Financial Data Visualization Tools are no longer a luxury but a necessity in today’s fast-paced financial world. Imagine trying to decipher a mountain of spreadsheets – a truly Sisyphean task! Instead, picture clear, concise charts and dashboards effortlessly revealing crucial insights hidden within complex datasets. This exploration delves into the exciting world of financial data visualization, examining the tools, techniques, and best practices that empower financial professionals to make smarter, data-driven decisions.

We’ll navigate the diverse landscape of visualization tools, categorizing them by functionality and comparing their strengths and weaknesses. From understanding the nuances of different chart types to mastering the art of dashboard design, this guide will equip you with the knowledge to harness the power of visual analytics. We’ll also address crucial aspects like data integration, security, and choosing the right tool for your specific needs. Get ready to transform your financial data from a confusing jumble into a compelling narrative.

Introduction to Financial Data Visualization Tools

Let’s face it, staring at endless spreadsheets of financial data is about as exciting as watching paint dry. But what if I told you there’s a way to transform those monotonous numbers into insightful, even captivating, visuals? Financial data visualization tools are the superheroes your financial analysis needs, rescuing you from the clutches of numerical boredom and empowering you to make smarter, faster decisions.

Visualizing financial data is crucial for effective decision-making because it allows us to quickly identify trends, patterns, and anomalies that might otherwise be buried under layers of raw numbers. Instead of wading through thousands of data points, a well-crafted chart can instantly reveal a key performance indicator (KPI) that’s underperforming, a market trend about to explode, or a potential risk lurking in the shadows. Think of it as financial X-ray vision, but way less invasive (and significantly cheaper).

Types of Financial Data Suitable for Visualization

Financial data visualization isn’t a one-size-fits-all solution. Different types of data lend themselves to different visualization techniques. Choosing the right tool and method is paramount to getting the most out of your data. An inappropriate visualization can be as confusing as the raw data itself.

- Time Series Data: Stock prices, sales figures, and investment returns are classic examples. Line charts are excellent for showcasing trends over time, allowing you to quickly spot upward or downward movements. Imagine a vibrant line graph illustrating the meteoric rise of a particular tech stock – instant clarity!

- Financial Ratios: Metrics like profitability ratios (e.g., Return on Equity, Gross Profit Margin), liquidity ratios (e.g., Current Ratio), and solvency ratios (e.g., Debt-to-Equity Ratio) can be effectively visualized using bar charts or heatmaps to compare performance across different periods or companies. A heatmap, for instance, could visually highlight companies with exceptionally high debt levels – a potential red flag!

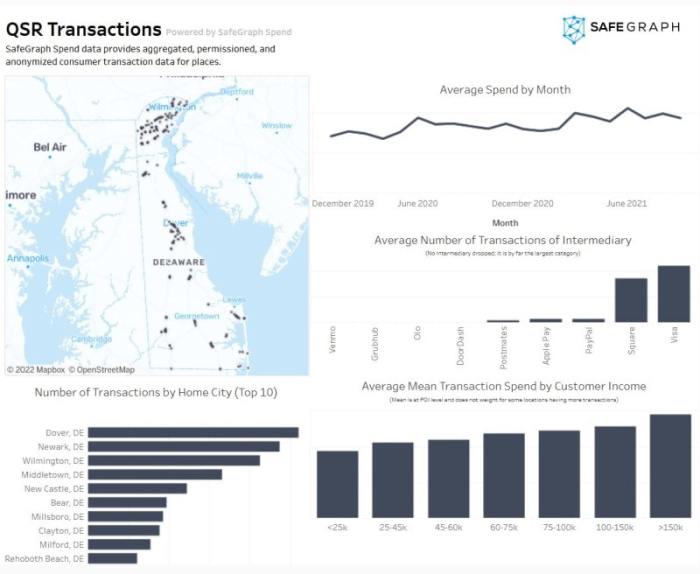

- Geographical Data: Visualizing sales data by region, investment distribution across different countries, or the location of branches using maps can provide valuable geographical insights. Picture a world map showcasing the global reach of a multinational corporation, color-coded by revenue generation – a compelling visual narrative.

Advantages of Specialized Financial Visualization Tools

While you *could* try to shoehorn your financial data into general-purpose software like Microsoft Excel, using specialized tools offers significant advantages. Think of it like trying to build a skyscraper with a toy set – you *could*, but the results might be… less than ideal.

- Industry-Specific Features: Specialized tools are designed with the unique needs of financial professionals in mind. They often include pre-built templates, charts, and calculations tailored for financial analysis, saving you valuable time and effort. No more painstakingly crafting charts from scratch!

- Advanced Analytics Capabilities: Many specialized tools integrate advanced analytical features, such as forecasting models, risk assessment tools, and scenario planning capabilities, that are typically absent in general-purpose software. Imagine the power of predicting future market trends with just a few clicks!

- Data Integration and Connectivity: These tools often seamlessly integrate with various data sources, simplifying the process of importing, cleaning, and analyzing your financial data. No more manual data entry – a true lifesaver!

Categorizing Financial Data Visualization Tools

The world of financial data visualization is a vibrant, ever-evolving landscape, a bit like a particularly well-funded, highly-caffeinated jungle. Navigating this jungle requires a machete (metaphorically speaking, of course; nobody wants to see a spreadsheet-related machete incident). Categorizing these tools helps us find the perfect weapon – I mean, tool – for the job. We’ll slice and dice these tools into neat categories, making sense of the seemingly endless options.

Financial data visualization tools aren’t just pretty pictures; they’re powerful instruments for extracting insights from the often-murky waters of financial data. Choosing the right tool depends heavily on your specific needs, from simple charting to complex interactive dashboards. Think of it like choosing the right fishing rod: you wouldn’t use a fly rod to catch a whale (unless you’re exceptionally ambitious, and perhaps a little delusional).

Categorization of Financial Data Visualization Tools by Functionality

We can effectively categorize financial data visualization tools based on their core functionalities. This approach provides a clear framework for understanding the strengths and weaknesses of different platforms and helps users make informed decisions based on their specific requirements. Think of it as organizing your spice rack – much more efficient than a chaotic jumble of cumin and cayenne.

Comparison of Financial Data Visualization Tools

The following table compares five popular financial data visualization tools, highlighting their key features and pricing models. Note that pricing can fluctuate, so always check the vendor’s website for the most up-to-date information. Also, remember that “free” often comes with limitations – a bit like a free sample of gourmet cheese; it’s delicious, but you’ll soon want the whole wheel.

| Tool | Key Features | Pricing Model | Strengths |

|---|---|---|---|

| Tableau | Interactive dashboards, drag-and-drop interface, extensive data connectivity, advanced analytics | Subscription-based, various tiers | Powerful, versatile, excellent for complex visualizations and large datasets. |

| Power BI | Interactive dashboards, data modeling capabilities, integration with Microsoft ecosystem, robust reporting features | Subscription-based, various tiers, including a free version with limitations | Seamless integration with other Microsoft products, strong community support. |

| Qlik Sense | Associative data exploration, self-service BI, data storytelling capabilities, strong visualization options | Subscription-based, various tiers | Excellent for exploring relationships within data, intuitive user interface. |

| Google Data Studio (Looker Studio) | Free, collaborative dashboards, integration with Google ecosystem, easy-to-use interface | Freemium model, paid version offers advanced features | Cost-effective, great for simple dashboards and collaborative projects. |

| Plotly | Interactive charts, Python and R integration, publication-quality visualizations, open-source library | Open-source (free) with paid cloud services for collaboration and hosting | Highly customizable, ideal for programmers and those needing highly specific visualizations. |

Chart Types and Their Applications in Finance

Financial data visualization isn’t just about pretty pictures; it’s about turning complex numbers into compelling narratives that even your grandma could understand (maybe). Choosing the right chart type is crucial for effectively communicating financial insights, avoiding the dreaded “data-induced coma” in your audience. Let’s explore some key chart types and their financial superpowers.

Bar Charts: Unveiling the Financial Landscape

Bar charts are the workhorses of financial visualization. Their straightforward design allows for easy comparison of discrete data points. Imagine comparing the quarterly profits of different divisions within a company. A bar chart instantly highlights which division is raking in the big bucks (or needs a serious pep talk). For example, a horizontal bar chart could display the market share of various tech companies, with each bar representing a company’s percentage, making it easy to see who’s dominating the market and who’s playing catch-up. The length of each bar directly represents the value, allowing for quick and intuitive interpretation. No complex calculations needed – just pure visual impact.

Line Charts: Tracking Trends Over Time

Line charts are the storytellers of the financial world. They excel at showcasing trends and patterns over time, making them ideal for tracking stock prices, sales figures, or even your personal investment portfolio’s performance. Imagine a line chart depicting the price of a particular stock over a year. An upward trending line indicates growth, while a downward trend… well, let’s just say it’s not ideal. Key features like peaks and troughs can be easily identified, allowing for analysis of market fluctuations and potential turning points. The smooth curves connecting data points highlight the evolution of the metric, creating a clear narrative of progress or decline.

Scatter Plots: Uncovering Hidden Relationships

Scatter plots are the detectives of financial data. They reveal the relationship between two variables, helping to identify correlations and potential causal links. For instance, a scatter plot could show the relationship between a company’s advertising spend and its sales revenue. A positive correlation would suggest that increased advertising leads to increased sales (a welcome sight for marketers!). Conversely, a lack of correlation might indicate that other factors are at play. Each point on the plot represents a data pair, and the overall pattern reveals the nature of the relationship – whether it’s positive, negative, or non-existent. This allows for deeper insights beyond simple comparisons.

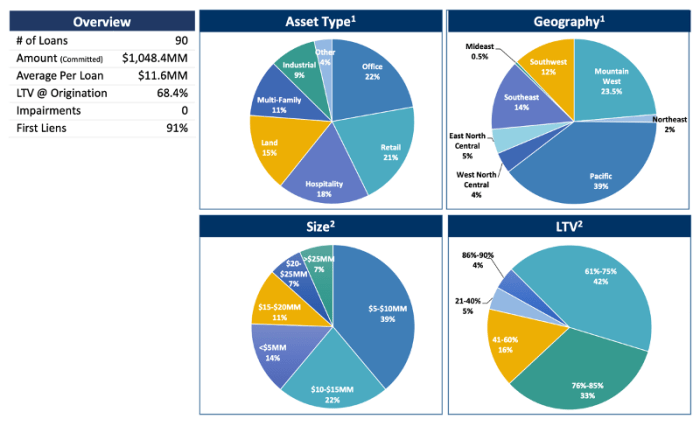

Pie Charts: Slicing and Dicing Financial Proportions

Pie charts are perfect for showing the composition of a whole. They’re excellent for visualizing budget allocation, portfolio diversification, or the breakdown of revenue streams. For example, a pie chart could represent the percentage allocation of an investment portfolio across different asset classes like stocks, bonds, and real estate. Each slice represents a proportion of the whole, making it easy to grasp the relative contribution of each component. However, be mindful of using too many slices – too much detail can make the chart hard to decipher. Keep it concise and impactful.

Area Charts: Highlighting Cumulative Values

Area charts are similar to line charts, but they add a dimension of visual emphasis by filling the area under the line. This is especially useful for showcasing cumulative values, such as total sales over time or the growth of a savings account. The filled area draws attention to the magnitude of the cumulative value, providing a clearer picture of overall growth or decline than a simple line chart might offer. This makes them a great choice for presenting trends involving accumulation.

Dashboard Design and Functionality

Designing a financial dashboard is like crafting a finely tuned Swiss watch – each component must work in perfect harmony to provide a clear and insightful view of your financial landscape. A poorly designed dashboard is not just unhelpful; it’s actively detrimental, potentially leading to misinformed decisions and missed opportunities. Think of it as a financial crystal ball, but one that needs careful calibration to avoid showing you only sparkly distractions instead of the real financial future.

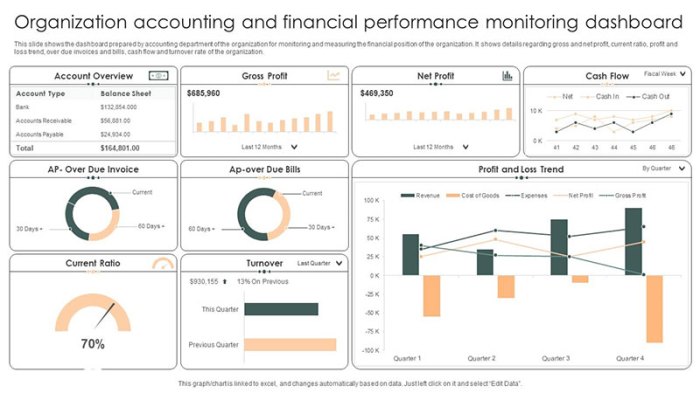

Effective financial dashboards go beyond simply presenting data; they tell a story. They distill complex information into easily digestible visualizations, enabling users to quickly grasp key trends and identify potential issues. Interactive elements further enhance this process, allowing users to drill down into specific data points, customize their view, and gain a deeper understanding of the underlying factors driving performance. Think of it as a financial detective story, and the dashboard is the magnifying glass that helps you find the clues.

Components of an Effective Financial Dashboard

An effective financial dashboard incorporates several crucial components working in synergy. These include carefully selected Key Performance Indicators (KPIs), intuitive navigation, clear and concise visualizations, and interactive elements that allow for dynamic data exploration. Ignoring any of these components risks creating a dashboard that’s more confusing than clarifying – a financial enigma, rather than a solution.

- Key Performance Indicators (KPIs): These are the core metrics that reflect the overall health and performance of the financial system. Examples include Return on Investment (ROI), Net Profit Margin, and Cash Flow. These should be chosen strategically, reflecting the specific goals and priorities of the user.

- Interactive Elements: These allow users to interact with the dashboard, such as filtering data by time period, comparing different metrics, or drilling down into specific data points for a more detailed analysis. Think of these as the dashboard’s adjustable lenses, letting you focus on specific areas of interest.

- Visualizations: Charts and graphs are the visual language of the dashboard, translating numerical data into easily understandable patterns and trends. Appropriate chart types are crucial; a pie chart might be perfect for showing portfolio allocation, but a line graph would be better for illustrating performance over time. Choosing the right visual is key to effective communication.

- Data Refresh Rate: The frequency with which the data updates is vital. Real-time or near real-time updates are ideal for actively managed portfolios, while daily or weekly updates might suffice for long-term investment strategies. The frequency should match the speed of the information your financial world demands.

Best Practices for Dashboard Design

Designing a user-friendly and informative dashboard requires careful consideration of several best practices. A well-designed dashboard is intuitive, visually appealing, and provides the right information at the right time, in the right way. Think of it as designing a user-friendly financial cockpit – you need clear instruments, easily accessible controls, and a view that’s both comprehensive and focused.

- Prioritize Key Information: Focus on the most important KPIs and present them prominently. Avoid overwhelming the user with too much data; less is often more.

- Use Consistent Visual Style: Maintain a consistent color scheme, font, and chart style throughout the dashboard to ensure a cohesive and professional look. A consistent style avoids visual chaos and allows the data to speak for itself.

- Provide Contextual Information: Include clear labels, legends, and tooltips to provide context for the data. Don’t leave your users guessing; guide them through the information.

- Ensure Responsiveness: Design the dashboard to be responsive across different devices (desktops, tablets, and smartphones). Accessibility is key in today’s mobile world.

Conceptual Design: Investment Portfolio Dashboard

This dashboard focuses on providing a clear overview of investment portfolio performance. The design prioritizes ease of use and clear visualization of key metrics. It’s designed to be intuitive and insightful, like a financial map guiding you to investment success.

- Section 1: Portfolio Summary: This section provides a high-level overview of the portfolio’s overall performance, including total value, return on investment (ROI), and allocation across different asset classes (e.g., stocks, bonds, real estate). A simple, clean design is paramount here, emphasizing the big picture.

- Section 2: Asset Class Performance: This section displays the performance of each asset class within the portfolio, using line charts to show performance over time. This allows users to quickly identify top and underperforming asset classes.

- Section 3: Top Holdings: This section highlights the top performing and underperforming individual holdings within the portfolio. This allows for a more granular view of portfolio composition and performance.

- Section 4: Risk Metrics: This section displays key risk metrics such as standard deviation, Sharpe ratio, and maximum drawdown. These provide insights into the risk profile of the portfolio.

- Section 5: Interactive Filters: This section allows users to filter the data by time period, asset class, or individual holdings. This adds flexibility and allows users to customize their view.

Data Integration and Connectivity

Integrating financial data into your visualization tools is like assembling a ridiculously complex LEGO castle – except instead of tiny plastic bricks, you’re dealing with potentially millions of data points from wildly different sources. The reward, however, is a breathtakingly insightful model of your financial empire (or at least a pretty good chart). Getting there, though, requires a careful understanding of your data sources and the methods available to bring them together.

Data integration methods bridge the gap between your disparate financial information and your chosen visualization tool. The efficiency and reliability of these methods directly impact the accuracy and timeliness of your insights. A poorly integrated system can be like trying to build that LEGO castle blindfolded – frustrating, time-consuming, and prone to catastrophic collapse. Let’s explore some key techniques.

Data Integration Methods

Several approaches exist for integrating financial data, each with its strengths and weaknesses. Choosing the right method depends heavily on the nature of your data sources and the capabilities of your visualization tool. A crucial consideration is the volume and velocity of the data – a small spreadsheet is a far cry from a high-frequency trading database.

- Direct Database Connections: This involves establishing a direct link between your visualization tool and a database (like SQL Server, MySQL, or PostgreSQL). This offers high efficiency for large datasets, but requires database expertise and often involves configuring drivers and credentials. Imagine it as having a dedicated, high-speed data pipeline directly feeding your visualization tool.

- APIs: Application Programming Interfaces provide a structured way to access data from various services. Many financial data providers offer APIs (e.g., Alpha Vantage, Tiingo), allowing you to retrieve specific data points on demand. Think of APIs as convenient, pre-packaged data delivery services, but be aware that they might impose rate limits.

- File Imports: This involves importing data from files like CSV, Excel, or JSON. It’s a simple approach suitable for smaller datasets, but can be inefficient and prone to errors for large or frequently updated data. This is like manually carrying each LEGO brick to the building site – functional, but potentially tedious.

- ETL Processes: Extract, Transform, Load (ETL) tools are designed for complex data integration tasks. They automate the process of extracting data from multiple sources, transforming it into a consistent format, and loading it into a data warehouse or visualization tool. ETL tools are your heavy-duty construction equipment, ideal for large-scale, complex projects.

Connecting to a Hypothetical Financial Database, Financial Data Visualization Tools

Let’s imagine connecting our visualization tool to “FinCorp,” a hypothetical financial database containing stock prices, trading volumes, and financial ratios. The process would generally involve these steps:

1. Identify Database Credentials: Obtain the necessary login credentials (username, password, database name) from FinCorp’s database administrator.

2. Install Necessary Drivers: Install the appropriate database drivers for your visualization tool. These drivers act as translators, enabling communication between your tool and the database.

3. Configure Connection Settings: Within your visualization tool, specify the connection details (database type, server address, credentials). This might involve entering the information into a dialogue box or modifying a configuration file.

4. Test the Connection: Execute a test query to verify the connection and data accessibility. This is a crucial step to prevent later headaches.

5. Import or Query Data: Once the connection is confirmed, import the relevant data into your visualization tool or write queries to directly access the needed data.

Remember: Always prioritize data security and adhere to best practices for handling sensitive financial information.

Interactive Features and Advanced Analytics: Financial Data Visualization Tools

Financial data visualization tools are no longer just pretty pictures; they’re interactive powerhouses capable of unearthing insights hidden within mountains of numbers. Think of them as your personal financial Sherlocks, armed with magnifying glasses (zooming!), sieves (filtering!), and an uncanny ability to follow the money trail (drill-down!). The combination of interactive features and advanced analytics transforms these tools from static reports into dynamic engines of discovery.

Interactive features significantly enhance the analysis and interpretation of financial data by allowing users to dynamically explore datasets, focusing on specific aspects and uncovering patterns that might otherwise remain hidden. This dynamic exploration empowers users to make more informed and timely decisions, reducing reliance on static reports that might quickly become outdated.

Filtering Capabilities

Filtering allows users to isolate specific subsets of data based on pre-defined criteria. For example, an investor might filter a portfolio’s performance data to show only investments in a particular sector (e.g., technology) or exceeding a specific return threshold (e.g., 15%). This allows for a focused analysis of specific areas of interest, rather than being overwhelmed by the entire dataset. The ability to combine multiple filters, such as sector AND return threshold, further refines the analysis.

Zooming and Panning Functionality

Zooming and panning capabilities allow for a detailed examination of specific data points or time periods within a larger dataset. Imagine zooming in on a specific quarter’s performance within a year-long chart to identify any anomalies or trends. Panning allows for a broader view, shifting focus from one time period to another without losing the overall context. This detailed view is invaluable for detecting subtle fluctuations and identifying potential risks or opportunities.

Drill-Down Capabilities

Drill-down functionality allows users to progressively delve deeper into the data, moving from high-level summaries to granular details. For instance, starting with a summary of overall company revenue, a user might drill down to analyze revenue by product line, then further to individual product sales within each line. This multi-layered exploration reveals the underlying drivers of performance, uncovering hidden patterns and correlations.

Integration of Advanced Analytics

The integration of advanced analytics, such as forecasting and trend analysis, adds another layer of sophistication to data visualization tools. Forecasting models, often based on historical data and statistical algorithms, can project future performance, providing valuable insights for strategic planning. Trend analysis identifies patterns and directions in data over time, allowing for proactive adjustments to strategies and risk mitigation. For example, a tool might project future sales based on past trends, allowing a company to adjust production or marketing strategies accordingly. A real-world example would be a retail company using sales data and trend analysis to predict holiday season demand, optimizing inventory and staffing levels.

Security and Data Privacy Considerations

Protecting your financial data is serious business – think of it as guarding Fort Knox, but instead of gold, you’re protecting potentially life-altering financial information. Using financial data visualization tools introduces unique security challenges, requiring a robust strategy to ensure both the confidentiality and integrity of your data. Ignoring these considerations could lead to anything from minor inconveniences to major financial disasters – nobody wants that kind of spreadsheet-induced meltdown!

Financial data visualization tools, while incredibly useful, inherently handle sensitive information. This necessitates stringent security measures to prevent unauthorized access, modification, or disclosure. The consequences of a breach can be devastating, ranging from reputational damage and financial losses to legal penalties and erosion of customer trust. A strong security posture is not just a good idea; it’s a necessity for responsible data handling.

Data Encryption and Access Control

Data encryption is the bedrock of financial data security. Think of it as wrapping your valuable data in an impenetrable digital vault. Encryption transforms data into an unreadable format, rendering it useless to unauthorized individuals. Strong encryption algorithms, such as AES-256, should be employed to protect data both in transit (while being transmitted across networks) and at rest (while stored on servers or databases). Access control mechanisms, such as role-based access control (RBAC), further enhance security by restricting access to sensitive data based on user roles and responsibilities. For example, a junior analyst might only have read-only access to certain datasets, while a senior manager might have full read-write privileges. This layered approach significantly minimizes the risk of unauthorized access.

Data Privacy and Regulatory Compliance

Navigating the complex landscape of data privacy regulations requires careful planning and execution. Compliance with regulations such as GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in the US is paramount. These regulations dictate how personal and financial data should be collected, processed, and stored. Key aspects include obtaining explicit consent for data processing, ensuring data minimization (collecting only necessary data), and providing individuals with the right to access, correct, or delete their data. Failure to comply can result in hefty fines and legal repercussions. A comprehensive data privacy policy, coupled with robust data governance procedures, is crucial for maintaining compliance.

Security Best Practices for Handling Sensitive Financial Data

Implementing security best practices is essential for safeguarding sensitive financial data within visualization platforms. Regular security audits and penetration testing can identify vulnerabilities and weaknesses before they can be exploited. Employing multi-factor authentication (MFA) adds an extra layer of security, requiring users to provide multiple forms of authentication before accessing the system. This makes it significantly harder for attackers to gain unauthorized access, even if they manage to obtain a username and password. Regular software updates and patching are also critical to address known security vulnerabilities. Finally, robust data loss prevention (DLP) measures, such as data encryption and access controls, should be in place to prevent sensitive data from leaving the organization’s control. Think of it as a sophisticated alarm system for your financial data, alerting you to any suspicious activity.

Choosing the Right Tool for Specific Needs

Selecting the perfect financial data visualization tool is like choosing a bespoke suit – it needs to fit your specific needs perfectly. A tool that’s ideal for a multinational corporation juggling terabytes of data will likely be overkill (and over budget!) for a small startup. Therefore, a careful and considered approach is crucial, lest you end up with a tool that’s either too flashy for its purpose or hopelessly inadequate.

The decision-making process hinges on several key factors, each demanding careful consideration. Ignoring these could lead to a costly and frustrating experience, leaving you with a tool that’s more trouble than it’s worth. Think of it as choosing the right weapon for a financial battle – the wrong choice can be disastrous.

Factors Influencing Tool Selection

Budget constraints, technical expertise within the team, and the sheer volume of data to be processed are the three pillars upon which your tool selection should rest. A robust framework considers these elements to ensure a successful implementation. Failing to properly assess these will lead to disappointment, wasted resources, and possibly even missed opportunities.

A Decision-Making Framework

This framework helps navigate the complexities of tool selection. First, establish your budget. This will immediately eliminate some contenders. Next, assess the technical skills of your team. A highly sophisticated tool requires skilled users; otherwise, you’ll be paying for features you can’t utilize effectively. Finally, determine your data volume. A tool designed for small datasets won’t cope with terabytes of financial information. Matching these three elements is key.

Comparison of Market Trend Analysis Tools

Let’s consider three hypothetical tools – “ChartMaster 5000,” “DataViz Pro,” and “SimpleGraphs.” These represent different ends of the spectrum in terms of features, cost, and technical complexity. Imagine we’re analyzing market trends for a medium-sized investment firm.

| Feature | ChartMaster 5000 | DataViz Pro | SimpleGraphs |

|---|---|---|---|

| Cost | High (Enterprise-level licensing) | Medium (Subscription-based) | Low (One-time purchase) |

| Technical Expertise Required | High (Advanced programming skills beneficial) | Medium (Some data analysis knowledge needed) | Low (User-friendly interface) |

| Data Volume Handling | Very High (Handles terabytes effortlessly) | Medium (Handles gigabytes effectively) | Low (Suitable for smaller datasets) |

| Advanced Analytics | Extensive (Predictive modeling, AI integration) | Moderate (Basic statistical analysis) | Limited (Basic charting functions) |

| Strengths | Unmatched power and flexibility; ideal for complex analyses. | Good balance of features and affordability; suitable for many users. | Easy to use and affordable; perfect for simple visualizations. |

| Weaknesses | Steep learning curve; expensive. | Lacks some advanced features of ChartMaster 5000. | Limited functionality; struggles with large datasets. |

For our medium-sized investment firm, DataViz Pro might represent the optimal balance, offering a good blend of features, affordability, and manageable technical requirements. ChartMaster 5000 would be overkill, while SimpleGraphs might prove too limiting for their needs. This highlights the importance of carefully considering each factor before making a decision.

Final Conclusion

In conclusion, mastering financial data visualization is akin to wielding a superpower in the financial realm. By understanding the various tools available and applying best practices in design and security, you can transform raw data into actionable insights. This journey into the world of visual analytics isn’t just about pretty pictures; it’s about unlocking the potential within your data to make informed decisions, optimize performance, and ultimately, achieve your financial goals. So, ditch the spreadsheets and embrace the power of visualization!

FAQ Summary

What are the limitations of using free financial data visualization tools?

Free tools often come with limitations such as restricted features, limited data storage, and potentially less robust security compared to paid alternatives. They may also lack advanced analytics capabilities.

How can I ensure the accuracy of my visualized financial data?

Data accuracy is paramount. Verify data sources, regularly check for errors, and implement data validation processes within your visualization workflow. Consider using tools with built-in data quality checks.

What are some common mistakes to avoid when designing financial dashboards?

Common mistakes include overcrowding dashboards with too much information, using inappropriate chart types, and neglecting clear labeling and visual hierarchy. Prioritize clarity and focus on key performance indicators (KPIs).