Financial Modeling Best Practices: Forget boring spreadsheets! This isn’t your grandpappy’s accounting class. We’re diving headfirst into the thrilling world of financial modeling, where accurate data battles rogue formulas, and sensitivity analysis is the ultimate superhero. Prepare for a rollercoaster ride of best practices, because even numbers can be wild.

This guide tackles the crucial aspects of building robust and reliable financial models. From ensuring data integrity (because garbage in, garbage out is a very real and very embarrassing problem) to mastering the art of model presentation (so your boss doesn’t spontaneously combust from boredom), we’ll cover it all. Get ready to level up your financial modeling game – and maybe even impress your colleagues with your newfound expertise.

Data Integrity and Validation

Garbage in, garbage out. This age-old adage is particularly true in the world of financial modeling. A model is only as good as the data it uses, and inaccurate data can lead to disastrously wrong conclusions, potentially costing your company millions (or, let’s be honest, embarrassing you in front of the board). Ensuring data integrity is paramount; it’s the bedrock upon which your financial fortress is built. Think of it as the foundation of a skyscraper – you wouldn’t build a skyscraper on a cracked foundation, would you?

Identifying and Correcting Data Errors

Identifying and correcting data errors requires a multi-pronged approach, combining automated checks with good old-fashioned human scrutiny. Simply put, don’t trust your model blindly. Regularly review your data sources, comparing them against other reliable sources whenever possible. Look for outliers – those pesky data points that seem wildly out of sync with the rest. These are often indicative of errors, whether it’s a typo, a data entry mistake, or something more sinister. Reconcile your data frequently, and remember that even small errors can compound and snowball into significant inaccuracies.

Data Validation Techniques

Several techniques can be employed to ensure data integrity. These methods range from simple checks to sophisticated algorithms, all aimed at catching those sneaky errors before they wreak havoc. For example, range checks ensure that data falls within acceptable limits (e.g., a percentage cannot be greater than 100%). Cross-field checks compare data across different fields to ensure consistency (e.g., the sum of individual line items should equal the total). Data type checks verify that data conforms to the expected format (e.g., dates are in the correct format, numbers are numeric). Finally, consistency checks compare data against historical trends or industry benchmarks to identify potential anomalies. Consider using a combination of these methods for robust validation.

Data Integrity Checklist

A well-structured checklist is your best friend in the fight against data errors. Here’s a sample checklist to ensure data integrity throughout your modeling process:

- Source Verification: Verify the reliability and accuracy of all data sources.

- Data Cleaning: Cleanse the data by removing duplicates, correcting inconsistencies, and handling missing values.

- Range Checks: Implement range checks to ensure data falls within acceptable limits.

- Cross-Field Checks: Use cross-field checks to ensure consistency across different fields.

- Data Type Checks: Verify data types to prevent unexpected results.

- Consistency Checks: Compare data against historical trends and benchmarks.

- Audit Trail: Maintain a comprehensive audit trail to track data changes and modifications.

- Regular Review: Regularly review and validate data to identify and correct errors promptly.

Comparison of Data Validation Methods

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Range Check | Ensures data falls within predefined limits. | Simple to implement, effective for identifying obvious errors. | May miss subtle errors; requires defining appropriate ranges. |

| Cross-field Check | Compares data across different fields to ensure consistency. | Identifies inconsistencies and errors related to data relationships. | Can be complex to implement for intricate data relationships. |

| Data Type Check | Verifies that data conforms to the expected format. | Prevents errors caused by incorrect data types. | May require significant upfront effort in defining data types. |

| Consistency Check | Compares data against historical trends or benchmarks. | Identifies unusual patterns and potential anomalies. | Requires access to historical data and relevant benchmarks. |

Model Structure and Design

Building a financial model is like constructing a skyscraper: a chaotic jumble of numbers will inevitably collapse under its own weight. A well-structured model, however, stands tall, providing clear, reliable insights. This section explores the architectural principles that transform a spreadsheet from a potential disaster into a robust, insightful tool.

Effective model organization is crucial for both the model’s creator and any future users (including your future self, who may not remember the brilliance of your initial design). A poorly structured model is a breeding ground for errors and frustration, leading to missed deadlines and questionable business decisions. Think of it as the difference between finding your keys in a neatly organized drawer versus hunting through a mountain of junk. The former saves time and sanity; the latter… well, let’s just say it’s less fun.

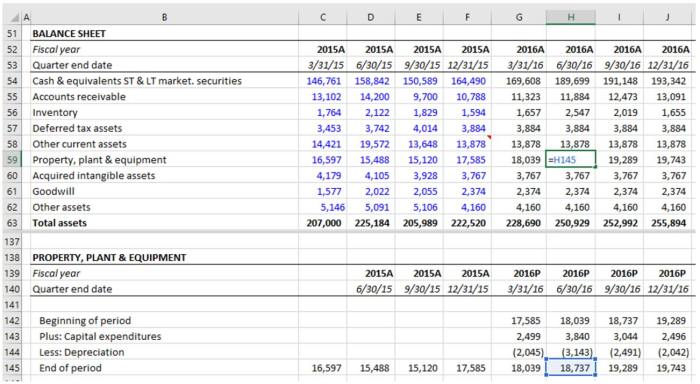

Modularity in Financial Models

Modularity, the practice of breaking down a large model into smaller, self-contained units, is the cornerstone of effective model design. Each module focuses on a specific aspect of the business, such as revenue projections, operating expenses, or capital expenditures. This approach allows for easier debugging, updating, and collaboration. Imagine trying to fix a faulty component in a complex machine versus a modular system where you can simply swap out the broken part. The latter is significantly less headache-inducing. This compartmentalization significantly reduces the risk of errors cascading throughout the entire model, leading to more reliable results. A change in one module doesn’t automatically trigger a chain reaction of unintended consequences across the entire model.

Model Documentation Best Practices

Clear and concise documentation is the lifeblood of any successful financial model. Think of it as the instruction manual for your meticulously crafted machine. Without it, even the most brilliant design will be rendered useless. Thorough documentation includes clear descriptions of inputs, assumptions, calculations, and outputs. This allows others (and your future self) to understand the model’s logic and easily make updates or modifications. A well-documented model acts as a living, breathing testament to your financial modeling prowess. It ensures transparency, accountability, and maintainability, making it a valuable asset for years to come. Poor documentation, on the other hand, leads to confusion, errors, and a whole lot of head-scratching.

Examples of Model Architectures

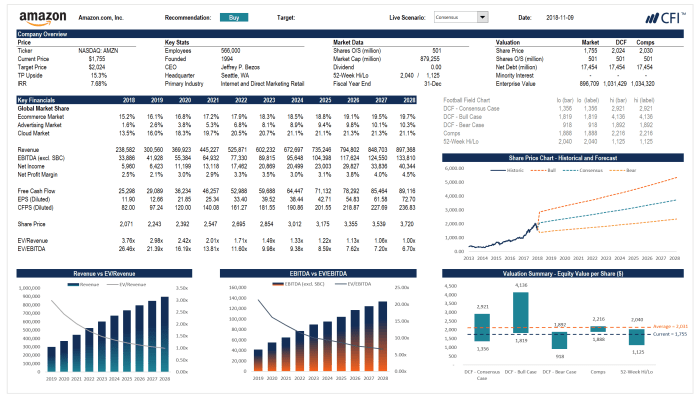

Several common model architectures exist, each tailored to specific needs. The three-statement model, linking the income statement, balance sheet, and cash flow statement, provides a comprehensive overview of a company’s financial performance. This is a workhorse of financial modeling, offering a holistic view of the business’s financial health. Alternatively, a discounted cash flow (DCF) model is often used for valuation purposes, projecting future cash flows and discounting them back to their present value to determine a company’s intrinsic worth. Choosing the right architecture depends on the specific analysis required and the data available.

Best Practices for Naming Conventions

Consistent naming conventions are essential for model clarity and maintainability. Inconsistent naming can quickly lead to confusion and errors, especially in large and complex models. Imagine trying to navigate a city with streets named randomly – it’s a recipe for disaster! A well-defined naming system makes the model easier to understand, debug, and maintain. Consider these best practices:

- Use descriptive names that clearly indicate the purpose of each cell, range, or sheet.

- Maintain consistency in capitalization and spacing (e.g., consistently use camel case or underscores).

- Avoid using abbreviations or jargon unless widely understood within the context of the model.

- Use a hierarchical naming structure to reflect the model’s organization (e.g., Revenue_Sales_RegionA).

- Create a naming convention guide and distribute it to all model users to maintain consistency.

Assumptions and Sensitivity Analysis: Financial Modeling Best Practices

Financial modeling isn’t just about crunching numbers; it’s about building a robust, believable story. And like any good story, it needs a solid foundation – that foundation being clearly defined and documented assumptions. Without this, your model is a house of cards, ready to crumble at the slightest gust of unexpected economic wind. Sensitivity analysis is the sturdy scaffolding that helps you understand how those cards might react to different breezes.

Assumptions are the bedrock of any financial model. They represent the future projections, market conditions, or operational choices that underpin your calculations. Think of them as the educated guesses you make to fill in the gaps where perfect foresight is, sadly, unavailable. Documenting these assumptions meticulously is crucial, not only for transparency and auditability but also to ensure that anyone – even your replacement, who may or may not be a financial modeling ninja – can understand and potentially update your work.

Defining and Documenting Model Assumptions

Clearly defined assumptions prevent ambiguity and ensure consistency. Each assumption should be explicitly stated, along with its source and rationale. For example, instead of simply stating “Revenue growth of 5%,” you should specify: “Revenue growth of 5% annually, based on market research reports indicating consistent growth in the target market segment over the past three years and projections from industry analysts predicting continued expansion.” This level of detail allows for easier scrutiny and potential adjustments as new information becomes available. Failure to do so can lead to misunderstandings and, even worse, inaccurate conclusions. Consider using a dedicated assumptions sheet within your model, neatly organized and clearly labelled. Think of it as the model’s “legend” – essential for understanding the map (the model itself).

Performing Sensitivity Analysis

Sensitivity analysis is where the fun begins (for the analytically inclined, at least!). It involves systematically changing key assumptions, one at a time, to observe their impact on the model’s output. This allows you to identify which assumptions are most critical and have the biggest impact on your bottom line. For example, if you’re modeling a new product launch, you might want to test the sensitivity of your projected sales to changes in market penetration rate, pricing, and marketing spend. The results will highlight the assumptions requiring the most careful consideration and monitoring. A simple “what-if” scenario is not sufficient; a rigorous and methodical approach is necessary.

Identifying and Managing Model Risk

Model risk is the potential for loss arising from inaccuracies or limitations in the financial model itself. Identifying and managing this risk is paramount. This includes ensuring data integrity (which we’ve already covered, thank goodness!), verifying the accuracy of formulas, and testing the model’s robustness under various scenarios. A well-structured model with clear documentation and thorough testing significantly reduces this risk. Remember, even the most sophisticated model is only as good as the data and assumptions it’s built upon. Ignoring potential flaws is like sailing a ship without a map – potentially exciting, but ultimately disastrous.

Scenarios to Test Model Robustness

Testing the robustness of your model involves running various scenarios that simulate different economic conditions or operational challenges. Consider scenarios such as a sudden drop in sales, an increase in interest rates, or a change in regulatory environment. This stress-testing approach reveals the model’s weaknesses and identifies areas needing improvement. For example, if your model relies heavily on a single revenue stream, you might want to test its sensitivity to a significant decline in that stream. This is not merely an academic exercise; it’s a crucial step in building a model that can withstand the inevitable bumps in the road.

Impact of Different Assumptions on Key Model Outputs

The following table demonstrates the impact of varying assumptions on key model outputs. Remember, these are illustrative examples and should be tailored to the specific model being developed.

| Assumption | Value | Net Present Value (NPV) | Internal Rate of Return (IRR) |

|---|---|---|---|

| Discount Rate | 8% | $1,000,000 | 15% |

| Discount Rate | 10% | $800,000 | 12% |

| Revenue Growth | 5% | $1,000,000 | 15% |

| Revenue Growth | 3% | $900,000 | 13% |

| Initial Investment | $10,000,000 | $1,000,000 | 15% |

| Initial Investment | $12,000,000 | $800,000 | 12% |

Formula Auditing and Error Detection

Financial modeling isn’t just about crunching numbers; it’s about building a robust, reliable, and (dare we say it?) beautiful machine. A well-audited model is the difference between a confident presentation and a panicked scramble for explanations. Think of it like this: you wouldn’t launch a rocket without rigorous checks, would you? Similarly, launching a financial model without proper auditing is a recipe for disaster (and possibly a very embarrassing meeting).

Auditing formulas and detecting errors is the detective work of financial modeling. It’s about meticulously examining every formula, every cell reference, and every assumption to ensure the model’s integrity. This involves more than just hoping for the best; it requires a systematic approach, a keen eye for detail, and perhaps a slightly obsessive personality. Fortunately, Excel offers several tools to assist in this vital process, turning you from a worried modeler into a confident maestro.

Methods for Auditing Formulas and Identifying Potential Errors

Identifying errors in financial models requires a multi-pronged approach. Excel’s Formula Auditing tools, such as Trace Precedents and Trace Dependents, are invaluable. Trace Precedents visually highlights the cells that feed into a particular formula, allowing you to follow the data’s journey through the model. Trace Dependents, conversely, shows which cells rely on a specific cell’s value. Imagine these tools as forensic investigators, meticulously tracing the flow of data to pinpoint the source of any discrepancies. Combining these visual tools with manual checks, especially in complex models, provides a comprehensive audit. For instance, if a final profit figure seems unusually high, tracing precedents can quickly highlight the source of the error – perhaps an incorrect input or a flawed formula in an earlier calculation.

Debugging Techniques in Financial Modeling

Debugging is the art of finding and fixing those pesky errors. One effective technique is the “divide and conquer” method. Instead of trying to understand the entire model at once, break it down into smaller, manageable sections. Test each section individually, ensuring each component works correctly before integrating it into the larger model. Another useful strategy is the use of intermediate calculations. Instead of cramming a complex calculation into a single cell, break it down into smaller, more understandable steps, making it easier to identify where errors occur. For example, instead of calculating net profit directly from revenue and expenses, you might calculate gross profit first, then deduct operating expenses, then interest, etc. This makes the logic of the calculation transparent and facilitates easier error detection.

Importance of Cell Referencing and Named Ranges, Financial Modeling Best Practices

Cell referencing and named ranges are the backbone of a well-structured model. Using absolute cell references ($A$1) prevents errors when copying formulas, ensuring that the correct cells are always referenced. Named ranges, on the other hand, give meaningful names to groups of cells, making formulas more readable and less prone to errors. For example, instead of using “=SUM(A1:A100)”, you can name the range “Revenue” and use “=SUM(Revenue)”. This improves readability and reduces the risk of accidentally referencing the wrong cells. Imagine trying to decipher a formula with hundreds of cell references – a nightmare! Named ranges transform this into a clear, concise, and understandable calculation.

Common Formula Errors and Their Corrections

Let’s face it, everyone makes mistakes. Even seasoned financial modelers encounter errors. Some common pitfalls include incorrect cell referencing (referencing the wrong cell, or forgetting to use absolute referencing when copying formulas), using the wrong operators (e.g., using “+” instead of “*”), and circular references (a formula referencing itself directly or indirectly). Another common mistake is using inconsistent data types, mixing text and numbers in calculations, leading to unexpected results. The solution often lies in carefully reviewing formulas, using Excel’s error-checking tools, and employing good debugging practices. Always double-check your formulas, especially those involving complex calculations or large datasets.

Flowchart Illustrating the Steps Involved in Auditing a Financial Model

Imagine a flowchart resembling a detective’s investigation board. It would begin with a “Start” node, followed by a box indicating “Review Model Assumptions and Inputs.” This leads to “Check Formula Logic and Cell Referencing,” which then branches into “Use Trace Precedents and Trace Dependents.” Next, we have “Identify and Correct Errors,” followed by “Test Model with Different Inputs.” Finally, we reach the “End” node, signifying a successfully audited model, ready to confidently present to your stakeholders. This visual representation of the auditing process provides a structured and systematic approach to ensure thoroughness.

Presentation and Communication

Let’s face it, even the most meticulously crafted financial model is useless if nobody understands it. A model’s value isn’t solely determined by its accuracy; it’s equally, if not more so, dependent on its ability to effectively communicate insights to its intended audience. Think of it as a delicious cake – you can bake the most exquisite cake, but if you don’t present it beautifully, it might not get the appreciation it deserves. So, let’s learn how to make our financial models both accurate and irresistibly appealing.

Effective communication of model results is crucial for influencing decisions and ensuring buy-in from stakeholders. Remember, your audience likely isn’t as enamored with intricate formulas as you are. Therefore, translating complex data into easily digestible formats is paramount. This involves not just the visual presentation but also the narrative accompanying the data. A compelling story woven around the numbers significantly increases the impact and persuasiveness of your model’s findings.

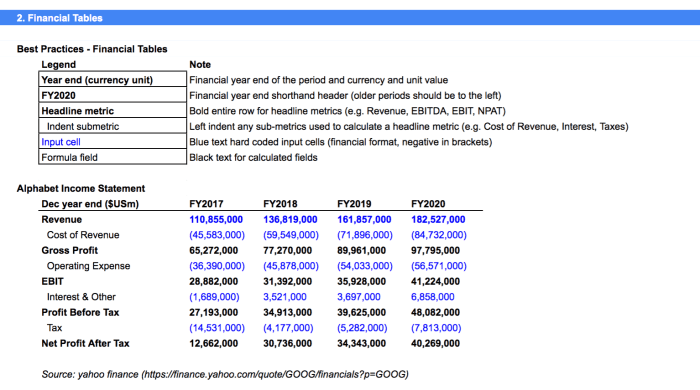

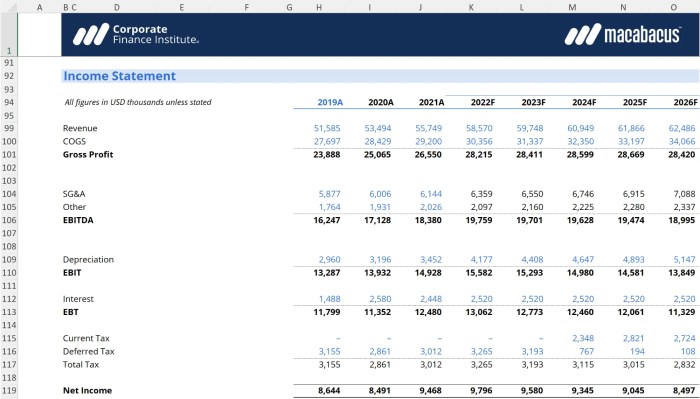

Clear and Concise Model Presentation

A well-structured model presentation should follow a logical flow, guiding the audience through the key assumptions, calculations, and results. Avoid overwhelming the reader with excessive detail upfront. Start with a concise executive summary highlighting the most important findings and implications. Then, progressively delve into the specifics, providing sufficient context and explanations without losing the audience in a sea of numbers. Think of it as a carefully curated journey, not a chaotic expedition. A well-structured presentation increases the likelihood of your model’s findings being understood and acted upon. Consider using clear headings, subheadings, and bullet points to break down complex information into manageable chunks.

Effective Methods for Communicating Model Results to Stakeholders

Tailoring your communication style to your audience is key. A presentation to the board of directors will differ significantly from a presentation to a junior analyst. For executive-level audiences, focus on the high-level implications and strategic recommendations. For more technical audiences, provide greater detail on the model’s methodology and underlying assumptions. Remember, effective communication involves active listening and adapting your approach based on the audience’s questions and feedback. A simple, yet effective technique is to anticipate potential questions and address them proactively within your presentation.

Best Practices for Creating Visually Appealing and Informative Charts and Graphs

Charts and graphs are your secret weapons in transforming complex data into easily digestible visuals. Choose chart types appropriate for the data being presented. Avoid clutter by using clear and concise labels, a consistent color scheme, and a minimal amount of text. A well-designed chart should instantly communicate the key message without requiring extensive explanation. Consider using high-quality visuals and ensuring the charts are easily readable, even when printed in black and white. Remember, a picture is worth a thousand words – especially when those words are financial projections.

Examples of Effective Model Visualizations

Imagine a waterfall chart illustrating the impact of various factors on a company’s projected net income. The visual representation of each contributing factor, from revenue streams to operating expenses, makes it immediately clear where the greatest impact lies. Another example could be a simple bar chart comparing the projected market share of different competitors, offering a quick and easy comparison. Finally, a line graph showing the projected growth of a key metric over time allows for the easy identification of trends and potential inflection points. These are just a few examples; the key is to select the visualization that best highlights the key insights of your model.

Chart Types Suitable for Various Financial Data

| Chart Type | Suitable for | Example |

|---|---|---|

| Bar Chart | Comparing different categories of data (e.g., revenue by product line) | Comparing sales figures across different regions. |

| Line Chart | Showing trends over time (e.g., revenue growth) | Illustrating the change in a company’s stock price over a year. |

| Pie Chart | Showing proportions of a whole (e.g., revenue breakdown by segment) | Representing the percentage of total costs attributed to different expense categories. |

| Scatter Plot | Showing the relationship between two variables (e.g., correlation between advertising spend and sales) | Analyzing the correlation between marketing investment and revenue generation. |

| Waterfall Chart | Showing the cumulative effect of positive and negative contributions to a final result (e.g., net income) | Demonstrating the impact of various income and expense items on a company’s profit. |

Version Control and Collaboration

Financial modeling, especially in collaborative environments, can be a chaotic free-for-all akin to a three-legged race involving caffeinated squirrels. Without a robust version control system, tracking changes, resolving conflicts, and maintaining model integrity becomes a Herculean task, potentially leading to inaccurate forecasts, missed deadlines, and a general sense of impending doom. Implementing a clear version control strategy is crucial for sanity and success.

Version control systems provide a structured approach to managing changes made to a financial model over time. Think of it as a detailed history book of your model, meticulously documenting every tweak, adjustment, and accidental deletion (we’ve all been there). This history allows you to easily revert to previous versions if errors are discovered, compare different iterations, and understand the evolution of your model’s logic and assumptions. It’s like having a time machine for your spreadsheets, but without the paradoxes (mostly).

Methods for Managing Different Model Versions

Several methods exist for managing model versions, ranging from simple file naming conventions (e.g., “Model_v1.xlsx,” “Model_v2_Revised.xlsx”) to sophisticated version control software. Simple methods are suitable for small projects with few collaborators, while more complex systems are necessary for larger, more complex models involving multiple users. The choice depends on the project’s size, complexity, and the team’s technical expertise. A well-defined versioning strategy, regardless of the method employed, is essential for clarity and traceability. Consider using a consistent naming convention that clearly indicates the version number and any significant changes.

Best Practices for Collaborative Modeling

Effective collaboration requires clear communication, defined roles, and a shared understanding of the modeling process. To avoid the dreaded “merge conflicts” – where two users simultaneously edit the same cell, resulting in a spreadsheet meltdown – establish a clear workflow. This might involve designating specific sections of the model to individual team members, implementing a review process before merging changes, or using version control software with robust merge capabilities. Regular check-ins and open communication are key to keeping everyone on the same page and preventing conflicts before they arise.

Tools and Techniques for Version Control

A variety of tools can facilitate version control. Simple solutions include using cloud storage services with version history (like Google Drive or Microsoft OneDrive), which automatically saves previous versions of files. For more advanced control and collaboration, consider dedicated version control systems such as Git, often used in conjunction with platforms like GitHub or GitLab. These systems provide granular control over changes, allowing for branching, merging, and conflict resolution. While the learning curve might seem steep initially, the long-term benefits of improved collaboration and model integrity are significant. Imagine the peace of mind!

Strategies for Effective Communication and Collaboration

Effective communication is the bedrock of any successful collaborative effort. Here are some strategies to foster seamless collaboration among modelers:

- Establish clear communication channels (e.g., project management software, regular team meetings).

- Define roles and responsibilities for each team member.

- Use a shared model repository accessible to all collaborators.

- Implement a formal review process for all model changes.

- Utilize collaborative editing tools that allow multiple users to work on the same model simultaneously.

- Document all assumptions, changes, and decisions made throughout the modeling process.

- Schedule regular check-in meetings to discuss progress and address any issues.

Closing Summary

So there you have it – a whirlwind tour through the often-overlooked, yet utterly crucial world of financial modeling best practices. Remember, a well-structured, meticulously audited model isn’t just about crunching numbers; it’s about telling a compelling story with data. A story that will hopefully lead to fewer panicked calls at 2 AM and more celebratory champagne toasts. Now go forth and model responsibly (and maybe, just maybe, have a little fun while you’re at it).

FAQ Corner

What’s the best software for financial modeling?

While Excel reigns supreme for its accessibility and widespread use, specialized software like Python with libraries like Pandas offer greater power and scalability for complex models. The “best” choice depends on your needs and comfort level – think of it like choosing between a trusty bicycle and a high-performance sports car.

How do I handle circular references in my model?

Circular references are the bane of any modeler’s existence! Excel will usually flag them, but tracking them down requires detective-like skills. Carefully review your formulas, identify the loop, and restructure your model to break the cycle. It’s like untangling a particularly nasty ball of yarn – methodical and potentially frustrating, but ultimately rewarding.

What are some common mistakes to avoid?

Hardcoding values (instead of using cell references), neglecting proper documentation, and failing to perform sensitivity analysis are all rookie errors. Think of them as financial modeling’s version of tripping over your own feet – avoidable with a little care and attention.