounting software, CRM systems, and e-commerce platforms, providing a unified and accurate view of your financial landscape. This eliminates data silos and ensures you’re working with a single source of truth.

Real-Time Data Visualization in Decision-Making

Real-time data visualization is not just a fancy phrase; it’s the key to proactive financial management. Instead of reacting to problems after they’ve occurred, our dashboard provides immediate insights into key metrics, allowing you to identify trends and address potential issues before they escalate. Imagine seeing a sudden dip in sales – with real-time visualization, you can instantly investigate the cause and take corrective action, preventing further losses. This rapid response capability is invaluable in today’s fast-paced business environment.

Customizable Dashboards Enhance User Experience

One size does not fit all, especially when it comes to financial dashboards. Our software allows you to customize your dashboard to reflect your specific needs and preferences. Need to track specific KPIs? No problem. Want to change the color scheme to something less…beige? Absolutely! This level of customization ensures that the dashboard is intuitive and user-friendly, maximizing its effectiveness and minimizing the time spent navigating complex interfaces. Think of it as your own personal financial command center, tailored to your exact specifications.

Hypothetical Dashboard for a Small Business

Below is an example of a customizable dashboard designed for a small business, showcasing key financial metrics. This is just a sample; the possibilities are endless!

| Metric | Current Value | Trend | Target |

|---|---|---|---|

| Monthly Revenue | $15,000 | Up 10% | $20,000 |

| Net Profit Margin | 15% | Stable | 20% |

| Customer Acquisition Cost (CAC) | $50 | Down 5% | $40 |

| Customer Lifetime Value (CLTV) | $500 | Up 15% | $600 |

Data Security and Compliance

Protecting your financial data is no laughing matter – unless you enjoy the prospect of explaining a data breach to a very unhappy auditor. Financial dashboard software, while incredibly useful for visualizing your financial empire (or, let’s be honest, sometimes just surviving the month), handles sensitive information. This means security and compliance are not optional extras; they’re the bedrock upon which your peace of mind is built.

Data security in financial dashboard software involves a multifaceted approach, encompassing technical safeguards, robust processes, and a healthy dose of vigilance. Failing to prioritize these elements can lead to significant financial losses, reputational damage, and legal repercussions – none of which are particularly fun.

Potential Security Risks

Financial dashboard software, by its very nature, is a prime target for malicious actors. The potential risks include unauthorized access to sensitive financial data, data breaches resulting in identity theft or financial fraud, and system disruptions leading to business interruptions. For instance, a successful phishing attack could grant access to a user’s account, potentially compromising sensitive financial data and opening the door to fraudulent activities. Similarly, a poorly configured server could be vulnerable to hacking, leading to a massive data breach. These scenarios highlight the critical need for robust security measures.

Best Practices for Securing Sensitive Financial Data

Implementing strong security practices is paramount. This includes utilizing robust authentication mechanisms such as multi-factor authentication (MFA), encrypting data both in transit and at rest, regularly updating software and patching vulnerabilities, and implementing strict access control measures. Regular security audits and penetration testing can identify and address potential weaknesses before they’re exploited. Think of it like regularly servicing your car – preventative maintenance is far cheaper than a complete engine overhaul. Furthermore, employee training on security best practices and awareness of phishing scams is crucial to prevent human error, a common entry point for cyberattacks.

Compliance Requirements

Navigating the legal landscape of data security can feel like traversing a minefield. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose stringent requirements on how personal and financial data is collected, processed, and protected. These regulations mandate data minimization, transparency with data subjects, and the right to data portability and erasure. Non-compliance can result in hefty fines and significant legal battles. Understanding and adhering to these regulations is not just a legal necessity; it’s a demonstration of responsible data handling and a commitment to protecting user trust.

Security Features to Look For

Choosing the right financial dashboard software requires careful consideration of its security features. Before signing on the dotted line, ensure the software provider boasts a strong security posture.

- Multi-factor authentication (MFA): This adds an extra layer of security beyond just a password.

- Data encryption (in transit and at rest): This ensures that your data is unreadable even if intercepted.

- Regular security audits and penetration testing: This demonstrates a commitment to proactive security.

- Access control and role-based permissions: This limits access to sensitive data based on user roles.

- Compliance certifications (e.g., ISO 27001, SOC 2): These certifications demonstrate adherence to industry best practices.

- Data backup and disaster recovery plans: These ensure business continuity in case of a system failure.

Selection and Implementation

Choosing the right financial dashboard software and implementing it smoothly is akin to choosing the perfect pair of dancing shoes – you need the right fit for a graceful performance (and to avoid tripping over your own spreadsheets). The wrong choice can lead to a financial tango gone wrong, leaving you in a budgetary twist. Let’s navigate this process with precision and a dash of humor.

This section will guide you through the crucial steps of selecting and implementing your new financial dashboard software, transforming your financial data from a chaotic jumble into a beautifully orchestrated symphony of insights.

Pricing Models: Subscription vs. One-Time Purchase

The choice between a subscription model and a one-time purchase often boils down to your budget and long-term financial strategy. Subscription models typically offer ongoing updates, technical support, and access to new features, akin to a financial gym membership that keeps you fit and up-to-date. One-time purchases, on the other hand, offer a fixed upfront cost, like buying a sturdy, reliable accounting bicycle, but might require separate payments for upgrades and maintenance. Consider your needs and resources carefully; a subscription model might offer better value in the long run, even if the initial cost is higher, while a one-time purchase might be more suitable for smaller businesses with stable, predictable financial needs. For example, a rapidly growing startup might find a subscription model advantageous, allowing them to scale their software alongside their business, while an established, less dynamic company might prefer the predictability of a one-time purchase.

Step-by-Step Implementation Guide

Implementing new software requires a strategic approach; it’s not just a matter of installing the program and hoping for the best. Think of it as carefully orchestrating a financial orchestra – each instrument (department, employee) needs to be tuned and in sync for a harmonious performance.

- Needs Assessment: Before you even start browsing software options, define your specific needs and requirements. What information do you want to track? What reports do you need to generate? This detailed assessment will guide your selection process and ensure the chosen software meets your exact needs.

- Software Selection: Carefully evaluate different options based on your needs, budget, and user-friendliness. Don’t be afraid to test out demos and free trials before making a final decision.

- Data Migration: Transferring your existing financial data to the new software can be a delicate operation. Plan carefully and ensure data integrity. Consider professional assistance if the data migration is complex.

- Testing and Refinement: Thoroughly test the new software to identify any issues or areas for improvement before fully deploying it. Involve key users in this testing phase for valuable feedback.

- Go-Live and Monitoring: Once you’re satisfied with the software’s performance, roll it out to the entire team. Continuously monitor its performance and make adjustments as needed.

Integrating with Existing Accounting Systems

Integrating your new financial dashboard software with your existing accounting systems is crucial for efficient data flow. It’s like connecting different sections of a well-oiled machine – each part working seamlessly together. A smooth integration ensures data accuracy, minimizes manual data entry, and saves valuable time. Consider using APIs (Application Programming Interfaces) for seamless data exchange, or explore options offered by the software vendor for direct integration with popular accounting packages such as Xero, QuickBooks, or SAP.

Employee Training Best Practices

Effective employee training is paramount for successful software adoption. Imagine trying to play a musical instrument without lessons – it would be chaotic! Training should be comprehensive, covering all aspects of the software’s functionality.

- Interactive Training Sessions: Use a combination of presentations, hands-on exercises, and interactive workshops to engage employees and ensure they fully grasp the software’s features.

- Personalized Support: Provide individual support and guidance to employees who need extra assistance. Consider assigning mentors or creating a dedicated support channel.

- Ongoing Training and Updates: Software evolves, so provide ongoing training and updates to keep employees informed about new features and best practices.

- Gamification: Incorporate gamification elements into your training program to make it more engaging and fun. Offer rewards for successful completion of training modules.

Advanced Features and Integrations

Let’s face it, a basic financial dashboard is like a bicycle – functional, but ultimately limiting. To truly zoom ahead in the world of financial management, you need to upgrade to a rocket ship – and that’s where advanced features and integrations come in. These aren’t just bells and whistles; they’re the essential components that transform your data into actionable insights and, dare we say it, even a little fun.

Integrating your financial dashboard with other powerful tools unlocks a world of possibilities. Think of it as assembling your dream team of financial superheroes, each with unique skills ready to tackle any challenge.

Business Intelligence (BI) Tool Integration

Integrating your financial dashboard with a robust Business Intelligence (BI) tool is akin to giving your financial data a supercharged espresso. The combination allows for a much deeper and broader analysis of financial performance. BI tools often offer advanced visualization capabilities, allowing you to create interactive dashboards that tell a compelling story with your data, far beyond simple charts and graphs. For example, you can drill down into specific areas of concern, identify trends, and create customized reports tailored to specific stakeholders – all within a unified interface. Imagine effortlessly comparing sales figures across different regions, instantly identifying underperforming segments, and proactively addressing potential issues before they become major headaches.

Predictive Analytics

Predictive analytics is the crystal ball of the financial world, offering glimpses into the future based on historical data and sophisticated algorithms. By analyzing past trends and patterns, predictive analytics can forecast future financial performance, helping businesses make more informed decisions. For example, a retail company might use predictive analytics to forecast sales for the upcoming holiday season, allowing them to optimize inventory levels and staffing needs. This prevents overstocking leading to potential losses or understocking leading to lost sales opportunities. The accuracy of these predictions, of course, depends on the quality and completeness of the data fed into the system, but even rough estimates are better than none at all, especially in planning.

Automation and Reduced Manual Data Entry

Manual data entry is the bane of any finance professional’s existence – tedious, time-consuming, and prone to errors. Imagine a world without it! With automation, financial dashboards can automatically collect, process, and update financial data from various sources, significantly reducing manual effort. This frees up valuable time and resources, allowing finance teams to focus on more strategic tasks, such as analysis and decision-making. Think of it as your own personal financial assistant, diligently working behind the scenes to keep everything up-to-date and accurate, while you enjoy a well-deserved cup of coffee. The reduction in human error alone can save businesses significant amounts of money, as incorrect data can lead to misinformed decisions and potential financial losses.

Forecasting Tools and Improved Business Planning

Forecasting tools within a financial dashboard can significantly improve business planning by providing accurate and timely predictions of future financial performance. This allows businesses to proactively adjust their strategies and allocate resources effectively.

- Scenario: A manufacturing company uses its dashboard’s forecasting tool to predict demand for its products over the next quarter. Based on this prediction, they adjust their production schedule, ensuring they have enough inventory to meet demand without overproducing and incurring storage costs.

- Improved Resource Allocation: By accurately forecasting revenue and expenses, the company can allocate resources more efficiently, investing in areas with high growth potential while controlling costs in less profitable areas.

- Proactive Risk Management: If the forecast indicates potential financial difficulties, the company can take proactive steps to mitigate risks, such as reducing expenses or seeking additional funding.

- Data-Driven Decision Making: The forecasting tool provides data-driven insights, reducing reliance on guesswork and improving the overall accuracy of business decisions.

Case Studies and Examples

Let’s ditch the boring case study format and dive straight into the real-world drama of how financial dashboards rescued businesses from the jaws of impending doom (or at least, from mildly stressful budget meetings). We’ll explore how these digital saviors streamlined operations and prevented potential financial meltdowns. Prepare for some seriously satisfying before-and-after stories.

Retail Efficiency Enhancement

A large retail chain, let’s call them “Trendy Threads,” was drowning in data. Sales figures, inventory levels, marketing campaign results – it was a chaotic ocean of spreadsheets. Their financial reporting was slow, inaccurate, and frankly, depressing. Implementing a financial dashboard changed everything. Trendy Threads gained real-time visibility into their sales performance across all locations. They could instantly identify underperforming products, optimize inventory levels to reduce storage costs and waste, and track the ROI of their marketing campaigns with unprecedented accuracy. The result? A significant increase in profitability, happier shareholders, and a much-needed reduction in stress levels among the finance team. They went from frantically searching for data needles in a haystack to confidently steering their business towards success. Their decision-making became proactive instead of reactive – a truly transformative shift.

Near-Financial Crisis Averted

Imagine a small but ambitious tech startup, “Code Crafters,” on the verge of a funding crunch. Their cash flow was erratic, and they were struggling to predict their expenses accurately. Without a clear financial overview, they were teetering on the brink of a potential crisis. Then, they adopted a financial dashboard. The dashboard provided real-time insights into their burn rate, revenue streams, and upcoming expenses. This allowed them to identify a critical discrepancy between projected and actual revenue, stemming from a delayed payment from a major client. Thanks to the early warning system provided by the dashboard, Code Crafters were able to proactively negotiate payment terms with the client, securing the necessary funds and avoiding a potentially devastating financial crisis. The dashboard, in essence, became their financial life raft, preventing them from capsizing.

Visual Representation: Before and After, Financial Dashboard Software

Before:

Imagine a chaotic scene: a cluttered desk piled high with spreadsheets, sticky notes, and half-empty coffee cups. The air is thick with tension. A stressed-out finance manager is hunched over a computer, desperately trying to make sense of the disjointed data. The overall visual is one of disorganization, confusion, and impending doom. The color palette is muted greys and tired browns. The overall mood is stressful and inefficient.

After:

Now picture a bright, clean workspace. A relaxed finance manager is calmly reviewing a sleek, intuitive dashboard on a large monitor. The dashboard displays key financial metrics in clear, concise visualizations – vibrant charts and graphs showcase the company’s financial health. The overall mood is calm, confident, and efficient. The color palette is vibrant and professional, conveying a sense of order and control. The atmosphere is one of clarity, efficiency, and strategic decision-making. The difference is night and day.

Final Conclusion

Ultimately, the choice and implementation of financial dashboard software is a journey, not a destination. It’s a journey filled with exciting discoveries, occasional bumps in the road (like unexpected data glitches), and the undeniable satisfaction of transforming raw financial data into actionable insights. By understanding the key features, security considerations, and integration possibilities, businesses can harness the power of financial dashboards to make smarter decisions, improve efficiency, and perhaps even discover a hidden talent for data visualization. So, embrace the chaos (of numbers), and let your financial data sing!

Clarifying Questions: Financial Dashboard Software

What is the typical cost of Financial Dashboard Software?

Costs vary wildly depending on features, vendor, and whether it’s a one-time purchase or subscription. Expect a range from surprisingly affordable to “I need a second mortgage.”

Can I integrate my existing accounting software?

Many dashboards offer integrations with popular accounting software, but compatibility varies. Check for specifics before purchasing.

How much training is needed to use Financial Dashboard Software?

It depends on the software’s complexity and user experience design. Some are incredibly intuitive, others… well, let’s just say they might require a bit more patience (and possibly a spreadsheet-themed meditation retreat).

What happens if my internet goes down with cloud-based software?

Your access to real-time data will be interrupted. On-premise solutions offer offline access, but require more upfront investment.