Financial Inclusion Strategies Indonesia: Let’s dive headfirst into the fascinating, and sometimes hilariously complicated, world of getting everyone in Indonesia access to financial services. Imagine a nation where even the most remote villager can effortlessly pay their bills using their smartphone – that’s the dream, right? But the reality is a complex tapestry woven with threads of government policy, private sector innovation, and the ever-present challenge of reliable internet access in a sprawling archipelago. This exploration will unravel the strategies, successes, and (let’s be honest) the occasional spectacular failure in Indonesia’s quest for financial freedom for all.

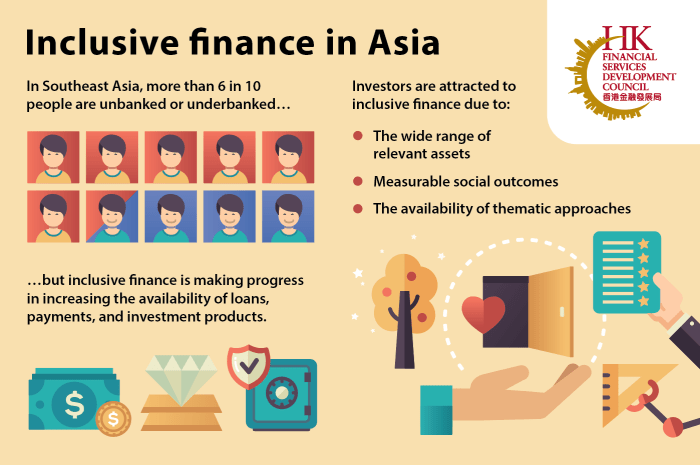

This journey will examine Indonesia’s progress towards financial inclusion, comparing its successes and challenges with other Southeast Asian nations. We’ll analyze government initiatives, the role of innovative fintech companies, and the crucial importance of financial literacy. We’ll even delve into the surprisingly significant impact of reliable internet connectivity – because let’s face it, trying to manage your finances without a working Wi-Fi connection is about as fun as a root canal.

Defining Financial Inclusion in Indonesia

Indonesia, the world’s fourth most populous nation, presents a fascinating – and frankly, hilarious – case study in financial inclusion. Imagine a country with an archipelago of over 17,000 islands, each with its own unique economic quirks and challenges. That’s the playground where Indonesia’s financial inclusion story unfolds, a rollercoaster of progress and persistent hurdles.

Financial inclusion in Indonesia refers to the extent to which individuals and businesses have access to and use formal financial services. This isn’t just about having a bank account; it’s about having the tools to manage your money, save for the future (maybe even a beachfront villa!), borrow for investments (like that beachfront villa!), and participate fully in the economy. It’s about escaping the clutches of informal, often exploitative, financial practices.

The Current State of Financial Inclusion in Indonesia

Indonesia has made significant strides in recent years, but the journey is far from over. The government’s ambitious targets, coupled with the rise of fintech, have fueled impressive growth in digital financial services. However, challenges remain, including limited financial literacy, geographical barriers (those pesky islands!), and a digital divide that leaves many behind. Think of it as a financial marathon, and Indonesia is currently sprinting – but still has a long way to go.

Demographic Segments Most Impacted by Financial Exclusion

The impact of financial exclusion isn’t evenly distributed. Rural populations, particularly in remote areas, struggle with limited access to financial institutions. Women, often facing societal barriers to financial autonomy, also experience significant exclusion. Micro, small, and medium-sized enterprises (MSMEs), the backbone of the Indonesian economy, frequently lack access to credit and other financial services, hindering their growth potential. It’s like a financial three-legged race where some runners are carrying extra weight.

Comparison of Indonesia’s Financial Inclusion Landscape with Other Southeast Asian Nations

Indonesia’s progress in financial inclusion is comparable to, but not always ahead of, other Southeast Asian nations. Countries like Singapore and Malaysia boast higher levels of bank account penetration and access to credit, reflecting their more developed financial infrastructure. However, Indonesia’s rapid adoption of digital financial services, particularly mobile money, positions it competitively in the region. It’s a regional financial footrace, and Indonesia’s strategy is a blend of speed and agility.

Key Indicators of Financial Inclusion in Indonesia

Let’s get down to the nitty-gritty with some numbers. While precise figures fluctuate based on the source and year, the table below offers a snapshot of key indicators.

| Indicator | 2020 Estimate | 2023 Estimate | Trend |

|---|---|---|---|

| Bank Account Ownership (%) | 76% | 85% | Increasing |

| Access to Credit (%) | 45% | 55% | Increasing |

| Mobile Money Usage (%) | 30% | 60% | Rapidly Increasing |

| Financial Literacy (%) | 38% | 45% | Slowly Increasing |

Note: These figures are estimates based on various reports and may vary depending on the source and methodology. The goal is to provide a general understanding of the trends, not precise, audited figures.

Government Initiatives and Policies

Indonesia’s journey towards financial inclusion has been, shall we say, a rollercoaster ride – filled with thrilling upswings and the occasional stomach-churning dip. The government, ever the intrepid conductor of this financial orchestra, has implemented a variety of strategies and policies to ensure everyone gets a seat in the economic concert hall, not just those with the best tickets. Their efforts, while commendable, haven’t always hit the high notes. Let’s delve into the specifics.

The Indonesian government’s approach to financial inclusion is multifaceted, a delightful blend of carrots and sticks (mostly carrots, thankfully). They’ve recognized that a financially included populace is a happier, healthier, and more economically productive populace – a win-win situation for everyone involved, except maybe for the tax evaders. This multi-pronged approach involves initiatives aimed at expanding access to financial services, improving financial literacy, and fostering a supportive regulatory environment. The ultimate goal? To make sure even your eccentric Uncle Budi, who insists on paying for everything in coconuts, can access the financial tools he needs.

National Strategy for Financial Inclusion

The National Strategy for Financial Inclusion (SNKI) acts as the government’s overarching blueprint for achieving its ambitious goals. This strategy Artikels key objectives, targets, and action plans across various sectors. It’s a comprehensive document, meticulously crafted to address the unique challenges faced by Indonesia’s diverse population. The SNKI focuses on several key areas, including expanding access to financial services in rural and underserved areas, promoting digital financial literacy, and strengthening the regulatory framework to ensure a safe and secure financial ecosystem. Think of it as the ultimate financial inclusion playbook, complete with detailed strategies and tactics.

Specific Government Programs

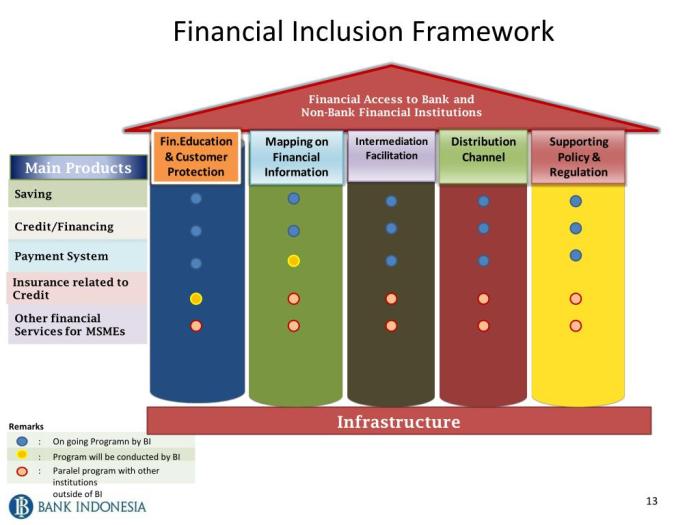

The government’s commitment to financial inclusion is evident in the numerous programs it has launched. One notable example is the program to promote the use of electronic money (e-money) and digital payments. This initiative aims to reduce reliance on cash transactions, particularly in rural areas where access to traditional banking services is limited. The government provides incentives to encourage adoption of digital financial services, such as subsidies for digital transactions and financial literacy training programs. Another significant initiative is the expansion of microfinance institutions, providing small loans and financial services tailored to the needs of micro, small, and medium enterprises (MSMEs). These programs, while individually effective, require robust coordination for maximum impact. Imagine them as individual musical instruments – each beautiful on its own, but far more powerful when playing in harmony.

Effectiveness of Existing Policies

While significant progress has been made, the effectiveness of existing government policies remains a subject of ongoing debate. While the number of Indonesians with access to formal financial services has increased, challenges remain, particularly in reaching remote and marginalized communities. The digital divide, coupled with varying levels of financial literacy across the population, continues to hinder progress. Think of it as trying to orchestrate a symphony with some musicians playing slightly off-key. The overall sound is still good, but could be much better with improved coordination and additional practice.

Proposed Policy Improvement: Addressing the Digital Divide

One key challenge is the digital divide, preventing many Indonesians, particularly in rural areas, from accessing digital financial services. A proposed improvement involves a targeted investment in rural digital infrastructure, coupled with subsidized digital literacy training programs specifically designed for these communities. This should include training on using smartphones, internet banking, and mobile payment apps, delivered in local languages and culturally sensitive ways. This initiative could be funded through a combination of government allocations and public-private partnerships, ensuring sustainability and wider reach. Imagine it as upgrading the instruments and providing individual tutoring to those musicians who need a little extra help – leading to a more harmonious and powerful symphony.

Role of the Private Sector: Financial Inclusion Strategies Indonesia

The private sector in Indonesia, a vibrant mix of established banks and nimble fintech startups, plays a pivotal, and frankly, hilarious role in expanding financial inclusion. Think of it as a financial comedy show, with everyone scrambling to get a piece of the action, but ultimately working towards a common goal (mostly). This isn’t just about altruism; it’s about tapping into a massive, previously underserved market – a market that’s finally getting its moment in the spotlight.

Private sector involvement isn’t just about handing out money (although that’s part of it!). It’s about innovative solutions, strategic partnerships, and a dash of healthy competition that pushes the boundaries of financial access. The results are, well, quite fascinating, to say the least.

Examples of Private Sector Contributions to Financial Inclusion

Several Indonesian private sector companies have demonstrated remarkable commitment to expanding financial access. For instance, Bank Rakyat Indonesia (BRI), a state-owned bank with a significant private sector element, has aggressively expanded its reach into rural areas through its extensive branch network and agent banking model. This has brought financial services to previously unreachable communities, allowing even the most remote goat herder to access banking services (though we’re not sure how many goats are involved in the transactions). Meanwhile, fintech companies like GoPay and OVO, integrated into popular ride-hailing and e-commerce platforms, have revolutionized digital payments, making transactions simpler and more accessible than ever before. Imagine the sheer volume of transactions, a dizzying spectacle of digital money swirling around the archipelago!

Impact of Technological Advancements on Financial Inclusion

Technological advancements, particularly the rise of mobile banking and digital payments, have been game-changers. Mobile penetration in Indonesia is incredibly high, making mobile banking a natural fit. The ability to access financial services via a smartphone, even with limited internet access, has opened up opportunities for millions. Digital payments have further simplified transactions, eliminating the need for physical cash and reducing the reliance on traditional banking infrastructure. This has been particularly beneficial in rural areas where access to physical banks is limited. Picture this: a bustling market in a remote village, where transactions are conducted swiftly and seamlessly using mobile phones – a far cry from the old days of bartering chickens for rice.

Comparison of Approaches by Different Financial Institutions

Traditional banks often focus on establishing physical branches and agent networks, which, while effective, can be expensive and time-consuming. Fintech companies, on the other hand, leverage technology to offer more agile and cost-effective solutions, often targeting specific segments of the population. This isn’t a competition, though; it’s more of a collaborative effort. Banks are increasingly partnering with fintech companies to leverage their technological expertise and reach a wider customer base. It’s like a financial “Odd Couple” situation, with each entity contributing their unique strengths to the overall goal.

Best Practices Adopted by Private Sector Players

The private sector’s success in Indonesia stems from a variety of strategies. A crucial element is the development of user-friendly interfaces and services tailored to the needs of diverse customer segments. This includes offering services in local languages and providing financial literacy training. Furthermore, strategic partnerships with local communities and government agencies are essential for building trust and overcoming logistical hurdles. Finally, the utilization of innovative technologies, such as biometric authentication and AI-powered credit scoring, enables faster and more efficient service delivery. It’s a winning combination of technology and human connection – a recipe for financial inclusion success!

Infrastructure and Technology

Indonesia’s journey towards comprehensive financial inclusion is inextricably linked to its digital infrastructure. Think of it as building a highway system for money – without the right roads (internet and mobile networks), even the fanciest financial vehicles can’t reach their destinations. This section delves into the crucial role of technology, highlighting both the triumphs and the hilarious challenges encountered along the way.

The availability and reliability of digital infrastructure, specifically internet access and mobile network coverage, are paramount for expanding financial inclusion. In a country as geographically diverse as Indonesia, with its sprawling archipelago and varying levels of development, ensuring equitable access presents a significant, yet undeniably comical, logistical puzzle. Imagine trying to deliver a bank account to a remote village accessible only by dugout canoe – that’s the kind of challenge we’re talking about, only with slightly more sophisticated technology involved (hopefully).

Digital Infrastructure’s Role in Promoting Financial Inclusion

Broadband internet and robust mobile network coverage are the lifeblood of digital financial services. They allow for the seamless operation of mobile banking apps, online payment platforms, and other innovative financial tools. Areas with strong digital infrastructure witness significantly higher rates of financial inclusion, as individuals gain easier access to savings accounts, credit facilities, and insurance products. This isn’t just about convenience; it’s about empowering people to participate more fully in the economy. The contrast between a bustling city with ubiquitous Wi-Fi and a remote village relying on infrequent satellite phone connections vividly illustrates the disparity in access and its implications for financial inclusion.

Challenges Related to Digital Literacy and Technology Access

While technology offers incredible potential, its benefits remain out of reach for many Indonesians. A significant hurdle is digital literacy – the ability to effectively use technology for financial transactions. Many underserved populations lack the necessary skills to navigate online banking platforms or understand the nuances of digital financial products. Furthermore, access to technology itself is unevenly distributed. The cost of smartphones and internet data plans can be prohibitive for low-income households, leaving them excluded from the digital financial revolution. This creates a digital divide that needs to be bridged with creative and effective solutions.

Initiatives to Improve Digital Infrastructure and Promote Digital Literacy

The Indonesian government, in collaboration with the private sector, has launched several initiatives to address these challenges. These include expanding internet infrastructure through government-led projects, promoting affordable internet packages, and investing heavily in digital literacy programs. Numerous non-governmental organizations (NGOs) also play a crucial role, providing training and support to underserved communities. These initiatives are not without their humorous anecdotes; imagine teaching a grandmother how to use a smartphone while simultaneously battling unreliable internet connectivity – a true test of patience and ingenuity.

Effectiveness of Technological Solutions in Promoting Financial Inclusion

| Technological Solution | Strengths | Weaknesses | Overall Effectiveness |

|---|---|---|---|

| Mobile Money (e.g., OVO, GoPay) | Wide reach, ease of use, low transaction costs | Security concerns, reliance on smartphone ownership, digital literacy requirements | High in urban areas, moderate in rural areas |

| Agent Banking | Expands access to financial services in underserved areas, requires less digital literacy | Agent network density varies, potential for fraud, higher transaction costs compared to mobile money | Moderate to high, depending on agent network density |

| Online Banking | Convenience, 24/7 accessibility, wide range of services | Requires high digital literacy, internet access, and computer/smartphone ownership | High for digitally literate populations, low for others |

| Biometric Identification | Enhanced security, reduces fraud, facilitates access for those without formal identification | Requires investment in infrastructure and training, potential for privacy concerns | Increasingly effective as infrastructure improves |

Financial Literacy and Education

Financial literacy isn’t just about knowing the difference between a debit and credit card (though that’s a good start!). It’s the key that unlocks the door to financial inclusion, allowing individuals to participate meaningfully in the economy. Without understanding basic financial concepts, people are vulnerable to exploitation, unable to make informed decisions about savings, investments, or even managing debt. Think of it as the secret sauce – without it, the recipe for financial well-being is incomplete.

The importance of financial literacy in achieving financial inclusion is paramount. It empowers individuals to navigate the financial landscape, make informed choices, and ultimately improve their economic well-being. This, in turn, contributes to a more stable and prosperous society. A financially literate population is less likely to fall prey to predatory lending practices or make poor investment decisions, leading to greater economic stability and reduced inequality. It’s a win-win, really.

Existing Financial Literacy Programs in Indonesia and Their Impact

Indonesia has implemented various financial literacy programs, often in collaboration with government agencies, banks, and NGOs. These programs typically involve workshops, seminars, and educational materials covering topics such as budgeting, saving, investing, and debt management. While assessing the precise impact of these programs is challenging due to a lack of comprehensive, standardized evaluation metrics, anecdotal evidence suggests that some programs have had positive effects on participants’ financial knowledge and behaviors. However, the reach and effectiveness of these initiatives vary significantly depending on factors such as program design, implementation quality, and the target audience’s level of engagement. More rigorous evaluation is needed to determine the true extent of their success. Imagine a well-designed financial literacy program as a perfectly brewed cup of Indonesian coffee – invigorating and impactful, but only if the beans are properly sourced and the brewing process is precise.

A Comprehensive Financial Literacy Program for Indonesian Farmers, Financial Inclusion Strategies Indonesia

Indonesia’s agricultural sector employs a significant portion of the population, many of whom are underserved by formal financial services. A comprehensive financial literacy program targeting this group should focus on practical skills relevant to their daily lives. The program would utilize a multi-faceted approach, combining group workshops conducted in local languages with easily accessible digital resources. The curriculum would cover topics such as:

- Basic bookkeeping and record-keeping for farm income and expenses.

- Understanding different types of savings and credit products available.

- Risk management strategies for agricultural businesses, including crop insurance.

- Financial planning for investments in farm improvements and technology.

The program would leverage existing community networks and utilize trusted local leaders to promote participation and ensure cultural sensitivity. Regular follow-up sessions and support would be provided to reinforce learning and address individual challenges. Imagine this program as a sturdy, locally-made cart, carrying the tools and knowledge needed to help farmers cultivate not just their crops, but also their financial futures.

Successful Financial Literacy Initiatives from Other Countries Adaptable to Indonesia

Several successful financial literacy initiatives from other countries offer valuable lessons for Indonesia. For example, Kenya’s M-Pesa mobile money platform incorporated financial literacy training into its user onboarding process, resulting in increased financial inclusion. Similarly, India’s Self Help Groups (SHGs) have proven effective in promoting savings and credit among women in rural areas. These models could be adapted to the Indonesian context by integrating financial literacy training into existing mobile banking platforms or community-based initiatives. The key is to leverage existing infrastructure and tailor the content to the specific needs and preferences of the target population. Think of these examples as proven blueprints, readily adaptable to construct a strong and sustainable financial literacy edifice in Indonesia.

Challenges and Barriers

Financial inclusion in Indonesia, while progressing, still faces a comedically stubborn set of hurdles. Think of it as a financial obstacle course, complete with unexpected potholes and giggling mischievous gremlins (representing bureaucratic red tape). Let’s delve into the hilarious, yet serious, challenges.

Geographical Barriers

Indonesia’s sprawling archipelago presents a logistical nightmare for financial service providers. Imagine trying to deliver banking services to remote villages accessible only by boat (and maybe a slightly temperamental monkey as a guide). The sheer distance between islands, coupled with inadequate infrastructure, makes it incredibly difficult and expensive to reach underserved populations. This results in limited access to ATMs, branch offices, and reliable internet connectivity, leaving many Indonesians financially stranded on their own private islands of economic hardship. The cost of transporting personnel and equipment is astronomical, leading to higher service costs and potentially excluding those who can least afford them.

Socio-Economic Factors

Poverty, low levels of education, and a lack of trust in formal financial institutions are significant obstacles. Many Indonesians, particularly in rural areas, rely on informal financial systems (think friendly neighborhood loan sharks, but perhaps less charming). These systems, while offering convenience, often charge exorbitant interest rates and lack the transparency and regulatory oversight of formal institutions. Low financial literacy further compounds the problem, leaving individuals vulnerable to exploitation and hindering their ability to make informed financial decisions. This creates a vicious cycle of poverty and financial exclusion.

Cultural Factors

Cultural norms and practices also play a significant role. Traditional methods of saving and borrowing, often within family and community networks, can be resistant to change. The reluctance to adopt new technologies or engage with formal institutions, stemming from a lack of trust or understanding, significantly hinders the penetration of financial services. Overcoming these deeply ingrained cultural preferences requires a sensitive and culturally appropriate approach. It’s like trying to convince a stubborn coconut tree to dance the tango – it requires patience, creativity, and maybe a little bit of coconut oil as a bribe.

Regulatory Framework Impact

The regulatory environment plays a crucial role, both positively and negatively. While regulations aim to protect consumers and ensure the stability of the financial system, overly complex or stringent requirements can inadvertently exclude smaller institutions and limit access to financial services, especially for those in remote areas. Imagine trying to navigate a maze of red tape while simultaneously juggling flaming torches – it’s not exactly conducive to smooth financial operations. A balance needs to be struck between consumer protection and promoting financial inclusion. This requires streamlined regulations, simplified procedures, and a supportive policy environment that encourages innovation and competition.

Rural vs. Urban Access

The contrast between rural and urban access to financial services is stark. Urban populations generally enjoy relatively easy access to a wide range of financial products and services, with numerous banks, ATMs, and digital payment options readily available. Rural populations, however, often face significant limitations, including limited infrastructure, lack of financial literacy, and a greater reliance on informal financial systems. It’s a tale of two cities, or rather, two worlds – one bustling with financial activity, the other struggling to catch up. This disparity necessitates targeted interventions focused on bridging the digital and physical divides.

Recommendations for Overcoming Challenges

The importance of addressing these challenges cannot be overstated. A financially included Indonesia is a more prosperous and equitable Indonesia. To achieve this ambitious goal, a multi-pronged approach is required.

- Invest in infrastructure: Expand internet access and improve transportation networks, particularly in rural areas. Think of it as building financial highways and bridges to connect the unconnected.

- Promote financial literacy: Implement comprehensive financial education programs tailored to different demographics and cultural contexts. This involves engaging communities and making financial education fun and accessible – think financial literacy game shows!

- Simplify regulations: Streamline regulatory processes to reduce the burden on smaller financial institutions and promote innovation. Let’s cut the red tape and let the financial innovation flow freely!

- Leverage technology: Utilize mobile banking, digital payment systems, and other technological solutions to overcome geographical barriers and reach underserved populations. Think of it as harnessing the power of the digital age to bring financial services to everyone.

- Support microfinance institutions: Encourage the growth of microfinance institutions and other organizations that cater to the needs of low-income individuals and small businesses. They are the unsung heroes of financial inclusion, often operating in the most challenging environments.

- Foster public-private partnerships: Encourage collaboration between the government, private sector, and non-governmental organizations to maximize resources and expertise. Think of it as a superhero team-up to fight financial exclusion!

Measuring Impact and Success

Measuring the success of financial inclusion strategies in Indonesia isn’t just about counting bank accounts; it’s about understanding whether these initiatives are genuinely improving people’s lives. We need robust metrics to avoid celebrating superficial gains while missing the real impact on the ground. Think of it as evaluating a delicious Indonesian meal – you need to assess not only the presentation but also the taste and nutritional value!

The effectiveness of financial inclusion initiatives hinges on demonstrating a tangible positive impact on the lives of Indonesians, particularly those previously excluded from the formal financial system. This requires a multifaceted approach to measurement, incorporating both quantitative and qualitative data to provide a comprehensive understanding of the progress achieved. It’s not just about numbers; it’s about the story behind the numbers.

Key Performance Indicators (KPIs) for Financial Inclusion

Several key performance indicators (KPIs) are crucial for evaluating the effectiveness of financial inclusion initiatives. These indicators offer a quantifiable way to track progress and identify areas needing improvement. Choosing the right KPIs depends on the specific goals of the initiative, but some common ones provide a solid starting point.

- Account Ownership: The percentage of the adult population with access to and actively using formal financial accounts (bank accounts, mobile money accounts, etc.). This is a fundamental indicator, showing the breadth of reach of financial inclusion programs.

- Financial Service Usage: This goes beyond simply owning an account. It measures the frequency and types of financial services used, such as deposits, withdrawals, payments, and loans. This reveals whether people are actively utilizing their accounts for their intended purposes.

- Credit Access: The percentage of the population with access to credit, especially microloans and small business loans. This is crucial for economic empowerment and entrepreneurship.

- Savings Rates: Tracking the growth of savings among previously unbanked populations indicates improved financial security and resilience.

- Digital Financial Inclusion: The percentage of the population using digital financial services like mobile banking and online payments. This reflects the adoption of modern financial technology and its contribution to inclusion.

- Poverty Reduction: While not a direct measure of financial inclusion, it’s a strong indicator of its impact. Analyzing poverty rates among target populations before and after the implementation of financial inclusion programs can reveal a significant correlation.

Data Sources for Monitoring Progress

Reliable data is the lifeblood of effective monitoring and evaluation. Fortunately, Indonesia has several sources available, although integrating them effectively can be a challenge – think of it as assembling a delicious *nasi campur* with various ingredients that need to work harmoniously together!

- Government Surveys: Data from national surveys like the Susenas (Survei Sosial Ekonomi Nasional) and other government-led initiatives provide valuable insights into household finances and access to financial services. This is a crucial source of macro-level data.

- Financial Institution Data: Banks and other financial service providers hold detailed data on account ownership, transactions, and loan disbursement. This data, when aggregated responsibly and anonymously, provides granular insights into usage patterns.

- Mobile Money Operators: Companies offering mobile money services possess detailed transaction data that can reveal trends in digital financial inclusion, especially in rural areas.

- Microfinance Institutions: These institutions provide data on microloan disbursement, repayment rates, and the impact on borrowers’ livelihoods. This is particularly valuable for understanding the impact on small businesses and vulnerable populations.

Visual Representation of Financial Inclusion Progress

Imagine a bar chart. The X-axis represents time (e.g., years), and the Y-axis represents the percentage of the adult population with bank accounts. Each bar represents a year, with its height showing the percentage of account ownership. A clear upward trend indicates successful progress towards financial inclusion. Different colored bars could represent different regions or demographics, highlighting disparities and the success of targeted interventions. For instance, one bar could represent the national average, while others represent rural versus urban areas, showcasing the unevenness of progress. Adding a secondary Y-axis could display the parallel trend in poverty reduction rates, visually demonstrating the correlation between financial inclusion and poverty alleviation. A line graph could illustrate the parallel trends of mobile money usage and poverty rates, revealing the positive correlation.

End of Discussion

In conclusion, Indonesia’s pursuit of financial inclusion is a dynamic and ongoing process, a thrilling blend of ambition and practicality. While challenges remain, the progress made through government initiatives, private sector innovation, and improved digital infrastructure is undeniably impressive. The journey towards universal financial access is not without its bumps, but the ultimate goal – a financially empowered Indonesia – remains a worthy and achievable aspiration. Let’s hope they bring snacks to the next policy meeting; this is a marathon, not a sprint.

User Queries

What are the biggest obstacles to financial inclusion in rural areas of Indonesia?

Limited infrastructure (internet, banking branches), low digital literacy, and cultural barriers are major hurdles. Reaching these communities requires creative solutions beyond simply building more ATMs.

How does Indonesia’s approach to financial inclusion compare to other ASEAN countries?

Indonesia’s progress is mixed. While it has seen significant growth in mobile money usage, it still lags behind some neighbors in terms of overall bank account penetration, particularly in rural areas. The specifics vary greatly depending on the country’s unique circumstances.

What role do microfinance institutions play in Indonesia’s financial inclusion strategy?

Microfinance plays a vital, albeit often overlooked, role. These institutions provide crucial credit access to underserved populations, empowering entrepreneurs and fostering economic growth at the grassroots level. They often work in conjunction with government programs.