Financial Market Analysis Report: Prepare yourself for a rollercoaster ride through the exhilarating (and sometimes terrifying) world of finance! This report isn’t your grandpa’s dusty economics textbook; we’re diving headfirst into the thrilling data-driven drama of market trends, risk assessment, and the ever-elusive quest for profitable investments. Buckle up, because it’s going to be a wild ride.

We’ll explore the diverse landscape of financial market reports, from those meticulously crafted for seasoned institutional investors to the more digestible versions aimed at the everyday retail investor. We’ll uncover the secrets of data collection, the magic (and occasional mayhem) of key performance indicators (KPIs), and the art of deciphering market trends using both technical and fundamental analysis. Get ready to become a financial market forecasting whiz kid (or at least, a much more informed one!).

Defining the Scope of a Financial Market Report

Financial market reports: they’re the bread and butter of informed investment decisions, the crystal ball (well, slightly cloudy crystal ball) of market trends, and frankly, sometimes a source of delightful, albeit slightly nerve-wracking, surprises. This section delves into the wonderfully diverse world of these reports, exploring their different types, target audiences, and key characteristics. Buckle up, it’s going to be a rollercoaster ride (of data).

Financial market reports come in a dizzying array of flavors, each meticulously crafted to satisfy the specific needs of its intended consumer. Understanding this variety is crucial for both report creators and those who rely on them for investment strategies. One size most definitely does *not* fit all in this arena.

Types of Financial Market Reports

Financial market reports can be broadly categorized based on their focus, frequency, and target audience. For example, we have daily market summaries providing a snapshot of the day’s trading activity, weekly or monthly reports offering more in-depth analysis of market trends, and quarterly or annual reports that delve into longer-term performance and forecasts. Then there are specialized reports focusing on specific sectors, asset classes (like equities or bonds), or geographical regions. The possibilities are as endless as the number of stocks traded on the NYSE – and possibly even more so!

Target Audiences for Financial Market Reports

The intended audience heavily influences the style, content, and level of detail in a financial market report. A report for seasoned institutional investors will differ significantly from one aimed at retail investors just starting their investment journey. Internal stakeholders within a financial institution will also require a different kind of report than external clients.

Comparison of Reports Targeting Different Audiences

The following table highlights the key differences in reports tailored to various audiences. Remember, these are generalizations; the specifics will vary depending on the individual report and the firm producing it. Think of it as a helpful guideline, not a rigid rulebook – after all, even Wall Street has its share of creative license.

| Audience | Content Focus | Level of Detail | Presentation Style |

|---|---|---|---|

| Institutional Investors | Sophisticated quantitative analysis, complex financial models, risk assessment, macroeconomic factors | Highly detailed, including extensive data, charts, and statistical analysis | Formal, concise, data-driven, often uses technical jargon |

| Retail Investors | Simplified explanations of market trends, investment strategies, risk tolerance, specific investment opportunities | Less technical, focuses on key takeaways and actionable insights | Accessible, engaging, visually appealing, avoids excessive jargon |

| Internal Stakeholders | Performance reviews, risk management, compliance issues, strategic planning | Highly detailed, specific to the internal operations of the firm | Formal, confidential, may include sensitive information not shared externally |

| Regulatory Bodies | Compliance with regulations, risk assessment, transparency of operations | Highly detailed and precise, must adhere to specific reporting requirements | Formal, legally compliant, often audited |

Data Sources and Collection Methods

Gathering data for a financial market analysis report is like a thrilling treasure hunt, except instead of buried gold, we’re after insightful numbers. The accuracy of our findings hinges entirely on the quality of our data, so we’re incredibly meticulous (and slightly obsessive) about our sources and methods. This section details our approach, highlighting the joys (and occasional heartaches) of data collection.

The process involves a carefully orchestrated ballet between primary and secondary data sources. Primary data, our own original research, provides the freshest insights, while secondary data, the work of others, provides a broader context and historical perspective. Think of it as assembling a magnificent mosaic: some tiles are hand-crafted (primary), others are sourced from reputable tile shops (secondary). Both are crucial to the final masterpiece.

Primary Data Sources

Primary data collection often involves direct interaction with the market. This might include conducting surveys of investors, analyzing company filings directly from regulatory bodies, or even employing sophisticated econometric modeling techniques to predict future trends (though, let’s be honest, even the best models can’t predict the whims of the market with 100% accuracy – remember the dot-com bubble?). The process is time-consuming and resource-intensive, but the rewards of fresh, original data are well worth the effort. For instance, directly surveying institutional investors provides invaluable qualitative insights that are not readily available through secondary sources. This allows for a deeper understanding of market sentiment and expectations.

Secondary Data Sources

Our secondary data sources are as diverse as the financial markets themselves. We delve into the rich archives of financial databases like Bloomberg Terminal and Refinitiv Eikon, consulting reputable economic publications such as the International Monetary Fund’s World Economic Outlook and the Federal Reserve’s publications. We also utilize publicly available data from stock exchanges, government agencies, and industry reports. Think of it as a delicious financial smorgasbord, with each dish offering a unique flavor and perspective. However, we always remain mindful of potential biases present in these secondary sources, critically evaluating the methodology and potential conflicts of interest. For example, a company’s own press release might paint a rosier picture than an independent analysis would reveal.

Data Collection and Verification Procedures

Data collection is not a simple copy-paste affair; it’s a rigorous process involving several crucial steps. First, we meticulously define our data requirements based on the specific objectives of the report. Then, we identify and select the most appropriate data sources, considering their reliability, timeliness, and coverage. Data is then extracted, cleaned, and transformed to ensure consistency and accuracy. This involves handling missing values, correcting inconsistencies, and transforming data into a usable format for analysis. Finally, we rigorously validate the collected data by cross-referencing it with multiple sources and applying appropriate statistical techniques.

Ensuring Data Accuracy and Reliability

The accuracy and reliability of our data are paramount. To ensure this, we follow a strict protocol:

- Multiple Source Verification: We never rely on a single source. We cross-reference data from at least two independent and reputable sources to minimize the risk of errors and biases.

- Data Cleaning and Transformation: We meticulously clean and transform the data to ensure consistency and accuracy, addressing missing values and outliers.

- Statistical Validation: We employ appropriate statistical techniques to identify and address potential biases and inconsistencies in the data.

- Peer Review: Our findings undergo a rigorous peer review process to ensure accuracy and validity.

- Regular Updates: We regularly update our data to reflect the dynamic nature of financial markets. This is crucial, as outdated information is as useful as a dial-up modem in the age of 5G.

Key Metrics and Indicators

Analyzing financial markets is like trying to decipher a cryptic crossword – challenging, but ultimately rewarding if you have the right tools. Those tools, of course, are the key metrics and indicators that allow us to peek behind the curtain of market performance and uncover the underlying trends. Understanding these metrics is crucial for making informed investment decisions and navigating the often-whimsical world of finance. Without them, you’re essentially playing financial pin the tail on the donkey – blindfolded and hoping for the best.

The selection and interpretation of these metrics depend heavily on the specific market segment being analyzed and the investment objectives. A focus on short-term trading will prioritize different indicators than a long-term value investing strategy. We’ll explore several key categories and their associated metrics, highlighting both the calculations and their practical implications. Think of this section as your cheat sheet for decoding the financial market’s secret language.

Profitability Ratios

Profitability ratios are, as the name suggests, all about determining how well a company or investment is making money. These are the metrics that reveal whether your investment is actually, you know, profitable. A consistently high profitability suggests a healthy and potentially lucrative venture, while low or negative profitability signals potential trouble. We’ll examine some key ratios.

- Return on Equity (ROE): This ratio measures how effectively a company uses shareholder investments to generate profit. It’s calculated as Net Income divided by Shareholder Equity. A high ROE indicates efficient capital utilization. For example, an ROE of 20% means that for every dollar of shareholder equity, the company generated $0.20 in profit.

- Return on Assets (ROA): Similar to ROE, ROA measures how well a company uses its assets to generate profit. Calculated as Net Income divided by Total Assets, it provides a broader perspective of profitability than ROE, encompassing both equity and debt financing. A high ROA, say 15%, shows strong asset management and efficient use of resources.

- Profit Margin: This simple yet powerful ratio indicates the percentage of revenue that translates into profit. It’s calculated as Net Income divided by Revenue. A higher profit margin generally implies greater efficiency and pricing power. A company with a 10% profit margin retains $0.10 from every dollar of revenue.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations. Think of it as checking if the company has enough readily available cash to pay its bills. Low liquidity can be a warning sign, potentially leading to financial distress. High liquidity, however, doesn’t always translate to high profitability. It’s a balance.

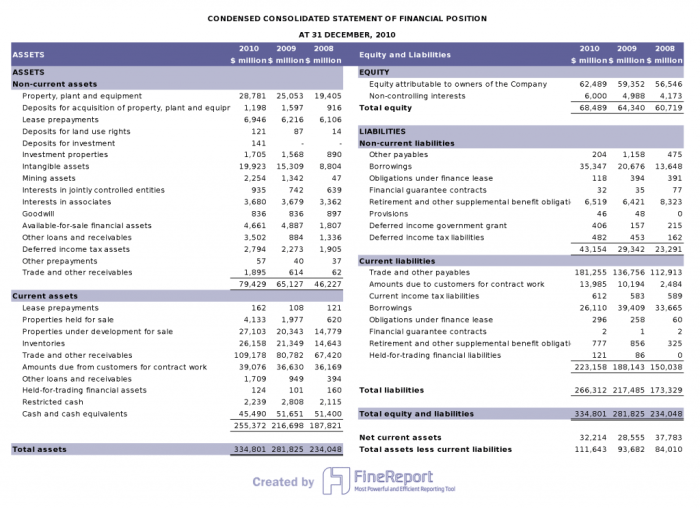

- Current Ratio: This classic ratio compares current assets (easily convertible to cash) to current liabilities (short-term debts). A ratio of 1 or higher generally indicates sufficient liquidity. A current ratio of 2, for example, suggests that the company has twice as many current assets as current liabilities.

- Quick Ratio (Acid-Test Ratio): A more stringent measure of liquidity, the quick ratio excludes inventory from current assets. This provides a clearer picture of a company’s immediate ability to meet its obligations. A quick ratio above 1 is usually considered healthy.

Solvency Ratios

Solvency ratios gauge a company’s ability to meet its long-term obligations. Unlike liquidity, which focuses on short-term debts, solvency examines the company’s overall financial health and its capacity to survive over the long haul. These ratios are vital for assessing the financial stability of a company.

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholder equity. A higher ratio indicates greater reliance on debt financing, which can increase financial risk. A low ratio suggests a more conservative financial structure.

- Times Interest Earned Ratio: This ratio measures a company’s ability to cover its interest expenses with its earnings. It’s calculated by dividing earnings before interest and taxes (EBIT) by interest expense. A higher ratio signifies a stronger ability to service its debt obligations.

Calculating KPIs: Different Approaches

There are several methods for calculating KPIs, and the choice depends on the context and the available data. Some methods might emphasize historical data, while others might incorporate forecasting techniques. Regardless of the method, consistency is key for meaningful comparisons over time. The devil, as they say, is in the details. Inconsistency in calculation can lead to flawed analysis.

Market Trend Analysis

Predicting the future is a fool’s errand, unless you’re a particularly insightful financial analyst armed with the right tools. Market trend analysis, while not a crystal ball, offers a structured approach to navigating the sometimes chaotic waters of the financial markets. This section will explore various techniques to identify and interpret market trends, illustrating their application with examples and a hypothetical scenario. Buckle up, it’s going to be a wild ride!

Technical Analysis Techniques

Technical analysis uses historical price and volume data to predict future price movements. It’s based on the belief that market history repeats itself, which, let’s be honest, is sometimes terrifyingly accurate. This approach eschews fundamental factors like company earnings and focuses solely on chart patterns and indicators. Think of it as reading the tea leaves, but with more spreadsheets.

Fundamental Analysis Techniques

Unlike its chart-obsessed cousin, fundamental analysis digs deep into the underlying value of an asset. This involves scrutinizing financial statements, industry trends, and macroeconomic factors to determine if an asset is overvalued or undervalued. It’s like being a financial detective, searching for clues to uncover the true worth of a company or commodity. This method is often more time-consuming but can provide a more robust understanding of long-term trends.

Chart Types and Their Applications

Visual representations are key to understanding market trends. Different chart types offer unique insights.

| Chart Type | Description | Application |

|---|---|---|

| Line Chart | Shows price movements over time. Simple and easy to interpret. | Tracking price trends over a specific period. Ideal for long-term analysis. |

| Bar Chart | Displays price ranges (high, low, open, close) for each period. | Identifying support and resistance levels, candlestick patterns. |

| Candlestick Chart | Similar to bar charts but with visual cues indicating the opening and closing prices. | Identifying candlestick patterns (e.g., hammer, engulfing patterns) to predict price reversals. |

Hypothetical Scenario: Analyzing Market Trends of XYZ Corporation

Let’s imagine XYZ Corporation, a fictional tech company, experienced a significant surge in its stock price from $50 to $100 over six months. A line chart would clearly illustrate this upward trend. However, a closer examination using candlestick charts reveals a series of “hammer” patterns near the $50 mark, indicating potential support levels. Furthermore, fundamental analysis reveals that XYZ Corporation’s recent product launch has exceeded expectations, boosting investor confidence. This confluence of technical and fundamental indicators suggests the upward trend may continue, though caution is always advised. Remember, past performance is not indicative of future results!

Risk Assessment and Management: Financial Market Analysis Report

Navigating the thrilling, yet sometimes terrifying, world of financial markets requires a keen understanding of risk. Think of it as a rollercoaster – exhilarating, but with the potential for a stomach-churning drop if you’re not prepared. This section delves into the various types of risks and the strategies employed to keep your financial portfolio from taking an unexpected plunge.

Risk assessment and management are not just for the faint of heart; they’re essential for anyone participating in the financial markets. A well-defined risk management strategy can help investors and businesses protect their capital, enhance returns, and sleep soundly at night (or at least, sleep *more* soundly). Ignoring risk is like driving a car without brakes – eventually, you’ll face the consequences.

Types of Financial Market Risks

Financial markets are a breeding ground for a variety of risks, each with its own unique characteristics and potential impact. Understanding these risks is the first step towards effectively managing them. Ignoring these risks can lead to significant financial losses. The following are some of the major categories.

Market risk refers to the potential for losses due to fluctuations in market prices. This includes changes in interest rates, exchange rates, and equity prices. For example, a sudden drop in the stock market can wipe out significant portions of an investor’s portfolio. Credit risk, on the other hand, is the risk that a borrower will default on their debt obligations. This is a significant concern for lenders and investors holding debt instruments. Imagine lending money to a company that suddenly goes bankrupt – ouch! Liquidity risk is the risk that an asset cannot be quickly bought or sold without significantly impacting its price. This is particularly relevant during times of market stress when investors scramble to sell assets, driving down prices. Think of trying to sell a large amount of a relatively obscure stock – you might find yourself waiting a long time, and accepting a lower price than you’d hoped for.

Risk Management Strategies

Effective risk management involves a combination of strategies aimed at mitigating potential losses. These strategies are not mutually exclusive and can be implemented in conjunction with each other. A diversified approach is often the most effective.

Diversification is a cornerstone of risk management, spreading investments across different asset classes to reduce the impact of losses in any single asset. This is akin to not putting all your eggs in one basket. Hedging involves using financial instruments to offset potential losses from adverse price movements. Think of it as an insurance policy for your investments. Stress testing involves simulating extreme market scenarios to assess the potential impact on a portfolio. This allows investors to anticipate potential problems and develop contingency plans. Value at Risk (VaR) is a statistical measure that quantifies the potential loss in value of an asset or portfolio over a specific time period and confidence level. It provides a numerical estimate of the potential downside risk.

Comparison of Risk Mitigation Strategies

The following table compares and contrasts different risk mitigation strategies. Remember, the optimal strategy will depend on individual circumstances and risk tolerance.

| Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Diversification | Spreading investments across different asset classes. | Reduces overall portfolio risk. | May reduce potential returns. |

| Hedging | Using financial instruments to offset potential losses. | Protects against specific risks. | Can be costly and complex. |

| Stress Testing | Simulating extreme market scenarios. | Identifies potential vulnerabilities. | Requires sophisticated models and data. |

| Value at Risk (VaR) | Quantifies potential loss in value. | Provides a numerical measure of risk. | Relies on assumptions and historical data. |

Report Structure and Presentation

Crafting a compelling financial market report isn’t just about crunching numbers; it’s about presenting those numbers in a way that even your accountant’s pet goldfish could understand (and maybe even impress). A well-structured report, complete with dazzling visuals, is the key to unlocking the secrets of your market analysis and captivating your audience. Think of it as a financial performance art piece – except instead of interpretive dance, we’re using bar charts.

The structure of your report should be a carefully orchestrated symphony of information, not a chaotic mosh pit of data. A logical flow is essential to guide the reader smoothly from the executive summary’s tantalizing teaser to the detailed analysis that leaves them begging for more (of your insightful commentary, of course).

Executive Summary: The Cliff Notes Version, Financial Market Analysis Report

The executive summary is your report’s VIP guest, the first and (sometimes) only thing people read. It’s a concise, impactful overview of your findings, a tantalizing appetizer before the main course. Imagine it as the trailer for a blockbuster movie – it needs to grab attention and leave the audience wanting more. It should succinctly state the key market trends, highlight significant risks and opportunities, and present your core conclusions. For example, an executive summary for a report on the burgeoning market for artisanal pickle-flavored ice cream might begin: “The artisanal pickle-flavored ice cream market shows explosive growth potential, driven by a confluence of factors including increased consumer demand for unique flavor profiles and the rise of social media influencers promoting this niche product. However, significant challenges exist including supply chain limitations and potential negative consumer reactions.” This sets the stage without overwhelming the reader.

Visual Aids: Data’s Best Friend

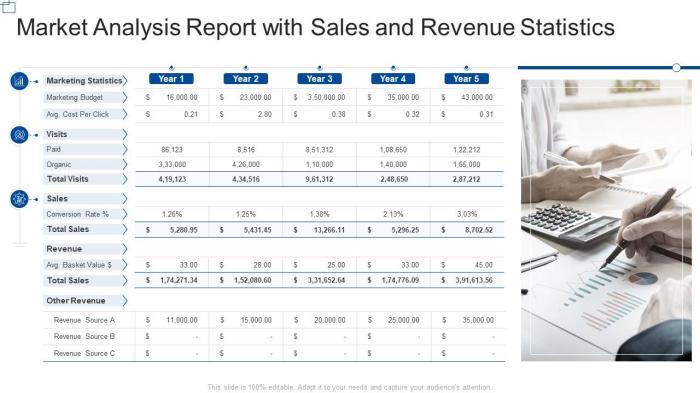

Visual aids are your secret weapon in the battle against boring reports. They transform complex data into easily digestible information, making even the most number-phobic reader understand your analysis.

Consider a line graph illustrating the price fluctuations of a particular stock over time. Imagine a smoothly rising line representing a period of steady growth, punctuated by a dramatic dip – perfectly illustrating a market correction. This allows readers to quickly grasp the stock’s performance visually, much easier than sifting through endless rows of numerical data. The graph’s title should clearly state the subject (e.g., “Stock Price of Acme Pickle Co. (2020-2024)”) and the y-axis should represent the price, while the x-axis shows the time period.

Next, let’s examine a bar chart, perfect for comparing different market segments or data points. Imagine a bar chart comparing the market share of different artisanal pickle-flavored ice cream brands. Each bar represents a brand, its height corresponding to its market share. Clear labeling of each bar and a title like “Market Share of Artisanal Pickle Ice Cream Brands (Q4 2024)” will make this chart easily understandable. This instantly reveals which brand dominates and highlights the competitive landscape.

Finally, a pie chart provides a visual representation of proportions. For example, a pie chart could show the distribution of investments across different asset classes in a portfolio. Each slice represents an asset class, its size corresponding to the proportion of the portfolio it occupies. This provides an immediate visual understanding of portfolio diversification.

Report Structure: A Logical Journey

The structure of your report should be as clear and logical as a well-organized pantry (or as close as one can get in the world of finance). It needs a clear introduction, a comprehensive analysis section (where your market trend analysis, risk assessment and data sit), and a conclusion that ties everything together neatly. Using clear headings and subheadings, along with consistent formatting, will make your report easy to navigate. Think of it as a well-marked hiking trail – you want your readers to enjoy the journey, not get hopelessly lost in the wilderness of data.

Regulatory Compliance and Ethical Considerations

Navigating the world of financial market analysis isn’t just about crunching numbers; it’s also about staying on the right side of the law and maintaining the highest ethical standards. Failure to do so can lead to penalties ranging from hefty fines to reputational ruin – a fate worse than a spreadsheet error on a Friday afternoon. This section delves into the crucial aspects of regulatory compliance and ethical considerations, ensuring your analysis remains both accurate and above board.

The regulatory landscape for financial market reports is, let’s just say, complex. It’s a labyrinth of rules and regulations designed to protect investors and maintain market integrity. Think of it as a particularly intricate game of financial Jenga – one wrong move, and the whole thing could come tumbling down. The specific regulations applicable will vary depending on the jurisdiction, the type of report, and the target audience. However, common themes include requirements for data accuracy, transparency, and the prevention of insider trading. Imagine the chaos if everyone could just make up market data!

Relevant Regulatory Frameworks and Compliance Requirements

Compliance hinges on understanding and adhering to relevant regulations. For instance, in the United States, the Securities and Exchange Commission (SEC) sets the standards for financial reporting, with regulations like Regulation S-X dictating the format and content of financial statements used in filings. Similarly, the European Union has its own comprehensive set of regulations, including the Market Abuse Regulation (MAR), aimed at preventing market manipulation and insider dealing. Non-compliance can result in severe penalties, including substantial fines, legal action, and reputational damage, impacting the credibility and future prospects of the firm involved. Let’s just say, it’s not a game you want to lose.

Ethical Considerations in Data Reporting and Analysis

Transparency and objectivity are the cornerstones of ethical financial market analysis. Presenting data in a biased or misleading manner, even unintentionally, can have serious repercussions. Imagine the fallout if a crucial piece of data is omitted, leading investors to make decisions based on incomplete information. This could undermine trust in the market and damage investor confidence. Maintaining objectivity requires rigorous methodology, thorough data validation, and a commitment to presenting all relevant information, even if it contradicts initial assumptions or predictions. Think of it as being a financial referee – fair play is essential.

Potential Consequences of Non-Compliance

The consequences of regulatory non-compliance can be severe, ranging from financial penalties to reputational damage and even criminal prosecution. For example, a firm that knowingly misrepresents financial data in a report could face substantial fines, lawsuits from affected investors, and a significant blow to its reputation. This could lead to loss of clients, decreased profitability, and ultimately, business failure. In the worst-case scenario, individuals involved could face criminal charges, leading to imprisonment and a permanent stain on their professional careers. It’s a risky game, and the stakes are high.

End of Discussion

So, there you have it – a whirlwind tour through the fascinating, and frequently frenetic, world of financial market analysis. While predicting the future remains an inexact science (even for the most seasoned gurus), understanding the tools, techniques, and risks involved is crucial for navigating this complex landscape. Remember, even the most sophisticated analysis can’t eliminate risk entirely – it’s all about informed decision-making, and hopefully, this report has equipped you with the knowledge to make those decisions with a bit more confidence (and maybe a touch of amusement along the way).

FAQ Section

What’s the difference between technical and fundamental analysis?

Technical analysis focuses on chart patterns and historical price movements to predict future trends, while fundamental analysis digs deeper into a company’s financial health and economic factors to assess its intrinsic value.

How often should a financial market report be updated?

The frequency depends on the market’s volatility and the report’s purpose. Daily updates might be necessary for highly volatile markets, while less frequent updates might suffice for more stable ones.

Can I use this report to make guaranteed profits?

Absolutely not! This report provides tools and insights, but no investment guarantees exist. Market fluctuations are unpredictable, and losses are always a possibility.