Financial News Updates Daily: Dive headfirst into the exhilarating, terrifying, and occasionally hilarious world of daily financial news! From the breathless pronouncements of Bloomberg to the slightly more measured (but still dramatic) pronouncements of the Wall Street Journal, we’ll explore the rollercoaster ride of market information, deciphering the jargon, the biases, and the sheer, unadulterated drama that unfolds each and every day. Prepare for a journey into the heart of the financial beast – complete with charts, graphs, and the occasional existential crisis.

This exploration will cover the various types of financial news, their sources (and their inherent biases – because let’s be honest, everyone has an agenda), and the impact this information has on investors, both psychologically and financially. We’ll dissect how major economic indicators and corporate announcements ripple through the markets, and we’ll even attempt to make sense of those baffling candlestick charts. Buckle up, it’s going to be a wild ride!

Understanding the Scope of “Financial News Updates Daily”

Daily financial news updates are, as the name suggests, a whirlwind tour of the world’s money matters. They aim to provide a concise snapshot of the key events shaping markets, economies, and individual investor portfolios. Think of it as your daily dose of financial espresso – strong, concentrated, and hopefully, not too bitter.

Categories of Financial News in Daily Updates

Daily updates typically cover a broad spectrum of financial topics. These include macroeconomic news (think interest rate changes, inflation reports, GDP growth), market movements (stock indices, commodity prices, currency fluctuations), company-specific news (earnings reports, mergers and acquisitions, regulatory changes), and geopolitical events (which often have a significant impact on markets). There’s also a healthy dose of analysis and commentary thrown in, usually served with a side of speculation.

Sources of Financial News and Potential Biases

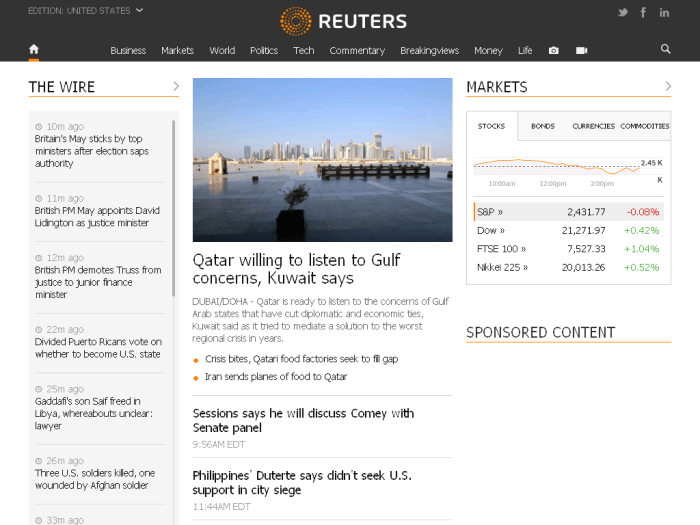

The financial news landscape is a crowded one. Major players like Bloomberg, Reuters, and the Wall Street Journal dominate, but countless smaller firms and independent analysts also contribute to the daily flow of information. It’s crucial to remember that no source is entirely unbiased. Bloomberg, for example, might lean slightly towards a more quantitative, data-driven approach, while the Wall Street Journal might give more space to in-depth analysis with a focus on longer-term trends. Smaller, less established sources might have their own agendas, potentially driven by advertiser influence or ideological leanings. A discerning consumer of financial news needs to be aware of these potential biases and critically evaluate the information presented.

Typical Audience and Information Needs

The audience for daily financial news updates is diverse, ranging from seasoned investors and portfolio managers to everyday individuals interested in keeping tabs on their investments or simply understanding the broader economic climate. Their information needs vary considerably. Experienced investors may require detailed market analysis and sophisticated data, while the average person might be more interested in clear, concise summaries of major events and their potential impact on their personal finances. Regardless of their level of expertise, all readers benefit from clear, accurate, and well-sourced reporting.

Comparison of Financial News Sources

| Source | Reliability | Speed of Reporting | Target Audience |

|---|---|---|---|

| Bloomberg | High | Very High | Professional investors, financial analysts, traders |

| Reuters | High | Very High | Broad audience, including professionals and general public |

| Wall Street Journal | High | High | Investors, business professionals, individuals interested in in-depth analysis |

Key Information Conveyed in Daily Financial News: Financial News Updates Daily

Daily financial news, much like a rollercoaster, offers a thrilling ride of ups and downs, fueled by a potent cocktail of economic indicators, corporate announcements, and market sentiment. Understanding the key information conveyed requires navigating this exciting, sometimes terrifying, landscape. Let’s unpack the essentials.

The most impactful types of financial news events are those that significantly affect investor confidence and market behavior. These events ripple through the financial world, causing tremors felt by everyone from seasoned traders to your grandma’s surprisingly savvy investment portfolio.

Impactful Financial News Events

Major economic indicators provide the bedrock upon which daily financial news is built. These numbers, often released by government agencies or international organizations, paint a picture of the overall economic health. A strong employment report, for example, often sends the markets soaring, while disappointing inflation figures can trigger a sell-off. Similarly, changes in interest rates, announced by central banks, have a profound and immediate impact on lending, borrowing, and investment strategies. These announcements can make or break a company’s quarterly earnings.

Influence of Major Economic Indicators, Financial News Updates Daily

Consider the impact of a surprise interest rate hike by the Federal Reserve. This event immediately affects bond yields, impacting the value of fixed-income securities. Furthermore, it influences borrowing costs for businesses and consumers, potentially slowing economic growth and affecting corporate profitability. Conversely, a positive GDP report suggests a robust economy, boosting investor confidence and driving stock prices higher. The ripple effect is substantial.

Influence of Corporate Announcements

Corporate announcements, from earnings reports to mergers and acquisitions, are the daily bread and butter of financial news. A company exceeding earnings expectations can trigger a sharp rise in its stock price, while a disappointing announcement can send it plummeting. Major mergers and acquisitions shake up entire industries, causing a chain reaction in related sectors. For example, the announcement of a significant merger between two tech giants could lead to increased competition and potentially affect the valuations of other companies in the same space. The impact can be felt across the board.

Presentation of Data in Daily Financial News Updates

Financial news thrives on data visualization. It’s not just about dry numbers; it’s about making sense of complex information quickly and effectively.

- Charts and Graphs: Line graphs illustrate trends over time (e.g., stock prices, GDP growth). Bar charts compare different data points (e.g., company profits, unemployment rates across states). Pie charts show proportions (e.g., market share distribution). These visuals are crucial for presenting complex data concisely.

- Numerical Data: Precise figures are essential, including percentages, ratios, and dollar amounts. These numbers give context and allow for in-depth analysis. For instance, reporting a company’s revenue growth as “15% year-over-year” is more impactful than simply stating “revenue increased”.

- Tables: Tables are used to organize and compare multiple data points, often across different companies or time periods. For example, a table comparing the performance of various tech stocks in the last quarter provides a quick overview of the market.

Impact and Interpretation of Financial News Updates

The daily deluge of financial news can be both exhilarating and terrifying, a rollercoaster of emotions for even the most seasoned investor. It’s a bit like watching a particularly dramatic soap opera, except the stakes involve your retirement fund, not just a messy love triangle. Understanding how to navigate this information landscape is crucial for maintaining a healthy relationship with your portfolio and your sanity.

The psychological impact of daily financial news is significant. Constant exposure to market fluctuations can trigger anxiety, fear, and even panic selling, leading investors to make rash decisions based on short-term market noise rather than long-term strategies. Conversely, a positive news cycle can inflate confidence to unrealistic levels, encouraging excessive risk-taking. The key is to approach financial news with a healthy dose of skepticism and a long-term perspective, remembering that the market is inherently volatile.

Market Trends Reflected in Daily Financial News Updates

Daily financial news acts as a reflection, albeit sometimes a distorted one, of prevailing market trends. Positive economic indicators, such as strong employment numbers or rising consumer confidence, are typically reported with enthusiastic headlines, often leading to increased market optimism and higher stock prices. Conversely, negative news, like rising inflation or geopolitical instability, tends to trigger sell-offs and market declines. However, it’s important to remember that correlation doesn’t equal causation; news reports often amplify existing trends rather than creating them. For example, a report on rising interest rates might simply reflect a pre-existing trend already priced into the market.

Identifying Potential Risks and Opportunities Based on Daily Financial News

Discerning genuine risks and opportunities from the daily noise requires critical analysis. Look beyond the sensational headlines and focus on the underlying fundamentals. A company’s earnings report, for example, might be presented negatively by one news outlet while another highlights its positive long-term growth prospects. Consider the source’s potential biases and look for corroborating information from multiple, reputable sources. A sudden surge in a specific sector’s stock prices might indicate a short-term speculative bubble rather than a sustainable growth trend. Similarly, a seemingly negative event might present a buying opportunity for long-term investors willing to ride out short-term volatility.

Hypothetical Scenario: Differential Impact of a News Event on Market Sectors

Imagine a sudden and unexpected announcement of a new, highly effective renewable energy technology. This event could have drastically different consequences across various market sectors. The renewable energy sector would likely experience a massive surge in investment, driving up stock prices significantly. Conversely, the fossil fuel industry might face a sharp decline as investors shift their capital towards cleaner alternatives. The automotive industry would also be impacted, with electric vehicle manufacturers benefiting from increased demand while traditional automakers might struggle to adapt quickly enough. This scenario illustrates how a single news event can create both winners and losers, highlighting the importance of diversification and a nuanced understanding of market dynamics. The ripple effects could even extend to related sectors, like battery technology or materials science, potentially creating unexpected opportunities in previously overlooked areas.

Visual Representation of Financial News Data

Financial news, often a whirlwind of numbers and jargon, becomes significantly more digestible—and dare we say, entertaining—when presented visually. Charts and graphs transform complex data into easily understood narratives, allowing even the most numerically challenged among us to grasp market trends and individual stock performances. Think of them as the visual spice that makes the otherwise bland financial data palatable.

Different chart types serve distinct purposes. Bar charts excel at comparing discrete data points, while line graphs illustrate trends over time. Pie charts show proportions, and candlestick charts provide a wealth of information about price movements within a specific time frame. The choice of chart depends entirely on the story the data is telling.

Bar Chart Illustrating Daily Stock Index Performance

This bar chart depicts the daily performance of three major stock indices: the Dow Jones Industrial Average (DJIA), the S&P 500, and the Nasdaq Composite, on a particular day (let’s say, October 26th, 2024, for the sake of example).

The horizontal (x) axis lists the three indices. The vertical (y) axis represents the percentage change from the previous day’s closing price. Let’s imagine the DJIA experienced a 0.5% increase, represented by a bar reaching the 0.5% mark on the y-axis. The S&P 500 shows a 0.8% increase, with a taller bar correspondingly, and the Nasdaq Composite had a more modest 0.2% gain, resulting in a shorter bar. Clear labeling of each bar with its corresponding percentage change would enhance readability and understanding. The chart’s title would be “Daily Stock Index Performance – October 26th, 2024,” making the information immediately clear. Different colors for each index would further improve visual distinction.

Line Graph Showing Currency Exchange Rate Fluctuation

This line graph illustrates the fluctuation of the Euro to US Dollar (EUR/USD) exchange rate over a week, from Monday to Friday. The horizontal (x) axis represents the days of the week, while the vertical (y) axis displays the exchange rate (e.g., 1 EUR = $x USD).

The line itself traces the daily closing rate. Let’s assume the week started at 1 EUR = $1.08 USD on Monday. The line would then show a slight dip to $1.07 on Tuesday, a climb back to $1.09 on Wednesday, a minor drop to $1.085 on Thursday, and finally, a rise to $1.10 on Friday. Key data points, such as the highest and lowest exchange rates for the week, would be clearly marked on the graph. A clear title, “EUR/USD Exchange Rate – Week of October 21st-25th, 2024,” and a legend indicating the currency pair would ensure clarity.

Interpreting Candlestick Charts

Candlestick charts are a unique way to represent price movements. Each “candle” encapsulates the price action over a specific period (e.g., one day). The “body” of the candle shows the range between the opening and closing prices. A green or white body indicates a closing price higher than the opening price (an up day), while a red or black body shows the opposite (a down day).

The “wicks” (or “shadows”) extending above and below the body represent the high and low prices for that period. A long upper wick suggests strong resistance at higher prices, while a long lower wick suggests strong support at lower prices. Short wicks imply less price fluctuation during that period. By analyzing the size and color of the bodies and the lengths of the wicks, traders can identify potential trends, reversals, and other significant price patterns. Understanding candlestick patterns takes practice, but mastering them provides a powerful tool for interpreting market sentiment.

Ethical Considerations in Financial News Reporting

The world of financial news reporting, while often glamorous (think sharp suits and hushed tones), isn’t immune to the occasional ethical minefield. Navigating these treacherous waters requires a keen sense of responsibility and a moral compass that wouldn’t be swayed by a billion-dollar bribe (okay, maybe a slightly smaller bribe). The stakes are high: inaccurate or biased reporting can cause significant financial harm, impacting investors and the overall market stability. It’s a delicate dance between informing the public and avoiding the temptation to manipulate the market.

Potential Ethical Dilemmas Faced by Financial News Reporters are numerous and varied. Reporters frequently face conflicts of interest, pressure to meet deadlines, and the temptation to sensationalize news for higher viewership or readership. The pressure to be first with a story can lead to cutting corners on fact-checking, resulting in the dissemination of false or misleading information. Furthermore, the close relationships that can develop between reporters and their sources, especially in the tight-knit world of finance, can create situations where objectivity is compromised. For example, a reporter might be hesitant to report negatively on a company if they have personal investments in that company, or if they rely on that company for future stories.

Accuracy and Objectivity in Financial News Reporting

Accuracy and objectivity are the cornerstones of ethical financial news reporting. Without them, the entire system crumbles. Accuracy involves meticulously verifying information from multiple reliable sources, ensuring that all facts are presented correctly and completely. Objectivity means presenting information without bias, avoiding language that could sway readers’ opinions, and offering a balanced perspective on different viewpoints. For example, reporting on a company’s earnings should include both positive and negative aspects, along with expert analysis from various perspectives. Failing to maintain accuracy and objectivity can lead to legal ramifications, loss of credibility, and significant damage to the public trust.

The Role of Fact-Checking and Verification

Fact-checking and verification are not mere afterthoughts; they are the lifeblood of reliable financial news. This involves cross-referencing information from multiple independent sources, scrutinizing financial statements and regulatory filings, and interviewing multiple experts to gain a comprehensive understanding of the subject matter. The process should involve rigorous scrutiny of data, figures, and claims. Imagine a reporter relying solely on a press release from a company without independently verifying the information. This could lead to the spread of false information, potentially causing significant financial losses for investors who rely on the reported information. A robust fact-checking process minimizes the risk of errors and ensures the integrity of the news.

Ethical Standards of Different Financial News Organizations

Different financial news organizations adhere to varying ethical standards, reflecting their individual cultures and priorities. Some organizations may have stricter guidelines and enforcement mechanisms than others. For example, organizations with a strong commitment to journalistic ethics might have dedicated fact-checking teams and rigorous editorial review processes. Others might prioritize speed and breaking news, potentially compromising accuracy or objectivity in the process. Comparing these organizations involves examining their codes of conduct, internal policies, and track records in handling ethical dilemmas. A reputation for accuracy and transparency often indicates a higher commitment to ethical reporting. Analyzing news coverage of similar events by different organizations can also reveal variations in their approaches to ethical considerations.

Final Review

So, there you have it – a whirlwind tour through the often-chaotic, always-interesting world of daily financial news. While predicting the market is akin to predicting the weather in a hurricane, understanding the information flow and its potential impact is crucial for navigating the financial landscape. Remember, while the news can be a powerful tool, it’s essential to approach it with a healthy dose of skepticism, a dash of humor, and a firm grip on your investment strategy. After all, even the most seasoned market veterans sometimes need a good laugh – and maybe a stiff drink – to get through the day.

Q&A

What’s the best time to check financial news?

Honestly? Whenever you can handle the potential emotional rollercoaster. There’s no magic time – just be prepared for volatility.

How can I avoid being manipulated by biased news?

Read multiple sources, compare their perspectives, and always question the underlying motivations. Think critically, and don’t invest based solely on a single headline.

Are financial news websites always accurate?

Sadly, no. Fact-checking and cross-referencing are crucial. Remember, even the most reputable sources can make mistakes (or have their own agendas).

What if I don’t understand a financial news report?

Don’t panic! There are plenty of resources available to help you understand the jargon. Start with reputable financial education websites and don’t hesitate to ask for help.