Financial Institution Risk Assessment: It sounds thrilling, doesn’t it? Like a high-stakes game of financial Jenga, where one wrong move could topple the entire system. This isn’t your grandma’s knitting circle; we’re talking about the intricate dance between profitability, regulation, and the ever-present threat of…well, everything going wrong. From credit crunches to cyberattacks, we’ll explore the multifaceted world of risk in the financial sector, examining the methodologies, mitigation strategies, and regulatory hurdles that keep the money flowing (mostly).

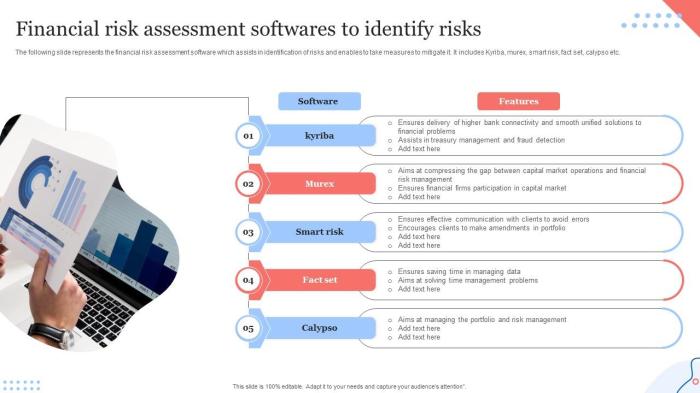

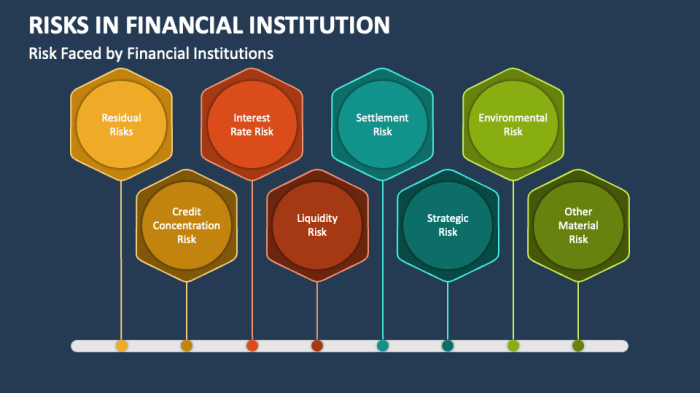

This exploration will cover the various risk categories faced by financial institutions, from the classic credit and market risks to the more modern operational and reputational threats. We’ll delve into the quantitative and qualitative aspects of risk assessment, examining frameworks like Basel III and CAMELS. We’ll also explore the crucial role of stress testing and scenario analysis in preparing for the inevitable “what ifs.” Finally, we’ll touch upon the importance of robust internal controls, regulatory compliance, and the ever-growing influence of technology and cybersecurity on the financial landscape.

Defining Financial Institution Risk

Financial institutions, those bustling hubs of money magic, face a dizzying array of risks. It’s not all champagne wishes and caviar dreams; navigating the financial landscape requires a keen eye for potential pitfalls, a bit of daring, and a whole lot of risk assessment. Think of it as a high-stakes game of financial Jenga – one wrong move, and the whole tower could come tumbling down.

Understanding these risks is paramount for survival and prosperity. Failure to accurately assess and mitigate these risks can lead to significant financial losses, regulatory penalties, and even complete collapse. The following sections delve into the thrilling world of financial institution risk, exploring the various categories and their impact.

Credit Risk

Credit risk, the ever-present shadow of lending, represents the potential loss a financial institution faces when a borrower fails to repay a loan or meet other contractual obligations. This risk is as old as finance itself, dating back to the earliest forms of lending. Imagine a medieval moneylender fretting over a knight’s overdue payment – the same anxieties resonate today, albeit with more sophisticated models and credit scoring systems. The severity of credit risk is directly related to the creditworthiness of the borrower and the size of the loan. A default on a small personal loan is a minor inconvenience compared to a large corporate loan default, which could trigger a domino effect across the entire financial system. Think of the 2008 subprime mortgage crisis – a stark reminder of the devastating consequences of poorly managed credit risk.

Market Risk

Market risk is the rollercoaster ride of unpredictable changes in market prices. This includes fluctuations in interest rates, exchange rates, and the prices of securities like stocks and bonds. A sudden drop in interest rates could severely impact a bank’s profitability, while unfavorable exchange rate movements can wipe out profits from international transactions. Remember the “Flash Crash” of 2010? A stark example of how quickly market conditions can change and impact financial institutions. Sophisticated hedging strategies and robust risk management frameworks are crucial for mitigating this ever-present danger.

Operational Risk

Operational risk encompasses the myriad of internal failures and external events that can disrupt a financial institution’s operations. This isn’t just about faulty computers (although those can be a problem); it also includes fraud, cyberattacks, human error, and even natural disasters. The infamous 1995 Barings Bank collapse, caused by a rogue trader’s reckless bets, serves as a cautionary tale. Today, cyberattacks pose an increasingly significant threat, with the potential to cripple operations and expose sensitive customer data. Robust internal controls, strong cybersecurity measures, and business continuity plans are essential for mitigating operational risk.

Liquidity Risk

Liquidity risk is the ever-present fear of not having enough readily available cash to meet obligations as they come due. It’s the financial equivalent of running out of gas on a long road trip – inconvenient at best, disastrous at worst. A sudden rush of withdrawals, a credit crunch, or an inability to quickly sell assets can all trigger a liquidity crisis. The 2008 financial crisis highlighted the systemic nature of liquidity risk, as banks struggled to find funding in the frozen credit markets. Maintaining adequate cash reserves, diverse funding sources, and robust liquidity management strategies are vital for mitigating this risk.

Reputational Risk

Reputational risk is the subtle yet potent danger of damage to a financial institution’s reputation. A single negative news story, a regulatory violation, or a major scandal can severely erode public trust and lead to significant financial losses. The Wells Fargo account fraud scandal is a prime example of how reputational damage can translate into tangible financial consequences, including fines, customer churn, and plummeting stock prices. Maintaining ethical business practices, transparent communication, and a strong commitment to corporate social responsibility are crucial for mitigating reputational risk.

Regulatory Changes and Risk Assessment

Regulatory changes, often a response to past crises or evolving financial landscapes, significantly impact risk assessment methodologies. New regulations, like Basel III, introduce stricter capital requirements and more rigorous stress testing procedures. These changes force financial institutions to refine their risk models, enhance their data collection capabilities, and improve their internal controls. The ongoing evolution of regulatory frameworks necessitates continuous adaptation and refinement of risk assessment methodologies to ensure compliance and maintain financial stability. The impact can range from increased compliance costs to a fundamental shift in how risk is identified, measured, and managed.

Emerging Risks

The financial world is a dynamic beast, constantly evolving and throwing up new challenges. Emerging risks, such as those related to climate change, artificial intelligence, and geopolitical instability, pose significant threats to financial institutions. Climate change, for instance, could lead to increased losses from extreme weather events and necessitate a reassessment of loan portfolios related to carbon-intensive industries. The increasing use of AI in financial markets introduces new vulnerabilities, including the potential for algorithmic bias and sophisticated cyberattacks. Geopolitical uncertainty can trigger market volatility and disrupt global trade flows, impacting the profitability and stability of financial institutions. Proactive monitoring of emerging risks and the development of appropriate mitigation strategies are crucial for ensuring long-term financial health.

Risk Assessment Methodologies

Navigating the thrilling world of financial institution risk assessment requires a sturdy map – and that map is comprised of robust methodologies. Choosing the right approach is crucial, much like selecting the perfect wine to pair with a particularly pungent cheese; the wrong choice can lead to indigestion (or, you know, financial ruin). This section explores the diverse landscape of risk assessment frameworks and the processes involved in conducting a thorough and (hopefully) hilarious analysis.

Different frameworks offer various perspectives on risk, much like a kaleidoscope reveals different patterns depending on how you turn it. Each framework provides a unique lens through which to examine the financial health and stability of an institution. Understanding their strengths and weaknesses is essential for a comprehensive assessment.

Comparison of Risk Assessment Frameworks: Basel III and CAMELS

Basel III and CAMELS represent two prominent, yet distinctly different, approaches to evaluating financial risk. Basel III, a globally recognized set of regulatory standards, focuses heavily on capital adequacy and liquidity risk, ensuring institutions have enough cushions to absorb potential losses. Think of it as the rigorous, rule-following accountant. CAMELS, on the other hand, offers a more holistic view, assessing Capital adequacy, Asset quality, Management quality, Earnings, Liquidity, and Sensitivity to market risk. It’s the experienced, slightly more whimsical, risk manager who considers the whole picture. While Basel III provides a quantitative framework, CAMELS incorporates both quantitative and qualitative factors, making it a more comprehensive – if slightly less rigidly defined – approach. The key difference lies in their scope: Basel III focuses primarily on capital and liquidity, while CAMELS casts a wider net, considering a broader range of factors.

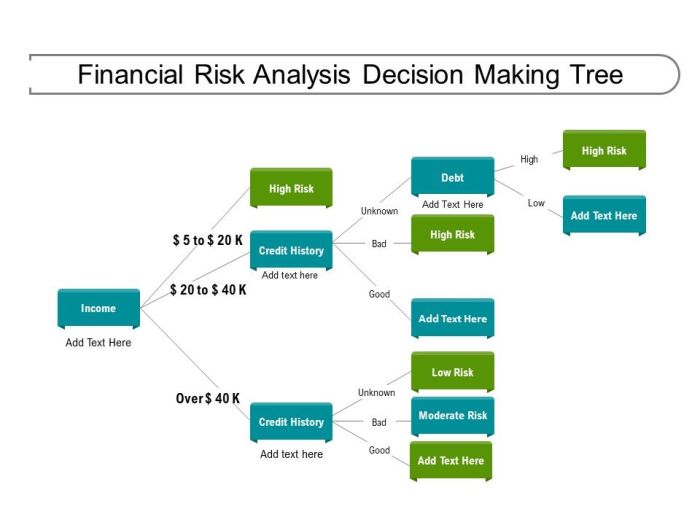

Quantitative Risk Assessment: Data Collection and Analysis

Conducting a quantitative risk assessment is like being a detective – you need to gather clues (data) and analyze them to solve the case (identify risks). This involves collecting data on various aspects of the financial institution, such as loan defaults, market volatility, and operational expenses. Techniques like statistical modeling, regression analysis, and scenario analysis are employed to quantify the likelihood and potential impact of different risks. For instance, a bank might use historical loan default data to predict future defaults and estimate the potential loss. Remember, even the most sophisticated models are only as good as the data they’re based on – garbage in, garbage out, as they say.

The Role of Qualitative Factors in Risk Assessment

While numbers are undeniably important, ignoring the qualitative aspects of risk is like ignoring the elephant in the room. Qualitative factors, such as management competence, governance structure, and the overall business environment, can significantly influence a financial institution’s risk profile. For example, a bank with a strong management team and robust internal controls might be better equipped to handle unexpected shocks than one with weak governance and internal controls. Assessing these qualitative factors often involves interviews, reviews of internal documents, and expert judgment – a far cry from the precise world of statistical models.

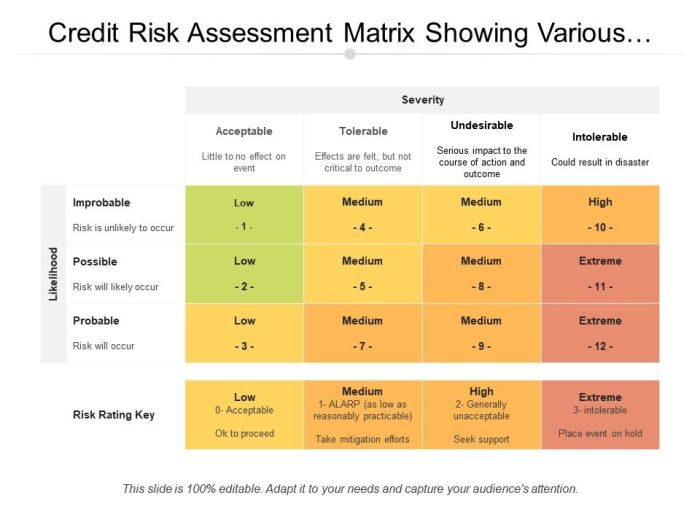

Hypothetical Risk Assessment Matrix for a Commercial Bank

Below is a hypothetical risk assessment matrix for a commercial bank. Remember, this is a simplified example; a real-world assessment would be far more nuanced and complex. The Risk Score is a simple product of Likelihood and Impact, but more sophisticated scoring systems could be used.

| Risk Category | Likelihood (1-5, 1=Low, 5=High) | Impact (1-5, 1=Low, 5=High) | Risk Score (Likelihood x Impact) |

|---|---|---|---|

| Credit Risk | 4 | 5 | 20 |

| Market Risk | 3 | 3 | 9 |

| Operational Risk | 2 | 4 | 8 |

| Liquidity Risk | 1 | 2 | 2 |

| Reputational Risk | 3 | 4 | 12 |

Risk Mitigation Strategies

So, you’ve identified the risks lurking in the shadowy corners of your financial institution. Congratulations! Now for the fun part: making those risks go away (or at least, significantly reduce their chances of turning your perfectly good spreadsheets into a weeping mess). Risk mitigation isn’t about eliminating all uncertainty – that’s about as likely as finding a unicorn wearing a tiny bowler hat. It’s about building a robust defense, a financial fortress, if you will, capable of withstanding even the most mischievous market tremors.

Risk mitigation involves proactively implementing strategies to lessen the impact of potential threats. This isn’t a one-size-fits-all affair; the best approach depends on the specific risk, the institution’s risk appetite (and tolerance for slightly-too-spicy jalapeños), and the regulatory landscape (which can sometimes feel as unpredictable as a squirrel on a caffeine binge).

Internal Controls: The Unsung Heroes of Risk Management

Internal controls are the backbone of any effective risk management framework. Think of them as the diligent, ever-vigilant guardians of your financial kingdom, tirelessly checking for vulnerabilities and ensuring that everything operates smoothly. These controls, encompassing everything from robust accounting procedures to rigorous cybersecurity protocols, are designed to prevent, detect, and correct errors and irregularities. A strong internal control system acts as a safety net, minimizing the potential for fraud, operational failures, and regulatory breaches. Without them, you’re essentially navigating a minefield blindfolded, which, let’s face it, is never a good look.

Key Risk Mitigation Strategies by Risk Category

The following list Artikels some key mitigation strategies, categorized by risk type. Remember, a diversified approach is often the most effective. Don’t put all your eggs in one basket, unless that basket is made of unbreakable adamantium and guarded by trained attack squirrels.

- Credit Risk: Diversification of loan portfolio, robust credit scoring models, thorough due diligence on borrowers, effective loan monitoring and recovery processes. Think of it like this: instead of betting your entire fortune on a single, potentially unreliable horse, you spread your bets across several promising steeds.

- Market Risk: Hedging strategies (derivatives, futures), diversification of investments, stress testing, scenario planning. Predicting the market is like predicting the weather in Scotland – you might get it right occasionally, but it’s best to be prepared for anything.

- Operational Risk: Robust business continuity plans, regular system backups, employee training, segregation of duties, strong internal audit function. This is about making sure your systems are resilient enough to withstand unexpected events, like a sudden surge of enthusiastic hamsters attempting to access your databases.

- Liquidity Risk: Maintaining adequate cash reserves, diversified funding sources, robust liquidity management strategies, access to emergency funding lines. Think of it as having a well-stocked emergency kit – you hope you’ll never need it, but it’s comforting to know it’s there.

- Reputational Risk: Proactive communication with stakeholders, strong customer service, ethical business practices, effective crisis management plans. A strong reputation is invaluable – once lost, it’s incredibly difficult to regain.

- Compliance Risk: Staying abreast of regulatory changes, implementing comprehensive compliance programs, regular internal audits, and robust record-keeping. This is less about avoiding fines and more about ensuring you’re operating within the legal framework. Think of it as following the rules of the game – it’s much more enjoyable that way.

Best Practices in Risk Management for Financial Institutions

Implementing a robust risk management framework is crucial for the long-term health and success of any financial institution. Here are some best practices to consider:

Regular risk assessments are essential for identifying emerging threats. Ignoring risks is like ignoring a slowly-growing crack in your foundation – it’ll only get worse over time.

Establishing a strong risk culture is vital. This involves embedding risk awareness throughout the organization, from top to bottom.

Regular training and development for employees are essential to ensure that they are equipped to identify and mitigate risks effectively. A well-trained workforce is a more resilient workforce.

Independent audits provide an objective assessment of the effectiveness of the risk management framework. It’s always good to have a fresh pair of eyes review your work.

Stress Testing and Scenario Analysis

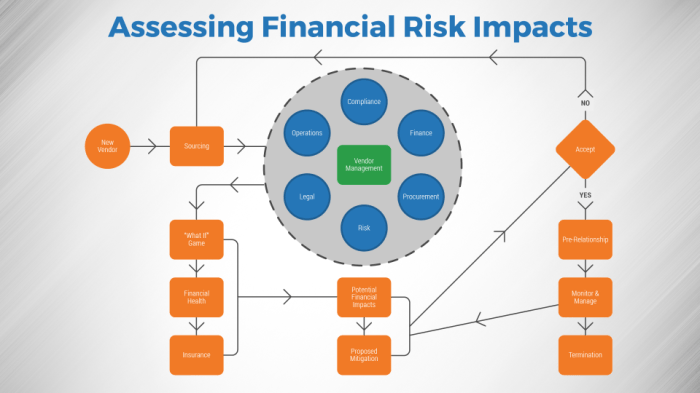

Stress testing and scenario analysis are not your grandma’s knitting circle; they’re crucial tools for financial institutions to avoid a complete unraveling. Essentially, they’re sophisticated “what if” games played with potentially disastrous outcomes, allowing institutions to prepare for the worst before it happens – and hopefully avoid becoming another cautionary tale in a finance textbook. These methods help institutions understand their vulnerability to various shocks and plan accordingly, preventing a sudden, unexpected trip to the financial ICU.

The methodology involves identifying potential risks, assigning probabilities to their occurrence, and modeling their impact on the institution’s financial health. This isn’t about predicting the future (though we wish it were that simple!), but rather about understanding how different events could unfold and how the institution might react. Think of it as a financial institution’s very own, high-stakes, slightly neurotic war game.

Adverse Scenarios and Their Impact

Several adverse scenarios could significantly impact a financial institution. These range from relatively predictable events (like a sudden increase in interest rates) to the more unpredictable (a global pandemic, for example, or a sudden, inexplicable surge in the popularity of pet rocks). Let’s look at some examples:

A significant economic downturn could lead to a surge in loan defaults, reducing the institution’s profitability and potentially causing liquidity problems. Imagine a scenario where unemployment spikes to 20%, leading to a domino effect of defaults on mortgages, auto loans, and credit cards. The resulting losses could be catastrophic, especially if the institution hasn’t adequately provisioned for such an event.

A rapid and unexpected increase in interest rates could drastically reduce the value of the institution’s bond portfolio, potentially leading to significant losses. Picture this: The Federal Reserve unexpectedly hikes interest rates by 5 percentage points. Bonds, being fixed-income securities, would plummet in value, wiping out a considerable chunk of the institution’s capital. This scenario highlights the importance of diversification and interest rate risk management.

A major cyberattack could cripple the institution’s operations, leading to significant financial losses and reputational damage. A sophisticated attack could disrupt transactions, steal sensitive customer data, and ultimately lead to regulatory fines and legal battles. The resulting costs and reputational damage could be far-reaching and long-lasting.

Utilizing Stress Test Results for Risk Management

Stress testing isn’t just about identifying problems; it’s about using those insights to make better decisions. The results provide crucial information that can be used to refine risk management strategies, strengthen capital positions, and improve operational resilience. By simulating various scenarios, institutions can proactively identify vulnerabilities and develop contingency plans to mitigate potential losses. Think of it as a financial pre-emptive strike against potential disaster.

Here’s a hypothetical stress test report illustrating how these results inform risk management:

Hypothetical Stress Test Report – Acme National Bank

Key Findings:

• A severe economic downturn (20% unemployment) could lead to a 15% increase in loan defaults.

• A 5% increase in interest rates would result in a 10% decrease in the value of the bond portfolio.

• A major cyberattack could lead to losses of up to $50 million and significant reputational damage.

Recommendations:

• Increase loan loss provisions by 10% to better absorb potential defaults.

• Diversify the bond portfolio to reduce interest rate risk.

• Invest in enhanced cybersecurity measures to mitigate the risk of cyberattacks.

• Develop a comprehensive business continuity plan to ensure operational resilience during a crisis.

Regulatory Compliance and Reporting

Navigating the regulatory landscape of financial institutions is akin to traversing a minefield of paperwork – exciting, potentially lucrative, and utterly terrifying if you step on the wrong thing. Risk assessment and reporting aren’t just good practice; they’re legally mandated exercises designed to prevent financial institutions from becoming unwitting participants in their own spectacular implosion. Ignoring these regulations is, to put it mildly, a bad idea.

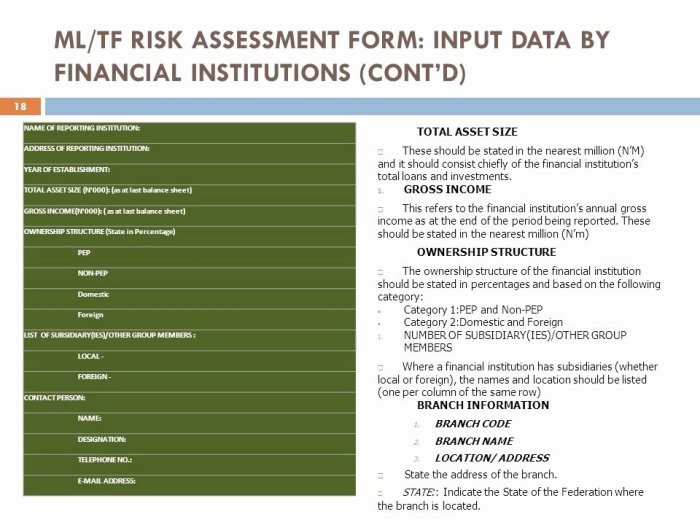

Regulatory requirements for risk assessment and reporting vary significantly depending on the type of financial institution, its size, and the jurisdictions in which it operates. Generally, these requirements aim to ensure transparency, promote stability, and protect consumers. The specific rules often cover areas such as capital adequacy, liquidity management, and anti-money laundering (AML) compliance. Failure to meet these requirements can lead to a plethora of unpleasant consequences, ranging from hefty fines to operational restrictions, and in extreme cases, even license revocation. Let’s delve into the specifics.

Regulatory Requirements for Risk Assessment and Reporting

The regulatory requirements mandate comprehensive risk assessments encompassing credit risk, market risk, operational risk, liquidity risk, and other relevant risks. These assessments must be regularly updated and reviewed to reflect changing circumstances and emerging threats. Furthermore, institutions must maintain detailed records of their risk assessments, including methodologies, assumptions, and findings. This documentation isn’t just for show; it’s crucial for audits and regulatory scrutiny. Imagine a regulatory auditor arriving and finding a filing cabinet stuffed with only slightly crumpled napkins instead of meticulously documented risk assessments – not a good look.

Implications of Non-Compliance

Non-compliance can result in a cascade of negative repercussions. Financial penalties can be substantial, often calculated as a percentage of assets or based on the severity of the violation. Reputational damage can be equally, if not more, devastating, leading to a loss of customer confidence and potentially impacting the institution’s ability to secure funding. Regulatory action can also include restrictions on operations, such as limitations on lending activities or expansion plans. In severe cases, the institution might face license revocation, effectively shutting down its operations. It’s a bit like getting a parking ticket, but instead of a fine, you lose your entire business.

Effective Regulatory Reporting Practices

Effective regulatory reporting involves more than just ticking boxes. It demands a robust and integrated risk management framework. This framework should include clearly defined roles and responsibilities, regular monitoring and reporting processes, and independent validation of risk assessments. Utilizing technology to streamline data collection and analysis can significantly improve efficiency and accuracy. Proactive communication with regulators fosters a collaborative relationship and can help prevent misunderstandings or disputes. Think of it as maintaining a healthy relationship with your regulatory overlords – far better than ending up in a regulatory showdown.

Key Regulatory Requirements for a Commercial Bank

Before we list the requirements, remember that these are general examples and the specific requirements will vary based on jurisdiction and the bank’s size and complexity. Also, remember that these are not exhaustive lists. The world of banking regulation is famously complex and ever-changing. So, buckle up, buttercup.

- Capital Adequacy: Maintaining sufficient capital to absorb potential losses, as defined by regulations like Basel III. This involves calculating risk-weighted assets and maintaining a minimum capital adequacy ratio.

- Liquidity Risk Management: Ensuring the bank has sufficient liquid assets to meet its short-term obligations. This involves stress testing and maintaining adequate liquidity coverage ratios.

- Credit Risk Management: Implementing robust credit risk assessment and monitoring procedures to minimize the risk of loan defaults. This involves detailed credit scoring and regular portfolio reviews.

- Operational Risk Management: Identifying, assessing, and mitigating risks arising from internal processes, people, and systems. This often includes implementing robust internal controls and business continuity plans.

- Anti-Money Laundering (AML) Compliance: Implementing measures to prevent the bank from being used for money laundering or terrorist financing. This involves customer due diligence, transaction monitoring, and suspicious activity reporting.

Technological Risks and Cybersecurity

The digital age has gifted financial institutions with incredible efficiency, but it’s also gifted them a rather large, slightly grumpy goblin named “Cybersecurity Risk.” This goblin, if left unchecked, can wreak havoc on even the most robust institutions, turning perfectly sound balance sheets into a chaotic mess faster than you can say “phishing scam.” Let’s delve into the hairy details of this technological beast and how to keep it at bay.

Technological risks for financial institutions aren’t just about hackers in dimly lit rooms; they’re a multifaceted menace encompassing everything from software glitches that accidentally send millions to the wrong account (oops!), to the more sinister exploits of malicious actors. These risks are ever-evolving, mirroring the relentless pace of technological innovation – a bit like a digital game of Whac-A-Mole, except the moles are armed with sophisticated malware.

The Importance of Cybersecurity in Mitigating Technological Risks

Cybersecurity is the financial institution’s digital shield, the knight in shining armor (or perhaps, the highly caffeinated security guard) protecting against a variety of threats. Without robust cybersecurity measures, even the smallest technological vulnerability can become a gaping chasm leading to data breaches, financial losses, reputational damage, and regulatory penalties – essentially, a financial institution’s worst nightmare. A strong cybersecurity posture involves multiple layers of defense, from firewalls and intrusion detection systems to employee training and incident response plans. It’s not just about technology; it’s about a culture of security.

The Impact of Emerging Technologies on Risk Assessment and Management

Artificial intelligence (AI) and blockchain, while offering exciting possibilities for the financial sector, also introduce new and complex risks. AI algorithms, for example, can be susceptible to bias and manipulation, leading to inaccurate risk assessments. Similarly, the decentralized nature of blockchain can make it challenging to track and regulate transactions, potentially increasing the risk of money laundering or other illicit activities. The rapid evolution of these technologies necessitates a continuous adaptation of risk assessment and management methodologies. Think of it as a constant game of catch-up, with the rules changing every few months.

Hypothetical Cybersecurity Breach and Its Impact

Imagine a scenario: A seemingly innocuous email, disguised as a routine bank statement, contains malware that grants hackers access to a major financial institution’s internal network. This malware, initially undetected, silently siphons customer data – names, addresses, account numbers, and social security numbers. The breach remains undetected for several weeks, allowing the hackers to transfer significant funds to offshore accounts. The impact? Millions of dollars lost, a massive reputational hit, regulatory investigations, lawsuits from affected customers, and potentially, criminal charges. This hypothetical scenario is sadly, all too realistic. The cost, in financial and reputational terms, could cripple the institution. Real-world examples like the Equifax data breach serve as stark reminders of the potential consequences. The aftermath involves significant costs associated with notifying affected customers, credit monitoring services, legal fees, and the implementation of enhanced security measures. The long-term effects can include diminished customer trust and a significant drop in market valuation.

Board and Management Oversight of Risk: Financial Institution Risk Assessment

The board of directors and senior management are the ultimate guardians of a financial institution’s health, a bit like the highly-paid, slightly eccentric, but ultimately responsible caretakers of a very, very large and complicated goldfish bowl. Their oversight of risk management isn’t just a box to tick; it’s the lifeblood of the entire operation. Get it wrong, and you’re not just dealing with a messy tank; you’re staring down the barrel of a full-blown financial crisis.

The board and senior management share responsibility for establishing and maintaining a robust risk management framework. This isn’t about playing a game of “who’s to blame?” but about creating a system of checks and balances designed to identify, assess, and mitigate potential risks before they become full-blown, headline-grabbing catastrophes. Think of it as a highly sophisticated early warning system for the financial equivalent of a rogue asteroid.

The Board’s Role in Risk Oversight

The board, acting as the ultimate authority, provides strategic direction for risk management. They are responsible for approving the institution’s risk appetite – essentially, how much risk the institution is willing to take on to achieve its objectives. This isn’t a free-for-all; it’s a carefully considered balance between potential reward and acceptable levels of risk. They also review and approve the risk management framework, ensuring it aligns with the institution’s strategic goals and regulatory requirements. They don’t need to understand every nuance of every risk, but they need to understand the big picture and the overall effectiveness of the risk management process. Imagine them as the conductor of a vast orchestra, ensuring each section plays its part harmoniously (and without crashing into each other).

Senior Management’s Role in Risk Management, Financial Institution Risk Assessment

Senior management is responsible for implementing the board’s directives and ensuring the day-to-day effectiveness of the risk management framework. They are the ones who actually get their hands dirty, implementing risk mitigation strategies, monitoring key risk indicators, and reporting to the board. They are the ones who deal with the nitty-gritty, ensuring that the risk management plans are put into action effectively. They act as the orchestra’s section leaders, ensuring that their individual teams play their parts to perfection.

Establishing a Strong Risk Culture

A strong risk culture is not merely a set of policies and procedures; it is the very DNA of the institution. It’s about embedding risk awareness and responsible behavior at all levels of the organization. This means fostering a culture where employees feel empowered to identify and report risks without fear of retribution. Think of it as creating a workplace where everyone feels comfortable saying, “Hey, that’s a bit dodgy,” without worrying about their job security. A strong risk culture leads to better risk identification, improved risk mitigation, and ultimately, a more resilient and successful institution. This is achieved through comprehensive training programs, clear communication of risk expectations, and consistent reinforcement of responsible behavior. A failure to cultivate a strong risk culture is akin to building a house on a foundation of sand; it’s just waiting to collapse.

Reporting Risk to the Board of Directors

Regular and transparent reporting to the board is critical. This reporting should provide a comprehensive overview of the institution’s risk profile, including key risk indicators, significant risk events, and the effectiveness of risk mitigation strategies. The reports should be concise, clear, and easily understandable, even for board members who aren’t financial experts. Think of it as a carefully crafted executive summary – just the important bits, without the jargon. The frequency of reporting will depend on the institution’s size and complexity, but it should be frequent enough to provide the board with a timely and accurate picture of the institution’s risk landscape. For example, a monthly report on key risk indicators, coupled with a quarterly review of the overall risk profile, might be appropriate. Failure to provide accurate and timely reports can leave the board uninformed and unable to effectively fulfill its oversight responsibilities.

Final Conclusion

So, there you have it – a whirlwind tour through the exhilarating (and sometimes terrifying) world of Financial Institution Risk Assessment. While the prospect of systemic collapse might keep you up at night, understanding and mitigating these risks is crucial for the stability of the financial system. Remember, it’s not about avoiding risk entirely (that’s impossible!), but about intelligently managing it. Think of it as financial tightrope walking – a delicate balance of calculated risk and strategic mitigation. Now go forth and assess!

Essential FAQs

What is the difference between inherent risk and residual risk?

Inherent risk is the level of risk present before any mitigating controls are implemented. Residual risk is the risk that remains *after* controls are in place. Think of it like this: inherent risk is the size of the hole, residual risk is the size of the hole after you’ve patched it (hopefully, a smaller hole!).

How often should a financial institution conduct a risk assessment?

The frequency varies depending on the institution’s size, complexity, and regulatory requirements. However, regular assessments (at least annually, often more frequently) are essential to stay ahead of emerging threats and adapt to changing circumstances. Think of it like a regular health check-up for your financial institution – proactive is always better than reactive.

What are the consequences of failing to comply with regulatory requirements regarding risk assessment?

The penalties for non-compliance can be severe, ranging from hefty fines and reputational damage to legal action and even business closure. It’s not a game you want to play – compliance is paramount.