Financial Goal Setting Strategies: Mastering your financial future isn’t about luck; it’s about a well-defined plan. This guide unravels the secrets to setting SMART financial goals, from short-term savings sprints to long-term investment marathons. We’ll navigate the sometimes treacherous waters of budgeting, debt management, and investment strategies, equipping you with the tools to confidently chart your course to financial freedom. Forget the financial anxieties; let’s build a brighter, more secure future, one strategic goal at a time.

We’ll explore various budgeting methods, delve into the nuances of saving versus investing, and tackle debt reduction strategies head-on. We’ll also examine the crucial role of long-term planning, including retirement and estate planning, and discuss when seeking professional financial advice is a smart move (hint: it often is!). Prepare to ditch the financial guesswork and embrace a future filled with fiscal fortitude!

Defining Financial Goals

So, you want to conquer the world of finance? Excellent! But before you start imagining a life of luxury yachts and private islands (which, let’s be honest, is totally achievable with the right plan), we need to talk about goals. Specifically, *smart* financial goals. Because haphazardly throwing money at things is less “financial freedom” and more “financial frenzy.”

Setting financial goals isn’t just about dreaming big; it’s about creating a roadmap to get there. Think of it as a treasure map, but instead of “X marks the spot,” it’s “$$$ marks the spot.” And unlike a real treasure map, this one won’t lead you to a cursed pirate’s chest. It’ll lead you to financial security, early retirement (if that’s your jam), or whatever shiny financial object catches your eye.

The Importance of SMART Goal Setting in Finance

SMART goals are the superheroes of financial planning. They’re Specific, Measurable, Achievable, Relevant, and Time-bound. Without these qualities, your financial goals are more like wishes than plans. A wish might be “I want to be rich.” A SMART goal is “I will save $10,000 in the next 12 months by setting aside $833 each month and investing in a high-yield savings account.” See the difference? One is a vague aspiration, the other is a concrete strategy.

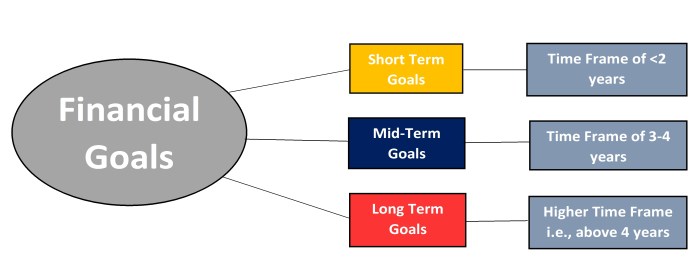

Examples of Short-Term, Mid-Term, and Long-Term Financial Goals

Let’s get practical. Short-term goals (achievable within a year) might include paying off a credit card balance, saving for a down payment on a car, or building an emergency fund. Mid-term goals (1-5 years) could involve saving for a down payment on a house, paying off student loans, or funding a child’s education. Long-term goals (5+ years) often involve retirement planning, investing for a child’s college education, or funding a significant purchase like a vacation home (that luxurious yacht is still on the table!).

Prioritizing Financial Goals Based on Urgency and Importance

Not all financial goals are created equal. Some are more pressing than others. To prioritize, use an Eisenhower Matrix (also known as the Urgent/Important Matrix). Plot your goals on a 2×2 grid: Urgent and Important (do first!), Important but Not Urgent (schedule), Urgent but Not Important (delegate if possible), and Neither Urgent nor Important (eliminate). This method helps you focus on what truly matters and avoid getting bogged down in less significant tasks.

Comparison of Different Types of Financial Goals

| Goal Type | Time Horizon | Example | Required Actions |

|---|---|---|---|

| Saving | Short-term to Long-term | Emergency fund of $10,000 | Budgeting, automatic transfers, high-yield savings account |

| Investing | Mid-term to Long-term | Retirement savings of $1 million | Researching investment options, regular contributions, diversification |

| Debt Reduction | Short-term to Mid-term | Paying off $5,000 in credit card debt | Creating a debt repayment plan, budgeting, extra payments |

| Buying a Home | Mid-term to Long-term | Purchasing a house for $300,000 | Saving for a down payment, improving credit score, securing a mortgage |

Budgeting and Expense Tracking

Ah, budgeting. The word itself conjures images of spreadsheets, tiny numbers, and the faint scent of impending doom. But fear not, dear reader! Mastering the art of budgeting isn’t about becoming a financial monk; it’s about taking control of your money so you can actually *enjoy* it, instead of it enjoying you. This section will equip you with the tools and techniques to transform your financial life from a chaotic mess to a well-oiled, money-making machine (or at least, a well-oiled, money-managing machine).

Creating a Realistic Personal Budget involves a few key steps, each as crucial as the last (like a well-made soufflé, if you’re into that sort of thing). First, you need to honestly assess your income – this includes your salary, side hustles, and any other regular money inflow (even that questionable inheritance from your eccentric Uncle Barry). Next, meticulously track your expenses for at least a month. This is where the rubber meets the road, and you’ll likely discover some surprising spending habits (like that daily latte habit that’s quietly draining your bank account faster than a leaky faucet).

Creating a Personal Budget

To create a truly effective budget, you need a clear picture of your financial landscape. Begin by listing all sources of income, including salary, bonuses, investments, and any other recurring revenue streams. Then, meticulously track your expenses for a month, categorizing them into essential needs (housing, food, transportation), wants (entertainment, dining out), and savings. A simple spreadsheet or budgeting app can streamline this process. Remember, honesty is key here. Don’t shy away from those impulse buys – acknowledging them is the first step to conquering them.

Sample Budget Template

| Category | Income | Expenses |

|---|---|---|

| Salary | $4,000 | |

| Investments | $200 | |

| Housing | $1,200 | |

| Food | $500 | |

| Transportation | $200 | |

| Utilities | $150 | |

| Entertainment | $250 | |

| Savings | $700 | |

| Total | $4,200 | $4,200 |

This is a simplified example. You’ll need to adjust categories and amounts to reflect your personal financial situation. Remember to include all sources of income and expenses.

Different Budgeting Methods

Several budgeting methods can help you manage your finances effectively. The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Zero-based budgeting, on the other hand, requires you to allocate every dollar of your income to a specific expense category, ensuring that all your spending is intentional and planned. The best method depends on your personal preferences and financial goals. For example, a young professional might find the 50/30/20 rule more flexible, while someone aiming for aggressive debt repayment might prefer zero-based budgeting.

Benefits of Budgeting Apps and Software

Budgeting apps and software offer several advantages, including automated expense tracking, personalized financial reports, and goal-setting tools. These tools can simplify the budgeting process, providing a clear overview of your financial situation and facilitating better decision-making. Many apps offer features like automated savings transfers, which can help you build savings consistently without having to manually transfer funds each month. Think of them as your friendly financial robot assistants, constantly monitoring your finances and gently nudging you towards your financial goals. Some popular examples include Mint, YNAB (You Need A Budget), and Personal Capital. Each has its strengths and weaknesses, so choosing one that aligns with your preferences and needs is crucial.

Saving and Investing Strategies: Financial Goal Setting Strategies

So, you’ve conquered the budgeting beast and tamed your expenses. Congratulations! Now comes the truly exciting part: making your money work *for* you, not just against you. This isn’t about hoarding pennies under your mattress (though, admittedly, that *can* be a surprisingly effective short-term strategy against inflation if you’re a squirrel). We’re talking about strategically building your financial future – a future potentially filled with enough avocados to build a small country.

Saving and investing are like two peas in a pod, but peas with very different personalities. Saving is the reliable, steady friend; investing is the high-roller cousin with a penchant for risk. One provides a safe haven for your funds; the other aims for potentially higher returns, but with the possibility of… well, let’s just say it’s not always a smooth ride.

Savings Vehicles

Choosing the right savings vehicle depends on your needs and goals. Do you need quick access to your cash, or is it tucked away for a rainy day (or a down payment on that avocado country)? Here are a few options to consider: High-yield savings accounts offer competitive interest rates, making your money grow steadily, though usually at a slower pace than investments. Money market accounts provide slightly higher interest rates than savings accounts, but often come with restrictions on withdrawals. Certificates of Deposit (CDs) offer a fixed interest rate for a specific term. The longer the term, the higher the rate, but accessing your money before maturity usually comes with penalties. Think of it as a financial commitment with a potentially rewarding payoff, but with a hefty breakup fee if you change your mind.

Investment Strategies

Investing can feel like navigating a financial jungle, but with the right tools and knowledge, it can be quite rewarding. Remember, the goal is not to become a Wall Street guru overnight (unless you are, in which case, please teach me your ways!).

Diversification is a cornerstone of smart investing. It’s the idea of spreading your money across various asset classes (stocks, bonds, real estate, etc.) to minimize risk. Think of it as not putting all your eggs in one basket. Unless you really like omelets, then by all means, go ahead.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market fluctuations. This helps to mitigate the risk of investing a large sum at a market peak. Imagine buying groceries weekly instead of making one giant purchase once a month. You smooth out the cost and avoid potentially buying at the most expensive time.

Factors to Consider When Choosing Investments, Financial Goal Setting Strategies

Before diving headfirst into the world of investing, it’s crucial to assess your risk tolerance, investment time horizon, and financial goals.

- Risk Tolerance: How comfortable are you with the possibility of losing some or all of your investment? Are you a cautious tortoise or a daring hare?

- Return Expectations: What kind of return are you hoping for? Higher potential returns often come with higher risk.

- Time Horizon: How long do you plan to invest your money? Long-term investments generally have more time to recover from market downturns.

Remember, investing involves risk, and past performance is not indicative of future results. It’s always wise to seek professional financial advice before making any significant investment decisions. Your financial future is too important to leave to chance (or to a coin toss).

Debt Management and Reduction

Ah, debt. That delightful financial friend who never seems to leave, even when you’ve given it a strongly worded eviction notice. Let’s tackle this unwelcome houseguest head-on with some strategies that are less “emotional meltdown” and more “strategic ninja warrior.” We’ll explore the various types of debt, effective repayment methods, and how to calculate the true cost of borrowing, ensuring you’re not just paying for the initial purchase but also for a front-row seat to the “Interest Rate Circus.”

Common Types of Debt

Debt comes in many flavors, each with its own unique aroma (mostly the pungent smell of interest accruing). Understanding these differences is crucial for crafting an effective repayment plan. Failing to do so is like trying to fight a hydra with a feather duster – ultimately futile and slightly ridiculous.

- Credit Card Debt: This high-interest debt is often the quickest to accumulate, but also the easiest to reduce with diligent payments and responsible spending habits. Think of it as the pesky mosquito of the debt world; annoying, but swattable.

- Student Loans: The often-necessary evil of higher education. These loans typically have lower interest rates than credit cards but represent a substantial sum, demanding a long-term repayment strategy. Consider this the slightly larger, but still manageable, debt-sized fly.

- Mortgages: The heavyweight champion of debt. While a mortgage is a long-term commitment, responsible management is key to avoiding foreclosure and maintaining financial stability. This is the debt-sized rhino, requiring a more calculated approach.

Debt Repayment Strategies

Choosing the right repayment method is like selecting the perfect weapon for a financial battle. Two popular approaches stand out:

- Debt Snowball Method: This method focuses on paying off the smallest debts first, regardless of interest rate. The psychological boost from quickly eliminating small debts can provide motivation to tackle larger ones. Think of it as a quick victory to build momentum.

- Debt Avalanche Method: This strategy prioritizes paying off the debts with the highest interest rates first, minimizing the overall interest paid. This is a mathematically efficient approach, but can be less motivating initially due to the slow initial progress on larger debts. This is a more long-term, mathematically sound approach.

Calculating the Total Cost of Debt

Ignoring interest is like ignoring a slowly growing fungus in your house; it might seem small at first, but it will eventually consume everything. Calculating the total cost of debt involves understanding both principal and interest.

The total cost of debt = Principal + Total Interest Paid

For example, a $10,000 loan at 10% annual interest over 5 years will cost significantly more than $10,000. The exact amount depends on the amortization schedule, but the total cost will likely be substantially higher. Online calculators can easily help you determine this.

Step-by-Step Plan for Reducing High-Interest Debt

Conquering high-interest debt requires a disciplined approach. Here’s a plan that’s less “winging it” and more “strategic master plan”:

- Create a Detailed Debt Inventory: List all your debts, including balances, interest rates, and minimum payments.

- Choose a Repayment Strategy: Select either the debt snowball or debt avalanche method based on your personality and financial goals.

- Increase Your Income: Explore ways to boost your income, such as a side hustle or asking for a raise.

- Reduce Unnecessary Expenses: Identify areas where you can cut back on spending to free up extra cash for debt repayment.

- Make Extra Payments: Whenever possible, make extra payments towards your chosen debt, accelerating the repayment process.

- Stay Disciplined: Consistency is key! Stick to your plan, and celebrate small victories along the way.

Long-Term Financial Planning

Let’s face it, nobody wants to end up living under a bridge in their golden years, subsisting solely on discarded pizza crusts. Long-term financial planning isn’t just about securing a comfortable retirement; it’s about ensuring you have the financial freedom to enjoy life’s later chapters – whether that involves leisurely cruises, competitive shuffleboard, or finally writing that epic novel about your pet hamster. Proper planning now translates to peace of mind later.

Retirement Planning

Retirement planning is the art of ensuring you have enough money to live comfortably after you stop working. This isn’t about hoarding gold coins in your basement (although, that could be fun); it’s about strategically saving and investing over time to build a nest egg that can sustain your lifestyle. Consider it a marathon, not a sprint – consistency is key. Delaying retirement planning only increases the pressure and the required contributions later on. For example, starting to save at age 25 versus age 45 requires significantly less annual contribution to achieve the same retirement goal, thanks to the magic of compound interest.

Retirement Savings Options

Several vehicles exist to help you achieve your retirement dreams. Each has its own set of rules and tax implications, so choosing the right one depends on your individual circumstances and risk tolerance.

- 401(k): This employer-sponsored plan allows you to contribute pre-tax dollars, reducing your current taxable income. Many employers offer matching contributions, essentially giving you free money! Think of it as a generous financial high-five from your boss.

- Traditional IRA: Similar to a 401(k), contributions are tax-deductible, but withdrawals in retirement are taxed. This is a good option for those who expect to be in a lower tax bracket in retirement.

- Roth IRA: Contributions aren’t tax-deductible, but withdrawals in retirement are tax-free. This is a better choice for those who anticipate being in a higher tax bracket during retirement. It’s like paying your taxes now to avoid a bigger bill later.

Estate Planning Strategies

Estate planning isn’t just for the super-rich; it’s for anyone who wants to ensure their assets are distributed according to their wishes after they’re gone. Failing to plan can lead to lengthy legal battles and unexpected tax burdens for your loved ones. It’s essentially creating a detailed roadmap for your financial legacy.

- Wills: A will dictates how your assets will be distributed. Without one, the state decides, which might not align with your preferences.

- Trusts: Trusts provide more control over asset distribution and can offer tax advantages. They can be complex, but a financial advisor can help navigate the options.

Protecting Your Financial Future

Life throws curveballs. Unexpected events, like job loss, illness, or accidents, can significantly impact your financial stability. Insurance acts as a safety net, mitigating the financial burden of such unforeseen circumstances.

- Health Insurance: Protects against crippling medical expenses.

- Disability Insurance: Replaces income if you’re unable to work due to illness or injury.

- Life Insurance: Provides financial security for your dependents in case of your death. Think of it as a financial hug for your loved ones.

Seeking Professional Financial Advice

Let’s face it: navigating the world of finance can feel like trying to assemble IKEA furniture blindfolded. While DIY is admirable, sometimes you need an expert to prevent a catastrophic bookshelf collapse (or, you know, a financial meltdown). Seeking professional financial advice isn’t a sign of weakness; it’s a smart strategy for achieving your financial goals with less stress and more success.

The benefits of enlisting a financial advisor are numerous, ranging from increased clarity to significantly improved outcomes. A seasoned advisor acts as your financial Sherpa, guiding you through the sometimes treacherous terrain of investments, retirement planning, and debt management. They provide personalized strategies tailored to your unique circumstances, offering a level of expertise that’s difficult to match on your own.

Benefits of Consulting a Financial Advisor

A financial advisor offers a multitude of advantages. They provide objective analysis of your financial situation, identifying areas for improvement and suggesting tailored solutions. This impartial perspective can be invaluable, helping you avoid emotional decision-making that could derail your long-term plans. Furthermore, advisors can significantly reduce the time and effort spent on managing your finances, freeing up your time for other pursuits. They also provide access to a wider range of investment options and strategies that may not be readily available to individual investors. Finally, a good advisor can help you stay disciplined and focused on your financial goals, even when faced with unexpected challenges.

Qualifications and Credentials of a Financial Advisor

Choosing a financial advisor requires careful consideration of their qualifications and experience. Look for advisors with relevant certifications, such as a Certified Financial Planner (CFP) designation, a Chartered Financial Analyst (CFA) designation, or a Certified Public Accountant (CPA) designation. These credentials demonstrate a commitment to professional standards and a high level of expertise. Experience is equally important; a proven track record of success is a reassuring sign. Check for any disciplinary actions or complaints filed against the advisor with regulatory bodies. Don’t hesitate to inquire about their investment philosophy and their approach to client relationships. Remember, a good advisor should be transparent, communicative, and readily available to answer your questions.

Finding and Selecting a Suitable Financial Advisor

The process of finding the right financial advisor begins with identifying your needs and goals. Are you looking for help with retirement planning, investment management, or estate planning? Once you’ve clarified your requirements, you can start your search. Utilize online resources, professional networks, and referrals from trusted sources to identify potential candidates. Schedule initial consultations with several advisors to discuss your financial situation and their services. During these meetings, pay attention to their communication style, their ability to understand your needs, and their overall approach to financial planning. A good fit is crucial for a successful and productive working relationship. Remember to always check their background and reputation before committing to their services.

Types of Financial Advice Provided by Professionals

Financial advisors offer a wide array of services, tailored to individual needs. These can include retirement planning, encompassing strategies for maximizing savings and managing retirement income; investment management, involving portfolio construction, asset allocation, and risk management; tax planning, aiming to minimize your tax liability through strategic financial decisions; estate planning, assisting in the creation of wills, trusts, and other legal documents; debt management, helping you develop a plan to reduce and eliminate high-interest debt; and insurance planning, guiding you in selecting appropriate insurance coverage. A comprehensive financial plan often incorporates several of these areas to provide a holistic approach to financial well-being.

Closure

Ultimately, achieving your financial goals is a journey, not a sprint. By understanding the principles of SMART goal setting, mastering budgeting techniques, and employing effective saving and investing strategies, you can take control of your financial destiny. Remember, even small, consistent steps can lead to significant long-term gains. So, dust off those financial dreams, create a robust plan, and watch your financial landscape transform. Happy saving, investing, and prospering!

Clarifying Questions

What if I don’t have any savings to start with?

Even small amounts saved consistently add up. Start with a micro-savings plan, focusing on reducing expenses and identifying areas where you can cut back. Every little bit helps!

How do I choose the right investment strategy for my risk tolerance?

Consider your comfort level with potential losses. Lower-risk investments like bonds generally offer lower returns, while higher-risk investments like stocks have the potential for greater (but also potentially lower) returns. Diversification across asset classes is key.

When should I seek professional financial advice?

If you feel overwhelmed, lack the time to manage your finances effectively, or have complex financial situations (inheritance, significant debt, etc.), consulting a financial advisor is a smart move.

What’s the difference between a 401(k) and an IRA?

A 401(k) is employer-sponsored, often with matching contributions. An IRA is individually managed and offers different contribution limits and tax advantages depending on the type (Traditional or Roth).