The stability of the global financial system hinges on the effective management of risk within financial institutions. From credit defaults to market volatility and cybersecurity threats, these entities face a complex web of potential vulnerabilities. Understanding and mitigating these risks is crucial not only for the institutions themselves but also for the broader economic health. This exploration delves into the multifaceted nature of financial institution risk, examining key categories, management strategies, and the evolving regulatory landscape.

This examination will cover a range of critical risk areas, including credit, market, operational, liquidity, regulatory, reputational, and cybersecurity risks. We will analyze the interconnectedness of these risks, explore best practices for mitigation, and discuss the role of technology and regulatory frameworks in shaping a resilient and stable financial environment. The ultimate goal is to provide a comprehensive understanding of the challenges and opportunities inherent in managing risk within the financial services sector.

Types of Financial Institution Risks

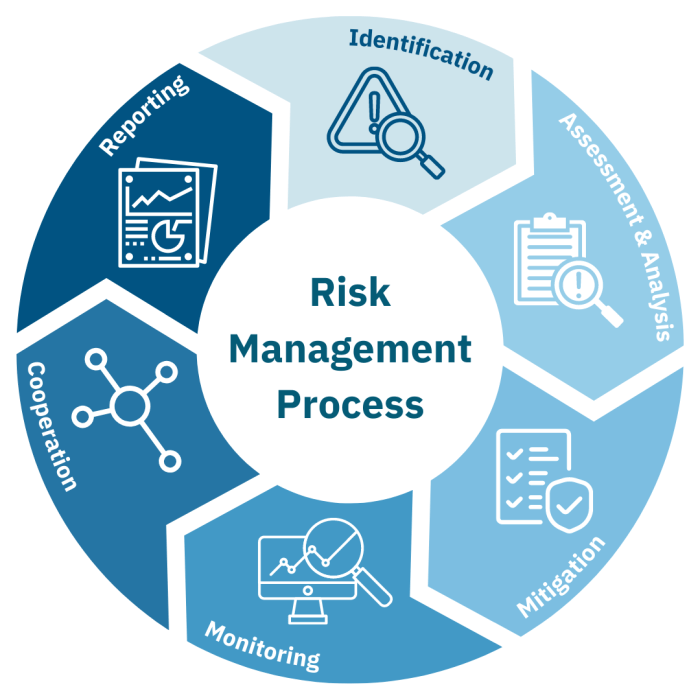

Financial institutions, by their very nature, operate in a complex and dynamic environment, constantly exposed to a multitude of risks. Understanding these risks is crucial for maintaining the stability of both individual institutions and the broader financial system. Effective risk management requires a comprehensive approach that identifies, assesses, and mitigates these risks proactively.

Major Categories of Financial Institution Risks

Financial institutions face a diverse range of risks, broadly categorized into several key areas. These categories often overlap and interact, creating complex risk profiles. Effective risk management requires a holistic approach that considers these interdependencies.

| Risk Category | Description | Examples | Impact |

|---|---|---|---|

| Credit Risk | The risk of loss resulting from a borrower’s failure to repay a loan or meet other contractual obligations. | Loan defaults, bond downgrades, counterparty risk in derivatives transactions. | Reduced profitability, capital erosion, potential insolvency. |

| Market Risk | The risk of losses arising from changes in market prices, such as interest rates, exchange rates, and equity prices. | Interest rate risk on bond portfolios, foreign exchange risk on international transactions, equity price risk on investment holdings. | Decreased asset values, reduced profitability, potential losses exceeding capital. |

| Operational Risk | The risk of losses resulting from inadequate or failed internal processes, people, and systems, or from external events. | Fraud, cyberattacks, system failures, natural disasters, regulatory breaches. | Financial losses, reputational damage, legal liabilities, operational disruptions. |

| Liquidity Risk | The risk that a financial institution will be unable to meet its short-term obligations as they come due. | Unexpected large withdrawals, inability to sell assets quickly enough, funding gaps. | Forced asset sales at fire-sale prices, inability to honor commitments, potential insolvency. |

| Regulatory Risk | The risk of losses stemming from non-compliance with existing or changing regulations. | Fines, penalties, legal actions, reputational damage, operational disruptions. | Significant financial penalties, loss of market share, damage to reputation. |

Systemic Risk versus Idiosyncratic Risk

Systemic risk refers to the risk of a widespread collapse of the financial system, triggered by the failure of one or more large institutions. Idiosyncratic risk, on the other hand, is the risk specific to a single institution or a small group of institutions. The 2008 financial crisis serves as a prime example of systemic risk, where the collapse of Lehman Brothers triggered a cascade of failures across the global financial system. In contrast, the failure of a smaller, less interconnected institution would represent idiosyncratic risk, with limited spillover effects. Systemic risk poses a far greater threat to the stability of the financial system as a whole.

Interdependencies Between Financial Institution Risks

Different types of risks are interconnected and can amplify each other. For example, a liquidity crisis (lack of readily available cash) can exacerbate credit risk (borrowers defaulting) as institutions struggle to meet their obligations. Similarly, operational failures can increase market risk exposure if they lead to inaccurate pricing or trading losses. A decline in market values (market risk) can trigger increased credit risk as borrowers face financial distress.

| Risk 1 | Risk 2 | Interdependence | Example |

|---|---|---|---|

| Credit Risk | Liquidity Risk | High levels of loan defaults can reduce a bank’s available funds, leading to liquidity problems. | A bank with a high percentage of non-performing loans may struggle to meet unexpected withdrawals. |

| Market Risk | Operational Risk | Operational failures can lead to inaccurate risk assessments and increased market risk exposure. | A trading error caused by a software glitch could result in significant market losses. |

| Liquidity Risk | Regulatory Risk | Regulatory changes can restrict access to funding sources, increasing liquidity risk. | New capital requirements may force banks to sell assets quickly, potentially at a loss. |

Credit Risk Management

Effective credit risk management is crucial for the financial health and stability of any financial institution. It involves a comprehensive process of assessing, monitoring, and mitigating the potential losses associated with borrowers failing to repay their debts. This process encompasses a wide range of activities, from initial loan application screening to ongoing portfolio monitoring and recovery efforts. The goal is to balance the need for profitability with the need to maintain a healthy level of capital and minimize potential losses.

Credit risk assessment varies significantly depending on the type of loan. For example, assessing the creditworthiness of a large corporation seeking a syndicated loan requires a far more in-depth analysis than evaluating an individual applying for a personal loan. Best practices incorporate a multi-faceted approach, combining quantitative and qualitative data to create a holistic view of the borrower’s creditworthiness.

Credit Risk Assessment Processes for Different Loan Types

The process of credit risk assessment involves several key steps, although the specific details vary depending on the type of loan. Generally, it begins with collecting information about the borrower, analyzing that information to assess their creditworthiness, and then making a lending decision. For consumer loans, this might involve checking credit scores and verifying income. For commercial loans, a more detailed financial analysis, including review of financial statements and industry benchmarks, is necessary. Large corporate loans may involve extensive due diligence, including assessments of the borrower’s management team, industry position, and overall economic outlook. Throughout the process, lenders use various models and techniques to quantify the risk and determine appropriate interest rates and loan terms. The process concludes with ongoing monitoring of the borrower’s performance to detect early warning signs of potential default.

The Role of Credit Scoring and Credit Rating Agencies

Credit scoring models, such as the FICO score, provide a standardized numerical representation of a borrower’s creditworthiness based on their credit history. These scores are widely used by lenders to quickly assess the risk associated with extending credit to individuals. Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, play a critical role in assessing the creditworthiness of corporations and governments. They provide ratings that reflect the likelihood of default, influencing investor decisions and the cost of borrowing. Examples of models used in credit risk assessment include the Altman Z-score, which predicts corporate bankruptcy, and the KMV model, which estimates the probability of default for corporate borrowers. These models utilize financial ratios and other data to quantify the likelihood of default.

Impact of Macroeconomic Factors on Credit Risk

Macroeconomic factors significantly influence the overall level of credit risk in the economy. Changes in these factors can increase or decrease the likelihood of borrowers defaulting on their loans.

- Economic Growth: A strong economy generally leads to lower credit risk, as borrowers are more likely to be able to repay their debts. Conversely, economic downturns increase the risk of defaults.

- Interest Rates: Rising interest rates can increase the cost of borrowing, making it more difficult for borrowers to repay their loans and increasing the risk of default. Falling interest rates have the opposite effect.

- Inflation: High inflation erodes the purchasing power of money, making it harder for borrowers to repay their debts in real terms. Unexpected inflation can also lead to higher interest rates.

- Unemployment: High unemployment rates reduce borrowers’ income and increase the risk of default. Job losses can significantly impact a borrower’s ability to meet their financial obligations.

- Regulatory Changes: Changes in banking regulations and lending standards can impact credit risk. Tighter regulations may reduce risk, while looser regulations may increase it.

Market Risk Management

Market risk, encompassing the potential for losses stemming from fluctuations in market prices, is a critical concern for financial institutions. These institutions are inherently exposed to various market risks due to their trading activities, investment portfolios, and the overall sensitivity of their business models to market movements. Effective management of these risks is paramount for maintaining profitability and ensuring long-term solvency.

Key Market Risks Faced by Financial Institutions

Financial institutions face a multitude of market risks. These risks, if not properly managed, can significantly impact their profitability and even threaten their solvency. Understanding the nature and potential impact of these risks is the first step towards effective risk mitigation. For example, interest rate risk, the risk of losses due to changes in interest rates, can significantly impact the value of a bank’s bond portfolio or its net interest margin. Similarly, equity price risk, stemming from fluctuations in stock prices, can affect the value of investments held by the institution. Foreign exchange risk, the risk of losses arising from changes in exchange rates, impacts institutions involved in international transactions. Commodity price risk affects institutions exposed to fluctuations in commodity prices, such as energy or agricultural products. Finally, volatility risk, the risk of unexpected and large price swings, can impact the value of all types of assets. A sharp and unexpected downturn in the market can lead to significant losses and even insolvency if not adequately hedged.

Techniques Used to Hedge Against Market Risk

A range of techniques are employed to mitigate market risks. Hedging strategies aim to offset potential losses from one investment by taking an opposite position in another related investment. For instance, interest rate swaps can be used to hedge against interest rate risk by locking in a fixed interest rate, protecting against unfavorable rate movements. Options contracts provide the right, but not the obligation, to buy or sell an asset at a predetermined price, offering flexibility in managing price risk. Futures contracts obligate the buyer and seller to exchange an asset at a future date, allowing for price risk mitigation through pre-agreed prices. Diversification, spreading investments across various asset classes and geographies, reduces the impact of losses from any single investment. Value-at-Risk (VaR) models provide a quantitative measure of potential losses over a specified period and confidence level, aiding in risk assessment and management. Stress testing, simulating the impact of extreme market events, allows institutions to assess their resilience and identify vulnerabilities. These techniques, employed individually or in combination, form a robust approach to market risk management.

Market Risk Management Framework

A comprehensive framework is essential for effective market risk management. This framework should integrate various components to ensure a holistic and proactive approach.

| Component | Description | Implementation | Monitoring & Reporting |

|---|---|---|---|

| Risk Identification & Assessment | Identifying all market risks faced by the institution, analyzing their potential impact and likelihood. | Regular risk assessments using quantitative models (VaR, stress testing) and qualitative analysis. | Regular reporting to senior management on identified risks and their potential impact. |

| Hedging Strategies | Developing and implementing appropriate hedging strategies to mitigate identified risks. | Selecting suitable hedging instruments (derivatives, diversification) based on risk profile and market conditions. | Monitoring the effectiveness of hedging strategies and making adjustments as needed. |

| Risk Monitoring & Control | Establishing robust monitoring systems to track market risk exposures and ensure adherence to risk limits. | Real-time monitoring of market movements and risk metrics, regular reporting and alerts. | Regular review of risk limits and adjustments based on market conditions and risk appetite. |

| Risk Reporting & Communication | Transparent and timely reporting of market risk exposures to senior management, board of directors, and regulators. | Regular reports detailing risk exposures, hedging strategies, and risk mitigation measures. | Clear communication channels to ensure timely information dissemination and effective decision-making. |

Operational Risk Management

Operational risk encompasses a wide range of potential threats to a financial institution’s operations, encompassing internal failures, external events, and human error. Effective management of these risks is crucial for maintaining stability, profitability, and the overall reputation of the institution. Failure to adequately address operational risk can lead to significant financial losses, regulatory penalties, and damage to customer trust.

Operational risks faced by financial institutions are diverse and can be broadly categorized. These risks can disrupt business processes, damage reputation, or result in direct financial losses. Examples include internal fraud, external fraud, technology failures, regulatory breaches, and natural disasters. A comprehensive risk management framework should address each of these categories.

Types of Operational Risks

Operational risks are multifaceted and can stem from various sources within and outside the financial institution. Internal failures such as inadequate processes, lack of staff training, or errors in judgment can lead to significant operational losses. External factors like natural disasters, cyberattacks, or regulatory changes also pose considerable threats. The interconnected nature of these risks means that a failure in one area can cascade and affect other parts of the organization. For instance, a cyberattack could cripple a bank’s payment systems, leading to significant financial losses and reputational damage. Similarly, a natural disaster could disrupt operations, leading to service interruptions and potential customer dissatisfaction.

Internal Controls for Operational Risk Mitigation

Robust internal controls are paramount in mitigating operational risks. These controls act as a safeguard against potential failures, ensuring compliance with regulations, and promoting efficient and effective operations. Effective internal controls involve a combination of preventative, detective, and corrective measures. Preventative controls aim to stop errors or irregularities from occurring in the first place, while detective controls identify errors or irregularities that have already occurred. Corrective controls address the identified issues and prevent their recurrence. Examples of effective internal controls include segregation of duties, regular audits, robust security systems, and employee training programs.

Implementing effective internal controls requires a structured approach. This includes establishing clear responsibilities, documenting processes, conducting regular reviews, and ensuring that controls are consistently applied across all departments. Regular testing and updating of controls are also crucial to ensure their effectiveness in light of evolving threats and regulatory changes. For example, a bank might implement a multi-factor authentication system to prevent unauthorized access to sensitive data, or conduct regular security audits to identify vulnerabilities in its IT infrastructure.

Technology’s Role in Operational Risk Management

Technology plays a pivotal role in both creating and mitigating operational risks within financial institutions. While technology offers numerous opportunities to improve efficiency and reduce risks, it also introduces new vulnerabilities. A balanced approach is required to leverage the benefits of technology while effectively managing the associated risks.

A well-designed and implemented technology framework can enhance operational risk management significantly. However, the rapid pace of technological advancement and the evolving nature of cyber threats necessitate a proactive and adaptive approach to managing technology-related risks.

- Benefits of Technology in Risk Management: Automated processes, enhanced monitoring capabilities, improved data analytics for risk identification, streamlined compliance procedures, and improved fraud detection systems.

- Challenges of Technology in Risk Management: Dependence on technology systems, increased vulnerability to cyberattacks, potential for data breaches, the need for specialized expertise to manage complex systems, and the cost of implementing and maintaining advanced technology solutions.

Liquidity Risk Management

Liquidity risk is the risk that a financial institution will be unable to meet its short-term obligations as they come due. This inability stems from a lack of readily available funds or the inability to quickly convert assets into cash without significant losses. The implications for financial institutions are severe, potentially leading to insolvency, reputational damage, and even systemic instability within the broader financial system. Maintaining sufficient liquidity is paramount for the continued operation and stability of any financial institution.

Liquidity crises occur when a financial institution faces a sudden and unexpected surge in withdrawals or a sharp decline in its ability to raise funds. These events can be triggered by various factors, including market shocks, loss of confidence, regulatory changes, or even rumors.

Liquidity Crisis Examples

The 2008 global financial crisis serves as a stark example of a widespread liquidity crisis. The collapse of Lehman Brothers, a major investment bank, triggered a domino effect, as other institutions struggled to access funding due to a freeze in the interbank lending market. More recently, the collapse of Silicon Valley Bank in 2023 highlighted the vulnerability of institutions with significant mismatches between the maturity of their assets and liabilities, coupled with a rapid loss of depositor confidence. These events underscore the critical importance of robust liquidity risk management practices.

Liquidity Risk Management Methods

Financial institutions employ various methods to manage liquidity risk. These methods can be broadly categorized into proactive and reactive strategies. Proactive strategies focus on preventing liquidity crises from occurring in the first place, while reactive strategies aim to mitigate the impact of a crisis if one does occur.

Proactive Liquidity Management Strategies

Proactive strategies involve maintaining sufficient liquid assets, diversifying funding sources, and implementing stress testing to identify potential vulnerabilities. Holding a substantial amount of high-quality liquid assets (HQLA), such as government bonds and cash, provides a buffer against unexpected withdrawals. Diversifying funding sources, such as relying on a mix of deposits, wholesale funding, and capital markets, reduces dependence on any single source and enhances resilience. Stress testing simulates various adverse scenarios to assess the institution’s ability to withstand shocks and identify potential weaknesses.

Reactive Liquidity Management Strategies

Reactive strategies focus on actions to be taken during a liquidity crisis. These include accessing emergency funding sources, such as central bank lending facilities, selling assets, and implementing contingency plans. The ability to quickly access emergency funding is crucial during times of stress. Selling assets can provide immediate liquidity, although it may come at a cost. Well-defined contingency plans help to ensure a coordinated and effective response to a liquidity crisis.

Comparison of Liquidity Management Strategies

Proactive and reactive strategies are complementary; a robust liquidity risk management framework requires both. Proactive strategies are preventative, aiming to avoid crises altogether, while reactive strategies are corrective, focusing on damage control during a crisis. The optimal balance between these strategies depends on the specific circumstances of the financial institution, including its size, business model, and risk appetite. A heavily reliant institution on short-term funding might need to focus more on diversification and stress testing, while a less reliant institution may have more room to focus on asset sales as a reactive strategy.

Key Components of a Robust Liquidity Risk Management Framework

| Component | Description | Implementation | Monitoring |

|---|---|---|---|

| Liquidity Risk Assessment | Identifying and measuring all sources and uses of liquidity. | Regular assessments using various models and scenarios. | Continuous monitoring of key liquidity metrics. |

| Liquidity Planning | Developing strategies to maintain sufficient liquidity under various scenarios. | Defining liquidity buffers, funding plans, and contingency plans. | Regular review and updates based on market conditions and internal changes. |

| Liquidity Stress Testing | Simulating various stress scenarios to assess the institution’s resilience. | Using historical data and forward-looking scenarios to project liquidity positions. | Analyzing results to identify vulnerabilities and adjust strategies accordingly. |

| Liquidity Reporting and Disclosure | Providing timely and accurate information to internal and external stakeholders. | Regular reporting to senior management, regulators, and investors. | Ensuring transparency and accuracy of information. |

Regulatory and Compliance Risk

Regulatory and compliance risk represents the potential for financial losses or reputational damage stemming from a financial institution’s failure to adhere to applicable laws, regulations, and internal policies. This risk encompasses a broad spectrum of legal and ethical considerations, impacting all aspects of a financial institution’s operations. Effective management of this risk is crucial for maintaining operational stability and preserving public trust.

Regulatory and compliance risks are multifaceted and constantly evolving, driven by changes in the global regulatory landscape and technological advancements. Understanding and mitigating these risks is paramount for long-term sustainability and success within the financial services industry.

Key Regulatory and Compliance Risks Faced by Financial Institutions

Financial institutions face a diverse range of regulatory and compliance risks, including but not limited to anti-money laundering (AML) regulations, know your customer (KYC) requirements, data privacy laws (like GDPR), sanctions compliance, and consumer protection regulations. Failure to comply with these regulations can lead to significant penalties, reputational harm, and operational disruptions. For example, a failure to adequately implement AML procedures can result in substantial fines and legal action, while breaches of data privacy laws can severely damage a financial institution’s reputation and erode customer trust. The increasing complexity of financial products and services further exacerbates these challenges, requiring institutions to maintain robust compliance frameworks.

Examples of Regulatory Changes and Their Impact

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, enacted in the aftermath of the 2008 financial crisis, exemplifies a significant regulatory shift. This legislation introduced stricter capital requirements, increased oversight of derivatives trading, and established the Consumer Financial Protection Bureau (CFPB) to protect consumers from unfair or deceptive financial practices. The impact of Dodd-Frank has been widespread, requiring financial institutions to invest heavily in compliance infrastructure and personnel to meet the new regulatory demands. Similarly, the introduction of GDPR in the European Union has profoundly impacted how financial institutions handle customer data, necessitating significant changes to data management processes and security protocols. These examples highlight the dynamic nature of the regulatory environment and the need for financial institutions to adapt continuously.

Importance of a Strong Compliance Program in Mitigating Regulatory and Compliance Risk

A robust compliance program is the cornerstone of effective regulatory and compliance risk management. Such a program should incorporate a comprehensive risk assessment, clearly defined policies and procedures, regular training for employees, effective monitoring and reporting mechanisms, and a strong internal audit function. Best practices include establishing a dedicated compliance department with experienced professionals, implementing a robust whistleblower protection program, and fostering a culture of compliance throughout the organization. Regular review and updates to the compliance program are crucial to adapt to evolving regulations and emerging risks. Proactive identification and mitigation of potential compliance issues are far more cost-effective than reacting to regulatory violations.

Consequences of Non-Compliance with Regulations

Non-compliance with regulations can have severe consequences for financial institutions. These consequences can include:

- Significant financial penalties: Regulatory authorities can impose substantial fines for violations, potentially impacting profitability and shareholder value.

- Reputational damage: Non-compliance can erode public trust, leading to loss of customers and damage to the institution’s brand.

- Legal action: Financial institutions may face lawsuits from customers, investors, or other stakeholders.

- Operational disruptions: Regulatory investigations and enforcement actions can disrupt business operations, leading to delays and inefficiencies.

- Criminal charges: In severe cases, individuals within the institution may face criminal charges.

- Loss of licenses or operating permits: Regulatory authorities may revoke licenses or permits, effectively shutting down the institution’s operations.

Reputational Risk Management

Reputational risk, for financial institutions, is the potential for damage to an institution’s reputation, leading to financial losses and other negative consequences. This risk stems from a variety of sources, both internal and external, and can significantly impact a firm’s ability to attract and retain customers, employees, and investors. Maintaining a strong reputation is crucial for long-term sustainability and profitability.

Reputational damage can manifest in several ways, including decreased customer trust, reduced market share, difficulty attracting and retaining talent, increased regulatory scrutiny, and legal challenges. The severity of the impact depends on factors such as the nature and scale of the event, the institution’s response, and the overall media landscape.

Causes and Consequences of Reputational Damage

A negative event, such as a high-profile fraud case, a data breach leading to customer identity theft, or involvement in a scandal, can severely damage a financial institution’s reputation. The consequences can be far-reaching and long-lasting. For example, the 2008 financial crisis severely damaged the reputation of many banks, leading to decreased customer confidence and increased regulatory oversight. Similarly, instances of unethical lending practices or discriminatory loan applications have resulted in significant reputational harm and hefty fines. These events often lead to a decline in stock prices, reduced profitability, and difficulty in securing future funding.

Strategies for Managing Reputational Risk

Effective reputational risk management requires a proactive and comprehensive approach. This involves establishing a robust risk assessment framework to identify potential threats, developing clear communication protocols to address issues transparently, and building a strong ethical culture within the organization. Regularly monitoring media coverage, social media sentiment, and customer feedback is essential for early detection of emerging risks.

Best Practices for Maintaining a Positive Reputation

Several best practices can help financial institutions cultivate and maintain a positive reputation. These include fostering a culture of ethics and integrity, prioritizing customer satisfaction, proactively addressing customer complaints, investing in employee training and development, and actively engaging with the community. Strong corporate governance, transparent financial reporting, and compliance with all relevant regulations are also critical. A commitment to sustainability and social responsibility can further enhance a financial institution’s reputation.

Illustrative Example of Reputational Damage and Cascading Effects

Imagine a hypothetical scenario where a regional bank experiences a significant data breach, exposing sensitive customer information. The initial impact is a loss of customer trust, leading to a withdrawal of deposits and a decline in new customer acquisition. Negative media coverage amplifies the damage, further eroding public confidence. Regulatory scrutiny intensifies, resulting in investigations and potentially significant fines. The bank’s stock price plummets, impacting shareholder value. Employee morale suffers, leading to increased turnover. Ultimately, the bank faces a significant financial loss, diminished market share, and a severely tarnished reputation that takes years to rebuild, even with effective remediation strategies. This illustrates the cascading nature of reputational damage, where one negative event can trigger a chain reaction of negative consequences.

Cybersecurity Risk Management

Cybersecurity has become a paramount concern for financial institutions, given their reliance on digital systems and the sensitive nature of the data they handle. A single successful cyberattack can lead to significant financial losses, reputational damage, and legal repercussions. This section details the key cybersecurity risks faced by financial institutions, Artikels best practices for mitigation, and presents a sample cybersecurity risk management plan.

Key Cybersecurity Risks Faced by Financial Institutions

Financial institutions face a multitude of cybersecurity threats, ranging from sophisticated, state-sponsored attacks to simpler phishing scams. These risks can be broadly categorized into several areas, each demanding a dedicated and comprehensive approach to risk mitigation. The consequences of successful attacks can range from minor data breaches to complete system failures and significant financial losses.

Examples of Cyberattacks and Their Consequences

Several high-profile cyberattacks against financial institutions have highlighted the devastating consequences of inadequate cybersecurity measures. For instance, the 2014 attack on JPMorgan Chase, which exposed the personal data of millions of customers, resulted in substantial financial losses and reputational damage. Similarly, the 2016 Yahoo! data breaches, which affected billions of user accounts, demonstrated the far-reaching implications of compromised security. These attacks underscore the critical need for robust cybersecurity measures within financial institutions.

Importance of a Robust Cybersecurity Framework

A robust cybersecurity framework is essential for mitigating cybersecurity risks and ensuring the confidentiality, integrity, and availability of sensitive data. Such a framework should encompass a comprehensive range of security controls, including preventative measures, detection mechanisms, and incident response plans. A proactive and adaptable approach to cybersecurity is crucial, given the ever-evolving nature of cyber threats. Regular security assessments, vulnerability scanning, and penetration testing are essential components of a successful cybersecurity program.

Best Practices for Cybersecurity

Effective cybersecurity involves a multi-layered approach, combining technological safeguards with robust policies and procedures. Key best practices include implementing strong authentication mechanisms (multi-factor authentication is highly recommended), regularly updating software and systems, conducting thorough security awareness training for employees, and establishing a comprehensive incident response plan. Furthermore, robust data encryption and secure data storage practices are vital for protecting sensitive information. Regular security audits and penetration testing help identify vulnerabilities and ensure the effectiveness of security controls. Finally, establishing clear roles and responsibilities for cybersecurity is essential for a cohesive and effective response to threats.

Cybersecurity Risk Management Plan for a Hypothetical Financial Institution

The following table Artikels a sample cybersecurity risk management plan. This plan should be adapted to the specific needs and circumstances of each institution.

| Risk Category | Mitigation Strategy | Responsible Party | Monitoring and Review |

|---|---|---|---|

| Phishing Attacks | Security awareness training, email filtering, multi-factor authentication | IT Security Department | Quarterly security awareness assessments, review of phishing attempts |

| Malware Infections | Antivirus software, endpoint detection and response (EDR), regular software updates | IT Security Department | Regular vulnerability scans, analysis of security logs |

| Data Breaches | Data encryption, access control, regular security audits | IT Security Department, Compliance Department | Annual penetration testing, review of security incident reports |

| Denial-of-Service (DoS) Attacks | Network security appliances, DDoS mitigation services | IT Operations Department | Monitoring of network traffic, regular stress testing |

| Insider Threats | Background checks, access control policies, monitoring of user activity | Human Resources Department, IT Security Department | Regular reviews of access privileges, analysis of user activity logs |

| Third-Party Risks | Vendor risk management program, security assessments of third-party vendors | IT Security Department, Procurement Department | Regular reviews of vendor security controls |

Final Summary

Effectively managing financial institution risk is a continuous process requiring vigilance, adaptability, and a proactive approach. While the specific risks and their relative importance may vary across institutions and over time, the fundamental principles of robust risk assessment, mitigation strategies, and effective internal controls remain paramount. By embracing technological advancements, adhering to regulatory compliance, and fostering a strong risk-aware culture, financial institutions can navigate the complexities of the modern financial landscape and contribute to a more stable and secure global economy.

FAQ Guide

What is the difference between systemic and idiosyncratic risk?

Systemic risk threatens the entire financial system, while idiosyncratic risk is specific to a single institution.

How do macroeconomic factors impact credit risk?

Economic downturns increase defaults; interest rate changes affect borrowing costs and repayment ability.

What are some examples of operational failures?

Examples include fraud, system failures, and inadequate internal controls leading to significant losses.

What is reputational risk, and why is it important?

Reputational risk is damage to an institution’s image affecting customer trust and business operations. It can lead to significant financial losses.

What are some best practices for cybersecurity risk management?

Implement strong authentication, regular security audits, employee training, and incident response plans.