Financial Literacy Games: Forget dusty textbooks and boring lectures! We’re diving headfirst into the thrilling world of gamified finance, where learning about budgeting, investing, and debt management becomes an unexpectedly fun adventure. Prepare for a journey that’s as engaging as it is enlightening, proving that mastering your finances doesn’t require a PhD in boredom. This exploration will cover game design, target audiences, and the innovative ways technology is transforming how we teach crucial financial skills. Buckle up, it’s going to be a wild ride!

This document details the creation and implementation of effective financial literacy games. We’ll explore various game mechanics, target audiences, and design considerations, ultimately aiming to create engaging and impactful learning experiences. We’ll delve into assessment strategies, accessibility issues, and even peek into the future of financial literacy gaming, examining the potential of emerging technologies.

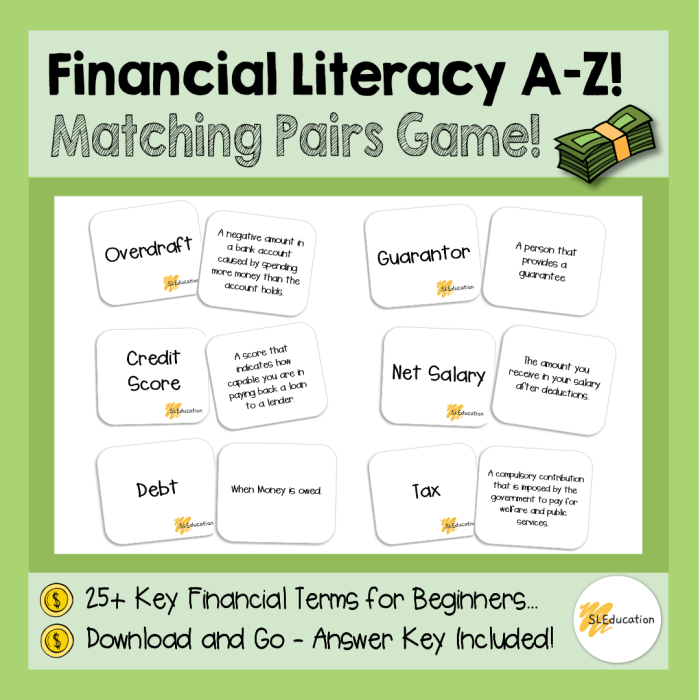

Defining Financial Literacy Games

Financial literacy games, unlike their less-enlightening cousins (let’s be honest, Candy Crush doesn’t exactly teach you about compound interest), aim to impart valuable financial knowledge in a fun and engaging way. They cleverly disguise learning as entertainment, making the often-dreaded topic of personal finance surprisingly palatable. The key is to strike a balance between educational rigor and pure, unadulterated fun – a delicate tightrope walk that only the most skilled game designers can master.

Successful financial literacy games hinge on several core components. These aren’t just arbitrary elements; they are the very building blocks upon which engaging and effective learning experiences are constructed. A well-designed game will seamlessly integrate these components to create a compelling and informative experience.

Core Components of Successful Financial Literacy Games

A successful financial literacy game requires a compelling narrative, clear learning objectives, interactive gameplay mechanics, and immediate feedback. Without a strong narrative, players may quickly lose interest. Clearly defined learning objectives ensure the game effectively teaches specific financial concepts. Interactive gameplay keeps players engaged, while immediate feedback helps them understand their progress and identify areas for improvement. Finally, the game should also be appropriately challenging, providing a sense of accomplishment without being frustrating. Imagine a game where you learn about budgeting while designing your dream house – engaging and relevant!

Game Mechanics for Teaching Financial Concepts, Financial Literacy Games

Several game mechanics prove particularly effective for teaching financial concepts. These mechanics provide different ways to interact with the financial material and can cater to diverse learning styles.

- Resource Management: Players must strategically allocate limited resources (money, time, etc.) to achieve goals. Think of a game where you manage a small business, making decisions about hiring, marketing, and inventory. Poor resource management leads to financial struggles, while smart choices lead to success.

- Decision-Making: Players face various financial dilemmas and must make choices with consequences. This could involve choosing between saving and spending, investing in different assets, or managing debt. Each decision shapes the player’s financial outcome, teaching the importance of thoughtful choices.

- Simulation: Games can simulate real-world financial scenarios, such as buying a house, paying off student loans, or investing in the stock market. This allows players to experience the complexities of financial decisions in a safe and controlled environment. Imagine a game where players simulate investing in the stock market, experiencing the thrill (and sometimes the heartbreak) of market fluctuations.

Diverse Game Genres for Financial Literacy

The beauty of financial literacy games lies in their adaptability across various genres. This versatility allows developers to cater to a wide range of player preferences and learning styles.

- Simulation Games: These games offer a realistic portrayal of financial situations, allowing players to experience the consequences of their decisions in a risk-free environment. Examples include games that simulate running a business or managing a personal budget.

- Adventure Games: Financial literacy can be woven into the narrative of an adventure game, where players must make financial decisions to progress through the story. For example, a game where players need to manage their funds to explore a fantasy world, buying equipment and supplies.

- Puzzle Games: These games can present financial concepts in a challenging yet engaging format, requiring players to solve puzzles to achieve financial goals. Think of a puzzle game where players need to balance a budget by solving mathematical equations or matching financial terms.

- Role-Playing Games (RPGs): RPGs can immerse players in a world where financial decisions directly impact their character’s progression and success. For example, players might need to manage their in-game economy to upgrade their skills or purchase powerful items.

Target Audience & Learning Objectives

Designing financial literacy games requires a keen understanding of the target audience and their unique needs. After all, teaching a kindergartener about compound interest is about as effective as teaching a Wall Street executive the value of a piggy bank (though, admittedly, some executives might benefit from the latter!). The key is to tailor the games and their objectives to specific age groups, ensuring the learning experience is both engaging and effective.

The effectiveness of any educational game hinges on aligning its mechanics with clear learning objectives. These objectives should be SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. Failure to do so results in a fun but ultimately pointless digital playground. We must ensure our games actively contribute to the financial well-being of our players, not just their enjoyment levels.

Age Group Segmentation and Learning Objectives

We’ll segment our target audience into three primary age groups: Elementary School (ages 6-12), Middle School (ages 13-15), and High School (ages 16-18). Each group presents unique challenges and opportunities in financial literacy education. The learning objectives will reflect these differences, gradually increasing in complexity and scope.

Elementary School (Ages 6-12): Needs and Objectives

Children in this age group are primarily focused on concrete concepts. Abstract ideas like compound interest or credit scores are largely beyond their grasp. Instead, the emphasis should be on building foundational knowledge.

- Objective 1: Understanding Needs vs. Wants: Games could involve scenarios where children must choose between essential items (food, shelter) and non-essential items (toys, candy), teaching them to prioritize. A visual representation might involve a game board with different item categories and point values reflecting their importance. For example, a healthy meal might be worth more points than a video game.

- Objective 2: Saving Money: Games could involve saving virtual coins or tokens to purchase items, introducing the concept of delayed gratification and the power of saving. The game could incorporate a visual piggy bank that fills up as the player saves, providing immediate feedback.

- Objective 3: Basic Budgeting: Simple budgeting activities, like allocating a small amount of virtual money between different categories (saving, spending, sharing), can be introduced. A pie chart showing how money is allocated would provide a visual aid for understanding.

Middle School (Ages 13-15): Needs and Objectives

As students transition to middle school, their cognitive abilities develop, allowing for more complex concepts. They start to grasp the importance of long-term planning and the impact of financial decisions.

- Objective 1: Understanding Earning and Spending: Games could simulate part-time jobs, allowing players to earn virtual money and manage expenses, introducing the concept of income and expenses. A simple spreadsheet interface within the game could track income, expenses, and savings.

- Objective 2: Introduction to Banking: Games can simulate opening and managing a bank account, introducing concepts like deposits, withdrawals, and interest. A virtual bank interface with account balances and transaction history would enhance the learning experience.

- Objective 3: Debt Awareness: Introducing the concept of debt in a simplified manner, focusing on the importance of responsible borrowing and repayment. A game could present scenarios where players must make choices about borrowing money and manage the consequences of their decisions. Visual representation could include a debt meter showing the increasing or decreasing debt levels.

High School (Ages 16-18): Needs and Objectives

High school students are on the cusp of adulthood and need to understand more advanced financial concepts to prepare for independent living.

- Objective 1: Investing Basics: Games could introduce basic investment concepts, such as stocks and bonds, in a simplified manner. A simulated stock market environment where players can buy and sell stocks, tracking their portfolio’s performance would be highly engaging. Visual representation could include graphs and charts showing stock prices and portfolio growth.

- Objective 2: Credit and Debt Management: A more in-depth exploration of credit scores, interest rates, and the long-term implications of debt. A game could simulate real-life scenarios involving credit card use and loan applications, showing the impact of responsible and irresponsible financial behavior. A credit score tracker could show how actions affect the credit score visually.

- Objective 3: Budgeting and Financial Planning: Games could involve creating realistic budgets, planning for major expenses (college, car), and exploring different financial goals. A budgeting tool allowing players to input income, expenses, and savings goals could enhance the realism and practical application of the learning experience. A visual calendar or timeline could be used to track long-term financial goals.

Game Design & Development

Designing a financially savvy game requires more than just a good idea; it needs a solid strategy to hook players and impart valuable knowledge without inducing an existential crisis about their bank balance. Our approach blends engaging gameplay with subtle educational elements, ensuring players learn without even realizing they’re being schooled in the art of fiscal responsibility.

The core gameplay loop needs to be both rewarding and informative. We must ensure the learning objectives are seamlessly integrated into the game mechanics, not tacked on as an afterthought. This requires careful consideration of the user interface and experience, game progression, and reward systems. Otherwise, we risk creating a game that’s either boringly educational or entertainingly financially irresponsible.

Game Concept: “Budget Bonanza: A Financial Adventure”

Budget Bonanza is a city-building simulation game where players start with a small plot of land and a meager budget. The goal is to build a thriving metropolis while managing their finances effectively. Players earn income through various means, such as building houses, businesses, and attractions. They must carefully budget their funds, balancing expenses on infrastructure, services, and unexpected events (like virtual “natural disasters” requiring costly repairs). The game incorporates mini-games related to investing, saving, budgeting, and debt management. For instance, players might participate in a stock market simulation mini-game where smart investment decisions lead to greater city development funds. Successful completion of these mini-games unlocks new city building options and upgrades. Failure to manage funds effectively results in decreased city growth, potentially leading to game over scenarios.

User Interface (UI) and User Experience (UX) Design

The UI must be intuitive and easy to navigate, even for players with limited experience with financial concepts. Visual representations of budgets, income, and expenses, like colorful charts and graphs, are key. Progress indicators and clear explanations of game mechanics are essential to minimize player frustration. A simple, clean design, avoiding clutter and information overload, is paramount. Think of a vibrant, easy-to-read dashboard that displays crucial financial data at a glance, accompanied by friendly, helpful tooltips that explain complex terms in an accessible way. The UX should focus on a smooth, rewarding experience that encourages exploration and experimentation without overwhelming the player with too much information at once. The overall aesthetic should be bright and engaging, avoiding the often sterile feel of traditional financial applications.

Game Progression and Reward Systems

Game progression is based on achieving financial milestones, such as reaching specific budget targets, successfully completing investment mini-games, or expanding the city to a certain size. Rewards could include unlocking new buildings, city upgrades, cosmetic items for the city, or even virtual currency that can be used to purchase in-game advantages. A tiered reward system, with increasingly challenging milestones and more substantial rewards, keeps players engaged and motivated. For example, early milestones could reward players with basic city upgrades, while later milestones might unlock access to more complex financial tools and investment opportunities. Furthermore, a leaderboard system allows players to compare their financial acumen against others, adding a competitive element to the game. This encourages players to strive for better financial management, learning from their mistakes and the successes of others.

Game Mechanics & Content

Making a financial literacy game engaging requires more than just a catchy title; it demands clever mechanics that seamlessly integrate learning with fun. We need players to absorb financial concepts without realizing they’re learning – think “edutainment” at its finest. The key is to create a compelling narrative and reward system that keeps players hooked while subtly imparting crucial financial knowledge.

The core gameplay should revolve around managing virtual finances. This involves simulating real-world scenarios, allowing players to make choices with tangible consequences, thus fostering a deeper understanding of budgeting, saving, investing, and debt management. These elements are not simply added as features, but rather serve as the very foundation upon which the game is built.

Budgeting Simulation

The game could begin with a character starting with a specific income and a list of monthly expenses (rent, utilities, groceries, etc.). Players must allocate their income to meet these expenses, making choices about which bills to prioritize and which expenses to cut back on. Successful budgeting earns in-game rewards, such as bonus income or access to better investment opportunities. Failure to budget effectively could lead to penalties, such as late fees or accumulating debt. This provides a direct and immediate consequence for poor financial decisions.

Saving and Investing Challenges

Mini-games could focus on the power of compounding interest. For example, a “Savings Spree” mini-game could present players with different savings accounts, each offering varying interest rates and terms. Players choose where to deposit their money, and the game simulates the growth of their savings over time, visually demonstrating the benefits of long-term saving and smart investment choices. A “Stock Market Simulator” mini-game could present players with various stocks and require them to make investment decisions based on market trends and risk tolerance. The game could utilize simplified charts and graphs to illustrate stock performance.

Debt Management Scenarios

Players might face scenarios involving unexpected expenses, such as car repairs or medical bills. The game could present them with choices about how to handle these situations – using savings, taking out a loan, or using a credit card. Each choice has consequences, impacting their credit score and future financial opportunities. For instance, using a credit card irresponsibly could lead to high interest payments and a lower credit score, while responsibly managing debt could unlock new in-game opportunities. The game could visually represent the accumulation and repayment of debt using simple bar graphs, demonstrating the impact of interest rates on total debt.

Interactive Elements for Enhanced Learning

To enhance engagement, the game could include interactive tutorials that explain complex financial concepts in a clear and concise manner. These tutorials could use simple analogies and real-world examples to make the concepts more accessible. The game could also incorporate a “Financial Glossary” that defines key terms and concepts, allowing players to easily look up unfamiliar terms. Finally, leaderboards could encourage competition and motivate players to improve their financial management skills. A well-designed reward system, incorporating badges and achievements for reaching financial milestones, could further enhance engagement and encourage continued learning.

Assessment & Evaluation

Evaluating the effectiveness of a financial literacy game requires a multifaceted approach, going beyond simple enjoyment scores. We need robust methods to determine if players genuinely grasped the core financial concepts and, crucially, if the game facilitated meaningful learning. Think of it as a financial fitness test, but far more fun!

We must employ a combination of in-game assessments and post-game evaluations to get a complete picture of the game’s impact. This allows us to identify areas of strength and weakness, ensuring the game effectively educates and empowers players. After all, what good is a fun game if it doesn’t actually teach anything?

In-Game Assessment Methods

In-game assessments are crucial for continuous feedback and adaptive learning. These assessments should be seamlessly integrated into the game’s narrative, avoiding the dreaded “test” feeling. Imagine a scenario where players must manage a virtual budget to buy a house – success depends on their understanding of interest rates, mortgages, and saving strategies. This makes learning both engaging and relevant.

- Integrated Quizzes: Short quizzes embedded throughout the game can test comprehension of key concepts as they are introduced. These quizzes should be low-stakes and provide immediate feedback, allowing players to learn from their mistakes.

- Scenario-Based Challenges: These challenges present players with realistic financial dilemmas requiring them to apply their knowledge. For example, players might need to decide between different investment options, considering risk and return.

- Performance-Based Metrics: The game can track player performance on various tasks, such as budgeting, investing, or debt management. Success in these areas directly reflects their understanding of the related concepts.

Post-Game Evaluation Methods

Post-game evaluation provides a broader perspective on the game’s impact, moving beyond the immediate context of gameplay. This involves more formal assessments to gauge the lasting effects of the game on players’ financial knowledge.

- Pre- and Post-Game Tests: Administering a standardized financial literacy test before and after playing the game allows us to measure the change in players’ knowledge. This quantifies the game’s effectiveness in improving financial literacy.

- Surveys: Surveys can gather qualitative data on players’ experiences, perceptions, and learning outcomes. Open-ended questions allow players to express their thoughts and provide valuable insights.

- Focus Groups: Focus groups offer a more in-depth understanding of player engagement and learning processes. Moderated discussions can uncover unexpected insights and identify areas for improvement.

Player Feedback Collection and Analysis

Collecting and analyzing player feedback is essential for iterative game development and improvement. This allows us to identify bugs, address confusion, and refine the game’s educational effectiveness. Think of it as continuous quality control, but for learning!

- In-Game Feedback Mechanisms: Implement easy-to-use in-game mechanisms, such as suggestion boxes or feedback forms, to allow players to share their thoughts and experiences directly within the game. This provides immediate feedback during gameplay.

- Post-Game Surveys: Post-game surveys provide a more structured way to collect player feedback. These surveys can be used to gather information on various aspects of the game, including its educational value, engagement, and overall enjoyment.

- Data Analytics: Track player progress, choices, and performance within the game to identify patterns and areas where players struggle. This data-driven approach allows for targeted improvements and enhancements.

Accessibility & Inclusivity

Creating a financially savvy game that’s both fun and accessible to everyone is a challenge worthy of a seasoned Wall Street tycoon (minus the questionable ethics, of course). Our goal isn’t just to teach about budgeting and investing; it’s to ensure that everyone, regardless of their background or abilities, can participate and benefit from the experience. This requires a thoughtful approach to design and development, ensuring inclusivity isn’t just a buzzword, but a core principle.

Ensuring our game is truly accessible involves considering a wide range of needs and tailoring the game mechanics and content accordingly. This isn’t about lowering the bar; it’s about widening the playing field. We need to make sure the game is enjoyable and understandable for players of all abilities, and reflects the diverse cultural backgrounds of our audience.

Accessibility Features for Diverse Needs

Implementing accessibility features is crucial for ensuring a broad player base can enjoy the game. This includes providing options for players with visual, auditory, motor, and cognitive impairments. For example, we could offer adjustable text sizes and colors, high-contrast modes, audio descriptions for visual elements, keyboard-only navigation, and customizable control schemes. We should also explore the possibility of integrating assistive technologies like screen readers and switch controls. This commitment to accessibility ensures that the game is inclusive and welcoming to everyone. Consider, for example, how a visually impaired player might use a screen reader to navigate the game’s menus and understand the financial concepts presented. Similarly, a player with limited motor skills might benefit from alternative input methods. By anticipating these needs, we create a richer, more welcoming game experience.

Culturally Sensitive and Inclusive Content

The game’s content must avoid perpetuating stereotypes and reflect the diversity of our global financial landscape. We must ensure that the scenarios, characters, and language used are representative of different cultures and backgrounds. For example, we can avoid using imagery or language that might be considered offensive or insensitive to particular groups. Instead, we’ll showcase diverse characters in various financial situations, highlighting successful financial management across different cultural contexts. This approach not only enriches the game but also educates players about the importance of financial literacy in diverse communities. A simple example would be depicting diverse families managing their budgets effectively, demonstrating that sound financial practices are universally applicable.

Promoting Equity and Avoiding Financial Biases

Financial literacy games can inadvertently reinforce existing financial biases if not carefully designed. We must actively work to avoid this. This includes ensuring that the game mechanics and challenges do not disproportionately disadvantage certain groups. For instance, we must avoid scenarios that rely on implicit cultural knowledge or assumptions about access to financial resources. The game should present realistic financial scenarios that are fair and equitable to all players, regardless of their background. For instance, rather than focusing solely on high-income scenarios, we can include challenges that represent the financial realities of diverse income levels, fostering a more inclusive and equitable learning experience. The goal is to create a level playing field where everyone has a fair chance to succeed, learning valuable financial lessons without encountering undue hurdles based on their background.

Illustrative Examples & Case Studies: Financial Literacy Games

This section delves into the fascinating world of existing financial literacy games, examining their successes and shortcomings. We’ll also conjure a hypothetical scenario demonstrating the triumphant implementation of such a game in a real-world educational setting. Buckle up, it’s going to be a wild ride through the realm of fiscal fun!

Examples of Existing Financial Literacy Games

A detailed analysis of three existing financial literacy games will illuminate the diverse approaches and design considerations involved in creating engaging and effective learning experiences. The games selected represent a range of target audiences and game mechanics.

| Game Name | Target Audience | Key Features | Strengths/Weaknesses |

|---|---|---|---|

| Pocket Change (Hypothetical Example) | Children aged 8-12 | Simple budgeting simulator, interactive mini-games focused on saving and spending, visually appealing interface with cartoon characters. Includes a reward system for achieving financial goals. | Strengths: Engaging for the target age group, teaches basic financial concepts in a fun and accessible way. Weaknesses: Oversimplification of complex financial issues, limited scope for advanced learning. |

| LifeSim (Hypothetical Example) | Teenagers and young adults (13-25) | Life simulation game where players make choices about education, career, spending, and investing. Consequences of financial decisions are realistically modeled, encouraging strategic planning. Includes elements of risk management and debt management. | Strengths: Holistic approach to financial literacy, simulates real-world scenarios, encourages critical thinking. Weaknesses: Can be overwhelming for some players, requires a higher level of financial knowledge to fully appreciate the complexities. |

| InvestEd (Hypothetical Example) | Adults (25+) | Stock market simulation game where players manage a virtual portfolio, research investments, and learn about market trends. Incorporates realistic market data and economic indicators. | Strengths: Provides a practical and engaging way to learn about investing, fosters understanding of market dynamics. Weaknesses: Requires some prior knowledge of financial markets, can be stressful for risk-averse players, may not cater to those without an interest in investing. |

Successful Implementation Scenario

Imagine a bustling high school classroom. Ms. Periwinkle, a charismatic economics teacher, introduces her students to “Finance Fiesta,” a newly developed financial literacy game designed specifically for high schoolers. The game uses a captivating narrative about starting a lemonade stand, progressing to managing a small business, and eventually investing profits. Students, initially skeptical, quickly become engrossed in the challenge of making smart financial decisions. The game’s intuitive interface and gamified reward system keep them motivated. Through interactive challenges and real-time feedback, students learn about budgeting, saving, investing, and debt management in a dynamic and memorable way. Ms. Periwinkle observes increased student engagement and a significant improvement in their understanding of key financial concepts, as evidenced by post-game assessments and classroom discussions. The success of “Finance Fiesta” leads to its adoption across the school district, demonstrating the potential of game-based learning to transform financial literacy education.

Future Trends & Innovations

The world of financial literacy is undergoing a thrilling metamorphosis, fueled by technological advancements and a growing recognition of the need for engaging, accessible education. Forget dusty textbooks and monotonous lectures; the future of learning about money is fun, interactive, and surprisingly immersive. We’re poised on the brink of a revolution in how we teach and learn about personal finance, and the innovations are nothing short of spectacular.

The integration of emerging technologies and innovative game mechanics promises to transform financial literacy games from tedious exercises into captivating experiences that stick with learners long after the credits roll. This evolution is not just about making learning more enjoyable; it’s about making it more effective, accessible, and ultimately, life-changing.

Augmented and Virtual Reality Applications in Financial Literacy Games

AR/VR technologies offer unprecedented opportunities to create immersive and engaging learning environments. Imagine a virtual supermarket where players learn to budget by navigating aisles, selecting groceries, and managing their virtual shopping cart, all while receiving real-time feedback on their spending habits. Or perhaps a VR simulation of investing in the stock market, allowing learners to experience the highs and lows of investment strategies without risking real money. These immersive experiences can significantly enhance understanding and retention by making abstract concepts tangible and relatable. For instance, a VR experience could simulate the impact of different saving strategies on long-term financial goals, visualizing the growth of savings over time in a compelling and memorable way. The visual representation of compound interest, often a confusing concept, could become strikingly clear within such a simulated environment.

Enhanced Gamification in Financial Education Platforms

Gamification, the application of game-design elements in non-game contexts, has already proven its effectiveness in boosting engagement and motivation. However, the potential for further integration remains largely untapped. We can expect to see more sophisticated reward systems, personalized learning paths, and competitive elements that foster collaboration and friendly competition among learners. Imagine a financial literacy platform that incorporates leaderboards, badges, and unlockable content to incentivize consistent learning and progress. The integration of social features, allowing learners to connect, share tips, and compete in friendly challenges, can further amplify engagement and create a sense of community around financial literacy. Examples include platforms that reward users with virtual currency for completing modules or achieving financial milestones, which can then be used to purchase in-game items or unlock advanced features.

Innovative Game Mechanics for Enhanced Learning and Engagement

The future of financial literacy games hinges on the development of innovative game mechanics that go beyond simple quizzes and multiple-choice questions. We can expect to see a rise in narrative-driven games that embed financial literacy concepts within compelling storylines, allowing players to learn through active participation and decision-making. For example, a game could place the player in the role of a young adult navigating the challenges of budgeting, saving, and investing, with choices impacting their virtual financial success. Furthermore, the use of AI-powered adaptive learning systems can personalize the game experience, tailoring the difficulty and content to the individual learner’s needs and progress. This ensures that the game remains challenging yet accessible, maximizing learning outcomes for all players. Another example could be the integration of real-time financial data feeds into the game, allowing players to make decisions based on current market conditions, further enhancing the realism and engagement.

Outcome Summary

From the initial concept to the final assessment, designing a successful financial literacy game requires a multi-faceted approach. By carefully considering game mechanics, target audience, and accessibility, we can create engaging experiences that empower individuals with the financial knowledge needed to thrive. The future of financial literacy is interactive, engaging, and undeniably fun – and we’ve only just scratched the surface of its potential. So, let the games begin!

Expert Answers

What age groups benefit most from financial literacy games?

Financial literacy games can benefit individuals of all ages, from children learning about saving to adults managing investments. The key is tailoring the game’s complexity and content to the specific age group and their financial needs.

Are there any free financial literacy games available?

Yes, many free financial literacy games and apps exist, often offered by educational institutions or non-profit organizations. A quick online search should reveal a variety of options.

How can I ensure a financial literacy game is effective?

Effective games incorporate clear learning objectives, engaging mechanics, and robust assessment methods. Regular player feedback and iterative design improvements are also crucial.

What are some common pitfalls to avoid when designing a financial literacy game?

Common pitfalls include overly simplistic mechanics, lack of clear learning objectives, and neglecting accessibility for diverse learners. Thorough testing and user feedback are essential to avoid these issues.