Financial inclusion, the process of ensuring everyone has access to useful and affordable financial services, is a crucial element in fostering economic growth and reducing global inequality. This exploration delves into the multifaceted strategies employed to achieve this goal, examining the challenges and successes encountered along the way. We will investigate innovative solutions, technological advancements, and policy considerations that are shaping the future of financial inclusion worldwide.

From understanding the barriers faced by underserved populations to analyzing the impact of government regulations and the transformative potential of fintech, this examination provides a comprehensive overview of the strategies driving progress towards universal financial access. The discussion will also highlight successful case studies and explore the ongoing challenges and future directions of this critical field.

Defining Financial Inclusion

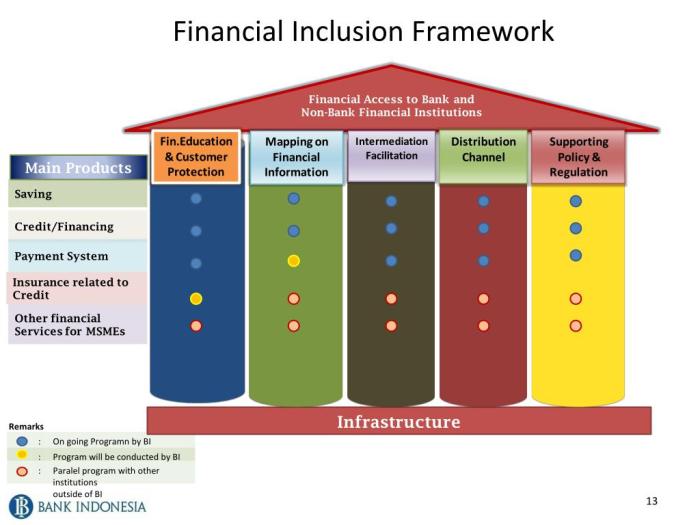

Financial inclusion is a multifaceted concept that goes beyond simply having a bank account. It signifies the ability of individuals and businesses to access and utilize a range of formal financial services that meet their needs. This access enables them to participate more fully in the economy, improve their livelihoods, and build resilience against financial shocks.

Financial inclusion encompasses several dimensions, including access to a variety of financial products and services, such as savings accounts, credit, insurance, and payment systems. Equally important is the quality and affordability of these services, along with the financial literacy of individuals to make informed decisions. Furthermore, a truly inclusive financial system is one that is fair, transparent, and protects consumers from exploitation.

Characteristics of a Financially Inclusive Society

A financially inclusive society is characterized by widespread access to a diverse range of financial services, coupled with a high level of financial literacy among its citizens. This translates into greater economic participation, reduced poverty, and increased resilience to economic downturns. Businesses, especially small and medium-sized enterprises (SMEs), thrive due to access to credit and other financial tools, leading to job creation and economic growth. The overall societal stability is enhanced as individuals have better tools to manage their finances and plan for the future. For example, the availability of microfinance institutions has demonstrably improved the livelihoods of millions in developing countries, showcasing the impact of financial inclusion on poverty reduction.

The Global Landscape of Financial Inclusion

Significant regional disparities exist in the global landscape of financial inclusion. While developed economies generally boast high levels of financial inclusion, many developing countries face substantial challenges. Sub-Saharan Africa, for instance, has the lowest rate of financial inclusion globally, with a large percentage of the population lacking access to formal financial services. Conversely, regions like North America and Western Europe exhibit significantly higher rates of inclusion, with almost universal access to basic banking services. These disparities are often linked to factors such as infrastructure limitations, regulatory hurdles, and the prevalence of informal financial systems in certain regions. The impact of these disparities is profound, leading to significant economic inequality and hindering sustainable development efforts. Initiatives like mobile banking have shown promise in bridging this gap, especially in regions with limited physical banking infrastructure. However, digital literacy and reliable technology infrastructure remain significant obstacles in many developing countries.

Access to Financial Services

Access to financial services is a cornerstone of financial inclusion. Without it, individuals and communities are excluded from participating fully in the economic system, hindering their ability to improve their livelihoods and build financial resilience. This section examines the barriers preventing access and explores innovative solutions designed to overcome these challenges.

Underserved populations often face significant hurdles in accessing essential financial services. These barriers are multifaceted and interconnected, stemming from both systemic issues and individual circumstances.

Barriers to Accessing Financial Services

Several key barriers limit access to financial services for underserved populations. These include geographical limitations, particularly in rural or remote areas with limited branch networks; high transaction costs, including fees and charges disproportionately affecting low-income individuals; a lack of suitable financial products tailored to the needs and circumstances of underserved groups; limited financial literacy, leading to a lack of understanding of financial products and services; and stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations that can be challenging for individuals lacking formal identification or documentation. Furthermore, discriminatory lending practices and a lack of trust in formal financial institutions can also significantly impact access.

Innovative Solutions for Enhanced Access

Numerous innovative solutions are emerging to address these barriers. Mobile banking, for instance, leverages the widespread adoption of mobile phones to provide convenient and affordable access to financial services, even in remote areas. Agent banking networks expand reach by utilizing local agents to provide services in underserved communities. Digital lending platforms utilize technology to streamline the loan application process and make credit more accessible to those traditionally excluded from the formal financial system. Financial literacy programs equip individuals with the knowledge and skills needed to make informed financial decisions. Finally, the development of alternative credit scoring models considers factors beyond traditional credit history, making credit more accessible to those with limited credit scores.

Comparison of Traditional and Digital Financial Service Delivery Models

| Feature | Traditional Model | Digital Model |

|---|---|---|

| Accessibility | Limited by geographical location and branch network density. | Accessible anytime, anywhere with an internet connection or mobile phone. |

| Cost | Potentially higher transaction costs due to physical infrastructure and personnel. | Generally lower transaction costs due to reduced operational overhead. |

| Convenience | Requires physical presence at a branch during operating hours. | Offers 24/7 convenience and flexibility. |

| Speed | Processing times can be slower due to manual processes. | Faster processing times due to automation and digital systems. |

Financial Literacy and Education

Financial literacy is crucial for individuals to make informed decisions about their financial well-being, particularly for low-income populations who often face greater financial challenges. A comprehensive approach to financial inclusion must include robust financial literacy programs designed to equip individuals with the knowledge and skills needed to manage their finances effectively. This involves creating accessible and engaging educational materials and delivering them through various channels.

Curriculum for a Financial Literacy Program Targeting Low-Income Individuals

A successful financial literacy curriculum for low-income individuals should be practical, relevant, and culturally sensitive. It needs to move beyond theoretical concepts and focus on real-world applications. The curriculum should be modular, allowing for flexibility in delivery and adaptation to specific needs.

- Module 1: Budgeting and Saving: This module introduces basic budgeting principles, including tracking income and expenses, creating a realistic budget, and setting savings goals. Practical exercises, such as creating a sample budget based on a hypothetical income, would be included.

- Module 2: Understanding Debt: This module covers different types of debt (credit cards, loans, etc.), the importance of credit scores, and strategies for managing debt effectively, including debt consolidation and negotiation techniques. Case studies of individuals successfully managing debt could be presented.

- Module 3: Banking and Financial Products: This module explains the functions of different financial institutions (banks, credit unions), various banking products (checking accounts, savings accounts), and the benefits of using formal financial services. A comparison of different banking options and their associated fees would be beneficial.

- Module 4: Investing and Retirement Planning: This module introduces basic investment concepts, different investment vehicles (stocks, bonds, mutual funds), and the importance of long-term retirement planning. Simple investment scenarios and retirement calculators could be used to illustrate key concepts.

- Module 5: Protecting Your Finances: This module covers topics such as fraud prevention, identity theft, and insurance (health, life, property). Real-life examples of fraud and scams, along with preventative measures, would be included.

The Role of Technology in Enhancing Financial Literacy

Technology offers significant opportunities to enhance the reach and effectiveness of financial literacy programs. Mobile banking, online learning platforms, and financial management apps can make learning more accessible and engaging.

- Mobile-based learning: Short, interactive lessons delivered via SMS or mobile apps can reach individuals with limited internet access.

- Online courses and resources: Websites and online platforms offer a wealth of free and low-cost financial literacy resources, including videos, articles, and interactive tools.

- Financial management apps: These apps can help individuals track their spending, create budgets, and set savings goals. Many offer personalized financial advice and insights.

- Gamification: Incorporating game-like elements into financial literacy programs can make learning more fun and engaging, improving knowledge retention.

Practical Strategies for Improving Financial Literacy Among Vulnerable Groups

Reaching vulnerable groups requires a multi-faceted approach that considers their specific needs and challenges.

- Community-based programs: Partnering with community organizations and local leaders can help build trust and ensure culturally relevant program delivery.

- Peer-to-peer learning: Encouraging individuals to share their financial experiences and knowledge can be particularly effective.

- Financial coaching and mentoring: One-on-one support from trained financial coaches can provide personalized guidance and support.

- Simplified language and materials: Using clear, concise language and avoiding jargon is essential for ensuring accessibility.

- Multilingual resources: Offering materials in multiple languages is crucial for reaching diverse populations.

Regulation and Policy

The regulatory landscape surrounding financial inclusion varies significantly across nations, reflecting differing economic priorities, levels of technological advancement, and existing financial infrastructure. Understanding these variations is crucial for designing effective inclusion strategies. Government policies play a pivotal role in shaping the accessibility and affordability of financial services for underserved populations.

Regulatory frameworks governing financial inclusion often encompass a broad range of measures, from establishing minimum standards for financial service providers to implementing consumer protection laws. These frameworks aim to balance the need for financial stability with the goal of expanding access to financial services. The effectiveness of these regulations, however, hinges on their enforcement and adaptability to the evolving financial landscape.

Comparative Regulatory Frameworks

Different countries employ diverse approaches to regulating financial inclusion. For instance, some countries prioritize the establishment of specialized microfinance institutions, offering tailored products and services to low-income individuals and small businesses. Others focus on leveraging technology, such as mobile money platforms, to reach remote and underserved populations. Developed nations may emphasize consumer protection and data privacy, while developing countries might prioritize access to basic financial services. The regulatory approaches often reflect the unique characteristics of each country’s financial system and its developmental stage. For example, Kenya’s robust mobile money regulatory framework, facilitating the growth of M-Pesa, contrasts sharply with the more traditional banking-centric regulations found in many European countries.

Impact of Government Policies

Government policies significantly influence financial inclusion initiatives. Subsidies for financial service providers to operate in underserved areas can incentivize expansion. Targeted lending programs, such as those focusing on women-owned businesses or agricultural enterprises, can directly increase access to credit. Furthermore, policies promoting financial literacy and education are essential for ensuring that individuals can effectively utilize financial services. Conversely, policies that inadvertently create barriers, such as stringent KYC (Know Your Customer) requirements without sufficient infrastructure for identity verification, can hinder financial inclusion. The implementation of digital identification systems, for example, can greatly impact the ability of governments to support financial inclusion. A country with a robust digital ID system can streamline the onboarding process for financial services, allowing more people to access accounts and services.

Policy Recommendations for Inclusive Financial Systems

Several policy recommendations can foster a more inclusive financial system. First, governments should streamline regulatory processes for financial service providers, reducing bureaucratic hurdles to entry and expansion, particularly for smaller institutions focused on serving low-income populations. Second, investments in digital infrastructure, including internet access and mobile network coverage, are essential for expanding access to digital financial services. Third, robust consumer protection laws are crucial to safeguard individuals from predatory lending practices and fraud. Fourth, targeted financial literacy programs should be implemented to empower individuals to make informed financial decisions. Fifth, collaboration between government agencies, financial institutions, and non-governmental organizations is crucial for effective program design and implementation. Finally, regular evaluation and adaptation of policies are essential to ensure their continued relevance and effectiveness in the dynamic landscape of financial inclusion.

Role of Technology

Technology is revolutionizing the landscape of financial inclusion, offering unprecedented opportunities to connect underserved populations with essential financial services. The accessibility and affordability of technology, particularly mobile devices, are key drivers in this transformation, enabling the delivery of financial services to remote and previously unreachable areas. This section will explore the significant impact of mobile money and fintech solutions, as well as the associated challenges and opportunities.

Mobile money, leveraging the widespread adoption of mobile phones, has emerged as a powerful tool for expanding financial access. It allows individuals to conduct various financial transactions, including sending and receiving money, paying bills, and accessing credit, all through their mobile devices. This bypasses the traditional barriers of physical infrastructure and geographical limitations, significantly broadening the reach of financial services.

Mobile Money’s Impact on Financial Inclusion

Mobile money platforms have demonstrably increased financial inclusion in many developing countries. For example, M-Pesa in Kenya has enabled millions of previously unbanked individuals to participate in the formal financial system. The ease of use, coupled with the extensive network of agents, has made mobile money a convenient and accessible option for a wide range of transactions. This has not only facilitated personal finance management but has also stimulated economic activity by providing a secure and efficient channel for business transactions. The platform’s success showcases the transformative potential of technology in bridging the financial inclusion gap.

Fintech Solutions and Financial Inclusion

Fintech companies are developing innovative solutions that are further driving financial inclusion. These solutions range from digital lending platforms offering microloans to individuals and small businesses, to digital payment systems facilitating seamless transactions. The use of algorithms and data analytics allows these platforms to assess creditworthiness even in the absence of traditional credit history, thus expanding access to credit for previously excluded populations. For instance, companies using alternative data sources, such as mobile phone usage patterns, can help determine creditworthiness in regions with limited traditional credit information.

Challenges and Opportunities in Leveraging Technology for Financial Inclusion

The integration of technology into financial inclusion strategies presents both challenges and opportunities. It is crucial to address these carefully to maximize the positive impact and mitigate potential risks.

The following points Artikel some key considerations:

- Challenge: Digital literacy and infrastructure gaps. Many individuals lack the necessary digital skills or access to reliable internet connectivity to effectively utilize technological financial services. This digital divide needs to be addressed through targeted training programs and infrastructure investments.

- Opportunity: Development of user-friendly interfaces and multilingual support. Designing intuitive and accessible interfaces can overcome language and technological barriers, ensuring broader adoption of these services.

- Challenge: Data privacy and security concerns. The handling of sensitive financial data requires robust security measures to prevent fraud and protect user privacy. Building trust and confidence in these systems is paramount.

- Opportunity: Implementing strong cybersecurity protocols and transparent data governance frameworks. Investing in advanced security technologies and adhering to strict data protection regulations will enhance user trust and confidence.

- Challenge: Regulatory frameworks and oversight. The rapid evolution of fintech necessitates adaptable regulatory frameworks to ensure consumer protection and prevent misuse of technology. This requires collaborative efforts between governments, regulators, and industry stakeholders.

- Opportunity: Developing inclusive and adaptable regulatory frameworks. A balanced regulatory approach that promotes innovation while safeguarding consumer interests can unlock the full potential of technology for financial inclusion.

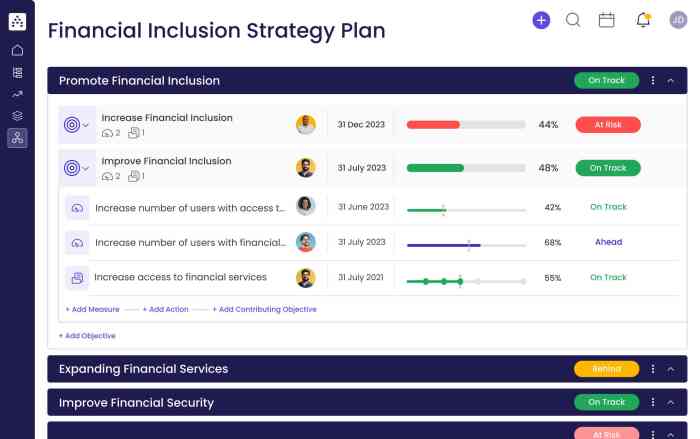

Measuring the Impact of Strategies

Measuring the effectiveness of financial inclusion programs requires a robust evaluation framework. This involves identifying relevant Key Performance Indicators (KPIs), employing appropriate methodologies, and establishing a reliable data collection process. The ultimate goal is to understand whether the program is achieving its intended objectives and to identify areas for improvement.

A successful evaluation provides valuable insights into program effectiveness, informing future strategy and resource allocation. By tracking key metrics and analyzing the data, organizations can demonstrate the impact of their initiatives and build a stronger case for continued investment in financial inclusion. Furthermore, a rigorous evaluation process enhances transparency and accountability, building trust with stakeholders and fostering a culture of continuous improvement.

Key Performance Indicators (KPIs) for Financial Inclusion Programs

Selecting appropriate KPIs is crucial for effectively measuring the impact of financial inclusion strategies. These metrics should align directly with the program’s objectives and provide a clear picture of progress towards achieving financial inclusion goals. While the specific KPIs will vary depending on the program’s focus, several common indicators are used across various initiatives.

These indicators can be broadly categorized into those measuring access, usage, and impact on financial well-being. A balanced scorecard approach, incorporating both quantitative and qualitative data, is often recommended for a comprehensive assessment.

Methodologies for Evaluating Financial Inclusion Initiatives

Several methodologies exist for evaluating the impact of financial inclusion initiatives, each with its own strengths and limitations. The choice of methodology depends on factors such as the program’s design, available resources, and the specific questions being addressed.

Common approaches include randomized controlled trials (RCTs), quasi-experimental designs, and before-and-after studies. RCTs, while considered the gold standard, can be expensive and time-consuming to implement. Quasi-experimental designs offer a more practical alternative, while before-and-after studies provide a simpler approach, though they are more susceptible to confounding factors.

Data Collection Methods for Measuring Financial Inclusion Success

Effective data collection is fundamental to measuring the success of a financial inclusion strategy. Multiple data sources and methods should be considered to ensure a comprehensive and reliable assessment.

Data can be collected through various channels, including surveys (both household and institutional), administrative data from financial service providers, and qualitative data gathering through focus group discussions and interviews. The integration of different data sources helps to triangulate findings and enhance the credibility of the evaluation.

Case Studies of Successful Strategies

Financial inclusion initiatives have yielded diverse results globally. Examining successful programs provides valuable insights into effective strategies, highlighting replicable models and best practices for expanding access to financial services. This section details several impactful case studies, analyzing their approaches and outcomes.

Successful financial inclusion strategies often share common elements: a clear understanding of the target population’s needs, tailored product offerings, accessible delivery channels, and robust capacity-building initiatives. Furthermore, supportive regulatory environments and technological innovation play crucial roles in achieving widespread impact.

Examples of Successful Financial Inclusion Programs

The following table presents several successful financial inclusion programs, showcasing their diverse approaches and impressive results. Note that the success of these programs is often multifaceted, influenced by contextual factors and ongoing adaptation.

| Program Name | Target Population | Key Features | Outcomes |

|---|---|---|---|

| M-Pesa (Kenya) | Unbanked and underbanked populations in Kenya | Mobile money platform enabling peer-to-peer transfers, bill payments, and micro-financing. | Significant increase in financial inclusion, improved access to credit, and economic empowerment, particularly for women. |

| BancoSol (Bolivia) | Micro, small, and medium enterprises (MSMEs) and low-income individuals in Bolivia | Microfinance institution providing small loans and financial services tailored to the needs of underserved communities. | Increased access to credit for MSMEs, leading to business growth and job creation. Improved financial literacy and management skills among clients. |

| Grameen Bank (Bangladesh) | Rural poor, particularly women, in Bangladesh | Microfinance pioneer offering group-based lending programs with a focus on social development and empowerment. | Significant reduction in poverty, increased income generation, and improved living standards for participating households. Empowerment of women through economic independence. |

| India’s Jan Dhan Yojana | Low-income and unbanked populations in India | National financial inclusion initiative providing access to bank accounts, debit cards, and insurance products. | Dramatic increase in bank account ownership, particularly among rural populations. Facilitated access to government benefits and other financial services. |

Visual Representation of M-Pesa’s Impact

A bar chart could effectively illustrate M-Pesa’s impact. The horizontal axis would represent years, starting from the program’s launch. The vertical axis would show the percentage of the Kenyan population with access to mobile money services. The chart would display a clear upward trend, starting from a low percentage at the launch and steadily increasing over the years to reach a significantly higher percentage of the population. Different colored bars could be used to represent different demographic groups (e.g., men, women, rural vs. urban populations) to showcase the differential impact across segments. The visual would clearly demonstrate the dramatic expansion of financial access facilitated by M-Pesa.

Challenges and Future Directions

Despite significant progress, achieving universal financial inclusion remains a complex undertaking, hampered by a multitude of persistent obstacles. Addressing these challenges requires innovative strategies and a collaborative approach involving governments, financial institutions, technology providers, and the individuals themselves. Future directions in financial inclusion necessitate a shift towards more inclusive and sustainable models that cater to the specific needs of diverse populations.

Persistent Challenges Hindering Financial Inclusion

Several key barriers continue to impede widespread access to financial services. These challenges are interconnected and often exacerbate each other, creating a complex web of obstacles that require multifaceted solutions.

- Digital Divide: Unequal access to technology and digital literacy skills creates a significant hurdle, particularly in underserved rural communities and among older populations. This limits the effectiveness of digital financial services, which are often touted as a key solution to broadening access.

- Infrastructure Limitations: Lack of reliable infrastructure, including electricity, internet connectivity, and secure payment systems, hinders the expansion of financial services, especially in remote areas. The cost of building and maintaining such infrastructure can be prohibitive.

- Regulatory and Policy Gaps: Inadequate regulatory frameworks and inconsistent policies can stifle innovation and create uncertainty for financial service providers, discouraging investment in inclusive financial solutions. This includes issues related to data privacy, consumer protection, and cross-border payments.

- Financial Literacy and Education: A lack of understanding of financial products and services limits the ability of individuals to make informed decisions and effectively manage their finances. This can lead to misuse of services and financial exclusion.

- Trust and Confidence: Building trust in financial institutions is crucial, particularly in communities with past experiences of exploitation or lack of access. Transparency and accountability are vital to foster trust and encourage adoption of financial services.

Emerging Trends and Future Directions

The landscape of financial inclusion is constantly evolving, with several emerging trends shaping its future trajectory. These trends offer opportunities to overcome existing challenges and expand access to financial services in innovative ways.

- Mobile Money and Fintech Innovations: Mobile money platforms and other fintech solutions are playing an increasingly significant role in expanding access to financial services, particularly in underserved markets. Kenya’s M-Pesa is a prime example of the transformative potential of mobile money.

- Open Banking and APIs: The rise of open banking and application programming interfaces (APIs) is facilitating greater interoperability and innovation within the financial sector, enabling the development of new and more inclusive products and services.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being leveraged to improve credit scoring models, personalize financial products, and automate processes, making financial services more accessible and efficient.

- Blockchain Technology: Blockchain technology has the potential to improve transparency, security, and efficiency in financial transactions, particularly in cross-border payments and remittances.

- Government Initiatives and Public-Private Partnerships: Government policies and initiatives, coupled with effective public-private partnerships, are crucial for creating an enabling environment for financial inclusion. Examples include targeted subsidies, financial literacy programs, and infrastructure development.

Roadmap for Addressing Challenges

A multi-pronged approach is necessary to effectively address the challenges and realize the potential of financial inclusion. This roadmap Artikels key areas of focus.

- Invest in Digital Infrastructure: Expand internet and mobile network coverage, particularly in rural and underserved areas. This includes investments in infrastructure, affordability initiatives, and digital literacy training.

- Strengthen Regulatory Frameworks: Develop and implement robust regulatory frameworks that promote innovation, protect consumers, and ensure the stability of the financial system. This includes clear guidelines for data privacy, consumer protection, and anti-money laundering measures.

- Promote Financial Literacy and Education: Implement comprehensive financial literacy programs tailored to different demographics and contexts. This should include education on budgeting, saving, borrowing, and investing.

- Foster Public-Private Partnerships: Encourage collaboration between governments, financial institutions, technology providers, and civil society organizations to develop and implement inclusive financial solutions.

- Leverage Technology for Scalability: Utilize mobile money, fintech innovations, AI, and other technologies to expand access to financial services in a cost-effective and scalable manner.

Closing Notes

Ultimately, achieving universal financial inclusion requires a multi-pronged approach that combines innovative technology, effective policies, robust financial literacy programs, and a commitment to addressing the unique needs of diverse populations. While challenges remain, the progress made and the ongoing innovations offer a promising outlook for a more equitable and financially inclusive future. By learning from successes and addressing persistent obstacles, we can move closer to a world where everyone benefits from the opportunities afforded by access to financial services.

FAQ Guide

What is the difference between financial inclusion and financial literacy?

Financial inclusion refers to access to financial services, while financial literacy is the understanding of how to use those services effectively.

How does financial inclusion impact poverty reduction?

Access to credit, savings, and insurance can empower individuals to start businesses, manage risk, and improve their financial well-being, contributing to poverty reduction.

What role do microfinance institutions play in financial inclusion?

Microfinance institutions provide small loans and other financial services to low-income individuals and entrepreneurs, often those excluded from traditional banking systems.

What are some examples of successful financial inclusion initiatives?

Examples include M-Pesa in Kenya (mobile money), Grameen Bank in Bangladesh (microcredit), and various government-sponsored financial literacy programs.