Financial Inclusion Strategies Indonesia: Imagine a nation where everyone, from the bustling city dweller to the quiet farmer, has access to the financial tools to thrive. Sounds utopian, right? Well, Indonesia’s journey towards this financial nirvana is a fascinating blend of government initiatives, private sector innovation, and the sheer willpower of its people to overcome significant hurdles. This exploration delves into the strategies, successes, and (let’s be honest) the occasional hilarious misadventure in Indonesia’s quest for complete financial inclusion.

This report examines the current state of financial inclusion in Indonesia, comparing it to regional neighbors and analyzing the socioeconomic factors at play. We’ll dissect government policies, the crucial role of fintech, and the unique challenges faced by specific population segments like rural communities and women-led businesses. We’ll even peek into the crystal ball to predict future trends and potential solutions, all while maintaining a healthy dose of analytical rigor (and perhaps a chuckle or two).

Defining Financial Inclusion in Indonesia

Indonesia, the world’s fourth most populous nation, presents a fascinating case study in financial inclusion – a story filled with both hilarious hurdles and surprisingly successful leaps. Imagine trying to manage the financial lives of over 270 million people, some living in bustling metropolises and others in remote villages accessible only by riverboat! That’s the Indonesian challenge, and it’s not for the faint of heart (or the poorly-funded).

The Current State of Financial Inclusion in Indonesia

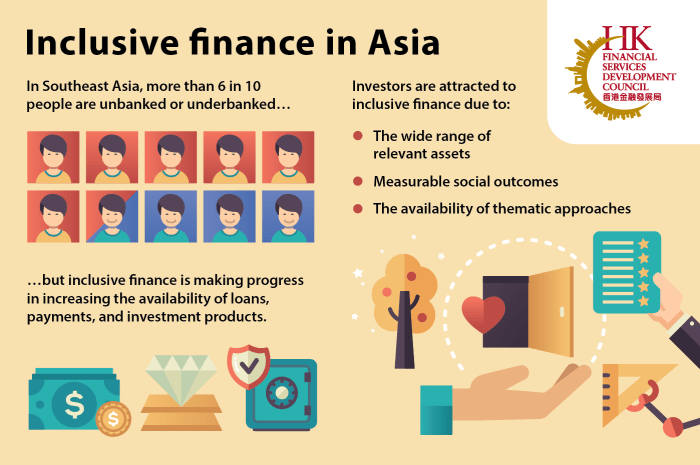

Indonesia has made significant strides in expanding access to financial services, but the journey is far from over. While mobile banking has exploded in popularity, reaching even the most remote corners via ubiquitous handphones (often more reliable than electricity!), a significant portion of the population remains unbanked or underbanked. Challenges include a lack of financial literacy, particularly in rural areas where trust in formal institutions can be low, and the sheer logistical nightmare of reaching everyone. Opportunities abound, however, with the potential for fintech innovations to revolutionize the landscape and create a truly inclusive financial ecosystem. Think of it as a financial game of whack-a-mole, but instead of moles, it’s unbanked citizens, and the mallet is a cleverly designed mobile app.

Government Initiatives and Policies: Financial Inclusion Strategies Indonesia

Indonesia’s journey towards comprehensive financial inclusion has been a rollercoaster ride – a thrilling blend of ambitious policy launches and the occasional, slightly bumpy landing. The government, bless its cotton socks, has thrown a considerable amount of money and effort at this crucial endeavor, resulting in a mixed bag of successes and, let’s be honest, areas needing a serious spruce-up.

The Indonesian government’s approach to financial inclusion is multifaceted, employing a blend of carrots and sticks (mostly carrots, thankfully). Key policies revolve around expanding access to financial services, particularly in underserved rural areas, improving financial literacy, and fostering a more inclusive regulatory environment. This involves initiatives ranging from targeted subsidies for micro, small, and medium-sized enterprises (MSMEs) to digital financial literacy programs for the general public. The effectiveness of these initiatives, however, is a story best told with a healthy dose of nuance.

National Strategy for Financial Inclusion

The National Strategy for Financial Inclusion (NSFI), a multi-year plan, provides a roadmap for achieving broader financial inclusion. Specific targets are set for increasing access to bank accounts, expanding the use of digital financial services, and promoting financial literacy. While the NSFI has undoubtedly spurred progress, challenges remain in effectively reaching the most marginalized populations, particularly in remote regions with limited infrastructure. For instance, while the number of bank accounts has increased significantly, the usage rate, especially for transactions beyond simple deposits, lags behind in some areas. This highlights the need for a more comprehensive approach that tackles both access and usage.

Effectiveness of Existing Initiatives: Successes and Shortcomings

Successes include the significant growth in mobile money usage, driven partly by government support for digital financial services. The expansion of branchless banking and agent networks has also played a crucial role in extending financial services to previously unbanked populations. However, challenges persist. For example, digital literacy remains a significant barrier, especially among older generations and those in rural areas with limited internet access. Furthermore, the regulatory environment, while improving, could be more streamlined to facilitate innovation and competition in the financial services sector. The success of existing initiatives varies considerably across different regions and demographics, underscoring the need for a more targeted and localized approach.

A Potential New Government Program: The “Financial Inclusion Village” Initiative

To address the persistent challenge of reaching remote and underserved communities, a new program, the “Financial Inclusion Village” initiative, is proposed. This program would focus on establishing comprehensive financial services hubs in strategically selected villages. These hubs would offer a range of services, including access to bank accounts, microloans, financial literacy training, and digital financial services support. The program would involve partnerships between the government, financial institutions, and local community leaders to ensure sustainability and effectiveness. This integrated approach aims to overcome the infrastructural and logistical hurdles that often prevent financial inclusion initiatives from reaching their full potential. Success will be measured not only by increased account ownership but also by demonstrable improvements in the economic well-being of participating villagers.

Successful International Examples and Their Applicability to Indonesia

Kenya’s M-Pesa mobile money platform stands as a shining example of successful financial inclusion. Its widespread adoption demonstrates the transformative potential of leveraging mobile technology to reach large underserved populations. Adapting elements of M-Pesa’s model, such as robust agent networks and user-friendly interfaces, could significantly benefit Indonesia’s financial inclusion efforts. Similarly, India’s Aadhaar-enabled Payment System (AEPS) demonstrates the power of biometric identification in facilitating financial transactions, particularly for those lacking traditional identification documents. Integrating biometric identification into Indonesia’s systems could enhance security and access for a broader population. However, it’s crucial to adapt these models to the specific context of Indonesia, considering its unique demographic and infrastructural characteristics. Directly transplanting a foreign model without careful consideration of local conditions would be akin to trying to fit a square peg into a round hole – a recipe for disaster.

Role of the Private Sector

The private sector in Indonesia, particularly banks and fintech companies, plays a crucial, and frankly, hilarious, role in expanding financial inclusion. Think of it as a financial comedy show, with banks as the seasoned veterans and fintechs as the energetic newcomers, all striving for the same punchline: a financially included Indonesia. Without their efforts, the government’s initiatives would be akin to a one-man show – entertaining, perhaps, but ultimately lacking the widespread impact needed.

Banks and other financial institutions form the backbone of Indonesia’s financial system. Their traditional branch networks, while sometimes feeling like a trip back in time, still provide crucial access to financial services, especially in underserved areas. However, their expansion into digital banking and mobile money services has proven to be a game-changer, reaching customers previously excluded due to geographical limitations or lack of technological literacy. It’s like watching a seasoned comedian learn some new tricks – the results are often surprisingly effective.

Banks and Financial Institutions Expanding Financial Access

The expansion of financial access hinges on banks’ willingness to adapt. This includes developing products and services tailored to the needs of low-income individuals and small businesses. Microfinance initiatives, for example, provide small loans and savings accounts, empowering individuals to participate in the economy. Imagine it as a financial “boot camp” for the previously excluded, equipping them with the tools to succeed. This involves overcoming challenges such as high transaction costs and a lack of collateral, requiring creative solutions and risk-management strategies. Banks are also increasingly leveraging technology to reduce costs and reach wider audiences, a strategy as smart as a comedian’s well-crafted punchline.

Innovative Financial Technologies (FinTech) Promoting Financial Inclusion

Fintech companies are disrupting the traditional financial landscape with their innovative approaches. Mobile money platforms, such as GoPay and OVO, have become incredibly popular, allowing users to conduct transactions through their smartphones. This is the equivalent of a stand-up comedian going viral – reaching a massive audience instantly. Peer-to-peer (P2P) lending platforms connect borrowers and lenders directly, bypassing traditional banking systems. Digital lending platforms offer quick and convenient loan applications, making credit more accessible to those who may not qualify for traditional bank loans. This rapid growth demonstrates the potential of FinTech to bridge the financial inclusion gap. It’s a financial revolution as hilarious as it is impactful.

Successful Government-Private Sector Partnerships, Financial Inclusion Strategies Indonesia

Several successful partnerships demonstrate the power of collaboration. The government often provides regulatory frameworks and incentives, while the private sector contributes its expertise and resources. For example, initiatives promoting financial literacy programs often involve collaborations between the government and banks, ensuring that the population is equipped to use financial services effectively. This is like a well-rehearsed comedy duo – the government setting the stage and the private sector delivering the punchlines. These partnerships create synergies that are far greater than the sum of their individual parts.

Comparison of FinTech Solutions in Indonesia

The following table compares different FinTech solutions used to increase financial inclusion in Indonesia. It’s a veritable who’s who of the Indonesian FinTech comedy scene.

| FinTech Solution | Service Offered | Target Audience | Impact on Financial Inclusion |

|---|---|---|---|

| GoPay | Mobile payments, e-wallet | General population, especially younger demographics | Increased access to digital transactions, reduced reliance on cash |

| OVO | Mobile payments, e-wallet, investments | General population, with a focus on everyday transactions | Increased financial accessibility, particularly for those without bank accounts |

| Dana | Mobile payments, e-wallet, bill payments | Broad range of users, including those in rural areas | Facilitates cashless transactions, improving convenience and security |

| Kredivo | Buy now, pay later (BNPL) services | Consumers with limited access to traditional credit | Provides access to credit for purchases, enhancing purchasing power |

Addressing Specific Population Segments

Financial inclusion in Indonesia isn’t a one-size-fits-all affair; it’s more like trying to fit a square peg into a round hole… repeatedly, with increasingly inventive tools. Reaching every citizen requires acknowledging the unique hurdles faced by different groups, from the intrepid villagers of remote regions to the dynamic entrepreneurs running bustling MSMEs. Let’s delve into the fascinating, and sometimes frustrating, world of targeted financial inclusion strategies.

The Indonesian archipelago presents a logistical nightmare, a beautiful tapestry woven with threads of diverse challenges. Geographic isolation, limited infrastructure, and a complex regulatory landscape all contribute to the uneven distribution of financial services. This isn’t just a matter of convenience; it’s a matter of economic empowerment and social justice.

Challenges Faced by Specific Population Segments

The struggles faced by various groups in accessing financial services are as varied as the Indonesian spice islands themselves. Rural populations often lack the physical proximity to banks or financial service providers, while women may encounter systemic barriers related to property ownership and patriarchal norms. MSMEs, the backbone of the Indonesian economy, frequently struggle with accessing credit due to a lack of collateral or formal business documentation. It’s a complex web, and untangling it requires a multi-pronged approach.

Tailored Financial Inclusion Strategies

Addressing these challenges requires a nuanced approach. For rural populations, mobile banking and agent networks offer a lifeline, bringing financial services directly to their doorsteps. Imagine a bustling village market, where instead of bartering chickens for rice, transactions are smoothly conducted via a smartphone app. For women, targeted financial literacy programs and microfinance initiatives specifically designed to empower female entrepreneurs are crucial. Similarly, MSMEs can benefit from government-backed loan guarantee schemes and capacity-building programs to enhance their creditworthiness.

Effectiveness of Different Approaches

The effectiveness of various approaches depends heavily on context. While mobile banking has proven revolutionary in reaching remote areas, its success hinges on digital literacy and reliable network coverage. Similarly, microfinance programs can be highly effective in empowering women, but their success is contingent on factors such as group solidarity and appropriate loan design. A comparison of different models highlights the importance of tailoring strategies to specific contexts and regularly evaluating their impact.

Successful Microfinance Programs in Indonesia and Their Impact

Indonesia boasts several successful microfinance programs that have made a tangible difference in the lives of countless individuals and businesses. One example is the program run by a major Indonesian bank, which provides small loans and financial literacy training to women entrepreneurs. This initiative has not only empowered women economically but has also contributed to a significant reduction in poverty rates within targeted communities. Another example is a government-backed program focused on supporting MSMEs, which has led to increased business activity and job creation in various sectors. The success of these programs demonstrates the transformative potential of well-designed financial inclusion initiatives. These programs are not just about numbers; they’re about building livelihoods, fostering resilience, and empowering communities.

Digital Financial Services and Infrastructure

Indonesia’s journey towards comprehensive financial inclusion is inextricably linked to its burgeoning digital landscape. While traditional banking struggles to reach remote villages, the ubiquitous smartphone has become a surprisingly effective financial tool, transforming the way Indonesians manage their money. This section delves into the exciting, albeit sometimes chaotic, world of digital finance in Indonesia.

The rapid expansion of mobile money and other digital financial services has dramatically increased access to finance, particularly for the unbanked and underbanked population. Imagine a bustling Jakarta street market, where previously cash-only transactions are now seamlessly conducted via mobile apps. This shift represents a monumental leap forward in financial accessibility. Mobile wallets, peer-to-peer payment systems, and digital lending platforms are bypassing the traditional banking infrastructure, empowering individuals and businesses alike. This isn’t just about convenience; it’s about economic empowerment.

Mobile Money’s Impact on Financial Inclusion

The rise of mobile money, epitomized by services like OVO and GoPay, has been nothing short of revolutionary. These platforms offer a simple, user-friendly interface, enabling even those with limited financial literacy to send and receive money, make payments, and even access micro-loans. The ease of use and wide network coverage have proven particularly effective in reaching rural communities, previously excluded from formal financial systems. The impact on small businesses, particularly those run by women, has been significant, allowing them to manage their finances more efficiently and access crucial credit. This, in turn, stimulates local economies and contributes to broader national development.

Challenges in Digital Literacy and Infrastructure

Despite the impressive progress, significant challenges remain. Digital literacy, or the ability to effectively use digital tools, varies widely across the Indonesian population. While younger generations are generally tech-savvy, older individuals and those in rural areas often lack the necessary skills to navigate digital financial platforms. Furthermore, inconsistent internet connectivity and a lack of reliable infrastructure in certain regions pose significant hurdles. Imagine trying to transfer money via a mobile app when your internet connection is as reliable as a rickety old bicycle – frustrating, to say the least!

Indonesia’s Digital Financial Ecosystem

Indonesia’s digital financial ecosystem is a vibrant, albeit complex, tapestry of interconnected players. At its heart are the mobile money providers (e.g., GoPay, OVO), acting as the conduits for transactions. These platforms are supported by telecommunication companies providing the network infrastructure and fintech companies developing innovative financial products. Banks play a crucial, albeit evolving, role, often partnering with fintechs to offer digital banking services. The government, through regulatory frameworks and initiatives, provides the overarching governance. Finally, the consumers, both individuals and businesses, are the ultimate beneficiaries (and sometimes victims) of this dynamic ecosystem. The interactions are multifaceted: consumers utilize mobile money services, banks provide underlying financial services, and fintech companies innovate to meet evolving consumer needs, all under the watchful eye of the government.

Solutions for Improving Digital Financial Infrastructure and Literacy

Addressing the challenges requires a multi-pronged approach. Investing in robust and affordable internet infrastructure, particularly in underserved areas, is paramount. Simultaneously, targeted digital literacy programs, tailored to different age groups and levels of technological proficiency, are crucial. These programs should be engaging and accessible, perhaps utilizing local languages and culturally relevant content. The government can play a pivotal role in fostering collaboration between stakeholders, creating a supportive regulatory environment, and promoting financial education initiatives. Think of it as a collaborative orchestra, with each player (government, private sector, individuals) playing their part to create a harmonious symphony of financial inclusion. This coordinated effort is essential for realizing the full potential of digital finance in Indonesia.

Measuring the Impact of Financial Inclusion Strategies

Measuring the success of financial inclusion initiatives in Indonesia isn’t just about counting bank accounts; it’s about understanding whether these programs are truly improving people’s lives. Think of it as a financial health check-up for the nation – are we seeing tangible improvements in economic well-being, or are we just rearranging deck chairs on the Titanic? A robust evaluation framework is crucial to ensure that resources are allocated effectively and that progress is genuinely impactful.

Effective measurement requires a multi-faceted approach, combining quantitative data with qualitative insights. Simply tracking the number of new accounts opened, while useful, doesn’t tell the whole story. We need to delve deeper to understand how these accounts are being used, the impact on household income, and the overall contribution to economic growth. Ignoring this crucial step is akin to baking a cake without checking if the oven is on – the result might be… less than desirable.

Methods for Evaluating the Effectiveness of Financial Inclusion Programs

Several methods exist to assess the effectiveness of financial inclusion programs. Randomized controlled trials (RCTs), for instance, compare outcomes for a group receiving the intervention with a control group that doesn’t. This approach, while rigorous, can be expensive and time-consuming. Other methods include before-and-after studies, which compare outcomes before and after the implementation of a program, and comparative case studies, which analyze the impact of different programs across various regions or populations. These methods offer varying levels of rigor and cost-effectiveness, requiring careful consideration based on the specific context and resources available. Choosing the wrong method is like trying to hammer in a screw – it might work, but it’s not the most efficient approach.

Key Indicators to Track Progress Towards Financial Inclusion Goals

Tracking progress towards financial inclusion requires a suite of key performance indicators (KPIs). These go beyond simply counting the number of accounts. We need to look at metrics like account usage frequency, loan repayment rates, the percentage of the population with access to formal financial services, and the level of financial literacy. Furthermore, measuring the impact on household income, poverty reduction, and access to essential services like healthcare and education provides a more holistic picture of success. Ignoring these broader indicators is like judging a book by its cover – you miss the richness of the story within.

Examples of Successful Impact Assessments of Financial Inclusion Initiatives

Several successful impact assessments highlight the effectiveness of targeted financial inclusion strategies. For example, studies on the impact of mobile money in Kenya have demonstrated significant improvements in household income and economic empowerment, particularly for women. Similarly, research on microfinance initiatives in Bangladesh has shown a positive correlation between access to credit and improved livelihoods. These success stories, while context-specific, provide valuable insights into the design and implementation of effective programs and highlight the importance of tailoring interventions to the specific needs of the target population. Failing to learn from these successes is like reinventing the wheel – unnecessarily time-consuming and potentially inefficient.

Best Practices for Monitoring and Evaluating Financial Inclusion Strategies

A robust monitoring and evaluation framework is essential for maximizing the impact of financial inclusion initiatives.

- Establish clear goals and targets: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide the evaluation process.

- Develop a comprehensive data collection plan: Use a mix of quantitative and qualitative data to capture a holistic picture of the program’s impact.

- Employ appropriate evaluation methods: Select methods that align with the program’s goals and available resources.

- Ensure data quality and integrity: Implement rigorous data quality control measures to ensure the reliability of findings.

- Conduct regular monitoring and reporting: Track progress regularly and provide timely feedback to program managers.

- Disseminate findings widely: Share evaluation results with stakeholders to inform policy decisions and program improvements.

- Promote learning and adaptation: Use evaluation findings to adapt and improve programs over time.

Following these best practices ensures that financial inclusion strategies are not just implemented, but also effectively measured and improved, ultimately maximizing their positive impact on Indonesian society. Ignoring these practices is like navigating without a map – you might eventually arrive, but it will likely be a much longer and more difficult journey.

Closing Summary

Indonesia’s journey towards comprehensive financial inclusion is a marathon, not a sprint. While challenges remain, the progress made – from innovative fintech solutions to targeted government programs – is undeniably impressive. The path forward requires continued collaboration between the public and private sectors, a commitment to digital literacy, and a willingness to adapt strategies to the unique needs of diverse populations. The ultimate goal? A financially empowered Indonesia, where economic opportunity is within everyone’s reach. And that, my friends, is a story worth celebrating.

Detailed FAQs

What are the biggest obstacles to financial inclusion in rural areas of Indonesia?

Limited infrastructure (internet access, bank branches), low digital literacy, and geographical isolation are major hurdles. Trust in formal financial institutions is also a factor.

How does Indonesia’s financial inclusion compare to other ASEAN nations?

Indonesia’s progress is significant but varies regionally. While it’s making strides, some neighboring countries may have higher rates of mobile money usage or broader access to certain financial services.

What role do cooperatives play in promoting financial inclusion in Indonesia?

Cooperatives provide crucial financial services, particularly to underserved communities, often offering microloans and savings schemes with a strong emphasis on community engagement.