Financial Planning Apps Indonesia are rapidly transforming how Indonesians manage their finances. This burgeoning market, fueled by increasing smartphone penetration and a growing middle class, presents a fascinating case study in fintech adoption. From budgeting apps to investment platforms, Indonesian users are embracing digital tools to navigate the complexities of personal finance, leading to a vibrant and competitive landscape. But navigating this digital jungle requires a machete – or at least, a good understanding of the market.

This exploration delves into the size and growth of the Indonesian financial planning app market, examining user behavior, the competitive landscape, technological underpinnings, and future trends. We’ll uncover the secrets behind successful apps, analyze the challenges faced by both users and developers, and predict the trajectory of this exciting sector. Prepare for a rollercoaster ride through the world of Indonesian personal finance apps!

Market Overview of Financial Planning Apps in Indonesia: Financial Planning Apps Indonesia

Indonesia’s burgeoning digital economy is fueling explosive growth in fintech, and financial planning apps are riding the wave. With a massive, young, and increasingly tech-savvy population, the market presents a compelling opportunity for both established players and ambitious startups. However, navigating this exciting landscape requires understanding its nuances – from market size and demographics to regulatory hurdles and competitive dynamics.

Market Size and Growth Potential

The Indonesian financial planning app market is experiencing rapid expansion, driven by factors such as rising smartphone penetration, increased internet access, and a growing awareness of the importance of personal finance. While precise figures are difficult to obtain due to the fragmented nature of the market and the lack of comprehensive public data, estimates suggest a substantial market size with significant year-on-year growth. We can expect this growth to continue as more Indonesians embrace digital financial tools and seek convenient, accessible ways to manage their money. Think of it as the “gojek” effect, but for your finances – a convenient, readily available solution for a previously underserved market.

Key Demographic Segments

The primary users of financial planning apps in Indonesia are generally young adults (18-35 years old) and increasingly, the millennial and Gen Z demographics. These groups are digitally native, comfortable with online transactions, and actively seeking tools to help them achieve their financial goals, whether that’s saving for a down payment on a house, planning for retirement, or simply tracking their spending. However, the market is expanding to include older demographics as well, as financial literacy improves and trust in digital platforms grows.

Market Penetration Compared to Other Southeast Asian Countries

While Indonesia boasts a large and rapidly growing market for financial planning apps, its penetration rate lags behind some of its Southeast Asian neighbors, such as Singapore and Malaysia. This is partly due to factors such as lower levels of financial literacy, varying levels of internet access across the archipelago, and a more complex regulatory environment. However, Indonesia’s sheer population size and potential for growth mean it remains a highly attractive market for investors and app developers. The race is on, and the finish line is a fully digitally-enabled Indonesian financial landscape.

Regulatory Landscape

The Indonesian regulatory landscape for financial planning apps is evolving. Authorities are working to balance innovation with consumer protection, leading to a complex regulatory environment. Compliance with regulations related to data privacy, financial transactions, and licensing is crucial for app developers. This means navigating a path through various government bodies and ensuring adherence to evolving rules and standards. Think of it as a financial regulatory obstacle course – challenging, but with great rewards for those who successfully complete it.

Market Share of Top 5 Financial Planning Apps in Indonesia

It’s difficult to obtain precise, publicly available data on market share for all Indonesian financial planning apps. The market is dynamic and data often comes from private research firms. However, a hypothetical representation based on various reports and market analysis could look like this:

| App Name | Market Share (%) | User Base (Estimate) | Key Features |

|---|---|---|---|

| Finansialku | 25 | 5,000,000 | Budgeting, investment tracking, financial goal setting |

| Bareksa | 20 | 4,000,000 | Mutual fund investment, portfolio management |

| Bibit | 15 | 3,000,000 | Robo-advisory, automated investment |

| Ovo | 12 | 2,400,000 | Integrated payments, investment features |

| Akulaku | 8 | 1,600,000 | Buy now, pay later, investment options |

User Behavior and Needs

Navigating the wild world of Indonesian personal finance can feel like trying to assemble IKEA furniture without the instructions – challenging, occasionally frustrating, but ultimately rewarding. Financial planning apps are stepping in to be that much-needed Allen wrench, streamlining the process and hopefully preventing any unexpected trips to the emergency room (metaphorically speaking, of course). Let’s delve into the fascinating habits and desires of Indonesian users of these apps.

The typical Indonesian user journey with a financial planning app often begins with a moment of financial epiphany – perhaps a particularly jarring credit card bill, or the realization that their savings are about as substantial as a single grain of rice. From there, they download an app, often based on recommendations from friends or online reviews (word-of-mouth marketing is still king in Indonesia!). Initial exploration is typically focused on the most basic features, gradually expanding as comfort and trust develop. Many users see the app as a tool for monitoring expenses, while others aspire to more advanced features like investment planning or budgeting. It’s a journey of gradual empowerment, one meticulously tracked expense at a time.

Reasons for Utilizing Financial Planning Apps

Indonesians utilize financial planning apps for a variety of reasons, driven by a blend of practical needs and aspirational goals. The most common drivers include: better expense tracking, easier budgeting, improved savings management, and access to investment opportunities. The desire for greater financial control and transparency is a powerful motivator, especially among younger generations. Furthermore, many find the convenience and accessibility of mobile apps far superior to traditional banking methods. The ability to manage finances anytime, anywhere, on a device that’s already constantly in hand, is a huge selling point.

Popular Features of Indonesian Financial Planning Apps

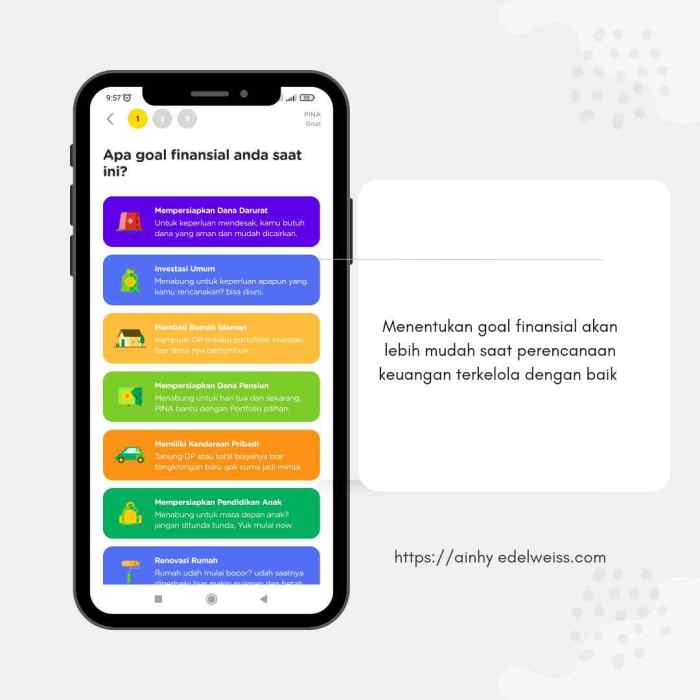

A survey of Indonesian financial planning app users reveals some clear favorites. Features like automated expense categorization, personalized budgeting tools, and easy-to-understand investment dashboards are consistently ranked highly. The ability to set financial goals (like buying a house or funding a child’s education) and track progress towards them is also a major draw. Integration with existing bank accounts and e-wallets is another critical success factor, reducing the friction of data entry and ensuring a seamless user experience. Finally, features offering financial literacy resources, such as articles and tutorials, are increasingly popular, demonstrating a growing desire for financial education amongst users.

Challenges Faced by Indonesian Users, Financial Planning Apps Indonesia

While financial planning apps offer tremendous potential, several challenges hinder their widespread adoption and effective use. Language barriers can be a significant hurdle, particularly for users with limited English proficiency. Furthermore, technological literacy varies considerably across the Indonesian population, with some users struggling to navigate even basic app features. Concerns about data security and privacy also remain, particularly in a country where digital literacy is still evolving. Finally, the sheer variety of apps available can be overwhelming, making it difficult for users to choose the right one for their needs.

User Persona: A Typical Indonesian Financial Planning App User

Meet Ani, a 32-year-old marketing professional living in Jakarta. Ani is tech-savvy but prefers user-friendly interfaces. Her primary financial goals are saving for a down payment on an apartment and investing for her long-term financial security. While she understands basic financial concepts, she appreciates apps that offer clear explanations and educational resources. Ani is comfortable using digital banking and e-wallets, but she’s also wary of scams and prioritizes data security. She values convenience and personalization, and appreciates apps that can adapt to her specific financial circumstances and goals. Ani represents a growing segment of Indonesian consumers seeking smarter, more efficient ways to manage their finances.

Competitive Landscape

The Indonesian financial planning app market is a bustling bazaar, a vibrant marketplace where apps jostle for the attention of increasingly savvy Indonesian consumers. It’s a fight for financial freedom, one app at a time! Understanding the competitive landscape requires a discerning eye, a keen sense for strategy, and perhaps a strong cup of kopi.

Feature and Functionality Comparison of Leading Apps

Three leading contenders in this digital financial arena are (hypothetical examples for illustrative purposes, replace with actual apps and data): “InvestAja,” “UangKu,” and “RencanaKeuangan.” InvestAja focuses heavily on investment tools, offering sophisticated portfolio tracking and algorithmic advice, but may lack robust budgeting features. UangKu provides a strong budgeting and expense tracking system, with a user-friendly interface, but its investment options are relatively limited. RencanaKeuangan attempts to strike a balance, offering a comprehensive suite of features including budgeting, investment tracking, and even debt management tools. However, this breadth of functionality might lead to a slightly less polished user experience in certain areas compared to its more specialized competitors.

Business Models of Major Players

The business models of these apps vary. InvestAja, with its focus on investment, likely generates revenue through commissions on trades executed through its platform. UangKu might employ a freemium model, offering basic budgeting features for free while charging for premium features like advanced analytics or personalized financial coaching. RencanaKeuangan could adopt a hybrid model, combining commission-based revenue from investment services with subscription fees for access to its full range of financial planning tools. Each model reflects a different strategy for capturing value in this competitive landscape.

Key Competitive Advantages

InvestAja’s competitive advantage lies in its sophisticated investment tools and algorithm-driven advice, catering to a more experienced and potentially wealthier user base. UangKu’s strength is its user-friendly interface and strong focus on budgeting, appealing to a broader market of users new to personal finance management. RencanaKeuangan aims for a comprehensive offering, hoping to attract users who value an all-in-one solution, but risks being less specialized than its competitors.

User Acquisition and Retention Strategies

These apps employ various strategies to acquire and retain users. Aggressive marketing campaigns, partnerships with banks and financial institutions, and leveraging social media influencers are common tactics. Retention strategies often include gamification, personalized financial advice, and loyalty programs, aimed at keeping users engaged and encouraging long-term usage. The use of push notifications reminding users to update their budgets or review their investment portfolios also plays a significant role in keeping the app top-of-mind.

Key Features of Top Indonesian Financial Planning Apps

The following table summarizes the key features of these hypothetical apps, highlighting their unique selling propositions:

| App Name | Key Features | Unique Selling Proposition |

|---|---|---|

| InvestAja | Advanced portfolio tracking, algorithmic investment advice, real-time market data | Sophisticated investment tools for experienced investors |

| UangKu | Intuitive budgeting tools, expense tracking, personalized financial reports | User-friendly interface and strong budgeting focus for beginners |

| RencanaKeuangan | Budgeting, investment tracking, debt management, financial goal setting | Comprehensive all-in-one solution for various financial needs |

Technological Aspects

Building a robust financial planning app in Indonesia requires more than just a catchy name and a pretty interface; it needs a technological backbone as strong as a Sumatran rhinoceros. Let’s delve into the nitty-gritty of the tech powering these apps, exploring the infrastructure, security, and challenges involved in bringing financial peace of mind to millions.

The technological infrastructure supporting Indonesian financial planning apps is a fascinating blend of cutting-edge solutions and pragmatic adaptations to the local context. High-speed internet access, while improving, remains unevenly distributed across the archipelago. This necessitates careful consideration of data usage and offline capabilities, a challenge many developers are cleverly overcoming with optimized data compression and caching techniques. Cloud computing, specifically services offered by providers with strong Indonesian presence, plays a crucial role in scalability and resilience. This ensures apps can handle the fluctuating demands of millions of users without breaking a sweat (or a server).

Security Measures Implemented in Indonesian Financial Planning Apps

Protecting user data is paramount, especially in the financial sector. Indonesian financial planning apps employ a multi-layered security approach. This includes robust encryption protocols (like TLS/SSL) to safeguard data in transit, secure storage solutions employing encryption at rest, and multi-factor authentication (MFA) to verify user identities. Regular security audits and penetration testing are also crucial elements, ensuring the apps remain resilient against evolving cyber threats. Compliance with Indonesian data privacy regulations (like the Personal Data Protection Law) is mandatory and forms the bedrock of their security strategy. Imagine a digital fortress, impenetrable to even the most cunning digital bandits.

Role of APIs and Integrations

APIs (Application Programming Interfaces) are the unsung heroes of these apps. They allow seamless integration with various financial institutions, payment gateways, and other services. For example, an API might connect the app to a user’s bank account to fetch transaction data, automatically categorizing expenses and providing a clearer picture of their financial health. Other integrations might include credit score providers, investment platforms, and even tax calculation tools, creating a truly comprehensive financial planning ecosystem. This interconnectivity is key to providing a user-friendly and holistic experience, transforming a simple budgeting app into a powerful financial management tool.

Challenges of Providing Financial Planning Services via Mobile Applications in Indonesia

Providing financial planning services through mobile apps in Indonesia presents unique challenges. The diverse technological landscape, with varying levels of internet access and device capabilities, requires developers to create apps that are both functional and accessible across a wide range of devices and network conditions. Financial literacy levels also vary significantly, requiring apps to be user-friendly and intuitive, even for those with limited financial knowledge. Furthermore, overcoming user trust and ensuring data security in a developing market demands a strong emphasis on transparency and robust security measures. It’s a delicate balancing act between innovation and accessibility, a tightrope walk across the digital chasm.

Technology Stack of a Hypothetical Indonesian Financial Planning App

Let’s imagine “KeuanganKu,” a hypothetical Indonesian financial planning app. Its technology stack might look something like this:

Frontend: React Native (for cross-platform compatibility), leveraging its ability to create native-like experiences on both Android and iOS devices. This allows for a consistent user interface across different platforms, minimizing development effort and maximizing user satisfaction.

Backend: Node.js with Express.js framework for its speed and scalability. This robust framework handles API requests, database interactions, and other backend processes efficiently.

Database: PostgreSQL, a powerful and reliable relational database system, ideal for managing structured financial data. Its scalability ensures the app can handle a growing user base and increasing data volume without performance issues.

Cloud Services: Amazon Web Services (AWS) or Google Cloud Platform (GCP), providing infrastructure as a service (IaaS) and platform as a service (PaaS) solutions for scalability, reliability, and cost-effectiveness. These cloud providers offer a range of services that simplify the development and deployment of the app, allowing developers to focus on building features rather than managing infrastructure.

Programming Languages: JavaScript (for both frontend and backend), SQL (for database interactions), and potentially Python for data analysis and machine learning features, further enhancing the app’s capabilities and providing users with personalized insights.

Future Trends and Predictions

The Indonesian financial planning app market is poised for explosive growth, a veritable rocket ship fueled by fintech innovation and a burgeoning digitally savvy population. Forget about slow and steady; we’re talking about a market that’s practically sprinting towards a future where managing finances is as easy as ordering a Gojek. Buckle up, because this ride is going to be wild.

Predicting the future is, of course, a risky business (unless you’re a time-traveling octopus with a crystal ball). However, based on current trends and the undeniable momentum of fintech in Indonesia, we can paint a reasonably accurate picture of what’s to come. The key factors are the increasing smartphone penetration, growing financial literacy, and the relentless innovation within the fintech ecosystem.

Emerging Trends in the Indonesian Financial Planning App Market

The Indonesian financial planning app market is experiencing a fascinating confluence of trends. Hyper-personalization is becoming the norm, with apps tailoring their advice and features to individual user profiles and financial goals with laser-like precision. Gamification is also playing a significant role, transforming saving and investing from a chore into an engaging game. Imagine earning virtual badges for reaching financial milestones – it’s not just about numbers, it’s about building positive habits. Furthermore, the integration of AI-powered financial advisors is gaining traction, providing users with personalized insights and recommendations that were previously only accessible to high-net-worth individuals. This democratization of financial expertise is a game-changer.

Impact of Fintech Innovation on the Indonesian Financial Planning App Sector

Fintech innovation is the lifeblood of the Indonesian financial planning app market. Open banking initiatives, for instance, are streamlining data aggregation, allowing apps to provide a holistic view of a user’s finances across multiple accounts. This seamless integration simplifies financial planning considerably. The rise of embedded finance is also noteworthy; imagine booking a flight and simultaneously setting aside a portion of the cost for future travel. These integrated solutions make financial planning effortless and less daunting. The expansion of digital payments infrastructure, meanwhile, is paving the way for seamless transactions within the apps, further boosting user engagement and adoption.

Future Evolution of Financial Planning Apps in Indonesia

In the coming years, Indonesian financial planning apps will evolve from simple budgeting tools to comprehensive financial management platforms. Expect to see enhanced features like automated investing, sophisticated risk management tools, and personalized financial education modules. The integration of blockchain technology for secure and transparent transactions will also gain prominence. Furthermore, we can anticipate the emergence of hyper-localized features catering to the specific needs and preferences of diverse Indonesian communities. The apps will become more intuitive, user-friendly, and deeply integrated into the fabric of daily life.

Market Size and User Adoption Predictions (Next 5 Years)

Predicting precise numbers is, shall we say, a bit of a gamble. However, based on current growth rates and projected economic expansion, the Indonesian financial planning app market is expected to experience a Compound Annual Growth Rate (CAGR) of at least 25% over the next five years. This translates to a significant increase in both market size and user adoption. We can expect millions of new users joining the platform, driven by factors like increased smartphone penetration, rising financial literacy, and the convenience of these apps. Consider the success of GoPay and OVO as a parallel – these apps demonstrated the potential for rapid user adoption in the Indonesian digital finance space.

Projected Growth Trajectory (Next Decade)

Imagine a graph charting the growth of the Indonesian financial planning app market over the next decade. The line starts relatively flat, reflecting the market’s initial stages. Then, around the 3-year mark, the line begins to sharply ascend, representing the acceleration of growth driven by increased smartphone penetration, fintech innovation, and improved financial literacy. The line continues its upward trajectory, though at a slightly less steep angle after year 7, suggesting a maturation of the market. However, the overall trend remains strongly positive, showcasing substantial growth and sustained market expansion over the entire decade. The final point on the graph is significantly higher than the starting point, visually demonstrating the impressive scale of market expansion.

Final Review

In conclusion, the Indonesian financial planning app market is a dynamic and rapidly evolving ecosystem. While challenges remain, particularly concerning digital literacy and regulatory hurdles, the potential for growth is immense. The innovative solutions offered by these apps are not only improving financial management for individuals but also contributing to a more inclusive and accessible financial system. The future looks bright, with further technological advancements and market expansion on the horizon. So, buckle up and get ready for the next chapter in Indonesian fintech!

FAQ Explained

What are the biggest risks associated with using financial planning apps in Indonesia?

Security breaches, data privacy concerns, and the potential for scams are key risks. Users should always choose reputable apps with strong security measures and be wary of phishing attempts.

How do Indonesian financial planning apps compare to those in other Southeast Asian countries?

This varies greatly depending on the specific app and features, but Indonesia’s market shows a strong focus on local needs and payment methods, often differing from its regional neighbors.

Are there any government regulations specifically targeting financial planning apps in Indonesia?

Yes, Indonesia’s financial regulatory authorities have implemented rules concerning data protection, licensing, and anti-money laundering measures, impacting the operation of these apps.

What languages are typically supported by Indonesian financial planning apps?

Most popular apps support Bahasa Indonesia, with some also offering English support to cater to a wider user base.