Financial Forecasting Methods Comparison: Dive into the fascinating world of predicting financial futures! We’ll unravel the mysteries of qualitative and quantitative forecasting, exploring everything from the mystical Delphi method (think psychic predictions, but with spreadsheets) to the rigorous world of ARIMA models (they sound scary, but we promise it’s less complicated than it seems). Prepare for a rollercoaster ride of numbers, charts, and surprisingly insightful conclusions – buckle up!

This exploration will cover a range of methods, highlighting their strengths, weaknesses, and the crucial factors that determine which approach is best suited for a given situation. We’ll delve into the practical application of these methods, using real-world examples and hypothetical scenarios to illustrate their use. Expect tables, charts, and enough data to make your head spin (in a good way, we promise!).

Introduction to Financial Forecasting Methods: Financial Forecasting Methods Comparison

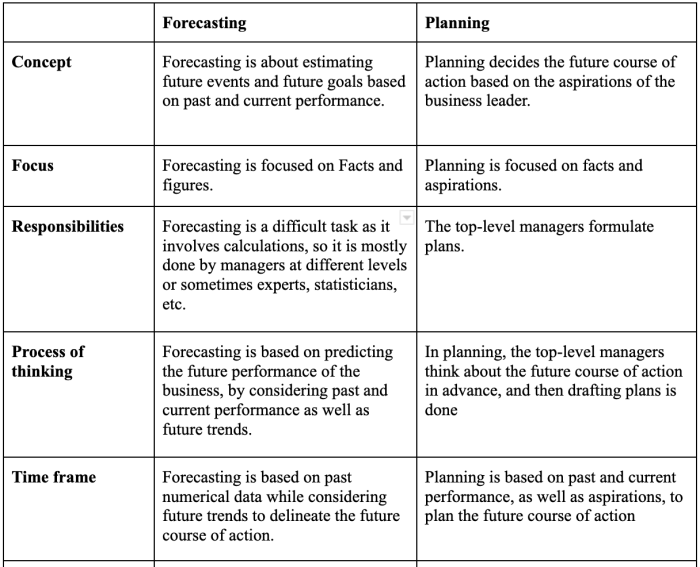

Financial forecasting, the crystal ball of the business world (though thankfully less prone to shattering), is crucial for making informed decisions. Whether you’re launching a new product, securing funding, or simply planning next quarter’s budget, accurate predictions are your compass, guiding you through the sometimes-treacherous waters of the market. Without reliable forecasts, you’re essentially navigating by the stars… while blindfolded.

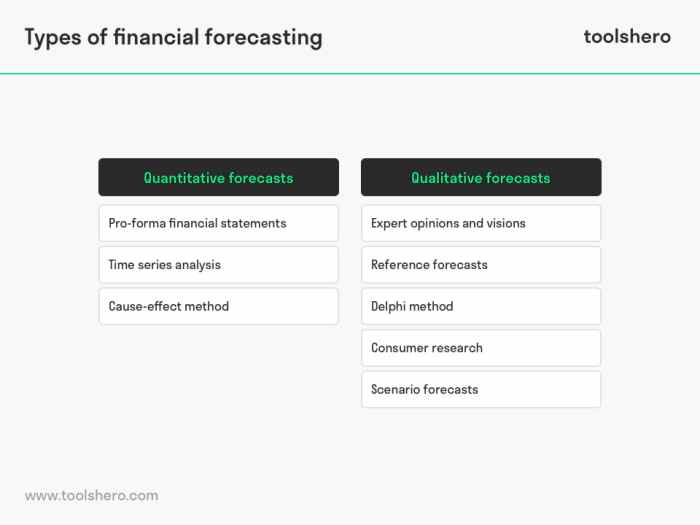

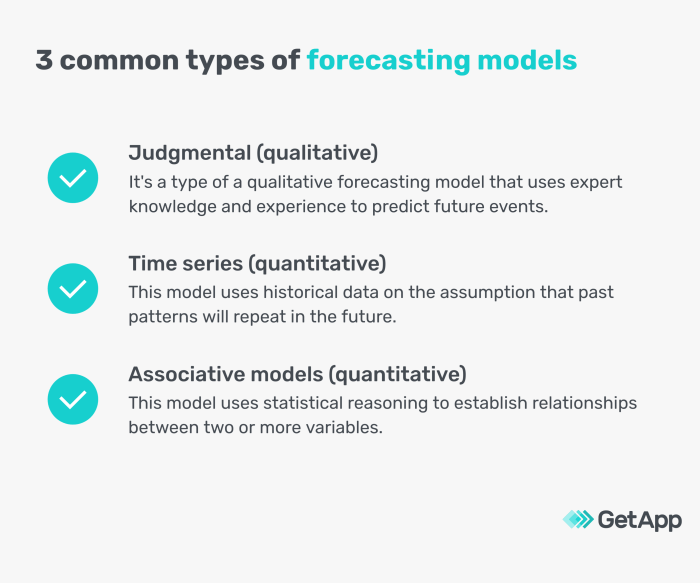

Financial forecasting methods can be broadly categorized into two camps: qualitative and quantitative. Think of it as the difference between reading tea leaves (qualitative) and analyzing stock market trends (quantitative). Both have their place, and the best approach often involves a blend of both, creating a powerful synergy of intuition and data.

Qualitative Forecasting Methods

Qualitative methods rely on expert judgment, intuition, and subjective assessments. These are particularly useful when historical data is scarce or unreliable, such as for new products or in rapidly changing markets. Think of it as the art of forecasting, where experience and insights play a pivotal role. Examples include the Delphi method, which aggregates expert opinions through iterative questionnaires, and market research surveys, which gauge consumer preferences and demand. While less precise than quantitative methods, qualitative methods offer valuable insights, especially when dealing with uncertain futures. Consider the launch of a revolutionary new technology – predicting its market impact relies heavily on expert judgment and understanding of technological trends, rather than historical sales data.

Quantitative Forecasting Methods

Quantitative forecasting methods, on the other hand, are all about the numbers. These methods use historical data and statistical techniques to project future outcomes. This is the science of forecasting, where algorithms and models reign supreme. Common quantitative methods include time series analysis (like moving averages and exponential smoothing), which identifies patterns in past data to predict future values, and causal models (like regression analysis), which explore the relationships between different variables to forecast outcomes. For instance, a company might use time series analysis to predict future sales based on past sales data, or regression analysis to forecast demand based on factors like advertising spend and economic indicators. The accuracy of quantitative forecasts depends heavily on the quality and relevance of the historical data used.

Factors Influencing the Choice of Forecasting Method

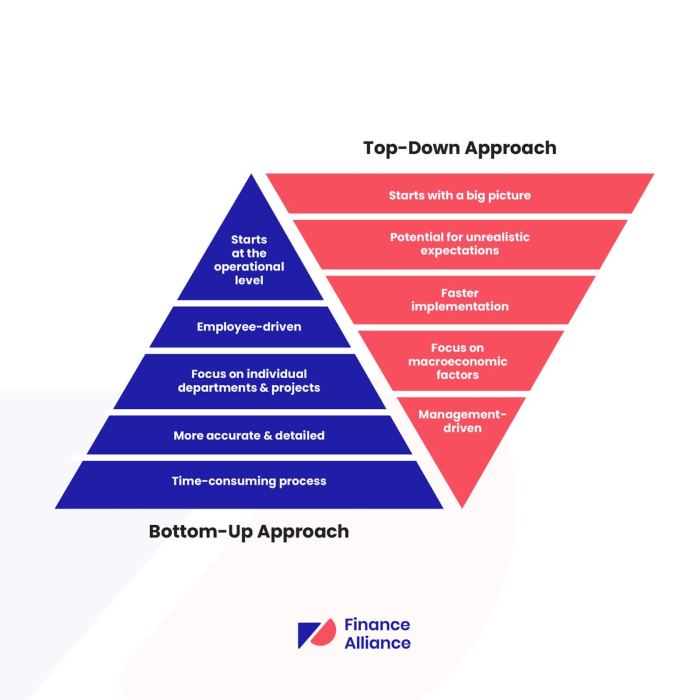

Selecting the right forecasting method is akin to choosing the right tool for the job. Several factors influence this crucial decision. The availability of historical data plays a crucial role; if data is abundant and reliable, quantitative methods are generally preferred. However, if data is scarce or unreliable, qualitative methods may be more appropriate. The forecasting horizon also matters; short-term forecasts often benefit from simpler methods, while long-term forecasts may require more sophisticated models. Finally, the cost and resources available will impact the choice. Complex quantitative models require more expertise and computing power than simpler qualitative methods. Consider a small startup versus a multinational corporation – their resources and forecasting needs will differ significantly.

Qualitative Forecasting Methods

Predicting the future of finance isn’t just about crunching numbers; sometimes, you need to channel your inner Nostradamus (minus the cryptic poems). Qualitative forecasting methods, while less precise than their quantitative counterparts, offer valuable insights into the “why” behind financial trends, often revealing nuances that numbers alone can’t capture. They’re like the seasoned financial detective, piecing together clues to solve the mystery of future market behavior.

Qualitative forecasting relies heavily on human judgment and expert opinions, a process that can be both insightful and, let’s face it, hilariously subjective. Think of it as a financial brainstorming session, but with more structure (and hopefully, fewer questionable PowerPoint presentations). The results, while not as numerically precise, can provide crucial context and strategic direction, especially when dealing with emerging markets or unprecedented events.

The Delphi Method: A Panel of Prophets

The Delphi method is a structured communication technique used to gather expert opinions on a specific topic. Imagine a panel of financial oracles, each anonymously sharing their predictions. These predictions are then aggregated and fed back to the panel, allowing them to revise their initial estimates based on the collective wisdom (or lack thereof). This iterative process continues until a consensus, or at least a manageable level of disagreement, is reached. Strengths include minimizing the influence of dominant personalities and encouraging a more nuanced understanding of the issue. However, weaknesses include the time and resource commitment required, and the potential for bias if the initial panel isn’t diverse enough. A classic example of a successful application would be forecasting the impact of a major technological disruption on a specific industry, gathering opinions from industry experts, economists, and technology analysts.

Market Research Techniques in Qualitative Forecasting

Market research, the lifeblood of many businesses, provides invaluable qualitative data for financial forecasting. Techniques like focus groups and in-depth interviews can uncover consumer sentiment, brand perception, and potential market shifts. For example, a company launching a new financial product might conduct focus groups to gauge consumer interest and identify potential challenges. However, limitations exist: focus groups can be influenced by groupthink, and in-depth interviews can be time-consuming and expensive. The results are subjective and may not accurately represent the broader population. Furthermore, interpretation of qualitative data can be subjective, leading to different conclusions depending on the researcher’s biases.

Expert Opinions and Judgment: The Art of the Guess

Expert opinions and judgment play a crucial role in qualitative forecasting. This isn’t about wild speculation; it’s about leveraging the knowledge and experience of individuals who possess deep understanding of relevant markets and trends. For example, a seasoned investment banker might offer valuable insights into potential mergers and acquisitions, based on their extensive experience in the industry. The limitations, however, are clear: biases, personal agendas, and even plain old bad judgment can significantly impact the accuracy of predictions. It’s crucial to use multiple experts with diverse backgrounds and perspectives to mitigate these risks.

Let’s compare three common qualitative forecasting methods:

- Delphi Method: Iterative expert consultation, minimizing individual influence, but resource-intensive and potentially slow.

- Scenario Planning: Developing multiple plausible future scenarios, fostering adaptability, but complex and requiring significant expertise.

- Market Research (Focus Groups & Interviews): Direct consumer input, valuable for understanding market sentiment, but subjective and potentially expensive.

Quantitative Forecasting Methods

Predicting the future of finance isn’t about gazing into a crystal ball; it’s about wielding the power of numbers. Quantitative forecasting methods offer a more rigorous, data-driven approach than their qualitative counterparts, allowing us to make informed decisions based on historical trends and relationships. While crystal balls might be fun, they’re not exactly known for their accuracy in predicting market fluctuations.

Time Series Analysis versus Causal Modeling

Time series analysis and causal modeling represent two distinct, yet sometimes complementary, approaches to quantitative forecasting. Time series analysis focuses solely on the historical pattern of the data itself, assuming that past performance is indicative of future performance (a brave assumption, we know!). Think of it as letting the data speak for itself, without considering external factors. Causal modeling, on the other hand, takes a more holistic view, attempting to identify the relationships between the variable being forecast and other relevant variables. It’s like saying, “Let’s not just look at the past; let’s figure out *why* things happened the way they did.” The choice between these methods depends heavily on the available data and the complexity of the system being modeled. A simple time series might suffice for forecasting daily sales of a stable product, while a more complex causal model might be necessary to predict the impact of interest rate changes on housing prices.

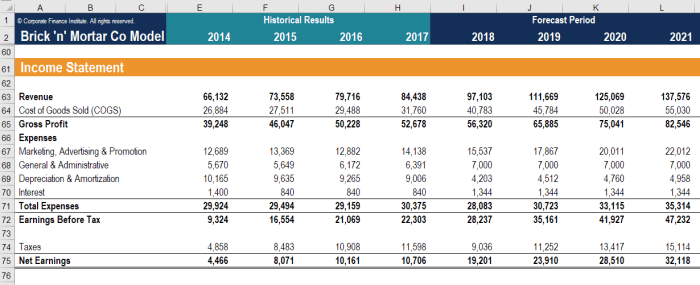

Comparison of Quantitative Forecasting Methods

Let’s dive into the nitty-gritty with a comparison of four popular quantitative forecasting methods. Each has its own strengths and weaknesses, much like a financial superhero team with a diverse range of powers.

| Method | Data Requirements | Accuracy | Complexity |

|---|---|---|---|

| Moving Average | Historical data of the variable being forecast | Relatively low; smooths out fluctuations but lags behind trends | Low; easy to implement and understand |

| Exponential Smoothing | Historical data of the variable being forecast | Higher than moving average; gives more weight to recent data | Moderate; slightly more complex than moving average |

| ARIMA | Historical data of the variable being forecast; often requires significant data | Potentially high; can capture complex patterns | High; requires statistical expertise and software |

| Regression | Historical data of the variable being forecast and relevant variables | Varies depending on the model and data quality; can be very high with a good model | Moderate to high; requires understanding of statistical relationships |

Assumptions and Their Impact on Forecast Accuracy

Each quantitative method rests on a set of assumptions. Violating these assumptions can significantly impact the accuracy of the forecast, leading to results that are less reliable than a magic 8-ball. For instance, the moving average method assumes that the data is stationary (meaning the mean and variance don’t change over time), while exponential smoothing assumes that recent data is more relevant than older data. ARIMA models assume that the data follows a specific autoregressive integrated moving average process, while regression models assume a linear relationship between the dependent and independent variables. Failure to meet these assumptions can lead to inaccurate and misleading forecasts. Consider, for example, using a simple moving average to forecast the price of a volatile cryptocurrency – the results would likely be far from accurate. A more sophisticated model, like ARIMA, might be better suited for such volatile data.

Time Series Analysis Techniques

Predicting the future is a tricky business, even for seasoned financial wizards. While crystal balls remain stubbornly unreliable, time series analysis offers a more statistically sound approach to peering into the financial future. This powerful technique leverages historical data to identify patterns and trends, allowing us to make informed (and hopefully profitable) forecasts. Let’s dive into the fascinating world of time series analysis, where data dances to the rhythm of predictability (or at least, attempts to).

Stationarity in Time Series Data

Stationarity, in the context of time series data, refers to the property of a time series having a constant mean, variance, and autocorrelation structure over time. Think of it as the data’s personality remaining consistent—no sudden mood swings or dramatic shifts. Why is this important for forecasting? Because non-stationary data, with its fluctuating characteristics, makes accurate predictions a Herculean task. Imagine trying to forecast the stock price of a company undergoing a major restructuring; the volatility would render many forecasting methods useless. Stationarity, therefore, provides the stable foundation upon which reliable forecasting models can be built. Methods to achieve stationarity include differencing (subtracting consecutive data points) or transformations (like taking logarithms).

Simple Moving Average and Weighted Moving Average Methods

These methods are relatively straightforward, providing a simple way to smooth out fluctuations in time series data. A simple moving average calculates the average of a specified number of consecutive data points. For example, consider the monthly sales of a fictional lemonade stand: [100, 120, 110, 130, 140, 150]. A 3-month simple moving average would be: (100+120+110)/3 = 110 for the third month, (120+110+130)/3 = 120 for the fourth month, and so on. The weighted moving average assigns different weights to each data point, giving more importance to recent data. For instance, a 3-month weighted moving average with weights of 0.5, 0.3, and 0.2 (giving more weight to the most recent month) applied to the same data would yield different results, emphasizing the recent trend. While simple, these methods can provide a valuable baseline forecast, particularly when dealing with relatively stable time series.

Exponential Smoothing Methods, Financial Forecasting Methods Comparison

Exponential smoothing techniques assign exponentially decreasing weights to older data points, giving more emphasis to recent observations. This approach is particularly useful for forecasting time series with trends or seasonality.

Single Exponential Smoothing

Single exponential smoothing is suitable for time series without trends or seasonality. The forecast for the next period is a weighted average of the current observation and the previous forecast. The formula is:

Ft+1 = αYt + (1-α)Ft

where Ft+1 is the forecast for the next period, Yt is the current observation, Ft is the previous forecast, and α (alpha) is the smoothing parameter (0 ≤ α ≤ 1). A higher α gives more weight to recent data.

Double Exponential Smoothing

Double exponential smoothing extends single exponential smoothing to handle trends. It uses two smoothing equations: one for the level and one for the trend. This allows the forecast to adapt to both changes in level and the rate of change.

Triple Exponential Smoothing

Triple exponential smoothing, also known as Holt-Winters method, tackles both trends and seasonality. It involves three smoothing equations: one for the level, one for the trend, and one for the seasonal component. This sophisticated approach provides highly accurate forecasts for time series exhibiting complex patterns. The added complexity, however, comes with the need for more data and careful parameter tuning. Think of it as a high-performance sports car—powerful but requiring a skilled driver.

Causal Modeling Techniques

Predicting the future is a tricky business, like trying to catch a greased piglet. While time series analysis looks at the piglet’s past movements, causal modeling attempts to understand *why* the piglet squirms in the first place – identifying the factors influencing its trajectory. This involves exploring the relationships between various economic variables and the financial metric you’re trying to forecast. Essentially, we’re moving from simply observing the piglet’s path to understanding its motivations.

Regression analysis is the workhorse of causal modeling in finance. It allows us to model the relationship between a dependent variable (what we want to predict, like future stock prices) and one or more independent variables (predictors, like interest rates or consumer confidence). Think of it as building a sophisticated equation to describe the piglet’s path based on its environment.

Regression Model Types

Different types of regression models exist, each with its own strengths and weaknesses. Simple linear regression examines the relationship between one independent and one dependent variable, providing a straight-line approximation of their relationship. Multiple linear regression extends this to incorporate multiple independent variables, allowing for a more nuanced understanding of the piglet’s movements (consider the impact of mud, the presence of a bucket, etc.). Non-linear regression models are used when the relationship isn’t straight – perhaps the piglet’s speed increases exponentially with the amount of grease.

Economic Indicators as Predictors

Several economic indicators serve as reliable predictors in causal models. Gross Domestic Product (GDP) growth, for instance, is a powerful predictor of corporate earnings. Inflation rates, reflecting the general price level, impact consumer spending and investment decisions. Interest rates, the price of borrowing money, influence investment and capital expenditures. Unemployment rates provide insight into consumer spending power and overall economic health. Imagine these indicators as clues in a detective novel, each providing a piece of the puzzle to understand the piglet’s behavior. For example, high GDP growth often correlates with increased corporate profits, while rising interest rates might dampen investment.

Challenges in Building Accurate Causal Models

Building accurate causal models isn’t a walk in the park. Multicollinearity, where independent variables are highly correlated, makes it difficult to isolate the individual impact of each predictor. It’s like trying to determine which of several similarly greased piglets caused the mess. Omitted variable bias occurs when a significant predictor is left out of the model, leading to inaccurate estimations. Imagine failing to account for the presence of a slippery bucket, leading to a flawed understanding of the piglet’s movements. These challenges highlight the need for careful model specification and rigorous testing to ensure that our predictions are as accurate as possible, getting closer to that greased piglet without slipping.

Model Selection and Evaluation

Choosing the right forecasting model is like picking the perfect pair of shoes – you need the right fit for the job. A clunky, oversized model for predicting daily stock fluctuations is as unhelpful as tiny ballet slippers for hiking Mount Everest. This section will guide you through the process of selecting and evaluating forecasting models, ensuring you don’t end up with forecasting footwear that gives you blisters.

Selecting the best forecasting model involves a careful consideration of several factors, including the characteristics of the data, the desired forecast horizon, and the computational resources available. It’s a bit like choosing a superhero for a specific mission – you wouldn’t send Superman to defuse a bomb (unless he’s really, really good at it).

Model Selection Flowchart

The process of selecting the most appropriate forecasting model can be visualized using a flowchart. Imagine it as a decision tree, guiding you through a series of logical steps to reach the optimal model.

[Unfortunately, I cannot create visual flowcharts within this text-based format. However, I can describe a typical flowchart for model selection. The flowchart would begin with a decision node asking: “Is the data time series data?”. If yes, the flowchart would branch to options like ARIMA, Exponential Smoothing, etc. If no, the flowchart would branch to options like regression models. Subsequent decision nodes would consider factors such as data stationarity, the presence of seasonality, and the desired forecast horizon. Each path would lead to a specific model recommendation. The final node would be the chosen model. ]

Forecast Evaluation Metrics

Once you’ve got your models, you need to evaluate their performance. This is where we bring out the measuring tape (metaphorically speaking, of course). Several metrics exist to help us assess the accuracy of our forecasts. Think of them as different lenses through which to view the performance of your model.

- Mean Absolute Error (MAE): This measures the average absolute difference between the forecasted and actual values. A lower MAE indicates better accuracy. It’s like calculating the average distance between your forecast and reality. For example, if MAE is 5, it means your average error is 5 units.

- Root Mean Squared Error (RMSE): This is similar to MAE, but it squares the errors before averaging them and then takes the square root. This gives more weight to larger errors. Imagine it as penalizing bigger mistakes more heavily. A lower RMSE suggests better accuracy.

- Mean Absolute Percentage Error (MAPE): This expresses the average error as a percentage of the actual values. This is useful for comparing the accuracy of forecasts across different datasets with varying scales. For instance, a MAPE of 10% means your average error is 10% of the actual value.

Model Validation and Backtesting

Validating and backtesting your model is crucial; it’s like test-driving a car before buying it. You wouldn’t buy a car without taking it for a spin, would you?

Model validation involves splitting your data into training and testing sets. The model is trained on the training set and then evaluated on the unseen testing set. This helps assess the model’s ability to generalize to new, unseen data. Backtesting involves applying the model to historical data to see how well it would have performed in the past. This gives you a sense of its robustness and reliability over time. A well-validated and backtested model is more likely to provide accurate forecasts in the future. For example, if you are forecasting sales, backtesting could involve comparing your model’s predictions to actual sales data from previous periods. A successful backtest would show that the model accurately predicted past sales trends.

Software and Tools for Financial Forecasting

Predicting the future of finances is a bit like predicting the weather – sometimes you nail it, sometimes you’re left wondering if your crystal ball needs new batteries. Fortunately, we have more than just crystal balls these days. A plethora of software and tools exist to help us navigate the sometimes-murky waters of financial forecasting, each with its own strengths and quirks. Let’s delve into the digital arsenals available to the modern financial prognosticator.

Choosing the right tool depends heavily on your specific needs, budget, and level of technical expertise. From simple spreadsheet programs to sophisticated statistical packages, the options are as diverse as the financial markets themselves. The following table provides a quick overview of commonly used software, while subsequent sections offer a deeper dive into the capabilities of specific programs.

Software and Tools Comparison

| Software/Tool | Type | Strengths | Weaknesses |

|---|---|---|---|

| Microsoft Excel | Spreadsheet Software | Widely accessible, relatively inexpensive, versatile with add-ins. | Limited statistical capabilities compared to specialized software, prone to errors with complex models. |

| R | Statistical Programming Language | Powerful statistical capabilities, open-source and free, highly customizable. | Steeper learning curve, requires programming knowledge. |

| Python (with libraries like Pandas and Statsmodels) | Programming Language | Flexible, powerful, large community support, open-source and free. | Requires programming knowledge, potentially more complex setup than other options. |

| SPSS | Statistical Software Package | User-friendly interface, strong statistical capabilities, robust data management. | Can be expensive, not as flexible as programming-based solutions. |

Microsoft Excel Functionalities

Microsoft Excel, despite its humble beginnings as a spreadsheet program, has become a surprisingly powerful tool for financial forecasting. Its user-friendly interface makes it accessible to a wide range of users, while its extensive library of functions, including those for time series analysis (like forecasting trends using exponential smoothing or linear regression), makes it surprisingly capable. The addition of add-ins further expands its capabilities, allowing for more complex models and visualizations. For instance, one could use Excel to project sales based on historical data and seasonal trends, creating a simple yet effective forecast. Imagine projecting the sales of ice cream – a clear seasonal pattern could be modeled with Excel’s forecasting tools, allowing a business to anticipate high demand during summer months.

R Functionalities

R, on the other hand, represents a different beast entirely. This open-source statistical programming language offers unparalleled flexibility and power. While the learning curve is steeper, requiring a grasp of programming concepts, its extensive library of packages (collections of pre-written functions) allows for incredibly sophisticated forecasting models. For example, R can handle complex time series models (like ARIMA) and advanced econometric techniques far beyond the capabilities of Excel. Imagine a financial institution using R to model the risk of loan defaults by incorporating macroeconomic indicators and individual borrower characteristics – a level of sophistication impossible to achieve with simpler tools. The ability to customize and extend R’s functionalities makes it an invaluable tool for researchers and advanced analysts.

Advantages and Disadvantages of Different Software Tools

The choice between Excel, R, and other software hinges on a trade-off between ease of use and power. Excel provides a simple, accessible entry point for basic forecasting, but its limitations become apparent when dealing with complex models or large datasets. R, while powerful, demands a significant investment in learning and mastering its programming language. Other specialized software packages offer a middle ground, balancing ease of use with advanced capabilities, but often at a higher cost. The “best” tool is ultimately the one that best suits the user’s skillset and the complexity of the forecasting task at hand. Selecting the right tool is akin to choosing the right weapon for a battle – a simple sword might suffice for a small skirmish, but a more complex arsenal might be necessary for a full-scale war.

Limitations and Considerations

Financial forecasting, while a powerful tool for navigating the turbulent seas of finance, is not without its flaws. Think of it as a highly sophisticated crystal ball – sometimes it shows you a remarkably clear picture, and other times it’s a bit… hazy. Understanding these limitations is crucial for responsible and effective financial decision-making. Ignoring them can lead to disastrous consequences, much like ignoring the “Do Not Feed the Bears” sign in Yellowstone.

Potential sources of error in financial forecasting are numerous and varied, ranging from the mundane to the truly catastrophic. In essence, any assumption made, any data point used, and any model employed carries the potential for inaccuracy. This isn’t to say forecasting is useless; rather, it highlights the importance of a nuanced approach, recognizing that even the most sophisticated models are merely tools, and their outputs are estimates, not guarantees.

Sources of Error in Financial Forecasting

The accuracy of financial forecasts is significantly impacted by the quality and completeness of the input data. Inaccurate or incomplete data, whether due to data entry errors, missing information, or outdated statistics, will inevitably lead to flawed predictions. Imagine trying to bake a cake with the wrong ingredients – the result will be less than stellar. Similarly, using unreliable data will lead to unreliable forecasts. Another major source of error lies in the limitations of the forecasting models themselves. Models are simplifications of complex realities, and therefore, they inevitably omit certain factors or make assumptions that may not hold true in the real world. For instance, a model that assumes constant economic growth might significantly misrepresent the future during a recession. Finally, human error in model selection, parameter estimation, or interpretation of results can also contribute to forecast inaccuracy.

Impact of Unforeseen Events

Unforeseen events, such as economic crises (think the 2008 financial crisis), natural disasters (like Hurricane Katrina), or geopolitical upheavals (the war in Ukraine), can drastically impact forecast accuracy. These “black swan” events are, by definition, unpredictable and can render even the most meticulously crafted forecasts obsolete almost overnight. These events often introduce significant volatility and uncertainty into the financial markets, making accurate predictions extremely difficult. For example, the COVID-19 pandemic severely disrupted global supply chains and consumer behavior, rendering many pre-pandemic economic forecasts completely irrelevant. The resulting market volatility made it extremely difficult for even experienced forecasters to accurately predict short-term or long-term trends.

Ethical Considerations in Financial Forecasting

The use of financial forecasting models carries significant ethical implications. Forecasts should be presented transparently, with a clear acknowledgment of their limitations and potential sources of error. Misrepresenting the accuracy or certainty of a forecast can have serious consequences, potentially leading to poor investment decisions, financial losses, and even market manipulation. Furthermore, the potential for bias in model selection or interpretation must be carefully considered and mitigated. For example, a forecaster might unconsciously select a model that supports a pre-existing belief, leading to a biased and potentially misleading forecast. Maintaining objectivity and transparency is paramount to ensuring ethical conduct in financial forecasting. The misuse of forecasting models for personal gain, at the expense of others, is simply unacceptable and highlights the need for robust ethical guidelines within the field.

Final Thoughts

So, there you have it – a whirlwind tour through the exciting landscape of financial forecasting methods! While no crystal ball can perfectly predict the future, understanding the strengths and limitations of various approaches empowers businesses to make more informed decisions, navigate uncertainty with greater confidence, and hopefully, avoid a financial apocalypse. Remember, even the most sophisticated model is only as good as the data it’s fed, and a healthy dose of common sense always helps.

FAQ Summary

What’s the difference between accuracy and precision in forecasting?

Accuracy refers to how close a forecast is to the actual value. Precision refers to how close repeated forecasts are to each other. A highly precise model might be inaccurate if its consistently wrong predictions are all clustered together.

How do I choose the right forecasting software?

Consider your budget, technical expertise, the complexity of your data, and the specific features you need (e.g., time series analysis, regression modeling). Start with a free trial or demo before committing.

Can financial forecasting predict black swan events?

No. Black swan events, by definition, are unpredictable and highly improbable. Forecasting models can help assess risks and probabilities, but they cannot foresee truly unforeseen circumstances.