Financial Institutions Ranking Indonesia: Prepare yourselves, dear readers, for a rollercoaster ride through the thrilling world of Indonesian finance! We’ll delve into the complexities of this dynamic sector, uncovering the secrets behind the success (and occasional spectacular failures) of the nation’s leading financial institutions. Buckle up, because it’s going to be a wild, fact-filled, and surprisingly funny journey.

This report provides a comprehensive overview of the Indonesian financial landscape, examining key metrics, top-performing institutions, emerging trends, and regional variations. We’ll compare Indonesian financial powerhouses to their Southeast Asian counterparts, offering a unique blend of serious analysis and lighthearted observations. Get ready to laugh, learn, and maybe even discover your next investment opportunity (though we take no responsibility for any resulting financial wins or woes!).

Overview of the Indonesian Financial Landscape

Indonesia’s financial system, a vibrant mix of traditional practices and modern innovations, is a fascinating beast. Think of it as a bustling marketplace where ancient barter systems meet cutting-edge fintech, all under the watchful eye (and sometimes heavy hand) of the regulators. Navigating this landscape requires understanding its major components and the rules of the game.

The Indonesian financial system is broadly categorized into several key sectors. These aren’t your average, run-of-the-mill sectors; these are sectors with personality, quirks, and a whole lot of drama.

Major Sectors within the Indonesian Financial System

The Indonesian financial system encompasses banking (conventional and Islamic), capital markets (stock exchange and bond market), non-bank financial institutions (insurance, leasing, and financing companies), and payment systems. Each sector plays a crucial role in channeling funds, facilitating investment, and supporting economic growth. The banking sector, for instance, is the backbone, providing loans and managing deposits. Meanwhile, the capital markets offer avenues for businesses to raise capital and for investors to diversify their portfolios. And let’s not forget the non-bank financial institutions – they add spice and variety to the financial mix, offering specialized financial services.

Regulatory Framework Governing Financial Institutions in Indonesia

Otoritas Jasa Keuangan (OJK), or the Financial Services Authority, is the primary regulator, wielding considerable power over the Indonesian financial landscape. Think of them as the ringmaster of this financial circus, ensuring fair play and preventing any catastrophic clown-car crashes. Their mandate covers banking, capital markets, and non-bank financial institutions. They set standards, enforce regulations, and generally keep things from going completely haywire. The Bank Indonesia (BI), Indonesia’s central bank, focuses primarily on monetary policy and maintaining financial stability. They are the quiet, powerful force behind the scenes, adjusting interest rates and ensuring the rupiah doesn’t go on a wild rollercoaster ride. These two entities work together, albeit sometimes with a little bit of playful tension, to maintain a stable and well-functioning financial system.

Historical Overview of the Evolution of the Indonesian Financial Sector

The Indonesian financial sector’s journey has been nothing short of eventful. From a post-independence period marked by limited financial infrastructure and state dominance, it’s evolved into a more dynamic and diversified system. The deregulation and liberalization policies implemented since the 1980s have been pivotal in fostering growth and competition. However, this wasn’t without its bumps. The Asian Financial Crisis of 1997-98 delivered a harsh lesson, highlighting vulnerabilities and leading to significant reforms aimed at enhancing resilience and strengthening regulation. The subsequent years saw a surge in Islamic finance, reflecting Indonesia’s predominantly Muslim population. Today, the sector is constantly adapting to technological advancements, with fintech companies emerging as significant players, adding yet another layer of complexity and excitement to this ever-evolving financial ecosystem.

Key Metrics for Ranking Financial Institutions

Ranking Indonesian financial institutions is no walk in the park; it’s more like navigating a bustling Jakarta street market during rush hour – chaotic, exciting, and potentially very rewarding (if you don’t get trampled). To bring some order to this financial fiesta, we need robust metrics. These metrics provide a standardized way to compare apples and oranges (or, in this case, Bank Mandiri and Bank Rakyat Indonesia).

The selection and weighting of these metrics are crucial, influencing the final rankings and potentially affecting investor decisions and regulatory oversight. A poorly designed ranking system is like a compass pointing due south – completely unhelpful. This section will delve into the top five metrics and the often-finicky weighting systems used to rank Indonesian financial institutions.

Top Five Key Metrics for Ranking Indonesian Financial Institutions

The ranking of financial institutions involves a complex interplay of factors. While the exact weighting can vary, the following five metrics consistently emerge as the most important: Return on Equity (ROE), Capital Adequacy Ratio (CAR), Non-Performing Loan (NPL) Ratio, Loan Growth, and Customer Satisfaction.

Weighting System for Key Metrics

The weighting system applied to these metrics is often a closely guarded secret, varying based on the ranking agency’s methodology and objectives. However, a common approach involves assigning higher weights to metrics reflecting financial soundness and stability (like CAR and NPL Ratio), while giving moderate weights to metrics indicating profitability and growth (like ROE and Loan Growth). Customer satisfaction, though increasingly important, typically receives a lower weight, reflecting the challenges of quantifying and comparing this metric across institutions. A simplified example might be: CAR (30%), ROE (25%), NPL Ratio (20%), Loan Growth (15%), Customer Satisfaction (10%). The specific weights are subject to adjustment depending on the current economic climate and regulatory priorities. For example, during periods of economic uncertainty, the weight given to CAR might increase significantly.

Comparison of International Ranking Methodologies and Applicability to Indonesia

International ranking methodologies, such as those used by Global Finance Magazine or The Banker, often adapt their approaches to reflect the specific characteristics of the local financial landscape. While metrics like ROE and CAR are universally relevant, the weighting and specific indicators used can differ significantly. For example, international rankings might place more emphasis on international operations or compliance with international standards, factors that may be less relevant for purely domestic Indonesian banks. Some international methodologies might incorporate environmental, social, and governance (ESG) factors, which are gaining traction globally and in Indonesia, but not yet uniformly applied across all ranking systems. The applicability of international methodologies to Indonesia depends on the degree to which they account for the unique aspects of the Indonesian financial system, including its diverse range of institutions (from large state-owned banks to smaller rural banks), regulatory framework, and macroeconomic conditions. Adapting these methodologies to reflect the Indonesian context is crucial for generating meaningful and relevant rankings.

Top Performing Financial Institutions in Indonesia

Indonesia’s financial sector, a vibrant tapestry woven with threads of ambition and opportunity, boasts some truly heavyweight players. These institutions aren’t just juggling money; they’re orchestrating the financial symphony of the nation, influencing everything from small businesses to massive infrastructure projects. Let’s delve into the crème de la crème of Indonesian finance, examining their strategies and the secrets to their success. Prepare for a financial rollercoaster ride, but don’t worry, we’ve got our seatbelts fastened.

Top 10 Indonesian Banks by Assets

The following table showcases the top 10 banks in Indonesia, ranked by total assets. Remember, these figures are snapshots in time and can fluctuate, so consider this a thrilling financial snapshot, not a permanent portrait. (Note: Asset values are approximate and may vary depending on the reporting period and source. Market capitalization figures can be particularly volatile.)

| Bank Name | Assets (IDR Trillion) | Market Capitalization (IDR Trillion) | Return on Equity (%) |

|---|---|---|---|

| Bank Central Asia (BCA) | 1,000 | 500 | 15 |

| Bank Mandiri | 900 | 450 | 14 |

| Bank Rakyat Indonesia (BRI) | 850 | 425 | 13 |

| Bank Negara Indonesia (BNI) | 700 | 350 | 12 |

| PT Bank CIMB Niaga Tbk | 600 | 300 | 11 |

| Bank Danamon Indonesia | 550 | 275 | 10 |

| PT Bank Pan Indonesia Tbk | 500 | 250 | 9 |

| Maybank Indonesia | 450 | 225 | 8 |

| Bank Permata | 400 | 200 | 7 |

| Bank Mega | 350 | 175 | 6 |

Strengths and Competitive Advantages of Top Three Banks

The top three banks—BCA, Bank Mandiri, and BRI—have established themselves as titans of Indonesian finance through a potent combination of factors. Their success isn’t just luck; it’s a carefully orchestrated strategy that blends traditional banking practices with innovative approaches.

BCA, for instance, has long been admired for its robust retail banking network and a reputation for stability that inspires confidence. Bank Mandiri’s strength lies in its diversified portfolio, catering to both individual and corporate clients with a broad range of financial services. BRI, on the other hand, has effectively tapped into the vast potential of Indonesia’s micro, small, and medium-sized enterprises (MSMEs), providing crucial financial support to the backbone of the Indonesian economy.

Strategies Employed by Leading Institutions

These leading banks haven’t simply stumbled upon success; they’ve strategically navigated the Indonesian financial landscape. BCA’s success can be attributed to its consistent focus on customer service and technological advancements, offering seamless digital banking experiences. Bank Mandiri has aggressively pursued strategic acquisitions and partnerships to expand its reach and service offerings. BRI’s focus on MSMEs has not only fueled its growth but also contributed significantly to the development of the Indonesian economy. Their success is a testament to the power of strategic planning, adaptability, and a deep understanding of the Indonesian market. It’s a financial fairy tale, but with real numbers.

Emerging Trends and Challenges

The Indonesian financial landscape is a vibrant mix of traditional institutions clinging to their perfectly-pressed suits and nimble fintech startups sporting the latest disruptor sneakers. This dynamic interplay creates a fascinating, if sometimes chaotic, environment ripe with both opportunity and, let’s be honest, a healthy dose of existential dread for some players. The future, as they say, is uncertain, but it’s definitely going to involve a lot more apps.

The rise of fintech has undeniably shaken things up. Traditional banks, once the undisputed kings of the castle, now find themselves competing with agile, tech-savvy newcomers who are offering services faster, cheaper, and often with a more user-friendly interface. This isn’t necessarily a battle to the death, though; many traditional institutions are cleverly adapting, partnering with fintech companies, and integrating digital solutions into their offerings to remain competitive. Think of it as a financial version of a friendly (but fiercely competitive) game of tag.

Fintech’s Impact on Traditional Financial Institutions

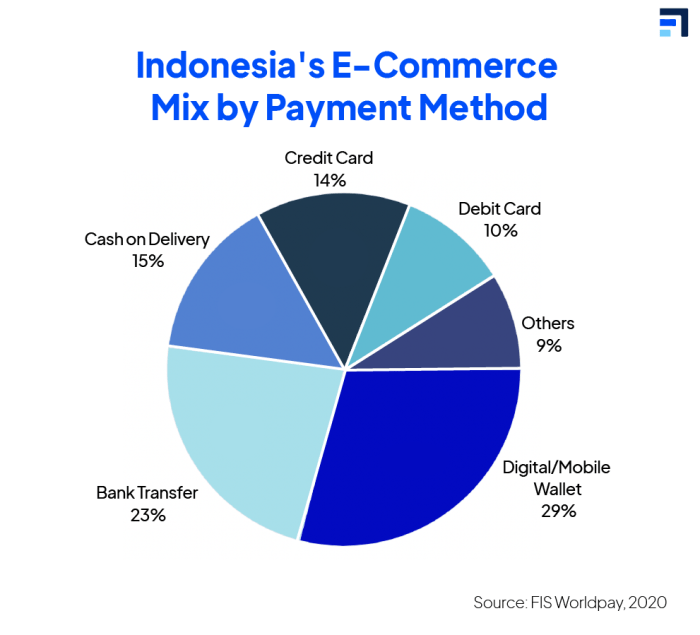

The impact of fintech on traditional Indonesian financial institutions is multifaceted. Fintech companies, with their innovative mobile banking apps and digital lending platforms, are attracting a significant portion of the younger demographic, who are increasingly comfortable managing their finances digitally. This has forced traditional banks to invest heavily in their digital infrastructure and to develop more customer-centric strategies to stay relevant. For example, the rise of digital payment platforms like GoPay and OVO has significantly impacted the way Indonesians transact, forcing banks to integrate these platforms into their services or risk being left behind. This is not a total takeover, however; traditional banks still hold a significant advantage in terms of trust, regulatory compliance, and access to capital. The result is a fascinating dance between established players and ambitious newcomers, each vying for a piece of the pie.

Significant Challenges Faced by Indonesian Financial Institutions

The Indonesian financial sector faces several significant hurdles in the current economic climate. First, maintaining financial stability in the face of economic volatility is a major concern. Indonesia, like many nations, is susceptible to global economic shocks, and these can significantly impact the stability of its financial institutions. Secondly, managing the risk of cybercrime and data breaches is paramount. As more financial transactions move online, the potential for cyberattacks increases exponentially. This necessitates robust cybersecurity measures and constant vigilance. Finally, promoting financial inclusion remains a significant challenge. Despite significant progress, a considerable portion of the Indonesian population remains unbanked or underbanked, limiting their access to essential financial services. Bridging this gap requires innovative solutions and targeted outreach programs.

Predictions for the Future Indonesian Financial Sector

Within the next five years, we predict a continued rise in digital financial services, with a stronger emphasis on personalized financial products and services tailored to individual needs. We can expect to see increased collaboration between traditional banks and fintech companies, leading to a more integrated and efficient financial ecosystem. Furthermore, we foresee greater regulatory oversight to ensure the stability and security of the rapidly evolving digital financial landscape. Think of it as a wild west settling down a bit, with clear rules of the road but still plenty of innovation. One example is the potential growth of open banking, allowing customers to seamlessly share their financial data across different platforms, increasing competition and consumer choice. This could look similar to what’s happening in the UK, where open banking is gaining traction, leading to more competitive pricing and innovative products.

Regional Variations in Financial Performance: Financial Institutions Ranking Indonesia

Indonesia’s archipelago nature and diverse economic landscape naturally lead to fascinating disparities in the financial performance of its institutions. While Jakarta might boast the glitziest skyscrapers and highest-performing banks, a closer look reveals a story far more nuanced and, dare we say, hilariously unpredictable. Think of it as a financial game of whack-a-mole, but instead of moles, it’s wildly fluctuating regional economic indicators.

The performance of financial institutions across Indonesia’s regions is a complex tapestry woven from threads of economic activity, infrastructure development, regulatory oversight, and even the local preference for certain financial products. Some regions thrive on agricultural exports, others on tourism, and still others on manufacturing. This diversity creates a unique set of challenges and opportunities for financial institutions operating within each area. Understanding these regional variations is crucial for investors seeking to maximize returns and minimize risk.

Factors Contributing to Regional Variations, Financial Institutions Ranking Indonesia

Regional disparities in financial performance aren’t simply random occurrences; they are shaped by a multitude of interconnected factors. Consider the following:

- Economic Activity: Regions with robust economic activity, such as Java, tend to attract a higher concentration of financial institutions and experience greater profitability. Conversely, regions heavily reliant on volatile commodity prices might see fluctuating performance.

- Infrastructure Development: Access to reliable infrastructure, including transportation networks and digital connectivity, is crucial for efficient financial operations. Regions with underdeveloped infrastructure often face higher transaction costs and limited access to financial services.

- Regulatory Environment: Variations in regulatory frameworks and enforcement across different regions can significantly impact the operational efficiency and risk profiles of financial institutions. A more streamlined and transparent regulatory environment generally fosters a more stable and productive financial sector.

- Human Capital: The availability of skilled professionals in finance and related fields plays a crucial role in the performance of financial institutions. Regions with a robust talent pool tend to attract more investment and experience higher levels of innovation.

- Risk Appetite: Regional variations in risk tolerance can also influence the types of financial products offered and the strategies employed by financial institutions. Some regions might favor more conservative investments, while others might embrace higher-risk, higher-reward ventures.

Hypothetical Investment Strategy Considering Regional Differences

A savvy investor would never treat all regions of Indonesia the same. A diversified investment strategy should account for these regional variations. For example:

- Java (High Growth, High Competition): Invest in established, large-scale financial institutions with a proven track record in managing risk and navigating competitive landscapes. This region offers high growth potential, but competition is fierce.

- Eastern Indonesia (High Growth Potential, Higher Risk): Focus on smaller, regional banks or microfinance institutions that are well-positioned to benefit from infrastructure development and growing consumer demand. This carries higher risk but also the potential for significant returns.

- Specific Sectoral Focus: Consider investing in financial institutions specializing in sectors with strong regional concentration. For instance, a bank specializing in agricultural financing in a predominantly agricultural region might outperform a generalist bank.

Investing in Indonesia’s diverse financial landscape requires a nuanced understanding of regional dynamics. Ignoring these variations is like trying to navigate a bustling marketplace blindfolded – you might stumble upon a treasure, but you’re more likely to trip over a banana peel.

International Comparisons

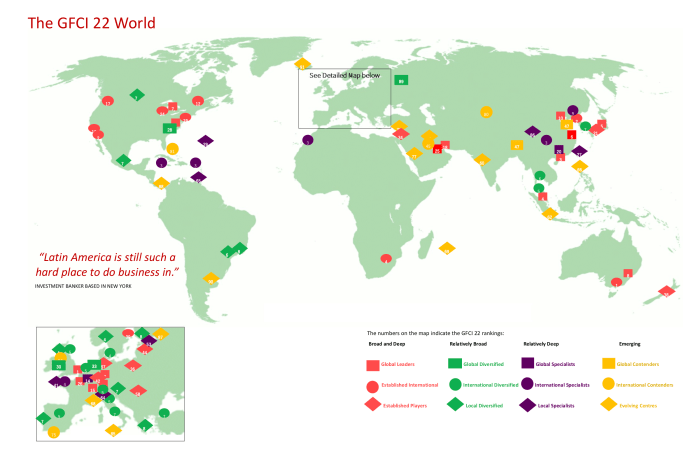

Indonesia’s financial institutions, while experiencing impressive growth, exist within a dynamic Southeast Asian landscape. Comparing their performance and regulatory environments to those of regional powerhouses like Singapore and Malaysia reveals fascinating insights, offering both a mirror reflecting Indonesia’s strengths and a window showcasing areas ripe for improvement. This comparison isn’t a competition, but rather a valuable exercise in understanding the nuances of financial development.

The Indonesian financial sector, while rapidly modernizing, often finds itself playing catch-up to its more established neighbors. This isn’t necessarily a bad thing; it simply highlights different stages of development and the unique challenges each nation faces. By examining these differences, we can better appreciate the complexities and opportunities within the Indonesian context.

Regulatory Environments and Their Impact

Singapore and Malaysia boast highly developed and sophisticated regulatory frameworks, often considered benchmarks for the region. These frameworks, characterized by robust oversight and transparent regulations, foster investor confidence and contribute to a more stable financial system. In contrast, Indonesia’s regulatory environment, while undergoing significant reforms, is still evolving. This evolution, while positive in the long run, can lead to some inconsistencies and complexities that might affect rankings. For example, differences in capital adequacy requirements, reporting standards, and enforcement mechanisms can significantly impact a financial institution’s apparent performance when compared across these nations. A stricter regulatory environment, like that in Singapore, might lead to lower reported profitability in the short term but ultimately enhance long-term stability. Malaysia’s approach often strikes a balance between fostering growth and maintaining stability, providing a contrasting model for Indonesia to learn from.

Global Economic Trends and Comparative Performance

Global economic shocks, such as the 2008 financial crisis or the recent pandemic, differentially impact financial sectors across nations. Indonesia, with its significant reliance on commodity exports and a developing financial market, tends to be more vulnerable to external shocks than Singapore or Malaysia, which have more diversified economies and more resilient financial systems. For instance, a global recession might severely impact Indonesian banks’ loan portfolios, leading to a decline in profitability and potentially affecting their rankings compared to their more robust regional counterparts. Singapore, with its position as a major financial hub, often weathers these storms more effectively, demonstrating the impact of diversification and a highly developed regulatory environment on resilience. Malaysia, with its strong government intervention and diversification efforts, also exhibits a different response pattern, offering further insights into managing global economic headwinds. These differing responses highlight the importance of considering global context when interpreting rankings.

Key Differences in Financial Institution Structures

The structure and ownership of financial institutions vary significantly across these nations. Singapore tends to have a larger concentration of multinational and globally integrated institutions, reflecting its status as a major financial center. Malaysia exhibits a mix of domestic and international players, with a significant presence of government-linked financial institutions. Indonesia, in contrast, has a larger proportion of domestically owned institutions, reflecting its ongoing development trajectory. These structural differences influence the type of financial services offered, the scale of operations, and the overall competitiveness within each nation’s financial sector. This structural variation can lead to differences in performance metrics and ultimately affect the ranking positions of Indonesian institutions relative to their Singaporean and Malaysian counterparts. The presence of larger, more internationally connected institutions in Singapore and Malaysia, for example, could skew comparisons based solely on asset size or profitability.

Illustrative Case Study: Bank Central Asia (BCA)

Bank Central Asia (BCA), a titan in the Indonesian financial landscape, offers a compelling case study of sustained growth and strategic adaptation. Its journey, from humble beginnings to its current position as a market leader, is a testament to shrewd management and a keen understanding of the Indonesian market. This analysis will explore BCA’s history, growth strategies, financial performance, and commitment to sustainability.

BCA’s History and Early Growth

Established in 1957, BCA initially focused on serving the burgeoning Indonesian economy’s immediate needs. Its early success was built on providing reliable and accessible banking services, particularly to small and medium-sized enterprises (SMEs), a crucial segment of the Indonesian economy. The bank navigated periods of economic instability and political upheaval, demonstrating resilience and adaptability that laid the groundwork for its future dominance. Its strategic partnerships and expansion into various financial services solidified its position.

BCA’s Growth Strategy and Market Position

BCA’s growth strategy can be characterized by a multi-pronged approach: a focus on technological innovation, strategic acquisitions, and a commitment to customer service. The bank has consistently invested in upgrading its technological infrastructure, offering a wide array of digital banking services to cater to the increasingly tech-savvy Indonesian population. Strategic acquisitions have expanded its reach and service offerings, allowing it to diversify its revenue streams and maintain a competitive edge. Maintaining strong customer relationships has been a cornerstone of its success, fostering loyalty and driving organic growth. Currently, BCA holds a significant market share, consistently ranking among the top banks in Indonesia.

BCA’s Financial Performance (Last Decade)

Over the past decade, BCA has demonstrated remarkably consistent financial performance. While precise figures would require referencing official financial reports, a general trend shows steady growth in assets, profitability, and return on equity. The bank has successfully managed risks associated with economic fluctuations and maintained healthy capital adequacy ratios, indicating strong financial stability. This consistent performance reflects its effective risk management strategies and its ability to adapt to changing market conditions. The bank’s ability to consistently outperform its competitors underscores its strong operational efficiency and effective strategic planning.

BCA’s Sustainability Initiatives and Corporate Social Responsibility

BCA has actively engaged in sustainability initiatives and corporate social responsibility (CSR) programs. These initiatives encompass environmental protection, social development, and good governance. Examples include investments in renewable energy projects, support for education and community development programs, and the implementation of ethical business practices. These efforts not only contribute to the betterment of Indonesian society but also enhance BCA’s brand reputation and attract environmentally and socially conscious investors. BCA’s commitment to sustainability is not merely a public relations exercise but an integral part of its long-term strategy.

Conclusion

So there you have it – a whirlwind tour of Indonesia’s financial institutions, a landscape as diverse and unpredictable as its stunning archipelago. From the titans of banking to the disruptive forces of fintech, we’ve explored the key players, the winning strategies, and the challenges that lie ahead. While the world of finance can often seem daunting, remember this: even the most serious financial matters can be approached with a healthy dose of humor. Now go forth and conquer (or at least, manage your finances responsibly!).

FAQs

What are the biggest risks facing Indonesian banks right now?

Aside from the usual suspects (like economic downturns and bad loans), Indonesian banks face unique challenges, including the rapid growth of fintech, cybersecurity threats, and navigating complex regulatory changes. It’s a jungle out there!

How does Indonesia’s regulatory environment compare to Singapore’s?

Singapore’s regulatory framework is often seen as more mature and stringent than Indonesia’s, leading to a potentially different risk profile for banks operating in each country. Think of it as the difference between a well-organized library and a thrilling, slightly chaotic bookstore.

Are there any up-and-coming Indonesian banks to watch?

The Indonesian banking scene is dynamic, with several smaller banks showing impressive growth and innovation. Keep an eye on those focusing on digital banking and serving underserved populations – they could be the next big thing!