Navigating the complex world of financial markets requires sophisticated tools. From charting software visualizing price trends to complex algorithms predicting future movements, technology plays a crucial role in informing investment decisions. This guide explores the diverse landscape of financial market analysis tools, examining their capabilities and applications for both novice and seasoned investors.

We delve into the core methodologies of technical and fundamental analysis, showcasing how these approaches, aided by powerful software, can be used to identify potential opportunities and mitigate risks. The evolution of these tools, from basic charting to AI-driven predictive models, is also explored, highlighting the transformative impact of technology on the financial world.

Introduction to Financial Market Tools

The financial industry relies heavily on a diverse range of tools to analyze market trends, assess risk, and make informed investment decisions. These tools have evolved significantly, driven by technological advancements and the increasing complexity of financial markets. Understanding the landscape of available tools is crucial for anyone involved in financial markets, from individual investors to seasoned professionals.

The evolution of financial market tools has been closely tied to technological progress. Early methods relied heavily on manual calculations and rudimentary charting techniques. The advent of computers revolutionized the field, enabling the development of sophisticated software capable of handling vast datasets and performing complex calculations in real-time. The rise of the internet further accelerated this evolution, providing access to real-time market data and fostering the development of online trading platforms and analytical tools. More recently, the integration of artificial intelligence and machine learning has opened new avenues for predictive analytics and algorithmic trading.

Categories of Financial Market Tools

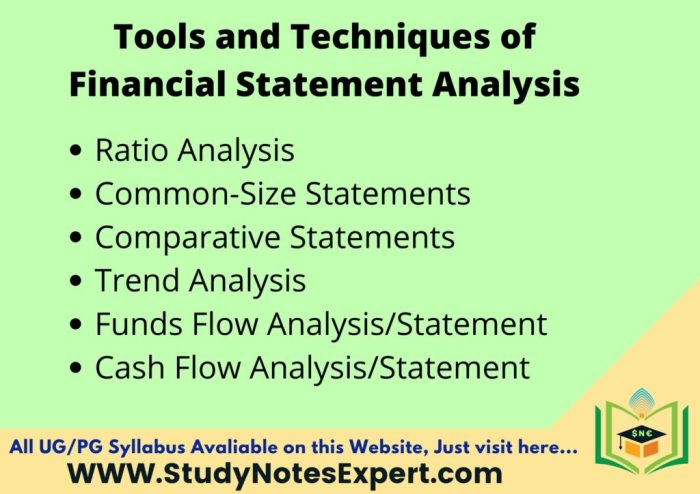

Financial market tools can be broadly categorized into several groups, each serving a specific analytical purpose. Charting software provides visual representations of market data, enabling the identification of trends and patterns. Fundamental analysis tools focus on evaluating the intrinsic value of securities by examining financial statements, economic indicators, and industry trends. Quantitative analysis platforms employ mathematical and statistical models to identify trading opportunities and manage risk. Other categories include screening tools for identifying stocks meeting specific criteria, portfolio management software for tracking and optimizing investments, and risk management systems for assessing and mitigating potential losses.

Comparison of Prominent Financial Market Tools

The following table compares the features and functionalities of five prominent financial market tools. Note that specific features and pricing may vary over time.

| Tool | Charting Capabilities | Fundamental Analysis Features | Quantitative Analysis Features |

|---|---|---|---|

| TradingView | Extensive charting capabilities, including various technical indicators and drawing tools. Supports multiple chart types and timeframes. | Integrates with fundamental data providers, allowing for the overlay of financial data on charts. | Limited built-in quantitative analysis features, but supports custom scripting and integration with external platforms. |

| Bloomberg Terminal | Robust charting capabilities with access to a wide range of market data. | Comprehensive fundamental data and analysis tools, including financial statement analysis and company news. | Advanced quantitative analysis tools, including statistical modeling and risk management functions. High cost. |

| Refinitiv Eikon | Similar charting capabilities to Bloomberg, with access to a broad range of market data. | Provides comprehensive fundamental data and analysis tools, comparable to Bloomberg. | Offers a range of quantitative analysis tools, including econometric modeling and risk management capabilities. High cost. |

| AlphaSense | Limited charting capabilities; focus is on alternative data and qualitative analysis. | Access to a vast library of company filings, news articles, and research reports. Strong search and filtering functionality. | Limited quantitative analysis features. |

| FactSet | Provides charting and data visualization capabilities. | Extensive fundamental data and research capabilities, including financial statement analysis and industry comparisons. | Offers quantitative analysis tools for portfolio management and risk assessment. High cost. |

Technical Analysis Tools

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis focuses solely on price action and market trends to predict future price movements. The underlying principle is that market prices reflect all available information, and historical price patterns tend to repeat themselves. This allows analysts to identify potential trading opportunities by recognizing these patterns and predicting future price direction.

Principles of Technical Analysis

Technical analysis rests on several key principles. The first is the concept of market trends, suggesting that prices move in discernible trends (uptrends, downtrends, or sideways trends). Secondly, history tends to repeat itself; past price patterns often reappear, offering clues about future price movements. Thirdly, volume confirms price action. Significant price movements are typically accompanied by increased trading volume, validating the strength of the trend. Finally, technical analysis assumes that market prices are influenced by both rational and irrational investor behavior, creating opportunities for astute traders to profit from predictable patterns.

Commonly Used Technical Indicators

Several technical indicators help traders analyze price charts and identify potential trading opportunities. These indicators are mathematical calculations based on historical price data, offering insights into momentum, trend strength, and potential reversals.

- Moving Averages: Moving averages smooth out price fluctuations, revealing underlying trends. Simple moving averages (SMA) calculate the average price over a specific period, while exponential moving averages (EMA) give more weight to recent prices. A common strategy involves using multiple moving averages (e.g., a 50-day and 200-day SMA) to identify potential buy or sell signals based on crossovers.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 typically indicate an overbought market (potential sell signal), while readings below 30 suggest an oversold market (potential buy signal). It’s important to note that RSI can generate false signals.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It consists of a MACD line and a signal line. Buy signals often occur when the MACD line crosses above the signal line, while sell signals occur when the MACD line crosses below the signal line.

- Bollinger Bands: Bollinger Bands consist of three lines: a simple moving average and two standard deviation bands above and below the moving average. These bands measure price volatility. When prices touch the upper band, it can signal an overbought condition, and when prices touch the lower band, it can signal an oversold condition. Breakouts above or below the bands can indicate strong price movements.

Charting Techniques in Technical Analysis

Different charting techniques visually represent price data, each offering unique insights.

- Candlestick Charts: These charts display the opening, closing, high, and low prices for a specific period, providing a visual representation of price action and momentum. Different candlestick patterns (e.g., hammer, engulfing pattern) can indicate potential reversals or continuations of trends.

- Bar Charts: Similar to candlestick charts, bar charts display the high, low, open, and close prices for a given period. They are simpler than candlestick charts but provide less visual information about price action.

- Line Charts: Line charts simply connect the closing prices over time, providing a straightforward representation of price trends. They are less detailed than candlestick or bar charts but are useful for identifying long-term trends.

Using Moving Averages to Identify Trading Opportunities

A simple strategy using moving averages involves identifying potential buy and sell signals based on crossovers of two different moving averages, such as a 50-day and 200-day simple moving average.

- Identify the Trend: Observe the longer-term moving average (e.g., 200-day SMA). An uptrend is indicated when the price is consistently above the 200-day SMA, while a downtrend is indicated when the price is consistently below it.

- Look for Crossovers: Watch for the shorter-term moving average (e.g., 50-day SMA) to cross above the longer-term moving average. This is a potential buy signal, suggesting a bullish trend. Conversely, a crossover of the shorter-term moving average below the longer-term moving average is a potential sell signal, suggesting a bearish trend.

- Confirm with Volume: Increased volume accompanying the crossover strengthens the signal. High volume during a bullish crossover confirms the buying pressure, while high volume during a bearish crossover confirms selling pressure.

- Set Stop-Loss and Take-Profit Orders: To manage risk, always set stop-loss orders to limit potential losses and take-profit orders to secure profits.

Fundamental Analysis Tools

Fundamental analysis is a crucial method for evaluating investment opportunities by examining a company’s underlying financial health and future prospects. Unlike technical analysis, which focuses on price charts and trading patterns, fundamental analysis delves into the qualitative and quantitative aspects of a business to determine its intrinsic value. This approach aims to identify companies that are undervalued by the market, presenting potentially attractive investment opportunities.

Fundamental analysis relies on a comprehensive assessment of various factors, providing a more in-depth understanding of a company’s financial performance and future potential than simply looking at its stock price. By carefully analyzing financial statements, industry trends, and management quality, investors can make more informed decisions, reducing the risk of investing in fundamentally weak companies.

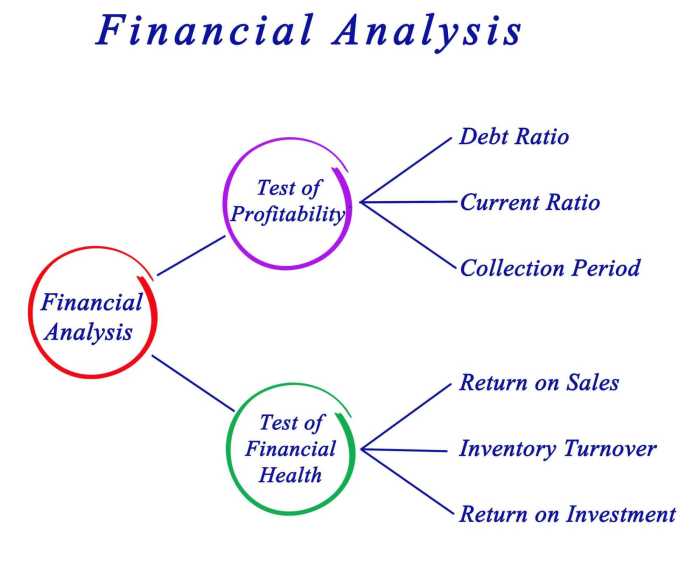

Key Financial Ratios and Metrics

Several key financial ratios and metrics are integral to fundamental analysis. These ratios provide a standardized way to compare companies within the same industry and across different sectors. Analyzing these metrics allows investors to gain insights into profitability, liquidity, solvency, and efficiency.

- Price-to-Earnings Ratio (P/E Ratio): This ratio compares a company’s stock price to its earnings per share (EPS). A high P/E ratio might suggest that the market anticipates strong future growth, while a low P/E ratio could indicate undervaluation or lower growth expectations. For example, a P/E ratio of 20 means that investors are willing to pay $20 for every $1 of earnings.

- Return on Equity (ROE): ROE measures a company’s profitability relative to shareholders’ equity. A higher ROE generally indicates better management efficiency in generating profits from the invested capital. A consistently high ROE suggests a strong and well-managed company.

- Debt-to-Equity Ratio: This ratio shows the proportion of a company’s financing that comes from debt compared to equity. A high debt-to-equity ratio indicates higher financial risk, as the company relies heavily on debt to fund its operations. Conversely, a lower ratio suggests a more conservative financial structure.

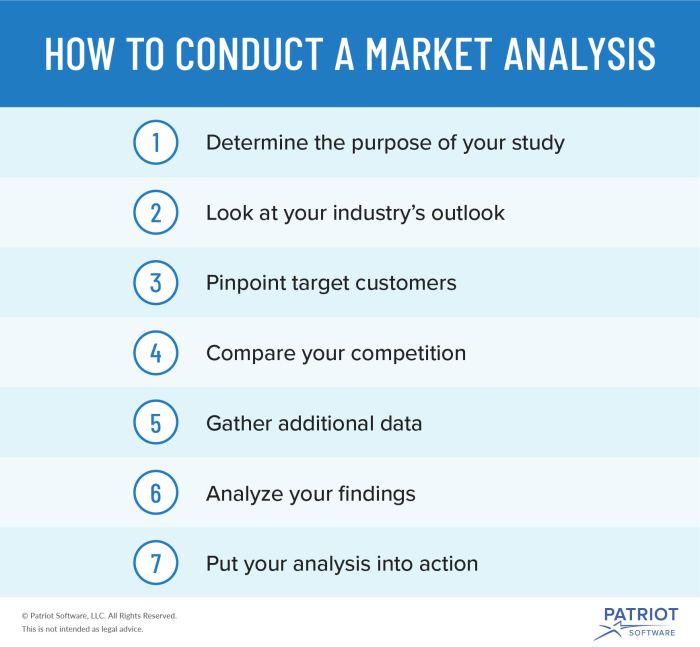

Conducting a Fundamental Analysis of a Publicly Traded Company

Conducting a thorough fundamental analysis involves a multi-step process. It requires careful examination of various financial reports and external factors influencing the company’s performance. A comprehensive analysis provides a solid foundation for informed investment decisions.

The process typically involves:

- Gathering Information: This initial step involves collecting relevant data from the company’s financial statements (10-K, 10-Q), press releases, investor presentations, and industry reports. Analyzing competitor data is also crucial to understand the company’s competitive landscape.

- Analyzing Financial Statements: This stage focuses on scrutinizing the balance sheet, income statement, and cash flow statement to assess the company’s financial health, profitability, and liquidity. Key ratios, such as those mentioned above, are calculated and analyzed to understand the company’s financial performance over time.

- Assessing Qualitative Factors: This involves evaluating the company’s management team, competitive advantage, industry outlook, and regulatory environment. Qualitative factors can significantly impact a company’s future performance and should not be overlooked.

- Estimating Intrinsic Value: Using the information gathered, various valuation models (like discounted cash flow analysis or comparable company analysis) can be employed to estimate the company’s intrinsic value. This value is then compared to the current market price to determine whether the stock is undervalued or overvalued.

Resources and Databases for Fundamental Analysis

Access to reliable and up-to-date financial data is crucial for effective fundamental analysis. Several resources provide the necessary data for this process.

- SEC Edgar Database: The U.S. Securities and Exchange Commission’s EDGAR database provides access to company filings, including 10-K and 10-Q reports, which contain detailed financial information.

- Bloomberg Terminal: A widely used professional platform providing comprehensive financial data, including real-time stock quotes, financial statements, and news.

- Reuters Eikon: Similar to Bloomberg, Reuters Eikon offers a comprehensive suite of financial data and analytics tools.

- Yahoo Finance: A free online resource providing basic financial data, including stock quotes, financial statements, and analyst ratings.

Quantitative Analysis Tools

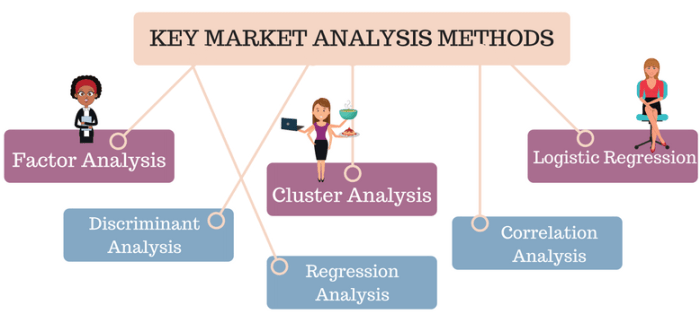

Quantitative analysis plays a crucial role in modern financial markets, leveraging mathematical and statistical methods to model market behavior and inform investment decisions. This approach moves beyond qualitative assessments, employing rigorous techniques to identify patterns, predict trends, and optimize portfolio performance. The increasing availability of data and advancements in computing power have fueled the growth of quantitative analysis, leading to sophisticated algorithmic trading strategies and advanced risk management tools.

Quantitative analysis in finance utilizes a variety of statistical modeling techniques and algorithmic approaches to analyze financial data and make informed investment decisions. These methods allow for the systematic identification of market inefficiencies and the development of robust trading strategies. The integration of advanced computational tools further enhances the capabilities of quantitative analysis, enabling the processing of vast datasets and the execution of complex simulations.

Statistical Modeling in Financial Markets

Statistical modeling forms the cornerstone of quantitative analysis. Various models are employed to understand relationships between financial variables, predict future outcomes, and assess risk. These models often rely on historical data and statistical assumptions. The accuracy of predictions depends heavily on the quality of the data and the appropriateness of the chosen model. Misspecification of a model can lead to inaccurate forecasts and poor investment decisions. Therefore, rigorous model validation and testing are critical.

Examples of Quantitative Analysis Techniques

Regression analysis is frequently used to model the relationship between dependent and independent variables. For example, a linear regression could model the relationship between a stock’s price and relevant economic indicators. Time series analysis examines data points collected over time, identifying trends, seasonality, and volatility. This is crucial for forecasting future price movements or understanding the risk associated with a particular asset. Monte Carlo simulations use random sampling to model the probability of different outcomes. This technique is widely used in options pricing and portfolio risk management, providing insights into potential losses or gains under various market scenarios. For instance, a Monte Carlo simulation could be used to estimate the value at risk (VaR) of a portfolio, quantifying the potential loss over a specific time horizon and confidence level.

Programming Languages in Quantitative Modeling

Python and R are the dominant programming languages in quantitative finance due to their extensive libraries and capabilities for data manipulation, statistical analysis, and model building. Python’s versatility extends to areas such as backtesting and algorithmic trading, while R’s strength lies in its statistical computing capabilities. Both languages offer a wide array of packages specifically designed for financial applications, streamlining the development and implementation of quantitative models. For example, Python’s Pandas library facilitates data manipulation and analysis, while Scikit-learn provides a suite of machine learning algorithms. In R, packages like quantmod and xts are commonly used for financial time series analysis.

Backtesting a Quantitative Trading Strategy

Backtesting involves evaluating a trading strategy using historical data. This process helps assess the strategy’s performance under past market conditions, providing insights into its potential profitability and risk profile. A successful backtest doesn’t guarantee future success, but it provides valuable information for refining the strategy and managing expectations. A common approach involves using historical price data to simulate trades based on the strategy’s rules. Key performance metrics, such as Sharpe ratio, maximum drawdown, and win rate, are then calculated to evaluate the strategy’s effectiveness. For example, a quantitative strategy might be backtested using 10 years of daily price data for a specific stock index, simulating trades based on signals generated by a chosen model. The backtesting results would then be analyzed to determine the strategy’s profitability, risk, and overall performance. Robust backtesting requires careful consideration of transaction costs, slippage, and data quality to avoid over-optimistic results.

Data Visualization and Reporting Tools

Data visualization is crucial in financial market analysis because it transforms complex numerical data into easily understandable visual representations. This allows analysts to quickly identify trends, patterns, and anomalies that might be missed when examining raw data alone. Effective visualization facilitates better decision-making, clearer communication of findings, and a more comprehensive understanding of market dynamics.

Importance of Data Visualization in Financial Market Analysis

Visualizations significantly enhance the speed and accuracy of interpreting financial data. Charts and graphs allow analysts to spot correlations, outliers, and significant shifts in market behavior much faster than poring over spreadsheets. This improved efficiency leads to more timely and informed investment decisions. Furthermore, visual representations are exceptionally effective for communicating complex analyses to a wider audience, including clients or colleagues who may not possess specialized financial expertise.

Examples of Chart Types and Their Applications

Several chart types are commonly used in financial market analysis, each suited to highlighting different aspects of the data.

- Line Charts: Ideal for showing trends over time, such as stock prices, index performance, or economic indicators. A line chart clearly illustrates the direction and magnitude of changes over a specified period.

- Bar Charts: Effective for comparing discrete data points, such as the performance of different assets within a portfolio or the financial ratios of competing companies. They readily show differences in magnitude between categories.

- Candlestick Charts: Specifically designed for displaying price movements of financial instruments, providing information on opening, closing, high, and low prices for each period. These are frequently used in technical analysis to identify patterns and predict future price movements.

- Scatter Plots: Useful for identifying correlations between two variables, such as the relationship between a company’s earnings per share and its stock price. They show the degree of association between the variables.

Visual Representation of a Hypothetical Investment Portfolio’s Performance

The following table illustrates the hypothetical performance of a diversified investment portfolio over a five-year period.

| Year | Stock A | Stock B | Bond C | Total Portfolio Value |

|---|---|---|---|---|

| 2019 | $10,000 | $5,000 | $5,000 | $20,000 |

| 2020 | $11,000 | $4,500 | $5,200 | $20,700 |

| 2021 | $12,500 | $5,500 | $5,400 | $23,400 |

| 2022 | $11,800 | $6,000 | $5,600 | $23,400 |

| 2023 | $13,000 | $7,000 | $5,800 | $25,800 |

This data could be further visualized using a line chart, with each asset’s performance represented by a separate line and the total portfolio value shown as a final line. This would clearly illustrate the growth of the portfolio over time and the relative performance of each asset.

Sample Financial Market Analysis Report Summary

This report summarizes the key findings of a recent analysis of the technology sector. The analysis utilized fundamental and technical indicators to assess the potential for future growth and risk.

- Key Finding 1: The sector shows strong growth potential, driven by increasing demand for [specific technology] and innovative product development. (This could be supported by a bar chart comparing growth rates across different sub-sectors.)

- Key Finding 2: Valuation multiples are currently elevated, suggesting a potential for near-term correction. (This could be illustrated by a line chart showing price-to-earnings ratios over time.)

- Key Finding 3: Technical indicators suggest a potential upward trend in the near term, supported by positive momentum and increasing trading volume. (This could be illustrated with a candlestick chart highlighting key price levels and trends.)

- Recommendation: A cautious approach is recommended, with a focus on diversification within the sector and careful risk management. (This could be further supported by a table summarizing the risk-reward profile of different investment options.)

Risk Management Tools

Navigating the dynamic landscape of financial markets necessitates a robust approach to risk management. Understanding and mitigating potential losses is crucial for both individual investors and institutional players to achieve their financial objectives and ensure long-term sustainability. Effective risk management involves identifying, assessing, and controlling various risks to minimize their negative impact.

Risk management techniques employed by market participants are diverse and often tailored to specific investment strategies and risk appetites. These range from simple diversification strategies to sophisticated quantitative models and hedging techniques. The choice of technique depends heavily on factors such as the investor’s investment horizon, risk tolerance, and the nature of the assets being traded.

Market Risk Measurement and Management

Market risk, encompassing fluctuations in asset values due to changes in market conditions, is a primary concern. Tools used to measure and manage this risk include Value at Risk (VaR), which estimates the potential loss in value over a specific time horizon with a given confidence level. Stress testing, another vital technique, simulates the impact of extreme market events on a portfolio’s value, helping investors assess their resilience to adverse scenarios. Scenario analysis, closely related to stress testing, explores the potential impact of various plausible scenarios, providing a more comprehensive risk assessment than single-point estimates. Diversification, a fundamental risk management strategy, involves spreading investments across different asset classes to reduce the impact of losses in any single asset. For example, an investor might allocate their portfolio across stocks, bonds, and real estate to mitigate the impact of market downturns in any one sector.

Credit Risk Assessment and Mitigation

Credit risk, the potential for losses due to a borrower’s default, is significant, especially for lenders and investors holding debt instruments. Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, play a crucial role in assessing the creditworthiness of borrowers and issuing credit ratings. These ratings help investors evaluate the likelihood of default and inform their investment decisions. Credit scoring models, using statistical techniques to assess credit risk, are widely used by financial institutions to evaluate loan applications and manage credit portfolios. Furthermore, techniques like collateralization and credit derivatives (such as credit default swaps) are employed to mitigate credit risk by providing a safety net against potential losses. For instance, a bank might require collateral from a borrower to secure a loan, reducing its exposure to credit risk in case of default.

Operational Risk Identification and Control

Operational risk, encompassing losses arising from inadequate or failed internal processes, people, and systems, is often overlooked but can have significant consequences. Operational risk management involves implementing robust internal controls, conducting regular audits, and investing in technology to improve operational efficiency and reduce errors. Key Risk Indicators (KRIs) are used to monitor operational processes and identify potential risks. For example, a high number of transaction errors could signal a potential operational risk. Business continuity planning, designed to ensure the continued operation of a business during disruptions, is also a crucial aspect of operational risk management. This includes developing backup systems and procedures to maintain essential functions even in the face of unforeseen events, such as natural disasters or cyberattacks.

Value at Risk (VaR) Model: A Detailed Example

The Value at Risk (VaR) model is a widely used quantitative risk management tool. It estimates the maximum potential loss in value of an investment or portfolio over a specific time horizon at a given confidence level. For example, a VaR of $1 million at a 95% confidence level over a one-day period means that there is a 5% chance of losing more than $1 million in one day. The calculation of VaR typically involves using historical data, statistical methods, and assumptions about the distribution of asset returns. Different approaches exist, including the historical simulation method, the variance-covariance method, and Monte Carlo simulation. The choice of method depends on factors such as data availability and the complexity of the portfolio. The VaR model provides a concise summary of market risk, facilitating portfolio optimization and risk-adjusted performance evaluation. However, it’s crucial to remember that VaR is not a perfect measure and has limitations, such as its reliance on historical data and its inability to capture tail risk (the risk of extreme losses). Despite these limitations, VaR remains a valuable tool for managing market risk.

Emerging Trends in Financial Market Tools

The financial technology (FinTech) landscape is constantly evolving, driven by advancements in computing power, data availability, and algorithmic sophistication. This section examines several key trends shaping the future of financial market analysis tools, focusing on the transformative impact of artificial intelligence, blockchain technology, and their implications for market analysis and risk management.

Artificial Intelligence and Machine Learning in Financial Markets

AI and machine learning (ML) are rapidly transforming financial market analysis. These technologies offer the ability to process vast datasets, identify complex patterns, and make predictions with greater speed and accuracy than traditional methods. ML algorithms, for instance, can be trained on historical market data to predict future price movements, identify potential trading opportunities, and optimize investment portfolios. AI-powered sentiment analysis tools can gauge market sentiment from news articles, social media posts, and other sources, providing valuable insights into investor behavior and market trends. The application of reinforcement learning is also gaining traction, allowing algorithms to learn optimal trading strategies through simulated market environments. For example, hedge funds are increasingly utilizing AI-driven high-frequency trading (HFT) systems to execute trades at optimal speeds and prices, capitalizing on even minuscule market inefficiencies.

Blockchain Technology in Financial Markets

Blockchain technology, initially known for its role in cryptocurrencies, is finding increasing applications in traditional finance. Its decentralized and transparent nature offers several advantages for financial market analysis. Blockchain can enhance data security and integrity, reducing the risk of fraud and manipulation. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate various financial processes, such as settlements and clearing, improving efficiency and reducing costs. Moreover, blockchain can facilitate the creation of more transparent and efficient financial markets by providing a secure and auditable record of all transactions. The use of distributed ledger technology (DLT) to track assets and ownership rights is becoming increasingly common, particularly in areas like securities lending and trade finance. For instance, several companies are exploring the use of blockchain to create digital securities, which can be traded more efficiently and transparently than traditional paper-based securities.

Predictions for the Future of Financial Market Analysis Tools

The future of financial market analysis tools points towards increasing automation, sophistication, and accessibility. We can anticipate further integration of AI and ML, leading to more accurate predictive models and personalized investment strategies. The use of alternative data sources, such as satellite imagery and social media sentiment, will become increasingly prevalent, providing richer insights into market dynamics. Blockchain technology will likely play a larger role in enhancing data security, transparency, and efficiency across financial markets. Furthermore, the increasing availability of cloud computing resources will allow for more powerful and scalable analytical tools, making advanced market analysis accessible to a wider range of investors. For example, the rise of robo-advisors, which utilize AI algorithms to manage investments, illustrates the growing trend towards automated and personalized financial advice. The increasing adoption of RegTech (regulatory technology) solutions, leveraging AI and blockchain to ensure compliance, also suggests a future where regulatory burdens are eased while maintaining robust market integrity.

Closing Notes

Mastering financial market analysis requires a blend of theoretical understanding and practical application of the right tools. This guide has provided a foundational overview of the various tools available, from charting packages to quantitative analysis platforms. By understanding the strengths and limitations of each, investors can make more informed decisions and navigate the complexities of the market with greater confidence. The ever-evolving nature of financial technology ensures that continuous learning and adaptation are key to success.

Frequently Asked Questions

What is the difference between technical and fundamental analysis?

Technical analysis focuses on price charts and historical data to predict future price movements, while fundamental analysis assesses the intrinsic value of an asset by examining its underlying financial health and economic factors.

Are these tools suitable for beginners?

Many tools offer varying levels of complexity. Beginners can start with simpler charting software and gradually progress to more advanced tools as their knowledge grows. It’s crucial to begin with a strong understanding of basic financial principles.

What are the potential risks associated with using these tools?

No tool guarantees profit. Over-reliance on any single tool can lead to flawed analysis. It’s crucial to use these tools in conjunction with sound judgment and risk management strategies. Market volatility and unforeseen events can significantly impact outcomes.

How much do these tools typically cost?

Costs vary significantly, from free charting tools to expensive professional platforms with advanced features. Many offer free trials or limited free versions, allowing users to assess suitability before committing to a paid subscription.