Navigating the daily deluge of financial news can feel overwhelming. This guide provides a framework for understanding, analyzing, and effectively utilizing daily financial updates, empowering you to make more informed investment decisions. We’ll explore key components, market trends, and the psychological impact of constant market news, offering strategies for responsible consumption.

From identifying reliable sources and mitigating biases to understanding the nuances of various data representations, we aim to equip you with the tools necessary to confidently interpret financial information. This isn’t about predicting the market; it’s about developing a strategic approach to consuming financial news to support your investment goals.

Defining “Financial News Updates Daily”

Financial News Updates Daily refers to the regular dissemination of information concerning the financial markets and the global economy. These updates provide a snapshot of the day’s most significant events, impacting investors, businesses, and anyone interested in understanding the financial landscape. The scope is broad, encompassing a wide array of sectors and providing insights into the interconnectedness of global finance.

Daily financial news updates cover a vast spectrum of information crucial for informed decision-making. Understanding these updates requires awareness of the different types of information included and the various sources available. The goal is to provide a comprehensive yet concise overview of the financial world’s daily activities.

Scope of Daily Financial News Updates

Daily financial news updates encompass a wide range of market sectors, including but not limited to equities (stocks), fixed income (bonds), commodities (oil, gold, etc.), foreign exchange (currencies), and derivatives (options, futures). Coverage extends to macroeconomic trends, geopolitical events, and their potential impact on financial markets. For example, a significant interest rate hike by a central bank will be reported alongside its potential effects on various asset classes and different geographical regions. Similarly, a major geopolitical event such as a conflict or trade agreement will be analyzed for its implications on global trade and investment flows.

Types of Information Included in Daily Financial News Updates

Daily financial news updates typically include several key types of information. Stock market movements, including indices like the Dow Jones Industrial Average, S&P 500, and NASDAQ Composite, are routinely reported, along with individual stock performance. Economic indicators such as inflation rates, unemployment figures, and gross domestic product (GDP) growth are also crucial components. Furthermore, company announcements, such as earnings reports, mergers and acquisitions, and new product launches, significantly impact market sentiment and are included in the updates. Finally, analysis and commentary from financial experts offer valuable context and interpretation of the day’s events.

Sources for Daily Financial News Updates

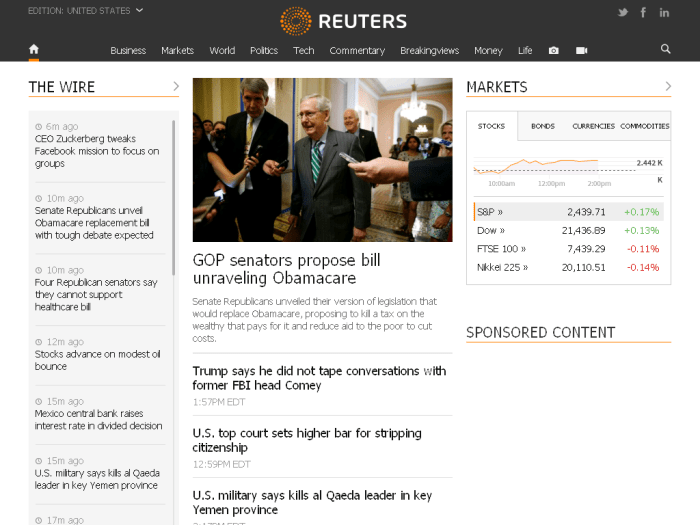

Reliable sources for daily financial news updates are crucial for accurate and unbiased information. Reputable news outlets such as the Wall Street Journal, Bloomberg, Reuters, and the Financial Times provide comprehensive coverage. Financial websites like Yahoo Finance, Google Finance, and MarketWatch offer real-time data and analysis. Specialized data providers like Refinitiv and Bloomberg Terminal provide in-depth market data and analytics, often used by professional investors and financial institutions. It’s important to critically evaluate the source’s reputation and potential biases when consuming financial news.

Key Components of Daily Financial News

Staying informed about daily financial news is crucial for investors of all levels, from seasoned professionals to those just starting their investment journey. Understanding the key components and their impact on different asset classes allows investors to make more informed decisions and navigate market volatility effectively. The type of news that holds significance varies depending on an investor’s profile, investment strategy, and risk tolerance.

Different types of financial news hold varying degrees of importance for different investor profiles. Retail investors, for example, may focus on news impacting individual stocks they own or are considering purchasing, while institutional investors might prioritize macroeconomic data and global market trends that affect their larger portfolios. Both groups, however, benefit from a broad understanding of the financial landscape.

Impact of Financial News on Asset Classes

Positive and negative news directly influences the performance of various asset classes. For instance, positive earnings reports typically lead to increased stock prices, while negative economic forecasts can cause a decline in stock values. Similarly, announcements of rising interest rates generally cause bond prices to fall, as investors seek higher yields elsewhere. Commodity prices, such as oil or gold, are heavily influenced by geopolitical events, supply chain disruptions, and global demand. A positive news event, like the discovery of a new oil field, could boost oil prices, while a negative event, like a major trade war, could depress commodity prices across the board.

For example, the announcement of unexpectedly strong job growth in the US often leads to a rise in stock prices, as investors anticipate increased consumer spending and corporate profits. Conversely, news of a significant natural disaster affecting a key agricultural region could negatively impact agricultural commodity prices, potentially impacting related stocks and funds. The 2008 financial crisis serves as a stark reminder of how negative news, particularly regarding mortgage-backed securities and the banking sector, can trigger widespread market declines across various asset classes.

Interpreting Financial News: Context and Nuance

The ability to interpret financial news accurately goes beyond simply reading headlines. Understanding the context and nuance of news reports is paramount for making sound investment decisions. A single data point, like a decrease in consumer confidence, needs to be viewed within the broader economic landscape, considering factors such as inflation rates, unemployment figures, and government policies. Furthermore, the source of the information and any potential biases need to be considered. A news report from a company’s press release may present a more optimistic outlook than an independent analysis from a reputable financial research firm.

Consider the example of a company announcing record profits. While this might seem like purely positive news, a closer examination might reveal that these profits were achieved through cost-cutting measures that negatively impacted employee morale and long-term sustainability. Similarly, a seemingly negative headline about a company’s declining sales could be offset by positive news about the company’s strategic pivot into a new, high-growth market. Careful analysis of the underlying details and consideration of the broader context are essential to avoid misinterpretations and make well-informed investment choices.

Analyzing Market Trends from Daily Updates

Daily financial news updates provide a constant stream of information, allowing investors to track market movements and make informed decisions. Analyzing these updates effectively requires understanding how to interpret various data points and employing suitable visualization techniques to identify trends and patterns. This section explores different methods for analyzing market trends using daily financial news and highlights potential pitfalls to avoid.

Data Visualization Techniques for Daily Financial News

Effective data visualization is crucial for understanding complex financial information quickly. Different methods offer unique advantages and disadvantages depending on the data and the insights sought. The following table compares several common techniques.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Line Charts | Show the trend of a single variable over time, such as stock price or index value. | Simple to understand, clearly shows trends and patterns over time. | Can become cluttered with multiple lines, may not show relationships between different variables effectively. |

| Bar Charts | Compare values across different categories, such as comparing the performance of different stocks or sectors. | Easy to compare values, visually appealing. | Not suitable for showing trends over time, can be difficult to interpret with many categories. |

| Scatter Plots | Show the relationship between two variables, such as correlation between stock price and trading volume. | Illustrates correlations effectively, reveals potential relationships. | Can be difficult to interpret with large datasets, may not show causal relationships. |

| Heatmaps | Represent data using color variations, showing the magnitude of a variable across different categories. For example, sector performance. | Visually highlights areas of high and low values, easy to identify outliers. | Can be difficult to interpret precise values, requires careful color selection. |

Using Daily News for Informed Investment Decisions

Consider a hypothetical scenario: Daily news reports consistently highlight increasing demand for electric vehicles and positive earnings reports from major EV manufacturers. Simultaneously, oil prices are showing a downward trend, suggesting weakening demand for fossil fuels. An investor analyzing this information might conclude that the electric vehicle sector is poised for growth. This could lead to an informed decision to invest in EV stocks or related ETFs, aligning the investment strategy with the observed market trends. This example demonstrates how combining multiple news sources and data points can contribute to a well-informed investment decision.

Potential Biases and Inaccuracies in Daily Financial News

Daily financial news reports, while valuable, are not without potential biases and inaccuracies. These include:

- Confirmation Bias: News outlets may selectively highlight information confirming pre-existing narratives or viewpoints.

- Analyst Bias: Financial analysts’ opinions and predictions can be influenced by their own interests or affiliations.

- Oversimplification: Complex financial situations are often simplified, potentially leading to misinterpretations.

- Sensationalism: News reports may exaggerate events to increase readership or viewership, potentially distorting the actual market situation.

- Data Manipulation: Selective presentation or manipulation of data can lead to misleading conclusions.

- Time Lags: News reports may not reflect the most up-to-date market conditions, particularly in rapidly changing markets.

The Impact of Daily Financial News on Investors

The constant barrage of financial news can significantly impact investor behavior, often leading to decisions driven by emotion rather than sound financial strategy. Understanding these psychological effects is crucial for navigating the market successfully and achieving long-term investment goals. The immediacy and often dramatic nature of daily updates can create a volatile emotional landscape for investors, influencing their perception of risk and reward.

Daily financial news significantly impacts investor psychology, often leading to emotional decision-making rather than rational analysis. The 24/7 news cycle, filled with market updates and expert opinions, can create a sense of urgency and fear of missing out (FOMO), prompting impulsive actions. This constant exposure can amplify existing biases and lead to poor investment choices.

Emotional Responses and Poor Investment Choices

Emotional responses to daily news frequently result in suboptimal investment decisions. For example, a sudden market downturn reported in the morning news might trigger fear and panic, leading investors to sell assets at a loss, locking in their losses instead of waiting for a potential market recovery. Conversely, overly positive news might inflate confidence, leading to over-investment in a specific asset, ignoring diversification principles and increasing exposure to risk. Consider the dot-com bubble of the late 1990s: fueled by positive media coverage and hype, many investors poured money into internet companies, regardless of their fundamental value, ultimately leading to significant losses when the bubble burst. Similarly, the 2008 financial crisis saw widespread panic selling driven by negative news coverage, exacerbating the market downturn.

Developing a Disciplined Investment Strategy

Creating and adhering to a well-defined investment strategy is essential to mitigate the negative effects of daily financial news. A disciplined approach involves setting clear financial goals, determining an appropriate asset allocation based on risk tolerance and time horizon, and regularly rebalancing the portfolio to maintain the desired allocation. This strategy should be based on long-term goals and not swayed by short-term market fluctuations. For instance, an investor with a long-term retirement plan should not panic and sell their holdings during a temporary market correction, as long as the underlying fundamentals of their investments remain strong. Instead, they should focus on their long-term strategy and continue contributing regularly. Ignoring the daily noise allows for a more rational and effective approach to investing. Regularly reviewing the investment strategy and making adjustments only when necessary, based on substantial changes in personal circumstances or long-term market trends, rather than daily news, is crucial for long-term success.

Effective Consumption of Daily Financial News

Staying informed about financial markets is crucial, but navigating the constant stream of news requires a strategic approach. Effective consumption involves filtering information efficiently, identifying reliable sources, and mitigating biases to make sound financial decisions. This section Artikels a step-by-step process for achieving this.

A Step-by-Step Guide to Processing Daily Financial News

Efficiently processing daily financial news involves prioritizing relevant information and filtering out noise. This structured approach minimizes time spent while maximizing the value gained.

- Prioritize Your Needs: Begin by identifying your specific investment goals and risk tolerance. This will help you focus on news directly relevant to your portfolio and investment strategy. For example, if you primarily invest in technology stocks, prioritize news related to the tech sector and avoid getting bogged down in details about agricultural commodities.

- Scan Headlines and Summaries: Quickly scan headlines and brief summaries from multiple sources to get a general overview of market movements and significant events. This provides context before diving into detailed articles.

- Focus on Key Data Points: Pay close attention to key economic indicators (e.g., GDP growth, inflation rates, unemployment figures), corporate earnings reports, and significant geopolitical events. These are the major drivers of market trends.

- Read Critically and Compare: Don’t accept information at face value. Compare information across multiple sources to identify inconsistencies or biases. Look for evidence-based reporting rather than opinion pieces.

- Summarize and Reflect: After reviewing the news, take a few minutes to summarize the key takeaways and reflect on their potential impact on your investments. This helps consolidate information and formulate a plan of action.

Identifying Reliable and Credible Sources of Financial Information

The credibility of your information sources significantly impacts your investment decisions. Reliable sources adhere to journalistic ethics, fact-checking, and transparency.

- Reputable Financial News Outlets: Seek information from established and well-respected financial news organizations with a history of accurate reporting, such as the Wall Street Journal, Financial Times, Bloomberg, and Reuters. These outlets often employ rigorous fact-checking processes.

- Government and Regulatory Agencies: Official government websites (e.g., the Federal Reserve, SEC) provide reliable economic data and regulatory announcements. These sources offer unbiased information directly from the source.

- Academic Research and Financial Journals: Peer-reviewed academic research and publications from reputable financial journals provide in-depth analysis and insights, although they may be less accessible to the average investor.

- Financial Professionals: Certified financial advisors and other qualified professionals can provide personalized guidance and insights based on your specific circumstances. However, it is important to choose a trusted and reputable advisor.

Diversifying News Sources to Avoid Confirmation Bias

Confirmation bias is the tendency to favor information that confirms pre-existing beliefs. Diversifying news sources helps mitigate this bias and provides a more balanced perspective.

Reading news from a variety of sources with different perspectives helps to create a more comprehensive understanding of market dynamics and reduces the risk of making decisions based on incomplete or biased information. For example, reading both bullish and bearish viewpoints on a particular stock can lead to a more nuanced and informed investment decision. This approach prevents the adoption of a single, potentially flawed narrative.

Visual Representation of Daily Financial News

Visualizing daily financial news effectively transforms complex data into easily digestible information for a wider audience. This enhances understanding and facilitates quicker decision-making for investors and market analysts alike. Clear and concise visuals are crucial for conveying the essence of often intricate market movements and economic indicators.

Infographic Illustrating Key Components of a Daily Financial News Report

An infographic summarizing a typical daily financial news report would ideally use a combination of charts, graphs, and icons to present key information. The data sources would include reputable financial news outlets (e.g., Bloomberg, Reuters, Financial Times), central bank websites (e.g., Federal Reserve, European Central Bank), and stock market data providers (e.g., Yahoo Finance, Google Finance). The visual elements could include a central map illustrating global market performance, using color-coded markers to represent market indices’ positive or negative movements. Smaller charts could show key economic indicators (inflation, unemployment, GDP growth) and major currency exchange rates. Icons could represent significant events affecting the markets, such as policy announcements or corporate earnings reports. The overall message should be a concise summary of the day’s most important market movements and their potential implications. The design should prioritize clarity and readability, using a consistent color scheme and easy-to-understand labels.

Correlation Between Financial Indicators

The following table illustrates the correlation between several key financial indicators frequently mentioned in daily financial news updates. Correlation does not imply causation, and the strength of relationships can vary over time.

| Indicator | Description | Correlation with other indicators | Example |

|---|---|---|---|

| Inflation Rate | The rate at which prices for goods and services are increasing. | Inversely correlated with bond yields (higher inflation often leads to higher yields); positively correlated with interest rates (central banks often raise rates to combat inflation). | High inflation often leads to increased interest rates by central banks to curb spending. |

| Interest Rates | The cost of borrowing money. | Positively correlated with bond yields (higher interest rates generally lead to higher bond yields); inversely correlated with stock prices (higher rates can make borrowing more expensive for companies and reduce investment). | A rise in interest rates can slow down economic growth as borrowing becomes more expensive. |

| Unemployment Rate | The percentage of the labor force that is unemployed. | Inversely correlated with economic growth (lower unemployment usually indicates stronger economic activity); often inversely correlated with inflation (low unemployment can lead to wage increases and higher inflation). | A low unemployment rate might indicate a healthy economy, but also a potential risk of rising inflation. |

| GDP Growth | The rate at which a country’s economy is growing. | Positively correlated with stock prices (strong economic growth often leads to higher corporate profits and higher stock valuations); positively correlated with employment levels (economic growth usually leads to more job creation). | Strong GDP growth often boosts consumer confidence and stimulates investment. |

Representing Stock Market Volatility Over Time

Stock market volatility can be effectively visualized using a line graph. The x-axis represents time (e.g., daily, weekly, monthly), and the y-axis represents a volatility measure, such as the VIX index (a measure of market expectation of near-term volatility). Each data point on the graph represents the volatility level at a specific point in time. A higher VIX value indicates higher volatility (more uncertainty and risk in the market), while a lower value indicates lower volatility (greater stability). For example, a sharp spike in the line graph would represent a period of increased market volatility, perhaps triggered by a major news event or economic announcement. Conversely, a relatively flat line would signify a period of low volatility and greater market stability. Analyzing the trend of the line graph over time provides insights into the overall market sentiment and risk appetite.

Final Conclusion

Successfully navigating the world of daily financial news requires a balanced approach: informed consumption, critical analysis, and a disciplined investment strategy. By understanding the inherent biases, utilizing effective data visualization, and focusing on long-term goals, investors can reduce emotional decision-making and improve their overall investment outcomes. Remember, consistent learning and adaptation are key to long-term success.

Quick FAQs

What are the risks of relying solely on free financial news sources?

Free sources may lack the depth of analysis, independent research, and fact-checking found in subscription-based services. They might also contain more advertising and promotional content influencing objectivity.

How often should I check financial news?

The frequency depends on your investment strategy and risk tolerance. Daily checks may increase anxiety for some; others may benefit from a weekly or even monthly review.

How can I avoid emotional decision-making based on daily news?

Develop a long-term investment plan, stick to it, and avoid frequent trading based on short-term market fluctuations. Consider automating investments to reduce emotional impulses.