Achieving financial security and fulfilling your dreams requires a structured approach. Financial goal setting isn’t just about saving money; it’s about strategically planning your financial future, aligning your spending with your aspirations, and creating a roadmap to success. This guide explores the essential elements of effective financial goal setting, from defining your objectives to tracking your progress and adapting to life’s inevitable changes.

We’ll delve into various methodologies, address common obstacles, and provide practical strategies to help you navigate the journey towards your financial aspirations. Whether you’re aiming for short-term goals like paying off debt or long-term goals like retirement planning, this comprehensive guide offers valuable insights and actionable steps to empower you to take control of your financial well-being.

Defining Financial Goals

Financial goal setting is the process of defining specific, measurable, achievable, relevant, and time-bound (SMART) objectives related to your financial well-being. It involves identifying your financial aspirations and creating a roadmap to achieve them, encompassing various aspects like saving, investing, spending, and debt management. This proactive approach helps you gain control over your finances and build a secure financial future.

The importance of SMART goal setting in finance cannot be overstated. Vague financial aspirations, such as “saving more money,” are ineffective because they lack the specificity and measurability required for effective planning and tracking progress. SMART goals provide a clear framework for making informed decisions and staying motivated throughout the process. For instance, a SMART goal might be “Save $10,000 in the next 18 months to make a down payment on a car.” This goal is specific, measurable, achievable (depending on income and expenses), relevant to the desired outcome (buying a car), and time-bound.

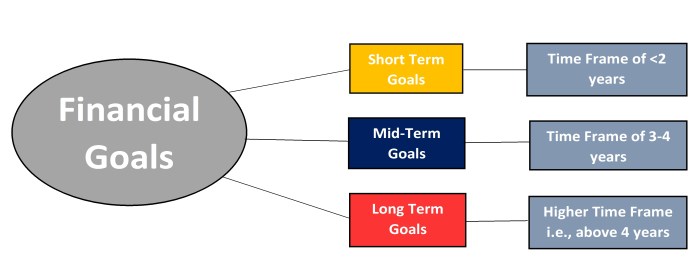

Types of Financial Goals

Financial goals can be categorized based on their timeframe. Short-term goals are typically achieved within one year, while long-term goals extend beyond that period. Medium-term goals fall somewhere in between. Understanding these distinctions helps prioritize resources and strategize effectively. Short-term goals might include paying off credit card debt or building an emergency fund. Medium-term goals could involve saving for a down payment on a house or funding a child’s education. Long-term goals often involve retirement planning or securing a substantial investment portfolio. Additionally, some goals might be categorized as lifestyle goals, focusing on achieving a certain level of comfort or fulfilling personal aspirations, like taking a dream vacation or buying a specific item.

A Framework for Setting Realistic Financial Goals

Creating a realistic financial goal requires a structured approach. First, honestly assess your current financial situation, including income, expenses, assets, and debts. This involves reviewing bank statements, credit reports, and investment accounts. Next, identify your financial aspirations, prioritizing them based on their importance and urgency. Then, break down larger goals into smaller, manageable steps. For example, a long-term goal of saving for retirement can be broken down into annual saving targets, quarterly contributions, and even monthly budgeting adjustments. Regularly monitor your progress and make adjustments as needed. Finally, celebrate milestones to stay motivated and maintain a positive mindset throughout the process. Consider using budgeting tools, financial planning software, or consulting a financial advisor for assistance. A sample framework could involve:

| Goal | Timeframe | Target Amount | Action Plan | Progress Tracking Method |

|---|---|---|---|---|

| Emergency Fund | 6 months | $3,000 | Automate monthly savings | Check savings balance monthly |

| Pay off Credit Card Debt | 12 months | $5,000 | Create a debt repayment plan | Track debt balance and payments |

| Down Payment for House | 3 years | $20,000 | Increase savings rate, explore investment options | Review savings and investment accounts quarterly |

“Successful financial planning is not about making money, but about managing it effectively.”

Goal Setting Processes and Methodologies

Effectively setting financial goals requires a structured approach. Choosing the right methodology and consistently employing sound financial planning principles are crucial for achieving your objectives, whether it’s saving for a down payment, paying off debt, or building long-term wealth. Several methods exist, each with its own strengths and weaknesses.

Various Goal Setting Methods and Their Effectiveness

Different methods cater to various personality types and financial situations. The most effective method is often the one that best suits an individual’s needs and commitment level. Some popular approaches include SMART goal setting, the use of visual aids like vision boards, and employing budgeting techniques like the zero-based budget or the 50/30/20 rule. SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) provide a framework for clarity and accountability. Visual methods can enhance motivation, while budgeting techniques help manage resources effectively. The choice depends on individual preferences and the complexity of the financial goals.

The Role of Budgeting and Financial Planning in Goal Achievement

Budgeting and financial planning are integral to achieving financial goals. A budget acts as a roadmap, allocating resources towards prioritized objectives. Thorough financial planning involves forecasting income and expenses, considering potential risks, and adjusting strategies as needed. Without a well-defined budget and a comprehensive plan, it’s difficult to track progress, identify areas for improvement, and stay motivated towards achieving long-term financial objectives. Regular review and adjustment of both the budget and the plan are crucial for adapting to changing circumstances and ensuring continued progress towards the goals.

Creating a Personalized Financial Plan: A Step-by-Step Guide

Creating a personalized financial plan involves several key steps. First, define your short-term and long-term financial goals. This involves identifying specific targets, such as saving for a down payment on a house or paying off credit card debt. Second, assess your current financial situation, including income, expenses, assets, and liabilities. Third, develop a budget that aligns with your goals and current financial standing. Fourth, implement your plan, tracking your progress regularly. Fifth, review and adjust your plan periodically to account for changes in your circumstances or unexpected events. This iterative process allows for adjustments and refinements, ensuring the plan remains relevant and effective.

Comparison of Financial Goal Setting Methodologies

| Methodology | Description | Advantages | Disadvantages |

|---|---|---|---|

| Zero-Based Budgeting | Allocating every dollar to a specific purpose each month. | Highly effective for controlling spending and achieving savings goals. Provides a clear picture of cash flow. | Requires significant time and effort for initial setup and ongoing maintenance. Can be inflexible if unexpected expenses arise. |

| 50/30/20 Rule | Allocating 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. | Simple and easy to understand and implement. Provides a balanced approach to spending and saving. | May not be suitable for all income levels or financial situations. The allocation percentages might need adjustment based on individual circumstances. |

| SMART Goal Setting | Setting goals that are Specific, Measurable, Achievable, Relevant, and Time-bound. | Provides clarity, focus, and accountability. Helps track progress and measure success. | Requires careful planning and consideration to ensure goals are realistic and achievable. |

| Vision Boards | Visual representation of financial goals using images and affirmations. | Increases motivation and visualization of desired outcomes. Serves as a constant reminder of goals. | Effectiveness depends on individual response to visual aids. May not be sufficient on its own for detailed financial planning. |

Overcoming Obstacles in Financial Goal Setting

Achieving financial goals rarely happens without encountering challenges. Understanding common obstacles and developing strategies to overcome them is crucial for long-term success. This section will explore prevalent barriers and provide practical solutions to navigate these hurdles effectively.

Common Barriers to Achieving Financial Goals

Impulsive spending, unexpected expenses, and insufficient savings are among the most frequent obstacles to financial goal attainment. Impulsive purchases often deplete funds earmarked for savings or debt reduction, derailing progress. Unexpected events, such as medical emergencies or car repairs, can significantly impact budgets, forcing individuals to divert resources away from their planned goals. A lack of sufficient savings acts as a buffer against these unforeseen circumstances, leading to increased stress and potential setbacks. For example, a family saving for a down payment on a house might find their progress severely hampered by an unexpected medical bill or job loss.

Strategies for Managing Debt and Improving Credit Scores

Effective debt management is vital for achieving financial stability. Strategies include creating a debt repayment plan, prioritizing high-interest debts, and exploring debt consolidation options. A well-structured repayment plan, prioritizing debts with the highest interest rates, can significantly reduce the total interest paid and accelerate the debt-free process. Debt consolidation can simplify repayment by combining multiple debts into a single loan with potentially lower interest rates. Consistently paying bills on time is crucial for improving credit scores. Regular and on-time payments demonstrate responsible financial behavior to lenders, leading to a higher credit score, which can unlock better loan terms and interest rates in the future. Consider a scenario where an individual consolidates several high-interest credit card debts into a lower-interest personal loan, thereby reducing their monthly payments and accelerating their debt repayment journey.

Techniques for Building an Emergency Fund and Managing Risk

An emergency fund serves as a crucial safety net against unforeseen circumstances. Aim to save 3-6 months’ worth of living expenses in a readily accessible account. This fund acts as a buffer against job loss, medical emergencies, or unexpected home repairs, preventing individuals from resorting to high-interest debt. Diversification of investments can mitigate financial risk. By spreading investments across different asset classes (stocks, bonds, real estate, etc.), individuals can reduce the impact of losses in any single investment. For instance, having an emergency fund of $15,000 could provide significant peace of mind for an individual facing a sudden job loss or unexpected car repair, enabling them to cover essential living expenses without incurring high-interest debt.

Seeking Professional Financial Advice

Navigating complex financial matters can be challenging. Seeking professional financial advice from a qualified advisor provides personalized guidance and support. A financial advisor can assist in developing a comprehensive financial plan tailored to individual circumstances, goals, and risk tolerance. They can offer expert insights on investment strategies, debt management, tax planning, and retirement planning, ensuring informed decision-making. Consider the scenario where an individual nearing retirement seeks professional advice on optimizing their retirement portfolio to ensure a comfortable retirement income. The advisor’s expertise can help navigate complex investment options and minimize potential risks.

Tracking Progress and Making Adjustments

Successfully achieving financial goals requires consistent monitoring and the ability to adapt to unforeseen circumstances. Regularly tracking your progress allows you to identify areas where you’re excelling and areas needing improvement, enabling timely adjustments to your financial plan. This proactive approach significantly increases your chances of reaching your objectives.

Effective progress tracking involves a combination of consistent monitoring and strategic adjustments. It’s not simply about checking numbers; it’s about understanding the narrative behind those numbers and making informed decisions based on your overall financial health and evolving circumstances. This ensures your financial plan remains relevant and effective throughout your journey.

Methods for Monitoring Progress

Regularly reviewing your budget is crucial. Compare your actual spending against your planned spending in each budget category. Analyze any significant variances. For example, if you allocated $500 for groceries but spent $650, investigate why. Did you eat out more than anticipated? Were there unexpected price increases? Understanding these variances is key to making adjustments. Additionally, monitor your investment performance, noting both gains and losses. Regularly check your net worth by subtracting your liabilities from your assets. This provides a comprehensive overview of your financial standing.

Adjusting Financial Plans

Life throws curveballs. Job loss, unexpected medical expenses, or changes in family circumstances can significantly impact your financial plan. When faced with such events, it’s vital to reassess your goals and adjust your strategy accordingly. This might involve temporarily reducing savings contributions, exploring additional income sources, or re-prioritizing goals. For instance, if you experience a job loss, you might temporarily halt contributions to a retirement account while focusing on building an emergency fund. Conversely, a significant windfall could allow you to accelerate progress towards a specific goal, perhaps paying off debt faster or investing more aggressively.

Tools and Technologies for Tracking Financial Progress

Several tools can streamline the process of tracking financial progress. Budgeting apps, like Mint or YNAB (You Need A Budget), automatically categorize transactions, track spending, and provide visual representations of your financial health. Spreadsheet software like Microsoft Excel or Google Sheets allows for customized tracking, enabling detailed analysis and forecasting. Many financial institutions offer online banking portals with robust features for monitoring accounts, investments, and credit scores. These tools empower individuals to take a more active role in managing their finances.

Visual Representation of Tracking and Adjusting Financial Goals

Imagine a graph with time on the x-axis and financial progress (e.g., net worth, debt reduction) on the y-axis. A line represents your initial projected progress towards your goal. As you track your actual progress, plot additional data points. If your actual progress deviates significantly from the projected line (e.g., due to unexpected expenses), you would adjust your financial plan. This adjustment might be represented by a new, adjusted projection line that accounts for the change. The graph visually demonstrates how tracking enables you to identify deviations from your plan and how adjustments help you to stay on course, even with unforeseen circumstances. The process involves consistent monitoring, identifying variances, adjusting the plan based on these variances, and then continuing to monitor progress against the revised plan. This iterative process ensures your financial plan remains dynamic and responsive to life’s changes.

Specific Financial Goal Examples and Strategies

Setting specific financial goals is crucial for achieving long-term financial security. Understanding the strategies involved in reaching these goals, along with the role of investing, is essential for success. This section details strategies for common financial goals, illustrates successful outcomes, and provides a case study demonstrating the practical application of these principles.

Strategies for Achieving Specific Financial Goals

This section Artikels practical strategies for achieving three common financial goals: buying a house, saving for retirement, and paying off student loans. Each goal requires a different approach, emphasizing the need for personalized financial planning.

Buying a House: Begin by determining affordability. This involves calculating your debt-to-income ratio and determining a comfortable monthly mortgage payment. Next, save diligently for a down payment, aiming for at least 20% to avoid Private Mortgage Insurance (PMI). Explore various mortgage options, comparing interest rates and loan terms from different lenders. Finally, factor in closing costs and other associated expenses. Regularly review your budget and adjust your savings plan as needed.

Saving for Retirement: Start saving early to take advantage of the power of compound interest. Maximize contributions to employer-sponsored retirement plans, such as 401(k)s, to benefit from matching contributions. Consider opening a Roth IRA or traditional IRA to supplement your retirement savings. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk. Regularly review your investment portfolio and adjust your asset allocation as needed. Plan for potential healthcare costs in retirement, as these can significantly impact your retirement budget.

Paying Off Student Loans: Create a budget to identify areas where you can reduce spending and allocate more funds towards loan repayment. Explore different repayment options, such as income-driven repayment plans or refinancing, to find the most suitable approach. Prioritize high-interest loans to minimize the total interest paid. Consider making extra payments whenever possible to accelerate the repayment process. Seek professional advice if you are struggling to manage your student loan debt.

The Importance of Investing and Investment Strategies

Investing plays a crucial role in achieving long-term financial goals. Different investment strategies are suitable for various goals and risk tolerances. A diversified portfolio is generally recommended to mitigate risk.

For long-term goals like retirement, a long-term investment strategy focusing on growth is appropriate. This may involve investing in stocks and other higher-growth assets. For shorter-term goals, such as buying a house, a more conservative approach may be preferred, focusing on investments with lower risk and higher liquidity, such as bonds or money market accounts. Consider seeking advice from a qualified financial advisor to determine the most appropriate investment strategy for your individual circumstances. Understanding your risk tolerance and time horizon is key to making informed investment decisions.

Examples of Successful Financial Goal Attainment Stories

Many individuals have successfully achieved their financial goals through diligent planning and execution. These examples illustrate the power of perseverance and effective financial strategies.

- A couple saved diligently for 5 years, meticulously tracking their expenses and maximizing their savings, enabling them to purchase their dream home.

- An individual consistently invested in a diversified portfolio for 30 years, resulting in a substantial retirement nest egg, exceeding their initial projections.

- A recent graduate strategically paid off their student loans within 3 years by prioritizing high-interest debt and making extra payments whenever possible.

Case Study: The Millers’ Journey to Financial Freedom

The Millers, a young couple, set a financial goal to save for a down payment on a house within three years. They created a detailed budget, tracking their expenses and identifying areas where they could reduce spending. They prioritized saving a significant portion of their income each month and diligently invested a portion of their savings in a low-risk investment account. Through consistent effort and smart financial planning, they surpassed their initial goal, achieving their down payment target within two years. Their success highlights the importance of disciplined saving, budgeting, and strategic investing.

Ending Remarks

Mastering financial goal setting is a continuous process of planning, action, and adaptation. By defining clear, measurable goals, implementing effective strategies, and consistently monitoring your progress, you can build a solid foundation for financial success. Remember that seeking professional advice when needed is a sign of proactive financial management, not a sign of weakness. Embrace the journey, celebrate your milestones, and enjoy the rewarding experience of achieving your financial dreams.

Query Resolution

How often should I review my financial goals?

Ideally, review your financial goals at least annually, or more frequently if significant life changes occur (e.g., job change, marriage, birth of a child).

What if I fall short of my financial goals?

Don’t be discouraged! Analyze why you fell short, adjust your plan accordingly, and recommit to your goals. Flexibility and adaptation are key.

How can I stay motivated to achieve my financial goals?

Visualize your goals, track your progress regularly, reward yourself for milestones achieved, and find an accountability partner to support your journey.

Are there any free resources available to help with financial goal setting?

Many websites and government agencies offer free resources, including budgeting tools, financial calculators, and educational materials. Explore options from reputable sources.