Financial Institution Risk Assessment: It sounds thrilling, doesn’t it? Like a high-stakes game of financial Jenga, where one wrong move could topple the whole system. This isn’t your grandma’s knitting circle; we’re talking about the intricate dance between regulatory compliance, data analysis, and the ever-present threat of…well, everything going wrong. From credit crunches to cyberattacks, we’ll unravel the complexities of safeguarding the financial world, one risk assessment at a time. Prepare for a journey into the heart of financial stability (or the thrilling edge of potential chaos!).

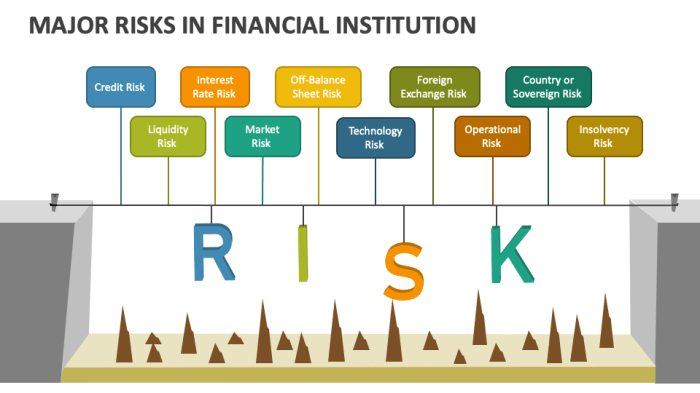

This comprehensive guide explores the multifaceted world of financial institution risk assessment, covering everything from defining and categorizing various risk types (operational, credit, market, and liquidity – oh my!) to navigating the labyrinthine regulatory landscape. We’ll delve into sophisticated risk assessment methodologies, the crucial role of data management, and the ingenious strategies for mitigation. Along the way, we’ll uncover the transformative power of technology, the importance of a robust risk culture, and the critical need for effective reporting and monitoring. Buckle up, it’s going to be a wild ride!

Defining Financial Institution Risk

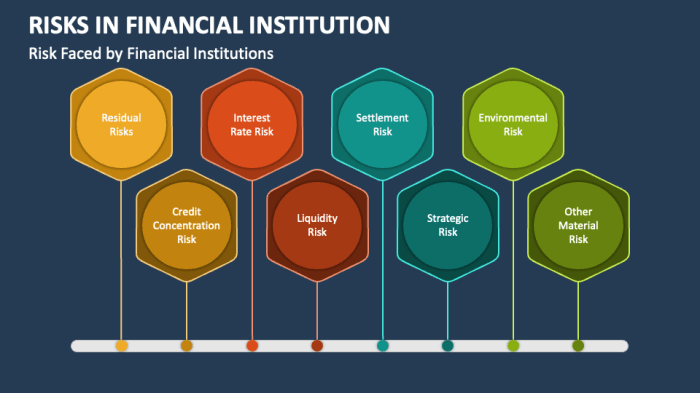

Financial institutions, those titans of the monetary world, aren’t immune to the rollercoaster ride of risk. From the seemingly mundane to the spectacularly catastrophic, these organizations face a dizzying array of potential pitfalls. Understanding these risks is crucial, not just for the survival of the institutions themselves, but for the stability of the entire financial ecosystem – think of it as a giant Jenga tower, where one wrong move can bring the whole thing crashing down.

Let’s delve into the fascinating (and sometimes terrifying) world of financial institution risk, exploring the various types and developing a framework for managing this intricate web of potential problems. We’ll uncover the differences between the key risk categories and discover how to prioritize them for effective risk management. Buckle up, it’s going to be a wild ride!

Operational Risk

Operational risk encompasses the perils arising from inadequate or failed internal processes, people, and systems, or from external events. Think rogue employees, system glitches that wipe out data, or even natural disasters shutting down operations. It’s the risk that things just…go wrong. A prime example is the 2012 Knight Capital Group trading fiasco, where a software error resulted in billions of dollars in losses in just minutes. This highlights the potentially devastating impact of seemingly minor operational failures. The cost of mitigating operational risk often involves significant investments in robust technology, stringent internal controls, and thorough employee training programs. Failing to do so can be incredibly expensive, not to mention embarrassing.

Credit Risk

Credit risk, the classic villain of the financial world, is the potential for loss arising from a borrower’s failure to repay a loan or meet other contractual obligations. This could be anything from a delinquent credit card payment to a corporate default on a massive bond issuance. Imagine lending money to a particularly unreliable individual, only to discover that they’ve used it to fund a questionable venture. That’s credit risk in a nutshell. Banks manage this risk through credit scoring, thorough due diligence, and diversification of their loan portfolio. However, even the most sophisticated models can’t predict every instance of borrower default. The 2008 subprime mortgage crisis serves as a stark reminder of the systemic consequences when credit risk management fails spectacularly.

Market Risk

Market risk, the unpredictable beast, is the potential for losses due to adverse movements in market prices, such as interest rates, exchange rates, or equity prices. Think of it as the wild fluctuations of the stock market – one day you’re up, the next you’re down, and sometimes the ride is just plain nauseating. Market risk affects a financial institution’s trading book, and also its holdings of securities. For example, a sudden drop in interest rates could severely impact a bank’s bond portfolio. Hedging strategies, such as using derivatives, are common tools for managing market risk, but they can be complex and come with their own set of risks. The 1987 Black Monday stock market crash vividly demonstrated the potential for sudden and severe market downturns.

Liquidity Risk

Liquidity risk, the risk of not having enough cash on hand when you need it, is the potential inability to meet obligations as they come due. Imagine a bank suddenly facing a massive withdrawal of deposits – if they don’t have the cash to cover it, they’re in trouble. This risk can stem from various sources, including sudden market shocks, a loss of confidence, or simply an unexpected surge in demand for funds. Maintaining sufficient cash reserves, managing funding sources effectively, and having access to readily available credit lines are crucial for mitigating liquidity risk. The 2008 financial crisis highlighted the critical role of liquidity in maintaining the stability of the financial system. When liquidity dries up, things can get ugly very quickly.

A Framework for Categorizing and Prioritizing Risks

Financial institutions typically employ a risk management framework that involves identifying, measuring, monitoring, and controlling various types of risks. This often involves a combination of quantitative and qualitative assessments, using models, stress testing, and scenario analysis to evaluate the potential impact of different risks. Prioritization depends on several factors, including the likelihood of the risk occurring, its potential severity, and the institution’s risk appetite. Risks are often categorized using a matrix, with higher-likelihood, higher-impact risks receiving the most attention and resources. A well-defined risk appetite statement sets the overall tone and provides a guideline for managing risk. This statement clarifies the level of risk the institution is willing to accept in pursuit of its strategic objectives. It’s a balancing act, a constant negotiation between risk and reward.

Regulatory Landscape and Compliance

Navigating the regulatory maze of financial risk assessment can feel like trying to solve a particularly complex Sudoku puzzle – except the stakes are considerably higher than a fleeting sense of intellectual frustration. Failure to comply can lead to hefty fines, reputational damage, and even the collapse of your institution. Let’s delve into the thrilling world of regulations and compliance, where the thrill of victory is matched only by the agony of defeat.

The financial sector operates under a dense web of regulations designed to maintain stability and protect consumers. These rules aren’t arbitrary; they’re born from past crises and a desire to prevent history from repeating itself (though history, being a mischievous imp, often finds new and creative ways to do so). These regulations dictate how financial institutions should identify, measure, monitor, and mitigate a wide array of risks, from credit risk to operational risk to, of course, the ever-present risk of accidentally sending a sarcastic email to your boss.

Key Regulatory Requirements for Risk Assessment

The key regulatory requirements for risk assessment in the financial sector are multifaceted and constantly evolving. They’re designed to ensure that institutions have robust systems in place to identify and manage a wide range of risks. These requirements are not just suggestions; they are legally binding obligations. Think of them as the financial equivalent of wearing a seatbelt – you might feel perfectly fine without it, but the consequences of not wearing one can be quite dramatic.

Impact of Basel III and Other International Standards

Basel III, a set of international banking regulations, has significantly impacted risk assessment practices globally. It introduced stricter capital requirements, increased liquidity standards, and a more sophisticated approach to risk measurement. Other international standards, such as those from the International Association of Insurance Supervisors (IAIS) and the International Organization of Securities Commissions (IOSCO), further shape the regulatory landscape, creating a truly global village of financial regulations. The overall effect is a system that is, theoretically, more resilient to shocks – though, as we all know, the world is full of unexpected shocks. Think of it as building a stronger house to withstand an earthquake; you still might get a few cracks, but hopefully, it won’t collapse entirely.

Consequences of Non-Compliance

Non-compliance with these regulations carries serious consequences. These can range from hefty fines and reputational damage to operational restrictions and, in extreme cases, even the closure of the institution. Remember the Enron debacle? That’s a cautionary tale about what happens when you ignore or sidestep the rules. The financial penalties can be staggering, and the reputational damage can be long-lasting, making it difficult to attract investors and maintain customer trust. It’s like forgetting to pay your taxes – it’s not a good look.

Summary of Key Regulatory Requirements and Their Implications

| Regulation | Description | Impact on Risk Assessment | Penalties for Non-Compliance |

|---|---|---|---|

| Basel III | Increased capital requirements, stricter liquidity standards, enhanced risk management frameworks. | More stringent stress testing, improved capital planning, and more sophisticated risk models. | Significant fines, operational restrictions, reputational damage. |

| Dodd-Frank Act (US) | Comprehensive financial reform legislation aimed at preventing another financial crisis. | Increased focus on systemic risk, enhanced consumer protection, and stricter oversight of financial institutions. | Substantial fines, legal action, and potential criminal charges. |

| Solvency II (EU) | Regulatory framework for insurance companies, focusing on solvency and risk management. | More sophisticated risk models, improved capital adequacy, and enhanced reporting requirements. | Significant fines, operational restrictions, reputational damage. |

| GDPR (EU) (relevant for data privacy aspects of financial risk) | Regulation on data protection and privacy. | Stricter data security measures and protocols in risk assessment processes. | Heavy fines for data breaches and non-compliance. |

Risk Assessment Methodologies

Financial institutions, those bastions of responsible lending and shrewd investment (mostly!), navigate a treacherous sea of risk. To avoid becoming another shipwreck story, they employ a variety of risk assessment methodologies – a sophisticated toolkit for staying afloat in the turbulent waters of finance. Choosing the right tools depends on the specific risk, the institution’s appetite for adventure (or rather, its risk tolerance), and its overall financial fitness.

Risk assessment methodologies can be broadly categorized as qualitative and quantitative. Think of it like this: qualitative assessments are like reading the tea leaves – insightful but not always precise, while quantitative assessments are more like using a high-powered telescope – providing precise measurements but possibly missing the bigger picture. The most effective approach often involves a cunning blend of both.

Qualitative Risk Assessment Methodologies

Qualitative methods rely on expert judgment and descriptive analysis to assess risk. This involves using scales (e.g., low, medium, high) to rate the likelihood and impact of various risks. While seemingly simple, this approach offers valuable insights, particularly when dealing with emerging risks or those lacking sufficient historical data for quantitative analysis. For instance, reputational risk, stemming from a social media firestorm, is difficult to quantify precisely, but a qualitative assessment can provide a reasonable estimate of its potential impact. The subjective nature of this approach, however, is its primary weakness; different experts might reach different conclusions.

Quantitative Risk Assessment Methodologies

Quantitative methods employ mathematical models and statistical analysis to assess risk. These methods provide numerical estimations of risk, allowing for more precise comparisons and decision-making. Common quantitative techniques include Value at Risk (VaR), Expected Shortfall (ES), and Monte Carlo simulations. For example, VaR calculates the maximum potential loss over a specific time horizon with a given confidence level. The precision offered by quantitative methods is undeniably attractive, but their reliance on historical data can be a limitation, especially when dealing with unprecedented events. Moreover, the accuracy of the results is heavily dependent on the quality and appropriateness of the underlying data and models used.

A Hybrid Approach: Combining Qualitative and Quantitative Methods

A truly robust risk assessment framework should leverage the strengths of both qualitative and quantitative approaches. This hybrid approach allows financial institutions to gain a more comprehensive understanding of their risk profile. For example, a bank might use qualitative methods to assess the creditworthiness of a small business applicant, considering factors like management experience and industry trends, while simultaneously employing quantitative methods to analyze the applicant’s financial statements and credit history. The combination of these two approaches leads to a more nuanced and well-rounded risk assessment.

Scenario Analysis and Stress Testing Techniques

Scenario analysis involves developing plausible future scenarios (e.g., a significant interest rate hike, a global pandemic) and assessing their potential impact on the financial institution. This “what if” approach helps identify vulnerabilities and develop contingency plans. Stress testing, a more extreme form of scenario analysis, involves subjecting the institution to hypothetical extreme events (e.g., a major market crash, a sovereign debt default) to assess its resilience. For instance, a bank might use stress testing to simulate the impact of a severe recession on its loan portfolio. The results can inform capital planning and risk mitigation strategies. While scenario analysis and stress testing can be computationally intensive, the insights gained are invaluable for building robust risk management frameworks. They help to avoid the pitfalls of relying solely on historical data, which may not adequately capture the full range of potential future events.

Data Management and Analysis for Risk Assessment

Data, the lifeblood of any effective risk assessment, can be a fickle friend. While promising insights into potential financial calamities, it can also lead you down a rabbit hole of inconsistencies and inaccuracies if not handled with the utmost care. Think of it as a high-stakes treasure hunt where the map (your data) might be riddled with errors, leading you to buried treasure…or a pile of accounting nightmares. Proper data management and analysis are crucial for navigating this treacherous landscape.

Data Quality and Integrity in Risk Assessment

The quality and integrity of your data are paramount. Garbage in, garbage out, as the old saying goes. Using flawed data will inevitably lead to flawed assessments, potentially resulting in inadequate risk mitigation strategies. Imagine relying on a faulty speedometer to navigate a treacherous mountain road – a recipe for disaster! Accurate, complete, consistent, and timely data is essential for generating reliable risk assessments. This requires robust data governance procedures, including data validation, error detection, and regular audits. For example, inconsistencies in reporting loan defaults across different branches of a bank could severely skew the overall assessment of credit risk.

Methods for Collecting, Cleaning, and Analyzing Relevant Data

Data collection methods must be carefully chosen to ensure comprehensive coverage and accuracy. This might involve extracting data from various sources such as internal databases, regulatory filings, external market data providers, and even social media sentiment analysis. Data cleaning, a less glamorous but equally important step, involves identifying and correcting inconsistencies, errors, and missing values. Think of it as meticulously polishing a diamond to reveal its true brilliance. Common techniques include data transformation, outlier detection, and imputation. Finally, data analysis utilizes statistical techniques and machine learning algorithms to uncover patterns and trends that highlight potential risks. Regression analysis, for instance, can be used to model the relationship between various financial indicators and the probability of loan defaults.

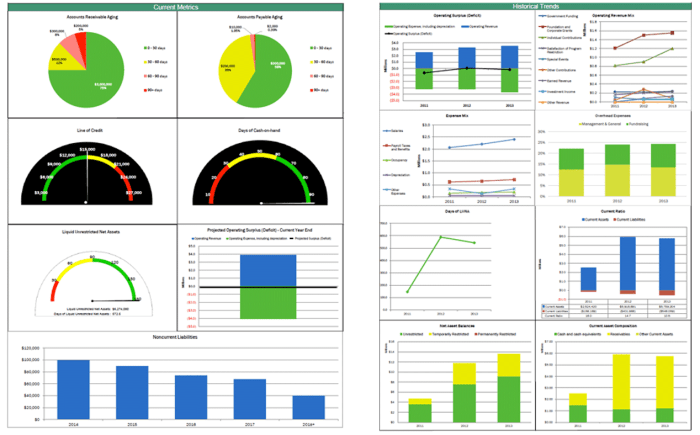

Data Visualization Techniques for Presenting Risk Assessment Findings

Visualizing risk assessment findings is key to effective communication. Think charts and graphs – they’re not just for boring spreadsheets! They transform complex data into easily digestible information, enabling stakeholders to understand the risks at a glance. Heatmaps can visually represent the concentration of risk across different business units, while dashboards can provide a real-time overview of key risk indicators. For example, a colorful heatmap could quickly show which geographical regions pose the highest credit risk for a lending institution. Furthermore, interactive dashboards allow for dynamic exploration of data, facilitating deeper insights.

Step-by-Step Guide for Data Processing in Risk Assessment

A structured approach is vital for successful data processing. Here’s a step-by-step guide:

1. Data Definition and Collection: Clearly define the data required for the risk assessment and identify the appropriate sources.

2. Data Cleaning and Transformation: Cleanse the data by addressing missing values, outliers, and inconsistencies.

3. Data Exploration and Analysis: Use descriptive statistics and visualizations to understand the data’s characteristics.

4. Risk Modeling: Develop models to quantify and predict potential risks.

5. Reporting and Visualization: Present the findings in a clear and concise manner using appropriate visualizations.

6. Validation and Review: Verify the accuracy and reliability of the results. This final step is crucial to ensure your findings aren’t just pretty pictures, but a robust reflection of reality.

Risk Mitigation Strategies

Ah, risk mitigation – the art of turning potential financial catastrophes into mildly inconvenient hiccups. It’s less about preventing *all* bad things (because let’s face it, Murphy’s Law is a shareholder in most financial institutions), and more about building a sturdy enough raft to survive the inevitable rogue waves. This involves a multifaceted approach, a carefully orchestrated dance between proactive planning and reactive responses. Think of it as financial institution aikido – using the force of the risk against itself.

Effective risk mitigation hinges on a thorough understanding of the institution’s risk profile, coupled with a robust strategy for addressing those risks. This isn’t a one-size-fits-all solution; it requires a tailored approach that considers the specific vulnerabilities and opportunities presented by the market, regulatory environment, and the institution’s own internal operations. The key is to develop a flexible, adaptable plan that can evolve as the risk landscape shifts – think of it as a financial institution’s ever-evolving survival guide.

Risk Transfer Mechanisms

Sometimes, the best way to deal with a risk is to shift it onto someone else’s shoulders (metaphorically speaking, of course. We’re not advocating for risk-related human trafficking). This is where risk transfer mechanisms come in, offering a clever way to offload some of the burden.

- Insurance: Think of insurance as a financial safety net. By paying premiums, a financial institution can transfer the risk of specific events (like cyberattacks or natural disasters) to an insurance company. For example, a bank might purchase cyber liability insurance to cover losses resulting from data breaches. The cost of this protection is significantly less than the potential losses that might arise from such an event.

- Derivatives: These financial instruments are more complex but can be used to hedge against various risks. For example, a bank might use interest rate swaps to mitigate the risk of fluctuating interest rates impacting its profitability. Imagine a farmer using weather derivatives to protect against crop failure; similarly, financial institutions use derivatives to manage a wide range of potential financial risks.

Implementation of Internal Controls

Internal controls are the backbone of any effective risk mitigation strategy. They’re the internal rules, policies, and procedures designed to ensure that things run smoothly and risks are managed effectively. Think of them as the institution’s internal security system, working to prevent and detect any fraudulent activities.

- Segregation of duties: This classic control prevents any single individual from having too much power, reducing the risk of fraud or errors. It’s like having multiple locks on a vault – even if one fails, the others provide protection.

- Regular audits: These independent examinations help ensure that the institution’s controls are working as intended. It’s like getting a financial health checkup; identifying and fixing potential problems before they become major issues.

- Strong access controls: Limiting access to sensitive data and systems prevents unauthorized access and potential breaches. This is like having a sophisticated alarm system and only giving the access code to trusted individuals.

Risk Management Policies

Effective risk management policies provide a framework for identifying, assessing, and mitigating risks. They should be comprehensive, clearly articulated, and regularly reviewed and updated. These policies should reflect the institution’s risk appetite and overall strategic goals. Think of these policies as the institution’s constitution, guiding its actions and setting the standard for risk management practices.

A robust policy should cover all aspects of risk management, from identifying potential risks to implementing mitigation strategies and monitoring their effectiveness. It should also clearly define roles and responsibilities, ensuring accountability across the organization. This clarity helps to avoid confusion and ensures that everyone is on the same page when it comes to managing risk.

Comprehensive Risk Mitigation Plan for a Hypothetical Financial Institution

Let’s imagine “First National Bank of Fun,” a fictional institution specializing in loans to artisanal cheesemakers. Their risk mitigation plan would need to address several key areas:

| Risk | Mitigation Strategy |

|---|---|

| Credit risk (cheesemakers defaulting on loans) | Diversified loan portfolio, thorough credit checks, collateral requirements, loan insurance |

| Interest rate risk (changes in interest rates affecting profitability) | Interest rate swaps, adjustable-rate loans, hedging strategies |

| Operational risk (system failures, employee errors) | Robust IT infrastructure, employee training, regular system backups, business continuity plan |

| Reputational risk (negative publicity) | Strong customer service, ethical business practices, proactive communication management |

| Regulatory risk (changes in banking regulations) | Close monitoring of regulatory changes, compliance programs, legal counsel |

This plan, while specific to “First National Bank of Fun,” illustrates the key components of a comprehensive risk mitigation plan for any financial institution. It’s a dynamic document, requiring constant review and adaptation to reflect the evolving risk landscape. Remember, in the world of finance, flexibility is key – and cheesemakers are notoriously unpredictable.

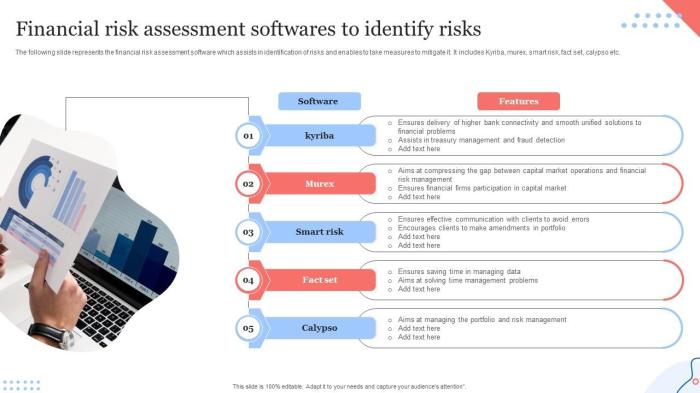

Technology and Risk Assessment

The digital age has revolutionized risk assessment, transforming it from a largely manual, paper-based process into a dynamic, data-driven endeavor. Technology’s role is no longer simply an enhancement; it’s become utterly indispensable for effectively navigating the complexities of modern financial risk. Imagine trying to analyze the creditworthiness of millions of customers using only spreadsheets – a truly terrifying thought!

Technology significantly improves the speed, accuracy, and comprehensiveness of risk assessment processes. Automated systems can analyze vast datasets far quicker than any human team, identifying subtle patterns and anomalies that might otherwise be missed. This leads to more timely interventions and better-informed decisions, ultimately bolstering the financial institution’s resilience.

AI and Machine Learning in Risk Prediction and Detection

Artificial intelligence (AI) and machine learning (ML) are game-changers in risk management. These technologies can analyze historical data, identify trends, and predict future risks with impressive accuracy. For instance, ML algorithms can be trained to identify patterns indicative of fraudulent transactions, allowing for the immediate flagging of suspicious activity. AI-powered systems can also assess credit risk more effectively by considering a wider range of factors than traditional models, leading to more accurate credit scoring and reduced defaults. Consider a scenario where an AI system, trained on millions of transactions, identifies a subtle shift in spending patterns that foreshadows a potential loan default; this proactive approach allows for timely intervention and mitigation of losses.

Fintech’s Impact on Risk Management

The rise of fintech presents both challenges and opportunities for risk management. On one hand, the innovative products and services offered by fintech companies introduce new and often uncharted risk landscapes. Think about the complexities of assessing the creditworthiness of borrowers using alternative data sources, or managing the risks associated with decentralized finance (DeFi). On the other hand, fintech also offers powerful tools and technologies to enhance risk assessment. For example, blockchain technology can improve transparency and traceability in financial transactions, reducing the risk of fraud and money laundering. Fintech’s rapid evolution necessitates a dynamic and adaptive approach to risk management, requiring constant monitoring and reassessment of existing frameworks.

Cybersecurity Threats and Risk Assessment Frameworks, Financial Institution Risk Assessment

In today’s interconnected world, cybersecurity threats pose a significant risk to financial institutions. Data breaches, ransomware attacks, and other cyber incidents can not only lead to financial losses but also severely damage an institution’s reputation and erode customer trust. Robust cybersecurity measures are therefore integral to any comprehensive risk assessment framework. Regular security audits, penetration testing, and incident response plans are crucial for mitigating these threats. Furthermore, incorporating cybersecurity risk into the overall risk appetite framework ensures that cybersecurity is not treated as an isolated issue but rather as an integral part of the institution’s overall risk profile. A hypothetical scenario could involve a sophisticated phishing attack compromising customer data, leading to regulatory fines and reputational damage – a stark reminder of the importance of proactive cybersecurity measures.

Reporting and Monitoring

Regular reporting on risk assessment findings isn’t just a box-ticking exercise; it’s the financial institution’s lifeblood, ensuring that potential calamities are spotted before they morph into full-blown crises (think of it as a financial institution’s early warning system, but way more sophisticated than a smoke alarm). Without consistent monitoring, even the most meticulously crafted risk assessment becomes a dusty tome gathering cobwebs in a forgotten corner.

The importance of this process lies in its ability to provide a dynamic view of the institution’s risk profile. It allows for proactive adjustments to mitigation strategies, ensuring that the institution remains resilient in the face of ever-changing market conditions and emerging threats. Think of it as constantly recalibrating your financial compass to navigate the turbulent seas of the financial world.

Key Metrics and Indicators for Risk Tracking

Tracking risk levels effectively requires a blend of quantitative and qualitative metrics. Key indicators can include things like credit default rates, market volatility indices, operational loss ratios, and regulatory compliance scores. These numbers paint a picture of the institution’s current risk exposure, but it’s crucial to remember that numbers alone don’t tell the whole story. Qualitative factors, such as changes in the regulatory environment or emerging geopolitical risks, also need to be considered. The combined analysis allows for a comprehensive understanding of the overall risk landscape.

Sample Risk Register

A risk register is a dynamic document, constantly evolving as new risks emerge and existing ones are mitigated. It serves as a central repository for all identified risks, their associated likelihood and impact, and the strategies employed to manage them. Below is a simplified example:

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Cybersecurity Breach | Medium | High | Invest in robust cybersecurity infrastructure, implement multi-factor authentication, conduct regular security audits. |

| Interest Rate Risk | High | Medium | Implement hedging strategies, diversify investment portfolio, adjust lending rates dynamically. |

| Regulatory Non-Compliance | Low | High | Enhance compliance training, implement robust compliance monitoring systems, engage external compliance consultants. |

| Reputational Damage | Medium | High | Proactive communication strategy, robust crisis management plan, commitment to ethical business practices. |

Risk Assessment Report Template

A well-structured risk assessment report is crucial for effective communication with stakeholders. It should provide a clear and concise overview of the institution’s risk profile, including identified risks, their potential impact, and the mitigation strategies in place. The report should also highlight key findings and recommendations for management. A template might include sections such as:

* Executive Summary: A concise overview of the key findings.

* Methodology: A description of the risk assessment methodology used.

* Risk Inventory: A detailed list of identified risks, their likelihood, and impact.

* Mitigation Strategies: A description of the strategies employed to mitigate each risk.

* Monitoring and Reporting: A plan for ongoing monitoring and reporting.

* Recommendations: Specific recommendations for management.

* Appendix: Supporting documentation and data.

Human Capital and Risk Culture

A strong risk culture isn’t just about having a well-stocked break room with artisanal coffee; it’s the lifeblood of a financially sound institution. It’s the collective mindset that prioritizes proactive risk identification and management, transforming potential catastrophes into mere footnotes in the annals of financial history. Without a robust risk culture, even the most sophisticated risk assessment methodologies are rendered as useless as a chocolate teapot in a hurricane.

A strong risk culture fosters a proactive and transparent environment where employees feel empowered to identify and report potential risks without fear of retribution. This, in turn, allows for early intervention and mitigation, preventing small problems from snowballing into monstrous, boardroom-shaking crises. Think of it as a financial immune system, constantly scanning for threats and neutralizing them before they can cause serious damage.

Key Competencies for Effective Risk Management

Effective risk management necessitates a team possessing a diverse skill set. This isn’t about finding the most financially gifted individuals, but rather a blend of expertise. Individuals need a solid understanding of financial markets, regulatory frameworks, and data analysis techniques. Crucially, they must also possess strong communication, problem-solving, and interpersonal skills. A team solely focused on numbers, lacking the ability to effectively communicate findings and collaborate, is a recipe for disaster. Imagine a symphony orchestra where only the violin section shows up – beautiful, but ultimately incomplete.

Training and Development in Risk Assessment Techniques

Investing in training is not an expense; it’s an investment in the future stability of the institution. Comprehensive training programs should cover a range of topics, from fundamental risk concepts to advanced analytical techniques. Interactive workshops, simulations, and case studies are particularly effective in helping staff develop practical risk assessment skills. For example, a simulated scenario involving a sudden market downturn can provide valuable insights into how to react effectively under pressure. Regular updates on regulatory changes and emerging risks are also crucial, ensuring staff remain current and competent. Think of it as ongoing professional development – constantly sharpening the saw, rather than letting it rust.

Independent Risk Oversight and Audit Functions

Independent oversight and audit functions are the ultimate checks and balances, ensuring that risk management processes are functioning as intended. These functions provide an objective assessment of the effectiveness of risk management practices, identifying weaknesses and recommending improvements. They act as a critical friend, offering constructive feedback and preventing groupthink. Think of them as the institution’s internal watchdogs, ensuring that everyone is playing by the rules and that the risk management system is robust and reliable. An independent audit provides a level of assurance to stakeholders that the institution is managing its risks effectively, building trust and enhancing reputation. Without this independent scrutiny, the risk management process risks becoming complacent and ineffective, much like a security system that is never tested.

Ultimate Conclusion: Financial Institution Risk Assessment

So, there you have it – a whirlwind tour through the fascinating, and frankly, slightly terrifying, world of financial institution risk assessment. We’ve journeyed from defining the various risks to implementing robust mitigation strategies, all while acknowledging the ever-evolving technological landscape and the crucial role of human capital. While the prospect of navigating this complex terrain might initially seem daunting, understanding the key principles and methodologies empowers financial institutions to proactively manage risk, ensuring stability and fostering confidence in the global financial system. Now go forth and conquer (those risks, that is!).

Detailed FAQs

What is the difference between inherent and residual risk?

Inherent risk is the level of risk before any mitigation efforts. Residual risk is the risk that remains *after* implementing controls.

How often should a financial institution conduct a risk assessment?

Frequency varies depending on the institution’s size, complexity, and regulatory requirements, but regular assessments (at least annually) are generally recommended.

What is the role of the board of directors in risk management?

The board provides oversight and accountability for the institution’s risk management framework, ensuring its effectiveness and alignment with strategic objectives.

What are key performance indicators (KPIs) used in risk assessment?

KPIs vary depending on the specific risk, but common examples include loss ratios, default rates, and capital adequacy ratios.