Accurate financial forecasting is crucial for informed business decisions. Understanding the nuances of various forecasting methods—from qualitative approaches relying on expert judgment to quantitative techniques utilizing statistical models—is paramount for effective financial planning. This exploration delves into the strengths and weaknesses of different methodologies, providing a framework for selecting the most appropriate approach based on specific circumstances and data availability.

We will examine both qualitative methods, such as the Delphi technique and expert panels, and quantitative methods, including time series analysis (moving averages, exponential smoothing, ARIMA), regression models, and causal forecasting using econometric models and leading indicators. The comparison will highlight the advantages and limitations of each, emphasizing the importance of selecting the most suitable method for a given situation and considering potential biases and uncertainties.

Introduction to Financial Forecasting Methods

Accurate financial forecasting is crucial for sound business decision-making. It allows businesses to anticipate future financial performance, enabling proactive planning for growth, resource allocation, and risk mitigation. Without reliable forecasts, companies risk making ill-informed choices that could jeopardize their financial stability and long-term success. Forecasting provides a framework for setting realistic goals, securing necessary funding, and adapting to changing market conditions.

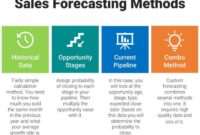

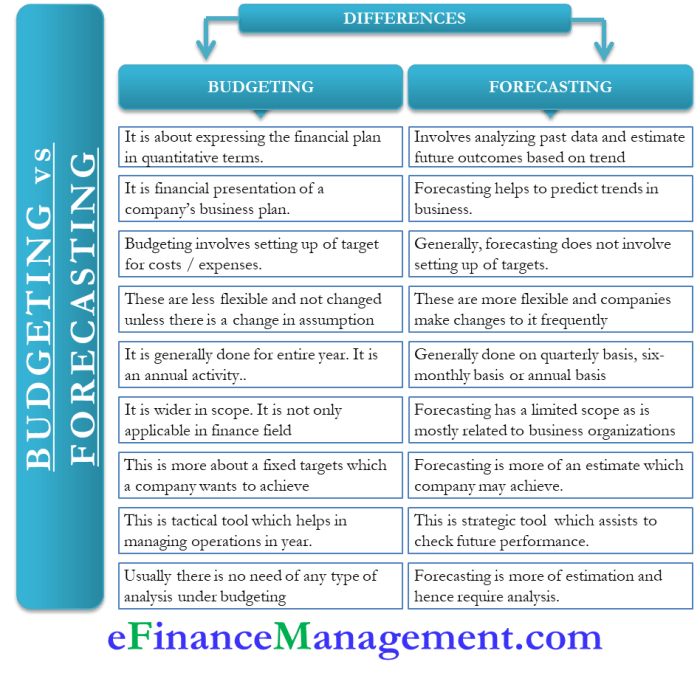

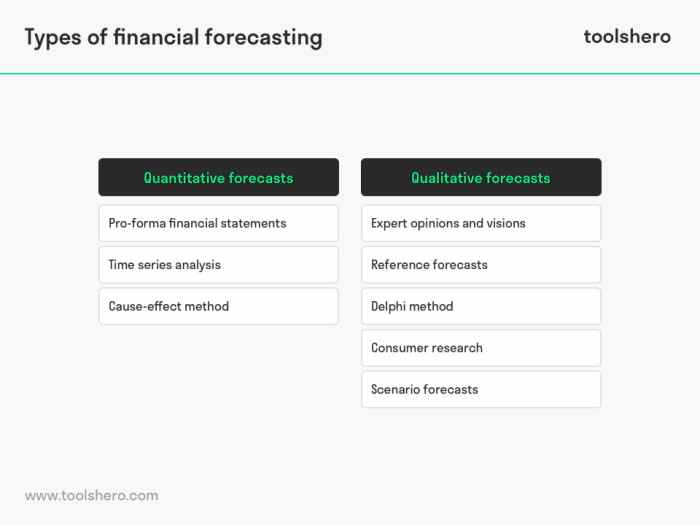

Financial forecasting methods can be broadly categorized into qualitative and quantitative approaches. Qualitative methods rely on expert judgment, intuition, and subjective assessments, often incorporating market research and industry analysis. Quantitative methods, conversely, utilize historical data and statistical techniques to generate numerical predictions. The choice of method depends on factors like data availability, forecasting horizon, and the desired level of accuracy.

Qualitative and Quantitative Forecasting Methods

Qualitative forecasting methods are valuable when historical data is limited or unreliable, or when dealing with emerging markets or new products where past trends may not be indicative of future performance. Examples include the Delphi method (gathering expert opinions through iterative questionnaires), market research surveys, and sales force composite (aggregating sales team predictions). Quantitative methods, on the other hand, leverage statistical models to identify patterns and trends in historical data, leading to more objective predictions. These include time series analysis (e.g., moving averages, exponential smoothing), regression analysis, and causal modeling.

Comparison of Forecasting Approaches

| Method | Strengths | Weaknesses | Example Application |

|---|---|---|---|

| Simple Moving Average | Easy to understand and calculate; smooths out short-term fluctuations. | Lags behind recent trends; gives equal weight to all data points, regardless of their relevance. | Predicting monthly sales for a stable product. |

| Exponential Smoothing | Assigns greater weight to more recent data; adapts to changing trends more quickly than simple moving averages. | Requires parameter tuning; may overreact to noise in the data. | Forecasting daily website traffic. |

| Regression Analysis | Identifies relationships between variables; allows for forecasting based on multiple factors. | Requires strong assumptions about the data; can be sensitive to outliers. | Predicting revenue based on advertising spending and economic indicators. |

| Delphi Method | Captures expert knowledge and insights; mitigates biases through anonymity and iteration. | Time-consuming; can be expensive; relies on the expertise and willingness of participants. | Forecasting technological advancements in a specific industry. |

Qualitative Forecasting Methods

Qualitative forecasting methods rely on expert judgment and subjective opinions rather than solely on numerical data. These methods are particularly valuable when historical data is scarce, unreliable, or when dealing with emerging trends or disruptive technologies that lack a historical precedent. They are often used in conjunction with quantitative methods to provide a more comprehensive forecast.

Qualitative methods offer valuable insights into market sentiment, consumer behavior, and emerging trends that are difficult to capture through purely numerical analysis. Their incorporation can enhance the accuracy and robustness of overall financial forecasts.

The Delphi Method in Financial Forecasting

The Delphi method is a structured communication technique used to elicit expert opinions on a particular topic. It involves a series of questionnaires sent to a panel of experts, with feedback provided after each round. The goal is to achieve consensus or identify a range of likely outcomes. In financial forecasting, this might involve predicting future market trends, estimating the success of a new product launch, or assessing the impact of a regulatory change. The iterative process helps to refine opinions, reduce biases, and identify areas of disagreement among experts. For example, a financial institution might use the Delphi method to forecast the interest rate environment over the next five years, gathering input from economists, financial analysts, and market strategists. The process would involve multiple rounds of questionnaires, with anonymous feedback provided to participants to encourage open and honest responses.

Expert Panels and Market Research in Qualitative Forecasting

Expert panels bring together individuals with specialized knowledge in a particular area to discuss and forecast future trends. This approach is useful when dealing with complex issues requiring diverse perspectives. Market research, on the other hand, involves collecting data directly from consumers through surveys, focus groups, or interviews. This can provide valuable insights into consumer preferences, purchasing behavior, and potential market demand for new products or services. For instance, a company launching a new financial product might conduct market research to understand consumer needs and preferences, while simultaneously using an expert panel to assess the competitive landscape and potential regulatory hurdles. Combining both approaches provides a comprehensive view of the market and the potential success of the new product.

Situations Favoring Qualitative over Quantitative Methods

Qualitative forecasting methods are preferred when dealing with situations where:

* Historical data is limited or unreliable. For example, forecasting the market for a completely new technology.

* The market is highly volatile and influenced by unpredictable events, such as geopolitical instability or unexpected regulatory changes.

* The forecasting horizon is very long-term, making it difficult to extrapolate from past data.

* Intangible factors such as consumer sentiment or brand reputation play a significant role in the outcome.

* The forecasting problem involves complex interactions between multiple factors that are difficult to quantify.

Limitations of Solely Relying on Qualitative Forecasts

While qualitative methods offer valuable insights, relying solely on them can have limitations:

- Subjectivity and Bias: Expert opinions can be influenced by personal biases and limited perspectives.

- Lack of Measurability: Qualitative forecasts are often difficult to quantify, making it challenging to compare different forecasts or track progress over time.

- Difficulty in Replication: The results of qualitative methods may be difficult to replicate, making it challenging to validate the findings.

- Time-Consuming Process: Gathering and analyzing qualitative data can be time-consuming and expensive.

- Potential for Groupthink: In expert panels, the tendency for group members to conform to the dominant opinion can lead to biased results.

Quantitative Forecasting Methods

Quantitative forecasting methods utilize mathematical and statistical models to predict future outcomes based on historical data. These methods offer a more objective and structured approach compared to qualitative methods, allowing for the identification of patterns and trends that might be missed through subjective judgment. The accuracy of these models, however, is heavily dependent on the quality and relevance of the input data and the appropriateness of the chosen model.

Time Series Analysis Methods

Time series analysis methods focus on the temporal dependencies within a dataset, assuming that past values can inform future values. Several prominent techniques exist, each with its own strengths and weaknesses. The choice of method depends on factors such as the nature of the data, the presence of trends and seasonality, and the desired level of forecast accuracy.

Moving Averages

Moving averages smooth out fluctuations in data by averaging values over a specified period. A simple moving average (SMA) gives equal weight to all observations within the window, while weighted moving averages assign different weights, often giving more importance to recent observations. For example, a 3-month SMA of stock prices averages the prices of the last three months. The assumption underlying moving averages is that recent past data is more relevant than older data, though the weighting scheme influences this. A limitation is the lag introduced by the averaging process; the forecast is always behind the most recent data point.

Exponential Smoothing

Exponential smoothing assigns exponentially decreasing weights to older observations. This method is particularly useful for data with trends and seasonality. Simple exponential smoothing is suitable for data without trends, while double and triple exponential smoothing account for trends and seasonality, respectively. The assumption here is that the most recent data points are the most informative, but the rate of decay in weighting needs careful consideration. A higher smoothing factor gives more weight to recent observations, potentially increasing responsiveness to short-term changes but also increasing volatility in the forecast. For instance, forecasting daily sales might benefit from a higher smoothing factor than forecasting yearly revenue.

ARIMA Models

Autoregressive Integrated Moving Average (ARIMA) models are more sophisticated time series models that capture complex patterns in data. They incorporate autoregressive (AR) terms, which model the dependence of the current value on past values, integrated (I) terms, which address non-stationarity in the data (meaning the statistical properties of the data change over time), and moving average (MA) terms, which model the dependence of the current value on past forecast errors. The selection of the appropriate ARIMA model (p,d,q) involves identifying the optimal orders for AR, I, and MA components. The key assumption is that the data can be made stationary through differencing (the I component) and that the remaining stationary series can be modeled using AR and MA components. Incorrect specification of the ARIMA model can lead to inaccurate and unreliable forecasts. ARIMA models are frequently used in financial time series forecasting, such as predicting stock prices or interest rates.

Linear Regression in a Financial Context

Linear regression models the relationship between a dependent variable (e.g., stock price) and one or more independent variables (e.g., interest rates, economic indicators). A simple linear regression model assumes a linear relationship between the dependent and independent variable. The model is expressed as:

Y = β0 + β1X + ε

where Y is the dependent variable, X is the independent variable, β0 is the intercept, β1 is the slope, and ε is the error term. The slope (β1) represents the change in Y for a one-unit change in X. For example, if X represents interest rates and Y represents stock prices, a negative β1 suggests an inverse relationship – as interest rates rise, stock prices tend to fall. The R-squared value indicates the proportion of variance in Y explained by X. A higher R-squared suggests a better fit of the model. Interpreting the results requires considering the statistical significance of the coefficients (t-tests) and the overall goodness of fit (R-squared and residual analysis).

Comparison of Regression Models in Financial Forecasting

The choice of regression model depends on the complexity of the relationship between variables and the nature of the data.

| Model | Description | Assumptions | Applications in Finance |

|---|---|---|---|

| Simple Linear Regression | Models the linear relationship between one dependent and one independent variable. | Linearity, independence of errors, homoscedasticity, normality of errors. | Predicting stock prices based on interest rates, forecasting bond yields based on inflation. |

| Multiple Linear Regression | Models the linear relationship between one dependent and multiple independent variables. | Linearity, independence of errors, homoscedasticity, normality of errors, no multicollinearity. | Predicting portfolio returns based on multiple market factors, assessing credit risk based on several financial ratios. |

| Non-linear Regression | Models non-linear relationships between variables. | Depends on the specific non-linear function used. | Modeling option prices using Black-Scholes model, forecasting asset prices with exponential growth models. |

| Logit/Probit Regression | Models the probability of a binary outcome (e.g., default/no default). | Independence of errors, linearity in the logit/probit function. | Credit scoring, predicting bankruptcy risk. |

Causal Forecasting Methods

Causal forecasting methods move beyond simply observing past trends; they attempt to identify and quantify the relationships between different variables to predict future outcomes. This approach is particularly valuable when dealing with complex financial systems where numerous factors influence performance. Understanding these causal relationships allows for more accurate and insightful predictions than purely time-series based methods.

Econometric models are the cornerstone of causal forecasting in finance. These statistical models use mathematical equations to represent the relationships between economic variables and business performance. They allow for the quantification of the impact of various macroeconomic factors, such as interest rates, inflation, and GDP growth, on a company’s sales, profits, and cash flow.

Econometric Models in Macroeconomic Forecasting

Econometric models offer a powerful framework for analyzing the influence of macroeconomic variables on business performance. For instance, a model might predict a company’s sales based on factors like consumer confidence, disposable income, and competitor activity. The model’s parameters (coefficients in the equations) represent the strength and direction of each factor’s impact. Sophisticated econometric models can incorporate numerous variables and account for complex interactions between them. For example, a model forecasting housing starts might include variables like mortgage interest rates, building material costs, consumer sentiment, and government regulations, weighting each factor according to its historical influence. The model would then project future housing starts based on projected values of these input variables.

Challenges in Identifying and Measuring Causal Factors

Identifying and accurately measuring the relevant causal factors is a significant challenge in financial forecasting. Many factors are interconnected, making it difficult to isolate the individual effects of each. Furthermore, data availability and quality can be limiting, especially for less frequently observed variables or those not readily captured in standard economic datasets. Omitted variable bias, where the model fails to include relevant variables, is a common problem, leading to inaccurate predictions. Also, the relationships between variables can change over time, requiring models to be regularly updated and recalibrated. For example, the impact of interest rate changes on consumer spending might differ significantly depending on prevailing economic conditions.

Using Leading Indicators to Improve Forecast Accuracy

Leading indicators are economic variables that tend to change *before* a change in the variable being forecast. By incorporating leading indicators into forecasting models, we can improve the accuracy and timeliness of predictions. These indicators provide early warning signals of future trends, allowing businesses to adapt their strategies proactively. For instance, a rise in consumer confidence (a leading indicator) might suggest increased future consumer spending, allowing a business to adjust production levels accordingly. The effective use of leading indicators requires careful selection and rigorous testing to ensure they have a strong predictive power.

Examples of Leading, Lagging, and Coincident Indicators

Leading indicators provide early signals of future economic activity. Examples include: the yield curve (the difference between long-term and short-term interest rates), building permits (indicating future construction activity), and consumer confidence indices. Lagging indicators change *after* the variable being forecast has changed. Examples include the unemployment rate (often rising after a recession begins) and the Consumer Price Index (reflecting past inflation). Coincident indicators change *at the same time* as the variable being forecast. Examples include industrial production, personal income, and manufacturing and trade sales. A business might use leading indicators (like consumer confidence) to predict future sales, lagging indicators (like unemployment) to assess the overall economic climate, and coincident indicators (like industrial production) to monitor current economic activity. By combining information from all three types of indicators, a more comprehensive and accurate forecast can be developed.

Forecasting Accuracy and Evaluation

Accurately assessing the performance of different financial forecasting methods is crucial for selecting the most suitable technique for a given situation. Several statistical measures can be employed to evaluate forecast accuracy, each offering a unique perspective on the errors involved. Understanding these metrics allows for a more informed decision-making process when choosing and applying forecasting models.

Methods for Evaluating Forecast Accuracy

Several methods exist for evaluating the accuracy of financial forecasts. These methods quantify the discrepancies between the predicted values and the actual observed values. The choice of method often depends on the specific context and the nature of the data.

Three commonly used methods are:

- Mean Absolute Deviation (MAD): MAD calculates the average absolute difference between the forecasted and actual values. A lower MAD indicates higher accuracy. The formula is:

MAD = (Σ|Actuali – Forecasti|) / n

where Actuali represents the actual value at time i, Forecasti represents the forecasted value at time i, and n is the number of data points.

- Mean Squared Error (MSE): MSE calculates the average of the squared differences between the forecasted and actual values. Squaring the errors emphasizes larger errors, making MSE more sensitive to outliers. The formula is:

MSE = (Σ(Actuali – Forecasti)²) / n

- Root Mean Squared Error (RMSE): RMSE is the square root of the MSE. Expressing the error in the original units of the data makes RMSE more interpretable than MSE. The formula is:

RMSE = √[(Σ(Actuali – Forecasti)²) / n]

Comparison of Forecasting Methods Using a Hypothetical Dataset

Let’s consider a hypothetical dataset comparing the performance of three forecasting methods: Simple Moving Average (SMA), Exponential Smoothing (ES), and ARIMA. We’ll use monthly sales figures for a fictional company over a year. The following table displays the actual sales, and the forecasts generated by each method.

| Month | Actual Sales | SMA Forecast | ES Forecast | ARIMA Forecast |

|---|---|---|---|---|

| 1 | 100 | – | – | – |

| 2 | 110 | – | – | – |

| 3 | 120 | 105 | 106 | 108 |

| 4 | 130 | 115 | 114 | 119 |

| 5 | 140 | 125 | 123 | 132 |

| 6 | 150 | 135 | 132 | 140 |

| 7 | 145 | 140 | 140 | 148 |

| 8 | 155 | 147.5 | 145 | 152 |

| 9 | 160 | 150 | 151 | 157 |

| 10 | 170 | 157.5 | 156 | 163 |

| 11 | 165 | 162.5 | 161 | 168 |

| 12 | 175 | 167.5 | 165 | 172 |

(Note: The “-” indicates that sufficient data for the forecast was not yet available for those months. Actual calculation of SMA, ES, and ARIMA forecasts would require specific parameters and data not included here for brevity.)

Visual Representation of Forecasting Accuracy

A line chart would effectively illustrate the accuracy of the different forecasting techniques over time. The x-axis would represent the months (time), and the y-axis would represent the sales figures (in monetary units). Three lines would be plotted on the chart, one for each forecasting method (SMA, ES, ARIMA). A fourth line representing the actual sales figures would serve as a benchmark. The vertical distance between the actual sales line and each forecast line would visually represent the forecasting error for each method at each time point. A legend would clearly identify each line. For example, a smaller vertical distance between the actual sales line and the ARIMA forecast line would indicate superior accuracy of the ARIMA model compared to other methods in that period.

Software and Tools for Financial Forecasting

Financial forecasting relies heavily on the use of specialized software to handle the complex calculations and data analysis involved. The choice of software depends significantly on the forecasting method employed, the complexity of the model, and the user’s technical expertise. Several software packages offer robust functionalities for various forecasting needs, ranging from simple spreadsheet programs to sophisticated statistical software.

Spreadsheet software, statistical packages, and dedicated financial forecasting platforms each offer unique strengths and weaknesses in the context of financial forecasting.

Spreadsheet Software for Financial Forecasting

Spreadsheet software like Microsoft Excel or Google Sheets provides a readily accessible and user-friendly environment for basic financial forecasting. Their built-in functions, such as linear regression, exponential smoothing, and moving averages, facilitate the implementation of simpler forecasting models. Users can easily input data, visualize results through charts and graphs, and perform what-if analyses by altering input parameters. However, the capabilities of spreadsheet software are limited when dealing with complex time series models or large datasets. Advanced statistical techniques may require the use of add-ins or external programming. For instance, a simple moving average forecast for monthly sales can be easily calculated in Excel using the AVERAGE function. More complex models, however, might necessitate the use of VBA (Visual Basic for Applications) or external statistical packages.

Statistical Software for Financial Forecasting

Statistical software packages such as R, SAS, and SPSS offer a much broader range of statistical techniques and functionalities for financial forecasting. These packages are particularly useful for handling large datasets, implementing sophisticated time series models (ARIMA, GARCH), and performing rigorous statistical tests for model evaluation. For example, R’s extensive libraries (like `forecast` and `tseries`) provide functions for various forecasting methods, including exponential smoothing, ARIMA modeling, and neural networks. SAS, known for its strength in statistical modeling and data management, is commonly used in large financial institutions for complex forecasting tasks. However, these packages typically require a steeper learning curve and a higher level of statistical expertise compared to spreadsheet software. The added complexity might outweigh the benefits for simpler forecasting tasks.

Dedicated Financial Forecasting Platforms

Specialized financial forecasting platforms, often offered by financial software providers, integrate specific tools and functionalities tailored to the needs of financial professionals. These platforms typically include features for data import, model building, scenario analysis, risk management, and report generation. They often automate many aspects of the forecasting process, providing a streamlined workflow for users. While these platforms offer powerful functionalities, they usually come with a higher price tag and might require specific training to master their features. The benefits of using such a platform are maximized when dealing with very large and complex financial models requiring high levels of automation and sophisticated risk management features. For example, a platform might incorporate Monte Carlo simulations to assess the uncertainty associated with a particular forecast.

Advantages and Disadvantages of Different Software

The choice of software for financial forecasting involves weighing the advantages and disadvantages of each option. Spreadsheet software offers ease of use and accessibility but lacks advanced statistical capabilities. Statistical software provides powerful tools for complex models but demands a higher level of technical expertise. Dedicated financial platforms offer streamlined workflows and specialized features but often come at a premium cost. The optimal choice depends on the specific forecasting needs, available resources, and the user’s skillset. A small business might find Excel sufficient, while a large multinational corporation may require a dedicated financial forecasting platform.

Limitations and Considerations

Financial forecasting, while a powerful tool for strategic decision-making, is not without its limitations. The inherent uncertainty of future events means that even the most sophisticated models can produce inaccurate predictions. Understanding these limitations is crucial for responsible use and interpretation of forecasts. This section will explore potential biases, external factors, and ethical considerations that impact forecast accuracy and reliability.

Potential biases and errors can significantly affect the accuracy of financial forecasts. Data used for forecasting might be incomplete, inaccurate, or simply outdated. For instance, relying solely on historical sales data to predict future performance might overlook significant market shifts or changes in consumer behavior. Furthermore, the forecasting model itself can introduce bias. A model overly reliant on linear trends may fail to capture cyclical or non-linear patterns. The selection of inappropriate forecasting methods, based on the specific characteristics of the data and the nature of the business, is another major source of error. Finally, subjective judgments and assumptions made by forecasters, such as estimations of future growth rates or market share, introduce further potential for inaccuracy.

Bias and Error Sources in Financial Forecasting

Several factors contribute to biases and errors. Data limitations, including missing or inaccurate historical data, can lead to flawed predictions. For example, a company experiencing rapid growth might have limited historical data to accurately project future performance. Model misspecification, where the chosen model does not accurately reflect the underlying relationships in the data, is another significant source of error. Using a simple linear regression to predict stock prices that are influenced by complex market dynamics is a clear example. Finally, human bias, such as overconfidence or anchoring to previous forecasts, can significantly skew results.

Impact of External Factors and Uncertainties

External factors and uncertainties play a critical role in influencing the accuracy of financial forecasts. Unforeseen events, such as economic recessions, geopolitical instability, or natural disasters, can significantly impact a company’s performance. Consider the impact of the COVID-19 pandemic on various industries – many forecasts made before the pandemic were rendered obsolete almost overnight. Similarly, changes in government regulations, technological advancements, and shifts in consumer preferences can all affect the accuracy of predictions. Effectively incorporating these uncertainties into forecasting models is a significant challenge, often requiring the use of sophisticated techniques like scenario planning or Monte Carlo simulations.

Ethical Considerations in Financial Forecasting

Ethical considerations are paramount in the use and interpretation of financial forecasts. Forecasts should be presented transparently, clearly outlining the assumptions, limitations, and potential sources of error. Misrepresenting the accuracy or certainty of a forecast is unethical and can have serious consequences. For instance, knowingly using a flawed model to inflate projected earnings to attract investors is a clear breach of ethical conduct. Furthermore, forecasters have a responsibility to use appropriate methods and data, avoiding manipulation or selective reporting that could mislead stakeholders. The ethical implications extend beyond the creation of the forecast to its interpretation and communication, emphasizing the importance of responsible disclosure and avoiding the misrepresentation of uncertain predictions as certainties.

Epilogue

Ultimately, the choice of financial forecasting method depends on a multitude of factors, including the nature of the data, the forecasting horizon, and the desired level of accuracy. While no single method guarantees perfect predictions, a thorough understanding of the strengths and weaknesses of each approach, coupled with a robust evaluation of forecast accuracy, enables businesses to make more informed decisions and mitigate potential risks. By carefully considering both qualitative and quantitative techniques and understanding their limitations, organizations can significantly improve the reliability and effectiveness of their financial planning.

FAQ Explained

What is the difference between leading, lagging, and coincident indicators?

Leading indicators precede economic changes, lagging indicators follow them, and coincident indicators occur simultaneously with economic shifts. They provide different perspectives on economic trends and are used together for a comprehensive understanding.

How can I choose the right forecasting method for my business?

Consider your data availability (time series, cross-sectional), forecasting horizon (short-term, long-term), desired accuracy, and the complexity of your business environment. Experimentation and evaluation of different methods are often necessary.

What are some common pitfalls to avoid in financial forecasting?

Common pitfalls include overreliance on historical data, ignoring external factors, neglecting uncertainty, and failing to properly evaluate forecast accuracy. Regular review and adjustments are essential.