Accurately predicting future financial performance is crucial for informed decision-making in any organization. Financial forecasting, a multifaceted discipline, involves employing various methods to estimate future financial variables like revenue, expenses, and cash flow. This guide delves into the diverse techniques available, ranging from qualitative approaches relying on expert judgment to quantitative methods utilizing statistical analysis and advanced algorithms. Understanding these methods empowers businesses to navigate uncertainty, optimize resource allocation, and achieve sustainable growth.

We will explore both qualitative and quantitative forecasting techniques, examining their strengths, weaknesses, and appropriate applications. We’ll also cover essential aspects like model selection, evaluation, risk management, and the incorporation of advanced techniques such as machine learning. The ultimate goal is to equip readers with a practical understanding of how to effectively forecast financial performance and make data-driven decisions.

Introduction to Financial Forecasting Methods

Financial forecasting is the process of estimating the future financial performance of a business or organization. It’s a crucial element of financial planning and management, providing a roadmap for decision-making across various departments and levels of the organization. Accurate forecasting allows businesses to anticipate challenges, capitalize on opportunities, and make informed choices regarding investments, resource allocation, and strategic planning. Without reliable forecasts, businesses operate with significantly increased risk.

Financial forecasting employs various techniques and methodologies to predict future financial outcomes. The accuracy and reliability of these predictions depend on a multitude of factors, including the quality of historical data, the chosen forecasting method, and the overall economic environment. The selection of the appropriate method is critical to achieving meaningful results.

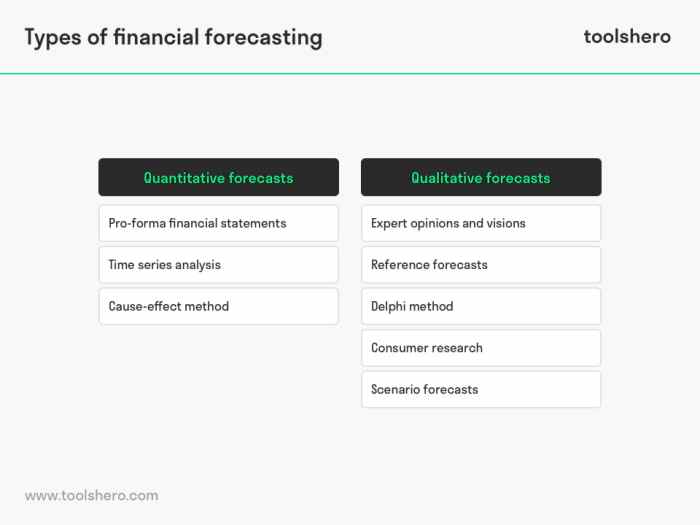

Categories of Financial Forecasting Methods

Financial forecasting methods are broadly categorized based on their time horizon: short-term, medium-term, and long-term. The choice of timeframe directly impacts the techniques employed and the level of detail required. Short-term forecasts typically cover periods of up to one year, focusing on immediate operational needs and cash flow management. Medium-term forecasts usually span one to five years, providing a broader perspective for strategic planning and investment decisions. Long-term forecasts extend beyond five years, concentrating on major strategic initiatives and long-term growth projections.

Factors Influencing the Selection of Forecasting Methods

Several key factors influence the choice of an appropriate financial forecasting method. The specific needs and context of the business are paramount. Consideration should be given to data availability, the complexity of the business environment, the desired level of accuracy, and the resources available for forecasting.

- Data Availability: The accuracy of any forecast is directly tied to the quality and quantity of historical data. Methods requiring extensive historical data might be unsuitable if such data is limited. For instance, a newly established business will have limited historical data, necessitating the use of simpler forecasting methods or relying on industry benchmarks.

- Business Complexity: Businesses operating in stable, predictable environments may find simpler forecasting methods sufficient. However, complex businesses operating in dynamic markets may require more sophisticated models capable of handling multiple variables and uncertainties. A large multinational corporation, for example, would likely employ more complex forecasting models than a small local bakery.

- Desired Accuracy: The level of accuracy required influences the choice of method. High-accuracy forecasts demand more sophisticated techniques and may involve higher costs. A company needing a precise forecast for a critical investment decision will invest more in a detailed and accurate forecasting process compared to a company making a smaller, less impactful decision.

- Resource Availability: Sophisticated forecasting methods often require specialized software, skilled personnel, and considerable time investment. Resource constraints may necessitate the selection of simpler, less resource-intensive methods. A small business with limited resources might opt for simpler methods like moving averages, whereas a larger corporation with dedicated financial analysts might employ more complex econometric models.

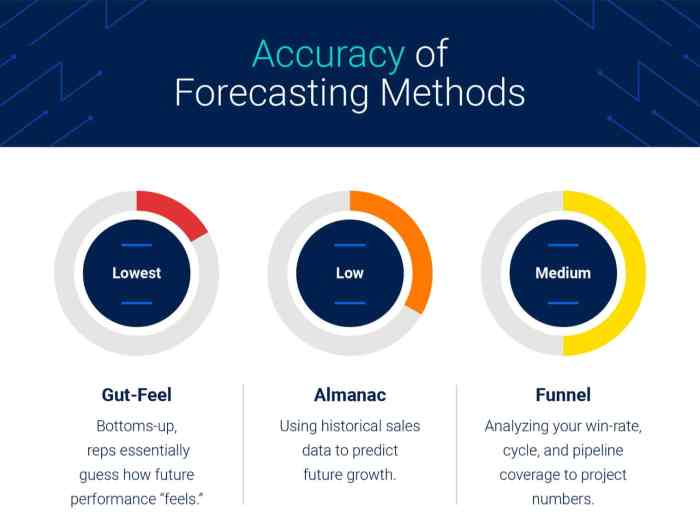

Examples of Forecasting Methods

Different forecasting methods utilize various approaches to predict future financial outcomes. These range from simple techniques suitable for short-term forecasts to complex models for long-term strategic planning. Examples include:

- Time Series Analysis: This involves analyzing historical data to identify patterns and trends, then extrapolating these patterns into the future. Simple moving averages and exponential smoothing are common time series methods used for short-term forecasting.

- Regression Analysis: This statistical technique identifies relationships between different variables to predict future values. For example, sales revenue might be regressed against advertising expenditure to predict future sales based on planned advertising spending.

- Econometric Modeling: These are complex models that incorporate macroeconomic variables and other external factors to predict financial performance. These are often used for long-term forecasts and require significant expertise and data.

- Qualitative Forecasting: This relies on expert judgment and opinion rather than purely quantitative data. The Delphi method, involving a panel of experts, is a common qualitative forecasting technique.

Qualitative Forecasting Methods

Qualitative forecasting methods rely on expert judgment and subjective opinions rather than solely on numerical data. These methods are particularly valuable when historical data is scarce, unreliable, or irrelevant to future trends, or when dealing with emerging markets or disruptive technologies. They offer a valuable counterpoint to quantitative methods, providing insights into market sentiment, emerging trends, and unforeseen events that might significantly impact future outcomes.

Qualitative forecasting methods offer a range of advantages, but also have inherent limitations.

Strengths and Limitations of Qualitative Forecasting Methods

Qualitative forecasting methods, such as the Delphi method and market research, provide valuable insights when quantitative data is limited or unreliable. The Delphi method, for instance, leverages the expertise of a panel of experts to reach a consensus forecast through iterative rounds of questionnaires and feedback. This process helps to mitigate individual biases and refine the forecast over time. Market research, on the other hand, directly gathers information from potential customers regarding their purchasing intentions, preferences, and perceptions of products or services. However, these methods are susceptible to biases, particularly from the selection of experts or the way questions are framed in market research. The results can also be subjective and difficult to quantify precisely, making it challenging to compare forecasts generated using different qualitative techniques. Further, the time and cost involved in conducting extensive market research or running a Delphi study can be significant.

Comparison of Qualitative Forecasting Techniques

Several qualitative forecasting techniques exist, each with its strengths and weaknesses and suitability for different scenarios. The Delphi method excels in situations requiring expert consensus on complex issues with limited historical data, such as technological breakthroughs or long-term economic projections. Market research is more effective when understanding customer preferences and demand for existing or new products. Other qualitative methods, such as scenario planning (developing multiple plausible future scenarios based on various assumptions) and focus groups (gathering in-depth information from small groups of individuals) can provide valuable complementary insights. The choice of the most appropriate method depends on the specific forecasting problem, the available resources, and the desired level of detail.

Hypothetical Scenario for Qualitative Forecasting

Consider a startup developing a revolutionary new medical device with no direct historical precedent. Quantitative forecasting methods would be of limited use, as there is no existing sales data or market share to extrapolate from. In this scenario, a qualitative approach, combining the Delphi method with extensive market research, would be most effective. A panel of medical experts could use the Delphi method to assess the device’s potential clinical efficacy and market adoption, while market research could gauge physician and patient interest. This combined approach would provide a more comprehensive and nuanced forecast than either method alone, informing crucial investment decisions and product development strategies. The rationale for this choice stems from the need to account for uncertainties and subjective factors, such as regulatory approval processes and potential competitor actions, which are difficult to capture in quantitative models.

Quantitative Forecasting Methods

Quantitative forecasting methods rely on mathematical and statistical models to predict future outcomes. Unlike qualitative methods, which rely on expert judgment and intuition, quantitative methods use historical data and established relationships to generate forecasts. This approach offers a more objective and potentially more accurate prediction, particularly when sufficient historical data is available. The choice of method depends heavily on the nature of the data, the forecasting horizon, and the desired level of accuracy.

Time-Series Analysis Techniques

Time-series analysis focuses on the temporal patterns within data to forecast future values. Several techniques exist, each with its strengths and weaknesses. The following table compares three common methods: moving averages, exponential smoothing, and ARIMA models.

| Method | Complexity | Data Requirements | Accuracy | Description | Example |

|---|---|---|---|---|---|

| Moving Averages | Low | Moderate | Moderate | Averages data points over a specified period. Simple moving averages give equal weight to all data points; weighted moving averages assign different weights. | A company uses a 3-month moving average of sales to forecast next month’s sales. If sales were $100,000, $110,000, and $120,000 over the past three months, the forecast for the next month would be $110,000. |

| Exponential Smoothing | Medium | Moderate | High | Assigns exponentially decreasing weights to older data points. Simple exponential smoothing uses a single smoothing parameter; double and triple exponential smoothing account for trends and seasonality. | A retail store uses exponential smoothing to forecast daily demand for a particular product. The model considers past demand, giving more weight to recent data. This helps to adjust for changes in customer preferences or seasonal fluctuations. |

| ARIMA Models | High | High | High (with proper model selection) | Autoregressive Integrated Moving Average models capture complex patterns in time series data, including trends, seasonality, and cyclical fluctuations. Model selection involves identifying the appropriate order of the autoregressive (AR), integrated (I), and moving average (MA) components. | A financial institution uses an ARIMA model to forecast daily stock prices. The model considers past stock prices, accounting for trends and volatility. Accurate model selection is crucial for reliable predictions. |

Regression Analysis in Financial Forecasting

Regression analysis examines the relationship between a dependent variable and one or more independent variables. In financial forecasting, the dependent variable is often a financial metric (e.g., sales, profits, stock prices), while the independent variables are factors that influence the dependent variable (e.g., economic indicators, interest rates, marketing expenditures).

For example, a company might use regression analysis to forecast sales based on advertising spending and economic growth. In this case, sales would be the dependent variable, while advertising spending and economic growth would be independent variables. The regression model would estimate the relationship between these variables, allowing the company to predict sales based on projected advertising spending and economic growth. Another example could be predicting a company’s stock price based on factors like industry performance, interest rates, and earnings per share.

Interpreting Regression Analysis Results

The output of a regression analysis typically includes the estimated coefficients for each independent variable, the R-squared value, and statistical significance tests. The coefficients indicate the magnitude and direction of the relationship between each independent variable and the dependent variable. A positive coefficient suggests a positive relationship, while a negative coefficient suggests a negative relationship. The R-squared value represents the proportion of the variance in the dependent variable that is explained by the independent variables. A higher R-squared value indicates a better fit of the model. Statistical significance tests (e.g., t-tests) assess whether the estimated coefficients are statistically different from zero. If a coefficient is statistically significant, it suggests that the corresponding independent variable has a real impact on the dependent variable. For instance, if a regression model predicts that a 1% increase in advertising spending leads to a 0.5% increase in sales (with statistical significance), this provides a quantifiable basis for marketing budget decisions. A low R-squared might suggest that the model is not capturing all relevant factors affecting sales, prompting a review of the independent variables included.

Forecasting Specific Financial Variables

Accurately forecasting specific financial variables is crucial for effective financial planning and decision-making. Understanding the nuances of each variable and employing appropriate forecasting methods significantly impacts a business’s ability to achieve its financial goals. This section will delve into forecasting techniques for key financial variables: sales revenue, cash flow, and capital expenditures.

Sales Revenue Forecasting Methods

Forecasting sales revenue requires a multifaceted approach, considering both internal and external factors. Seasonality, economic conditions, marketing campaigns, and competitor actions all influence sales. Effective forecasting integrates qualitative and quantitative methods. Qualitative methods, such as expert opinions and market research, provide valuable insights into market trends and customer behavior. Quantitative methods, like time series analysis (e.g., moving averages, exponential smoothing) and regression analysis, leverage historical sales data to project future sales. For instance, a company selling winter coats would expect significantly higher sales during the colder months, requiring a forecasting model that accounts for this seasonality. Similarly, macroeconomic indicators like GDP growth can be incorporated into regression models to predict sales sensitivity to economic fluctuations. Advanced techniques like ARIMA models can capture complex patterns in historical sales data, improving forecasting accuracy.

Cash Flow Forecasting Techniques

Accurate cash flow forecasting is paramount for business viability. Cash flow projections highlight periods of potential shortfalls or surpluses, allowing businesses to proactively manage their finances. The direct method of cash flow forecasting starts with actual cash inflows and outflows, while the indirect method begins with net income and adjusts for non-cash items. Both methods require detailed estimations of future revenues, expenses, and capital expenditures. For example, a business might use a simple cash flow projection based on historical data to predict its monthly cash balance, ensuring sufficient funds are available to meet operational needs and debt obligations. More sophisticated models can incorporate probabilistic scenarios, considering different levels of sales and expense variability, to generate a range of potential cash flow outcomes. This approach helps businesses prepare for unexpected events and make informed financial decisions.

Capital Expenditure Forecasting Procedure

Forecasting capital expenditures (CapEx) involves projecting future investments in fixed assets. This process typically begins with a strategic review of the business’s long-term plans and objectives. Planned investments, such as new equipment purchases or facility expansions, are identified and their costs estimated. Depreciation of existing assets should also be considered, as it affects the net book value of assets and influences future investment decisions. A company might use a simple forecasting method based on historical CapEx data and planned investments for the next few years. However, more sophisticated methods might incorporate discounted cash flow (DCF) analysis to evaluate the profitability of potential projects and prioritize investments based on their expected returns. For example, a manufacturing company might forecast its CapEx needs by projecting the replacement of aging machinery based on its useful life and planned capacity expansions, adjusting for inflation and technological advancements. This detailed approach ensures that capital is allocated efficiently to support the company’s growth strategy.

Model Selection and Evaluation

Selecting the appropriate forecasting model is crucial for generating reliable financial predictions. The best model depends on several factors, including the nature of the data, the forecasting horizon, and the desired level of accuracy. A thorough evaluation process is essential to ensure the chosen model’s suitability and to minimize the risk of inaccurate forecasts.

Model selection involves comparing various forecasting techniques based on their accuracy, robustness, and computational demands. This comparison helps identify the model best suited for the specific financial forecasting task. Robustness refers to a model’s ability to maintain accuracy even when faced with noisy data or unforeseen changes in market conditions. Computational requirements consider the resources (time and processing power) needed to implement and run the model.

Comparison of Forecasting Models

The following table compares several common forecasting models across key characteristics:

| Model | Accuracy | Robustness | Computational Requirements |

|---|---|---|---|

| Simple Moving Average | Generally low accuracy, suitable for stable data | Relatively robust to outliers | Low |

| Exponential Smoothing | Moderate accuracy, better for data with trends | Moderately robust | Low to moderate |

| ARIMA | High accuracy for stationary time series data | Can be sensitive to outliers and non-stationarity | Moderate to high |

| Regression Models (e.g., Linear Regression) | Accuracy depends on model specification and data quality | Can be sensitive to outliers and multicollinearity | Low to moderate |

| Neural Networks | Potentially high accuracy for complex data patterns | Can be robust to noise but requires significant training data | High |

Note that the accuracy and robustness ratings are relative and depend on the specific application and data characteristics.

Model Validation and Backtesting

Model validation and backtesting are critical steps in ensuring the reliability of forecasting results. Validation involves using a portion of the historical data (not used in model training) to assess the model’s performance on unseen data. Backtesting simulates the model’s performance on past data, evaluating its ability to predict past events accurately. This helps identify potential biases or limitations in the model. A model that performs well on both validation and backtesting is more likely to produce accurate future forecasts.

Step-by-Step Procedure for Evaluating Model Performance

Evaluating a financial forecasting model involves a systematic approach using appropriate metrics. The specific metrics employed may vary depending on the forecasting task and the nature of the data.

- Data Preparation: Divide the historical data into training, validation, and testing sets. The training set is used to build the model, the validation set for tuning model parameters, and the testing set for final evaluation.

- Model Training and Parameter Tuning: Train the chosen model using the training data and optimize its parameters using the validation set. Techniques like cross-validation can be employed to improve the robustness of parameter tuning.

- Performance Metrics Calculation: Evaluate the model’s performance on the testing set using relevant metrics. Common metrics include Mean Absolute Error (MAE), Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and Mean Absolute Percentage Error (MAPE). For example, a lower MAPE indicates better accuracy.

- Model Comparison: Compare the performance of the chosen model against alternative models using the same metrics. This helps determine if the chosen model is superior in terms of accuracy and other relevant criteria.

- Backtesting: Conduct backtesting by applying the model to historical data and comparing its predictions to actual outcomes. This helps assess the model’s ability to consistently predict past events and identify any potential biases or limitations.

For example, if forecasting quarterly earnings, a lower RMSE would indicate better prediction accuracy compared to a model with a higher RMSE.

Incorporating Risk and Uncertainty

Financial forecasting, while aiming for accuracy, inherently involves uncertainty. External factors and unforeseen events can significantly impact projected outcomes. Therefore, incorporating risk and uncertainty into the forecasting process is crucial for developing robust and realistic financial plans. This involves acknowledging the limitations of predictions and actively managing potential deviations from expected results.

Effective financial forecasting necessitates a pragmatic approach that acknowledges the inherent limitations of predictive models and the influence of unpredictable events. By integrating methods for quantifying and managing uncertainty, businesses can enhance the reliability and usefulness of their forecasts, improving decision-making processes and resource allocation.

Scenario Planning

Scenario planning involves creating multiple plausible future scenarios, each based on different assumptions about key variables. This allows businesses to assess the potential impact of various combinations of factors, such as economic downturns, changes in market demand, or technological disruptions. For example, a company might develop three scenarios: a best-case scenario (high growth, stable market), a base-case scenario (moderate growth, competitive market), and a worst-case scenario (low growth, significant market disruption). Each scenario would then inform a separate financial forecast, providing a range of potential outcomes. Analyzing these scenarios helps management identify potential risks and opportunities, allowing for proactive planning and contingency measures.

Monte Carlo Simulation

Monte Carlo simulation is a statistical technique that uses random sampling to model the probability of different outcomes. By assigning probability distributions to key variables (e.g., sales growth, interest rates, cost of goods sold), the simulation runs thousands of iterations, generating a distribution of potential outcomes. This approach helps quantify the uncertainty surrounding the forecast, providing a range of possible results and associated probabilities. For instance, a company forecasting future revenue might use Monte Carlo simulation to determine the probability of achieving different revenue targets, considering the variability in sales growth and market conditions. The resulting distribution would show not only the expected revenue but also the likelihood of exceeding or falling short of specific targets.

Impact of Economic and Market Conditions

Economic and market conditions significantly influence the accuracy of financial forecasts. Factors such as inflation, interest rates, exchange rates, and overall economic growth directly affect a company’s revenues, costs, and profitability. Changes in consumer confidence, competitor actions, and technological advancements can also impact the forecast’s accuracy. For example, an unexpected recession could drastically reduce sales, while a sudden increase in interest rates could negatively impact investment returns. Therefore, regular monitoring of economic indicators and market trends is crucial for updating and refining forecasts to reflect current conditions.

Quantifying and Managing Uncertainty

Several methods can be used to quantify and manage uncertainty in financial forecasts. These include sensitivity analysis (assessing the impact of changes in key variables on the forecast), probabilistic forecasting (incorporating probability distributions into the forecast), and stress testing (evaluating the forecast’s resilience to extreme events). The choice of method depends on the specific context, the level of uncertainty involved, and the available data. For example, a sensitivity analysis might show that a 10% decrease in sales volume would lead to a 5% decrease in profitability, while a stress test might simulate the impact of a major natural disaster on the company’s operations. By systematically quantifying and managing uncertainty, businesses can make more informed decisions and better prepare for potential risks.

Advanced Forecasting Techniques

Financial forecasting has evolved significantly, moving beyond traditional methods to incorporate sophisticated techniques leveraging the power of machine learning and advanced statistical modeling. These advanced approaches offer the potential for greater accuracy and more nuanced insights into future financial performance, but also present unique challenges. This section explores some of these cutting-edge techniques and their applications in financial forecasting.

Machine Learning Algorithms in Financial Forecasting

Machine learning algorithms, a subset of artificial intelligence, are increasingly used to predict financial variables. These algorithms learn from historical data to identify patterns and relationships that might be missed by traditional methods. They are particularly well-suited for handling large, complex datasets, a common characteristic of financial data. Examples include support vector machines (SVMs), which excel at classification and regression tasks, and random forests, which combine multiple decision trees to improve predictive accuracy. These algorithms can be used to forecast stock prices, predict credit risk, or estimate future sales revenue. For instance, a random forest model trained on historical market data, economic indicators, and company financials could provide a more accurate prediction of a company’s stock price than a simple linear regression model. The ability of machine learning to identify non-linear relationships is a key advantage in capturing the complexities of financial markets.

Artificial Neural Networks and Advanced Statistical Models

Artificial neural networks (ANNs), inspired by the structure and function of the human brain, are another powerful tool in financial forecasting. ANNs, particularly recurrent neural networks (RNNs) like Long Short-Term Memory (LSTM) networks, are particularly effective at analyzing time-series data, which is crucial for financial forecasting. LSTMs, for example, are adept at capturing long-term dependencies in data, making them suitable for predicting trends in stock prices or exchange rates over extended periods. Other advanced statistical models, such as Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models, are used to model volatility in financial markets, providing valuable insights for risk management. A GARCH model could be used to forecast the volatility of a specific stock, allowing investors to adjust their portfolios accordingly. The application of these models requires specialized expertise and computational resources.

Benefits and Challenges of Advanced Forecasting Techniques

The benefits of using advanced forecasting techniques are significant. They offer the potential for improved accuracy, the ability to handle large and complex datasets, and the capacity to identify non-linear relationships that traditional methods might miss. This leads to better informed decision-making, more effective risk management, and potentially higher returns on investments. However, these techniques also present challenges. The complexity of these models can make them difficult to interpret and understand, raising concerns about transparency and explainability. Furthermore, the accuracy of these models depends heavily on the quality and quantity of the data used to train them. Insufficient or biased data can lead to inaccurate or misleading predictions. The computational cost of training and deploying these models can also be substantial, requiring significant computing power and expertise. Finally, the ever-changing nature of financial markets necessitates continuous model retraining and adaptation to maintain accuracy.

Wrap-Up

Mastering financial forecasting is not merely about predicting numbers; it’s about understanding the underlying drivers of financial performance and mitigating potential risks. By carefully selecting and applying appropriate methods, considering both qualitative and quantitative factors, and incorporating risk assessment, organizations can significantly enhance their strategic planning and decision-making processes. This guide has provided a foundational understanding of the key methods and considerations involved. Continued learning and practical application will further refine forecasting skills and contribute to improved financial outcomes.

Question Bank

What is the difference between short-term and long-term forecasting?

Short-term forecasts typically cover periods of less than a year and focus on immediate operational decisions. Long-term forecasts extend beyond a year and inform strategic planning and major investment decisions.

How can I choose the right forecasting method for my business?

The optimal method depends on factors like data availability, forecasting horizon, desired accuracy, and resources. Consider the nature of your business, the variables you’re forecasting, and the level of detail required.

What are the limitations of using only quantitative forecasting methods?

Quantitative methods rely on historical data and may not adequately capture unexpected events or qualitative factors like changes in consumer preferences or unforeseen economic shifts. A balanced approach incorporating qualitative insights is often necessary.

How important is accuracy in financial forecasting?

While perfect accuracy is unattainable, striving for high accuracy is crucial. Inaccurate forecasts can lead to poor resource allocation, missed opportunities, and financial losses. Regular model evaluation and refinement are essential.