Achieving financial well-being requires a structured approach, and a well-defined financial goal-setting template is the cornerstone of success. This guide delves into the creation and utilization of such a template, providing a clear roadmap for individuals and families to define, track, and achieve their financial aspirations. We’ll explore practical strategies for budgeting, debt management, investment planning, and regular review, empowering you to take control of your financial future.

From understanding SMART goal principles to utilizing various budgeting methods and exploring diverse investment options, this template offers a comprehensive framework. It emphasizes the importance of regular review and adjustment, ensuring your financial plan remains relevant and effective as your circumstances evolve. By the end, you’ll possess the tools and knowledge to build a personalized financial plan that aligns with your unique goals and aspirations.

Defining Financial Goals

Setting clear and achievable financial goals is crucial for building a secure financial future. Without defined objectives, your financial efforts may lack direction and ultimately fall short of your aspirations. This section will guide you through the process of defining effective financial goals using the SMART framework and provide examples to illustrate the process.

Effective financial goal setting relies heavily on the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. This framework ensures your goals are well-defined, trackable, and realistic within your given timeframe and circumstances. Vague aspirations, like “saving more money,” are ineffective; SMART goals transform them into actionable plans. For instance, “saving $5,000 in 12 months for a down payment on a car” is a SMART goal because it is specific, measurable, achievable (depending on income and expenses), relevant to your car purchase goal, and time-bound.

Types of Financial Goals

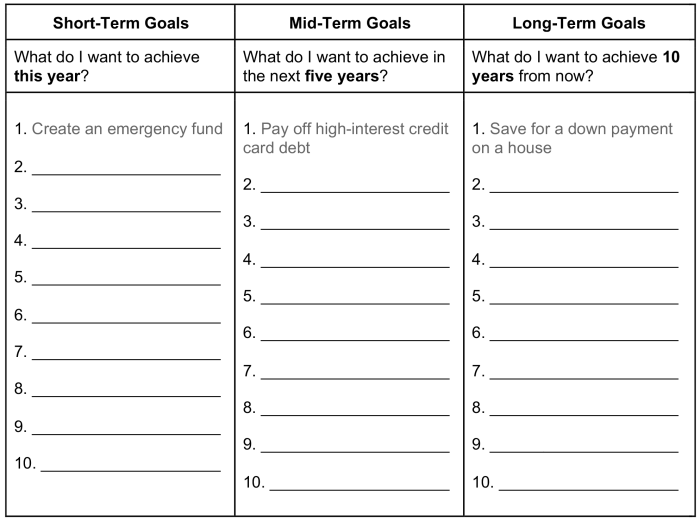

Financial goals encompass a wide range of objectives, varying in their time horizons and the strategies required to achieve them. These can broadly be categorized into short-term, long-term, saving, investing, and debt reduction goals. Short-term goals are typically achieved within a year, while long-term goals extend beyond that timeframe. Saving goals focus on accumulating funds, investing goals involve growing wealth through investments, and debt reduction goals center on eliminating outstanding debts.

Examples of Financial Goals

Several examples can illustrate the application of the SMART framework across various financial goals:

- Short-term saving goal: Save $1,000 in six months for a vacation. This goal is specific (vacation fund), measurable ($1,000), achievable (depending on income and expenses), relevant (vacation), and time-bound (six months).

- Long-term saving goal: Save $50,000 in five years for a down payment on a house. This goal is specific (down payment), measurable ($50,000), achievable (with a consistent savings plan), relevant (home purchase), and time-bound (five years).

- Investing goal: Increase investment portfolio value by 10% annually for the next three years. This is specific (portfolio growth), measurable (10% annual increase), achievable (depending on market conditions and investment strategy), relevant (wealth building), and time-bound (three years). This requires careful consideration of risk tolerance and market volatility.

- Debt reduction goal: Pay off $5,000 in credit card debt within one year. This goal is specific (credit card debt), measurable ($5,000), achievable (through budgeting and debt repayment strategies), relevant (improving financial health), and time-bound (one year).

Financial Goal Setting Table

The following table provides a structured format for outlining your financial goals:

| Goal Type | Time Horizon | Target Amount | Key Metrics |

|---|---|---|---|

| Emergency Fund | 6 months | $10,000 | Monthly savings, emergency fund balance |

| Down Payment (House) | 3 years | $50,000 | Monthly savings, investment returns, down payment fund balance |

| Vacation | 1 year | $3,000 | Monthly savings, vacation fund balance |

| Debt Reduction (Student Loans) | 5 years | $25,000 | Monthly payments, loan balance, interest paid |

Template Structure and Components

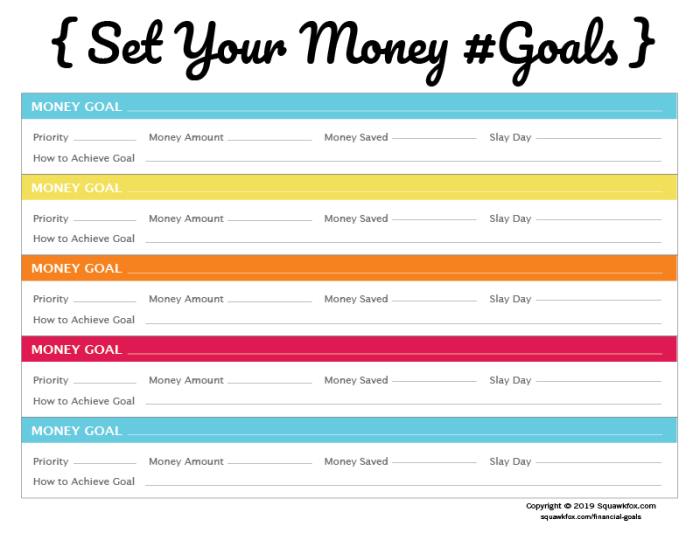

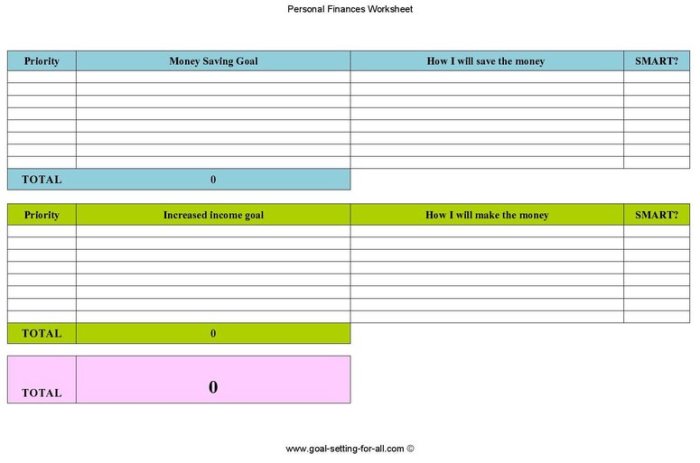

A well-structured financial goal-setting template is crucial for effective planning and achieving your financial aspirations. A clear and organized template simplifies the process, ensuring you consider all essential aspects of your financial future. This allows for easier tracking of progress and adjustments along the way.

A comprehensive financial goal-setting template should include several key components to ensure a holistic approach to financial planning. These components work together to provide a clear picture of your current financial situation, your desired future state, and a roadmap to bridge the gap.

Essential Template Components

The following sections are essential for a robust financial goal-setting template. Each section plays a vital role in creating a comprehensive and actionable plan.

- Current Financial Situation: This section involves documenting your current assets (e.g., savings, investments, property), liabilities (e.g., loans, credit card debt), and income (e.g., salary, rental income). A clear understanding of your starting point is paramount for setting realistic goals.

- Short-Term Goals (0-1 year): This section focuses on immediate financial objectives. Examples include paying off a small debt, saving for a vacation, or building an emergency fund. Specific targets and deadlines should be included.

- Mid-Term Goals (1-5 years): Here, you Artikel medium-term objectives such as saving for a down payment on a house, paying off larger debts, or funding a child’s education. More significant savings and investment strategies should be considered.

- Long-Term Goals (5+ years): This section addresses long-term aspirations, such as retirement planning, purchasing a larger home, or funding long-term care. This requires a robust investment strategy and potentially professional financial advice.

- Action Plan: This section details the specific steps required to achieve each goal. It should include concrete actions, timelines, and responsible parties (if applicable). For example, “Save $500 per month for a down payment; review progress quarterly.”

- Budget Allocation: This section Artikels how you will allocate your income to meet your goals. It may involve adjustments to spending habits or identifying areas where savings can be increased. A detailed budget is essential for tracking progress.

- Review and Adjustment Section: This section allows for regular review of your progress. It provides space to track actual versus planned performance, note any adjustments needed to your goals or action plan, and document any external factors affecting your financial situation.

Logical Organization of Template Sections

The sections should be arranged logically to facilitate a smooth planning process. A suggested order is:

- Current Financial Situation

- Short-Term Goals

- Mid-Term Goals

- Long-Term Goals

- Action Plan

- Budget Allocation

- Review and Adjustment Section

This order allows for a progression from assessing your current standing to defining your aspirations and creating a plan to achieve them. Regular review and adjustment are crucial for staying on track and adapting to changing circumstances.

Budgeting and Expense Tracking

Creating a budget and diligently tracking your expenses are fundamental to achieving your financial goals. Without understanding where your money goes, it’s nearly impossible to effectively save, invest, or pay down debt. A well-structured budget acts as a roadmap, guiding your spending and ensuring you allocate sufficient funds towards your prioritized objectives.

Budgeting involves planning how you will spend your money over a specific period, typically monthly. Effective expense tracking, on the other hand, involves monitoring your actual spending against your planned budget to identify areas for improvement and ensure you remain on track.

Budgeting Methods

Several effective budgeting methods exist, each with its own strengths and weaknesses. Choosing the right method depends on individual preferences and financial situations.

- 50/30/20 Budget: This popular method suggests allocating 50% of your after-tax income to needs (housing, groceries, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. For example, if your after-tax income is $4,000, you would allocate $2,000 to needs, $1,200 to wants, and $800 to savings and debt repayment. This provides a simple framework for balancing essential spending with discretionary spending and financial goals.

- Zero-Based Budgeting: This method assigns every dollar of your income to a specific expense category, ensuring that your income minus expenses equals zero. This requires meticulous planning and tracking but can be highly effective in controlling spending and maximizing savings. An example would be allocating $500 for rent, $200 for groceries, $100 for utilities, and so on, until all income is accounted for. Any leftover funds are then allocated to savings or debt repayment.

Expense Tracking Tools and Techniques

Numerous tools and techniques facilitate expense tracking, ranging from simple spreadsheets to sophisticated budgeting apps.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): Spreadsheets offer a highly customizable and flexible approach to expense tracking. You can manually input your expenses and create formulas to calculate totals, percentages, and other relevant metrics. This method provides complete control but requires more manual effort. A typical spreadsheet would have columns for date, category, description, and amount.

- Budgeting Apps (e.g., Mint, YNAB, Personal Capital): Budgeting apps automate many aspects of expense tracking by connecting to your bank accounts and credit cards. They often provide features such as category analysis, budgeting tools, and financial goal setting. While convenient, these apps may require sharing your financial data, and some offer premium features at an additional cost. For example, Mint automatically categorizes transactions, allowing users to quickly see where their money is going.

- Manual Tracking (e.g., Notebook, Journal): While less convenient, manually tracking expenses in a notebook or journal can foster greater awareness of spending habits. This method can be particularly useful for individuals who prefer a tangible record of their finances. A simple notebook entry might include the date, item purchased, and the cost.

The effectiveness of each method depends on individual preferences and technological comfort. Spreadsheet software provides maximum control and customization but demands more manual input, while budgeting apps automate the process but require sharing financial data. Manual tracking offers a simple, tangible record but is less efficient for managing larger budgets.

Income Projections and Sources

Accurately projecting your future income is crucial for effective financial goal setting. Understanding your current income and realistically estimating future earnings allows for a more accurate assessment of your financial capabilities and helps you create achievable financial plans. This section will guide you through the process of projecting your income and identifying potential additional income streams.

Accurate income projection involves more than simply assuming your current income will remain constant. It requires considering factors such as potential salary increases, promotions, bonuses, and other forms of compensation. It also involves anticipating potential changes in employment status or career trajectory. By considering these factors, you can create a more realistic and adaptable financial plan.

Strategies for Projecting Future Income

Developing realistic income projections requires a thorough analysis of your current financial situation and future prospects. Consider your current salary, the likelihood of salary increases based on your industry and performance reviews, and any potential bonuses or commissions. Research salary trends for similar roles in your geographic area to gain a broader perspective. For example, if you are a software engineer in San Francisco, researching average salary increases for software engineers in that city will provide a valuable benchmark. If you anticipate a career change, research the average salary for your target role. Factor in any potential career advancement opportunities and their associated salary increases. Remember, these projections should be conservative, accounting for potential unforeseen circumstances.

Identifying Potential Income Sources Beyond Regular Employment

Diversifying your income streams can significantly enhance your financial security and accelerate progress toward your financial goals. Several avenues exist beyond your primary employment, offering opportunities to increase your earnings and build wealth.

Potential Income Streams and Projected Contributions

| Income Source | Projected Annual Income | Notes |

|---|---|---|

| Primary Employment (Salary) | $70,000 | Current salary, projected 3% annual increase |

| Freelance Consulting | $10,000 | 10 hours/week at $50/hour, projected to increase with experience |

| Investment Income (Dividends & Interest) | $2,000 | Based on current investments, projected growth of portfolio |

| Rental Income (Real Estate) | $12,000 | Projected rental income from a single property, accounting for vacancy and maintenance |

Debt Management Strategies

Tackling debt effectively requires a strategic approach. Understanding different debt management strategies and choosing the right one for your circumstances is crucial for achieving financial freedom. This section Artikels several popular methods, compares their strengths and weaknesses, and provides a structured approach to creating a personalized debt repayment plan.

Debt Snowball Method

The debt snowball method prioritizes paying off the smallest debts first, regardless of interest rates. This approach focuses on building momentum and motivation. By quickly eliminating smaller debts, you experience early wins, boosting your confidence and reinforcing positive financial habits. This psychological benefit can be significant in maintaining adherence to your repayment plan.

Debt Avalanche Method

In contrast to the snowball method, the debt avalanche method prioritizes paying off debts with the highest interest rates first. While this may not provide the same immediate psychological boost, it ultimately saves you more money in interest charges over the long term. This is the mathematically optimal strategy for minimizing the total cost of debt.

Comparing Debt Snowball and Debt Avalanche

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Prioritization | Smallest debt balance first | Highest interest rate first |

| Motivation | High, due to quick wins | Lower initially, but higher long-term satisfaction from cost savings |

| Financial Savings | Lower overall savings | Higher overall savings |

| Example | Paying off a $500 credit card before a $10,000 student loan | Paying off a high-interest credit card before a lower-interest car loan |

Creating a Debt Repayment Plan

A well-structured debt repayment plan is essential for success. Follow these steps to create your personalized plan:

- List all debts: Include the creditor, balance, interest rate, and minimum payment for each debt.

- Choose a method: Decide whether to use the debt snowball or debt avalanche method based on your personal preferences and financial situation. Consider your need for quick wins versus long-term cost savings.

- Create a budget: Develop a detailed budget that identifies areas where you can reduce spending to allocate more funds towards debt repayment.

- Prioritize payments: Allocate extra funds towards your prioritized debt according to your chosen method.

- Track progress: Regularly monitor your progress and adjust your plan as needed. Celebrate milestones to maintain motivation.

- Seek professional help: If you are struggling to manage your debt, consider seeking advice from a financial advisor or credit counselor.

Remember, consistency and discipline are key to successfully managing and eliminating debt.

Investment Planning and Strategies

Investing wisely is a crucial component of achieving long-term financial goals. A well-defined investment strategy, tailored to your individual circumstances, can significantly impact your financial future, allowing your money to grow and work for you. This section Artikels different investment options and strategies to help you navigate this important aspect of financial planning.

Different Investment Options

Several investment options cater to varying risk tolerances and financial objectives. Understanding the characteristics of each is key to making informed decisions.

- Stocks: Represent ownership in a company. Their value fluctuates based on company performance and market conditions. Stocks generally offer higher potential returns but also carry higher risk compared to other options. For example, investing in a technology company’s stock could yield substantial profits if the company thrives, but could also lead to significant losses if the company underperforms or the overall tech sector declines.

- Bonds: Represent a loan to a company or government. They typically offer lower returns than stocks but are considered less risky. Bondholders receive regular interest payments and the principal amount at maturity. A government bond, for instance, is generally considered a safer investment than a corporate bond due to the lower risk of default.

- Real Estate: Investing in properties, either for rental income or appreciation, can be a long-term strategy. Real estate investments offer potential for both income generation and capital growth. However, they require significant capital outlay and involve ongoing management responsibilities. For example, purchasing a rental property can provide a steady stream of rental income, while the property’s value may also appreciate over time.

- Mutual Funds: These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management, reducing the risk associated with individual stock picking. A mutual fund focused on large-cap US companies, for example, provides exposure to a range of established businesses, mitigating the risk associated with investing in a single company.

Asset Allocation and Risk Management

Asset allocation is the process of dividing your investment portfolio across different asset classes (stocks, bonds, real estate, etc.). It’s a cornerstone of effective risk management. A well-diversified portfolio reduces the impact of poor performance in any single asset class.

A balanced portfolio typically includes a mix of higher-risk, higher-return assets and lower-risk, lower-return assets.

For example, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, accepting higher risk for potentially greater returns. Conversely, an older investor nearing retirement might prefer a more conservative allocation with a higher proportion of bonds to preserve capital.

Choosing an Investment Strategy

Selecting an investment strategy involves considering your risk tolerance and time horizon. Risk tolerance refers to your comfort level with the potential for investment losses, while your time horizon is the length of time you plan to invest your money.

- Risk Tolerance: Investors with a high risk tolerance are comfortable with the possibility of significant losses in pursuit of higher returns. Conversely, those with a low risk tolerance prioritize capital preservation and accept lower potential returns.

- Time Horizon: A longer time horizon allows investors to ride out market fluctuations and potentially benefit from long-term growth. Shorter time horizons necessitate a more conservative approach to minimize potential losses.

For instance, a young investor with a high risk tolerance and a long time horizon might invest heavily in stocks, while an older investor with a low risk tolerance and a short time horizon might prefer a portfolio heavily weighted towards bonds and cash equivalents. A middle-aged investor with a moderate risk tolerance and a medium time horizon might choose a balanced portfolio comprising stocks, bonds, and possibly real estate.

Regular Review and Adjustment

Regularly reviewing and adjusting your financial goals and plans is crucial for staying on track and achieving your long-term financial objectives. Life is dynamic, and your financial situation, goals, and priorities will inevitably change over time. Without periodic review, your plan may become outdated and ineffective, potentially leading to missed opportunities or unforeseen financial difficulties.

Consistent monitoring allows for proactive adjustments, ensuring your plan remains aligned with your evolving needs and circumstances. This process involves tracking your progress, identifying areas for improvement, and making necessary modifications to your budget, investment strategies, and debt management approaches.

Progress Tracking Methods

Effective progress tracking involves comparing your actual financial performance against your planned targets. This can be achieved through various methods, including using budgeting apps, spreadsheets, or financial software. These tools facilitate the monitoring of income, expenses, savings, and investment growth. Regularly reviewing these records allows you to identify discrepancies between your planned and actual performance, highlighting areas needing attention. For instance, if your actual savings are consistently lower than your target, you can analyze your spending habits to identify areas for reduction. Similarly, if your investment returns are below expectations, you might need to reassess your investment strategy.

Identifying Areas for Improvement

Identifying areas for improvement requires a thorough analysis of your financial performance relative to your goals. This may involve comparing your actual spending against your budget, assessing your investment portfolio’s performance, and reviewing your debt repayment progress. Analyzing these areas can reveal patterns and trends that highlight potential issues. For example, consistently exceeding your budgeted amount on dining out might indicate a need to adjust your spending habits in that category. Alternatively, underperforming investments may require a shift in your investment strategy or a review of your risk tolerance.

Sample Review Schedule

A structured review schedule ensures consistent monitoring and timely adjustments. The frequency of review depends on individual needs and circumstances, but a regular schedule is recommended.

- Monthly Review: This involves checking your budget against actual spending, tracking your progress towards savings goals, and reviewing any recent transactions for irregularities. This allows for quick identification and correction of minor deviations.

- Quarterly Review: A more in-depth review of your financial progress, comparing your actual performance against your annual targets. This includes assessing your investment portfolio performance, reviewing your debt repayment plan, and adjusting your budget as needed based on any significant changes in your income or expenses. For example, a significant increase in income could allow for an increase in savings or investment contributions.

- Annual Review: A comprehensive review of your entire financial plan, taking into account any significant life changes, such as a change in employment, marriage, or the birth of a child. This review should involve re-evaluating your financial goals, adjusting your budget, and revising your investment strategy to align with your long-term objectives. Consider reviewing your insurance coverage and estate planning documents as well.

Visual Representation of Financial Data

Visual aids significantly enhance our understanding and interpretation of complex financial information. Transforming raw numbers into easily digestible charts and graphs allows for quicker identification of trends, patterns, and areas needing attention within your financial plan. This visual approach makes it easier to monitor progress towards your goals and make informed decisions.

Visual representations are crucial for effective financial planning because they simplify complex data, revealing insights that might be missed when analyzing raw numbers alone. By presenting data in a visually appealing and easily understandable format, charts and graphs facilitate better decision-making and encourage consistent monitoring of financial health.

Types of Charts for Financial Data

Several chart types are particularly well-suited for representing various aspects of financial data. The choice depends on the specific information you want to highlight.

- Bar Charts: Ideal for comparing different categories of data, such as monthly expenses across various categories (housing, food, transportation).

- Line Graphs: Best for showing trends over time, such as the growth of investments or changes in net worth over several years.

- Pie Charts: Effective for displaying the proportion of a whole, such as the breakdown of your monthly income allocation among savings, investments, and expenses.

Sample Chart: Projected Income vs. Expenses

Consider a line graph depicting projected income versus expenses over a 12-month period. The horizontal axis represents the months (January to December), and the vertical axis represents the monetary value in dollars. Two lines are plotted: one for projected monthly income, which shows a relatively consistent upward trend reflecting a potential salary increase in July, and another for projected monthly expenses, which fluctuates slightly throughout the year, showing higher expenses during holiday months (November and December). The area between the two lines represents the difference between income and expenses (either surplus or deficit) for each month. Ideally, the income line should consistently remain above the expense line, indicating a positive cash flow each month. If the expense line surpasses the income line in any month, it highlights a potential deficit that requires attention and adjustment in the budget. This visual representation quickly reveals overall financial health and potential areas needing improvement. For example, if the gap between income and expenses shrinks significantly in certain months, it could signal the need for increased savings or reduced spending in those periods.

Final Wrap-Up

In conclusion, a well-structured financial goal-setting template is not merely a document; it’s a dynamic tool for building a secure financial future. By diligently defining your goals, tracking your progress, and adapting your strategy as needed, you can navigate the complexities of personal finance with confidence. This template provides the structure; your dedication and commitment will provide the results. Start planning your financial success today.

Question Bank

What if my income fluctuates significantly?

Incorporate a buffer into your budget to account for income variability. Consider using a flexible budgeting method that allows for adjustments based on actual income received.

How often should I review my financial goals?

Ideally, review your financial goals and plan at least quarterly, or more frequently if significant life changes occur (job change, marriage, etc.).

What if I don’t meet my goals?

Don’t be discouraged! Analyze why you fell short, adjust your plan accordingly, and recommit to your financial objectives. Flexibility and persistence are key.

Where can I find additional resources for financial education?

Numerous reputable online resources, books, and financial advisors offer valuable insights and support. Consider seeking professional advice if needed.