Mastering financial modeling is crucial for informed decision-making across various sectors. This guide delves into the core principles and advanced techniques that define best practices, equipping you with the knowledge to build robust, reliable, and insightful financial models. We’ll explore essential components, advanced methodologies, relevant software, and real-world applications, ultimately empowering you to confidently navigate the complexities of financial analysis.

From understanding the criteria for a high-quality model to implementing advanced techniques like DCF analysis and scenario planning, we cover the entire spectrum. We also address practical considerations such as software selection, data management, and effective communication of results. This comprehensive approach ensures you develop a thorough understanding of financial modeling, enabling you to leverage its power for strategic advantage.

Defining “Best” in Financial Modeling

Defining “best” in financial modeling isn’t about a single, universally accepted standard. Instead, it’s a multifaceted assessment based on the model’s purpose, accuracy, and usability. A “best” model is one that effectively addresses the specific needs of its users, providing reliable insights while remaining transparent and easy to understand.

Criteria for Judging Financial Model Quality

Several key criteria determine a financial model’s quality. Accuracy, of course, is paramount. The model should accurately reflect the underlying financial reality, using reliable data and appropriate assumptions. Transparency is equally crucial; the model’s logic and calculations should be readily understandable, allowing for easy review and auditing. Robustness refers to the model’s ability to withstand changes in input data without producing erratic or nonsensical results. Finally, usability considers the model’s ease of use and navigation, ensuring that users can effectively interact with and interpret its outputs. A model failing in any of these areas falls short of being considered “best.”

Characteristics of a Robust and Reliable Financial Model

A robust and reliable financial model possesses several key characteristics. It incorporates clear and well-defined assumptions, explicitly stated and justified. It utilizes appropriate formulas and methodologies, consistently applied throughout. It incorporates error-checking mechanisms, flagging potential inconsistencies or inaccuracies. It features comprehensive documentation, explaining the model’s structure, inputs, and outputs. Furthermore, it allows for sensitivity analysis, demonstrating the impact of changes in key variables on the model’s results. A model lacking these features is inherently less reliable and therefore not considered “best.”

Comparison of Different Financial Modeling Approaches

Different approaches to financial modeling exist, each with its strengths and weaknesses. Discounted Cash Flow (DCF) analysis, a cornerstone of valuation, provides a robust framework for valuing assets based on their projected future cash flows. However, it’s highly sensitive to discount rate assumptions. Relative valuation, comparing a company’s valuation multiples to its peers, offers a simpler approach but can be susceptible to market biases. Simulation modeling, using Monte Carlo simulations, allows for incorporating uncertainty and risk, providing a range of possible outcomes, but requires significant computational power and expertise. The “best” approach depends entirely on the specific context and the questions being addressed.

Examples of Best-Practice Models in Various Industries

Best-practice models often vary by industry. In real estate, sophisticated models incorporating market trends, property-specific characteristics, and financing details are considered best. These models may incorporate complex algorithms for predicting rental income and property appreciation. In the energy sector, models often integrate complex simulations of resource extraction, production costs, and commodity price fluctuations. These models might utilize stochastic optimization techniques to optimize production schedules and manage risk. Within the financial services industry, sophisticated credit risk models, employing statistical techniques and machine learning algorithms, are crucial for assessing borrower default risk and pricing financial instruments. These examples highlight the industry-specific nature of “best” financial models, emphasizing the need for tailored approaches.

Essential Components of a Top-Tier Financial Model

A robust financial model is the cornerstone of sound financial decision-making. It provides a structured framework for analyzing past performance, projecting future outcomes, and assessing the financial implications of various strategic choices. Building a top-tier model requires careful consideration of several essential components, ensuring accuracy, clarity, and ease of use.

Core Model Elements

Every comprehensive financial model should incorporate a specific set of core elements. These elements work in concert to provide a holistic view of a company’s financial health and prospects. Omitting even one critical component can significantly diminish the model’s reliability and usefulness.

| Component | Purpose | Functionality | Example |

|---|---|---|---|

| Assumptions | Define the underlying premises of the model. | Provides the foundation for all projections; clearly documented assumptions allow for easy model adjustments and sensitivity analysis. | Growth rates for revenue, cost of goods sold, operating expenses, and capital expenditures. Discount rate for net present value calculations. |

| Income Statement | Shows a company’s profitability over a period. | Calculates key profitability metrics such as gross profit, operating income, and net income. Drives many other model components. | Revenue less Cost of Goods Sold equals Gross Profit; Gross Profit less Operating Expenses equals Operating Income; Operating Income less Interest and Taxes equals Net Income. |

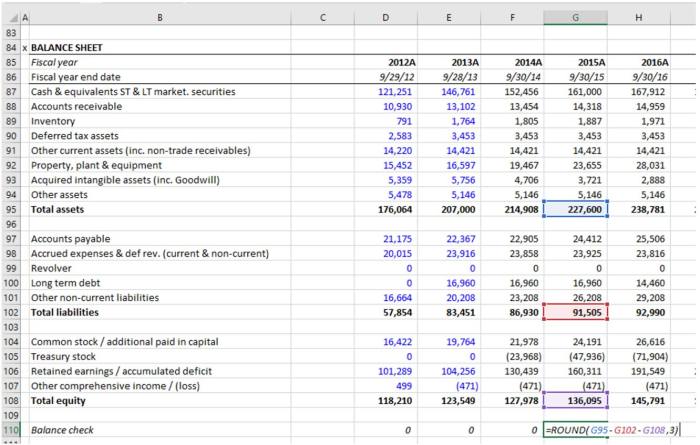

| Balance Sheet | Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. | Shows the financial position of the company and the relationship between its assets, liabilities, and equity. Interacts closely with the cash flow statement. | Assets (Cash, Accounts Receivable, Inventory, etc.) = Liabilities (Accounts Payable, Debt, etc.) + Equity (Common Stock, Retained Earnings). |

| Cash Flow Statement | Tracks the movement of cash into and out of a company. | Essential for evaluating liquidity and solvency. Directly linked to the balance sheet through changes in working capital. | Cash from Operations + Cash from Investing + Cash from Financing = Net Change in Cash. |

| Valuation Metrics | Provide insights into the financial health and value of a company. | Used to assess the attractiveness of an investment or business opportunity. | Discounted Cash Flow (DCF) analysis, multiples (e.g., Price-to-Earnings ratio), internal rate of return (IRR). |

| Supporting Schedules | Provide detailed breakdowns of key model inputs and calculations. | Increases model transparency and facilitates understanding of underlying assumptions and drivers. | Detailed revenue breakdowns by product or service line, capital expenditure schedules, and working capital projections. |

Structuring Inputs and Outputs

Effective model design necessitates a clear separation of inputs and outputs. Inputs, such as revenue growth rates and operating margins, should be clearly labeled and easily accessible for modification. Outputs, including key financial metrics and valuation results, should be presented in a concise and easily understandable format, often using charts and graphs. Using color-coding to distinguish between assumptions, calculations, and outputs can enhance readability. For example, inputs might be in blue, calculations in black, and outputs in green.

Documentation

Comprehensive documentation is paramount for any financial model. This includes clear descriptions of the model’s purpose, assumptions, methodologies, and limitations. Each input cell should be clearly labeled, and formulas should be well-documented, either through comments within the model itself or in a separate document. This ensures that others (or your future self) can easily understand and use the model. A well-documented model fosters trust and confidence in its results. For instance, a clear description of the discount rate used in a DCF analysis is crucial for interpreting the valuation.

Advanced Modeling Techniques

Building sophisticated financial models requires mastering advanced techniques that move beyond basic spreadsheet functionality. These techniques enhance accuracy, provide deeper insights, and allow for more robust decision-making. This section explores several key advanced modeling methods crucial for creating top-tier financial models.

Discounted Cash Flow (DCF) Analysis in Financial Modeling

DCF analysis is a cornerstone valuation method used to estimate the value of an investment based on its expected future cash flows. The core principle is that money received today is worth more than the same amount received in the future due to its potential earning capacity. This is captured through a discount rate, which reflects the risk associated with the investment. A higher discount rate implies higher risk and thus a lower present value. A typical DCF model projects free cash flows (FCF) for a specified period, then calculates a terminal value to account for cash flows beyond the explicit forecast horizon. These are then discounted back to their present value and summed to arrive at an enterprise value.

The basic DCF formula is: PV = CFt / (1 + r)t, where PV is the present value, CFt is the cash flow at time t, r is the discount rate, and t is the time period.

A practical example would be valuing a company. You’d project its FCF for the next 5 years, perhaps using a growth rate based on historical performance and industry trends. The terminal value could be calculated using a perpetuity growth model, assuming a stable long-term growth rate. These cash flows would then be discounted back to the present using a discount rate reflecting the company’s risk profile (e.g., its weighted average cost of capital, or WACC). The sum of the present values represents the estimated enterprise value of the company.

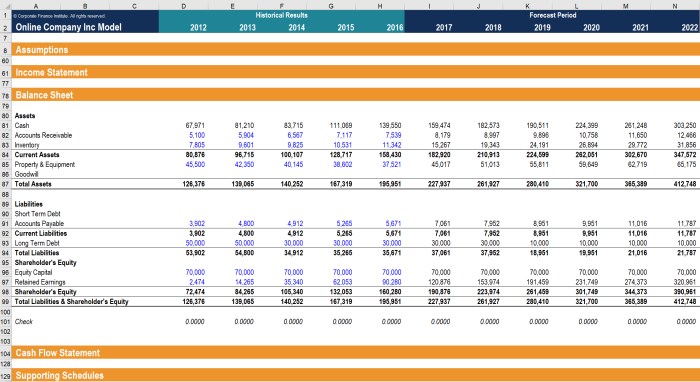

Building a Three-Statement Financial Model

A three-statement financial model integrates the income statement, balance sheet, and statement of cash flows. This interconnectedness ensures consistency and provides a more comprehensive view of a company’s financial health. Building such a model involves iterative steps, starting with assumptions about key drivers like revenue growth, margins, and capital expenditures.

- Income Statement: Begins with revenue projections, driven by assumptions about sales volume and pricing. Cost of goods sold (COGS), operating expenses, and taxes are then calculated to arrive at net income.

- Balance Sheet: Uses the net income from the income statement to update retained earnings. Changes in assets and liabilities are projected based on assumptions about working capital, capital expenditures, and debt levels. The balance sheet must always balance (Assets = Liabilities + Equity).

- Statement of Cash Flows: Reconciles changes in the balance sheet to calculate cash flows from operating, investing, and financing activities. This statement shows how the company’s cash position changes over time.

These three statements are linked; changes in one statement directly impact the others. For example, increased capital expenditures (investing activities) will reduce cash on the balance sheet and be reflected in the statement of cash flows. This iterative process requires careful attention to detail and consistency across all three statements.

Valuation Methodologies Comparison

Several valuation methodologies exist, each with strengths and weaknesses. DCF analysis, as discussed earlier, is a widely used intrinsic valuation method. Other common approaches include relative valuation (comparing multiples like Price-to-Earnings ratios to industry peers) and precedent transactions (analyzing the sale prices of comparable companies).

| Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| DCF Analysis | Projects future cash flows and discounts them to present value | Theoretically sound, based on fundamental company performance | Highly sensitive to assumptions, requires accurate forecasts |

| Relative Valuation | Compares multiples to industry peers | Simple, quick, readily available data | Relies on market sentiment, susceptible to market distortions |

| Precedent Transactions | Analyzes sale prices of comparable companies | Market-based, reflects actual transaction prices | Finding truly comparable companies can be difficult, limited data available |

Sensitivity Analysis and Scenario Planning

Sensitivity analysis examines how changes in key input variables (e.g., revenue growth, discount rate) affect the model’s output (e.g., net present value). Scenario planning builds upon this by creating multiple scenarios (e.g., best-case, base-case, worst-case) to explore a range of possible outcomes. This allows for a more robust assessment of risk and uncertainty.

For instance, a sensitivity analysis might show how a 10% change in revenue growth impacts the projected NPV of a project. Scenario planning could then create three scenarios: a high-growth scenario (e.g., 20% growth), a base-case scenario (e.g., 10% growth), and a low-growth scenario (e.g., 0% growth). Comparing the NPV under each scenario provides a better understanding of the project’s risk profile and potential returns under different market conditions.

Software and Tools for Financial Modeling

The choice of software significantly impacts the efficiency, accuracy, and overall quality of a financial model. While spreadsheets remain prevalent, dedicated financial modeling software offers distinct advantages, particularly for complex projects. Understanding the capabilities and limitations of each is crucial for selecting the best tool for a given task.

Comparison of Financial Modeling Software Packages

Selecting the right software depends on project complexity, budget, and user experience. The following table compares popular options, highlighting key features and considerations.

| Software | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Microsoft Excel | Widely accessible, familiar interface, extensive built-in functions, relatively inexpensive. | Limited built-in financial modeling features, prone to errors if not meticulously managed, scalability challenges with very large models. | Small to medium-sized models, basic financial analysis, users comfortable with spreadsheets. |

| Google Sheets | Collaborative capabilities, cloud-based access, relatively inexpensive. | Fewer advanced features compared to Excel or dedicated software, potential limitations with complex calculations. | Collaborative projects, smaller models, users needing cloud-based accessibility. |

| Bloomberg Terminal | Comprehensive financial data, advanced analytical tools, real-time data feeds. | High cost, steep learning curve, requires a subscription. | Professional financial analysts, investment banking, hedge funds, requiring access to real-time market data and sophisticated analytical tools. |

| Financial Modeling Prep (FMP) | Access to financial statements and data, pre-built templates, relatively affordable. | Limited functionality compared to dedicated software, may require manual data entry for custom models. | Users needing access to readily available financial data and templates for faster model building. |

Spreadsheets versus Dedicated Financial Modeling Software

Spreadsheets, like Excel and Google Sheets, offer accessibility and familiarity but lack the built-in functionalities and error-checking mechanisms of dedicated software. Dedicated software, while often more expensive, provides enhanced features for complex models, reducing the risk of errors and improving efficiency. For instance, dedicated software might offer automatic error checking, scenario planning tools, and improved data visualization. The choice depends on the model’s complexity and the user’s technical expertise. Simpler models might be adequately handled in spreadsheets, whereas intricate models benefit significantly from dedicated software.

Data Management and Validation Best Practices

Robust data management is paramount. Employ clear naming conventions for worksheets and cells, use data validation to restrict input types and ranges (e.g., ensuring only positive numbers are entered for revenue), and regularly audit the data for inconsistencies. Consider using separate input and output sheets to improve clarity and maintainability. Version control is also essential, tracking changes and allowing for easy rollback if necessary. For instance, maintaining a detailed change log helps in debugging and ensures model transparency.

Potential Pitfalls and Common Errors in Using Financial Modeling Software

Common errors include circular references (where formulas depend on each other creating infinite loops), incorrect formula application, and inconsistent data formats. Overly complex models can become difficult to understand and maintain, increasing the likelihood of errors. Insufficient testing and validation can lead to inaccurate results. Regularly reviewing and testing the model with various inputs, and using sensitivity analysis to understand the impact of changing variables, helps mitigate these risks. For example, a simple error in a discount rate can significantly alter the projected net present value of a project.

Real-World Applications of Financial Modeling

Financial models are not theoretical exercises; they are powerful tools used across various sectors to inform crucial business decisions. Their application spans from evaluating potential acquisitions to forecasting future revenue streams, ultimately contributing to enhanced profitability and reduced risk. The following examples illustrate the diverse and impactful ways financial models are deployed in the real world.

Financial Modeling in Investment Banking

Investment banks heavily rely on financial modeling for deal structuring and valuation. For example, during mergers and acquisitions (M&A), models are used to assess the target company’s financial health, project future cash flows under various scenarios, and determine an appropriate acquisition price. These models often incorporate discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and precedent transaction analysis to provide a comprehensive valuation. A DCF model, for instance, would project the target’s free cash flows over a forecast period, discount them back to their present value using a discount rate reflecting the risk involved, and then add a terminal value to represent the cash flows beyond the forecast horizon. The output informs the offer price and negotiation strategy.

Financial Modeling in Corporate Finance

Within corporations, financial models are integral to strategic planning and decision-making. Budgeting and forecasting are core applications. A company might use a financial model to predict revenue, expenses, and profitability over the next three to five years, considering various factors like market growth, pricing strategies, and operating efficiency. This forecast helps guide resource allocation, capital expenditure decisions, and overall business strategy. Sensitivity analysis, a key feature of these models, allows businesses to understand the impact of changes in key assumptions (e.g., sales growth rate, cost of goods sold) on the overall financial projections. For instance, a model might show how a 10% decrease in sales would affect profitability and cash flow.

Financial Modeling in Mergers and Acquisitions

Financial models are critical in M&A transactions. They are used to value potential acquisition targets, analyze synergies, and determine the financial implications of a deal. A model might compare the standalone value of the target company with its value as part of the acquiring company, highlighting potential synergies and cost savings. This analysis informs the offer price and helps justify the transaction to investors and stakeholders. Furthermore, these models often simulate various financing scenarios to determine the optimal capital structure for the combined entity after the acquisition. For example, a model could compare the impact of debt financing versus equity financing on the combined company’s financial health.

Financial Modeling for Risk Assessment and Management

Financial models play a crucial role in identifying and mitigating financial risks. They can simulate various scenarios, such as economic downturns or changes in market conditions, to assess the potential impact on a company’s financial performance. This allows businesses to proactively develop contingency plans and implement risk management strategies. Value-at-Risk (VaR) models, for instance, are used to estimate the potential loss in value of an asset or portfolio over a specific time period and confidence level. A company might use a VaR model to determine the maximum potential loss they might experience in a given period with a 95% confidence level. This information is critical for setting aside sufficient capital reserves and managing risk effectively.

Improving Financial Modeling Skills

Developing proficiency in financial modeling is an ongoing process requiring dedication and strategic learning. This involves mastering both the technical aspects of model building and the crucial soft skills necessary for effective communication and collaboration. The ability to create accurate, reliable, and user-friendly models is essential for informed decision-making in various financial contexts.

Resources and Learning Materials for Enhancing Financial Modeling Proficiency

Numerous resources exist to bolster financial modeling skills. These range from online courses and tutorials to textbooks and professional certifications. Effective learning involves a combination of theoretical understanding and practical application.

- Online Courses: Platforms like Coursera, edX, Udemy, and Skillshare offer a wide array of financial modeling courses, catering to different skill levels, from beginner to advanced. These courses often include practical exercises and case studies to reinforce learning.

- Textbooks: Several reputable textbooks provide comprehensive coverage of financial modeling techniques and best practices. Examples include “Financial Modeling” by Simon Benninga and “Valuation: Measuring and Managing the Value of Companies” by McKinsey & Company.

- Professional Certifications: Certifications like the Financial Modeling & Valuation Analyst (FMVA) demonstrate proficiency and can enhance career prospects. These certifications often involve rigorous examinations and practical assessments.

- Workshops and Seminars: Attending workshops and seminars led by experienced financial modelers provides valuable insights and networking opportunities. These events often feature real-world case studies and interactive exercises.

Steps Involved in Creating a Robust and User-Friendly Financial Model

Building a robust and user-friendly financial model involves a structured approach, encompassing careful planning, meticulous execution, and thorough testing. The goal is to create a model that is not only accurate but also easily understandable and maintainable.

- Define Objectives: Clearly articulate the purpose of the model and the key questions it aims to answer. This provides a framework for the entire modeling process.

- Data Gathering and Preparation: Collect reliable and relevant data from various sources, ensuring its accuracy and consistency. Clean and organize the data to facilitate efficient model building.

- Model Design and Structure: Design a logical and well-organized model structure, using clear and consistent naming conventions for cells and worksheets. Employ robust formulas and functions to ensure accuracy and avoid errors.

- Testing and Validation: Thoroughly test the model to identify and correct any errors or inconsistencies. Validate the results against known data or benchmarks to ensure reliability.

- Documentation and User Interface: Document the model’s assumptions, methodologies, and limitations. Create a user-friendly interface with clear instructions and explanations to facilitate understanding and use.

The Importance of Continuous Learning and Professional Development in Financial Modeling

The field of financial modeling is constantly evolving, with new techniques and technologies emerging regularly. Continuous learning is crucial to stay abreast of these advancements and maintain a competitive edge.

The rapid pace of technological advancements necessitates ongoing professional development. New software tools, analytical methods, and industry best practices require continuous learning to maintain relevance and proficiency. Staying updated ensures models remain accurate, efficient, and aligned with industry standards. This can involve attending conferences, participating in online communities, and pursuing further education opportunities.

Techniques for Effective Communication and Presentation of Financial Model Results

Effectively communicating financial model results is crucial for influencing decisions and gaining buy-in from stakeholders. Clear and concise presentation is key to conveying complex information in an accessible manner.

- Visualizations: Use charts, graphs, and dashboards to present key findings in a visually appealing and easily understandable format. This helps to highlight important trends and patterns.

- Narrative Summary: Provide a concise narrative summary of the model’s key findings and implications. This should be tailored to the audience’s level of understanding and their specific needs.

- Sensitivity Analysis: Present sensitivity analyses to demonstrate the impact of changes in key assumptions on the model’s results. This helps to quantify the uncertainty inherent in financial forecasting.

- Scenario Planning: Develop and present multiple scenarios to illustrate the potential range of outcomes under different conditions. This provides a more comprehensive and realistic view of the future.

Summary

Building exceptional financial models requires a blend of theoretical understanding and practical application. This guide has provided a roadmap, outlining the essential components, advanced techniques, and best practices for creating models that are both accurate and insightful. By mastering these principles and continuously honing your skills, you can unlock the true potential of financial modeling to drive informed decisions and achieve strategic objectives. Remember, continuous learning and adaptation are key to staying ahead in this ever-evolving field.

Frequently Asked Questions

What are the most common mistakes in financial modeling?

Common errors include inaccurate data input, flawed formulas, insufficient error checking, and a lack of clear documentation. Ignoring sensitivity analysis and neglecting proper model validation are also frequent pitfalls.

How can I improve my financial modeling communication skills?

Practice concise and clear explanations of your model’s assumptions, methodology, and results. Use visuals like charts and graphs effectively, and tailor your communication to your audience’s level of financial expertise.

What’s the difference between a three-statement model and a DCF model?

A three-statement model projects the income statement, balance sheet, and cash flow statement, providing a comprehensive picture of a company’s financial performance. A DCF model uses projected cash flows to estimate the present value of a business or investment.