Securing your financial future requires a proactive approach, and that begins with setting clear, achievable financial goals. This journey involves more than simply dreaming of a comfortable retirement or a down payment on a house; it demands a structured plan encompassing budgeting, saving, investing, and debt management. Understanding these strategies empowers you to take control of your finances and build a secure and prosperous life.

This guide provides a comprehensive framework for setting and achieving your financial objectives. We’ll explore various methods for defining SMART goals, crafting effective budgets, and navigating the complexities of saving, investing, and debt reduction. Whether you’re a young professional just starting out or an experienced individual looking to optimize your financial strategy, this resource offers practical advice and actionable steps to guide you toward your desired financial outcomes.

Defining Financial Goals

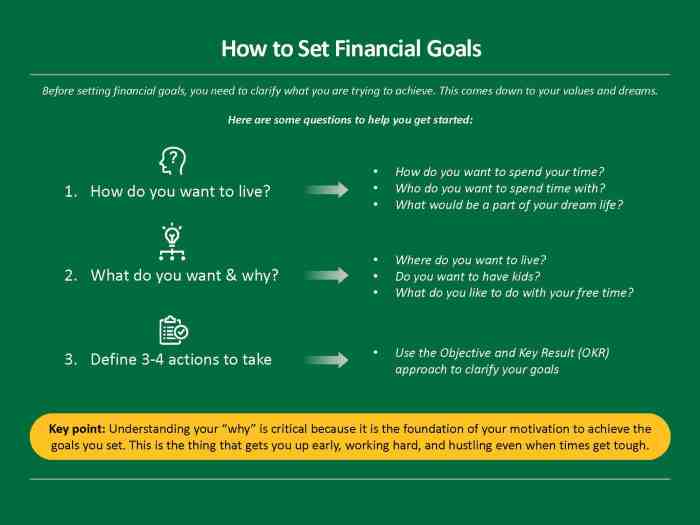

Setting clear, achievable financial goals is crucial for building a secure financial future. Understanding different goal types and employing effective strategies for prioritization is key to success. This section will explore the process of defining your financial goals, focusing on the SMART framework, goal categorization, and prioritization techniques.

The SMART Goal Framework

The SMART framework provides a structured approach to goal setting, ensuring goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Applying this framework enhances the likelihood of achieving your financial objectives.

- Specific: Clearly define your goal. Instead of “save more money,” aim for “save $10,000 for a down payment on a house.”

- Measurable: Track your progress. For the house down payment, you could track monthly savings and adjust your plan accordingly.

- Achievable: Set realistic goals. If your income is limited, saving $100,000 in a year is likely unachievable. A more realistic goal might be $10,000.

- Relevant: Ensure the goal aligns with your overall financial plan and life goals. Saving for a house is relevant if you plan to buy a home.

- Time-bound: Set a deadline. Aim to save $10,000 for a down payment within two years.

Short-Term, Mid-Term, and Long-Term Financial Goals

Financial goals span different time horizons, requiring varied strategies. Categorizing goals helps in allocating resources effectively.

- Short-Term Goals (0-1 year): These are goals achievable within a year. Examples include: paying off a credit card balance, saving for a vacation, or building an emergency fund.

- Mid-Term Goals (1-5 years): These are goals requiring a longer time horizon. Examples include: saving for a down payment on a car, paying off student loans, or funding a child’s education.

- Long-Term Goals (5+ years): These are long-range objectives. Examples include: retirement planning, buying a house, or funding a child’s college education.

Prioritizing Financial Goals

Prioritizing goals involves considering both urgency and importance. Urgency refers to the immediacy of the need, while importance relates to the long-term impact. A prioritization matrix can be helpful. For instance, an urgent and important goal might be paying off high-interest debt, while a less urgent but important goal might be saving for retirement.

Comparison of Different Types of Financial Goals

| Goal Type | Description | Time Horizon | Example |

|---|---|---|---|

| Saving | Setting aside money for future expenses. | Short, mid, or long-term | Emergency fund, down payment, retirement |

| Investing | Growing wealth through investments in stocks, bonds, or real estate. | Mid to long-term | Retirement portfolio, college fund |

| Debt Reduction | Paying off existing debts, such as loans or credit cards. | Short to mid-term | Paying off student loans, credit card debt |

| Budgeting | Creating and maintaining a plan for managing income and expenses. | Ongoing | Tracking spending, creating a monthly budget |

Budgeting and Expense Tracking

Effective budgeting and expense tracking are fundamental to achieving your financial goals. Understanding where your money goes is the first step towards controlling your spending and building a secure financial future. This section will explore various budgeting methods, guide you through creating a personal budget, and introduce tools to simplify the process.

Different Budgeting Methods

Several budgeting methods cater to different financial styles and priorities. The 50/30/20 rule, zero-based budgeting, and envelope budgeting are popular choices. The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting requires allocating every dollar of your income to a specific category, ensuring that spending is planned meticulously. Envelope budgeting involves physically allocating cash to different spending categories in envelopes. The effectiveness of each method depends on individual circumstances and financial discipline. Zero-based budgeting offers greater control but demands more effort, while the 50/30/20 rule provides a simpler framework.

Creating a Realistic Personal Budget

Creating a realistic budget involves a step-by-step process. First, meticulously track your income from all sources (salary, investments, etc.). Next, meticulously categorize your expenses. Common categories include housing, transportation, food, utilities, entertainment, and debt payments. Utilize bank statements, receipts, and credit card statements for accurate tracking. Compare your tracked expenses against your income to identify areas where adjustments are needed. This may involve cutting back on non-essential spending or increasing income. Finally, allocate a portion of your income towards savings and debt repayment goals. Regular review and adjustment are crucial to maintain a realistic and effective budget.

Sample Budget

| Income | Expenses | Savings | Debt Repayment |

|---|---|---|---|

| $5,000 (Monthly Salary) | $2,500 (Housing, Food, Transportation) | $1,000 | $500 |

| $200 (Investment Income) | $500 (Entertainment, Dining Out) | ||

| $200 (Utilities) | |||

| Total: $5,200 | Total: $3,200 | Total: $1,000 | Total: $500 |

Budgeting Apps and Tools

Numerous budgeting apps and tools simplify expense tracking and financial management. These apps often automate expense categorization, generate insightful reports, and offer features such as goal setting and debt tracking. Examples include Mint, Personal Capital, YNAB (You Need A Budget), and many others. Choosing the right tool depends on individual preferences and needs, considering features like ease of use, integration with financial accounts, and reporting capabilities. These tools can significantly enhance the efficiency and effectiveness of budgeting and expense tracking, fostering better financial habits.

Savings and Investment Strategies

Building a strong financial future requires a well-defined strategy encompassing both savings and investments. Savings provide a secure foundation and readily accessible funds for short-term needs, while investments offer the potential for long-term growth to achieve larger financial goals, such as retirement or purchasing a home. Understanding the nuances of various savings and investment vehicles is crucial for making informed decisions aligned with your individual risk tolerance and financial objectives.

Savings Vehicles: High-Yield Savings Accounts, Certificates of Deposit, and Money Market Accounts

Several options exist for securing your savings. High-yield savings accounts (HYSA), certificates of deposit (CDs), and money market accounts (MMA) each offer different levels of liquidity and potential returns, accompanied by varying degrees of risk. Choosing the right option depends on your short-term financial goals and your comfort level with risk.

- High-Yield Savings Accounts (HYSA): HYSAs offer higher interest rates than traditional savings accounts, providing a better return on your deposited funds. They are highly liquid, allowing easy access to your money whenever needed. However, interest rates can fluctuate, and returns might not keep pace with inflation in periods of high inflation.

- Certificates of Deposit (CDs): CDs offer a fixed interest rate for a specified term (e.g., 6 months, 1 year, 5 years). They generally provide higher interest rates than HYSAs but come with a penalty for early withdrawal. The longer the term, the higher the potential return, but also the less liquidity you have.

- Money Market Accounts (MMAs): MMAs offer a combination of features from savings accounts and checking accounts. They typically pay interest based on market rates, offer check-writing capabilities, and often have higher minimum balance requirements than HYSAs. Liquidity is generally good, but interest rates can fluctuate.

Investment Options for Long-Term Financial Goals

Investing your money allows for potentially higher returns over the long term, crucial for achieving significant financial goals like retirement or a down payment on a substantial purchase. However, it’s important to understand that investments carry inherent risks. The potential for higher returns often comes with greater risk of loss.

- Stocks: Represent ownership in a company. Stock prices fluctuate based on company performance and market conditions, offering high growth potential but also significant risk of loss.

- Bonds: Represent a loan to a company or government. Bonds generally offer lower returns than stocks but are considered less risky. They provide a fixed income stream and are less volatile than stocks.

- Mutual Funds: Pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, but come with fees.

- Real Estate: Investing in property can provide rental income and potential appreciation in value. However, real estate investments require significant capital and can be illiquid.

Diversification in Investment Portfolios

Diversification is a crucial risk management strategy in investing. It involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of any single investment performing poorly. A diversified portfolio reduces overall portfolio volatility and improves the chances of achieving long-term financial goals.

For example, a diversified portfolio might include a mix of large-cap and small-cap stocks, government and corporate bonds, and perhaps a small allocation to real estate investment trusts (REITs).

Hypothetical Investment Plan for Early Retirement

Let’s consider a hypothetical investment plan for a 25-year-old young professional aiming for early retirement at age 55. This plan emphasizes long-term growth and incorporates a higher risk tolerance given the longer time horizon.

Assumptions: The individual can contribute $10,000 annually to their retirement account, with a 7% annual return (this is an average and past performance is not indicative of future results). The risk tolerance is considered moderately high.

| Asset Class | Allocation | Rationale |

|---|---|---|

| Stocks (US and International) | 70% | Higher growth potential to achieve early retirement goals. |

| Bonds (Government and Corporate) | 20% | Provides stability and reduces overall portfolio risk. |

| Real Estate (REITs) | 10% | Offers diversification and potential for long-term appreciation. |

This is a simplified example. A real-world plan would require more detailed analysis and adjustments based on individual circumstances, market conditions, and regular rebalancing.

Debt Management and Reduction

Effective debt management is crucial for achieving long-term financial well-being. Understanding different debt types, their associated costs, and employing suitable repayment strategies are key to minimizing financial burdens and accelerating progress towards your financial goals. This section will Artikel strategies to help you navigate and overcome debt.

Debt can significantly impact your financial health, diverting funds that could be used for savings, investments, or other important goals. Understanding the various types of debt and their associated interest rates is the first step towards developing a successful debt reduction plan.

Types of Debt and Interest Rates

Different types of debt carry varying interest rates and repayment terms. Credit card debt typically has high interest rates, often exceeding 15%, and is often unsecured. Student loans can range widely in interest rates depending on the loan type (federal or private) and the borrower’s creditworthiness. Mortgages, being secured loans, generally have lower interest rates than unsecured debt but represent a significant long-term financial commitment. Understanding these differences is crucial for prioritizing repayment efforts. For example, a high-interest credit card debt might be prioritized over a lower-interest student loan.

Debt Repayment Strategies: Debt Snowball vs. Debt Avalanche

Two common debt repayment strategies are the debt snowball and the debt avalanche methods. The debt snowball method focuses on paying off the smallest debt first, regardless of its interest rate, to build momentum and motivation. This approach prioritizes psychological benefits, providing a sense of accomplishment that can encourage continued effort. The debt avalanche method, conversely, prioritizes paying off the debt with the highest interest rate first, to minimize the total interest paid over time. This strategy is mathematically more efficient but may lack the immediate psychological gratification of the debt snowball method. The best method depends on individual preferences and financial situations. A blended approach might also be considered, combining aspects of both methods.

Creating a Debt Repayment Plan

Creating a comprehensive debt repayment plan involves several steps. First, list all your debts, including the balance, interest rate, and minimum payment for each. Second, choose a repayment strategy (debt snowball or debt avalanche). Third, create a detailed budget that allocates funds towards debt payments. This budget should include all income and expenses, ensuring sufficient funds are available for debt repayment while still meeting essential living expenses. Fourth, monitor progress regularly and adjust the plan as needed. Unexpected expenses or changes in income may require modifications to maintain the plan’s effectiveness. Finally, celebrate milestones reached to maintain motivation.

Calculating the Total Cost of Debt and the Impact of Early Repayment

The total cost of debt includes the principal amount borrowed plus the accumulated interest. For example, a $10,000 loan with a 5% annual interest rate over 5 years will have a significantly higher total cost than the initial $10,000. Early repayment significantly reduces the total interest paid. Consider this example: repaying a portion of the loan each month, above the minimum payment, will shorten the repayment period and reduce the total interest paid. The impact is particularly noticeable with high-interest debt. Tools and calculators are readily available online to help calculate the total cost of debt and the potential savings from early repayment. Utilizing these tools provides a clear picture of the financial benefits of proactive debt management.

Retirement Planning

Securing a comfortable retirement requires careful planning and consistent effort. Starting early is crucial, not only to accumulate sufficient funds but also to leverage the power of compounding, where investment earnings generate further earnings over time. This section will explore key aspects of retirement planning, including different retirement account options and strategies for maximizing savings and minimizing tax burdens.

The Importance of Early Retirement Planning and Compounding

The earlier you begin saving for retirement, the more time your investments have to grow. Compounding, the process where investment returns are reinvested to generate additional earnings, is a powerful tool for wealth building. A small contribution made early can grow significantly over several decades, exceeding the growth of a larger contribution made later. For example, investing $5,000 annually at age 25, earning a 7% annual return, will yield significantly more at age 65 than investing $10,000 annually starting at age 45, even though the total contributions are less in the first scenario. This highlights the significant advantage of starting early and allowing the magic of compounding to work its wonders.

Different Retirement Accounts and Their Tax Implications

Several types of retirement accounts offer different tax advantages. Understanding these differences is crucial for making informed decisions.

401(k) plans: These employer-sponsored plans allow pre-tax contributions, reducing your current taxable income. Investment earnings grow tax-deferred, meaning you won’t pay taxes until you withdraw the funds in retirement. Many employers offer matching contributions, essentially providing free money towards your retirement savings.

Traditional IRA: Similar to a 401(k), contributions to a Traditional IRA are tax-deductible, and earnings grow tax-deferred. However, withdrawals in retirement are taxed as ordinary income. Contribution limits exist and may vary based on income.

Roth IRA: Unlike traditional retirement accounts, contributions to a Roth IRA are made after tax, meaning you won’t receive a tax deduction in the current year. However, withdrawals in retirement are tax-free, providing a significant advantage. Income limits apply to eligibility.

Strategies for Maximizing Retirement Savings Contributions and Minimizing Taxes

Maximizing contributions to retirement accounts is essential for building a substantial nest egg. Consider contributing the maximum allowed to your 401(k) and/or IRA, taking advantage of employer matching contributions where available. For tax minimization, consider tax-loss harvesting, a strategy involving selling losing investments to offset capital gains taxes. Also, consult a financial advisor to explore tax-advantaged investment strategies tailored to your specific financial situation.

Illustrative Representation of Retirement Savings Growth

The following textual representation demonstrates the growth of retirement savings over time with different contribution levels. Imagine a simple bar graph. The X-axis represents the years of investment (from age 25 to 65), and the Y-axis represents the accumulated savings. One bar represents an annual contribution of $2,000, another shows $5,000, and a third displays $10,000. Assuming a conservative 6% annual return, the $10,000 contribution bar would be significantly taller than the $5,000 bar at age 65, which in turn would be taller than the $2,000 bar. The difference in height visually illustrates the significant impact of higher contributions and the power of compounding over time. The graph visually shows how even small increases in contributions early on can lead to substantially larger retirement nest eggs. This underscores the importance of starting early and maximizing contributions whenever possible.

Seeking Professional Financial Advice

Navigating the complexities of personal finance can be challenging, even with diligent self-education. Seeking professional financial advice can significantly enhance your financial well-being, providing personalized guidance and support tailored to your unique circumstances and aspirations. A qualified advisor can offer objective insights, identify potential pitfalls, and help you develop a comprehensive strategy to achieve your financial goals.

The benefits of engaging a financial advisor extend beyond simply managing investments. They can assist with various aspects of financial planning, including budgeting, debt management, retirement planning, tax optimization, and estate planning. This holistic approach ensures a cohesive strategy, maximizing your financial potential and minimizing risks.

Financial Advisor Qualifications and Experience

Choosing the right financial advisor is crucial. Look for individuals with appropriate certifications and licenses, such as a Certified Financial Planner (CFP®) or Chartered Financial Analyst (CFA®) designation. These certifications demonstrate a commitment to professional development and adherence to ethical standards. In addition to certifications, consider the advisor’s experience, specializing in areas relevant to your needs. For example, if you’re nearing retirement, an advisor with extensive experience in retirement planning would be beneficial. Thoroughly review their track record and client testimonials to assess their competence and suitability.

Types of Financial Advisors and Their Services

Financial advisors utilize different compensation models, significantly influencing their services and potential biases. Fee-only advisors charge a pre-agreed fee for their services, eliminating potential conflicts of interest arising from commission-based compensation. Commission-based advisors earn a commission on the financial products they sell, which may influence their recommendations. Hybrid advisors combine fee-based and commission-based compensation structures. Understanding these models is essential for making an informed decision, aligning the advisor’s incentives with your best interests. Consider the transparency and clarity of their fee structure before engaging their services.

Communicating Financial Goals and Concerns

Effective communication is paramount when working with a financial advisor. Before your first meeting, consolidate your financial information, including income, expenses, assets, debts, and financial goals. Prepare a list of questions and concerns to ensure a productive discussion. During meetings, actively participate, asking clarifying questions and expressing your comfort level with proposed strategies. Openly share your risk tolerance, investment preferences, and long-term aspirations. Regularly review your financial plan with your advisor, adjusting the strategy as needed to reflect changing circumstances and priorities. Maintaining clear and consistent communication fosters a strong advisor-client relationship, leading to more effective financial planning.

Final Review

Mastering financial goal setting is a continuous process of learning, adapting, and refining your approach. By consistently reviewing and adjusting your strategies, you can navigate unexpected life events and maintain a steady path toward your financial aspirations. Remember, seeking professional guidance when needed can significantly enhance your journey. Embrace the power of planning, and watch your financial dreams transform into tangible realities.

Helpful Answers

How often should I review my financial goals?

Ideally, review your goals at least annually, or more frequently if significant life changes occur (e.g., marriage, job change, birth of a child).

What if my financial goals change over time?

It’s perfectly normal for your goals to evolve. Regularly reassess your priorities and adjust your plan accordingly. Flexibility is key to long-term success.

How can I stay motivated to stick to my financial plan?

Regularly track your progress, celebrate milestones, and remind yourself of the long-term benefits. Consider using visual aids like charts or apps to monitor your progress and stay engaged.

What is the role of emergency funds in financial goal setting?

An emergency fund is crucial. It provides a safety net for unexpected expenses, preventing you from derailing your long-term goals by using credit cards or loans.