Financial Goal Setting Strategies: Let’s face it, money talks, and sometimes it whispers “invest in a comfy retirement chair.” This isn’t your grandma’s budgeting lecture; we’re diving into practical strategies to help you achieve your financial aspirations, whether it’s a down payment on a llama farm or early retirement on a tropical island. We’ll explore everything from crafting SMART goals (yes, even the “T” is crucial) to conquering debt like a financial ninja.

This guide provides a roadmap to financial success, navigating the sometimes-murky waters of budgeting, investing, and debt management. We’ll arm you with the knowledge and tools to make informed decisions, turning your financial dreams into a tangible reality. Think of us as your friendly, slightly sarcastic financial Sherpas, guiding you to the summit of financial freedom (with minimal altitude sickness, we promise).

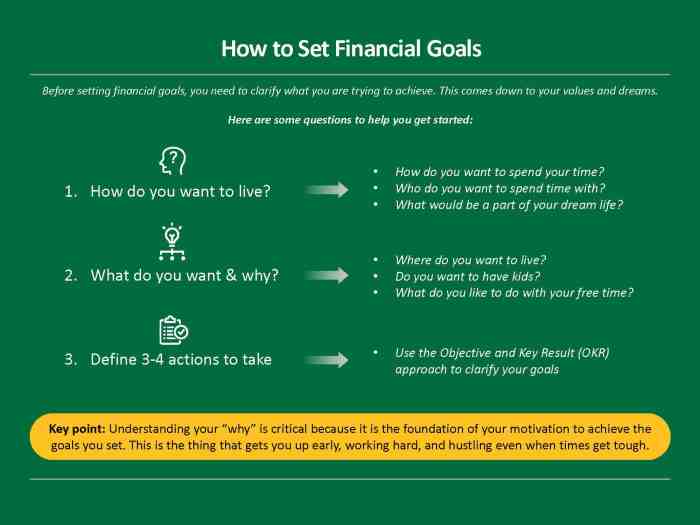

Defining Financial Goals

Let’s face it, money talks. And if your money isn’t saying what you want it to, it’s time for a serious chat – a chat facilitated by well-defined financial goals. Think of it as a financial GPS, guiding you away from the potholes of debt and towards the scenic route of financial freedom. Without a plan, you’re essentially driving blindfolded, hoping for the best. Spoiler alert: hoping rarely pays off in finance.

The SMART Goal Framework for Financial Planning

SMART goals aren’t just a buzzword; they’re a powerful tool for making your financial dreams a reality. This acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Let’s break it down: a vague goal like “get rich” is useless. A SMART goal, on the other hand, provides the clarity and direction you need. For example, instead of “get rich,” aim for “save $10,000 (Specific, Measurable) for a down payment on a house within two years (Achievable, Time-bound) to improve my living situation (Relevant).” See the difference? It’s night and day!

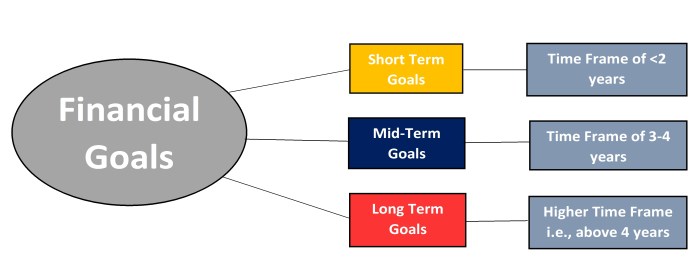

Examples of Short-Term, Mid-Term, and Long-Term Financial Goals

Short-term goals are your quick wins, the low-hanging fruit of your financial orchard. These are typically achieved within a year. Examples include: saving for a vacation, paying off a small credit card debt, or building an emergency fund. Mid-term goals take a bit longer, usually 1-5 years. Examples include: saving for a down payment on a car, paying off student loans, or investing in a rental property. Finally, long-term goals are your marathon, not a sprint. These goals usually span 5+ years and often involve significant financial planning. Examples include: retirement planning, buying a house, or funding your child’s education.

Prioritizing Financial Goals Based on Individual Circumstances, Financial Goal Setting Strategies

Prioritizing your goals is crucial; you can’t tackle everything at once. Think of it like a buffet: you can’t eat everything, so you choose the most appealing and nutritious options. Consider your current financial situation, your risk tolerance, and your overall life goals. If you’re drowning in debt, prioritizing debt reduction might be your top priority. If you’re financially stable, you might focus on long-term investments. This process requires honest self-assessment and a dash of ruthless prioritization.

Comparison of Different Types of Financial Goals

| Goal Type | Time Horizon | Risk Level | Example |

|---|---|---|---|

| Saving | Short-term to long-term | Low | Emergency fund, down payment |

| Investing | Mid-term to long-term | Moderate to High | Stocks, bonds, real estate |

| Debt Reduction | Short-term to mid-term | Low to Moderate (depending on debt type) | Credit card debt, student loans |

| Retirement Planning | Long-term | Moderate to High (depending on investment strategy) | 401(k), IRA contributions |

Budgeting and Expense Tracking

Ah, budgeting. The word itself conjures images of spreadsheets, tiny numbers, and the faint scent of impending doom. But fear not, dear reader! Budgeting doesn’t have to be a soul-crushing experience. Think of it as a financial GPS, guiding you towards your money goals instead of letting your finances wander aimlessly like a lost puppy in a giant shopping mall. This section will equip you with the tools and strategies to tame your spending, conquer your debts, and achieve financial freedom – or at least, financial comfort. We’ll turn your budget from a monster under the bed into a friendly financial sidekick.

Effective budgeting and expense tracking are the cornerstones of achieving any financial goal, whether it’s buying a yacht (a sensible goal, of course) or simply having enough for a rainy day (equally important!). By understanding where your money goes, you gain the power to control it. This isn’t about deprivation; it’s about making informed choices about how you spend your hard-earned cash.

Sample Budget Template

A well-structured budget separates needs from wants. Needs are essential expenses like rent, food, and utilities. Wants are…well, everything else. This template provides a clear picture of your financial landscape:

| Category | Needs | Wants |

|---|---|---|

| Housing | Rent/Mortgage Payment: $1500 | Home Improvement: $200 |

| Food | Groceries: $500 | Eating Out: $300 |

| Transportation | Car Payment/Public Transport: $400 | Gas/Entertainment: $100 |

| Utilities | Electricity, Water, Gas: $200 | Streaming Services: $50 |

| Debt Payments | Loan Payments: $300 | N/A |

| Savings | Emergency Fund: $200 | Investment Account: $300 |

| Other | Healthcare: $100 | Shopping/Hobbies: $250 |

| Total | $3200 | $1200 |

Remember, this is a sample. Adjust the categories and amounts to reflect your unique financial situation. The key is consistency and honest self-assessment.

Effective Expense Tracking Strategies

Tracking your expenses might seem tedious, but there are several user-friendly methods. These range from simple spreadsheets to sophisticated budgeting apps. The goal is to create a system you’ll actually use.

Using a budgeting app (like Mint or YNAB) automatically categorizes transactions, providing a clear visual representation of your spending habits. Alternatively, a simple spreadsheet allows for greater customization. The crucial element is consistent logging of every expense, no matter how small. Even that daily latte adds up!

Identifying and Reducing Unnecessary Expenses

Once you’ve tracked your expenses for a month or two, patterns will emerge. You might be surprised by where your money is going! This is where the magic happens – identifying areas where you can cut back without sacrificing your happiness.

Review your “wants” category. Are you subscribing to multiple streaming services you rarely use? Could you pack your lunch instead of eating out every day? Small changes can have a significant cumulative impact. For example, cutting $5 a day on coffee translates to $150 a month, or $1800 a year – enough for a fantastic vacation!

Allocating Funds Towards Financial Goals

With a clear understanding of your income and expenses, you can allocate funds strategically toward your financial goals. The 50/30/20 rule is a popular approach:

50% Needs, 30% Wants, 20% Savings & Debt Repayment

This framework provides a balanced approach, ensuring you meet your essential needs while still saving for the future and tackling debt. Adjust the percentages based on your individual circumstances and priorities. Remember, consistency is key! Even small, regular contributions to your savings and debt repayment will yield significant results over time.

Saving and Investing Strategies

So, you’ve conquered budgeting – congratulations, you magnificent money manager! Now, let’s talk about the fun part: making your money work for you. Saving and investing are like the dynamic duo of financial success; one provides the safety net, the other the potential for growth. Think of it as Batman and Robin, but instead of fighting crime, they’re fighting financial insecurity.

Saving and investing strategies are crucial for achieving long-term financial goals, from early retirement to a down payment on a dream house (or maybe a slightly less dreamy, but still comfortable, house). The key is to find the right balance between security and growth, depending on your risk tolerance and time horizon.

Types of Savings Accounts

Choosing the right savings account can be surprisingly exciting! It’s not just about finding the highest interest rate (though that’s definitely a perk). Different accounts cater to different needs and saving goals.

- Regular Savings Accounts: These are your classic, everyday savings accounts. They offer easy access to your money, typically with debit cards and online banking. Interest rates are usually modest, but they provide a safe place to park your emergency fund or short-term savings.

- High-Yield Savings Accounts: These accounts offer significantly higher interest rates than regular savings accounts, making your money grow faster. However, they might have slightly stricter requirements or higher minimum balance requirements.

- Money Market Accounts (MMAs): MMAs offer a blend of savings and checking account features. They often pay higher interest than regular savings accounts and may allow a limited number of checks or debit card transactions per month. Think of them as the slightly more sophisticated cousin of the regular savings account.

- Certificates of Deposit (CDs): CDs are like a savings account commitment. You lock your money away for a specific term (e.g., 6 months, 1 year, 5 years), and in return, you earn a fixed interest rate. The longer the term, the higher the interest rate, but you’ll face penalties for withdrawing your money early. They’re great for long-term goals, but less so for emergencies.

Investment Options: Stocks, Bonds, and Mutual Funds

Now for the exciting part: investing! Remember, investing involves risk, but the potential rewards can be substantial. Let’s look at some common options.

- Stocks (Equities): When you buy a stock, you’re buying a tiny piece of ownership in a company. Stock prices fluctuate based on the company’s performance and overall market conditions. High potential for growth, but also high risk.

- Bonds: Bonds are essentially loans you make to a company or government. You receive regular interest payments and get your principal back at maturity. Bonds are generally considered less risky than stocks, but their returns are typically lower.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, making them a popular choice for beginners. They come with fees, so it’s essential to compare expense ratios.

The Importance of Diversification

Diversification is your financial best friend. It’s like spreading your bets in a casino (but hopefully with better odds!). Don’t put all your eggs in one basket! By diversifying your investments across different asset classes (stocks, bonds, real estate, etc.), you reduce your overall risk. If one investment performs poorly, others might offset those losses. Think of it as financial insurance against the unexpected.

Factors to Consider When Choosing an Investment Strategy

Choosing an investment strategy is a deeply personal decision. Several factors should influence your choice.

- Risk Tolerance: How much risk are you comfortable taking? Higher risk investments have the potential for higher returns, but also higher losses. Are you a thrill-seeker or a cautious investor?

- Time Horizon: How long do you plan to invest your money? Longer time horizons allow you to ride out market fluctuations and potentially earn higher returns. Short-term investments usually require less risk.

- Financial Goals: What are you saving or investing for? Retirement, a down payment, or something else? Your goals will influence your investment choices and time horizon.

- Fees and Expenses: Investment options come with various fees and expenses. Compare these carefully before investing, as they can significantly impact your returns. Those fees can quietly nibble away at your profits like tiny, mischievous financial gremlins.

Debt Management Strategies

Ah, debt. That delightful financial friend who always seems to be asking for more. But fear not, intrepid financial adventurer! We’re here to equip you with the strategies to tame this beast and reclaim your financial freedom. We’ll explore different types of debt, effective repayment strategies, and the wonders of debt consolidation and refinancing. Prepare for a thrilling journey into the world of debt domination!

Debt, like a fine wine (or a not-so-fine headache), comes in many varieties. Understanding these different types is crucial for effective management.

Types of Debt and Associated Interest Rates

Different types of debt carry varying interest rates, reflecting the perceived risk involved. For instance, credit card debt typically boasts higher interest rates than mortgages due to its unsecured nature and shorter repayment terms. Student loans often fall somewhere in between, with interest rates varying depending on the loan type and the lender. Auto loans, secured by the vehicle, generally have moderate interest rates. It’s crucial to understand your specific interest rate for each debt to prioritize repayment effectively. A high interest rate means more money paid over the life of the loan, so tackling these debts first is key. Imagine a high-interest credit card as a tiny, voracious monster gobbling up your money – you want to deal with it before it grows into a Godzilla-sized problem.

Strategies for Paying Off High-Interest Debt

The avalanche method focuses on tackling the debt with the highest interest rate first, regardless of balance. This minimizes the total interest paid over time. Imagine it as a strategic military campaign: take out the most dangerous enemy first! The snowball method, on the other hand, involves paying off the smallest debt first, regardless of interest rate, for a quick morale boost. This approach can provide psychological satisfaction and momentum as you see debts disappear. Think of it as a quick victory to build confidence before tackling larger challenges. Both methods have their advantages; the best choice depends on your personal preferences and financial situation.

Benefits of Debt Consolidation and Refinancing

Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate or more manageable monthly payments. Think of it as a financial merger – streamlining your debt for easier management. Refinancing, on the other hand, involves replacing an existing loan with a new one, usually with better terms. This could mean securing a lower interest rate, a longer repayment period, or both. It’s like getting a better deal on your existing loan – a clever financial maneuver! However, it’s important to carefully consider all fees and terms before consolidating or refinancing. It’s a tool, not a magic bullet.

Creating a Debt Repayment Plan

A successful debt repayment plan starts with a clear understanding of your debts, including balances, interest rates, and minimum payments. Next, choose a repayment strategy (avalanche or snowball), and create a detailed budget to allocate funds for debt repayment. Regularly monitor your progress and make adjustments as needed. Remember, consistency is key. This plan isn’t a set-it-and-forget-it proposition. Regular review and adjustments are crucial for success. Think of it as a living document that adapts to your evolving financial situation. A spreadsheet or budgeting app can be your best friend in this process. It’s all about tracking, strategizing, and maintaining a consistent, dedicated approach.

Retirement Planning Strategies

Retirement planning: It’s not just about rocking on a beach with a margarita; it’s about securing your financial future so you can enjoy that margarita without the crippling anxiety of impending poverty. Think of it as a sophisticated game of financial Jenga – carefully removing blocks (expenses) without toppling the whole tower (your retirement fund). Let’s learn how to play this game, and win!

Retirement planning involves strategically saving and investing money over your working years to create a financial cushion for your post-work life. The goal is to ensure a comfortable and financially secure retirement, allowing you to maintain your desired lifestyle without relying solely on social security or pensions (which, let’s be honest, might be as exciting as watching paint dry).

Different Retirement Accounts

Several retirement accounts offer tax advantages and growth potential. Choosing the right mix depends on your individual circumstances and risk tolerance. It’s like choosing your superhero team – each member brings unique skills to the table.

- 401(k): Sponsored by your employer, often matching a portion of your contributions. Think of it as a generous sidekick, boosting your savings efforts.

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal in retirement. This is your loyal steed, carrying your savings safely through the years.

- Roth IRA: Contributions are made after tax, but withdrawals in retirement are tax-free. This is your trusty shield, protecting your retirement funds from the tax monster.

The Importance of Starting Early

The power of compound interest is your secret weapon in the battle for retirement security. Starting early allows your investments more time to grow exponentially, like a snowball rolling downhill, gathering momentum and size.

Compound interest: The interest earned on your initial investment, plus the interest earned on that interest. It’s the magic of money making money!

Imagine two individuals, both aiming for a $1 million retirement nest egg. One starts saving at age 25, the other at 45. Even with the same annual contribution, the earlier starter will likely reach their goal with significantly less effort, thanks to the magic of compound interest.

Factors Influencing Retirement Planning

Several factors influence your retirement planning strategy. Consider these variables as the terrain you’ll navigate on your journey to retirement.

| Factor | Impact |

|---|---|

| Age | The younger you start, the more time your investments have to grow. |

| Income | Higher income allows for larger contributions, accelerating savings growth. |

| Lifestyle | Desired lifestyle in retirement dictates the amount needed for a comfortable life. |

A Step-by-Step Guide to Retirement Planning

Retirement planning doesn’t have to be daunting. Follow these steps and you’ll be well on your way to a financially secure retirement.

- Determine your retirement goals: How much will you need, and what lifestyle do you envision?

- Estimate your retirement expenses: Consider housing, healthcare, travel, and entertainment.

- Calculate your savings needs: Use online calculators or consult a financial advisor.

- Choose appropriate retirement accounts: Consider 401(k)s, IRAs, and other options.

- Develop a savings and investment plan: Determine your contribution amounts and investment strategy.

- Regularly review and adjust your plan: Life changes, so should your retirement plan.

Emergency Fund Strategies

Let’s face it, life throws curveballs. One minute you’re cruising along, the next you’re staring down the barrel of an unexpected car repair or a surprise medical bill. That’s where the humble emergency fund steps in, saving the day (and your sanity) like a financial superhero. Building one isn’t about becoming a miser; it’s about creating a safety net that prevents minor mishaps from becoming major financial meltdowns.

The Importance of an Emergency Fund

An emergency fund is your financial life raft. It provides a cushion against unforeseen expenses, preventing you from resorting to high-interest debt like credit cards or payday loans – those financial vampires that suck the joy (and money) right out of your life. Having this safety net allows you to handle unexpected events calmly and rationally, rather than panicking and making rash decisions. Think of it as insurance against life’s little (and sometimes big) surprises. A robust emergency fund can mean the difference between weathering a storm and being completely capsized by it.

Methods for Building an Emergency Fund Gradually

Building an emergency fund doesn’t require a sudden influx of cash; it’s a marathon, not a sprint. Start small and be consistent. One effective method is to automate regular transfers from your checking account to your savings account. Even small amounts, like $25 or $50 a week, add up over time. Another strategy is to allocate a portion of any unexpected income, like a bonus or tax refund, directly to your emergency fund. Think of it as “paying yourself first” – a financially responsible self-care strategy. Finally, consider cutting back on non-essential expenses to free up extra funds. That daily latte might seem insignificant, but those small savings accumulate remarkably quickly.

Suitable Accounts for Storing Emergency Funds

The ideal account for your emergency fund should offer easy access to your money while also providing a degree of security and, ideally, a small amount of interest. High-yield savings accounts are a popular choice, offering better interest rates than traditional savings accounts. Money market accounts offer similar benefits, sometimes with check-writing capabilities. However, be wary of accounts with high fees or restrictive access rules, which could defeat the purpose of having readily available funds in an emergency.

Ideal Size of an Emergency Fund

The ideal size of your emergency fund is a matter of personal circumstances and risk tolerance. A commonly recommended target is three to six months’ worth of living expenses. This covers essential costs like rent, utilities, groceries, and transportation. However, if you have a less stable income or a higher risk tolerance, you might aim for a larger fund – perhaps eight months or even a year’s worth of expenses. Conversely, if your job security is high and you have other safety nets (like a supportive family), a smaller fund might suffice. Remember, it’s better to have more than less when unexpected expenses arise. Think of it like this: Would you rather have a small, flimsy raft or a large, sturdy one to navigate stormy financial waters?

Seeking Professional Financial Advice

Let’s face it: navigating the world of finance can feel like trying to assemble IKEA furniture blindfolded. While DIY financial planning can be rewarding (and occasionally hilarious), seeking professional guidance can significantly reduce stress and increase your chances of achieving your financial goals. Think of a financial advisor as your personal financial Sherpa, guiding you through the treacherous mountains of investments, taxes, and retirement planning.

The benefits of engaging a financial advisor are numerous and surprisingly delightful. A skilled advisor can provide personalized strategies tailored to your specific circumstances, offering a level of expertise that’s difficult to match independently. They can help you make sense of complex financial jargon, identify potential risks and opportunities, and create a comprehensive financial plan that aligns with your aspirations. Essentially, they’re like a financial superhero, saving you from the villains of debt and uncertainty.

Financial Advisor Qualifications and Certifications

Reputable financial advisors possess a combination of education, experience, and certifications. While specific requirements vary by jurisdiction, common certifications include the Certified Financial Planner (CFP) designation, which signifies a high level of competency and adherence to ethical standards. Other relevant certifications might include Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA), depending on the advisor’s specialization. It’s crucial to verify an advisor’s credentials through official regulatory bodies to ensure their legitimacy and avoid potential scams. Imagine the disappointment of discovering your financial guru is actually a mime with a penchant for disappearing money!

Questions to Ask a Potential Financial Advisor

Choosing the right financial advisor is akin to choosing a life partner – you need someone you trust and whose values align with yours. Before committing, it’s essential to clarify their fee structure, investment philosophy, and experience level. Finding out their approach to risk management is also critical; some advisors favor conservative strategies, while others embrace a more adventurous approach. Finally, inquire about their client communication style and how frequently you can expect updates on your portfolio’s performance. Understanding these factors upfront will prevent future misunderstandings and potential heartburn.

Types of Financial Advisors and Their Services

The financial advisory landscape is surprisingly diverse. Financial advisors can specialize in various areas, such as retirement planning, investment management, tax planning, or estate planning. Some advisors operate as fee-only advisors, charging a flat fee or hourly rate for their services, while others may receive commissions based on the financial products they recommend. Understanding these different models is essential to making an informed decision. For example, a fee-only advisor might be preferable if you want completely unbiased advice, whereas a commission-based advisor might offer a wider range of product options. The choice depends on your personal preferences and financial situation.

Visualizing Financial Progress

Let’s face it, staring at a spreadsheet of numbers can be about as exciting as watching paint dry. But visualizing your financial journey? Now that’s a party! Turning those cold, hard figures into a vibrant, dynamic representation of your progress is key to staying motivated and celebrating your wins along the way. Think of it as your personal financial victory parade, complete with confetti (metaphorical, of course, unless you’re *really* celebrating).

A visual representation of your financial progress can transform abstract concepts into a tangible, easily understood picture of your financial health. It provides a powerful motivational tool, allowing you to see the direct impact of your diligent saving and investing habits. This isn’t just about tracking numbers; it’s about witnessing your financial dreams taking shape before your very eyes. Prepare to be amazed (and maybe a little bit smug) by your own financial prowess.

A Sample Chart Showing the Impact of Consistent Saving and Investing

Imagine a line graph. The X-axis represents time, stretching out over, say, 10 years. The Y-axis shows the value of your investments. We’ll start with a modest initial investment of $5,000. The line itself represents the growth of this investment, assuming a conservative annual return of 7% (a reasonable average historical return for a diversified portfolio, though past performance is not indicative of future results). The graph would clearly illustrate the power of compounding interest, showing a relatively slow initial increase, followed by a steeper upward trajectory as the years progress. To make it even more visually appealing, you could add another line representing the growth of the same initial investment *without* consistent contributions, highlighting the significant difference that regular savings make. This visual would powerfully demonstrate the magic of consistent effort and the long-term rewards of patient investing. Think of it as a visual testament to your financial discipline – a beautiful graph showing how your patience and diligence are paying off handsomely. The difference between the two lines will be stark, serving as a potent reminder of the importance of consistent contributions.

Tracking Progress Towards Financial Goals Using a Visual Aid

Let’s say your goal is to save $20,000 for a down payment on a house within five years. You could use a simple bar graph. Each bar represents a year, and the height of the bar represents the amount saved in that year. As you save, you can visually fill in the bar, watching it grow towards your target. You could even color-code the bars, with green representing successful savings targets met and yellow or red indicating months where you fell short. This allows for immediate identification of areas needing attention. Consider adding a line across the graph representing your target of $20,000. As the bars reach and surpass this line, the visual accomplishment will be incredibly rewarding. You can even add fun details like little house icons on the bars to represent the progress toward your homeownership dream. This simple visual tool transforms a numerical goal into a dynamic, engaging journey, making the process far more motivating and rewarding.

Closure: Financial Goal Setting Strategies

So, there you have it – a comprehensive overview of Financial Goal Setting Strategies. Remember, financial planning isn’t just about numbers; it’s about building a life you love. By setting clear goals, creating a realistic budget, and strategically managing your finances, you’ll be well on your way to achieving financial security and, dare we say, even a little bit of fun along the way. Now go forth and conquer your financial future! (But maybe consult a professional if you’re feeling overwhelmed – we’re guides, not financial wizards.)

Detailed FAQs

What if I don’t have any savings to start with?

Start small! Even saving a small amount regularly is better than nothing. Focus on building good financial habits and gradually increasing your savings over time.

How often should I review my financial goals?

At least annually, or more frequently if there are significant life changes (new job, marriage, etc.). Regular review ensures your plan stays aligned with your evolving needs.

What’s the difference between a Roth IRA and a Traditional IRA?

A Roth IRA offers tax-free withdrawals in retirement, while a Traditional IRA provides tax deductions now but taxes later. The best choice depends on your current and projected tax brackets.

Is it worth it to hire a financial advisor?

For complex financial situations or if you lack the time or expertise to manage your finances effectively, a financial advisor can be invaluable. However, be sure to choose a qualified and reputable professional.