Financial Goal Setting Template Download: Unlocking your financial future just got easier! Forget vague aspirations and embrace the power of planning. This template isn’t just a spreadsheet; it’s your personalized roadmap to achieving those big (and small!) financial goals, whether it’s finally paying off that pesky credit card debt, saving for a dream vacation, or securing your retirement. We’ll guide you through creating a plan that’s as unique as your financial journey.

From understanding your motivations and crafting SMART goals to choosing the right template type and ensuring its legal soundness, we’ll equip you with the knowledge and tools to make your financial dreams a reality. We’ll explore various template designs, discuss progress tracking, and even touch upon the ethical considerations of handling your financial data. Get ready to ditch the guesswork and embrace a structured approach to financial success!

Understanding User Search Intent Behind “Financial Goal Setting Template Download”

The search query “financial goal setting template download” reveals a fascinating blend of ambition and, let’s be honest, a healthy dose of procrastination. These digital treasure hunters aren’t just looking for a spreadsheet; they’re searching for a shortcut to financial freedom, a roadmap to their dreams, perhaps even a magic spell to banish debt. Understanding their motivations is key to crafting a template that truly resonates.

The diverse motivations behind this search stem from a universal human desire: to achieve financial security and prosperity. However, the specifics vary widely depending on individual circumstances.

User Profiles and Motivations

The individuals searching for financial goal-setting templates represent a broad spectrum of ages, income levels, and financial literacy. We see young adults fresh out of college, eager to conquer student loans and build a solid financial foundation. Mid-career professionals, juggling mortgages, family expenses, and retirement planning, are another significant group. And finally, we have the seasoned investors, looking to optimize their portfolios and ensure a comfortable retirement. Their shared need is a structured approach, but their goals and resources differ greatly. A recent study by the National Endowment for Financial Education found that only 57% of adults have a written financial plan – a clear indication of the need for tools like these templates.

User Needs and Pain Points

These users often grapple with feelings of overwhelm and uncertainty. Many lack the knowledge or confidence to create a comprehensive financial plan from scratch. They might feel lost in a sea of financial jargon, intimidated by complex calculations, or simply lack the time to dedicate to meticulous planning. Others may have started planning but struggle to stay organized and track their progress effectively. The common thread is a desire for simplicity and structure, a tangible tool to help them take control of their financial future.

Examples of Financial Goals, Financial Goal Setting Template Download

The types of financial goals users are pursuing are as varied as the users themselves. Some might be focused on short-term goals like paying off credit card debt or saving for a down payment on a house. Others might be aiming for longer-term goals, such as funding their children’s education or securing a comfortable retirement. A wealthy investor might be looking to optimize their investment portfolio for tax efficiency, while a young adult might be setting savings goals for a dream vacation. The template needs to be flexible enough to accommodate all these ambitions, from the modest to the magnificent. Consider these examples: a young couple saving for a wedding, a family aiming to pay off their mortgage early, or a retiree aiming to manage their investment portfolio for a secure income stream.

Types of Financial Goal Setting Templates

Ah, financial goal setting – the thrilling pursuit of fiscal fitness! It’s less about crunching numbers and more about crafting a roadmap to your dreams, whether it’s a down payment on a llama farm or finally paying off that slightly embarrassing inflatable dinosaur you bought on impulse. The right template can be your trusty Sherpa on this journey.

Choosing the right template is crucial; it’s like selecting the perfect tool for the job. A Swiss Army knife might be handy, but it’s not ideal for brain surgery (unless you’re a very, very skilled surgeon, in which case, please ignore this analogy). Let’s explore the diverse landscape of financial goal-setting templates.

Financial Goal Setting Template Types

The following table compares various financial goal-setting templates. Remember, the “best” template depends entirely on your unique financial aspirations (and how much you enjoy spreadsheet sorcery).

| Template Type | Features | Pros | Cons |

|---|---|---|---|

| Short-Term Goals (e.g., Emergency Fund) | Specific savings goal, timeline (usually under 1 year), tracking progress | Easy to visualize progress, quick wins boost motivation, manageable timeframe. | Limited scope, may not address long-term financial health. |

| Long-Term Goals (e.g., Retirement, House Down Payment) | Projected income, expenses, investment growth projections, long-term timeline (5+ years) | Comprehensive planning, addresses major financial milestones, allows for adjustments. | Requires more detailed financial information, less immediate gratification. |

| Debt Reduction | List of debts, interest rates, minimum payments, payoff strategies (debt snowball, avalanche) | Focuses on eliminating debt, improves credit score, reduces financial stress. | Can be emotionally challenging, requires discipline and commitment. |

| Investment Tracking | Investment accounts, asset allocation, returns, projected growth | Monitors investment performance, helps make informed decisions, tracks progress towards goals. | Requires understanding of investment concepts, can be complex to manage. |

Debt Reduction Template Sample

This template focuses on conquering your debts. Remember, consistency is key; think of it as a financial martial arts training regimen.

| Debt Type | Balance | Interest Rate | Minimum Payment | Payment Plan (Amount & Frequency) |

|---|---|---|---|---|

| Credit Card A | $1,500 | 18% | $50 | $100 monthly |

| Student Loan | $10,000 | 5% | $100 | $150 monthly |

| Personal Loan | $2,000 | 8% | $75 | $125 monthly |

Visual Representations

Visuals can transform a dry spreadsheet into an engaging motivational tool. Imagine a progress bar for each debt, dynamically updating as payments are made. The bar starts full, representing the total debt, and shrinks as payments are applied, showing tangible progress. Alternatively, a pie chart could visually represent the allocation of your budget across different categories, highlighting spending habits and areas for potential savings. Think of it as a financial kaleidoscope, constantly shifting to reflect your progress.

Incorporating SMART Goals

SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) are the backbone of effective financial planning. For instance, instead of a vague goal like “pay off debt,” a SMART goal would be: “Pay off my $5,000 credit card debt by December 31, 2024, by making minimum payments plus an extra $200 per month.” This clarity ensures focus and tracks progress, transforming vague aspirations into tangible achievements. Integrating SMART goal frameworks directly into the template ensures that users naturally create and track goals aligned with this powerful methodology.

Features of a High-Quality Financial Goal Setting Template

Let’s face it, staring at a blank spreadsheet while trying to plan your financial future is about as exciting as watching paint dry. A good financial goal-setting template should be your trusty sidekick, not your financial nemesis. It should be user-friendly, motivating, and, dare we say, even a little bit fun. Think of it as your personal financial Sherpa, guiding you to the summit of fiscal fitness.

A high-quality financial goal-setting template is more than just rows and columns; it’s a carefully crafted tool designed to help you visualize, track, and ultimately achieve your financial aspirations. It should be adaptable to various financial situations and goals, allowing you to customize it to fit your unique circumstances. Think of it as a bespoke suit for your financial ambitions – tailored to your specific needs and style.

Essential Elements of a User-Friendly Template

A truly effective template needs several key ingredients. Without these, your financial planning could end up resembling a chaotic game of Jenga – one wrong move and the whole thing collapses. The core elements include clearly defined sections for income and expenses, dedicated areas for setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, and a robust system for tracking progress. Imagine a beautifully organized filing cabinet for your financial life – everything in its place, ready for inspection.

Comparison of Template Layouts: Spreadsheet, Worksheet, and Visual Flowchart

The best template layout depends entirely on your personal preferences and how you best process information. Spreadsheets offer a highly structured approach, perfect for those who love data and detailed analysis. They’re like a meticulously organized ledger, allowing for complex calculations and visualizations. Worksheets, on the other hand, often provide a more flexible and less intimidating format, ideal for beginners. They are simpler, less overwhelming, and great for brainstorming and initial planning. Visual flowcharts, while less common, offer a unique approach by illustrating the interconnectedness of different financial goals and the steps needed to achieve them. Think of it as a roadmap to your financial destiny.

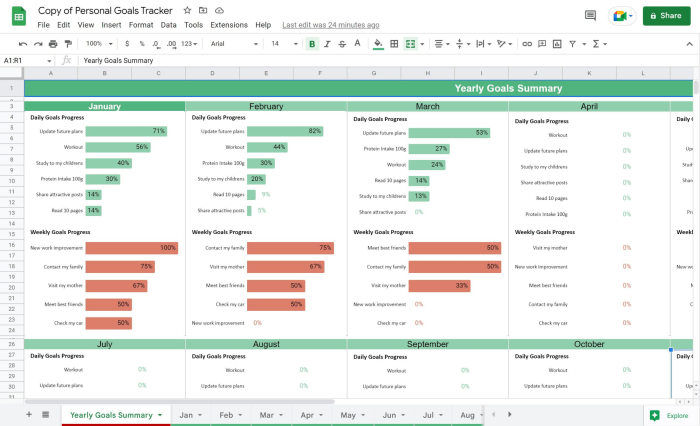

Incorporating Progress Tracking Mechanisms

Progress tracking is crucial; it’s the fuel that keeps your financial engine running. Without it, your carefully crafted plan might as well be a beautiful, yet useless, piece of art. Effective templates incorporate various progress tracking mechanisms, such as progress bars, checkboxes, and color-coded systems. These visual cues provide immediate feedback, motivating you to stay on track and celebrate milestones along the way. For example, a progress bar visually represents the percentage of a goal achieved, providing a clear picture of your progress.

Features that Enhance User Engagement and Motivation

Let’s be honest, financial planning isn’t always the most thrilling activity. To combat this, a high-quality template should incorporate features that make the process more engaging and rewarding. This might include celebratory sections for acknowledging achievements, motivational quotes to keep spirits high, or even space for personal reflections and notes. Consider incorporating a section where you can reward yourself for reaching milestones – because you deserve it! A well-designed template is a tool that fosters positive reinforcement, not just another chore.

Legal and Ethical Considerations for Financial Goal Setting Templates

Creating a financial goal-setting template might seem like a simple task, but navigating the legal and ethical minefield requires more finesse than juggling flaming bowling pins while riding a unicycle (we wouldn’t recommend trying that, by the way). Ignoring these considerations could lead to more than just a bruised ego; it could result in serious legal repercussions. Let’s delve into the crucial aspects to ensure your template remains both helpful and legally sound.

Potential Legal Risks of Providing Financial Advice Through a Template

Offering a financial goal-setting template walks a tightrope. While the template itself doesn’t directly offer advice, its very nature implies guidance. The risk lies in inadvertently crossing the line from providing a tool to dispensing regulated financial advice. This could expose you to liability if a user suffers financial losses based on information within the template, even if unintentional. For example, a poorly worded section on investment strategies could be interpreted as professional financial advice, leading to potential lawsuits. The key is to clearly delineate the template’s function as a tool for self-assessment, not a substitute for professional counsel.

Importance of Disclaimers and Limitations of Liability

Think of disclaimers as your legal armor. They are absolutely crucial. A robust disclaimer should clearly state that the template is for informational and educational purposes only and does not constitute financial advice. It should emphasize that users should consult with qualified professionals before making any significant financial decisions. Furthermore, a limitation of liability clause protects you from being held responsible for any losses incurred by users who utilize the template. This isn’t about dodging responsibility; it’s about setting realistic expectations and protecting yourself from potentially unfair claims. A well-crafted disclaimer should be prominently displayed and easily understood, even by someone who hasn’t finished their morning coffee.

Best Practices for Ensuring Accurate Financial Information

Accuracy is paramount. Inaccurate or misleading information can lead to significant financial harm for users and substantial legal trouble for you. Before releasing your template, thoroughly vet all the information it contains. Consult with financial professionals or utilize reputable sources for your data. Regularly review and update the template to ensure it reflects current laws and best practices. Consider employing a fact-checking process to minimize the risk of errors. Think of it as a rigorous quality control process, but for your users’ financial well-being. Remember, a small mistake can have big consequences.

Ethical Considerations of Data Privacy and Security

If your template collects user data, you have an ethical and potentially legal obligation to protect it. This includes implementing robust security measures to prevent unauthorized access, use, or disclosure. Clearly state your data collection practices in a privacy policy, and ensure compliance with relevant data privacy regulations (like GDPR or CCPA). Transparency and user consent are key. Treat user data with the utmost respect; after all, it’s their financial future we’re talking about. Consider the consequences of a data breach; it could damage your reputation and leave users vulnerable.

Distribution and Promotion Strategies for a Financial Goal Setting Template

Launching your financial goal-setting template into the wild requires a multi-pronged approach, akin to a highly coordinated flock of particularly financially savvy geese. We’re not talking about haphazardly tossing it into the digital ether; we’re talking strategic deployment for maximum impact. This involves carefully considering your target audience, crafting a compelling narrative, and selecting the optimal distribution channels. Think of it as a financial heist, but instead of robbing a bank, you’re enriching people’s lives (and hopefully, your own).

A well-executed marketing plan is crucial for achieving widespread adoption of your template. It’s not enough to simply create a great product; you need to shout it from the digital rooftops (or at least whisper it very persuasively into the right ears). This involves creating a compelling brand identity, defining clear marketing objectives, and selecting the right channels to reach your ideal customers.

Target Audience Definition and Segmentation

Understanding your target audience is paramount. Are you targeting young professionals just starting their financial journeys? Seasoned investors looking to refine their strategies? Or perhaps small business owners needing a tool to manage their company’s finances? Different audiences will respond to different marketing messages and channels. For instance, a social media campaign targeting young professionals might leverage trendy visuals and short, engaging videos, while a campaign aimed at seasoned investors could emphasize the template’s sophisticated features and data analysis capabilities. Consider creating separate marketing materials tailored to each segment for maximum effectiveness. Think of it as tailoring your message to the specific needs and aspirations of each financial “tribe.”

Compelling Template Description and Key Benefits

Your template’s description is its first impression – make it count! Avoid dry, technical jargon. Instead, focus on the benefits. For example, instead of saying “This template utilizes a dynamic spreadsheet format,” try “Effortlessly track your progress towards your financial dreams with our intuitive, easy-to-use template!” Highlight features that solve problems: “Say goodbye to confusing spreadsheets and hello to clear, concise financial planning!” Showcase the time-saving aspect: “Reclaim your precious time by streamlining your budgeting and goal-setting process.” Imagine your description as a captivating movie trailer, promising an exciting journey towards financial freedom.

Effective Calls to Action

A compelling call to action (CTA) is the crucial final push that encourages downloads. Avoid vague phrases like “Learn more.” Instead, use strong, action-oriented language: “Download your FREE Financial Goal Setting Template Now!”, “Get Started Today and Achieve Your Financial Goals!”, “Transform Your Finances – Download Now!”. Consider using a sense of urgency: “Limited-Time Offer: Download the Template Before It’s Gone!” Remember, a strong CTA is the bridge between interest and action. It’s the difference between a casual admirer and a committed user.

Distribution Channels

Several distribution channels can effectively reach your target audience. Your website should be the central hub, offering a prominent download button and detailed information. Social media platforms like Twitter, Facebook, Instagram, and LinkedIn provide opportunities to engage potential users with targeted ads and organic content. Email marketing allows for personalized communication and targeted campaigns to nurture leads. Consider partnerships with financial bloggers, influencers, or relevant websites to expand your reach. Think of this as building a diverse portfolio of distribution strategies, not putting all your eggs in one digital basket.

Final Summary: Financial Goal Setting Template Download

So, there you have it – a comprehensive guide to navigating the world of financial goal-setting templates. Remember, a well-structured plan isn’t just about numbers; it’s about visualizing your future and taking proactive steps to get there. Download your template today, and let the journey to financial freedom begin! Don’t just dream it – achieve it!

FAQ

What if I don’t have any specific financial goals yet?

The template can help you brainstorm! Start by identifying your financial aspirations (e.g., homeownership, early retirement), then break them down into smaller, achievable steps.

Can I customize the template?

Absolutely! The beauty of a template is its adaptability. Feel free to adjust the fields, add categories, or modify the layout to perfectly suit your needs.

Is the downloaded template secure?

Security is paramount. We employ industry-standard security measures to protect your data. However, always practice good password hygiene and be mindful of online security best practices.

What happens if my financial situation changes?

Life throws curveballs. Regularly review and update your financial goals and plan as needed. The template is designed to be a dynamic tool, adapting to your evolving circumstances.