Financial Institution Risk Management: It sounds about as exciting as watching paint dry, right? Wrong! While the stakes are undeniably high (we’re talking about money, people!), navigating the world of regulatory compliance, credit scoring models, and cybersecurity threats can be surprisingly comical. Think of it as a high-stakes game of financial Jenga, where one wrong move could bring the whole tower crashing down. This exploration will delve into the often-absurd realities of keeping financial institutions afloat, one witty risk assessment at a time.

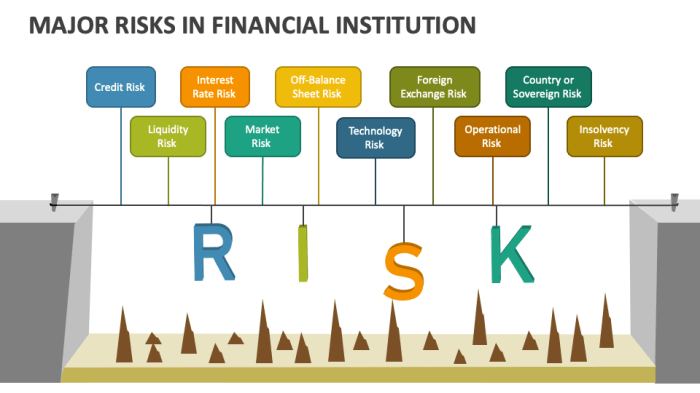

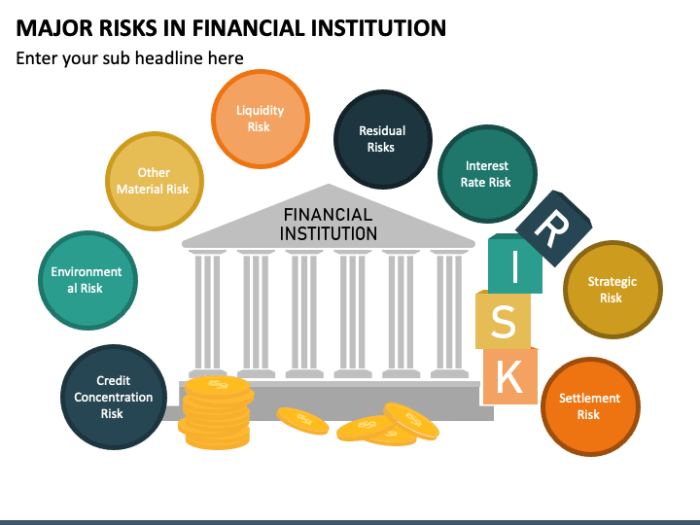

This document provides a comprehensive overview of the key aspects of Financial Institution Risk Management. We’ll examine the various types of risk faced by financial institutions, including credit risk, operational risk, market risk, liquidity risk, and cybersecurity risk. We’ll also explore the regulatory frameworks that govern risk management practices and the importance of establishing a strong risk culture. Get ready for a rollercoaster ride through the world of finance – buckle up, it’s going to be a wild one!

Regulatory Compliance in Financial Institution Risk Management

Navigating the regulatory landscape of financial risk management is like traversing a minefield blindfolded while juggling chainsaws – exhilarating, terrifying, and ultimately, essential for survival. Ignoring regulations isn’t just bad form; it’s a recipe for hefty fines, reputational damage, and potentially, the complete implosion of your institution. Let’s explore the key frameworks and practices that keep financial institutions on the straight and narrow (and solvent).

Key Regulatory Frameworks Impacting Financial Institution Risk Management Globally

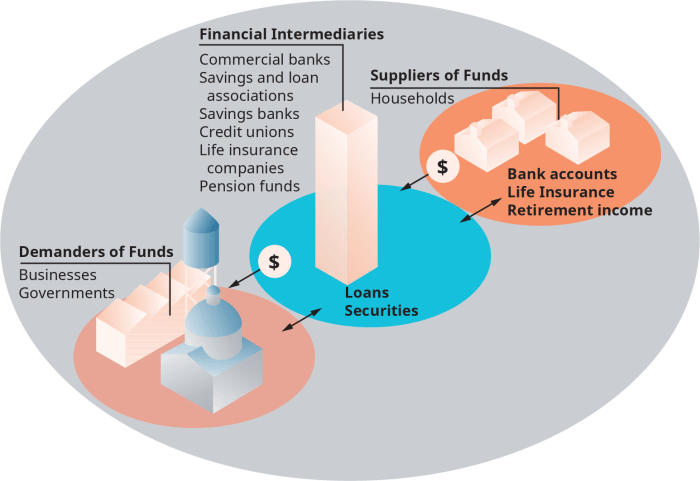

A bewildering array of international and national regulations governs financial institutions. These frameworks aim to maintain financial stability, protect consumers, and prevent illicit activities. Key players include the Basel Committee on Banking Supervision (BCBS), which sets international standards, and national regulatory bodies like the Federal Reserve (US), the European Central Bank (ECB), and the Bank of England. These bodies issue guidelines covering capital adequacy, liquidity, operational risk, and more. The sheer volume of regulations can feel overwhelming, but think of it as a comprehensive (if slightly draconian) instruction manual for avoiding financial catastrophe.

Impact of Basel III Accords on Capital Adequacy and Risk Management Practices

Basel III, the latest iteration of international banking regulations, significantly tightened capital requirements for banks. The accords introduced stricter capital adequacy ratios (CARs), requiring banks to hold more capital relative to their risk-weighted assets. This means banks need to have more “cushion” to absorb potential losses. Furthermore, Basel III introduced stricter rules on liquidity, requiring banks to maintain sufficient liquid assets to meet short-term obligations. Imagine it as forcing banks to keep a healthy emergency fund – a wise move, considering the potential for sudden market shocks. The implementation of Basel III has led to a more cautious and conservative approach to risk management within the banking industry, forcing institutions to reassess their risk profiles and strengthen their internal controls. For example, banks now employ more sophisticated risk models and stress testing scenarios to better understand and manage their exposure to various risks.

Ensuring Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

AML and KYC regulations are designed to prevent financial institutions from being used for money laundering and terrorist financing. Institutions achieve compliance through robust customer due diligence (CDD) processes, including thorough identity verification, ongoing monitoring of transactions, and suspicious activity reporting (SAR). Imagine it as a highly sophisticated game of “spot the suspicious activity,” where the stakes are extremely high. For example, a bank might use sophisticated transaction monitoring systems that flag unusual patterns of activity, such as large, unexplained cash deposits or wire transfers to high-risk jurisdictions. These systems often employ artificial intelligence to identify potentially suspicious transactions that might otherwise be missed by human analysts. Furthermore, banks frequently conduct enhanced due diligence on high-risk customers, such as politically exposed persons (PEPs), to mitigate the risk of involvement in illicit activities.

Hypothetical Compliance Program for a Small Financial Institution

Let’s imagine “Friendly Local Bank,” a small institution striving for compliance. Their program would include:

- A designated Compliance Officer responsible for overseeing all compliance activities.

- Regular employee training on AML/KYC, data privacy, and other relevant regulations.

- A streamlined customer onboarding process with robust identity verification checks.

- A transaction monitoring system (even a basic one) to flag suspicious activity.

- Procedures for reporting suspicious activity to the relevant authorities.

- Regular internal audits to assess compliance effectiveness.

This program, though simplified, highlights the essential elements of a comprehensive compliance framework, even for a smaller institution. Remember, even a small misstep can have significant consequences.

Credit Risk Management within Financial Institutions

Credit risk, the potential for financial loss stemming from a borrower’s failure to repay a debt, is the bread and butter (and sometimes the burnt toast) of financial institutions. Effectively managing this risk is not just about avoiding losses; it’s about ensuring the continued solvency and profitability of the entire organization. A robust credit risk management framework is the financial institution’s shield against the slings and arrows of outrageous fortune (and delinquent borrowers).

Assessing and Mitigating Credit Risk Across Loan Portfolios

Strategies for assessing and mitigating credit risk involve a multi-pronged approach, blending art and science in a way that would make Da Vinci proud (if he’d been a banker). This involves a thorough analysis of the borrower’s creditworthiness, considering factors like their financial history, income stability, and the purpose of the loan. Diversification of the loan portfolio is key – don’t put all your eggs in one basket, unless that basket is lined with gold and insured against chicken-related catastrophes. Regular monitoring of the borrower’s financial health, including early warning systems for potential defaults, is crucial. Proactive communication with borrowers facing financial difficulties can also help prevent defaults and minimize losses. Think of it as financial preventative medicine.

Credit Scoring Models and Their Limitations

Credit scoring models, those mathematical marvels that spit out a numerical representation of a borrower’s creditworthiness, are invaluable tools in the credit risk assessment process. These models typically use statistical techniques to analyze historical data and predict the likelihood of default. However, they are not without their flaws. For example, they may not adequately capture the nuances of individual circumstances, leading to potentially biased outcomes. Moreover, reliance on historical data can make them less effective in predicting defaults during periods of economic upheaval, akin to using a map from the 18th century to navigate modern-day Manhattan. The limitations of credit scoring models necessitate a holistic approach to credit risk assessment, combining quantitative data with qualitative factors and good old-fashioned human judgment.

Credit Risk Mitigation Techniques: Collateralization and Diversification

Collateralization and diversification are two prominent strategies for mitigating credit risk. Collateralization involves securing a loan with an asset of comparable or greater value. Think of it as a financial safety net – if the borrower defaults, the lender can seize the collateral to recoup its losses. Diversification, on the other hand, involves spreading credit risk across a wide range of borrowers and loan types. It’s the financial equivalent of not putting all your eggs in one basket. While both are powerful tools, they are not mutually exclusive; a well-structured loan portfolio often combines both strategies for maximum effect. Imagine a perfectly diversified portfolio, beautifully collateralized – a banker’s dream!

Stages of the Credit Lifecycle and Associated Risk Management Activities

The credit lifecycle is a journey, and like any journey, it involves various stages, each presenting unique risk management challenges.

| Stage | Risk Management Activities | Key Considerations | Potential Issues |

|---|---|---|---|

| Origination | Credit scoring, due diligence, loan structuring | Accurate assessment of borrower creditworthiness, appropriate loan terms | Incomplete application information, inaccurate credit scoring |

| Monitoring | Regular financial statement reviews, early warning systems | Identifying potential defaults, taking proactive measures | Delays in reporting, inadequate monitoring systems |

| Collection | Debt recovery strategies, legal action | Minimizing losses, recovering outstanding debt | Legal challenges, high collection costs |

| Write-off | Accounting treatment, loss reporting | Accurate reporting of losses, tax implications | Regulatory compliance, potential reputational damage |

Operational Risk Management in Financial Institutions

Operational risk, the unsung villain of the financial world, lurks in the shadows, ready to pounce when least expected. Unlike credit risk, which is relatively straightforward (though still prone to hilarious miscalculations), operational risk encompasses a vast and often unpredictable array of threats. It’s the stuff of nightmares for risk managers – the rogue trader, the system glitch that wipes out millions, the regulatory fine that leaves executives looking rather sheepish. Let’s delve into this thrilling, albeit terrifying, world.

Key Operational Risks and Their Potential Impact

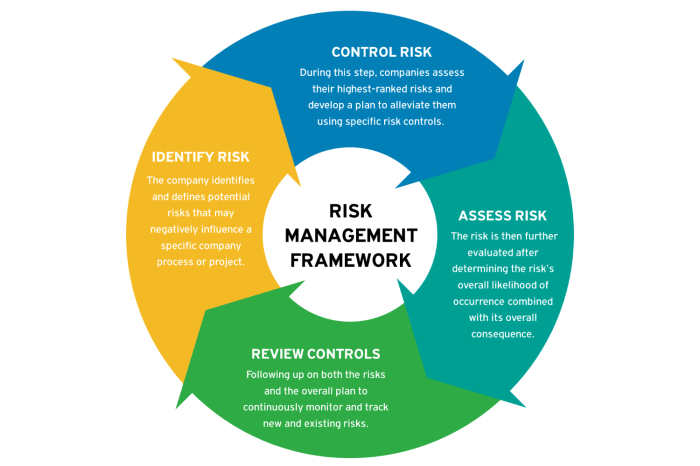

Operational risks in financial institutions are diverse and far-reaching, capable of causing significant financial losses, reputational damage, and even regulatory intervention. Failure to adequately manage these risks can lead to a cascade of negative consequences, impacting everything from profitability to the institution’s very survival. We’ll examine some key examples.

Business Continuity and Disaster Recovery Planning Best Practices

Robust business continuity and disaster recovery plans are not mere suggestions; they are essential lifelines for financial institutions. A well-structured plan should account for a range of scenarios, from localized outages to catastrophic events. Regular testing and updates are crucial to ensure the plan remains effective and relevant in the face of ever-evolving threats. Failing to plan is planning to fail, and in the financial world, failure is rarely pretty.

Internal Control Frameworks for Operational Risk Mitigation

A strong internal control framework is the bedrock of effective operational risk management. This framework should encompass a range of measures, from robust segregation of duties to comprehensive monitoring and reporting mechanisms. Think of it as a well-oiled machine, with each component playing a vital role in preventing operational mishaps. Examples of effective frameworks include COSO (Committee of Sponsoring Organizations of the Treadway Commission) and COBIT (Control Objectives for Information and Related Technologies).

Categorization of Potential Operational Risks by Severity and Likelihood

The following list categorizes potential operational risks based on a subjective assessment of their severity and likelihood. It’s important to remember that these are illustrative examples, and the specific risks faced by any given institution will vary depending on its size, complexity, and business model. Furthermore, the severity and likelihood of these risks can shift dramatically depending on the economic climate and the regulatory environment. Let’s face it, predicting the future is a risky business in itself!

- High Severity, High Likelihood: System failures leading to significant service disruptions; major fraud events; regulatory breaches resulting in substantial fines.

- High Severity, Low Likelihood: Catastrophic events (e.g., natural disasters) causing widespread operational disruption; large-scale cyberattacks leading to data breaches and reputational damage.

- Low Severity, High Likelihood: Minor system glitches causing temporary service interruptions; human error leading to processing delays; internal control weaknesses resulting in minor inaccuracies.

- Low Severity, Low Likelihood: Outdated technology leading to minor inefficiencies; minor security breaches with limited impact.

Market Risk Management for Financial Institutions

Market risk, the ever-present rollercoaster of financial instability, keeps risk managers on their toes. It’s the potential for losses stemming from unexpected movements in market prices, a thrilling ride indeed, but one best navigated with a carefully planned strategy. This section delves into the various types of market risks, the methods used to tame them, and the models employed to predict and measure their impact. Buckle up!

Types of Market Risks and Their Impact

Market risks are as diverse as a financial institution’s portfolio itself. Understanding these risks is the first step towards mitigating their potential havoc. A failure to adequately address these risks can lead to significant financial losses, reputational damage, and even insolvency.

- Interest Rate Risk: Fluctuations in interest rates can significantly impact the value of fixed-income securities. A rise in interest rates, for instance, will decrease the value of existing bonds, potentially leading to substantial losses for a financial institution holding a large portfolio of such securities. Imagine a bank holding a mountain of bonds – a sudden interest rate hike could trigger an avalanche of losses.

- Equity Risk: Changes in the market value of stocks held by a financial institution represent equity risk. A stock market crash, for example, could wipe out a significant portion of a bank’s equity holdings, leading to substantial losses. Picture this: a portfolio heavily invested in tech stocks suddenly plummets – ouch!

- Foreign Exchange Risk: Fluctuations in exchange rates between different currencies pose significant risks for institutions involved in international transactions. An unexpected devaluation of a currency can lead to losses on foreign currency-denominated assets or liabilities. Think of a bank with significant exposure to the Argentinian Peso – a sudden devaluation could be financially devastating.

- Commodity Risk: Changes in the prices of raw materials like oil, gold, or agricultural products can significantly impact the value of investments and the profitability of businesses dealing in these commodities. A sudden spike in oil prices could cripple an airline’s profitability, for example.

Hedging Strategies to Mitigate Market Risk Exposure

Financial institutions employ various hedging strategies to reduce their exposure to market risks. These strategies aim to offset potential losses from adverse market movements. These aren’t just theoretical exercises; they’re vital for survival in the volatile world of finance.

- Futures and Options Contracts: These derivative instruments allow institutions to lock in prices or hedge against future price movements. For example, an airline could use oil futures contracts to protect itself against rising fuel costs.

- Swaps: Swaps involve exchanging cash flows based on different interest rates or currencies. A bank might use an interest rate swap to convert variable-rate debt into fixed-rate debt, thereby reducing its interest rate risk.

- Diversification: Spreading investments across different asset classes and geographical regions can reduce overall market risk exposure. Don’t put all your eggs in one basket – a classic, yet crucial, piece of advice.

Risk Measurement Models in Market Risk Management

Accurately measuring market risk is crucial for effective risk management. Various models are employed to quantify and monitor market risk exposure. These models are not crystal balls, but rather sophisticated tools offering insights into potential losses.

- Value at Risk (VaR): VaR is a widely used statistical measure that quantifies the potential loss in value of an asset or portfolio over a specific time period and confidence level. For example, a VaR of $1 million at a 95% confidence level indicates that there is a 5% chance of losing more than $1 million over the specified period. It’s a commonly used tool, but remember, it’s just a probability, not a guarantee.

- Expected Shortfall (ES): ES, also known as Conditional VaR, provides a more comprehensive measure of risk than VaR by considering the expected loss in the tail of the distribution. It offers a more nuanced picture of potential losses in extreme market conditions.

Stress Testing for Assessing Portfolio Resilience

Stress testing is a crucial component of market risk management. It involves simulating adverse market scenarios to assess the resilience of a financial institution’s portfolio. This is where the rubber meets the road – it’s not just about predicting the future, but preparing for the worst.

Stress tests typically involve applying hypothetical shocks to market variables (e.g., a significant drop in interest rates or a sharp decline in equity prices) and assessing the impact on the portfolio’s value. This helps institutions identify vulnerabilities and develop appropriate contingency plans. A well-executed stress test can reveal hidden weaknesses before they cause significant damage, potentially saving the institution from a financial crisis. Think of it as a financial institution’s annual health checkup, but far more intense.

Liquidity Risk Management in Financial Institutions

Liquidity risk, the thrilling rollercoaster ride of finance! It’s the risk that a financial institution won’t be able to meet its short-term obligations as they come due. Think of it as the financial equivalent of running out of cash at the checkout – only with far more dramatic consequences. Let’s delve into the exhilarating (and sometimes terrifying) world of managing this risk.

Liquidity risk is a multifaceted beast, and understanding its various forms is crucial for survival in the financial jungle.

Sources and Types of Liquidity Risks

Financial institutions face a variety of liquidity risks, stemming from both internal and external factors. Internal sources include poor asset-liability management, inadequate forecasting, and overly aggressive lending practices (think: lending to borrowers who resemble cartoon characters – always promising but rarely delivering). External factors can range from sudden market shocks (like a flash mob of panicked depositors) to regulatory changes (the dreaded paperwork avalanche). Types of liquidity risk include funding liquidity risk (the inability to roll over maturing debt), structural liquidity risk (mismatch between assets and liabilities), and market liquidity risk (inability to sell assets quickly without significant price concessions). Ignoring these risks is like ignoring a volcano about to erupt – it’s not pretty.

The Importance of Liquidity Stress Testing and Scenario Analysis

Liquidity stress testing and scenario analysis are not just for rainy days; they’re essential survival tools. Stress testing involves simulating extreme market conditions (think zombie apocalypse scenarios for the financial world) to assess a financial institution’s ability to withstand shocks. Scenario analysis goes a step further, exploring a range of plausible scenarios, from mild to catastrophic. This helps institutions identify vulnerabilities and develop contingency plans. For example, simulating a sudden, widespread loss of confidence in the financial system can reveal hidden weaknesses and highlight the need for robust liquidity buffers. Without these tests, an institution is akin to a ship sailing without a map or compass – likely to end up on the rocks.

The Role of Liquidity Buffers and Contingency Funding Plans

Liquidity buffers, like a financial institution’s emergency stash of cash, act as a cushion against unexpected liquidity shocks. These buffers can include readily marketable securities, unused credit lines, and access to central bank facilities. Contingency funding plans, on the other hand, are detailed roadmaps outlining how an institution will secure additional funding under various stress scenarios. These plans should detail sources of funding, procedures for accessing them, and communication strategies. Think of these plans as a detailed escape route from a burning building – clear, concise, and effective. A well-defined contingency plan can be the difference between survival and utter chaos.

Liquidity Risk Management Process Flowchart

Imagine a flowchart, a visual representation of the liquidity risk management process. It begins with identifying and measuring liquidity risks. This involves analyzing the institution’s assets and liabilities, assessing funding sources, and monitoring market conditions. Next, the institution develops liquidity stress tests and scenarios, simulating various adverse events. Based on these tests, the institution establishes liquidity buffers and develops a contingency funding plan. Regular monitoring and reporting are crucial to track liquidity positions and ensure the effectiveness of the implemented strategies. Finally, the process is continuously reviewed and updated to reflect changes in the market and regulatory environment. This ongoing process is essential for maintaining a healthy liquidity profile and avoiding a liquidity crisis. The flowchart visually represents this cyclical process, showcasing the iterative nature of liquidity risk management. It’s a dynamic system, constantly adapting to the ever-changing landscape of the financial world.

Cybersecurity Risk Management in Financial Institutions

The digital age has transformed financial institutions into sprawling networks of interconnected systems, a veritable playground for cybercriminals. While offering unprecedented convenience to customers, this interconnectedness also presents a dramatically increased attack surface, making cybersecurity risk management not just a good idea, but a matter of survival. Failure to adequately address this risk can lead to significant financial losses, reputational damage, and regulatory penalties – enough to make even the most seasoned CFO break into a cold sweat.

Cybersecurity threats to financial institutions are constantly evolving, driven by technological advancements and the ingenuity (or should we say, deviousness?) of cybercriminals. These threats range from relatively simple phishing scams targeting unsuspecting employees to sophisticated, state-sponsored attacks aiming to steal sensitive data or disrupt operations. The sheer volume and variety of these threats necessitate a proactive and multi-layered approach to risk management.

The Evolving Landscape of Cybersecurity Threats

The landscape of cybersecurity threats is a dynamic and ever-changing battlefield. Traditional threats like malware and phishing remain prevalent, but new and more complex attacks are emerging constantly. Ransomware attacks, for example, have become increasingly sophisticated, often targeting critical systems and demanding hefty ransoms for data restoration. Furthermore, the rise of artificial intelligence (AI) is both a boon and a bane; while AI can enhance security measures, it also empowers cybercriminals to create more advanced and difficult-to-detect attacks. The increasing reliance on cloud services also expands the attack surface, requiring robust security protocols across multiple environments. One recent example involves a large bank experiencing a significant data breach due to a vulnerability in a third-party cloud service provider. The incident resulted in millions of dollars in losses and severe reputational damage, highlighting the importance of thorough due diligence and robust security measures for all third-party vendors.

Implementation of Cybersecurity Frameworks and Best Practices

Effective cybersecurity requires a structured approach. Frameworks like the NIST Cybersecurity Framework (CSF) provide a standardized methodology for managing cybersecurity risk. The CSF uses a five-function model – Identify, Protect, Detect, Respond, and Recover – to help organizations assess their current cybersecurity posture, develop appropriate controls, and improve their resilience. Best practices include implementing robust authentication and authorization mechanisms, employing strong encryption techniques for data at rest and in transit, regularly patching software vulnerabilities, and conducting penetration testing to identify weaknesses in the system. Implementing a Security Information and Event Management (SIEM) system is also crucial for monitoring and analyzing security logs, enabling early detection of potential threats. For example, a financial institution might use a SIEM system to detect unusual login attempts or data exfiltration attempts, enabling a timely response.

Examples of Effective Cybersecurity Incident Response Plans

A well-defined incident response plan is essential for minimizing the impact of a cybersecurity breach. This plan should Artikel clear procedures for identifying, containing, eradicating, recovering from, and learning from a security incident. Key components include establishing a dedicated incident response team, developing communication protocols for stakeholders, and establishing a process for forensic analysis and evidence preservation. A hypothetical example: If a financial institution experiences a ransomware attack, the incident response plan should specify steps to isolate affected systems, prevent further spread of the malware, communicate the incident to relevant authorities and customers, negotiate (or refuse) the ransom, and restore data from backups. Regular testing and updates of the incident response plan are vital to ensure its effectiveness in a real-world scenario.

Hypothetical Cybersecurity Awareness Training Program

A comprehensive cybersecurity awareness training program is crucial for educating employees about potential threats and best practices. The program should include interactive modules covering various topics such as phishing scams, social engineering tactics, password security, data loss prevention, and safe browsing habits. The program could incorporate realistic phishing simulations to train employees to identify and report suspicious emails. Gamification elements, such as quizzes and interactive scenarios, can improve engagement and knowledge retention. Regular refresher training should be conducted to reinforce key concepts and address emerging threats. For example, a module on identifying and reporting phishing emails might include a simulation where employees receive a seemingly legitimate email and are tasked with identifying the red flags. Another module could cover the importance of strong passwords and multi-factor authentication, demonstrating the vulnerabilities of weak passwords and the enhanced security provided by MFA.

Model Risk Management in Financial Institutions

The world of finance is a thrilling rollercoaster, full of exhilarating highs and stomach-churning lows. One of the less-than-thrilling aspects is model risk – the risk that the models financial institutions use to make crucial decisions are, shall we say, less than perfect. These models, often complex mathematical beasts, underpin everything from pricing derivatives to assessing creditworthiness. A flawed model can lead to inaccurate predictions, resulting in significant financial losses, regulatory penalties, and a serious dent in reputation. Think of it as building a skyscraper using blueprints drawn by a slightly tipsy architect – the consequences could be catastrophic.

Model risk isn’t just about a rogue decimal point; it encompasses the entire lifecycle of a model, from its conception to its eventual retirement. It’s about the assumptions made, the data used, and the interpretation of the results. The potential impact on financial institutions is immense, ranging from minor inconveniences to full-blown crises. Getting model risk management right is not optional; it’s a matter of survival.

Model Validation and Independent Review

Model validation is the rigorous process of ensuring a model is fit for its intended purpose. This involves a thorough examination of the model’s assumptions, data quality, methodology, and performance. Think of it as a thorough medical checkup for your model, making sure all its vital signs are within acceptable limits. Independent review takes this a step further, bringing in a fresh pair of eyes (or a team of them) to scrutinize the validation process itself. This ensures objectivity and helps identify any potential biases or blind spots. A good analogy would be having a second doctor review a complex diagnosis – a second opinion can often make all the difference. The validation and review process should be documented meticulously, providing a clear audit trail of the entire process. This documentation is crucial not only for regulatory compliance but also for ensuring transparency and accountability.

Documentation and Governance in Model Risk Management, Financial Institution Risk Management

Documentation is the unsung hero of model risk management. Without comprehensive documentation, it’s like trying to assemble a flat-pack wardrobe without instructions – a frustrating and potentially damaging experience. Every aspect of the model’s lifecycle, from initial design to final disposal, should be meticulously documented. This includes details about the model’s purpose, assumptions, data sources, validation results, and any changes made over time. Governance structures provide the framework for managing model risk effectively. This involves establishing clear roles and responsibilities, defining approval processes, and implementing a robust oversight mechanism. A well-defined governance structure ensures that model risk is appropriately considered at all levels of the organization, from the front line to the boardroom. It’s akin to having a well-structured company with clear lines of authority and responsibility – essential for smooth operations and avoiding chaos.

Best Practices for Managing Model Risk

Managing model risk effectively requires a multi-faceted approach. This includes selecting appropriate models based on their intended use and the available data, using robust data validation techniques, and implementing rigorous testing procedures. Regular monitoring and recalibration of models are essential to ensure they remain accurate and reliable over time. Furthermore, fostering a culture of continuous improvement and learning from past mistakes is vital. Think of it as regular maintenance on a finely tuned machine – constant attention ensures optimal performance and longevity. Ignoring this aspect can lead to unexpected breakdowns and significant problems down the line. A key best practice is to encourage a culture of skepticism and challenge within the organization. Questioning assumptions and critically evaluating model outputs is crucial to identifying and mitigating potential risks.

Risk Governance and Culture in Financial Institutions

Risk governance and culture aren’t just buzzwords; they’re the bedrock upon which a financially sound and ethically upright institution is built. Without a robust framework and a culture that prioritizes responsible risk-taking, even the most sophisticated risk management models are rendered useless – like a finely tuned race car driven by a chimpanzee. This section explores the crucial roles of leadership and the creation of a risk-conscious environment.

The Role of the Board of Directors and Senior Management in Overseeing Risk Management

The board of directors acts as the ultimate guardians of the institution’s risk profile. They’re not expected to be risk management experts (though a few surprisingly are!), but they are responsible for setting the overall risk appetite – essentially, deciding how much risk the institution is willing to take on to achieve its strategic goals. This isn’t a simple “high” or “low” decision; it’s a nuanced balancing act, carefully considering potential rewards against potential losses. Senior management, in turn, translates the board’s directives into actionable strategies and ensures that the risk management framework is effectively implemented and monitored. Think of them as the conductors of a complex orchestra, making sure all the different risk management instruments play in harmony. Failure to do so can lead to a cacophony of losses.

The Importance of Establishing a Strong Risk Culture Within a Financial Institution

A strong risk culture isn’t about fear; it’s about fostering a climate where identifying and managing risk is viewed as a shared responsibility, not a burden. It’s about empowering employees to speak up when they see something amiss, without fear of reprisal. Imagine a workplace where everyone feels comfortable saying, “Hey, that smells like a potential regulatory violation!” This proactive approach prevents small problems from snowballing into catastrophic events. A strong risk culture is built on transparency, accountability, and a commitment to ethical conduct. It’s a culture where everyone understands that taking calculated risks is part of the business, but reckless risk-taking is a career-limiting move.

The Use of Key Risk Indicators (KRIs) and Risk Appetite Statements in Risk Governance

Key Risk Indicators (KRIs) are the vital signs of an institution’s risk profile. These are measurable metrics that track the likelihood and potential impact of various risks. Think of them as the dashboard lights in a car – they warn of potential problems before they escalate into a complete breakdown. Regular monitoring of KRIs allows management to identify emerging risks and take corrective action. Risk appetite statements, on the other hand, provide a clear articulation of the institution’s tolerance for risk. They define the boundaries within which risks should be managed, acting as a guide for decision-making across the organization. Without a clearly defined risk appetite, the institution is essentially driving blindfolded.

A Sample Risk Governance Framework

The following table Artikels a simplified risk governance framework. Note that the specific responsibilities and reporting lines will vary depending on the size and complexity of the financial institution.

| Role | Responsibility | Reporting Line | Key Activities |

|---|---|---|---|

| Board of Directors | Oversight of risk management framework; setting risk appetite; approving risk strategy | None (ultimate authority) | Review of risk reports; approval of major risk-related decisions; setting risk tolerance levels |

| Risk Committee | Monitoring of key risks; reviewing risk reports; advising the board | Board of Directors | Regular meetings to discuss emerging risks; analysis of KRI data; recommending risk mitigation strategies |

| Chief Risk Officer (CRO) | Implementation of risk management framework; managing the risk function | CEO | Development and implementation of risk policies; overseeing risk assessments; reporting to the board and risk committee |

| Business Units | Identifying and managing risks within their respective areas | CRO and respective senior management | Conducting risk assessments; implementing risk mitigation plans; reporting on risk exposures |

Conclusion: Financial Institution Risk Management

So, there you have it – a whirlwind tour through the sometimes-hilarious, always-important world of Financial Institution Risk Management. From dodging rogue algorithms to battling cyber villains, the journey is fraught with peril (and plenty of paperwork). But fear not! With a healthy dose of wit, a robust risk management framework, and perhaps a slightly less-than-sober risk appetite, financial institutions can navigate the treacherous waters of the financial world and emerge victorious (or at least, solvent). Remember, even the most serious risks can be approached with a sense of humor—it might just save your sanity (and your bank).

General Inquiries

What’s the difference between systemic risk and idiosyncratic risk?

Systemic risk threatens the entire financial system (think domino effect!), while idiosyncratic risk affects only a single institution (like a rogue trader’s bad decisions).

How can a small financial institution effectively manage risk with limited resources?

Focus on prioritizing risks, leveraging technology for efficiency, and outsourcing certain specialized functions. Think smart, not necessarily big.

What role does stress testing play in risk management?

Stress testing simulates extreme scenarios (like a sudden market crash) to assess an institution’s resilience. It’s like a financial institution’s version of a fire drill—hopefully, they’re prepared!

What is the impact of climate change on financial risk management?

Climate change introduces new risks, such as physical damage from extreme weather and the transition to a low-carbon economy. It’s a growing area of concern and requires proactive risk assessment and mitigation strategies.