Financial Education Apps are rapidly transforming how we approach personal finance. Forget dusty textbooks and confusing seminars; these apps offer a surprisingly engaging, and often hilarious, journey to financial literacy. From budgeting battles to investment triumphs, this exploration delves into the booming world of apps designed to make managing your money less of a headache and more of a…well, less of a headache. We’ll examine market trends, user needs, app features, and the often-bizarre world of app monetization strategies. Buckle up, it’s going to be a wild ride!

This deep dive will cover the current market size and growth of financial education apps, profiling the typical user and their financial challenges. We’ll analyze app features, monetization models (some are truly ingenious!), and future trends like AI integration and the surprisingly relevant use of blockchain. We’ll also address regulatory compliance – because even fun apps need to play by the rules. Finally, we’ll examine illustrative examples of app designs, showing how great UI/UX can make even the most complex financial concepts surprisingly user-friendly (and dare we say, fun?).

Market Overview of Financial Education Apps

The world of personal finance can feel like a jungle, full of confusing jargon and predatory practices. Thankfully, a new breed of financial saviors has emerged: financial education apps. These digital guides are rapidly changing how people manage their money, offering everything from budgeting basics to sophisticated investment strategies. The market is booming, and it’s a fascinating landscape to explore.

Market Size and Growth Trajectory

The market for financial education apps is experiencing explosive growth. While precise figures vary depending on the source and definition of “financial education app,” estimates suggest a multi-billion dollar market currently, projected to expand significantly over the next decade. Factors driving this growth include increased smartphone penetration, rising financial literacy concerns, and a growing demand for personalized financial advice accessible at any time. The pandemic, ironically, accelerated this trend as many people reevaluated their financial situations and sought tools for better management. For example, the surge in interest in investing during the pandemic directly translated to a substantial increase in downloads and engagement for investment-focused apps.

Major Players and Market Share

Pinpointing exact market share for each app is challenging due to the competitive nature of the market and the lack of publicly available, comprehensive data. However, several key players dominate the space. Mint, a long-standing personal finance app, maintains a significant user base due to its comprehensive budgeting and tracking features. Other major players include Robinhood (known for its ease of investing), Acorns (for micro-investing), and Betterment (for automated investing). These apps often compete not only on features but also on brand recognition and user experience. The market is far from saturated, however, with numerous niche players catering to specific demographics and financial needs.

App Categories within the Financial Education Space

The financial education app market is incredibly diverse, catering to a wide range of needs and skill levels. Several key categories have emerged:

- Budgeting Apps: These apps help users track income and expenses, set budgets, and identify areas for savings. Mint and Personal Capital are prime examples.

- Investing Apps: These apps simplify the investment process, offering tools for researching stocks, bonds, and other assets. Robinhood and Acorns are popular choices in this category, catering to different investment styles.

- Debt Management Apps: These apps assist users in paying down debt efficiently, often employing strategies like the debt snowball or avalanche methods. Many budgeting apps incorporate debt management features.

- Financial Planning Apps: These apps provide more holistic financial planning tools, helping users set long-term goals (like retirement) and create strategies to achieve them. Many offer features like retirement planning calculators and investment portfolio analysis.

Comparison of Leading Financial Education Apps

This table compares three leading apps, highlighting their strengths and weaknesses. Keep in mind that user ratings and features can change over time.

| Feature | Mint | Robinhood | Acorns |

|---|---|---|---|

| Budgeting Tools | Excellent | Basic | Limited |

| Investing Features | Good (limited brokerage) | Excellent | Excellent (micro-investing focus) |

| Debt Management Tools | Good | None | None |

| Pricing | Free (with premium options) | Free (with commission fees) | Subscription-based |

| Average User Rating (Example) | 4.5 stars | 4.0 stars | 4.2 stars |

User Demographics and Needs

Let’s delve into the fascinating world of financial education app users – a diverse group united by a common goal: conquering their finances (or at least making a valiant attempt!). Understanding their demographics and needs is crucial for creating apps that are not only informative but also genuinely helpful and, dare we say, enjoyable. After all, who wants to learn about compound interest if it feels like a tax audit?

The typical user isn’t a single archetype; it’s more of a vibrant mosaic. However, some common threads emerge. We’ll explore these patterns, examining the age ranges, income brackets, and existing financial knowledge that define this user base, and how these factors shape their app usage.

Typical User Profile

The average user of a financial education app is likely to be a millennial or Gen Z individual, aged between 25 and 40. While income levels vary widely, many fall into the middle-income bracket, often juggling student loan debt, mortgages, and the ever-elusive dream of early retirement. Their financial literacy levels are generally moderate; they understand the basics but often lack the advanced knowledge to effectively manage complex financial situations, such as investing or retirement planning. Think of them as financially curious but slightly overwhelmed – ready for a friendly guide to navigate the often-murky waters of personal finance.

Reasons for App Download and Utilization

Users download and use financial education apps for a variety of reasons, primarily driven by a desire for improved financial well-being. Many seek to learn practical skills for budgeting, saving, and investing. Others are driven by specific goals, such as paying off debt, planning for retirement, or simply understanding their credit score. The convenience and accessibility of these apps are also major contributing factors, offering bite-sized learning experiences that fit into busy schedules. It’s a far cry from poring over dense financial textbooks!

Financial Challenges Addressed, Financial Education Apps

Users commonly seek solutions to several key financial challenges. Debt management is a significant concern, with many users actively seeking strategies to reduce or eliminate credit card debt, student loans, or other forms of personal debt. Retirement planning is another prevalent issue, with users looking for guidance on saving enough for a comfortable retirement, understanding different investment options, and navigating the complexities of retirement accounts. Budgeting and saving are also common areas of focus, with users striving to create realistic budgets, track their spending, and develop effective saving strategies. Many users are also looking for ways to improve their credit scores, a key element in accessing financial products and services.

User Persona: Meet “Sarah”

To illustrate the typical user, let’s introduce Sarah, a 32-year-old marketing professional with a moderate income. Sarah is juggling student loan payments, saving for a down payment on a house, and trying to build a comfortable emergency fund. She’s generally financially savvy but feels overwhelmed by the sheer volume of information available and lacks confidence in making sound investment decisions. Sarah represents the target audience for a new financial education app: someone motivated to improve their financial situation but lacking the time or expertise to navigate the complexities alone. She appreciates clear, concise information presented in an engaging and user-friendly format. Sarah wants a personalized experience, and she’s not afraid to admit she needs help.

App Features and Functionality

Crafting a truly successful financial education app isn’t just about throwing numbers at a screen; it’s about building a user experience so engaging, it makes budgeting feel like a thrilling treasure hunt (well, almost). It requires a careful blend of practical tools, intuitive design, and a dash of motivational magic.

Successful financial education apps need to be more than just static information dumps. They need to be interactive, personalized, and – dare we say it – fun! Think of it like this: you wouldn’t expect to learn to ride a bike by just reading a manual, would you? Similarly, effective financial literacy requires hands-on engagement and personalized guidance.

Essential Features of Successful Financial Education Apps

A well-rounded financial education app should offer a comprehensive suite of features designed to cater to diverse user needs and learning styles. These features shouldn’t just inform; they should empower users to take control of their finances.

- Personalized Financial Plans: Apps should allow users to input their financial information and generate customized budgets and savings plans, tailored to their specific goals and circumstances. Imagine a virtual financial advisor, always available to offer personalized advice.

- Interactive Budgeting Tools: Beyond simple spreadsheets, effective apps should provide visual representations of spending habits, allowing users to easily track income and expenses. Think colorful charts and graphs that make sense of even the most chaotic financial data.

- Educational Modules: Comprehensive educational content, delivered through engaging formats like videos, quizzes, and interactive simulations, is crucial. These modules should cover topics ranging from saving and investing to debt management and credit scores.

- Goal Setting and Tracking: The ability to set financial goals (e.g., buying a house, paying off debt) and track progress towards those goals is essential for motivation and accountability. Seeing tangible progress can be incredibly rewarding.

- Community Features: Incorporating forums or social features allows users to connect, share experiences, and learn from one another. This creates a sense of community and shared support.

User Interface (UI) and User Experience (UX) Design

The best financial education app in the world will fail miserably if it’s difficult to use. UI/UX design is paramount. It’s about making the app intuitive, visually appealing, and enjoyable to interact with.

Think clean layouts, clear navigation, and a consistent design language. A cluttered interface will overwhelm users, while a poorly designed navigation system will frustrate them. A well-designed app should feel effortless to use, guiding users smoothly through the various features and functionalities. Imagine a beautifully designed dashboard, providing at-a-glance insights into your financial health, without feeling overwhelming.

Educational Methodologies Employed by Financial Education Apps

Different apps employ diverse educational methodologies to cater to different learning styles. Some prioritize gamification, while others focus on a more traditional, textbook-like approach. The key is finding a balance that maximizes engagement and knowledge retention.

- Gamification: Many apps use game mechanics like points, badges, and leaderboards to incentivize user engagement and learning. This approach can make learning more fun and motivating.

- Interactive Simulations: Simulations allow users to experience real-life financial scenarios in a safe, risk-free environment. This is a particularly effective way to learn about complex topics like investing or debt management.

- Microlearning: Breaking down complex financial concepts into smaller, easily digestible modules allows users to learn at their own pace and focus on specific areas of interest. This approach is ideal for busy individuals who may not have time for lengthy learning sessions.

- Personalized Learning Paths: Adaptive learning algorithms can tailor the learning experience to each user’s individual needs and knowledge level, ensuring that the content is always relevant and challenging.

Gamification Strategies in Financial Education Apps: A Comparison

Gamification is key to keeping users engaged. Let’s compare three hypothetical apps and their approaches:

| App Name | Gamification Strategy | Rewards | Engagement Tactics |

|---|---|---|---|

| Finance Fun | Points-based system for completing lessons and challenges. | Virtual trophies, badges, and leaderboard rankings. | Daily challenges, personalized goals, and friendly competition. |

| Money Masters | Role-playing game where users manage a virtual portfolio. | Unlocking new investment opportunities, building a virtual empire. | Realistic market simulations, strategic decision-making, and long-term progress tracking. |

| Budget Battles | Competitive budgeting game where users compete against friends. | Bragging rights, virtual currency, and themed avatars. | Social interaction, team challenges, and friendly rivalry. |

Monetization Strategies

Choosing the right monetization strategy for your financial education app is crucial; it’s the difference between a financially healthy app and one destined for the digital graveyard. Think of it like choosing the right investment strategy – you wouldn’t put all your eggs in one basket, would you? Let’s explore some options, shall we?

Freemium Model

The freemium model offers a basic version of the app for free, enticing users with a taste of financial enlightenment. Then, it tempts them with a premium subscription for advanced features, personalized advice, or ad-free experiences. This model cleverly balances accessibility with revenue generation. Imagine offering a free budgeting tool, but charging for advanced features like automated savings plans or personalized financial goal setting. The advantages are clear: a wider user base thanks to the free offering and a steady stream of revenue from premium subscribers. However, the disadvantages include the challenge of converting free users to paying customers and the potential for frustration if the free version feels too limited. Successfully navigating this requires a delicate balance – making the free version genuinely useful while highlighting the compelling benefits of upgrading. A well-designed freemium model can be a financial goldmine, but a poorly executed one can leave you counting pennies.

Subscription Model

The subscription model is a recurring revenue dream. Users pay a regular fee (monthly, annually, etc.) for access to the app’s full features. Think Netflix for your finances. The advantages include predictable and recurring revenue, fostering user loyalty through consistent value. However, the disadvantages include potential churn (users cancelling their subscriptions) and the need to consistently deliver value to justify the ongoing cost. The price point needs careful consideration; too high and you’ll scare users away, too low and you might not cover your costs.

In-App Purchases

This model allows users to purchase individual features, courses, or content within the app. Think of it as an à la carte menu for financial knowledge. The advantages include flexibility and the ability to cater to diverse user needs and budgets. The disadvantages are the potential for impulsive spending by users (which may not always be a positive) and the challenge of pricing individual items effectively. The risk of users feeling nickel-and-dimed needs careful management.

Hypothetical Business Plan: Subscription Model

Let’s imagine a new financial education app called “Penny Pinchers Paradise.” This app focuses on helping young professionals manage their finances. We project 10,000 subscribers within the first year, at a monthly subscription fee of $9.99. This translates to a projected annual revenue of $1,198,800 ($9.99/month * 10,000 subscribers * 12 months). Year two projects a 20% growth in subscribers, reaching 12,000, generating $1,438,560 in annual revenue. These projections are based on market research indicating a growing demand for financial literacy apps amongst young professionals and a successful marketing campaign targeting this demographic. We’ll account for marketing costs, app development maintenance, and customer support in our overall budget, aiming for a healthy profit margin. This plan, of course, is a simplification; a real business plan would include detailed financial projections, market analysis, and risk assessment. But it gives you a taste of the potential!

Future Trends and Innovations

The financial education app market is not standing still; it’s doing the financial equivalent of a breakdance – evolving rapidly and impressively. We’re witnessing a surge in innovative features, driven by technological advancements and a growing demand for accessible, personalized financial learning. The future looks bright, or at least, financially sound.

The integration of cutting-edge technologies promises to revolutionize how we learn about money, moving beyond static lessons to dynamic, engaging, and truly personalized experiences. This evolution will not only improve user engagement but also broaden access to financial literacy, leading to a more financially empowered populace.

AI-Powered Personalized Learning

Artificial intelligence is poised to transform financial education apps. Imagine an app that adapts to your individual learning style, pace, and goals. This isn’t science fiction; AI algorithms can analyze user data, identify knowledge gaps, and curate personalized learning paths. For example, an app could detect that a user struggles with budgeting and subsequently provide more focused exercises and resources on that specific topic, rather than bombarding them with irrelevant information about investing. This level of personalization fosters better understanding and retention, leading to more effective financial management. Think of it as a financial Yoda, guiding you on your money journey, but without the cryptic pronouncements.

Gamification and Interactive Learning

The effectiveness of gamification in education is well-established. Financial education apps are increasingly leveraging game mechanics like points, badges, and leaderboards to make learning more engaging and rewarding. These features can transform complex financial concepts into fun and interactive challenges, encouraging users to actively participate and track their progress. Imagine a budgeting game where users earn points for making smart financial decisions, or a stock market simulator that allows users to practice investing without risking real money. Such gamified approaches significantly enhance user engagement and motivation.

Blockchain Technology for Enhanced Security and Transparency

Blockchain technology, best known for its role in cryptocurrencies, offers significant potential for enhancing security and transparency in financial education apps. Imagine an app that uses blockchain to securely store user data, ensuring privacy and preventing unauthorized access. Furthermore, blockchain could be used to create verifiable credentials, allowing users to demonstrate their financial literacy achievements to potential employers or financial institutions. This could be particularly beneficial in developing countries where access to traditional financial services is limited. This is like having a secure, tamper-proof vault for your financial knowledge and accomplishments.

Financial Inclusion Through Accessible Apps

Financial education apps play a crucial role in promoting financial inclusion. By offering accessible and affordable financial literacy resources, these apps can empower individuals from underserved communities to make informed financial decisions. Features like multilingual support, simplified language, and offline accessibility can significantly broaden the reach of financial education, particularly in regions with limited internet access or low digital literacy. This democratization of financial knowledge is a powerful tool for economic empowerment. Think of it as leveling the financial playing field.

Regulatory Landscape and Compliance

Navigating the regulatory waters for financial education apps can feel like trying to balance a checkbook on a unicycle – tricky, but definitely doable with the right guidance. This section will clarify the legal and ethical minefield, ensuring your app doesn’t end up in the financial equivalent of the penalty box.

The world of financial education apps is increasingly subject to scrutiny, and rightly so. We’re dealing with sensitive user data and information that can significantly impact individuals’ financial well-being. Therefore, understanding and adhering to relevant regulations is not just a good idea; it’s a non-negotiable requirement for maintaining trust and avoiding hefty fines.

Data Privacy and Security Regulations

Protecting user data is paramount. Regulations like GDPR (in Europe) and CCPA (in California) are major players, mandating transparency about data collection, usage, and storage. These regulations require explicit consent from users before collecting their personal information, providing clear and concise privacy policies, and implementing robust security measures to prevent data breaches. Failure to comply can result in significant fines and reputational damage. Think of it as building a digital fortress around your users’ financial information – no unauthorized access allowed!

Financial Advertising and Marketing Regulations

Promoting your app responsibly is crucial. Financial advertising regulations vary across jurisdictions, but common themes include prohibitions against misleading or deceptive claims, requirements for clear and conspicuous disclosures, and restrictions on targeting vulnerable populations. For example, you can’t promise guaranteed riches or imply your app is a magic money-making machine. Honesty and transparency are your best friends here. Imagine the app as a trustworthy financial advisor – never promising more than it can deliver.

Best Practices for Data Privacy and Security

Implementing robust security measures is not optional; it’s a necessity. This involves employing encryption to protect data both in transit and at rest, conducting regular security audits, and establishing clear protocols for handling data breaches. Think of it like this: your app’s security should be as impenetrable as Fort Knox. Consider implementing multi-factor authentication, regularly updating software, and training employees on data security best practices. A proactive approach to security can save you from costly headaches down the line.

Compliance Checklist

Before launching your app, a thorough compliance checklist is essential. This checklist should include:

- Review and understand all relevant data privacy and security regulations in your target markets.

- Develop a comprehensive privacy policy that clearly explains how user data is collected, used, and protected.

- Implement robust security measures to protect user data from unauthorized access, use, or disclosure.

- Obtain explicit consent from users before collecting their personal information.

- Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- Establish procedures for handling data breaches, including notification to affected users and relevant authorities.

- Ensure all marketing and advertising materials comply with relevant regulations.

- Regularly review and update your compliance program to reflect changes in regulations and best practices.

Remember, compliance isn’t just about avoiding legal trouble; it’s about building trust with your users and establishing your app as a reliable and responsible source of financial education. It’s a marathon, not a sprint, but with careful planning and execution, you can successfully navigate this crucial aspect of app development.

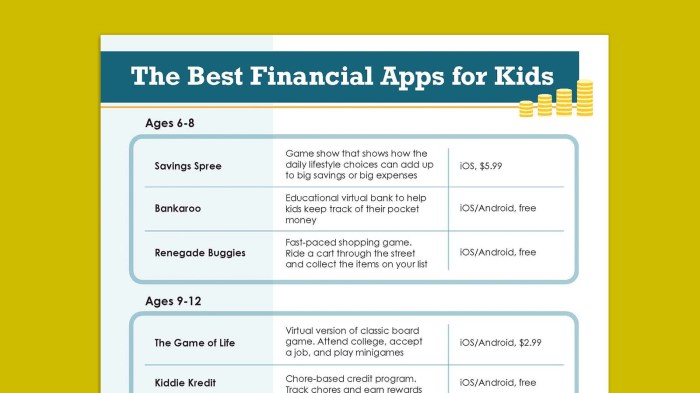

Illustrative Examples of App Designs: Financial Education Apps

Designing a truly engaging financial education app requires a delicate balance: it needs to be both informative and, dare we say it, fun. After all, who wants to learn about compound interest if it feels like doing taxes? Our hypothetical app designs aim for a user experience that’s as smooth as a perfectly-executed budget and as rewarding as a well-timed investment.

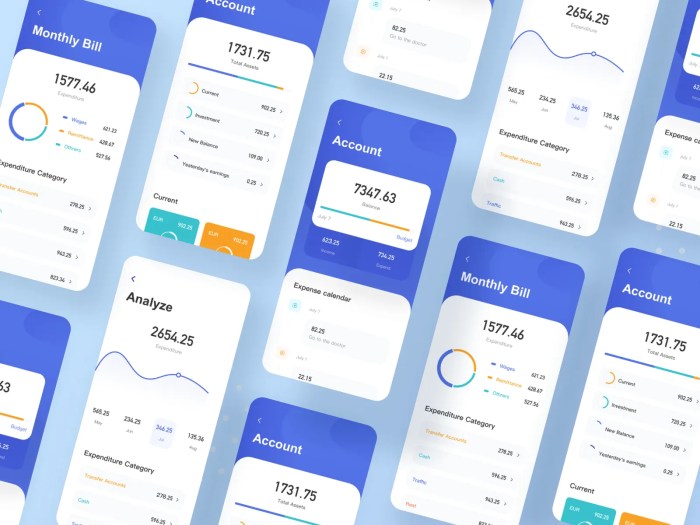

Budgeting App User Interface

This budgeting app, affectionately nicknamed “Penny Pinchers Paradise,” boasts a vibrant yet calming color scheme. Imagine a soft teal background punctuated by pops of sunny yellow and a reassuring shade of forest green for successful budget adherence. Navigation is intuitive, using a simple tab system at the bottom of the screen. One tab displays a clear, visually engaging pie chart showing spending categories (housing, food, entertainment, etc.). Hovering over each slice provides a detailed breakdown of spending within that category. Another tab allows users to easily input transactions, with clever features like photo import for receipts (because who has time for manual entry?). A third tab provides a forecast of future spending based on current trends and user-defined goals, allowing users to anticipate potential shortfalls or surpluses with delightful animations. Data visualization is key; instead of boring spreadsheets, we use interactive graphs that show spending patterns over time, highlighting trends and providing gentle nudges towards better financial habits. Think less “Excel spreadsheet” and more “infographic adventure.”

Investing App User Interface

Our investing app, “Grow Your Dough,” prioritizes both education and ease of use. The initial screens guide new users through a series of interactive tutorials explaining basic investment concepts like diversification and risk tolerance. These aren’t boring lectures; they’re presented as engaging animations and short, digestible videos. The app’s investment tracking tools are presented clearly and concisely, displaying portfolio performance with a customizable dashboard. Users can choose from a range of visualizations, from traditional line graphs to more innovative representations, such as a dynamic “growth tree” that visually represents the growth of their investments. Risk management is a key feature; the app offers personalized risk assessments and suggests suitable investment strategies based on the user’s profile and goals. It doesn’t shy away from explaining potential risks, but does so in an accessible, jargon-free manner. For example, instead of stating “high volatility,” it might say “this investment can experience big ups and downs, like a rollercoaster!” Educational content is integrated seamlessly throughout the app, with pop-up explanations of key terms and concepts available at a user’s fingertips. Think of it as having a friendly financial advisor always available, without the hefty fees.

Final Review

In conclusion, the financial education app market is a vibrant and ever-evolving landscape. While challenges remain, particularly in regulatory compliance and ensuring equitable access, the potential for these apps to empower individuals financially is undeniable. The innovative use of gamification, personalized learning, and emerging technologies promises to make financial literacy not just achievable, but actually enjoyable. So, ditch the spreadsheets and download an app – your future self (and your bank account) will thank you. (Seriously, though, check the reviews first.)

Quick FAQs

What are the security risks associated with using financial education apps?

Security risks vary widely depending on the app. Look for apps with strong encryption, two-factor authentication, and a clear privacy policy. Never share sensitive information unless you’re absolutely certain the app is legitimate and secure.

Are all financial education apps free?

No, many apps offer a freemium model with basic features free and premium features requiring a subscription or one-time purchase. Others are entirely subscription-based or offer in-app purchases.

How can I choose the best financial education app for my needs?

Consider your specific financial goals (budgeting, investing, debt management, etc.) and choose an app with features tailored to those goals. Read user reviews and compare features before making a decision.

What if I have trouble using a financial education app?

Most apps offer customer support through email, phone, or in-app help. Check the app’s website or settings for contact information.