Financial Modeling Best Practices are crucial for creating accurate, reliable, and insightful financial models. This guide delves into the essential elements of building robust models, from ensuring data integrity and employing effective validation techniques to mastering model structure, assumptions, and sensitivity analysis. We’ll explore how to communicate findings clearly and conduct thorough audits, ultimately helping you navigate the complexities of financial modeling with confidence and a healthy dose of humor.

Building a successful financial model is like baking the perfect cake – you need the right ingredients (data), a well-structured recipe (model design), and the patience to follow the instructions carefully. Ignoring any of these steps can lead to a disastrous outcome (inaccurate projections or, worse, a financial meltdown!). This guide will provide you with the tools and knowledge to avoid those baking mishaps and create a financial model that’s both delicious and informative.

Data Integrity and Validation

Garbage in, garbage out. It’s a cliché, yes, but in the world of financial modeling, it’s a brutally accurate statement. Building a robust and reliable financial model hinges entirely on the quality of the data you feed it. Using inaccurate data is like building a house on a foundation of sand – it might look impressive initially, but the whole thing is destined for a spectacular collapse.

Accurate and reliable data forms the bedrock of any successful financial model. Without it, your projections, valuations, and analyses become nothing more than educated guesses, potentially leading to disastrously wrong decisions. Imagine basing a multi-million dollar investment on a model using outdated or simply incorrect data; the consequences could be financially devastating, and might even involve a stern talking-to from your boss (or worse!). The importance of data integrity cannot be overstated; it’s the difference between a triumphant financial prediction and a spectacular financial flop.

Data Validation Techniques and Applications

Data validation involves a series of checks and balances to ensure that the data used in your model is accurate, complete, and consistent. This isn’t just about double-checking numbers; it’s about implementing systematic processes to catch errors before they wreak havoc. Think of it as quality control for your numbers.

Several techniques can be employed to ensure data integrity. Cross-referencing data from multiple sources, for instance, helps to identify inconsistencies. This might involve comparing sales figures from your internal accounting system with data from an independent market research report. Another technique is to use data validation rules within spreadsheets. These rules can flag cells that contain invalid data types (e.g., text in a numerical field) or values outside of an acceptable range (e.g., a negative sales figure). Visual checks, such as charts and graphs, can also highlight outliers or inconsistencies that might otherwise go unnoticed. Finally, regularly reviewing and updating your data sources is crucial to maintain accuracy over time. Outdated data is often worse than no data at all.

Consequences of Using Inaccurate Data

The repercussions of using inaccurate data in financial models can range from mildly embarrassing to utterly catastrophic. Minor inaccuracies might lead to slightly off projections, potentially affecting minor strategic decisions. However, more significant errors can lead to misinformed investment choices, flawed budgeting, and ultimately, significant financial losses. In extreme cases, inaccurate data can even lead to legal issues or reputational damage. Remember the Enron scandal? A prime example of what happens when data integrity goes out the window.

Data Validation Checklist

Before you unleash your financial model upon the unsuspecting world, run it through this checklist:

A comprehensive data validation process is essential to ensure accuracy and reliability. Consider the following checklist as a starting point, adapting it to your specific model’s needs:

- Source Verification: Confirm the reliability and accuracy of all data sources.

- Data Type Validation: Ensure all data is in the correct format (e.g., numbers, dates, text).

- Range Checks: Verify that all data falls within reasonable limits.

- Cross-Referencing: Compare data from multiple sources to identify discrepancies.

- Outlier Detection: Identify and investigate unusual or unexpected data points.

- Consistency Checks: Ensure that data is consistent across different parts of the model.

- Documentation: Maintain clear and comprehensive documentation of all data sources and validation procedures.

Comparison of Data Validation Methods

Different methods offer varying advantages and disadvantages. Choosing the right method depends on the specific context and the nature of the data being validated.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Cross-referencing | Comparing data from multiple sources | High accuracy, detects inconsistencies | Can be time-consuming, requires multiple data sources |

| Data validation rules | Using spreadsheet functions to check data types and ranges | Automated, efficient, easy to implement | Can miss subtle errors, requires understanding of spreadsheet functions |

| Visual checks | Using charts and graphs to identify outliers and inconsistencies | Easy to understand, highlights patterns | Subjective, may miss subtle errors |

| External Audits | Independent review of data and processes | High credibility, comprehensive review | Expensive, time-consuming |

Model Structure and Design

Building a robust financial model isn’t just about crunching numbers; it’s about crafting a masterpiece of financial engineering. Think of it as constructing a skyscraper – a poorly designed foundation will lead to a catastrophic collapse (and a very unhappy boss). A well-structured model, on the other hand, is a thing of beauty, easily audited, and resistant to the inevitable tweaks and changes that come with the territory.

A well-structured model is characterized by its clarity, efficiency, and ease of use. It’s like a well-organized filing cabinet, where every document (formula, data point) has its designated place, easily accessible and understandable. This is achieved through careful planning and adherence to best practices, ensuring that your model is not only functional but also a joy to work with (yes, really!).

Clear and Concise Formulas

Using clear and concise formulas is paramount. Avoid overly complex nested formulas that resemble a tangled ball of yarn. Think of each formula as a mini-sentence, expressing a single, clear idea. For instance, instead of embedding multiple calculations within a single cell, break them down into smaller, more manageable steps. This improves readability and makes debugging a breeze. Imagine trying to untangle a Gordian knot of formulas versus neatly organized steps – the difference is night and day. A good rule of thumb: If you can’t easily understand a formula at a glance, it’s probably too complicated. For example, instead of: `=SUM(A1:A10)*(B1+C1)/D1`, consider: `=TotalRevenue* (FixedCosts+VariableCosts)/NetSales`. The second example is far more readable and easier to understand, even without knowing the precise contents of the cells.

Modularity in Financial Modeling

Modularity is the cornerstone of a well-structured financial model. It’s the principle of breaking down a large, complex model into smaller, self-contained modules. Think of it as building with LEGOs – each brick (module) performs a specific function and can be easily combined with others to create a larger structure. This approach offers several advantages: It makes the model easier to understand, maintain, and debug. Changes to one module are less likely to impact other parts of the model, reducing the risk of errors. Furthermore, it facilitates collaboration, allowing different team members to work on different modules concurrently. A non-modular model, on the other hand, is like a sprawling, interconnected web of formulas – a nightmare to navigate and modify.

Pitfalls of Poorly Structured Models

Poorly structured models are a recipe for disaster. They’re prone to errors, difficult to audit, and time-consuming to update. Imagine trying to find a specific piece of information in a chaotic spreadsheet – it’s a frustrating and inefficient process. The lack of clarity can lead to incorrect conclusions and potentially costly mistakes. Inconsistent formulas, hardcoded values, and a general lack of organization can create a breeding ground for errors. Debugging becomes a Herculean task, and the model’s reliability is severely compromised. This can result in inaccurate financial projections and flawed decision-making. Consider the consequences of a poorly structured model used for a crucial investment decision – the potential financial losses could be substantial.

Designing a Robust Financial Model: A Step-by-Step Guide

Building a robust financial model is a systematic process. It requires careful planning, attention to detail, and a methodical approach. First, define the model’s objective and scope. What questions are you trying to answer? What data do you need? Next, design the model’s structure. How will the data be organized? What modules will you need? Then, build the model, starting with the most fundamental calculations and gradually adding complexity. Thoroughly test the model, validating your inputs and outputs. Finally, document the model clearly, providing explanations of the formulas and assumptions used. This detailed documentation is essential for future use and auditing. Remember, a well-documented model is a valuable asset, ensuring transparency and facilitating future updates. Ignoring this crucial step is akin to leaving a blueprint incomplete – it defeats the purpose of careful planning and organization.

Assumptions and Sensitivity Analysis

Financial models, much like elaborate cakes, rely heavily on a carefully chosen set of ingredients – assumptions. These aren’t just wild guesses; they’re educated estimations of future events that form the backbone of your projections. Getting these assumptions right is crucial, as even small changes can lead to wildly different – and potentially disastrous – results. Think of it like this: a tiny bit too much baking soda can turn your perfect cake into a volcanic eruption of bicarbonate. Similarly, inaccurate assumptions can make your financial model as useless as a chocolate teapot.

Assumptions are the bedrock upon which financial models are built. They represent our best guess about the future, encompassing everything from revenue growth rates and expense levels to interest rates and inflation. These guesses are informed by historical data, market research, and expert opinions, but they are ultimately just that – guesses. The accuracy of these assumptions directly influences the reliability and usefulness of the entire model. A model built on shaky assumptions is, to put it mildly, not very helpful.

Key Assumptions and Their Impact

Let’s delve into some common key assumptions and their potential impact. For instance, projecting revenue growth often relies on assumptions about market size, market share, and pricing strategies. Overestimating these could lead to overly optimistic projections, potentially causing you to miss critical risks or overextend resources. Conversely, underestimating these could lead to missed opportunities and a failure to capitalize on potential growth. Similarly, assumptions about operating expenses (like salaries, marketing, and rent) can significantly influence profitability. An overly optimistic assumption about cost reductions could lead to unrealistic profit forecasts, while overly pessimistic assumptions could stifle growth initiatives.

Documenting Assumptions and Rationale

Proper documentation is paramount. Think of your assumptions as the secret recipe to your financial model cake. Without it, nobody (including your future self) will be able to replicate or understand the results. A well-documented model should clearly state each assumption, its source (e.g., market research report, expert interview, historical data), and the rationale behind it. This ensures transparency, allowing others to review and validate your work and facilitating future adjustments as circumstances change. Imagine trying to recreate a cake without knowing the exact measurements – it’s a recipe for disaster!

Performing Sensitivity Analysis

Sensitivity analysis is your secret weapon against assumption-based uncertainty. It involves systematically changing key assumptions one by one (or in combination) to observe their impact on the model’s outputs. This helps you identify which assumptions are most critical and which ones have the greatest potential to derail your projections. By understanding the sensitivity of your model to changes in these assumptions, you can develop more robust and reliable forecasts. It’s like stress-testing your cake recipe – finding out if a slight change in oven temperature or baking time will ruin the final product.

Sensitivity Analysis Example

Let’s illustrate this with a simple example. Suppose we’re modeling a new product launch. We can perform a sensitivity analysis on key variables like sales volume, selling price, and manufacturing costs. The results might look something like this:

| Variable | Base Case Value | High Case Value | Low Case Value | Impact on Net Profit |

|---|---|---|---|---|

| Sales Volume (Units) | 10,000 | 15,000 | 5,000 | +50%, -50% |

| Selling Price ($) | 100 | 120 | 80 | +20%, -20% |

| Manufacturing Cost ($) | 60 | 70 | 50 | -10%, +10% |

This table shows that changes in sales volume have the most significant impact on net profit, highlighting the importance of accurate sales forecasting. This kind of analysis allows for a more informed decision-making process.

Presentation and Communication

Let’s face it, even the most meticulously crafted financial model is useless if nobody understands it. Think of it like baking the most delicious cake – if you don’t present it beautifully, nobody will appreciate the effort (or the deliciousness!). Effective communication is the final, crucial ingredient in a successful financial modeling project. Without it, your brilliant work risks gathering dust on a forgotten hard drive.

Presenting your financial model’s results isn’t just about showing numbers; it’s about telling a compelling story. You need to translate complex financial data into a clear, concise, and engaging narrative that resonates with your audience, whether they’re seasoned investors or less financially-savvy stakeholders. This involves careful consideration of your audience, the medium of presentation, and, of course, the visual appeal of your materials.

Visual Aids and Chart Selection

Choosing the right chart is paramount. A poorly chosen chart can obscure your message faster than a magician makes a rabbit disappear. For instance, showcasing trends over time? A line graph is your best friend. Comparing different categories? A bar chart is the way to go. Showing the proportion of different components within a whole? Pie charts are your allies (but use them sparingly – too many pie charts can induce a pie-induced coma). Avoid using 3D charts; they often obfuscate the data more than they illuminate it. Remember, clarity trumps complexity every time. Imagine trying to explain a complex investment strategy using a 3D exploded pie chart – it would be a financial modeling catastrophe! Stick to simple, clear visuals that support your narrative, not distract from it.

Effective Use of Tables and Key Metrics

Tables are invaluable for presenting detailed data in an organized manner. However, don’t just dump a spreadsheet onto a slide and call it a day. Highlight key metrics, use clear headings and formatting, and ensure the table is easy to read and understand at a glance. Imagine a table filled with thousands of rows and columns; it would resemble a spreadsheet from the financial modeling equivalent of the Bermuda Triangle – data goes in, and understanding never comes out. Instead, summarize key findings and highlight crucial figures in bold, or using color-coding. Focus on providing context and interpretation to avoid your audience drowning in a sea of numbers. Think of it as presenting a curated selection of your most important findings, rather than the entire dataset.

Common Presentation Mistakes

One common mistake is overloading slides with text. Remember, visuals should carry the weight of the message, not walls of text. Another frequent error is using overly complex charts or graphs that are difficult to interpret. A picture is worth a thousand words, but a confusing picture is worth a thousand headaches. Finally, failing to tailor the presentation to the audience is a recipe for disaster. A presentation geared towards experienced financial analysts will differ significantly from one aimed at a board of directors with limited financial expertise. Remember, your goal is clear communication, not to impress with your technical prowess.

Financial Model Presentation Template

A well-structured presentation should follow a logical flow. A suggested template includes: an executive summary highlighting key findings; a section explaining the model’s methodology and assumptions; a section presenting the key results, supported by clear and concise visuals; a sensitivity analysis illustrating the impact of key assumptions; and finally, a conclusion summarizing the key implications and recommendations. Remember to keep it concise, focusing on the most important findings and their implications. This structure helps guide the audience through your findings in a clear and efficient manner, reducing the likelihood of confusion or misinterpretation. Think of it as a roadmap to understanding your financial masterpiece.

Model Auditing and Review

Financial models are the lifeblood of any serious financial decision, but like any complex system, they can develop unforeseen – and sometimes hilarious – glitches. Regular auditing isn’t just about catching errors; it’s about preventing a financial comedy of errors from unfolding before your very eyes. Think of it as a financial health check-up, ensuring your model is robust, reliable, and won’t spontaneously combust under pressure.

Regular model auditing and review are crucial for maintaining the accuracy, reliability, and integrity of your financial projections. Without a diligent audit process, even the most meticulously crafted model can become a source of misleading information, leading to poor decision-making and potentially disastrous consequences. Think of it as regularly servicing your car – you wouldn’t drive across the country without a check-up, would you?

Common Errors Found During Model Audits

Model audits often uncover a surprising variety of errors, ranging from simple typos to more complex logical flaws. These errors can significantly impact the accuracy of the model’s outputs. For example, a seemingly innocuous error in a single cell can propagate through the entire model, leading to wildly inaccurate projections. Imagine the chaos if a decimal point was misplaced in a revenue projection for a multi-billion dollar company!

- Incorrect formulas: A common error involves incorrect or incomplete formulas, leading to inaccurate calculations. For example, a simple addition error in a sum formula could throw off the entire financial statement.

- Circular references: These occur when a formula refers back to itself, creating a loop that prevents the model from calculating correctly. Picture a financial ouroboros, endlessly chasing its tail and never reaching a conclusion.

- Data inconsistencies: Discrepancies between data sources can lead to significant errors. Imagine using two different datasets for sales figures – the resulting model would be as reliable as a three-legged stool.

- Missing or incorrect assumptions: Overlooking key assumptions or using unrealistic assumptions can drastically skew the model’s output. This is like building a house on a foundation of sand – beautiful on the surface, but destined for collapse.

Steps Involved in Conducting a Thorough Model Audit

A comprehensive model audit involves a systematic review of various aspects of the model, including data sources, formulas, assumptions, and outputs. Think of it as a forensic accounting investigation, meticulously examining every detail to ensure accuracy and integrity.

- Data Validation: Verify the accuracy and consistency of all input data, comparing it to source documents and identifying any discrepancies.

- Formula Review: Check the accuracy and logic of all formulas used in the model, ensuring they are correctly calculating the desired outputs. This might involve using trace precedents and dependents to follow the flow of calculations.

- Assumption Review: Evaluate the reasonableness and relevance of all assumptions used in the model, considering their potential impact on the results.

- Output Analysis: Scrutinize the model’s outputs, comparing them to historical data and industry benchmarks to identify any inconsistencies or anomalies.

- Documentation Review: Examine the model’s documentation, ensuring it is clear, comprehensive, and up-to-date.

Best Practices for Documenting Model Changes and Updates

Maintaining a detailed audit trail of all model changes and updates is crucial for ensuring transparency and accountability. Think of it as keeping a meticulous diary of the model’s evolution, documenting every tweak, adjustment, and significant alteration. This makes it easy to track down the source of any errors and understand the model’s history.

A version control system, detailed comments within the model itself, and a change log are all valuable tools for tracking updates. This helps prevent confusion and ensures that everyone involved understands the current state of the model. Failing to do so can lead to a situation where nobody remembers why a particular assumption was made, resulting in a model that’s more confusing than a tax code.

Financial Model Audit Checklist

A comprehensive checklist ensures no stone is left unturned during the audit process. This checklist should be tailored to the specific model being audited, but here are some key areas to consider:

| Area | Checklist Item |

|---|---|

| Data Integrity | Verify data sources and accuracy |

| Data Integrity | Check for inconsistencies and errors |

| Formula Accuracy | Review all formulas for correctness |

| Formula Accuracy | Check for circular references |

| Assumptions | Assess the reasonableness of assumptions |

| Assumptions | Evaluate the sensitivity of results to changes in assumptions |

| Output Analysis | Compare outputs to historical data and benchmarks |

| Documentation | Review model documentation for completeness and clarity |

| Overall | Assess the overall reliability and validity of the model |

Specific Modeling Techniques

Financial modeling isn’t just about crunching numbers; it’s about choosing the right weapons for the financial battlefield. Selecting the appropriate modeling technique is crucial for accuracy and, let’s be honest, avoiding a spectacular spreadsheet-induced meltdown. Different techniques offer unique strengths and weaknesses, and a savvy modeler knows when to wield each one. This section delves into the exciting world of financial modeling techniques, comparing and contrasting their strengths and weaknesses, and illustrating their proper application. Think of it as a financial modeling Swiss Army knife – you’ll need the right tool for the job.

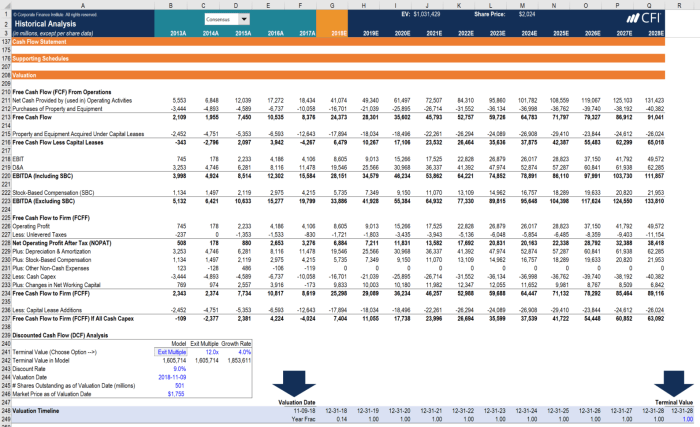

Discounted Cash Flow (DCF) Analysis

DCF analysis, the undisputed heavyweight champion of valuation, projects future cash flows and discounts them back to their present value. This provides an intrinsic value estimate, free from the whims of the market. The core of DCF is the time value of money – a dollar today is worth more than a dollar tomorrow (unless you’re investing in a particularly bizarre time-bending venture).

Advantages: DCF provides a theoretically sound valuation, focusing on fundamental business drivers rather than market sentiment. It’s particularly useful for valuing companies with consistent cash flows and predictable growth prospects. Think established businesses with a clear path to profitability – not your average internet startup promising to disrupt everything.

Disadvantages: DCF’s reliance on future projections makes it sensitive to assumptions. Small changes in growth rates or discount rates can significantly impact the valuation. Furthermore, it can be challenging to accurately predict long-term cash flows, particularly for companies operating in rapidly changing industries. Imagine predicting the iPhone’s success in 2006 – even the smartest minds struggled!

Example: Valuing a mature, stable utility company with predictable revenue streams and low capital expenditure needs is ideally suited for DCF. Conversely, valuing a high-growth tech startup with uncertain future cash flows would be less appropriate.

Comparable Company Analysis

This technique, often referred to as “comps,” involves comparing the valuation multiples (e.g., Price-to-Earnings ratio, Enterprise Value-to-EBITDA) of a target company to those of similar publicly traded companies. It’s like comparing apples to apples (or, in the case of finance, comparing one highly leveraged tech company to another).

Advantages: Comps are relatively quick and easy to perform, leveraging readily available market data. They provide a market-based perspective, reflecting current investor sentiment and market conditions. Think of it as a quick temperature check on the market’s appetite for a particular type of company.

Disadvantages: Finding truly comparable companies can be difficult. Differences in size, growth rates, profitability, and capital structure can skew the comparison. Furthermore, comps are susceptible to market fluctuations and may not reflect the intrinsic value of the target company. Imagine comparing a small, local bakery to a multinational food conglomerate – the results might be less than illuminating.

Example: Valuing a newly established biotech firm might be best approached using comps, comparing it to other publicly traded biotech companies of similar size and stage of development.

Choosing the Right Technique

The choice of modeling technique depends heavily on the specific circumstances. For stable, cash-generating businesses, DCF is often preferred. For companies with limited historical data or those operating in rapidly evolving industries, comps may be more appropriate. Often, a combination of techniques is employed to provide a more robust and reliable valuation. Think of it as a detective story – you need all the clues to solve the case.

Software and Tools

Choosing the right software is crucial for building robust and efficient financial models. The wrong tool can lead to frustration, inaccuracies, and even missed deadlines – a fate worse than a spreadsheet filled with #REF! errors. Let’s explore the options available and how to make the best choice for your needs.

Financial modeling software ranges from the ubiquitous spreadsheet to specialized, powerful packages. Each has its strengths and weaknesses, and the optimal choice depends on the complexity of the model, the team’s skillset, and the budget. We’ll examine popular options, highlighting their capabilities and limitations to help you navigate this crucial decision.

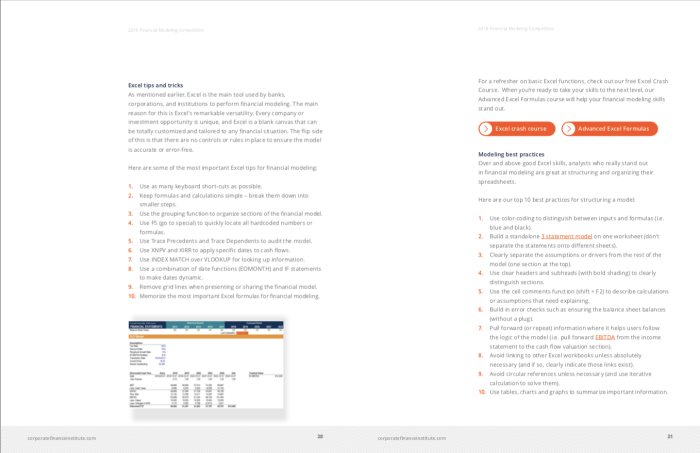

Excel’s Role in Financial Modeling

Excel remains the industry workhorse, despite its limitations. Its widespread familiarity, accessibility, and extensive built-in functions make it a starting point for many. However, its reliance on manual calculations increases the risk of errors, particularly in large or complex models. For instance, a simple mistake in a single cell can cascade through the entire model, leading to inaccurate projections and potentially disastrous consequences. Advanced features like VBA (Visual Basic for Applications) can help automate tasks and improve efficiency, but require specialized programming skills. Nevertheless, Excel’s ease of use and accessibility for data visualization remain significant advantages, particularly for smaller, less complex models.

Dedicated Financial Modeling Software

Dedicated software packages offer features designed specifically for financial modeling, often including functionalities absent in Excel. These packages typically provide advanced features like built-in error checking, data validation tools, and enhanced reporting capabilities. They often boast more robust functionalities for scenario planning, sensitivity analysis, and complex calculations. Examples include dedicated packages like Alteryx, Anaplan, or Vena. These tools often come with a higher price tag and a steeper learning curve compared to Excel, but can offer significant advantages for large-scale or highly complex projects. For example, a large multinational corporation forecasting revenue across multiple regions and product lines might find a dedicated package significantly more efficient and reliable than attempting the same in Excel.

Software Comparison, Financial Modeling Best Practices

Selecting the right software involves carefully weighing the pros and cons of each option against the project’s requirements. A simple model might be perfectly suitable for Excel, while a complex, multi-user project necessitates a more sophisticated solution.

| Software | Key Features | Advantages | Disadvantages | Pricing |

|---|---|---|---|---|

| Microsoft Excel | Widely available, versatile, VBA scripting, built-in functions (SUM, IF, VLOOKUP, etc.) | Familiar, inexpensive (often included with Office suite), accessible | Prone to errors, limited collaboration features, can become unwieldy for large models | Varies depending on Office suite subscription |

| Alteryx | Data blending, workflow automation, predictive modeling, advanced analytics | Powerful data manipulation capabilities, robust workflow management | Steeper learning curve, higher cost, specialized skills may be required | Subscription-based, pricing varies depending on features and user licenses. |

| Anaplan | Cloud-based, collaborative modeling, real-time data integration, advanced planning features | Excellent for large-scale planning and forecasting, strong collaboration features | High initial investment, requires specialized training | Subscription-based, pricing varies significantly based on usage and features. |

| Vena | Cloud-based, integrated with Excel, workflow automation, robust reporting | Combines the familiarity of Excel with enhanced collaboration and automation features | Can be expensive, requires training | Subscription-based, pricing varies based on features and users. |

Conclusive Thoughts: Financial Modeling Best Practices

Mastering financial modeling best practices isn’t just about crunching numbers; it’s about crafting a compelling narrative that informs decision-making. By focusing on data integrity, model structure, clear communication, and thorough auditing, you’ll transform your financial models from mere spreadsheets into powerful tools capable of driving strategic insights. So, ditch the guesswork, embrace the best practices, and prepare to impress (and perhaps even slightly bewilder) your audience with the elegance and accuracy of your financial modeling prowess. Remember, a well-structured model is a thing of beauty – a testament to your analytical skills and attention to detail.

FAQs

What’s the difference between a deterministic and a stochastic model?

Deterministic models use fixed inputs and produce a single, predictable outcome. Stochastic models incorporate randomness and probability, resulting in a range of potential outcomes.

How do I handle circular references in my model?

Circular references (where formulas depend on each other) should be carefully examined and corrected. They often indicate a flaw in the model’s logic and can lead to inaccurate results. Excel provides tools to identify and resolve these.

What are some common mistakes to avoid in financial modeling?

Common mistakes include using inaccurate data, neglecting sensitivity analysis, poor model structure, and ineffective communication of results. Regular auditing helps mitigate these risks.