Financial Inclusion Strategies Review: This isn’t your grandpappy’s banking lecture! We’re diving headfirst into the fascinating world of getting everyone access to the financial system – from microfinance marvels to the mind-bending potential of blockchain. Prepare for a rollercoaster ride through government initiatives, private sector partnerships, and technological breakthroughs, all while dodging the occasional regulatory hurdle (because let’s be honest, those exist). Buckle up, it’s going to be a wild, and hopefully profitable, ride.

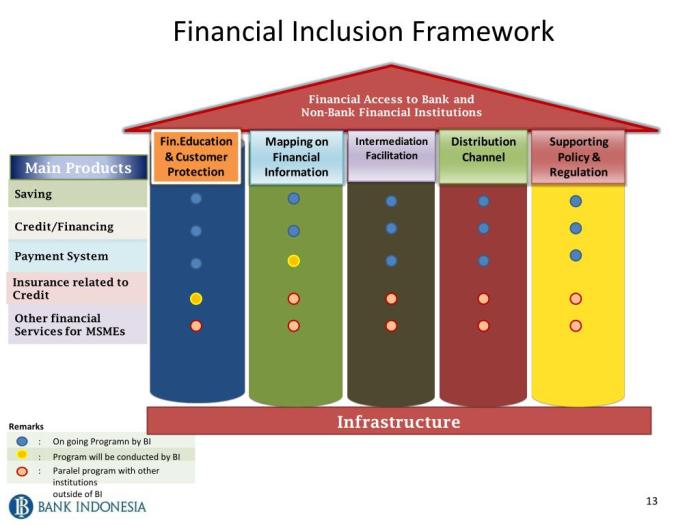

This review delves into the multifaceted nature of financial inclusion, exploring how access to, usage of, and the quality of financial services impact various economies. We’ll dissect successful government programs, examine the innovative roles of the private sector and technology, and analyze the persistent barriers hindering widespread financial inclusion. We’ll even tackle the thorny issue of measuring success – because let’s face it, proving you’ve made a difference is half the battle.

Defining Financial Inclusion

Financial inclusion, my friends, is far more exciting than it sounds. It’s not just about handing out piggy banks; it’s a multifaceted beast, a hydra of access, usage, and quality of financial services. Think of it as the financial equivalent of a well-stocked pantry – not just having the pantry (access), but knowing how to use the ingredients (usage) and having access to high-quality, fresh ingredients (quality). Getting everyone to that well-stocked pantry is the ultimate goal.

Financial inclusion isn’t a one-size-fits-all affair; it’s as diverse as the global population itself. We need robust methods to assess its effectiveness across different economies, and thankfully, we have several key indicators to do just that.

Key Indicators of Financial Inclusion

Measuring financial inclusion requires a multifaceted approach. We don’t just count bank accounts; we delve deeper. Key indicators include the percentage of adults with access to formal financial services (like bank accounts or mobile money), the frequency of usage of these services, the value of transactions conducted, and the breadth of services accessed (loans, insurance, etc.). Furthermore, indicators like the availability of financial literacy programs and the level of consumer protection also play crucial roles. Imagine trying to measure the success of a bakery just by counting the number of ovens; you’d miss the crucial metrics of customer satisfaction and the quality of the bread!

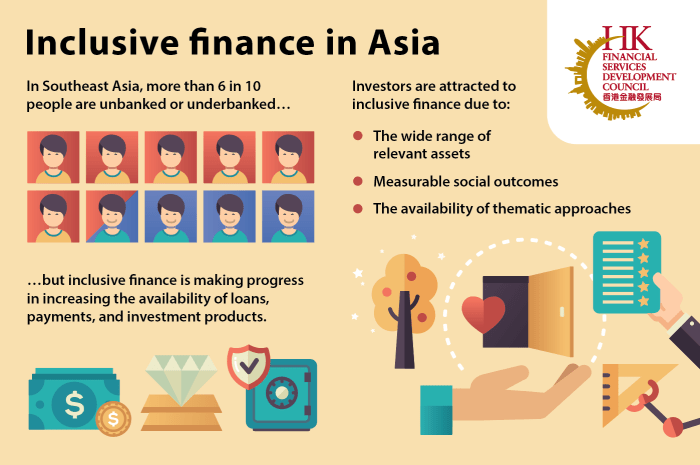

Populations Typically Excluded from Formal Financial Systems

The unfortunate reality is that certain segments of the population are systematically excluded from formal financial systems. This often includes rural populations with limited access to physical bank branches, low-income individuals lacking sufficient collateral for loans, women facing discriminatory practices, and the unbanked, who may lack identification documents or the technological literacy to use digital financial services. Think of it as a financial red-lining, but instead of drawing lines on a map, it’s drawing lines of exclusion around certain groups. It’s not pretty, but it’s a crucial issue to address.

Models of Financial Inclusion Strategies

Let’s take a look at how different approaches tackle this complex issue. Below is a comparison of various models, highlighting their targets, mechanisms, and success metrics. It’s important to note that these models are not mutually exclusive; often, a blended approach is most effective.

| Model Name | Target Population | Key Mechanisms | Success Metrics |

|---|---|---|---|

| Branchless Banking | Rural and underserved populations | Mobile money platforms, agent networks | Account penetration, transaction volume, loan disbursement rates |

| Microfinance Institutions | Low-income entrepreneurs and small businesses | Small loans, savings products, group lending | Loan repayment rates, business growth, poverty reduction |

| Financial Literacy Programs | Individuals lacking financial knowledge | Education and training on budgeting, saving, investing | Improved financial knowledge, increased savings rates, reduced debt levels |

| Government Subsidies and Incentives | Low-income households | Financial assistance, tax breaks, grants | Increased access to financial services, improved economic outcomes |

Reviewing Existing Strategies

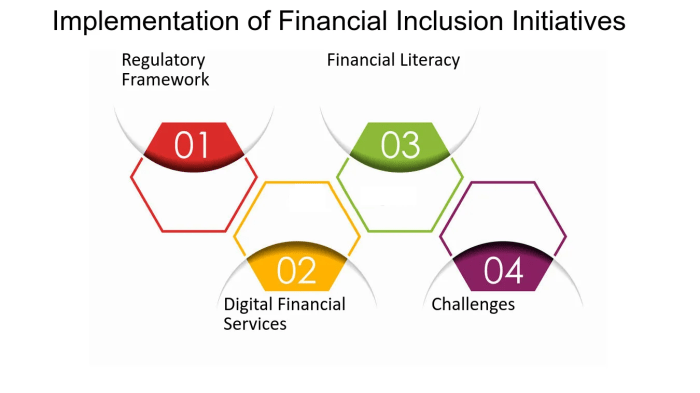

Governments, those benevolent (and sometimes bewildering) behemoths, play a pivotal role in the financial inclusion saga. Their actions, or inactions, can dramatically shape whether access to financial services remains a privilege for the few or becomes a reality for the many. This section delves into the fascinating – and occasionally frustrating – world of government initiatives aimed at boosting financial inclusion.

Government regulation acts as the conductor of this financial orchestra, ensuring a harmonious (or at least less cacophonous) playing field. It sets the stage for financial institutions to participate, establishing rules of engagement that encourage them to reach underserved populations. Without a regulatory framework that actively promotes inclusion, the private sector may find it more profitable to focus solely on already-banked customers, leaving the financially excluded in the dust. Think of it as a well-orchestrated waltz, where the government sets the tempo and ensures everyone gets a chance to twirl.

Government Initiatives to Expand Access to Financial Services

Successful government-led initiatives often involve a multi-pronged approach, combining carrots and sticks (metaphorically speaking, of course – we wouldn’t want any actual carrots or sticks involved). For instance, India’s Aadhaar-enabled Payments System (AePS) leverages biometric identification to facilitate digital transactions, even in remote areas. This system, like a technological magic wand, has dramatically increased access to banking services for millions. Another example is the Kenyan M-Pesa mobile money transfer service, which, while not strictly a government initiative, benefited significantly from a supportive regulatory environment that fostered innovation and widespread adoption. Imagine M-Pesa as a nimble gazelle, gracefully navigating the financial landscape thanks to a government-created ecosystem that protected it from predators (like overly restrictive regulations).

Challenges Faced by Governments in Implementing Financial Inclusion Policies, Financial Inclusion Strategies Review

Implementing effective financial inclusion policies is no walk in the park. Governments frequently grapple with logistical hurdles, such as reaching remote populations with limited infrastructure. Funding constraints also pose a significant challenge; convincing lawmakers to allocate sufficient resources to initiatives that may not yield immediate, easily quantifiable results can be a Herculean task. Furthermore, the digital divide exacerbates the problem; ensuring equitable access to technology requires substantial investment and careful planning. It’s like trying to build a bridge across a chasm – a monumental undertaking requiring careful engineering and significant resources.

Hypothetical Government Program: Financial Literacy for Underserved Populations

This hypothetical program, imaginatively titled “Financially Fluent Futures,” aims to equip underserved populations with the knowledge and skills to navigate the financial world confidently. The program will consist of a series of workshops, online modules, and community outreach initiatives, utilizing a blend of traditional and digital methods. The budget, estimated at $50 million over five years, will be allocated as follows: $20 million for curriculum development and instructor training, $15 million for technology infrastructure and digital content creation, and $15 million for community outreach and program evaluation. The implementation timeline involves a phased rollout, starting with pilot programs in selected communities in year one, followed by a nationwide expansion over the subsequent four years. Success will be measured by improvements in financial literacy scores, increased savings rates, and reduced reliance on high-cost financial products. We envision this program as a financial fitness boot camp, empowering individuals to achieve their financial goals.

Reviewing Existing Strategies

The private sector, those titans of industry who trade in profit and often (let’s be honest) a healthy dose of caffeine, plays a surprisingly crucial role in the often-overlooked world of financial inclusion. Their involvement isn’t just altruistic; it’s a shrewd business move, opening up vast new markets and fostering economic growth. Let’s delve into the fascinating (and occasionally hilarious) world of private sector partnerships in the quest for financial inclusion.

Private Sector Partnerships: Success Stories

Successful private sector partnerships often involve a delicate dance between profit and purpose. Consider the example of M-Pesa in Kenya. Safaricom, a mobile network operator, partnered with Vodafone to create a mobile money transfer system that revolutionized financial access in a country where traditional banking infrastructure was limited. The result? Millions of previously unbanked individuals gained access to financial services, demonstrating the transformative power of a well-executed private-public partnership. Another shining example is the Grameen Bank in Bangladesh, a microfinance institution that empowers individuals through small loans, often targeting women entrepreneurs. While not strictly a private sector initiative, its success showcases the potential for private sector engagement in innovative financial models.

Comparative Analysis of Financial Institution Approaches

Different financial institutions approach financial inclusion with varying degrees of enthusiasm (and, let’s face it, varying levels of marketing savvy). Some institutions adopt a purely philanthropic approach, focusing on social impact above all else. Others integrate financial inclusion strategies into their core business models, viewing it as a lucrative opportunity to expand their customer base. The contrast is stark: one approach is driven by a heart of gold, the other by a well-calculated bottom line. A key difference lies in the products and services offered. Some institutions focus on basic savings and loan products, while others offer more sophisticated services like insurance and investment options. This difference reflects varying risk appetites and target customer segments.

Technology’s Role in Expanding Financial Services

Technology, that ever-evolving beast, has emerged as a powerful engine for financial inclusion. Mobile banking and fintech solutions have bypassed traditional infrastructure limitations, bringing financial services to remote and underserved communities. Imagine the scene: a farmer in a remote village, previously reliant on cash-only transactions, now effortlessly transferring money to their family in the city using their mobile phone. This is the transformative power of mobile money, a technology that has democratized access to finance in ways previously unimaginable. The rise of fintech has also spurred innovation, leading to the development of creative solutions tailored to the specific needs of underserved populations.

Incentivizing Private Sector Participation

To encourage private sector involvement, a multi-pronged approach is needed. This includes:

- Tax incentives: Reducing tax burdens on businesses investing in financial inclusion initiatives.

- Regulatory support: Streamlining regulatory processes to facilitate the entry of new players into the market.

- Government guarantees: Providing guarantees to mitigate the risks associated with lending to underserved populations.

- Public-private partnerships: Creating collaborative platforms that leverage the strengths of both the public and private sectors.

- Capacity building: Providing training and technical assistance to build the capacity of private sector players to effectively serve underserved populations.

These incentives create a win-win situation: businesses gain access to new markets and generate profits, while underserved populations gain access to essential financial services, fostering economic empowerment and growth. It’s a beautiful symphony of capitalism and social good.

Technological Advancements and their Impact

The digital revolution, much like a particularly enthusiastic caffeinated squirrel, has scrambled its way into the world of finance, leaving a trail of both opportunity and chaos in its wake. While traditional banking systems often struggle to reach remote populations, technology has offered a surprisingly nimble solution, leapfrogging infrastructure limitations and democratizing access to financial services in ways previously unimaginable. Let’s delve into the exciting, and occasionally terrifying, world of fintech’s impact on financial inclusion.

Mobile money platforms, in particular, have proven to be game-changers, particularly in developing countries with limited banking infrastructure. Imagine a scenario where a farmer in a remote village can receive payments for their harvest directly to their mobile phone, eliminating the need for lengthy journeys to a distant bank branch. This isn’t science fiction; it’s the reality for millions thanks to the proliferation of mobile money services like M-Pesa in Kenya and similar platforms across Africa and Asia. These platforms empower individuals to manage their finances, make payments, and access credit with unprecedented ease and convenience, effectively bypassing traditional banking systems and significantly boosting financial inclusion.

Mobile Money Platforms: A Revolution in Access

The success of mobile money hinges on the ubiquity of mobile phones, even in areas lacking robust internet infrastructure. These platforms offer a simple, user-friendly interface, often requiring minimal digital literacy to operate. Transactions are typically facilitated through short message service (SMS), making them accessible even to individuals with basic mobile phones. The impact is profound: increased economic activity, improved savings habits, and reduced reliance on informal and often exploitative financial systems. For example, M-Pesa’s success story demonstrates how mobile money can transform lives by providing access to financial services for millions who were previously excluded.

Blockchain Technology’s Potential

Blockchain technology, the backbone of cryptocurrencies like Bitcoin, offers the potential to further revolutionize financial inclusion. Its decentralized nature and transparent record-keeping could significantly reduce transaction costs and increase efficiency, particularly for cross-border payments. Imagine a world where remittances to family members in other countries are processed quickly, securely, and at a fraction of the current cost. While still in its early stages of adoption in the financial inclusion space, blockchain’s potential to enhance transparency and security is undeniable, potentially creating a more equitable and accessible financial system.

Challenges in Digital Financial Inclusion

Despite the immense potential, the path to digital financial inclusion is paved with challenges. The digital divide, characterized by unequal access to technology and digital literacy, remains a significant hurdle. Not everyone possesses a smartphone or has the skills to navigate digital platforms. Furthermore, cybersecurity concerns are paramount. The reliance on digital systems creates vulnerabilities to fraud, data breaches, and other cyber threats, which can disproportionately impact vulnerable populations.

Potential Risks Associated with Increased Reliance on Digital Financial Services

As our reliance on digital financial services grows, it’s crucial to acknowledge the potential risks. While the benefits are numerous, a balanced perspective is essential. Let’s consider the potential downsides:

- Data Privacy and Security Breaches: The concentration of personal financial data in digital systems creates a tempting target for cybercriminals, potentially leading to identity theft and financial losses.

- Exclusion of the Digitally Illiterate: The digital divide risks exacerbating existing inequalities, leaving those without access to technology or digital literacy further marginalized.

- System Failures and Outages: Dependence on digital systems makes users vulnerable to disruptions caused by technical failures or power outages, potentially disrupting access to essential financial services.

- Financial Exploitation and Fraud: Sophisticated scams and phishing attempts can target users, leading to significant financial losses, especially among less tech-savvy individuals.

- Regulatory Challenges and Governance Gaps: The rapid evolution of digital financial services necessitates robust regulatory frameworks to ensure consumer protection and prevent misuse.

Addressing Key Barriers to Inclusion

Financial inclusion, while a noble goal, often finds itself tripping over a series of rather amusing – and sometimes infuriating – obstacles. Think of it as a hilarious game of financial parkour, where the participants leap over hurdles of bureaucracy and leapfrog over mountains of red tape. Let’s examine these barriers and the ingenious solutions being deployed to overcome them.

The path to financial inclusion is paved with good intentions, but also with some surprisingly hefty roadblocks. These barriers, often interconnected and delightfully complex, hinder individuals and communities from accessing essential financial services. Overcoming them requires a multi-pronged approach, a financial Swiss Army knife, if you will, that tackles each challenge with precision and panache.

Geographical Barriers

In many parts of the world, accessing a bank branch is akin to finding a unicorn – rare, mythical, and possibly only existing in legends. Vast distances, poor infrastructure, and a general lack of convenient banking locations leave large populations financially isolated. This geographical isolation isn’t just inconvenient; it’s a significant barrier to accessing crucial services like savings accounts, loans, and insurance.

Innovative solutions are emerging to address this, however. Mobile banking, for example, allows individuals to conduct transactions via their mobile phones, bypassing the need for physical bank branches. This is particularly impactful in rural areas with limited infrastructure. Imagine a farmer in a remote village, effortlessly transferring money to his family in the city – pure financial magic!

Lack of Identification Documents

The absence of official identification documents is a surprisingly common hurdle. Without proof of identity, individuals are often excluded from the formal financial system. This can stem from various factors, including poverty, lack of access to registration services, and complex bureaucratic processes – a delightful cocktail of challenges.

Biometric identification systems are revolutionizing this area. These systems use unique biological characteristics, such as fingerprints or iris scans, to verify identity. This allows individuals without traditional identification documents to access financial services, creating a more inclusive and efficient system. Think of it as a high-tech solution to a very low-tech problem.

High Transaction Costs

The cost of accessing and using financial services can be prohibitively high for many, especially low-income individuals. High fees for transfers, account maintenance, and other services can eat into already meager resources. This makes accessing financial services a luxury, rather than a necessity.

The rise of fintech companies and digital payment systems is helping to reduce these costs. These platforms often offer lower fees and greater convenience, making financial services more accessible to a wider range of people. It’s a beautiful example of technology disrupting the status quo and making financial services more affordable.

Financial Illiteracy

Financial illiteracy, the inability to understand and manage personal finances effectively, acts as a significant barrier to financial inclusion. Individuals lacking financial knowledge may struggle to make informed decisions, manage their finances effectively, and ultimately, benefit from financial services. It’s like trying to navigate a complex financial maze blindfolded – not a pretty picture.

A well-designed public awareness campaign is crucial to combat financial illiteracy. This campaign should employ a multifaceted approach, utilizing various channels to reach a broad audience. The key message should be simple, memorable, and easily understood. Imagine a catchy jingle, perhaps? Or a series of short, engaging videos. Distribution should involve community outreach programs, educational institutions, social media, and partnerships with local businesses.

Measuring the Effectiveness of Strategies

Measuring the success of financial inclusion strategies isn’t just about counting bank accounts; it’s about understanding the ripple effect on individuals, communities, and the economy as a whole. A well-designed evaluation framework is crucial to ensure that our efforts aren’t just throwing money at the problem but actually making a tangible difference. We need to move beyond simply tracking the number of accounts opened and delve into the real impact on people’s lives.

Evaluating the impact of financial inclusion strategies requires a multifaceted approach, much like assembling a particularly complex and slightly wobbly Jenga tower. Different methods are needed to capture the diverse aspects of financial inclusion, and the choice of methods will depend on the specific goals and context of the initiative. One size definitely does not fit all, and relying on a single metric would be like trying to judge a book by its cover (and a very poorly designed cover at that).

Methods for Evaluating Impact

Several methods can be employed to assess the effectiveness of financial inclusion strategies. These include quantitative methods like analyzing changes in access to financial services, usage rates, and financial indicators among target populations. Qualitative methods, such as conducting surveys, focus groups, and case studies, provide valuable insights into the lived experiences and perceptions of individuals impacted by these initiatives. A robust evaluation should integrate both quantitative and qualitative data to paint a complete picture. Think of it as the ultimate financial inclusion recipe: a perfectly balanced blend of hard data and insightful stories.

Key Performance Indicators (KPIs)

Tracking progress toward financial inclusion goals necessitates the use of carefully selected KPIs. These indicators offer a structured way to monitor the effectiveness of interventions. Examples of such KPIs include the percentage of the adult population with access to formal financial services, the number of active accounts, the value of transactions, and the level of credit penetration. Furthermore, indicators that reflect the impact of financial inclusion on economic empowerment, such as income levels, poverty reduction rates, and business growth, are essential for a holistic assessment. Selecting the right KPIs is like choosing the right tools for a job – you wouldn’t use a hammer to screw in a screw, would you?

Challenges in Measuring Impact

Accurately measuring the impact of financial inclusion initiatives presents several significant challenges. Data collection can be difficult, especially in remote or underserved areas where reliable data infrastructure may be lacking. Attribution – proving that a particular initiative directly caused a positive outcome – is another significant hurdle. It’s like trying to determine which raindrop filled your bucket first in a heavy downpour. Furthermore, the long-term impacts of financial inclusion may not be immediately apparent, requiring ongoing monitoring and evaluation over extended periods. Finally, comparing results across different contexts and countries can be tricky due to variations in data collection methods and definitions.

Visual Representation of Financial Inclusion and Economic Growth

Imagine a graph with two lines. The horizontal axis represents the level of financial inclusion, ranging from low to high. The vertical axis represents economic growth, measured by GDP per capita, for example. The line representing financial inclusion starts low and gradually rises, indicating an increase in access to and usage of financial services. The line representing economic growth shows a similar upward trend, but importantly, the economic growth line rises more steeply when the financial inclusion line also increases significantly. The visual would clearly demonstrate a positive correlation, with a steeper incline in economic growth as financial inclusion increases, showing a clear causal link. This visual would not show a perfectly linear relationship; rather, it would illustrate a clear positive correlation, with the economic growth accelerating as financial inclusion improves. The visual representation would showcase the synergistic relationship between financial inclusion and economic growth, reinforcing the notion that greater financial inclusion fuels greater economic prosperity. It’s a beautiful picture, really.

Closing Summary

So, there you have it – a whirlwind tour through the world of financial inclusion strategies. While the path to universal financial access is paved with challenges (and maybe a few potholes), the potential rewards are immense. From boosting economic growth to empowering individuals, the journey is well worth the effort. And who knows, maybe along the way we’ll even stumble upon the next big fintech innovation that changes the game forever. Stay tuned!

Query Resolution: Financial Inclusion Strategies Review

What are some examples of populations often excluded from formal financial systems?

Rural populations, low-income individuals, women, and undocumented immigrants often face significant barriers to accessing traditional financial services.

How can financial illiteracy be addressed effectively?

Financial literacy programs, utilizing diverse media and tailored to specific demographics, are crucial. Think interactive workshops, easily digestible online resources, and even gamified learning experiences.

What are the ethical considerations surrounding the use of financial technology in promoting inclusion?

Data privacy, algorithmic bias, and the digital divide all pose ethical challenges. Ensuring equitable access and responsible data handling are paramount.

What role does consumer protection play in financial inclusion?

Robust consumer protection frameworks are vital to prevent exploitation and build trust in financial services, especially among vulnerable populations. This includes clear regulations, accessible dispute resolution mechanisms, and transparent pricing.