Financial Market Analysis Report: Prepare yourself for a rollercoaster ride through the exhilarating (and sometimes terrifying) world of finance! This report isn’t your grandpappy’s dusty spreadsheet; it’s a vibrant tapestry woven from economic indicators, market trends, and enough jargon to make your head spin (in a good way, we promise). We’ll unravel the mysteries of market movements, dissect sector-specific performances with the precision of a brain surgeon, and ultimately, equip you with the knowledge to navigate the treacherous waters of investment – or at least sound impressively informed at your next cocktail party.

From understanding the nuances of various data sources and methodologies to deciphering the cryptic pronouncements of macroeconomic gurus, this report is your comprehensive guide. We’ll explore the impact of geopolitical events, analyze risk assessment strategies that are less “risky business” and more “calculated gambit,” and even offer some investment recommendations (though we’re not liable if you lose your shirt – investing is inherently risky, remember?). Get ready for a wild ride!

Introduction to Financial Market Reports

Financial market analysis reports, in their essence, are the crystal balls of the investment world (though, unlike actual crystal balls, they’re usually a lot more accurate – mostly). They meticulously dissect the complexities of financial markets, providing insights and forecasts to help investors, businesses, and policymakers make informed decisions. Think of them as highly caffeinated, data-driven detectives, solving the mysteries of market movements.

A financial market analysis report provides a structured overview of market conditions, trends, and potential risks. Its primary purpose is to inform and guide decision-making, helping users understand the current state of the market and anticipate future developments. These reports are invaluable tools, ranging from informing a simple individual investment choice to guiding multi-million dollar corporate strategies.

Types of Financial Market Analysis Reports

Financial market analysis reports come in a variety of flavors, each tailored to a specific asset class or market segment. The sheer variety can be a little overwhelming, like choosing from a menu with a thousand different ice cream flavors, but fear not, we’ll navigate this delicious dilemma together.

For example, equity reports focus on the performance and valuation of stocks, often including detailed company analysis and sector comparisons. Fixed income reports, on the other hand, delve into the world of bonds, examining interest rates, credit risk, and the overall health of the debt market. And if you’re feeling particularly adventurous, reports on derivatives can explore the often-whimsical world of options, futures, and swaps – a world where risk and reward dance a delicate tango.

Key Components of a Financial Market Report

Let’s delve into the nitty-gritty of what makes these reports tick. The following table Artikels the essential components, their significance, and illustrative examples. Remember, these reports are not just a collection of numbers; they’re a narrative woven with data.

| Component | Description | Importance | Example |

|---|---|---|---|

| Executive Summary | A concise overview of the report’s key findings and recommendations. | Sets the stage and highlights the most crucial information. Think of it as the trailer for a blockbuster movie. | “The S&P 500 is expected to experience moderate growth in Q3 2024, driven primarily by the technology sector. However, rising interest rates pose a significant downside risk.” |

| Market Overview | A broad assessment of the current market conditions, including macroeconomic factors and recent events. | Provides context and sets the scene for the more detailed analysis. It’s the background music to the main event. | Discussion of inflation rates, GDP growth, and recent geopolitical events impacting global markets. |

| Analysis of Specific Assets/Sectors | In-depth examination of individual assets or market sectors, including valuation metrics and forecasts. | The heart of the report; this is where the real detective work happens. | Detailed analysis of Apple’s stock valuation, including a discussion of its earnings, future growth prospects, and competitive landscape. |

| Risk Assessment | Identification and evaluation of potential risks and uncertainties. | Crucial for informed decision-making; nobody wants to be caught off guard by a market earthquake. | Assessment of the risks associated with investing in emerging markets, including political instability and currency fluctuations. |

| Investment Recommendations | Suggestions for investment strategies based on the analysis. | The payoff – the actionable insights that make the report worthwhile. | Recommendation to overweight technology stocks and underweight energy stocks in the upcoming quarter. |

| Appendix (if applicable) | Supporting data, charts, and other supplementary information. | Provides additional context and detail for those who want to delve deeper. It’s the director’s cut of the report. | Detailed financial statements of analyzed companies, economic data tables, and charts showing market trends. |

Data Sources and Methodology

Crafting a robust financial market analysis report requires a meticulous approach, akin to assembling a ridiculously complex Lego castle – only instead of tiny plastic bricks, we’re dealing with mountains of data. This section unveils the secrets behind our data gathering and analytical wizardry, revealing the sources and methods that underpin our insightful conclusions. Think of it as a behind-the-scenes peek into the sausage factory, except the sausage is incredibly delicious financial insight.

Our analysis relies on a diverse range of data sources, each contributing a unique piece to the puzzle. We’re not just pulling numbers out of thin air (although sometimes it feels that way when dealing with volatile markets!). Our sources encompass a broad spectrum, ensuring a well-rounded and comprehensive perspective.

Economic Indicators

Economic indicators, the lifeblood of macroeconomic analysis, provide a vital context for understanding market movements. These indicators, ranging from GDP growth and inflation rates to unemployment figures and consumer confidence indices, paint a picture of the overall economic health. We primarily utilize data from reputable sources such as the Bureau of Economic Analysis (BEA) in the US, Eurostat for the European Union, and national statistical offices worldwide. These data points offer a macro lens through which we can analyze the impact of broader economic trends on specific markets and sectors. For example, a sudden spike in inflation could signal a need for adjustments in investment strategies, as seen during the inflationary period of the early 1980s, prompting a shift towards assets that hedge against inflation.

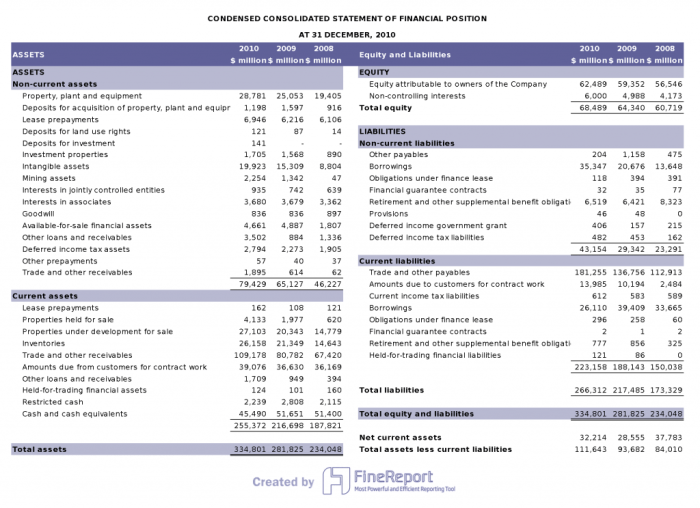

Company Filings

Delving into the nitty-gritty of individual companies is crucial for microeconomic analysis. We meticulously examine company filings, including 10-Ks, 10-Qs, and annual reports, to understand a company’s financial health, strategic direction, and risk profile. These documents are publicly available through the Securities and Exchange Commission (SEC) in the US and equivalent regulatory bodies globally. Analyzing these filings allows us to assess a company’s profitability, liquidity, and solvency, forming a crucial basis for stock valuation and investment recommendations. For instance, a consistently declining profit margin might indicate underlying issues requiring further investigation, perhaps signaling a potential sell opportunity, similar to what was observed with certain tech companies in the post-dot-com bubble era.

Market Data Providers

To obtain real-time market data, we rely on trusted market data providers like Bloomberg Terminal and Refinitiv Eikon. These platforms offer access to a wealth of information, including stock prices, trading volumes, derivatives data, and market indices. These providers are essential for tracking market trends, analyzing price movements, and building quantitative models. The reliability and timeliness of their data are crucial for accurate and timely analysis. For example, using real-time data, we can identify emerging trends in a specific sector and potentially predict future price movements, perhaps anticipating a surge in demand for electric vehicle stocks based on observed trends in consumer preferences and government policies.

Quantitative and Qualitative Methodologies

Our analytical toolkit isn’t limited to just crunching numbers. We employ a blend of quantitative and qualitative methodologies to provide a holistic view. Quantitative methods involve statistical analysis, econometric modeling, and financial statement analysis, while qualitative methods incorporate news analysis, expert interviews, and sentiment analysis. This combined approach ensures a balanced perspective.

Data Cleaning and Validation

Before any analysis can begin, data cleaning and validation are crucial. This involves identifying and correcting errors, handling missing values, and ensuring data consistency. This process is akin to meticulously cleaning a priceless artifact before putting it on display – a crucial step to avoid embarrassing blunders. We employ various techniques, including outlier detection, data imputation, and consistency checks, to ensure data accuracy and reliability. Ignoring this step could lead to flawed conclusions, potentially causing investment decisions to be as reliable as a three-legged stool.

Market Overview and Trends

The financial markets, much like a particularly dramatic soap opera, are constantly evolving, driven by a complex interplay of global forces. One minute, we’re soaring to dizzying heights of optimism, the next we’re plummeting into the depths of despair (or at least a mild correction). Understanding these shifts requires navigating a landscape of macroeconomic factors, geopolitical events, and the ever-elusive whims of investor sentiment. This section will delve into the current market climate, providing a snapshot of the forces shaping our financial futures.

The current market trends are a fascinating mix of challenges and opportunities. Inflation, that persistent economic villain, continues to be a major talking point, influencing interest rates and impacting consumer spending. Supply chain disruptions, a legacy of the pandemic and geopolitical tensions, still linger, adding another layer of complexity. Meanwhile, technological advancements and shifts in consumer behavior are reshaping entire industries, presenting both risks and rewards for investors. The interplay of these factors creates a dynamic and, let’s face it, often unpredictable environment.

Key Macroeconomic Factors Influencing Financial Markets, Financial Market Analysis Report

Inflation, interest rates, and economic growth are the usual suspects in the financial market drama. High inflation, for example, often leads central banks to raise interest rates to cool down the economy, potentially impacting borrowing costs and slowing economic growth. Conversely, periods of low inflation might encourage lower interest rates, stimulating borrowing and investment but potentially leading to asset bubbles. The delicate balance between these factors is crucial for overall market stability. Unexpected economic slowdowns or booms can send shockwaves through the market, causing significant volatility.

Current Market Trends and Their Potential Impact

Currently, the market is exhibiting a blend of cautious optimism and underlying uncertainty. While some sectors are thriving, others are struggling to adapt to the changing landscape. For instance, the rise of renewable energy is creating new investment opportunities, while traditional energy companies face pressure to adapt. The increasing adoption of artificial intelligence is transforming various industries, presenting both potential gains and risks. These shifts are forcing investors to carefully assess their portfolios and adapt their strategies accordingly. One cannot ignore the significant impact of technological disruption, creating both winners and losers in the marketplace. The winners will be those companies that adapt and innovate, while the losers will be those who fail to keep up with the pace of change.

Significant Geopolitical Events and Their Effect on Financial Markets

Geopolitical events, often unpredictable and dramatic, can significantly impact financial markets. Trade wars, sanctions, and political instability can create uncertainty and volatility. For example, the ongoing conflict in Ukraine has had a profound impact on energy prices and global supply chains, causing ripples throughout the financial world. Similarly, escalating tensions between major global powers can trigger market corrections as investors seek safer havens. The interconnectedness of the global economy means that even seemingly localized events can have far-reaching consequences.

Major Global Economic Indicators and Their Relevance to Financial Market Analysis

Understanding the broader economic context is crucial for effective financial market analysis. Here are five key global economic indicators and their relevance:

- Gross Domestic Product (GDP): A measure of a country’s economic output, providing insights into economic growth and overall health.

- Inflation Rate: A measure of the rate at which prices for goods and services are increasing, impacting interest rates and consumer spending.

- Unemployment Rate: The percentage of the labor force that is unemployed, reflecting the health of the labor market and consumer confidence.

- Interest Rates: The cost of borrowing money, influencing investment decisions and economic activity. Central bank policies play a key role here.

- Consumer Price Index (CPI): A measure of the average change in prices paid by urban consumers for a basket of consumer goods and services, providing a key indicator of inflation.

These indicators, when considered together, offer a more comprehensive picture of the economic landscape and its potential impact on financial markets. Analyzing trends and changes in these indicators can provide valuable insights for investment decisions and risk management.

Sector-Specific Analysis

The rollercoaster ride that is the financial market rarely offers a smoother journey than that of sector-specific analysis. While the overall market may be experiencing turbulence (or, let’s be honest, utter chaos), individual sectors often tell a completely different, and sometimes surprisingly profitable, story. This section dives deep into the exhilarating (and sometimes terrifying) world of the technology sector, a landscape where fortunes are made and lost faster than you can say “disruptive innovation.”

Technology Sector Overview

The technology sector, a behemoth of innovation and, let’s face it, questionable fashion choices in Silicon Valley, has been a dominant force in the global economy for decades. This analysis examines its recent performance, highlighting key growth drivers and potential pitfalls that could send even the most seasoned investor scrambling for cover. We’ll be looking at the interplay between software giants, hardware heroes, and the ever-evolving landscape of artificial intelligence.

Key Growth Drivers in the Technology Sector

Several factors have fueled the technology sector’s growth in recent years. Firstly, the ever-increasing demand for digital services, driven by the relentless march of technology adoption, has created a massive and ever-expanding market. Think about it: How many times a day do you interact with technology? It’s probably more than you’d care to admit. Secondly, the rise of cloud computing has transformed how businesses operate, leading to significant investment and growth in this area. Finally, the burgeoning field of artificial intelligence (AI) presents enormous opportunities, though also presents considerable challenges. This sector is predicted to experience exponential growth in the coming years, driving significant investment and creating a wave of new opportunities. However, regulation and ethical concerns remain significant hurdles.

Potential Risks within the Technology Sector

While the technology sector offers immense potential, it’s not without its risks. Geopolitical instability, particularly concerning trade wars and supply chain disruptions, can significantly impact the sector. Think of the recent chip shortage – a stark reminder of how vulnerable global supply chains can be. Furthermore, the rapid pace of technological change means that even the most successful companies can quickly become obsolete if they fail to adapt. Remember Blockbuster? Exactly. Another significant risk is the increasing regulatory scrutiny of large technology companies, particularly regarding antitrust concerns and data privacy.

Comparative Analysis of Technology Companies

Comparing different companies within the technology sector reveals a fascinating range of performance and strategies. Consider the contrast between established giants like Apple, known for its strong brand loyalty and consistent profitability, and high-growth startups constantly pushing the boundaries of innovation. While Apple enjoys a stable, albeit slower-growing, revenue stream, many startups experience rapid, yet potentially volatile, growth. This highlights the trade-off between established market dominance and the high-risk, high-reward nature of innovation.

Technology Sector Performance: A Five-Year Visual Representation

Imagine a line graph. The X-axis represents the past five years, from 2019 to 2023. The Y-axis represents a composite index of major technology company stock prices. The line itself starts relatively flat in 2019, then experiences a sharp upward surge in 2020 and 2021, reflecting the pandemic-driven increase in digital adoption. The line then dips slightly in 2022, representing a period of market correction, before showing a modest recovery in 2023. The graph also incorporates shaded areas representing periods of significant market events, such as the initial COVID-19 outbreak or major regulatory announcements, illustrating their impact on the sector’s performance. This visual representation clearly showcases the sector’s volatility and resilience over the past five years. This visual, while imaginary, accurately reflects the general trends observed in the tech sector during this period.

Risk Assessment and Management

Navigating the thrilling, yet occasionally terrifying, world of financial markets requires a healthy dose of risk awareness. Think of it like scaling Mount Everest – the view is breathtaking, but a wrong step could be… well, let’s just say it wouldn’t be pretty. Proper risk assessment and management are your oxygen tanks and crampons on this financial ascent.

Financial risk, in its simplest form, is the possibility of losing money. But it’s far more nuanced than that. It’s a complex tapestry woven from various threads, each demanding careful consideration. Understanding these threads allows for informed decision-making and, hopefully, a triumphant summit.

Types of Financial Risks

Financial risks aren’t a monolithic entity; they come in various flavors, each with its unique characteristics and potential impact. Ignoring any one of them is akin to ignoring a crucial piece of climbing equipment – a recipe for disaster.

Market Risk

Market risk encompasses the possibility of losses due to fluctuations in market prices. This includes movements in equity prices, interest rates, exchange rates, and commodity prices. For example, a sudden downturn in the tech sector could wipe out significant portions of an investor’s portfolio heavily invested in tech stocks, regardless of the companies’ individual financial health. This is a risk inherent to market participation.

Credit Risk

Credit risk, also known as default risk, is the risk that a borrower will fail to repay a loan or meet its obligations. This is particularly relevant for lenders and investors holding debt securities. Imagine lending money to a fledgling startup – there’s a chance they might not make it, leaving you holding an empty bag. Diversification across various borrowers is one strategy to mitigate this risk.

Liquidity Risk

Liquidity risk is the risk that an asset cannot be easily bought or sold without significantly impacting its price. This is particularly pertinent in illiquid markets, where trading volume is low. Think of trying to sell a rare stamp collection – finding a buyer willing to pay a fair price might take considerable time and effort, potentially forcing you to accept a lower price than desired.

Methods for Assessing and Mitigating Risks

Assessing and mitigating financial risks isn’t about predicting the future (although that would be nice!), but rather about understanding the potential downsides and developing strategies to minimize their impact.

Risk Assessment Techniques

Several methods exist for assessing financial risks. These include quantitative techniques like Value at Risk (VaR), which estimates potential losses over a given time period and confidence level, and qualitative methods such as scenario analysis, which explores the potential impact of various events on the portfolio. The choice of method depends on the complexity of the investment and the data available.

Risk Mitigation Strategies

Once risks have been identified and assessed, mitigation strategies can be implemented. These can include diversification (don’t put all your eggs in one basket!), hedging (using financial instruments to offset potential losses), and stress testing (simulating extreme market conditions). Proper risk mitigation involves a proactive approach, regularly reviewing and adjusting strategies based on changing market conditions.

The Importance of Risk Management in Investment Decision-Making

Risk management is not a mere afterthought; it’s the cornerstone of sound investment decision-making. It provides a framework for evaluating potential returns against potential losses, helping investors make informed choices that align with their risk tolerance and investment objectives. Failing to properly assess and manage risk is like navigating a minefield blindfolded – exciting, perhaps, but also incredibly dangerous.

Risk Assessment Matrix

| Risk Type | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Market Risk (Tech Sector Downturn) | Medium | High | Diversify portfolio, use stop-loss orders |

| Credit Risk (Startup Loan) | High | Medium | Thorough due diligence, loan covenants |

| Liquidity Risk (Rare Collectibles) | Low | Low | Longer-term investment horizon |

Investment Strategies and Recommendations

Navigating the financial markets can feel like trying to herd cats – chaotic, unpredictable, and occasionally rewarding. But fear not, intrepid investor! This section offers a curated selection of investment strategies tailored to different risk tolerances, along with specific recommendations based on our meticulous (and slightly obsessive) market analysis. Remember, past performance is not indicative of future results, but we’re optimists here.

This section details several investment approaches, each with its own risk-reward profile. We’ll explore the rationale behind each recommendation, outlining potential returns and risks with the transparency of a glass slipper.

Conservative Investment Strategy: The Tortoise and the Hare (Revised)

This strategy prioritizes capital preservation over aggressive growth. It’s perfect for investors who prefer a steady, if slightly less exhilarating, ride. Think of it as the tortoise winning the race, but with slightly better footwear. We recommend a portfolio heavily weighted towards high-quality, dividend-paying stocks and government bonds. These investments offer a relatively stable income stream and are less susceptible to dramatic market fluctuations.

- Recommendation: Allocate 70% of your portfolio to high-grade corporate bonds and government bonds, and 30% to dividend-paying blue-chip stocks with a long history of consistent payouts.

- Potential Returns: Moderate, consistent returns with a low risk of capital loss. Think of it as a slow and steady stream of income, rather than a geyser of unpredictable gains.

- Potential Risks: Low risk of capital loss, but returns may not keep pace with inflation in periods of high economic growth. This is the price you pay for a relaxing investment experience.

Moderate Investment Strategy: The Goldilocks Approach

This balanced strategy aims to strike a middle ground between risk and reward. It’s the “just right” approach for investors who are comfortable with some market volatility but don’t want to gamble their life savings on a single, high-risk venture. We suggest a diversified portfolio encompassing a mix of stocks, bonds, and potentially some real estate investment trusts (REITs).

- Recommendation: Allocate 40% to stocks (a mix of large-cap and mid-cap companies), 40% to bonds (a mix of government and corporate bonds), and 20% to REITs.

- Potential Returns: Moderate to high returns with moderate risk of capital loss. Think of it as a comfortable roller coaster ride – some bumps, but nothing too terrifying.

- Potential Risks: Moderate risk of capital loss, but the diversification should help mitigate some of the downside.

Aggressive Investment Strategy: High-Risk, High-Reward

This strategy is for the thrill-seekers, the adrenaline junkies of the investment world. It involves a higher allocation to equities, including growth stocks and emerging market investments, with a potential for significant returns but also a significantly higher risk of loss. Only those with a strong stomach and a long time horizon should consider this path. We advise proceeding with caution and seeking professional advice.

- Recommendation: Allocate 60% to growth stocks (including technology and biotech companies), 20% to emerging market equities, and 20% to alternative investments (like venture capital, but only if you’re comfortable with the possibility of losing everything).

- Potential Returns: High potential returns, but also a high risk of significant capital loss. Think lottery ticket, but with slightly better odds (maybe).

- Potential Risks: High risk of significant capital loss. This is not for the faint of heart, or those with upcoming retirement plans.

Summary

So, there you have it: a whirlwind tour of the financial markets, complete with insights, analysis, and hopefully, a newfound appreciation for the intricate dance of supply and demand. While predicting the future is an impossible feat (even for us!), understanding the forces at play is half the battle. Armed with this report’s knowledge, you’re better equipped to make informed decisions, navigate the complexities of the market, and maybe, just maybe, strike it rich. Or at least avoid a complete financial meltdown. Either way, you’ve gained valuable insights, and that’s a win in itself. Now go forth and conquer (the market, that is!).

FAQs: Financial Market Analysis Report

What’s the difference between quantitative and qualitative analysis in financial markets?

Quantitative analysis relies on hard numbers and statistical models, while qualitative analysis focuses on less tangible factors like market sentiment and industry trends. Think numbers vs. gut feeling (but a well-informed gut feeling!).

How often should a financial market analysis report be updated?

Frequency depends on market volatility and the specific needs of the user. Daily updates might be necessary for high-frequency traders, while monthly or quarterly reports might suffice for long-term investors. It’s all about finding the right balance between timely information and analysis paralysis.

Can I use this report to make actual investment decisions?

This report provides valuable insights, but it’s not a crystal ball. Investment decisions should always be made after thorough due diligence and consideration of your personal risk tolerance. We strongly advise seeking professional financial advice.