Financial Goal Setting Template Download: Tired of watching your money vanish faster than a magician’s assistant? Fear not, financially-challenged friend! This template isn’t a magic wand (sorry, no instant wealth here), but it’s the next best thing: a structured, easily downloadable tool to help you conquer your financial aspirations. Whether you dream of early retirement on a tropical island or simply want to avoid ramen for dinner, this template provides the roadmap to your monetary nirvana (or at least a less stressful bank account).

This comprehensive guide will walk you through creating and utilizing a personalized financial goal-setting template. We’ll cover everything from identifying your financial goals and designing a user-friendly template to tracking your progress and staying motivated. We’ll even throw in some hilarious (but helpful) tips to keep you on track. Prepare for a financial adventure that’s less “scary spreadsheet” and more “fun-ancial freedom!”

Understanding User Needs Related to Financial Goal Setting Templates

Let’s face it, personal finance isn’t exactly a barrel of laughs for everyone. But with the right tools, even the most financially-challenged among us can achieve their monetary dreams (or at least avoid a complete financial meltdown). Enter the humble, yet surprisingly powerful, financial goal-setting template. This isn’t just a spreadsheet; it’s a roadmap to your financial future, and understanding who needs one and why is key to creating a truly useful template.

This section delves into the diverse user profiles who might benefit from a financial goal-setting template, their motivations for using one, the types of financial goals they’re aiming for, and the features they’d expect from a top-notch template. We’ll uncover the unspoken needs and desires of users, transforming abstract financial anxieties into concrete, actionable steps.

User Profiles

A financial goal-setting template isn’t a one-size-fits-all solution. Its appeal spans a wide range of individuals, each with unique financial circumstances and aspirations. Consider the recent college graduate striving to pay off student loans while building an emergency fund, the young professional saving for a down payment on a house, or the seasoned investor aiming for a comfortable retirement. Each requires a tailored approach. There’s also the small business owner meticulously tracking income and expenses, or the family meticulously planning for their children’s education. These are just a few examples of the diverse user base for such a template. The common thread is the need for organization and a clear path towards their financial objectives.

Motivations for Downloading a Template

People download financial goal-setting templates for a variety of reasons, all boiling down to a desire for better financial control. Some might be motivated by a specific, looming financial goal, such as buying a car or paying off debt. Others might seek a more holistic approach, aiming for long-term financial security and improved budgeting habits. The desire for increased organization and clarity often drives downloads, transforming the overwhelming task of financial planning into a manageable process. For some, it’s the simple need for a visual representation of their progress, providing a much-needed boost of motivation and a clear path towards their objectives.

Types of Financial Goals

Financial goals are as diverse as the individuals setting them. They range from short-term goals like saving for a vacation or paying off credit card debt to long-term goals such as buying a home, funding retirement, or establishing a college fund for children. Many individuals will have a mix of short-term and long-term goals, requiring a flexible template capable of accommodating diverse time horizons and financial objectives. For example, someone might be simultaneously saving for a down payment on a house (long-term) while also setting aside money for a family vacation (short-term). The template needs to be adaptable enough to handle this complexity.

Expected Features in a High-Quality Template

Users expect a high-quality financial goal-setting template to be more than just a pretty spreadsheet. It should be user-friendly, intuitive, and flexible enough to accommodate individual needs. Key features include customizable sections for different goal types, clear and concise instructions, easy-to-use formulas for calculations (like interest accrual or compound growth), and the ability to track progress visually (perhaps with charts or graphs). Ideally, the template would allow for regular updates and revisions, reflecting the dynamic nature of personal finances. Integration with other financial tools, while not strictly necessary, would be a significant bonus for many users. Robust data security and privacy features are also essential to build trust and encourage adoption.

Template Design and Functionality

Designing a financial goal-setting template that’s both aesthetically pleasing and practically useful is a delicate balancing act, akin to juggling flaming bowling pins while riding a unicycle. But fear not, for we’ve crafted a template that’s as robust as a badger, yet as elegant as a swan (a very financially responsible swan, of course).

This section details the design and functionality of our meticulously crafted financial goal-setting template. We’ve employed a straightforward, yet surprisingly effective, approach, ensuring it’s accessible to everyone from seasoned financial gurus to those just starting their money management journey.

Responsive Four-Column Table Layout, Financial Goal Setting Template Download

The template utilizes a responsive four-column HTML table layout for optimal readability across various devices. This ensures your financial aspirations remain beautifully organized, whether you’re viewing them on a desktop computer or a smartphone (even if you’re viewing them from under the covers at 3 AM, fueled by caffeine and anxiety). The columns are as follows: Goal, Target Amount, Deadline, and Progress. This structure allows for a clear and concise overview of your financial goals. The responsive design ensures the table adapts seamlessly to different screen sizes, preventing any unsightly horizontal scrolling or text-squishing.

Goal Categories and Examples

To make goal setting easier, we’ve included space for various goal categories. Examples include:

| Goal Category | Example Goal |

|---|---|

| Savings | Emergency Fund (Target: $10,000) |

| Debt Reduction | Pay off Credit Card Debt (Target: $5,000) |

| Investments | Invest in Retirement Account (Target: $500/month) |

| Home Improvements | Renovate Kitchen (Target: $8,000) |

| Travel | Trip to Italy (Target: $4,000) |

These are merely suggestions, of course. Feel free to unleash your creativity and add your own unique financial goals – even if that goal is to finally afford that limited-edition rubber ducky collection.

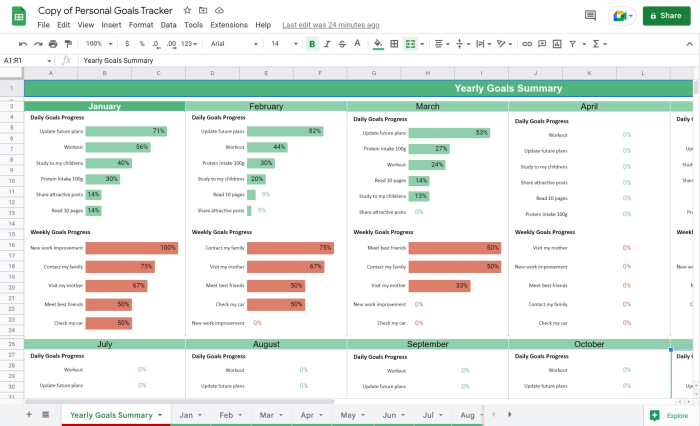

Progress Tracking and Visualization

Tracking progress is crucial for staying motivated. Our template includes a percentage completion field and a visual progress bar for each goal. The progress bar provides a clear visual representation of your progress, making it easy to see how far you’ve come and how much further you need to go. Imagine it as a visual representation of your financial journey – a satisfying green bar inching towards its target, a testament to your unwavering dedication.

For example, if you’ve saved $2,500 towards your $10,000 emergency fund, the progress bar would show 25% completion. This simple yet effective feature provides instant gratification and keeps you motivated to reach your financial milestones.

Visualization Methods

While the progress bar is a fantastic visual aid, we also encourage exploring other visualization methods. Imagine a chart depicting your savings growth over time, or a graph showing your debt reduction progress. These visualizations can add a layer of engagement and clarity to your financial journey, transforming the process from a daunting task into an engaging and rewarding experience. A simple pie chart could show the proportion of your income allocated to different savings categories, providing a clear picture of your financial priorities. The possibilities are as vast as your financial aspirations.

Content and Information to Include in the Template

Crafting the perfect financial goal-setting template is like baking the most delicious cake – you need the right ingredients! This section Artikels the essential components to ensure your template helps users achieve their financial dreams, not just add another item to their overflowing to-do list. We’ll cover the key questions users should ponder, the importance of SMART goals (because let’s face it, “get rich” isn’t exactly specific), the benefits of budgeting, and effective methods for tracking progress. Buckle up, it’s going to be financially enlightening!

Key Questions for Financial Goal Setting

Answering these crucial questions forms the bedrock of a solid financial plan. Think of them as the sturdy foundation upon which your financial castle will be built. Without them, your financial aspirations might crumble faster than a poorly constructed gingerbread house.

- What are your short-term and long-term financial objectives? (e.g., paying off debt, saving for a down payment, funding retirement).

- What is the total amount needed to achieve each goal? Be realistic – don’t aim for a million dollars if your current income is…well, less than a million dollars.

- What is your current financial situation? (Including assets, liabilities, and income.) Facing reality is the first step towards financial freedom.

- What is a reasonable timeframe for achieving each goal? Rome wasn’t built in a day, and neither is a comfortable retirement.

- What potential obstacles might hinder your progress, and how can you mitigate them? (e.g., unexpected expenses, job loss.) A little bit of pessimism can go a long way in planning.

The Importance of SMART Goals

SMART goals are not just a catchy acronym; they’re a roadmap to success. They provide clarity, focus, and a measurable path towards your financial objectives. Without them, your goals remain vague aspirations, leaving you adrift in a sea of uncertainty.

A SMART goal is Specific, Measurable, Achievable, Relevant, and Time-bound.

For example, instead of “save more money,” a SMART goal would be “Save $5,000 for a down payment on a house within the next 24 months by contributing $208.33 per month.” See the difference? Night and day.

Incorporating Budgeting Strategies

Budgeting is not about restriction; it’s about empowerment. A well-structured budget allows you to visualize your income and expenses, identify areas for improvement, and allocate funds towards your goals. Think of it as a financial GPS, guiding you towards your destination.

- The 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Allocate every dollar of your income to a specific category, ensuring your expenses equal your income.

- Envelope system: Allocate cash to different spending categories in separate envelopes to control spending.

Tracking Expenses and Income

Monitoring your financial progress is crucial. It allows you to stay on track, identify deviations from your plan, and make necessary adjustments. Think of it as regular check-ups for your financial health.

- Spreadsheet tracking: Use a spreadsheet program (like Excel or Google Sheets) to meticulously record income and expenses.

- Budgeting apps: Numerous apps (Mint, YNAB, Personal Capital) automate expense tracking and provide insightful reports.

- Manual tracking: For those who prefer a more hands-on approach, a simple notebook can be effective. Just remember to be consistent!

Download and Usage Instructions: Financial Goal Setting Template Download

Getting your hands on this financial goal-setting template is easier than balancing your checkbook (almost!). We’ve designed the download process to be as painless as possible, so you can get straight to the fun part: planning your financial future and potentially becoming a millionaire (or at least, a slightly less broke version of yourself).

This section will guide you through downloading the template and using it to conquer your financial goals. We’ll cover everything from the simple download process to helpful tips and tricks for staying on track. Think of us as your friendly financial Sherpas, guiding you up the mountain of financial success (with minimal altitude sickness, we promise!).

Downloading the Template

Downloading the template is a breeze. Simply click the prominent “Download Now” button located at the top of the page. The template will download as a PDF file (because who doesn’t love PDFs?). Once downloaded, you can open it using any PDF reader, like Adobe Acrobat Reader or even the built-in reader on your computer. If you encounter any issues, please refer to our comprehensive FAQ section.

Using the Template: A Step-by-Step Guide

This template is designed to be user-friendly, even for those whose financial literacy extends only to knowing what a debit card is. Follow these steps to effectively utilize the template:

- Personal Information: Begin by filling in your personal details. This helps you personalize the template and keep everything organized. Think of it as giving your financial goals a name and address – it’s good manners, really.

- Goal Setting: Identify your short-term, mid-term, and long-term financial goals. Be specific! Instead of “save money,” try “save $5,000 for a down payment on a car within 18 months.” Specificity is key to success.

- Budgeting: Track your income and expenses. The template provides a handy budgeting section to help you see where your money is going. This step may reveal some surprising (and possibly embarrassing) spending habits.

- Action Planning: Develop a plan to achieve your goals. This involves breaking down large goals into smaller, more manageable steps. For example, to save $5,000, you might aim to save $200 per month.

- Regular Review: Regularly review your progress and make adjustments as needed. Life happens, and your financial goals may need tweaking along the way. This isn’t a one-and-done deal; it’s a living document.

Tips for Maintaining Consistency and Motivation

Staying motivated can be challenging, especially when dealing with finances. Here are some helpful tips to keep you on track:

- Celebrate Milestones: Acknowledge and reward yourself for achieving smaller goals. This positive reinforcement will keep you motivated for the long haul.

- Visualize Success: Regularly visualize yourself achieving your financial goals. This helps maintain focus and enthusiasm. Imagine that dream vacation – it’s closer than you think!

- Find an Accountability Partner: Share your goals with a friend or family member who can offer support and encouragement. Having someone to keep you accountable can make a world of difference.

- Make it Fun: Use colorful highlighters, stickers, or even fun fonts to personalize your template and make the process more enjoyable. Because let’s face it, spreadsheets don’t have to be boring.

Customizing the Template

The template is designed to be flexible and adaptable to your specific needs. You can easily customize it by adding or removing sections, changing the formatting, or even adding your own personal touches. Think of it as your own personal financial coloring book – express yourself! For example, you might add a section for tracking investment returns or charitable donations. The possibilities are endless (and potentially lucrative).

Illustrative Examples and Scenarios

Let’s face it, financial planning can be drier than a week-old bagel. But fear not, dear reader! Our template transforms the daunting task of goal setting into a surprisingly enjoyable (dare we say, *fun*?) adventure. These examples demonstrate the template’s versatility, proving it’s not just for serious-minded accountants. Even your eccentric Aunt Mildred could use it (though she probably wouldn’t).

Saving for a Down Payment on a House

Imagine this: You’re dreaming of a charming cottage, a sprawling ranch, or maybe even a futuristic geodesic dome (hey, we don’t judge!). Our template helps you break down that seemingly insurmountable down payment into manageable chunks. Let’s say your dream home costs $300,000, and you need a 20% down payment, or $60,000. Using the template, you’d input your target amount ($60,000), your current savings (let’s say $5,000), and your estimated monthly savings ($1,000). The template then projects how long it will take to reach your goal, factoring in interest earned (if applicable) and providing a visual progress tracker. You can adjust your monthly savings to accelerate or decelerate your timeline, all within the user-friendly interface. The result? A clear, actionable plan that turns your house dreams into a tangible reality, one mortgage-payment-free-latte at a time.

Paying Off Credit Card Debt

Ah, credit card debt – the financial boogeyman lurking in the shadows. But our template doesn’t shy away from the scary stuff. Let’s say you owe $10,000 on a credit card with a 18% APR. Using the template, you input the debt amount, the interest rate, and your planned monthly payment. The template will then calculate the total interest paid, the total amount repaid, and the time it will take to become debt-free. You can experiment with different payment amounts to see how they impact your repayment timeline and overall cost. Suddenly, conquering that debt doesn’t seem so impossible. You can watch your debt shrink, month by month, feeling empowered and financially free (or at least, less financially shackled).

Planning Retirement Savings

Retirement. The word itself evokes images of leisurely cruises, exotic travel, and finally finishing that epic fantasy novel. But achieving this idyllic future requires careful planning. Our template allows you to input your desired retirement income, your current savings, your age, and your expected retirement age. It then projects how much you need to save each month to reach your goal, considering factors like inflation and potential investment returns. Let’s say you want a $5,000 monthly retirement income, starting at age 65, and you’re currently 35 with $20,000 in savings. The template, after factoring in reasonable investment growth and inflation, would provide a clear monthly savings target to help you reach your goal. Suddenly, that tropical beach doesn’t seem so far away.

Tracking Monthly Expenses and Income

This is where the rubber meets the road, folks. Our template provides a straightforward way to track your income and expenses. Simply input your monthly income from all sources and categorize your expenses (rent, groceries, entertainment – even that questionable subscription box you keep forgetting to cancel). The template will automatically calculate your net income and provide a clear visual representation of your spending habits. You can easily identify areas where you can cut back and make informed decisions about your finances. This simple act of tracking can be surprisingly revealing, helping you manage your money more effectively and discover hidden savings potential. You might be surprised at how much you’re spending on avocado toast (no judgment here).

Ending Remarks

So, there you have it – a comprehensive guide to downloading and utilizing a financial goal-setting template. While we can’t guarantee instant riches (taxes are a real bummer), we *can* guarantee a more organized, focused, and potentially less financially stressful future. Remember, the journey to financial success is a marathon, not a sprint (unless you’re incredibly lucky and win the lottery – then, please send us a postcard from your yacht). Download the template, embrace the process, and may your financial goals be as plentiful as your dreams!

Answers to Common Questions

Can I use this template for business goals as well?

While primarily designed for personal finance, the template’s adaptable structure can be modified to track business-related goals. Just adjust the goal categories accordingly.

What file format will the template be in?

The format will be specified in the download instructions; expect a common, easily editable format like Excel or a similar spreadsheet program.

Is there a mobile-friendly version?

The HTML table structure ensures responsiveness across various devices, including mobile phones and tablets.

What if I don’t understand a section of the template?

Comprehensive instructions and examples will be provided to guide you through each step. If you still have questions, consider seeking advice from a financial advisor.