Understanding the landscape of global finance requires a critical examination of how financial institutions are ranked. These rankings, influenced by diverse methodologies and data sources, significantly impact investor decisions, market perception, and the strategic direction of institutions themselves. This exploration delves into the intricacies of these rankings, examining the methodologies employed, the challenges in data acquisition, and the far-reaching consequences for the institutions involved.

From the key performance indicators (KPIs) used to assess performance to the regional variations in ranking criteria, we’ll uncover the complexities of this critical process. We’ll also investigate the impact of emerging technologies and ESG factors on future ranking methodologies, painting a comprehensive picture of this dynamic field.

Defining “Financial Institutions Ranking”

Financial institution rankings provide a comparative overview of the performance and standing of various entities within the global financial landscape. These rankings, compiled by reputable organizations and publications, utilize diverse methodologies to assess and categorize institutions based on a range of key performance indicators. Understanding these methodologies and the metrics employed is crucial for interpreting the rankings and drawing meaningful insights into the relative strengths and weaknesses of different financial players.

Methodologies Used in Ranking Financial Institutions

Several methodologies exist for ranking financial institutions, each with its own strengths and limitations. These methodologies often combine quantitative data analysis with qualitative assessments, leading to a multifaceted evaluation. Some methodologies focus primarily on financial strength and stability, while others emphasize aspects such as innovation, customer satisfaction, or social responsibility. The choice of methodology significantly influences the resulting rankings and should be considered when interpreting the results. A common approach is a composite score derived from weighting various KPIs.

Key Performance Indicators (KPIs) in Financial Institution Rankings

A wide array of KPIs are used to assess financial institutions. These indicators can be broadly categorized into financial strength metrics, profitability metrics, and efficiency metrics. Financial strength indicators often include capital adequacy ratios, asset quality, and liquidity ratios. Profitability is assessed through metrics like return on assets (ROA), return on equity (ROE), and net interest margin. Efficiency is measured by metrics such as cost-to-income ratio and operating efficiency. Beyond these core financial metrics, some rankings also incorporate qualitative factors, such as brand reputation, corporate social responsibility initiatives, and customer satisfaction scores.

Types of Financial Institutions Included in Rankings

Financial institution rankings typically encompass a broad range of institutions, including commercial banks, investment banks, insurance companies, asset management firms, and brokerage houses. The specific types of institutions included can vary depending on the ranking methodology and the scope of the ranking organization. For instance, some rankings may focus solely on global systemically important banks (G-SIBs), while others may include a wider spectrum of financial entities.

Comparison of Ranking Methodologies

| Methodology Name | Key Metrics | Data Sources | Limitations |

|---|---|---|---|

| Global Finance Magazine’s World’s Safest Banks | Capital adequacy, profitability, asset quality, liquidity | Public financial statements, regulatory filings | Focuses primarily on safety and stability, neglecting other aspects of performance. May not capture nuances of emerging market banks. |

| The Banker’s Top 1000 World Banks | Tier 1 capital, assets, profitability, return on equity | Public financial statements, regulatory filings | Primarily focuses on size and financial strength, potentially overlooking other important factors such as innovation or customer service. |

| S&P Global Ratings’ Bank Financial Strength Ratings | Capital adequacy, asset quality, earnings, liquidity, risk management | Public financial statements, regulatory filings, proprietary data | Relies heavily on quantitative data and may not fully capture qualitative factors influencing long-term bank performance. Ratings are subject to revision. |

Data Sources and Methodology

Ranking financial institutions requires a robust and transparent methodology, underpinned by reliable data sources. The process is complex, demanding careful consideration of data accuracy, consistency, and potential biases to ensure the rankings are meaningful and credible. A rigorous approach is crucial to maintaining the integrity and usefulness of any such ranking.

Data acquisition for financial institution rankings presents significant challenges. The sheer volume and variety of data needed, coupled with the often-proprietary nature of certain financial information, creates hurdles for researchers. Inconsistent reporting standards across different institutions and jurisdictions further complicate the task, making it difficult to achieve comparability and accuracy. Moreover, the dynamic nature of financial markets necessitates continuous data updates, adding to the complexity.

Data Transparency and Verification

Transparency and verification are paramount in ensuring the credibility of financial institution rankings. Openly disclosing data sources, methodologies, and any limitations enhances the reliability and trustworthiness of the rankings. Independent verification processes, potentially involving external audits or peer reviews, can further bolster confidence in the results. Without such transparency and verification, the rankings risk being perceived as subjective or biased, undermining their value. For example, a ranking that does not clearly state its data sources and weighting methodology would be significantly less credible than one that provides detailed explanations and allows for independent scrutiny.

Potential Biases in Financial Institution Rankings

Several biases can potentially influence financial institution rankings. Selection bias, for instance, may occur if the selection criteria exclude certain types of institutions or favor those with readily available data. Measurement bias can arise from using metrics that do not accurately capture the full performance or risk profile of an institution. Reporting bias may occur if institutions selectively report positive data or fail to disclose relevant negative information. Finally, confirmation bias can inadvertently influence the interpretation of data if the researchers have pre-conceived notions about which institutions should rank highly. Addressing these biases requires careful consideration of data selection, methodology design, and interpretation. A robust methodology should actively seek to minimize the impact of these potential biases.

Examples of Publicly Available Datasets

Several publicly available datasets can be used for ranking financial institutions. These include data from central banks (e.g., the Federal Reserve in the US, the European Central Bank), international financial organizations (e.g., the World Bank, the International Monetary Fund), and financial regulatory bodies (e.g., the Securities and Exchange Commission in the US). These sources often provide information on capital adequacy, profitability, asset quality, and other key financial indicators. Commercial data providers, such as Bloomberg and Refinitiv, also offer extensive financial data, although access usually requires a subscription. The choice of dataset will depend on the specific criteria and scope of the ranking. For example, a ranking focused on global systemic importance might utilize data from the Financial Stability Board, while a ranking focused on domestic bank performance might primarily use data from the relevant national central bank.

Hypothetical Data Collection Process

A hypothetical data collection process for a new financial institution ranking system would begin with clearly defined ranking criteria and a comprehensive list of institutions to be included. Data would then be systematically gathered from multiple sources, prioritizing publicly available data to ensure transparency. Data quality checks would be implemented throughout the process, involving data cleaning, validation, and consistency checks. Any missing or inconsistent data would be addressed through imputation techniques or exclusion of the affected institutions, with clear documentation of these decisions. A robust weighting scheme would be developed to assign relative importance to different metrics, taking into account the specific goals of the ranking. Finally, a rigorous verification process would be implemented, possibly involving independent review, to ensure the accuracy and reliability of the data and the methodology. This meticulous approach would strive to minimize bias and produce a credible and trustworthy ranking.

Impact of Rankings on Financial Institutions

Financial institution rankings exert a significant influence on the industry, shaping investor decisions, market perception, and the overall competitive landscape. These rankings, while not always perfectly reflective of true performance, act as powerful signals, impacting both the reputation and operational strategies of the institutions themselves.

Investor Decisions and Market Perception

Rankings significantly influence investor decisions. Positive rankings often attract increased investment, leading to lower borrowing costs and improved access to capital. Conversely, low rankings can deter investors, leading to reduced investment and potentially higher borrowing costs. Market perception is also heavily shaped by these rankings; a high ranking can bolster a firm’s reputation for stability and trustworthiness, attracting both individual and institutional clients. A low ranking, however, can damage reputation and erode client confidence.

Benefits and Drawbacks of High and Low Rankings

High rankings offer numerous benefits, including enhanced brand reputation, increased investor confidence, improved access to capital at favorable terms, and a competitive advantage in attracting both clients and talent. However, even high-ranking institutions can face challenges, such as increased regulatory scrutiny and the pressure to maintain their performance levels. Low rankings, on the other hand, lead to decreased investor confidence, higher borrowing costs, difficulty attracting and retaining talent, and potential loss of market share. The pressure to improve can also lead to risky strategies that may further damage the institution’s financial health.

Reactions of Different Financial Institution Types

Different types of financial institutions react to rankings in varied ways. Large, internationally active banks might focus on improving their capital adequacy ratios and strengthening their risk management frameworks to enhance their rankings. Smaller, regional banks may concentrate on enhancing customer service and community engagement to boost their scores. Investment firms might prioritize improving their investment performance and risk-adjusted returns. The specific strategies employed are heavily influenced by the institution’s size, business model, and target market.

Hypothetical Institution Improvement

Consider a hypothetical mid-sized regional bank consistently receiving below-average rankings due to high non-performing loan ratios. To improve its ranking, the bank could implement several strategies. First, it could tighten its lending criteria, focusing on lower-risk borrowers. Second, it could invest in advanced analytics and machine learning to better assess credit risk. Third, it could strengthen its loan recovery processes to reduce the number of non-performing loans. These combined actions would demonstrably improve its financial health and lead to a higher ranking.

Strategies for Ranking Enhancement

Financial institutions can employ various strategies to enhance their rankings. These include:

- Strengthening risk management frameworks and improving capital adequacy ratios.

- Improving operational efficiency and reducing costs.

- Enhancing customer service and client satisfaction.

- Investing in technology and innovation.

- Improving transparency and corporate governance.

- Increasing community engagement and social responsibility initiatives.

- Focusing on sustainable and responsible investing practices.

Implementing these strategies requires a comprehensive approach, careful planning, and a commitment to long-term improvement. The specific strategies chosen will depend on the institution’s individual circumstances and strategic goals.

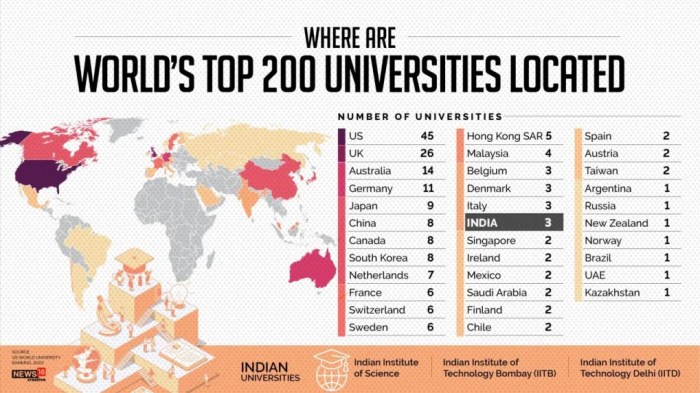

Regional Variations in Rankings

Financial institution rankings, while aiming for objectivity, are inevitably shaped by the unique contexts of different geographic regions. Methodologies, regulatory landscapes, and cultural perceptions all contribute to variations in how institutions are assessed and ultimately ranked. Understanding these regional differences is crucial for interpreting rankings accurately and appreciating their limitations.

Methodological Differences Across Regions

Ranking methodologies vary significantly across North America, Europe, and Asia, reflecting differing priorities and regulatory frameworks. North American rankings often emphasize profitability and shareholder return, reflecting a market-oriented approach. European rankings may place greater weight on factors like sustainability and social responsibility, aligning with a broader stakeholder perspective. Asian rankings frequently incorporate aspects of government influence and long-term strategic goals, reflecting the often greater role of state-owned enterprises in the financial sector. These variations make direct comparisons challenging and highlight the need for careful consideration of the specific criteria used in each ranking.

Challenges of Cross-Regional Comparisons

Ranking financial institutions across diverse regulatory environments presents considerable challenges. Different jurisdictions have varying accounting standards, disclosure requirements, and definitions of key metrics (e.g., capital adequacy). For example, the Basel Accords, while globally influential, are implemented differently across regions, leading to variations in how risk is assessed and capital is calculated. These differences make direct comparisons of financial health and performance across borders difficult, requiring sophisticated adjustments and contextual understanding.

Cultural Influences on Ranking Perceptions

Cultural factors significantly influence how rankings are perceived and interpreted. In some cultures, a focus on short-term profits might be valued more highly, while others might prioritize long-term stability and relationship-building. This can affect both the criteria used in rankings and how the results are received by stakeholders. For example, a bank emphasizing community investment might rank highly in a region valuing social impact but less so in a region prioritizing purely financial performance indicators. This underscores the importance of understanding the cultural context when interpreting ranking results.

Examples of Regionally Varying Rankings

A hypothetical example: Bank X, focused on sustainable lending and community development, might achieve a high ranking in a European sustainability index but a lower ranking in a North American index primarily focused on return on equity. Similarly, a large state-owned bank in Asia, prioritizing national development goals, might achieve high rankings in regional indices that reflect those priorities but rank lower in global indices with a more shareholder-focused perspective. These variations highlight the importance of considering the specific context and criteria of each ranking system.

Key Differences in Ranking Criteria Across Three Regions

The following table summarizes key differences in ranking criteria across three distinct regions:

| Region | Key Criteria | Emphasis |

|---|---|---|

| North America | Profitability, Return on Equity, Shareholder Value, Market Capitalization | Short-term financial performance, shareholder returns |

| Europe | Sustainability, Social Responsibility, Environmental Impact, Long-term Stability | Stakeholder value, long-term sustainability, responsible banking |

| Asia | Government Influence, Long-term Strategic Goals, Market Share, Systemic Importance | National development, long-term growth, systemic stability |

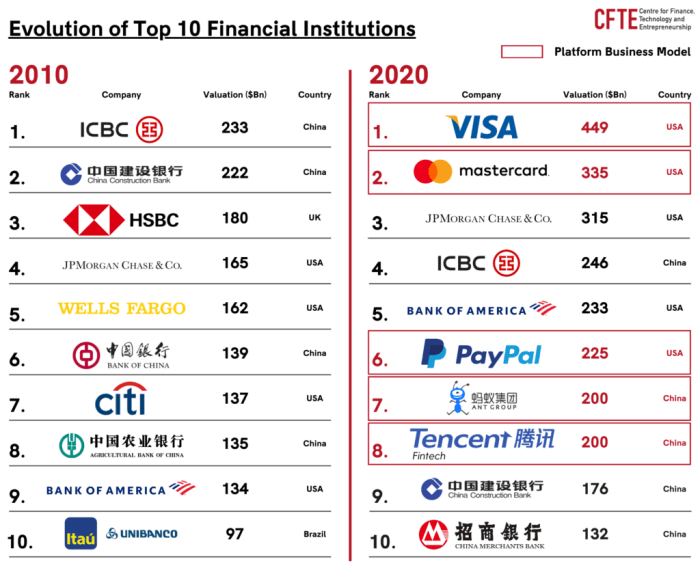

Future Trends in Financial Institution Rankings

The landscape of financial institution rankings is poised for significant transformation in the coming decade. Technological advancements, evolving societal values, and heightened regulatory scrutiny are all reshaping the criteria used to evaluate and compare financial institutions globally. Understanding these trends is crucial for both institutions striving for top rankings and analysts interpreting the results.

The Impact of Emerging Technologies on Ranking Methodologies

Fintech and artificial intelligence (AI) are rapidly altering the financial services sector, creating both opportunities and challenges for traditional institutions. AI-powered tools can analyze vast datasets to identify previously undetectable patterns of risk, efficiency, and customer satisfaction. This allows for a more nuanced and data-driven approach to ranking, moving beyond traditional metrics like profitability and asset size. For example, AI could analyze customer reviews and social media sentiment to gauge public perception of a bank’s customer service, incorporating a previously intangible factor into the ranking process. Similarly, fintech’s disruption of traditional banking models will necessitate new metrics that capture the innovative capacity and adaptability of institutions. Rankings will likely incorporate indicators of a firm’s investment in and adoption of new technologies, alongside measures of their effectiveness.

The Growing Importance of Environmental, Social, and Governance (ESG) Factors

ESG considerations are rapidly gaining prominence in financial institution rankings. Investors and consumers are increasingly demanding transparency and accountability regarding environmental sustainability, social responsibility, and good governance practices. Rankings will increasingly reflect a firm’s commitment to reducing its carbon footprint, promoting diversity and inclusion within its workforce, and adhering to ethical business practices. For instance, a bank’s financing of fossil fuel projects might negatively impact its ESG score, while strong commitments to renewable energy initiatives would likely improve it. The integration of ESG data into ranking methodologies is already underway, and we can expect to see a significant expansion of these criteria in the coming years.

Projected Evolution of Ranking Criteria

Over the next 5-10 years, we can anticipate several shifts in the criteria used to rank financial institutions. Traditional financial performance metrics will remain important, but their relative weight might decrease as other factors gain prominence. The emphasis on digital transformation, cybersecurity, and ESG performance will likely lead to the development of more comprehensive and holistic ranking systems. Furthermore, the increasing use of alternative data sources, such as social media sentiment and satellite imagery (for environmental impact assessment), will enrich the data used in the ranking process.

The Influence of Cybersecurity on Future Rankings

Cybersecurity breaches can have devastating consequences for financial institutions, eroding customer trust and impacting profitability. Consequently, a financial institution’s cybersecurity posture is becoming a critical factor in its overall assessment. Future rankings will likely incorporate metrics related to data breach prevention, incident response capabilities, and overall security infrastructure. Institutions with robust cybersecurity measures will be rewarded with higher rankings, while those with vulnerabilities will face penalties. For example, a ranking might include a score reflecting the institution’s investment in cybersecurity personnel, technology, and training programs.

Projected Changes in Ranking Criteria (Next Decade)

| Criterion | Current Weight | Projected Weight (2033) | Rationale |

|---|---|---|---|

| Financial Performance (Profitability, Return on Equity) | High | Medium | While still important, other factors will gain equal or greater weight. |

| Asset Size | High | Medium-Low | Focus shifting towards efficiency and innovation rather than sheer size. |

| ESG Performance (Environmental, Social, Governance) | Low-Medium | High | Increasing investor and consumer demand for responsible investing. |

| Cybersecurity Posture | Low | Medium-High | Growing importance of data protection and resilience against cyber threats. |

| Technological Innovation (Fintech Adoption) | Low-Medium | High | Competitive advantage driven by technological advancements. |

| Customer Satisfaction | Medium | High | Improved measurement through AI and big data analytics. |

Last Point

The ranking of financial institutions is a multifaceted process with significant implications for the global financial system. While providing valuable insights into institutional performance and driving improvements, the inherent challenges in data acquisition, methodological variations, and potential biases necessitate a critical approach to interpreting these rankings. By understanding the complexities involved, investors, institutions, and regulators can navigate this landscape more effectively and promote greater transparency and accountability within the financial sector.

Helpful Answers

What are the ethical implications of financial institution rankings?

Rankings can create pressure for institutions to prioritize short-term gains over long-term sustainability and ethical practices. Bias in data and methodology can also unfairly penalize certain institutions.

How often are financial institution rankings updated?

The frequency varies depending on the ranking agency and methodology. Some rankings are annual, while others may be updated quarterly or even continuously.

Can small financial institutions compete effectively in these rankings?

Smaller institutions often face challenges competing due to limited resources for data collection and reporting. However, focusing on niche markets and specialized services can allow them to differentiate themselves.

What role does government regulation play in shaping financial institution rankings?

Government regulations influence data availability, reporting standards, and the overall framework within which rankings are developed. Changes in regulations can significantly impact ranking methodologies.