Navigating the complexities of personal finance can feel daunting, but access to the right resources can empower individuals to make informed decisions and achieve their financial goals. This guide explores the diverse landscape of financial education, examining various resource types, accessibility challenges, and the crucial role of technology in shaping the future of financial literacy.

From traditional books and workshops to innovative online platforms and interactive apps, we delve into the pros and cons of each approach, considering their effectiveness across different age groups and financial backgrounds. We’ll also address critical aspects like evaluating resource credibility, overcoming barriers to access, and understanding the evolving trends in financial education.

Types of Financial Education Resources

Navigating the world of personal finance can feel overwhelming, but thankfully, a wealth of resources exists to guide you. Understanding the different types of financial education resources available, and their respective strengths and weaknesses, is crucial for choosing the best path to financial literacy. This section will categorize and analyze various resources to help you make informed decisions.

Categorization of Financial Education Resources

Financial education resources are diverse and cater to different learning styles and preferences. The following table categorizes these resources, providing examples and assessing their accessibility.

| Resource Type | Name | Description | Accessibility |

|---|---|---|---|

| Books | “The Total Money Makeover” by Dave Ramsey | A step-by-step guide to debt reduction and financial planning. | Widely available in bookstores and libraries, both physical and online. |

| Websites | Investopedia | A comprehensive website offering articles, tutorials, and financial tools. | Freely accessible online; some premium features may require a subscription. |

| Apps | Mint | A budgeting and financial tracking app. | Available for free download on iOS and Android devices; premium features may be available through subscription. |

| Courses | Khan Academy’s Finance courses | Free online courses covering various financial topics. | Freely accessible online; self-paced learning. |

| Workshops | Local community college financial literacy workshops | In-person sessions offering interactive learning and expert guidance. | Accessibility varies depending on location and availability; often require registration and may have fees. |

Pros and Cons of Different Resource Types

Each type of financial education resource offers unique advantages and disadvantages.

Books: Pros include in-depth explanations and comprehensive coverage. Cons include a slower pace and lack of immediate interaction.

Websites: Pros include easy access to a vast amount of information and frequent updates. Cons include potential for unreliable or outdated information and information overload.

Apps: Pros include convenience and personalized tracking. Cons include potential for privacy concerns and limited scope compared to other resources.

Courses: Pros include structured learning and interaction with instructors or peers. Cons include time commitment and potential costs.

Workshops: Pros include interactive learning and immediate feedback. Cons include limited availability and potential costs.

Effectiveness for Different Age Groups and Financial Literacy Levels

The effectiveness of different resources varies based on age and existing financial knowledge.

Younger audiences (teens and young adults): Interactive apps and engaging online courses might be more effective than lengthy books. Visual aids and gamified learning experiences can significantly improve comprehension and retention. For example, an app that allows users to simulate investing with virtual money could be more engaging than a textbook on portfolio diversification.

Older audiences (adults with established financial lives): Books offering in-depth analysis and workshops focused on specific financial goals (retirement planning, estate planning) might be more suitable. For instance, a workshop on estate planning would likely be more effective for someone nearing retirement than an introductory app on budgeting.

Individuals with low financial literacy: Simple, straightforward resources like introductory websites or basic budgeting apps might be a good starting point. A step-by-step approach is crucial to build a solid foundation. A website with clear explanations of basic financial concepts would be more beneficial than a complex investment course.

Individuals with high financial literacy: Advanced courses, specialized books, and professional workshops addressing complex topics like financial modeling or derivatives would be more appropriate. A course on advanced investment strategies would be more relevant than a basic budgeting app for someone already proficient in personal finance.

Accessing Financial Education Resources

Gaining access to reliable financial education is crucial for building a secure financial future. Fortunately, a variety of resources are available, catering to diverse learning styles and accessibility needs. Understanding these avenues and the potential barriers to access is key to ensuring everyone has the opportunity to improve their financial literacy.

Numerous avenues exist for individuals seeking financial education. These resources vary in format, content, and accessibility, highlighting the importance of exploring multiple options to find the best fit.

Online Platforms

The internet offers a wealth of financial education resources. Websites like the Consumer Financial Protection Bureau (CFPB), the National Foundation for Credit Counseling (NFCC), and various reputable financial institutions provide free online courses, articles, and tools. These platforms often offer interactive modules, calculators, and budgeting tools, allowing for personalized learning experiences. Many also provide resources in multiple languages, increasing accessibility for diverse populations. For example, the CFPB website offers multilingual resources and translations of key financial documents. However, reliable information must be carefully distinguished from misleading or predatory content, requiring critical evaluation of sources.

Libraries and Community Centers

Local libraries and community centers frequently offer free workshops, seminars, and access to financial literacy materials. These venues provide a supportive, in-person learning environment, fostering interaction and community engagement. Often, these programs are tailored to the specific needs of the local community, addressing issues such as homeownership, debt management, and retirement planning. For instance, a local library might host a workshop on budgeting basics, while a community center might offer financial counseling services. This hands-on approach is particularly beneficial for individuals who prefer in-person learning or lack consistent internet access.

Financial Institutions

Banks, credit unions, and other financial institutions often provide financial education resources to their customers. These resources can range from basic brochures and online tutorials to more comprehensive workshops and individual counseling sessions. The advantage here lies in the direct connection to financial services; education is integrated into the practical application of financial tools and products. For example, a bank might offer workshops on investing or provide personalized guidance on retirement planning. However, it’s important to be aware that the information provided might be biased towards the institution’s products and services.

Barriers to Accessing Financial Education

Despite the availability of resources, several barriers hinder access to financial education for many individuals. These barriers significantly impact underserved populations, perpetuating financial inequality.

Cost

While many resources are free, some programs or services, such as individual financial counseling or specialized workshops, may come with a fee. This cost can be prohibitive for low-income individuals, limiting their access to essential financial education.

Language

Language barriers significantly restrict access to financial education for non-native English speakers. Even when resources are available in multiple languages, the quality of translation and cultural relevance can vary, potentially hindering comprehension and effectiveness.

Technology

Access to technology, including reliable internet and computers, is essential for accessing online financial education resources. Individuals lacking this access are significantly disadvantaged, limiting their ability to engage in online learning and utilize digital financial tools.

Geographic Location

Geographic location plays a crucial role in access to in-person financial education resources. Individuals living in rural areas or underserved communities often have limited access to libraries, community centers, or workshops offering financial literacy programs.

Strategies to Overcome Barriers

Addressing these barriers requires a multifaceted approach. Increased funding for free programs, the development of multilingual and culturally relevant resources, and the expansion of access to technology are essential. Mobile financial education programs, partnerships with community organizations, and the utilization of diverse outreach strategies can help reach underserved populations. For example, offering financial education workshops in community centers, churches, or other easily accessible locations can significantly improve accessibility. Providing financial education materials in multiple languages and formats (print, audio, video) is also critical. Additionally, leveraging technology by creating user-friendly mobile applications and online resources can greatly expand access for those with limited internet access.

Evaluating the Quality of Financial Education Resources

Choosing reliable financial education resources is crucial for making sound financial decisions. Misinformation can lead to costly mistakes, so developing a critical eye is essential. This section will provide you with the tools to assess the quality and trustworthiness of different financial resources.

Evaluating the credibility and reliability of financial information requires a multifaceted approach. You should consider the source’s expertise, potential biases, and the overall presentation of the information. Using a checklist can help ensure you’re making informed choices.

Checklist for Evaluating Financial Education Resources

A thorough evaluation requires considering several factors. This checklist provides a framework for assessing the credibility and reliability of financial resources.

- Source Authority and Expertise: Does the source have relevant credentials or experience in finance? Are the authors or contributors qualified professionals (e.g., certified financial planners, economists)? Look for evidence of their expertise, such as professional certifications, affiliations with reputable institutions, or extensive experience in the field.

- Objectivity and Bias: Does the source present information objectively, or does it promote a specific product or service? Be wary of resources that heavily promote particular investments or financial products without disclosing potential conflicts of interest. Look for transparent disclosure of any affiliations or sponsorships.

- Accuracy and Evidence-Based Information: Does the source cite credible sources to support its claims? Are the statistics and data presented accurate and up-to-date? Reliable sources will often provide references or links to support their assertions.

- Currency and Timeliness: Is the information current and relevant? Financial regulations and market conditions change frequently, so outdated information can be misleading. Check the publication date or last update to ensure the information is recent.

- Clarity and Understandability: Is the information presented clearly and concisely, avoiding overly technical jargon? A good resource will explain complex concepts in a way that is easy to understand, regardless of your financial background.

- Website Reputation and Security: If accessing information online, check the website’s security (HTTPS) and look for reviews or testimonials from other users. A reputable website will usually have a clear “About Us” section and contact information.

Reputable Sources of Financial Education

Several organizations and institutions provide reliable financial education resources. These sources often undergo rigorous fact-checking and adhere to high standards of accuracy.

- The Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency dedicated to protecting consumers in the financial marketplace. They offer a wealth of free resources, including educational materials, tools, and guides on various financial topics. Their strength lies in their governmental authority and commitment to unbiased consumer protection.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit association of credit counseling agencies. They provide resources on budgeting, debt management, and financial planning. Their focus on credit counseling and debt management provides a valuable perspective.

- Investopedia: Investopedia is a well-known financial education website that offers articles, tutorials, and a glossary of financial terms. Their comprehensive coverage and clear explanations make them a valuable resource for many financial topics.

Identifying and Avoiding Misleading Financial Information

Recognizing misleading information is critical to protecting your financial well-being. Several red flags can signal potentially inaccurate or manipulative content.

- Unrealistic Promises of High Returns: Be wary of any investment opportunity promising exceptionally high returns with little or no risk. Such claims are often too good to be true and may indicate a scam.

- High-Pressure Sales Tactics: Legitimate financial advisors will not pressure you into making quick decisions. If you feel pressured to invest or act immediately, it’s a strong warning sign.

- Lack of Transparency and Disclosure: Reliable sources will be transparent about their affiliations, potential conflicts of interest, and the methodology behind their claims. A lack of transparency should raise concerns.

- Use of Fear-Mongering or Emotional Appeals: Beware of resources that use fear or emotional appeals to manipulate your decisions. Sound financial decisions are based on careful analysis and planning, not fear.

- Grammatical Errors and Poor Website Design: While not always definitive, poor writing and website design can indicate a lack of professionalism and credibility.

Specific Financial Topics Covered in Resources

Financial education resources address a wide range of topics crucial for building a strong financial foundation. Understanding these core concepts empowers individuals to make informed decisions about their money, leading to improved financial well-being. The specific approach and depth of coverage can vary significantly depending on the resource’s target audience and intended purpose.

- Budgeting: Budgeting involves tracking income and expenses to create a plan for how to spend money. Key concepts include identifying needs versus wants, creating a realistic budget, and monitoring spending to stay on track. Some resources emphasize simple budgeting methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), while others offer more sophisticated tools and software for detailed tracking and analysis. The level of detail and complexity offered will vary widely depending on the source.

- Saving: Saving involves setting aside money for future goals, whether short-term (like a vacation) or long-term (like retirement). Key concepts include setting savings goals, choosing appropriate savings vehicles (e.g., savings accounts, high-yield savings accounts, money market accounts), and developing consistent saving habits. Resources may focus on the importance of emergency funds, automatic savings plans, or strategies for maximizing interest earned.

- Investing: Investing involves putting money into assets with the expectation of earning a return. Key concepts include understanding different asset classes (stocks, bonds, real estate), risk tolerance, diversification, and long-term investment strategies. Resources can range from beginner-friendly guides explaining basic investment principles to advanced materials covering portfolio management and complex investment strategies. The level of sophistication and risk tolerance discussed will differ greatly depending on the target audience.

- Debt Management: Debt management focuses on strategies for effectively handling debt. Key concepts include understanding different types of debt (credit cards, loans, mortgages), calculating interest rates, developing a debt repayment plan (e.g., debt snowball, debt avalanche methods), and avoiding future debt accumulation. Resources might emphasize the importance of credit scores, debt consolidation strategies, or budgeting techniques to reduce spending and accelerate debt repayment. The specific strategies and tools suggested will often depend on the individual’s financial situation.

- Retirement Planning: Retirement planning involves saving and investing for retirement income. Key concepts include understanding retirement accounts (e.g., 401(k), IRA), calculating retirement needs, and choosing appropriate investment strategies for retirement savings. Resources may cover Social Security benefits, pension plans, and strategies for managing retirement income in retirement. The complexity of the information presented varies greatly depending on the resource; some focus on basic saving strategies, while others delve into advanced tax optimization techniques.

The Role of Technology in Financial Education

Technology has revolutionized the landscape of financial education, dramatically impacting both the delivery and accessibility of resources. The internet and mobile devices have broken down geographical barriers, making high-quality financial education available to a much wider audience than ever before. This increased accessibility is particularly crucial for underserved populations who may have previously lacked access to traditional educational programs.

Technology significantly enhances the learning experience, moving beyond static text and lectures to offer dynamic and engaging content. Interactive tools, simulations, and personalized learning platforms cater to diverse learning styles and preferences, fostering deeper understanding and retention of key financial concepts.

Interactive Tools and Simulations

Interactive tools and simulations provide a hands-on approach to learning complex financial concepts. For example, budgeting apps allow users to input their income and expenses, creating a visual representation of their financial situation. This allows them to experiment with different spending scenarios and see the immediate impact on their savings. Similarly, investment simulations allow users to practice investing in stocks, bonds, or mutual funds without risking real money, helping them understand risk tolerance and investment strategies. These tools transform abstract financial concepts into tangible experiences, making them easier to grasp and apply in real-life situations. A well-designed simulation, for instance, might present a user with various investment options, each with different levels of risk and potential return. The user can then make investment choices and observe the results over time, learning from both successful and unsuccessful outcomes without incurring financial losses.

Personalized Learning Platforms

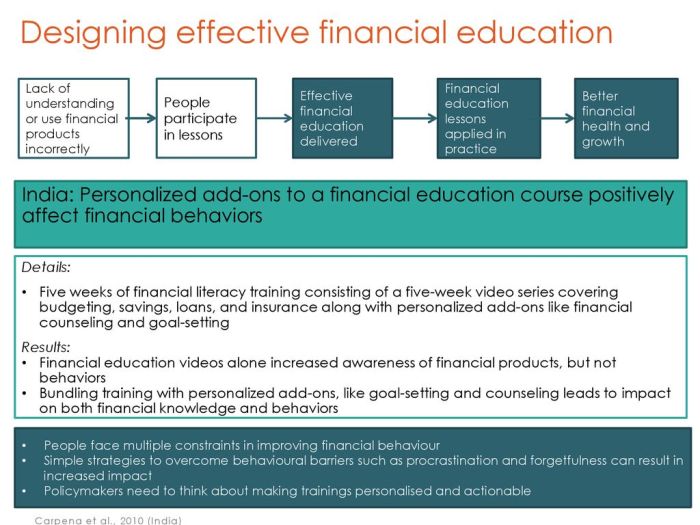

Personalized learning platforms leverage technology to tailor educational content to individual needs and learning styles. These platforms utilize algorithms to assess a user’s knowledge level and adapt the curriculum accordingly. This ensures that learners are challenged appropriately, preventing boredom or frustration. Adaptive learning systems, for example, can identify areas where a user is struggling and provide targeted support, such as additional practice exercises or videos. Furthermore, personalized platforms can track a user’s progress, providing valuable feedback and insights into their learning journey. Imagine a platform that identifies a user’s difficulty with compound interest calculations. The platform could then offer supplementary materials, such as interactive tutorials or personalized quizzes, focusing specifically on this area until mastery is achieved.

A Hypothetical Scenario Illustrating Improved Financial Literacy Outcomes

Consider a young adult, Sarah, who is starting her first job. Through a free, mobile-accessible financial literacy app, she completes interactive modules on budgeting, saving, and debt management. The app uses gamification to keep her engaged and provides personalized feedback based on her progress. Through the app’s budgeting simulator, Sarah experiments with different spending habits, visualizing the impact on her savings goals. She also uses the app’s debt calculator to understand the long-term costs of borrowing. As a result of using this technology-driven resource, Sarah develops strong financial habits early in her career, setting her on a path toward greater financial security. Compared to someone without access to such tools, Sarah is better equipped to make informed financial decisions, reducing the likelihood of accumulating high-interest debt or facing financial hardship in the future.

Future Trends in Financial Education Resources

The landscape of financial education is rapidly evolving, driven by technological advancements and shifting societal needs. We’re moving beyond static pamphlets and lectures towards more engaging, personalized, and accessible learning experiences. This shift promises to make financial literacy more attainable for a wider population, ultimately contributing to improved financial well-being.

The integration of technology is a key driver of these changes, leading to innovative approaches that enhance learning outcomes and accessibility. Emerging trends like gamification, personalized learning platforms, and the increasing use of artificial intelligence are transforming how financial education is delivered and consumed.

Gamification in Financial Education

Gamification leverages game mechanics and game design techniques to engage users in learning. This approach can make learning about complex financial concepts, such as budgeting or investing, more fun and less daunting. For example, interactive budgeting apps that reward users for tracking expenses and meeting savings goals are becoming increasingly popular. These apps often incorporate elements like points, badges, leaderboards, and challenges to motivate users and track progress. The benefits include increased engagement and improved knowledge retention, while challenges include the potential for oversimplification of complex topics and the need for careful design to avoid creating unrealistic expectations.

Personalized Learning in Financial Education

Personalized learning tailors the educational experience to individual needs and learning styles. This approach utilizes adaptive learning technologies that adjust the difficulty and content based on a learner’s performance. Imagine a platform that automatically adjusts the complexity of investment lessons based on a user’s prior knowledge and understanding. This personalized approach can lead to more effective learning and improved outcomes, but requires significant data collection and sophisticated algorithms to function effectively. Challenges include ensuring data privacy and addressing potential biases in algorithms.

Artificial Intelligence in Financial Education

Artificial intelligence (AI) is being integrated into financial education resources in several ways. AI-powered chatbots can provide instant answers to frequently asked questions, offering 24/7 support and personalized guidance. AI algorithms can also analyze user data to identify knowledge gaps and recommend relevant learning materials. For instance, an AI system could analyze a user’s investment portfolio and suggest educational resources focused on specific asset classes or risk management strategies. The benefits include increased accessibility and personalized support, while the challenges involve ensuring the accuracy and ethical implications of AI-driven recommendations.

Projected Evolution of Financial Education Resources (Next Five Years)

Over the next five years, we can expect a significant increase in the use of personalized learning platforms incorporating AI-driven features. Imagine a future where financial education is not a one-size-fits-all experience, but a dynamic and adaptive journey tailored to each individual’s unique circumstances and goals. The visual representation would show a shift from static, text-heavy resources to interactive, personalized platforms with gamified elements and AI-powered support. This evolution would be depicted as a gradual transition from a simple, linear progression of learning to a more complex, interconnected network of resources, dynamically adjusting based on user interaction and performance. This would include a growing reliance on mobile-first applications, incorporating augmented reality and virtual reality for immersive learning experiences, making financial education more accessible and engaging than ever before.

Closing Summary

Ultimately, achieving financial well-being requires a proactive approach to learning and utilizing available resources. By understanding the diverse options available, critically evaluating information sources, and leveraging technological advancements, individuals can build a strong foundation for financial success. This guide serves as a starting point on that journey, empowering readers to confidently navigate the world of personal finance and build a secure financial future.

Helpful Answers

What are some free financial education resources?

Many libraries offer free workshops and access to financial literacy books and websites. Numerous non-profit organizations also provide free online resources and educational materials.

How can I tell if a financial resource is reliable?

Look for resources from reputable organizations, government agencies, or accredited financial professionals. Check for unbiased information, clear explanations, and citations to support claims. Be wary of sources promising unrealistic returns or guaranteed financial success.

Are there financial education resources specifically for young adults?

Yes, many organizations offer resources tailored to young adults, focusing on topics like budgeting, student loan management, and saving for the future. These resources often utilize interactive tools and engaging formats to appeal to younger audiences.