Financial Education Resources Guide: Embark on a hilarious yet insightful journey into the wild world of personal finance! Forget stuffy lectures and boring spreadsheets; we’re here to demystify money matters with wit, wisdom, and maybe a few well-placed puns. This guide tackles everything from budgeting like a boss to investing like a pro, all while keeping things refreshingly relatable. Prepare for a financial awakening that’s both educational and entertaining—because who says learning about your finances can’t be fun?

This guide covers a wide range of topics designed to empower you to take control of your financial future. We’ll explore various resources available, delve into budgeting and saving strategies, navigate the complexities of debt management and credit scores, and chart a course for smart investing and retirement planning. We’ll even arm you with the knowledge to avoid those pesky financial scams lurking around every corner. Get ready to become a financial superhero!

Introduction to Financial Education Resources

Financial literacy, my friends, isn’t just about knowing how to balance a checkbook (remember those?). It’s the ability to understand and effectively manage your money – a skill as crucial as knowing how to parallel park (or at least, knowing *when* to call a tow truck). In today’s complex financial landscape, lacking this knowledge is like navigating a maze blindfolded while juggling chainsaws. Let’s avoid that, shall we?

Understanding and effectively managing your personal finances is paramount to achieving financial well-being and security. Without a solid grasp of financial concepts, individuals risk making poor decisions that can have long-term consequences, leading to debt, financial instability, and missed opportunities. Think of it as adulting, but with less awkward small talk and more strategic investment choices.

Benefits of Utilizing Financial Education Resources

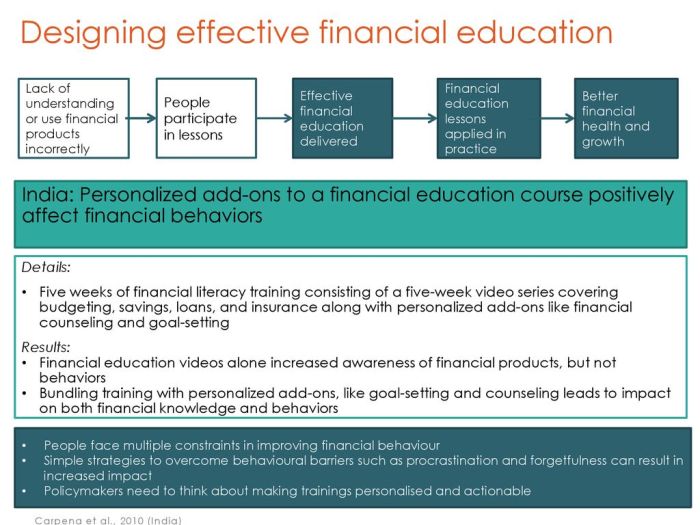

Access to reliable financial education resources offers a multitude of advantages. These resources provide individuals with the tools and knowledge necessary to make informed financial decisions, leading to improved financial health and a greater sense of control over their financial future. Think of it as a financial cheat code, but instead of unlocking unlimited lives, you unlock unlimited financial possibilities. It’s empowering, not to mention significantly less likely to get you banned from online gaming communities.

Target Audiences for Financial Education

Financial education is not a one-size-fits-all affair. Different life stages present unique financial challenges and opportunities, requiring tailored approaches to education. Let’s explore some key demographics:

- Students: Young adults embarking on their financial journeys need foundational knowledge in budgeting, saving, and understanding debt (student loans, anyone?). Resources focusing on responsible spending habits and the long-term implications of financial decisions are crucial for this group. Imagine a world where every student graduated with a solid grasp of compound interest – the world would be a much richer place (pun intended).

- Young Adults: This group faces challenges like navigating employment, establishing credit, and planning for major purchases like homes and cars. Resources focusing on credit management, saving for down payments, and investing are particularly relevant here. Think of it as leveling up in the game of life – you need the right skills and strategies to progress.

- Retirees: Retirement brings its own set of financial considerations, including managing retirement savings, healthcare costs, and estate planning. Resources tailored to retirement planning, including strategies for managing income and long-term care, are essential for this demographic. It’s about ensuring a comfortable and secure retirement, not just surviving on thin ramen until the end.

Types of Financial Education Resources

Navigating the world of personal finance can feel like trying to solve a particularly tricky Sudoku puzzle – lots of numbers, some seemingly random rules, and the constant fear of making a wrong move. Thankfully, unlike Sudoku, there are plenty of resources to help you master your money. Let’s explore the diverse landscape of financial education, from the digital delights of apps to the wisdom held within the pages of a good book.

Choosing the right resource depends on your learning style, budget, and the specific financial topic you’re tackling. Some people thrive in interactive workshops, while others prefer the quiet contemplation of a well-written book. The key is finding the approach that best suits your personality and learning preferences. Let’s dive into the specifics!

Categorization and Description of Financial Education Resources

Financial education resources come in many shapes and sizes, each with its own unique strengths and weaknesses. Understanding these differences will empower you to make informed choices about how you learn about your finances.

| Resource Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Websites | Online platforms offering articles, calculators, and interactive tools related to personal finance. Examples include Investopedia, Khan Academy, and NerdWallet. | Wide range of topics, readily accessible, often free, interactive tools. | Information quality can vary, potential for overwhelming amount of information, may require internet access. |

| Books | Comprehensive guides on various aspects of personal finance, ranging from budgeting to investing. Examples include “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki. | In-depth coverage, easily digestible information, can be read offline, tangible resource. | Can be expensive, may not be updated regularly, less interactive than other resources. |

| Workshops | In-person or online sessions led by financial experts, providing interactive learning and networking opportunities. | Interactive learning environment, opportunity for Q&A, potential for networking, personalized guidance. | Can be expensive, time commitment required, limited availability, geographic limitations for in-person workshops. |

| Apps | Mobile applications designed to help users track expenses, budget, and manage investments. Popular examples include Mint, Personal Capital, and YNAB (You Need A Budget). | Convenient and portable, real-time tracking, personalized insights, reminders and notifications. | Privacy concerns, potential for reliance on technology, may require subscription fees, features can vary widely. |

Accessibility and Cost-Effectiveness of Financial Education Resources

The cost and accessibility of financial education resources vary significantly. Free resources, such as many websites and some apps, offer a great starting point for those on a tight budget. However, for more in-depth knowledge or personalized guidance, paid resources like workshops or premium app subscriptions might be necessary. Consider your financial situation and learning needs when choosing a resource. Remember, investing in your financial education can pay off handsomely in the long run – think of it as an investment with potentially exponential returns!

Budgeting and Saving Strategies

Budgeting and saving—two words that might conjure images of tedious spreadsheets and joyless deprivation. But fear not, dear reader! With the right approach, these activities can become your secret weapons in the quest for financial freedom. Think of it less as restriction and more as strategic resource allocation—a financial Jedi mind trick, if you will. This section will equip you with the tools and techniques to master both, transforming your financial landscape from a chaotic wasteland into a meticulously planned oasis.

Effective budgeting and saving are inextricably linked. A well-crafted budget acts as the roadmap, guiding your spending and highlighting areas where you can save. These savings then fuel your various saving strategies, helping you achieve both short-term and long-term financial goals. Let’s delve into the specifics.

Sample Budget Template

A budget is simply a plan for how you’ll spend your money. While every individual’s needs are unique, a basic framework can be adapted to various income levels. The key is tracking your income and expenses to identify areas where you can make adjustments.

| Income | Amount |

|---|---|

| Salary/Wages | |

| Other Income (e.g., freelance work, investments) | |

| Total Income | |

| Expenses | Amount |

| Housing (rent/mortgage) | |

| Transportation (car payment, gas, public transport) | |

| Food (groceries, eating out) | |

| Utilities (electricity, water, gas) | |

| Healthcare (insurance, medical expenses) | |

| Debt Payments (loans, credit cards) | |

| Personal Care | |

| Entertainment | |

| Savings | |

| Other Expenses | |

| Total Expenses | |

| Net Income (Income – Expenses) |

Remember to fill in the amounts based on your individual circumstances. Regularly reviewing and adjusting your budget is crucial for its effectiveness. Consider using budgeting apps or spreadsheets to streamline the process. Think of it as a living document, constantly evolving to reflect your financial reality.

Saving Strategies: Emergency Funds and Long-Term Investments

Building an emergency fund is akin to constructing a financial safety net. It provides a cushion against unexpected expenses like job loss, medical emergencies, or car repairs, preventing you from falling into debt. Aim for 3-6 months’ worth of living expenses.

Long-term investments, on the other hand, focus on growing your wealth over time. This typically involves investing in assets like stocks, bonds, and real estate. The time horizon allows for weathering market fluctuations and benefiting from the power of compounding. Diversification across different asset classes is key to mitigating risk.

Applying the 50/30/20 Budgeting Rule

The 50/30/20 rule provides a simple yet effective framework for allocating your income. It suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

Example: Let’s say your monthly after-tax income is $3000. According to the 50/30/20 rule:

- Needs (50%): $1500 (rent, groceries, transportation, utilities)

- Wants (30%): $900 (entertainment, dining out, hobbies)

- Savings and Debt Repayment (20%): $600 (emergency fund, investments, debt payments)

This is just a guideline; you can adjust the percentages based on your specific financial goals and priorities. The crucial aspect is creating a conscious and intentional allocation of your funds.

The 50/30/20 rule is a flexible guideline, not a rigid law. Adapt it to fit your life, but stick to the principle of intentional spending.

Debt Management and Credit Scores

Navigating the world of debt and credit scores can feel like traversing a minefield blindfolded – thrilling, terrifying, and potentially very expensive. But fear not, intrepid financial adventurer! Understanding these crucial elements is key to building a strong financial foundation and avoiding the pitfalls of overwhelming debt. This section will equip you with the knowledge and strategies to conquer your debt and boost your credit score, transforming your financial future from a scary monster into a cuddly kitten (metaphorically speaking, of course. We’re not promising actual kittens).

Understanding your credit score and report is like having a financial X-ray. It reveals your creditworthiness to lenders, influencing everything from loan interest rates to securing an apartment. A higher credit score translates to better loan terms, lower interest rates, and even better insurance premiums – essentially, it’s a passport to financial freedom. Conversely, a low credit score can limit your options and cost you significantly more money over time. A credit report details your credit history, including payment history, outstanding debts, and credit inquiries. Regularly reviewing your credit report for errors is crucial; inaccurate information can negatively impact your score.

Understanding Credit Reports and Scores

Credit reports are compiled by three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau may have slightly different information, so it’s beneficial to check all three. Your credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Factors contributing to your score include payment history (the most important factor!), amounts owed, length of credit history, new credit, and credit mix (different types of credit accounts). A score above 700 is generally considered good, while a score below 600 can significantly hinder your borrowing ability. Imagine a credit score as your financial reputation – a high score whispers, “responsible and reliable,” while a low score shouts, “proceed with caution!”

Strategies for Debt Management, Financial Education Resources Guide

Effective debt management involves a multifaceted approach. Ignoring debt is like ignoring a persistent cough – it might go away eventually, but it’s likely to get worse before it does. Proactive strategies can significantly reduce your debt burden and improve your financial health. One common strategy is debt consolidation, where you combine multiple debts into a single loan with potentially lower interest rates. This simplifies payments and can save you money in the long run. Another effective approach is debt negotiation, where you attempt to negotiate lower interest rates or monthly payments with your creditors. This requires careful planning and communication, but it can yield significant results. Remember to document everything!

Tips for Improving Credit Scores

Improving your credit score takes time and consistent effort, but the rewards are well worth it. Think of it as training for a marathon – slow and steady wins the race. It’s not a sprint; it’s a marathon.

- Pay bills on time: This is the single most important factor affecting your credit score. Set up automatic payments to avoid late fees and negative marks on your report.

- Keep credit utilization low: Aim to keep your credit card balances below 30% of your credit limit. High utilization suggests you’re heavily reliant on credit.

- Maintain a mix of credit accounts: A diverse credit portfolio, including credit cards and loans, demonstrates responsible credit management.

- Don’t open too many new accounts: Numerous credit applications in a short period can negatively impact your score. Only apply for credit when necessary.

- Monitor your credit report regularly: Check your reports from all three major bureaus for errors and signs of identity theft. Dispute any inaccuracies promptly.

By implementing these strategies and consistently practicing responsible financial habits, you can effectively manage your debt, improve your credit score, and pave the way for a brighter financial future. Remember, a strong credit score is a powerful tool, and understanding how to use it wisely is essential for long-term financial success.

Investing and Retirement Planning

Investing and retirement planning might sound like a snooze-fest, but trust us, it’s the key to a financially comfortable (and possibly luxurious) retirement. Think of it as a long-term game of financial Jenga – carefully stacking your investments to build a solid, and hopefully, tall tower of savings. The earlier you start, the better your chances of winning.

Investing your money wisely is like planting a money tree; the longer you let it grow, the more fruit (or rather, financial rewards) you’ll reap. Retirement planning ensures that your money tree continues to provide shade and sustenance well into your golden years, allowing you to enjoy a comfortable lifestyle without relying solely on Social Security.

Investment Options

Several investment options cater to different risk tolerances and financial goals. Each option carries its own level of risk and potential return. Understanding these differences is crucial for making informed investment decisions.

- Stocks: Represent ownership in a company. Their value fluctuates based on the company’s performance and market conditions. Think of it as owning a piece of the pie – if the company does well, your piece grows bigger, and vice-versa.

- Bonds: Essentially, you’re lending money to a company or government. You receive regular interest payments and get your principal back at maturity. Bonds are generally considered less risky than stocks but offer lower potential returns. Think of it as a safer, albeit slower-growing, money tree.

- Mutual Funds: These pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. This diversification reduces risk, as the performance of one investment doesn’t solely dictate your overall returns. It’s like having multiple money trees in your financial orchard, so if one struggles, the others might thrive.

Diversification

Diversification is the art of not putting all your eggs in one basket. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk. If one investment performs poorly, others might compensate, reducing the overall impact on your portfolio. Imagine having a portfolio of investments like a well-balanced meal; you wouldn’t want to eat only one type of food, right? A balanced portfolio ensures your financial health is just as well-rounded.

Retirement Planning: A Step-by-Step Guide

Planning for retirement involves several crucial steps, akin to meticulously crafting a detailed roadmap to your financial future.

- Calculate Retirement Needs: Determine how much money you’ll need annually during retirement. Consider factors like your desired lifestyle, inflation, and healthcare costs. Many online calculators can assist with this. It’s like figuring out how many apples you need to feed your financial orchard for the rest of your life.

- Determine Your Retirement Savings Timeline: How many years do you have until retirement? The longer the timeline, the more time your investments have to grow. Think of it as giving your money tree enough time to fully mature.

- Choose Appropriate Investment Vehicles: Select investments aligned with your risk tolerance, time horizon, and retirement goals. Consider a mix of stocks, bonds, and mutual funds for diversification. This is like choosing the right soil and fertilizer for your money tree to thrive.

- Regularly Contribute to Retirement Accounts: Consistency is key. Contribute regularly to retirement accounts like 401(k)s and IRAs to maximize the benefits of compound interest. This is like consistently watering and nurturing your money tree for optimal growth.

- Monitor and Adjust Your Portfolio: Regularly review your investment portfolio and adjust it as needed based on your changing circumstances and market conditions. This is like pruning your money tree to ensure healthy growth and remove any dead branches.

The magic of compound interest: Your earnings generate more earnings over time. It’s the snowball effect in action.

Protecting Your Finances

Protecting your hard-earned cash isn’t just about making smart investments; it’s also about safeguarding it from those who would rather spend it than earn it. This section will equip you with the knowledge to navigate the treacherous waters of financial scams and the reassuring shores of insurance, leaving you feeling financially secure and (dare we say it) slightly smug.

Common Financial Scams and Avoidance Strategies

Financial scams are as diverse as they are deceptive, ranging from the surprisingly sophisticated to the laughably obvious. Understanding common tactics is your first line of defense. These range from phishing emails promising untold riches (if only you’d just share your bank details, naturally) to more complex schemes involving fake investments or promises of guaranteed returns. Remember, if it sounds too good to be true, it probably is.

The Importance of Insurance and Choosing Appropriate Coverage

Insurance isn’t just a boring adult thing; it’s a safety net, a financial parachute in case life throws you a curveball (or, let’s be honest, a whole bowling alley’s worth of curveballs). Health insurance protects against crippling medical bills, life insurance provides financial security for your loved ones, home insurance safeguards your biggest investment, and auto insurance…well, you get the picture. Choosing the right coverage involves assessing your risk tolerance and financial situation. For example, a young, healthy individual might opt for a high deductible health plan, while a homeowner in a hurricane-prone area might need comprehensive flood insurance. It’s all about finding the right balance between protection and cost.

Resources for Financial Assistance and Consumer Protection

Facing financial hardship? Don’t despair! Numerous resources exist to help you navigate difficult times and protect yourself from unscrupulous individuals or businesses. These include government agencies like the Consumer Financial Protection Bureau (CFPB), which offers guidance and complaint resolution services, and non-profit organizations providing financial literacy programs and debt counseling. Additionally, many states have their own consumer protection agencies and legal aid societies that can provide assistance. A quick online search will reveal a wealth of resources tailored to your specific needs and location. Remember, you’re not alone in this!

Finding Reliable Financial Resources

Navigating the world of personal finance can feel like traversing a minefield of misleading ads and questionable advice. Fear not, intrepid investor! This section will equip you with the tools to distinguish the financial gurus from the financial… well, let’s just say “not-so-gurus.” We’ll show you how to sniff out reliable information and avoid becoming a statistic in someone else’s get-rich-quick scheme.

The sheer volume of financial information available can be overwhelming, even for seasoned professionals. To ensure you’re making informed decisions, it’s crucial to develop a critical eye and apply a rigorous evaluation process to any source claiming to hold the key to your financial freedom. Remember, the path to financial wellness is paved with careful consideration, not impulsive decisions based on flashy promises.

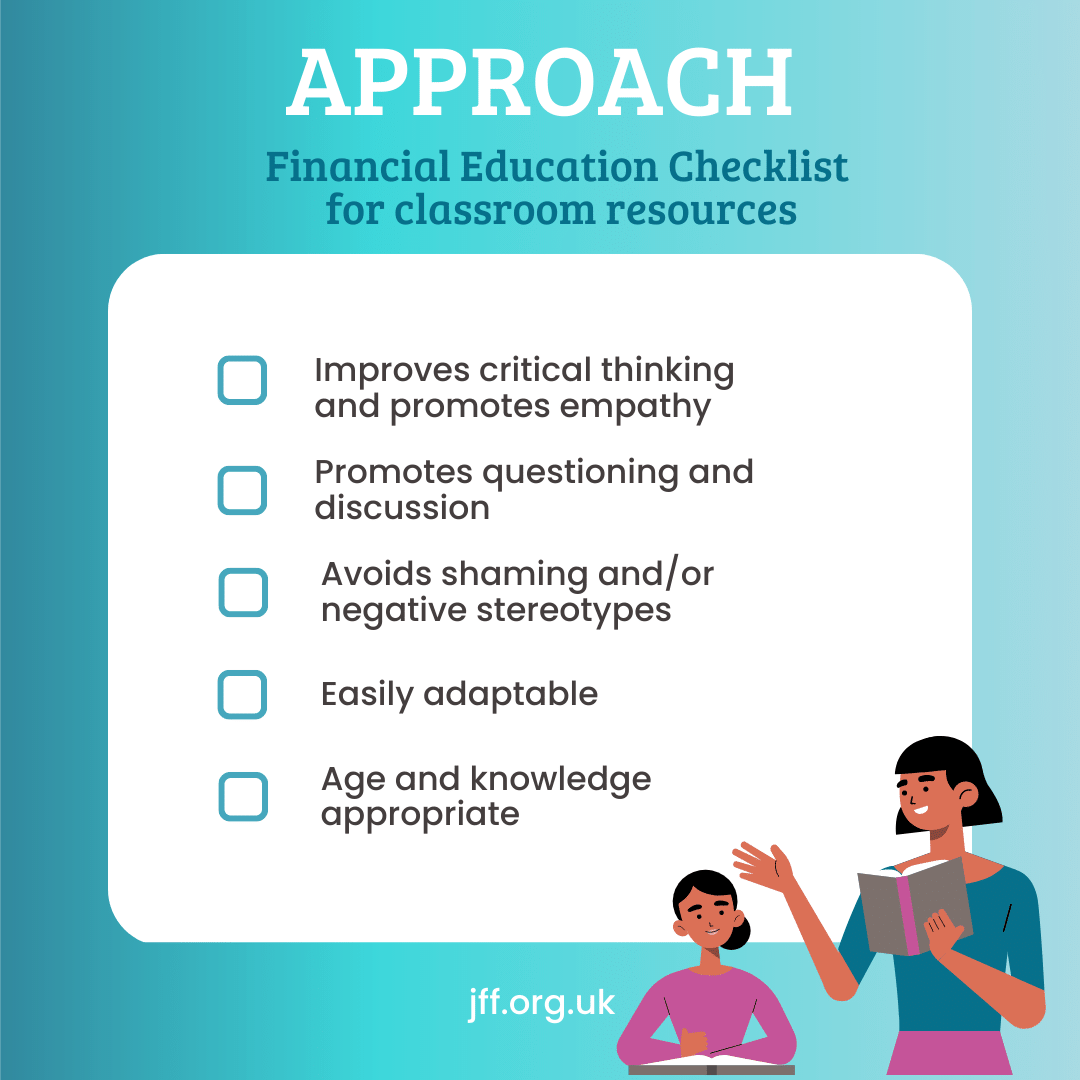

Criteria for Evaluating Financial Information Sources

Evaluating the credibility of financial information requires a discerning eye and a healthy dose of skepticism. Think of it as a financial detective game – you’re on the hunt for truth, and the clues are scattered throughout the source’s presentation. Look for sources that clearly identify their credentials, back up their claims with verifiable data, and avoid making overly optimistic or unrealistic promises. Beware of sources that rely heavily on testimonials alone or those that pressure you into immediate action.

Reputable Organizations Offering Financial Education Resources

Several organizations provide trustworthy financial education resources. These institutions typically employ qualified financial professionals, use peer-reviewed research, and undergo rigorous fact-checking processes. Examples include the National Foundation for Credit Counseling (NFCC), the Consumer Financial Protection Bureau (CFPB), and reputable universities with established finance departments offering free or low-cost educational materials. These organizations often provide resources such as workshops, online courses, and publications covering various financial topics. Choosing resources from such organizations significantly reduces the risk of encountering misleading or inaccurate information.

Verifying the Authenticity of Online Financial Advice

Imagine a flowchart, starting with a box labeled “Encounter Financial Advice Online.” From there, an arrow points to a diamond-shaped decision box: “Is the Source Clearly Identified and Reputable?” If yes, an arrow leads to “Further Investigate Source’s Credentials.” If no, the arrow points to “Proceed with Extreme Caution, or Discard.”

The “Further Investigate Source’s Credentials” box branches into several sub-boxes. One leads to “Check for Contact Information and Physical Address.” Another leads to “Verify Credentials with Independent Sources (e.g., Better Business Bureau).” A third leads to “Examine the Source’s History for Bias or Conflicts of Interest.” Finally, all paths converge at a final box: “Assess the Reliability of the Information Presented.” This involves checking for factual accuracy, unbiased presentation, and the avoidance of exaggerated claims. If the information passes muster, you proceed; otherwise, you revisit the “Proceed with Extreme Caution, or Discard” option. This flowchart visually represents a systematic approach to evaluating online financial advice. Remember, a little healthy skepticism can save you a lot of heartache (and money!).

Financial Education for Specific Life Stages

Navigating the financial world can feel like a thrilling rollercoaster ride, full of unexpected twists and turns. The good news is that understanding your stage of life can significantly smooth out the bumps and help you maximize your financial opportunities. Each life stage presents unique challenges and rewards, demanding a tailored approach to financial planning. Let’s explore how to navigate these exciting phases with wit and wisdom.

Financial planning isn’t a one-size-fits-all endeavor; it’s a personalized journey that evolves alongside our life experiences. Understanding the financial realities specific to each life stage is key to building a secure and prosperous future. Failing to plan for the future is planning to fail, as the old saying goes – but let’s make sure our plans are fun, too!

Young Adults (18-35)

This stage is often characterized by establishing independence, pursuing education or career goals, and potentially starting a family. Financial literacy is paramount during this period to build a strong foundation for future success. It’s a time of learning from both triumphs and setbacks, paving the way for more informed decisions later on.

- Key Challenges: Student loan debt, establishing credit, saving for a down payment on a home, navigating career changes.

- Opportunities: Time to build good financial habits, maximize employer-sponsored retirement plans, benefit from lower tax rates on investments.

- Recommendations: Create a realistic budget, prioritize paying down high-interest debt, start saving early for retirement, build an emergency fund, explore different investment options (but not too many at once, or you might get lost in the excitement).

Families (35-55)

This phase typically involves raising children, managing household expenses, and balancing career aspirations with family responsibilities. The financial demands are significant, requiring careful planning and resource allocation. It’s also a period of potential career advancement and increased earning potential.

- Key Challenges: Childcare costs, education expenses, mortgage payments, saving for college, managing multiple income streams (if applicable).

- Opportunities: Increased income potential, potential for tax benefits related to children and dependents, opportunities to invest in education savings plans.

- Recommendations: Develop a comprehensive family budget, explore tax-advantaged savings accounts (like 529 plans), review life insurance needs, plan for long-term care.

Retirees (55+)

Retirement marks a significant transition, requiring careful planning to ensure financial security during this phase of life. Managing expenses, healthcare costs, and potential longevity risks requires a well-defined financial strategy. It’s also a time to enjoy the fruits of your labor, if you’ve planned well, that is!

- Key Challenges: Managing healthcare expenses, maintaining a comfortable lifestyle on a fixed income, adjusting to reduced income, planning for potential long-term care needs.

- Opportunities: Time to pursue passions and hobbies, travel, spend time with loved ones, potentially downsize and reduce living expenses.

- Recommendations: Review retirement income sources, manage healthcare costs effectively, explore options for supplemental income, consider downsizing or relocating to a lower cost of living area, prepare for potential long-term care expenses. Remember, you’ve earned this time to relax and enjoy your well-deserved retirement!

Outcome Summary: Financial Education Resources Guide

So there you have it – a whirlwind tour through the exciting (yes, really!) world of personal finance. From budgeting basics to retirement strategies, we’ve covered the essentials, all while aiming for a balance between informative and amusing. Remember, taking control of your finances isn’t just about numbers; it’s about securing your future and achieving your dreams. Now go forth and conquer your financial goals – you’ve got this!

Questions Often Asked

What if I don’t have a regular income?

Even without a steady paycheck, budgeting and saving are still crucial. Track all income sources (even small ones) and prioritize essential expenses. Explore resources for financial assistance programs in your area.

How can I find a financial advisor I can trust?

Look for certified financial planners (CFPs) or advisors with a proven track record. Check online reviews and ask for references. Beware of anyone promising unrealistic returns or pressuring you into quick decisions.

What’s the best way to deal with unexpected expenses?

An emergency fund is your best defense! Aim to save 3-6 months’ worth of living expenses. If an unexpected expense arises, use your emergency fund before resorting to high-interest debt.