Achieving financial success requires a clear plan. This guide provides a structured approach to setting and achieving your financial goals, from defining your aspirations to tracking your progress and making necessary adjustments along the way. We’ll explore effective budgeting strategies, resource allocation techniques, and practical examples to help you build a personalized financial roadmap.

We delve into the creation of a comprehensive financial goal-setting template, covering essential components such as goal descriptions, timelines, budget allocation, and progress tracking mechanisms. Various budgeting methods, including the 50/30/20 rule and zero-based budgeting, will be examined, alongside strategies for managing unexpected expenses and income fluctuations. The importance of regular review and adaptation of your financial plan will also be highlighted.

Defining Financial Goals

Setting clear and achievable financial goals is crucial for building a secure financial future. Without defined goals, it’s easy to drift aimlessly, making it difficult to track progress and achieve financial success. This section will guide you through the process of defining your financial goals effectively.

The Importance of SMART Goal Setting in Finance

SMART goals provide a framework for ensuring your financial objectives are Specific, Measurable, Achievable, Relevant, and Time-bound. This structured approach increases the likelihood of achieving your goals by providing clarity and accountability. A vague goal like “save more money” is far less effective than “save $5,000 for a down payment on a house within two years.” The SMART framework ensures you have a roadmap to follow.

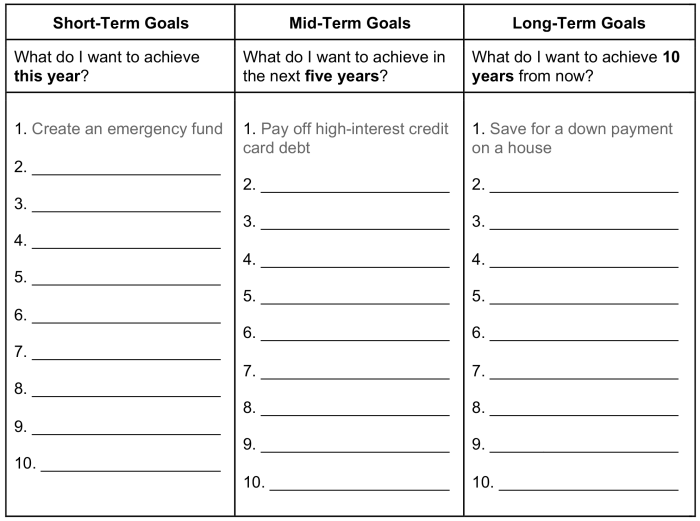

Examples of Short-Term, Mid-Term, and Long-Term Financial Goals

Financial goals span various time horizons, each requiring a different approach. Short-term goals are typically achieved within one year, mid-term goals within one to five years, and long-term goals extend beyond five years.

Short-Term Goals (within 1 year): Examples include paying off a credit card balance, saving for a vacation, or building an emergency fund. These goals often involve smaller amounts of money and require more immediate action.

Mid-Term Goals (1-5 years): Examples include saving for a down payment on a car or house, paying off student loans, or funding a child’s education. These goals typically require consistent saving and investment strategies.

Long-Term Goals (5+ years): Examples include retirement planning, funding a child’s college education, or achieving financial independence. These goals necessitate long-term investment strategies and consistent saving habits, often involving significant sums of money.

Prioritizing Financial Goals Based on Urgency and Importance

Not all financial goals are created equal. Prioritization involves considering both the urgency (how soon it needs to be addressed) and the importance (its overall impact on your financial well-being). A useful tool is the Eisenhower Matrix, which categorizes tasks (and in this case, goals) into four quadrants: Urgent and Important, Important but Not Urgent, Urgent but Not Important, and Neither Urgent nor Important. Focusing on the “Important but Not Urgent” quadrant allows proactive planning for long-term goals while addressing pressing needs in the “Urgent and Important” quadrant.

Comparison of Different Types of Financial Goals

| Goal Type | Description | Time Horizon | Example |

|---|---|---|---|

| Saving | Setting aside money for future expenses. | Short-term, mid-term, long-term | Emergency fund, down payment, retirement |

| Investing | Growing wealth through assets like stocks, bonds, or real estate. | Mid-term, long-term | Retirement portfolio, college fund |

| Debt Reduction | Paying off existing debts like loans or credit cards. | Short-term, mid-term | Paying off credit card debt, student loans |

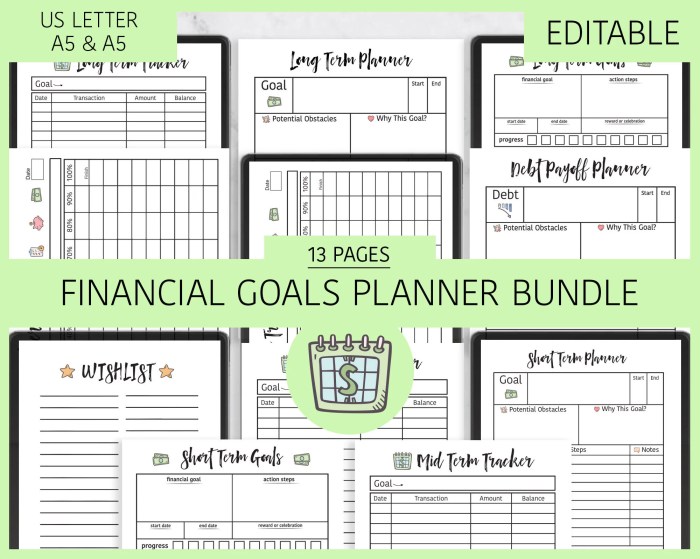

Creating a Financial Goal Setting Template

A well-structured financial goal setting template is crucial for effectively managing your finances and achieving your financial aspirations. It provides a clear roadmap, allowing you to visualize your progress and make necessary adjustments along the way. A personalized template ensures that your specific needs and circumstances are considered, maximizing the effectiveness of your financial planning.

Essential Components of a Financial Goal Setting Template

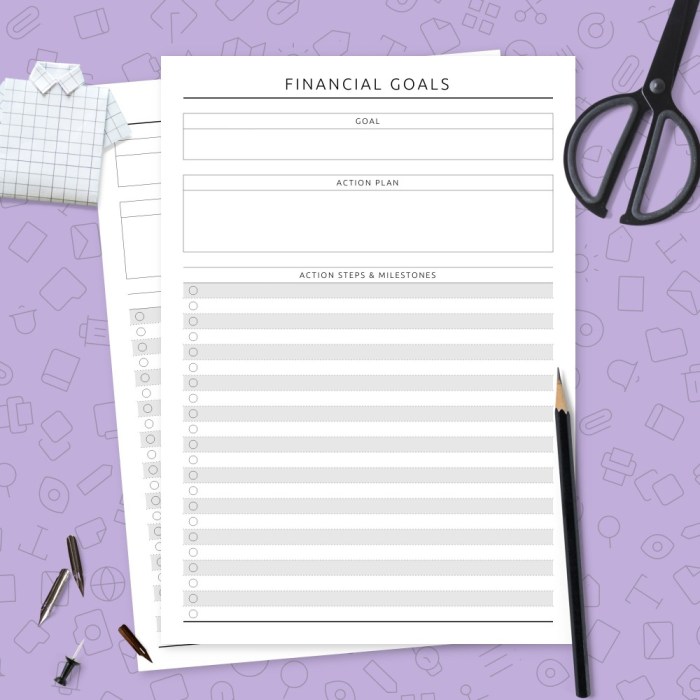

A comprehensive financial goal setting template should include several key components to ensure its effectiveness. These elements work together to provide a holistic view of your financial goals, facilitating better planning and tracking. The level of detail needed will vary depending on the complexity of your goals.

Template Sections

Several sections can enhance the functionality of a financial goal setting template. These sections work in tandem to provide a structured approach to goal setting and tracking. Consider including these sections to create a robust and user-friendly template.

- Goal Description: A clear and concise statement of the financial goal. For example, “Save $10,000 for a down payment on a house.” This section should also include a rationale for the goal, explaining its importance to you.

- Timeline: A specified timeframe for achieving the goal, including a start date and target completion date. For example, “Start date: January 1, 2024; Target completion date: December 31, 2025.”

- Budget Allocation: Details on how much money will be allocated towards the goal each month or other relevant time period. For example, “Allocate $500 per month from my savings account.”

- Progress Tracking: A section to monitor your progress towards the goal. This might involve tracking monthly savings, investment growth, or debt reduction. Include a place to record actual savings versus planned savings and any deviations from the plan.

- Contingency Planning: Address potential setbacks or unexpected expenses that could impact your progress. This might involve identifying potential risks and developing strategies to mitigate them. For example, “If I lose my job, I will reduce my monthly contribution to $250.”

- Review Schedule: Specify how often you will review your progress and make adjustments to your plan. Regular review is crucial to ensure your plan remains on track and aligned with your evolving needs.

Creating a Personalized Financial Goal Setting Template: A Step-by-Step Guide

The process of creating a personalized template involves several steps to ensure a tailored and effective approach. Following these steps will result in a template uniquely suited to your financial situation and goals.

- Identify Your Financial Goals: Begin by clearly defining your short-term and long-term financial goals. This could include saving for a down payment, paying off debt, investing for retirement, or funding a child’s education.

- Choose a Template Format: Decide on the format for your template. This could be a simple spreadsheet, a dedicated budgeting app, or a more complex financial planning software.

- Develop Your Template Sections: Create the sections Artikeld above (Goal Description, Timeline, Budget Allocation, Progress Tracking, Contingency Planning, and Review Schedule). Tailor these sections to reflect your specific goals and needs.

- Input Your Data: Enter your financial information into the template. This includes your current income, expenses, savings, and debts. Be accurate and thorough.

- Regularly Review and Adjust: Regularly review your progress and make necessary adjustments to your plan. Life circumstances change, so your financial plan should adapt accordingly.

Sample Financial Goal Setting Template

This sample template utilizes bullet points to illustrate the key elements. Remember to adapt it to reflect your individual circumstances and goals.

* Goal: Save $20,000 for a down payment on a car.

* Timeline: 24 months (Start Date: January 1, 2024; Target Completion Date: December 31, 2025).

* Monthly Allocation: $833.33.

* Progress Tracking: A monthly spreadsheet to record savings, with columns for “Month,” “Planned Savings,” “Actual Savings,” and “Difference.”

* Contingency Plan: If unexpected expenses arise, reduce the monthly contribution by 25% and adjust the timeline accordingly.

* Review Schedule: Review progress and make adjustments quarterly (March, June, September, December).

Budgeting and Resource Allocation

Effective budgeting and resource allocation are crucial for achieving your financial goals. A well-structured budget acts as a roadmap, guiding your spending and saving habits towards your desired financial future. This section will explore various budgeting methods and strategies to help you effectively manage your resources and reach your objectives.

Budgeting Methods

Several budgeting methods can be employed to suit individual needs and preferences. Choosing the right method depends on your financial situation, comfort level with budgeting, and personal goals. Two popular methods are the 50/30/20 rule and zero-based budgeting.

The 50/30/20 rule is a simple budgeting method that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Needs include essentials like housing, food, and transportation. Wants encompass discretionary spending such as entertainment and dining out. The remaining 20% is allocated towards building an emergency fund, paying down debt, or investing. This method provides a clear framework for managing expenses and prioritizing savings.

Zero-based budgeting, on the other hand, involves assigning every dollar of your income to a specific expense category. This method requires a detailed analysis of your spending habits and careful planning to ensure all income is accounted for. It’s a more meticulous approach that can be particularly beneficial for those seeking tighter control over their finances and aiming for aggressive savings or debt reduction.

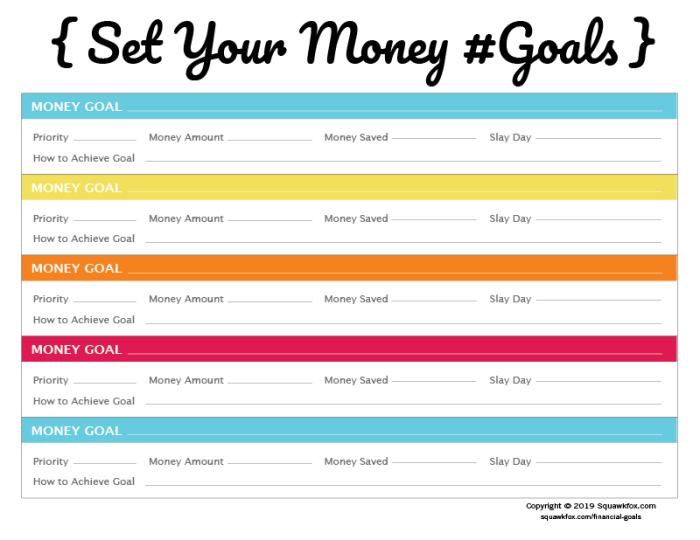

Resource Allocation Strategies

Successfully achieving multiple financial goals simultaneously requires strategic resource allocation. Prioritizing goals based on urgency and importance is essential. Consider using a weighted scoring system to rank your goals based on factors like time sensitivity, financial impact, and personal significance. This will help you allocate resources effectively, ensuring that you make progress on all your goals, even if at different paces. For example, if you’re saving for a down payment on a house and also paying off student loans, you might prioritize the loan repayment to reduce interest costs while still contributing regularly to your savings for the house.

Budget Adjustment Strategies

Life throws curveballs. Unexpected expenses, such as car repairs or medical bills, or changes in income can disrupt your budget. Having a robust contingency plan is crucial. An emergency fund is essential to cover unforeseen circumstances without derailing your financial goals. When unexpected expenses arise, reassess your budget and adjust spending in less critical areas. If your income decreases, consider temporarily reducing spending on non-essential items or exploring additional income streams. Regularly reviewing and adjusting your budget ensures its continued relevance and effectiveness.

Budget Allocation Examples

The following tables illustrate budget allocation for various financial goals. These are examples, and the percentages will vary depending on individual circumstances.

| Category | Emergency Fund (Goal: 3 Months Expenses) | Debt Repayment (Goal: Eliminate Credit Card Debt) | House Down Payment (Goal: 20% Down Payment) |

|---|---|---|---|

| Housing | 30% | 25% | 35% |

| Food | 15% | 15% | 10% |

| Transportation | 10% | 10% | 5% |

| Savings/Investments | 20% | 10% | 30% |

| Other Expenses | 25% | 30% | 20% |

| Category | Retirement Savings (Goal: Comfortable Retirement) | Child’s Education (Goal: College Fund) | Travel (Goal: Annual Vacation) |

|---|---|---|---|

| Housing | 25% | 20% | 30% |

| Food | 10% | 15% | 10% |

| Transportation | 5% | 5% | 10% |

| Savings/Investments | 40% | 30% | 20% |

| Other Expenses | 20% | 30% | 30% |

Tracking Progress and Making Adjustments

Successfully achieving financial goals requires consistent monitoring and proactive adaptation. Regularly tracking your progress allows you to identify areas needing improvement and make necessary adjustments to your financial plan, ultimately increasing your chances of success. Ignoring progress can lead to falling short of your targets and wasting valuable time and resources.

Regular review and adjustment of your financial plan is crucial for staying on track and achieving your goals. Life is dynamic; unforeseen circumstances, changing priorities, and unexpected opportunities will inevitably arise. By consistently evaluating your progress, you can ensure your plan remains relevant and effective in the face of these changes.

Methods for Tracking Financial Progress

Several effective methods exist for tracking your progress toward financial goals. Choosing the right method depends on your personal preferences and technological comfort level. Effective tracking keeps you motivated and informed, highlighting successes and areas needing attention.

- Spreadsheets: Spreadsheets offer a highly customizable and versatile option. You can create a detailed tracking sheet that includes all your financial goals, their target dates, current progress, and any associated expenses or income. For example, you could track your savings progress towards a down payment on a house, noting monthly contributions and the remaining balance. Visualizing your progress graphically, such as using charts to represent savings growth, can enhance motivation.

- Budgeting Apps: Numerous budgeting apps (Mint, YNAB, Personal Capital, etc.) provide automated tracking features, linking directly to your bank accounts and credit cards. These apps often offer visualizations of spending habits and progress toward savings goals. For instance, many apps allow you to categorize spending and automatically track progress toward a specific savings goal, providing clear visuals and notifications.

- Financial Dashboards: For a more comprehensive overview, a financial dashboard can consolidate data from various sources (bank accounts, investment accounts, etc.) into a single, easily digestible view. This provides a holistic picture of your financial health and progress toward multiple goals simultaneously. A well-designed dashboard could display net worth, debt levels, investment performance, and savings progress in a single view, offering a quick snapshot of your overall financial situation.

Importance of Regular Review and Adjustments

Regular review and adjustments are not merely optional; they are essential components of successful financial planning. Life throws curveballs, and your financial plan needs to be agile enough to adapt. Without regular reviews, you risk drifting off course without realizing it, ultimately jeopardizing your chances of achieving your goals.

Strategies for Overcoming Obstacles and Setbacks

Obstacles are inevitable. The key lies in having strategies to navigate them effectively. A proactive approach, involving contingency planning and flexible goal setting, significantly improves your ability to overcome challenges.

- Contingency Planning: Building a buffer into your plan for unexpected expenses (e.g., car repairs, medical bills) helps mitigate the impact of unforeseen events. This buffer can be a dedicated emergency fund or simply a slightly more conservative savings target.

- Goal Prioritization: If faced with a major setback, reassess your goals and prioritize them. Focus on the most crucial goals and temporarily adjust less critical ones. For example, if you experience a job loss, you might temporarily pause contributions to a less urgent savings goal while prioritizing essential expenses and debt repayment.

- Seeking Professional Advice: Don’t hesitate to seek help from a financial advisor. They can offer personalized guidance and support in navigating complex financial situations and adapting your plan to new circumstances.

Adapting the Financial Goal Setting Template

Your financial goal setting template should be a living document, evolving alongside your life. Regularly reviewing and updating it reflects changes in income, expenses, priorities, or unexpected events.

- Income Changes: A salary increase or job loss necessitates immediate adjustments to your budget and savings goals. You might increase savings contributions with a raise or reduce expenses if income decreases.

- Shifting Priorities: As life stages change (marriage, children, retirement), your financial priorities will shift. Your template should reflect these changes, adjusting savings targets and allocating resources accordingly. For instance, saving for a down payment might be replaced by saving for college tuition as children grow older.

- Unexpected Events: Unexpected events like medical emergencies or home repairs require immediate adjustments to your budget. You might need to temporarily reduce savings or use a contingency fund to cover unexpected costs.

Illustrative Examples of Financial Goal Templates

This section provides practical examples of financial goal setting templates tailored to different life stages and financial objectives. These templates illustrate how to apply the principles discussed previously to create personalized plans. Remember, these are examples; you should adapt them to your specific circumstances.

Financial Goal Setting Template: Young Professional Saving for a Down Payment

This template is designed for a young professional aiming to save for a down payment on a house within a specific timeframe. The key is to balance saving aggressively with maintaining a comfortable lifestyle.

| Section | Description | Example |

|---|---|---|

| Goal Definition | Clearly state the desired down payment amount and the target purchase price of the home. Specify the desired timeframe for saving. | Down Payment Goal: $50,000; Target Home Price: $250,000; Timeframe: 3 years |

| Current Financial Situation | Document current income, expenses, savings, and debts. This forms the baseline for your savings plan. | Monthly Income: $4,000; Monthly Expenses: $2,500; Current Savings: $5,000; Debt: $10,000 (student loans) |

| Savings Plan | Artikel a realistic monthly savings amount, considering your income and expenses. Explore options like increasing income or reducing expenses. | Monthly Savings Target: $1,000 (achieved by reducing entertainment spending by $500 and increasing income through a side hustle of $500) |

| Contingency Planning | Identify potential disruptions to your savings plan (e.g., unexpected expenses, job loss) and develop strategies to mitigate their impact. | Emergency Fund: Maintain a 3-6 month emergency fund to cover unexpected expenses. Consider a flexible savings plan to adjust for potential income fluctuations. |

| Progress Tracking | Regularly monitor your savings progress and make adjustments as needed. Use a spreadsheet or budgeting app to track your income, expenses, and savings. | Monthly review of savings progress and adjustments to the savings plan if needed (e.g., reducing expenses if falling behind). |

Financial Goal Setting Template: Family Paying Off Debt and Saving for Children’s Education

This template is for families juggling debt repayment and saving for their children’s education. Prioritization and strategic allocation of resources are crucial.

| Section | Description | Example |

|---|---|---|

| Debt Management | List all debts (mortgages, loans, credit cards), their interest rates, and minimum payments. Develop a debt repayment strategy (e.g., snowball or avalanche method). | Debt 1: Mortgage ($200,000, 4% interest); Debt 2: Student Loan ($30,000, 6% interest); Debt repayment strategy: Avalanche method (focus on highest interest debt first). |

| Education Savings Goals | Specify the desired amount to save for each child’s education, considering college costs and the timeframe until college enrollment. | Child 1: $100,000 by age 18; Child 2: $100,000 by age 18. |

| Budget Allocation | Allocate funds towards debt repayment, education savings, and essential living expenses. Prioritize debt repayment aggressively while still contributing to education savings. | Monthly Budget: $5,000 income; $1,500 debt repayment; $500 education savings; $3,000 living expenses. |

| Investment Strategy | Choose appropriate investment vehicles for education savings, considering risk tolerance and time horizon. | Investment Strategy: 529 plan for tax-advantaged growth. |

| Regular Review and Adjustments | Periodically review your progress and adjust your budget and investment strategy as needed. Consider changes in income, expenses, or interest rates. | Annual review of the debt repayment plan and education savings progress, adjusting allocations as necessary. |

Financial Goal Setting Template: Individual Aiming for Early Retirement

This template helps individuals plan for early retirement by focusing on aggressive savings and investment strategies. Consistent saving and wise investment choices are paramount.

| Section | Description | Example |

|---|---|---|

| Retirement Goal | Define the desired retirement age and the estimated annual income needed during retirement. Consider factors like inflation and lifestyle changes. | Retirement Age: 55; Estimated Annual Retirement Income: $60,000 (adjusted for inflation). |

| Current Financial Status | Assess current income, expenses, savings, and investments. This helps determine the required savings rate. | Monthly Income: $7,000; Monthly Expenses: $3,000; Current Savings: $100,000; Current Investments: $50,000. |

| Savings and Investment Strategy | Develop a comprehensive savings and investment plan to reach the retirement goal. Consider tax-advantaged accounts (401k, IRA) and diversification. | Monthly Savings Target: $2,000; Investment Strategy: Diversified portfolio of stocks, bonds, and real estate. |

| Risk Tolerance Assessment | Assess your risk tolerance and adjust your investment strategy accordingly. Consider your time horizon and the potential for market fluctuations. | Moderate risk tolerance, with a mix of stocks and bonds to balance growth and stability. |

| Regular Portfolio Review | Regularly review and rebalance your investment portfolio to maintain the desired asset allocation and risk level. | Annual portfolio review and rebalancing to adjust for market conditions and changes in risk tolerance. |

Closure

By utilizing a well-structured financial goal-setting template and consistently monitoring your progress, you can effectively navigate the complexities of personal finance. Remember, the key lies in defining SMART goals, allocating resources strategically, and adapting your plan as needed to overcome obstacles and celebrate successes. This structured approach empowers you to take control of your financial future and achieve your desired outcomes.

Query Resolution

What if my income changes unexpectedly?

Adjust your budget immediately. Re-evaluate your priorities and allocate resources accordingly. Consider cutting back on non-essential expenses or seeking additional income sources.

How often should I review my financial goals?

Ideally, review your goals and progress at least quarterly, or more frequently if significant life changes occur.

What if I don’t meet a goal?

Analyze why you fell short. Adjust your plan, perhaps by re-prioritizing goals or revising your timeline. Don’t be discouraged; learn from the experience and keep moving forward.

Are there any software tools to help with goal tracking?

Yes, numerous budgeting apps and software programs can assist with tracking progress, creating budgets, and visualizing financial data. Research options to find one that best suits your needs.