Financial Institutions Ranking Indonesia: Prepare yourselves for a rollercoaster ride through the exhilarating world of Indonesian finance! We’ll delve into the cutthroat competition, the dizzying heights of success, and the occasional, uh, *minor* financial hiccup. Buckle up, it’s going to be a wild ride.

This exploration will uncover the secrets behind the rankings, examining the various methodologies employed by rating agencies – some more reliable than others, we’ll be sure to point out. We’ll profile the top dogs of Indonesian finance, showcasing their strategies and market dominance. But it’s not all sunshine and rainbows; we’ll also tackle the challenges these institutions face, from the rise of fintech disruptors to the ever-shifting sands of economic policy. Get ready to learn about Indonesia’s financial landscape – from its humble beginnings to its ambitious future.

Overview of Indonesian Financial Institutions

Indonesia’s financial system, a vibrant tapestry woven with threads of tradition and modernity, boasts a fascinating history. From its humble beginnings as a largely informal system, it has undergone a dramatic transformation, fueled by economic growth and a push for greater financial inclusion. This evolution has resulted in a complex and diverse landscape of financial institutions, each playing a crucial role in the nation’s economic development. Understanding this system requires a look at its history, structure, and the regulatory bodies that keep it all running (mostly) smoothly.

The Indonesian financial system’s development can be broadly categorized into several phases. Initially, it was dominated by traditional practices and limited formal institutions. Post-independence, the government played a significant role in shaping the system, leading to the establishment of state-owned banks and a focus on national development. Subsequent reforms, often spurred by economic crises (like the Asian Financial Crisis of 1997-98), have led to deregulation, privatization, and a greater emphasis on market-based mechanisms. This period saw a significant increase in the number and types of financial institutions operating in the country, leading to the sophisticated system we see today. It’s been a rollercoaster, to say the least, but the Indonesian financial system has shown remarkable resilience.

Major Types of Indonesian Financial Institutions

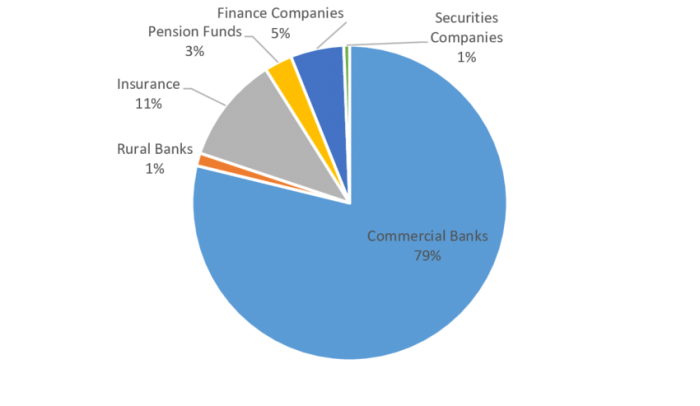

Indonesia’s financial landscape is populated by a diverse range of institutions, each serving a unique function within the broader ecosystem. These institutions work together, sometimes harmoniously, sometimes not so much, to channel funds from savers to borrowers, manage risk, and facilitate economic activity. A breakdown of the key players reveals the complexity and interconnectedness of the system. Think of it as a very well-organized (mostly) financial ecosystem.

- Banks: These are the heavy hitters, ranging from state-owned behemoths to nimble private players. They offer a full suite of services, from deposit accounts to loans, playing a critical role in credit allocation and monetary policy implementation. Think of them as the backbone of the financial system.

- Insurance Companies: These institutions provide risk mitigation services, offering protection against various financial uncertainties, from car accidents to retirement. They play a vital role in stabilizing the economy by absorbing shocks and managing risk. They are the financial safety net.

- Investment Firms: These firms offer a range of investment products and services, facilitating capital flows and supporting investment activities. They can range from mutual fund managers to brokerage houses, acting as intermediaries in the capital markets. Think of them as the engine of growth.

- Non-Bank Financial Institutions (NBFIs): This broad category encompasses a variety of entities, including finance companies, leasing companies, and pawnshops, each catering to specific market segments and offering specialized financial services. They fill in the gaps that banks sometimes miss.

Regulatory Framework and Key Authorities

Maintaining stability and integrity within such a complex system requires a robust regulatory framework. Bank Indonesia (BI), the central bank, is the primary regulator, responsible for monetary policy, banking supervision, and maintaining financial system stability. Other key players include the Financial Services Authority (OJK), which oversees non-bank financial institutions and the capital market, and the Deposit Insurance Corporation (LPS), which provides deposit insurance to protect depositors’ funds. It’s a multi-layered approach to keeping things under control, a bit like a financial Jenga game, but hopefully, without the collapse.

The Indonesian financial system operates under a framework of laws, regulations, and supervisory practices designed to promote stability, efficiency, and consumer protection.

Ranking Criteria and Methodologies

Ranking Indonesian financial institutions is no easy feat; it’s like trying to choose the best flavor of durian – everyone has a different opinion! But to bring some order to this deliciously chaotic situation, ranking agencies employ a variety of criteria and methodologies. Let’s delve into the fascinating world of financial institution evaluation.

The criteria used to assess these institutions are multifaceted, considering not only their financial health but also their impact on the broader Indonesian economy and the satisfaction of their clientele. It’s a balancing act between hard numbers and softer, more subjective metrics.

Criteria Used in Ranking Financial Institutions

Several key factors influence the rankings, each contributing a different piece to the overall puzzle. Some are straightforward, others are a bit more nuanced (and potentially prone to heated debate among ranking experts!).

- Asset Size: A simple, yet powerful indicator. Larger asset sizes often suggest greater financial strength and stability. Think of it as the financial institution’s “muscle mass” – bigger isn’t always better, but it certainly helps.

- Profitability: This metric reveals how efficiently an institution manages its resources and generates returns. High profitability indicates strong management and a healthy business model – the financial equivalent of a well-oiled machine.

- Customer Satisfaction: A crucial element often measured through surveys and feedback mechanisms. Happy customers are loyal customers, and customer satisfaction reflects the institution’s ability to meet its clients’ needs. It’s the “people’s choice award” of the financial world.

- Technological Advancement: In today’s digital age, this is paramount. Institutions with cutting-edge technology and innovative digital services are better positioned to serve customers and compete effectively. This is the “tech-savvy” factor – how well they keep up with the times.

- Capital Adequacy Ratio (CAR): This measures a bank’s capital relative to its risk-weighted assets. A higher CAR indicates a stronger ability to absorb losses. It’s the financial equivalent of a safety net – the higher, the better.

Methodologies Employed by Ranking Agencies

Different agencies utilize diverse methodologies, leading to variations in the final rankings. Understanding these methodologies is key to interpreting the results with a critical eye – and perhaps a touch of humor.

- Weighted Average Method: This common approach assigns weights to different criteria based on their perceived importance. For example, profitability might receive a higher weight than customer satisfaction. The weighted average then determines the final ranking. Think of it as a meticulously crafted recipe – each ingredient (criterion) contributes to the final dish (ranking).

- Factor Analysis: This statistical method identifies underlying factors that contribute to the overall performance of financial institutions. It’s a more sophisticated approach that aims to capture the complex interrelationships between various criteria. This is the “detective work” of ranking methodologies – uncovering hidden patterns.

- Data Envelopment Analysis (DEA): DEA is a non-parametric method used to evaluate the relative efficiency of a set of decision-making units (DMUs). It’s a more mathematically complex approach but can provide a more nuanced comparison of efficiency across institutions. This is the “high-powered statistical analysis” approach – best left to the experts (and those who enjoy complex formulas).

Hypothetical Ranking System

Let’s design a fun, yet (relatively) serious hypothetical ranking system. We’ll use a weighted average approach, because it’s simple, transparent, and allows for easy adjustments based on the relative importance of different factors.

| Criterion | Weight |

|---|---|

| Asset Size | 20% |

| Profitability (Return on Equity) | 25% |

| Customer Satisfaction (Net Promoter Score) | 20% |

| Technological Advancement (Innovation Score) | 15% |

| Capital Adequacy Ratio (CAR) | 20% |

This system prioritizes profitability and capital adequacy, reflecting the importance of financial strength and stability. Customer satisfaction and technological advancement are also given significant weight, recognizing the importance of customer-centricity and innovation in the modern financial landscape. This is our hypothetical “perfect” ranking system – at least until someone comes up with a better one!

Top-Performing Financial Institutions: Financial Institutions Ranking Indonesia

The Indonesian financial landscape is a vibrant jungle, teeming with institutions vying for the top spot. While precise rankings fluctuate depending on the criteria used (and let’s be honest, some methodologies are as clear as mud), certain players consistently emerge as titans of the industry. This section will delve into the consistently high-performing institutions, examining their strategies and providing a glimpse into their market dominance. Buckle up, it’s going to be a wild ride!

Analyzing the top performers reveals fascinating insights into successful strategies. While specific rankings vary across different rating agencies and publications, several institutions consistently demonstrate exceptional financial health, innovation, and customer satisfaction. Understanding their approaches can offer valuable lessons for both established players and newcomers.

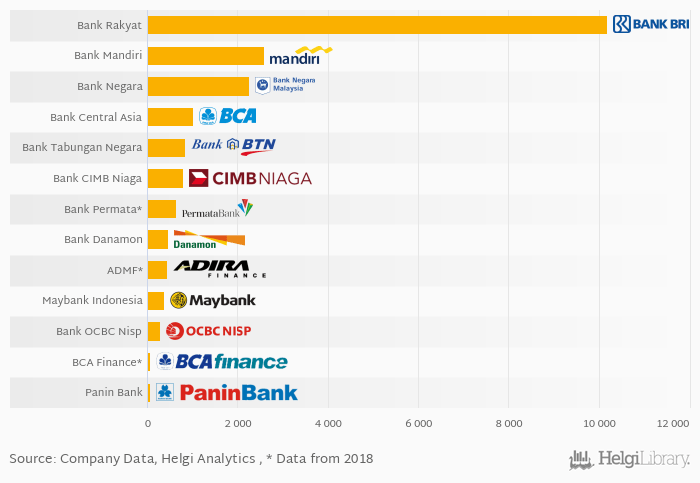

Consistently Top-Ranked Institutions and Their Strategies

Identifying the consistently top-ranked financial institutions requires a nuanced approach, considering various ranking systems. While no single institution universally holds the top spot across all metrics, several consistently appear near the top, suggesting a high level of overall performance. These institutions often exhibit a combination of robust financial management, innovative product offerings, and a strong customer focus.

| Name | Rank (Illustrative – Varies by Ranking System) | Key Strengths | Market Share (Illustrative – Varies by Sector) |

|---|---|---|---|

| Bank Central Asia (BCA) | Top 3 consistently | Extensive branch network, strong digital banking platform, robust risk management, loyal customer base. | Significant share in lending and deposits |

| Bank Mandiri | Top 3 consistently | Diversified portfolio, strong government backing, aggressive expansion into digital services, large corporate clientele. | High market share across various segments |

| Bank Rakyat Indonesia (BRI) | Top 3 consistently | Extensive reach in rural areas, focus on micro, small, and medium enterprises (MSMEs), government support, strong brand recognition. | Dominant market share in microfinance |

| PT Asuransi Jiwa Manulife Indonesia | Top performer in insurance sector | Strong brand reputation, diversified product offerings, robust distribution network, customer-centric approach. | Significant market share in life insurance |

Note: The ranks and market shares provided are illustrative and can vary depending on the specific ranking system and time period considered. These figures are intended to provide a general overview of the relative performance of these institutions and not to represent definitive, universally agreed-upon data.

Emerging Trends and Challenges

The Indonesian financial landscape is undergoing a thrilling rollercoaster ride, a dizzying blend of exhilarating growth and nail-biting challenges. The rapid rise of fintech and digitalization is transforming how Indonesians interact with money, creating both opportunities and headaches for established financial institutions. It’s a bit like watching a traditional gamelan orchestra suddenly incorporate electric guitars – exciting, but potentially a bit chaotic!

The interplay between traditional banking and the disruptive force of fintech is reshaping the competitive environment, forcing institutions to adapt or risk becoming relics of the past. This isn’t just about keeping up; it’s about reinventing the wheel – or perhaps, inventing a flying car to bypass traffic altogether.

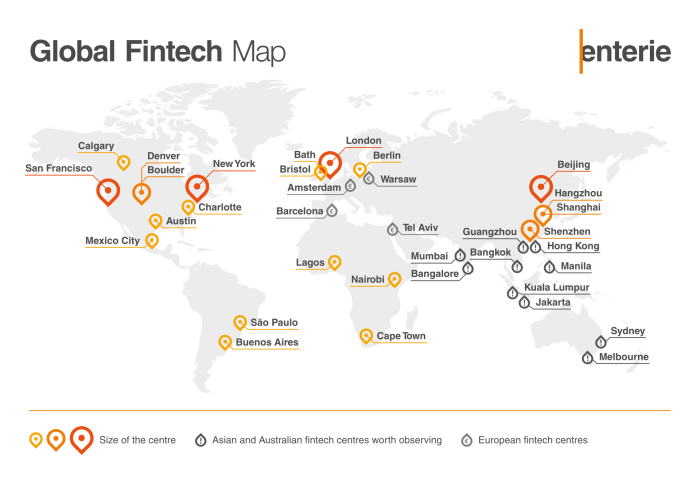

The Impact of Fintech and Digitalization

Fintech’s influence on Indonesia’s financial sector is undeniable. Digital payment platforms like GoPay and OVO have become ubiquitous, offering convenient and accessible financial services to millions previously underserved by traditional banks. This has led to increased financial inclusion, boosting economic activity and empowering individuals. However, it also presents challenges for traditional banks, who must now compete with agile, tech-savvy newcomers. The rise of mobile banking and online lending platforms further intensifies this competition, pushing financial institutions to innovate and enhance their digital offerings to remain relevant. Think of it as a digital arms race, with each player striving to develop the most advanced financial weaponry.

Challenges Faced by Indonesian Financial Institutions, Financial Institutions Ranking Indonesia

Indonesian financial institutions face a complex web of challenges. Intense competition from both domestic and international players is a constant pressure. Economic volatility, influenced by global factors and domestic conditions, creates uncertainty and necessitates robust risk management strategies. Furthermore, the regulatory landscape is constantly evolving, requiring institutions to adapt quickly and comply with new rules and regulations. It’s like navigating a minefield blindfolded, while simultaneously trying to win a high-stakes game of chess.

Strategies for Adaptation and Overcoming Challenges

Institutions are employing various strategies to navigate this dynamic environment. The need for adaptation is paramount; it’s not simply about survival, but about thriving in this new era.

- Investing in Digital Infrastructure and Technology: This involves upgrading systems, developing mobile apps, and implementing robust cybersecurity measures. It’s about building the digital fortress to protect against cyber threats and ensuring seamless operations.

- Developing Innovative Financial Products and Services: This includes creating tailored offerings for specific customer segments, leveraging data analytics to personalize services, and exploring new financial technologies such as blockchain and AI. Think of it as crafting bespoke financial solutions to meet the diverse needs of the Indonesian market.

- Strengthening Risk Management Capabilities: This entails enhancing fraud detection systems, improving credit scoring models, and implementing robust stress testing methodologies to withstand economic shocks. It’s about building a strong financial immune system to protect against various threats.

- Collaborating with Fintech Companies: Rather than viewing fintech as a threat, some institutions are forging strategic partnerships to leverage their technological expertise and reach. This is a case of embracing the competition, turning rivals into allies.

- Focusing on Financial Inclusion: Expanding access to financial services for underserved populations is not only a socially responsible act but also a strategic opportunity to tap into a vast and growing market. This is about extending a helping hand, while simultaneously growing the business.

Financial Inclusion and Access

Indonesia’s journey towards becoming a financially inclusive nation is a rollercoaster ride – thrilling, sometimes bumpy, but ultimately aiming for a destination where everyone can participate in the financial system. This requires a concerted effort from financial institutions, the government, and other stakeholders to bridge the gap between the financially served and the underserved. The success of this endeavor will significantly impact Indonesia’s economic growth and social well-being.

Financial institutions play a pivotal role in promoting financial inclusion by extending financial services to previously excluded segments of the population. This isn’t just about altruism; it’s also good business. A larger pool of financially active individuals translates to a larger market for financial products and services. Furthermore, increased financial inclusion fosters economic empowerment, reduces poverty, and contributes to a more stable and equitable society. However, the challenge lies in navigating the complexities of reaching remote areas, educating diverse populations, and overcoming the inherent risks associated with serving low-income individuals.

Initiatives to Improve Access to Financial Services

The Indonesian government and financial institutions have implemented various initiatives to expand access to financial services for underserved populations. These initiatives encompass a wide range of strategies, from expanding branch networks in rural areas to promoting digital financial services. A key strategy is to leverage technology to overcome geographical barriers and reduce transaction costs.

Examples of Successful Financial Literacy and Digital Inclusion Programs

Several programs have demonstrated success in improving financial literacy and promoting digital financial inclusion in Indonesia. For example, the government’s national financial literacy program, often implemented in partnership with banks and non-governmental organizations (NGOs), employs a multi-pronged approach involving workshops, educational materials, and public awareness campaigns. These programs focus on practical skills such as budgeting, saving, and understanding credit products. The impact is measured through increased savings rates, reduced reliance on informal lending, and improved financial decision-making among participants. Simultaneously, the rise of mobile banking and digital payment platforms, like OVO and GoPay, has dramatically expanded access to financial services, particularly in underserved rural areas. The ease of use and widespread availability of smartphones have made these platforms incredibly popular, enabling millions to access banking services and make transactions without needing a traditional bank account. The success of these programs can be seen in the increased adoption rates of digital financial services and the growing number of financially included individuals.

International Comparisons

The Indonesian financial landscape, while vibrant and growing, doesn’t exist in a vacuum. To truly understand its strengths and weaknesses, a peek across the border – or rather, across the Strait of Malacca and beyond – is necessary. Comparing Indonesian financial institutions to their Southeast Asian counterparts reveals fascinating insights, highlighting areas of excellence and pinpointing areas ripe for improvement. Think of it as a friendly financial Olympics, where we’re rooting for Indonesia but also acknowledging the impressive performances of other competitors.

Let’s delve into a comparative analysis, examining key performance indicators and identifying areas where Indonesia shines and where it could use a little extra polish. We’ll use a combination of readily available data and some well-informed speculation (because let’s face it, sometimes even the best data needs a little creative interpretation).

Southeast Asian Financial Institution Performance Comparison

This table presents a simplified comparison of select financial institutions across Southeast Asia. Remember, comparing apples and oranges (or, in this case, banks and insurance companies) requires careful consideration of different metrics and business models. This comparison uses a simplified key metric for illustrative purposes. Real-world comparisons would require a far more nuanced approach and a much larger dataset.

| Country | Institution | Key Metric (Return on Equity – ROE) | Performance (Illustrative – Percentage) |

|---|---|---|---|

| Indonesia | Bank Central Asia (BCA) | Return on Equity | 15% (Illustrative) |

| Singapore | DBS Bank | Return on Equity | 18% (Illustrative) |

| Malaysia | Maybank | Return on Equity | 12% (Illustrative) |

| Thailand | Bangkok Bank | Return on Equity | 14% (Illustrative) |

| Vietnam | Vietcombank | Return on Equity | 10% (Illustrative) |

Note: The ROE figures presented are illustrative and for comparative purposes only. Actual ROE figures fluctuate and depend on various factors, including accounting practices and the specific reporting period. A comprehensive comparison would require a deeper dive into individual financial statements and a consideration of other key performance indicators. This table serves as a simplified example to illustrate the concept of international comparison.

Areas of Indonesian Excellence and Areas Needing Improvement

While a detailed analysis would require a far more extensive report (and possibly a caffeine IV drip), some general observations can be made. Indonesian financial institutions often demonstrate strength in their reach and penetration within the domestic market, particularly in serving a large and growing population. However, compared to their more established counterparts in Singapore or Malaysia, they might lag in terms of international expansion and the sophistication of certain financial products and services. For instance, while Indonesian banks are masters of domestic lending, they might have fewer globally recognized investment banking arms compared to their Singaporean rivals. This isn’t necessarily a weakness, but it does highlight different strategic focuses. Furthermore, regulatory changes and improvements in technology adoption could help bridge the gap in areas like fintech innovation.

Future Outlook and Projections

Predicting the future of Indonesia’s financial sector is like trying to predict the next viral TikTok dance – a wild, unpredictable, and often hilarious endeavor. However, by analyzing current trends and macroeconomic factors, we can paint a somewhat clearer (though still potentially inaccurate) picture. The sector is poised for significant growth, but navigating the inevitable bumps in the road will require agility and strategic foresight.

The Indonesian financial sector’s future performance hinges heavily on macroeconomic stability. Sustained economic growth, coupled with prudent monetary policy, will undoubtedly boost the performance of financial institutions. Conversely, external shocks, such as global recessions or significant shifts in commodity prices (remember the coffee crisis of the late 90s?), could negatively impact rankings and profitability. The ripple effects of global events on Indonesia’s domestic financial landscape are considerable and should not be underestimated.

Macroeconomic Factors and Institutional Rankings

Fluctuations in inflation, interest rates, and exchange rates directly influence the profitability and stability of financial institutions. For instance, a period of high inflation could erode the value of assets held by banks, impacting their balance sheets and potentially lowering their ranking. Conversely, a stable exchange rate provides a more predictable environment for foreign investment, benefiting institutions engaged in international transactions. The interplay between these macroeconomic variables and the performance of individual institutions is complex and dynamic. A robust regulatory framework and effective risk management strategies are crucial for mitigating these risks. Imagine a seesaw – macroeconomic factors are the fulcrum, and the institutions are the weights. A balanced approach is essential to prevent a dramatic fall.

Emerging Trends in Indonesian Financial Services

The Indonesian financial landscape is undergoing a rapid transformation, driven by technological advancements and changing consumer behavior. Digitalization is at the forefront, with fintech companies disrupting traditional banking models. Mobile payments are becoming increasingly prevalent, offering convenient and accessible financial services to a broader population. This shift towards digital finance presents both opportunities and challenges for established institutions. They must adapt to remain competitive, embracing technological innovation while maintaining robust security measures to prevent fraud. For example, the rapid adoption of GoPay and OVO in Indonesia demonstrates the potential of fintech to reshape the financial services industry. The future will likely see a further integration of fintech and traditional banking, creating a hybrid model that leverages the strengths of both.

Final Review

So, there you have it – a whirlwind tour of Indonesia’s financial institutions and their rankings. While some institutions consistently reign supreme, the landscape is constantly evolving, a dynamic dance between innovation, regulation, and the unpredictable nature of global markets. One thing’s for certain: the Indonesian financial scene is anything but boring. Expect surprises, expect challenges, and expect continued growth – perhaps even more than expected. The future of Indonesian finance is bright, if a little unpredictable, and we’re excited to see what the next chapter holds!

Common Queries

What are the biggest risks facing Indonesian financial institutions?

Significant risks include macroeconomic volatility (inflation, currency fluctuations), increasing competition (especially from fintech companies), and the ever-evolving regulatory landscape. Navigating these challenges requires agility and strategic foresight.

How does Indonesia compare to other Southeast Asian nations in terms of financial development?

Indonesia’s financial sector is one of the largest in Southeast Asia, but its development is still evolving. Compared to Singapore or Malaysia, it might lag in certain areas like depth of capital markets, but it’s making strides in financial inclusion and digitalization.

What role does Bank Indonesia play in regulating the financial system?

Bank Indonesia is the central bank of Indonesia and plays a crucial role in maintaining monetary stability, regulating banks, and overseeing the overall health of the financial system. Think of them as the referees of Indonesian finance, ensuring fair play (mostly).