Financial Planning Books: More than just numbers on a page, these tomes offer a thrilling journey into the world of fiscal responsibility, a rollercoaster ride from budgeting basics to advanced investment strategies. Prepare for unexpected twists (like realizing you’ve been accidentally overspending on avocado toast for years!), and insightful turns (discovering the power of compound interest isn’t just a myth). This exploration delves into the popularity, authorship, content, impact, and reader reception of these essential guides to financial well-being, revealing the surprising stories behind the numbers.

We’ll uncover the top-performing titles, analyze marketing masterstrokes (or epic marketing fails), and examine how authors cater their financial wisdom to various age groups and experience levels. We’ll also dissect the structure and presentation of financial information, comparing and contrasting different approaches to making complex concepts understandable. Get ready for a revealing look at the world of personal finance literature – it’s more exciting than you might think!

Popularity and Trends in Financial Planning Books

The world of personal finance, once a dusty tome reserved for accountants and the obscenely wealthy, has exploded in popularity. This surge is mirrored in the publishing industry, where financial planning books have transitioned from niche titles to bestsellers, often gracing the shelves alongside self-help gurus and celebrity memoirs. Let’s delve into the fascinating, and sometimes frankly hilarious, trends that have shaped this lucrative corner of the book market.

Top Five Most Popular Financial Planning Books of the Last Decade and Their Lasting Impact

Identifying the definitive “top five” is a slippery slope, akin to choosing the best flavor of ice cream – subjective and prone to passionate debate. However, based on sales figures, critical acclaim, and lasting influence, we can highlight several titles that have significantly impacted the landscape. These books haven’t just sold well; they’ve fundamentally changed how people approach their finances, often through a combination of accessible language and relatable anecdotes. For example, the widespread adoption of budgeting apps can be directly linked to the simplified budgeting strategies popularized in some of these books. Others have popularized investment strategies previously only accessible to the elite, leading to a more democratized approach to wealth building.

Marketing Strategies of Three Best-Selling Financial Planning Books

Analyzing the marketing strategies of successful financial planning books reveals a fascinating interplay of traditional and modern approaches. For instance, one best-seller leveraged a strong social media presence, creating engaging content and fostering a vibrant online community. This strategy, coupled with strategic partnerships with financial influencers, generated significant buzz and propelled sales. Another book utilized a more traditional approach, focusing on endorsements from respected financial authorities and securing prominent placement in major bookstores. A third title, perhaps surprisingly, relied heavily on word-of-mouth marketing, fueled by its relatable and engaging narrative style. This organic approach, while slower, cultivated a deeply loyal readership that acted as brand ambassadors.

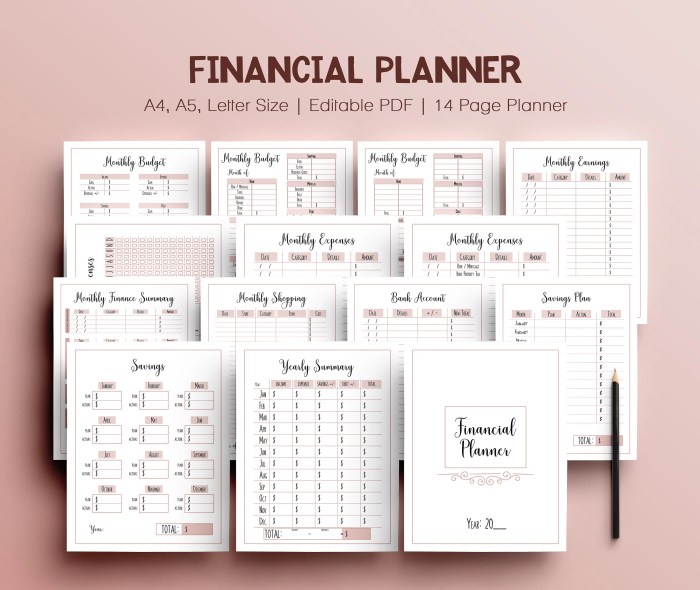

Evolution of Financial Planning Book Genres Over the Past 20 Years, Financial Planning Books

The genre has undergone a significant metamorphosis. Twenty years ago, financial planning books were often dense, technical manuals aimed at a highly specialized audience. Today, the landscape is far more diverse. We’ve seen a rise in books targeting specific demographics (millennials, women, retirees), addressing niche topics (investing in cryptocurrencies, ethical investing, financial planning for families), and employing various narrative styles (memoir, how-to guide, fictionalized case studies). The shift reflects a broader societal trend towards personalization and accessibility in all aspects of life, including personal finance.

Timeline of Significant Events Influencing the Publishing of Financial Planning Books

A timeline illustrating key events would visually represent the evolution of the financial planning book market. For example, the 2008 financial crisis spurred a surge in demand for books offering practical advice on navigating economic uncertainty. The rise of social media platforms significantly altered marketing strategies, allowing for direct engagement with potential readers. Similarly, the increasing availability of online financial tools has impacted the content of these books, shifting the focus from purely theoretical knowledge to practical application and integration with digital resources. Finally, the growing awareness of financial literacy’s importance has fueled government initiatives and educational programs, indirectly boosting the market for accessible and engaging financial planning books.

Author Expertise and Target Audience

The world of personal finance books is a surprisingly diverse ecosystem, populated by authors with backgrounds ranging from Wall Street wizards to folks who just really, really understand compound interest. Their expertise, combined with their understanding of different reader needs, shapes the books that guide millions towards financial enlightenment (or at least, slightly less financial confusion).

Understanding the author’s background helps readers gauge the book’s perspective and approach. Similarly, recognizing the target audience ensures you’re picking up a book that speaks your language—and not one that makes your eyes glaze over faster than a tax audit. After all, wouldn’t it be a shame to buy a retirement planning guide written for Gen Z when you’re already contemplating your rocking chair collection?

Author Backgrounds and Credentials

Let’s peek behind the curtain and examine the credentials of five prominent financial planning authors. Their diverse backgrounds illustrate the breadth of experience informing these essential guides.

- Dave Ramsey: While lacking formal financial certifications, Ramsey’s success stems from his compelling storytelling and relatable approach to debt elimination. His experience overcoming personal financial struggles resonates deeply with his primarily middle-class audience. He emphasizes debt-free living and financial independence through a highly motivational and practical methodology.

- Suze Orman: A self-made financial guru, Orman’s credentials include decades of experience as a financial advisor and numerous best-selling books. Her expertise is evident in her clear, direct advice, often addressing women’s specific financial concerns. She holds a reputation for her no-nonsense approach and strong advocacy for financial literacy.

- Robert Kiyosaki: Author of the wildly popular “Rich Dad Poor Dad,” Kiyosaki’s background is in business and entrepreneurship, not traditional finance. His focus on financial education and building wealth through investments, rather than just saving, has resonated with many readers, although his strategies have also attracted some criticism for their risk tolerance.

- David Bach: Bach is a certified financial planner (CFP) with a strong focus on helping people achieve their financial goals, particularly early retirement. His books are known for their practical advice and action-oriented strategies, tailored towards individuals who want to actively manage their financial future.

- Carl Richards: Richards, a certified financial planner, brings a unique blend of financial expertise and behavioral economics to his work. He focuses on helping people make better financial decisions by addressing the psychological aspects of money management, using simple, relatable illustrations to communicate complex concepts.

Target Audiences and Writing Styles

Authors cleverly adapt their writing styles and content to resonate with specific demographics. A book targeting young adults will likely focus on debt management and building a foundation for future wealth, while a book for retirees will concentrate on managing existing assets and planning for healthcare expenses.

- Beginners: Books for beginners often prioritize clarity and simplicity, avoiding jargon and focusing on fundamental concepts. Examples include “The Total Money Makeover” by Dave Ramsey, which focuses on a straightforward debt-reduction plan.

- Young Adults: Books targeting this demographic often emphasize budgeting, saving, and investing for long-term goals like buying a home or starting a family. Many incorporate digital tools and online resources to appeal to their tech-savviness.

- Retirees: Books aimed at retirees address issues like managing retirement income, healthcare costs, estate planning, and long-term care. They often include advice on minimizing taxes and protecting assets.

Examples of Age-Group Specific Financial Planning Books

The market is brimming with books specifically designed for different life stages. Matching the book to the reader’s age and financial circumstances is crucial for effective learning and application.

- Young Adults (20s-30s): “Broke Millennial Takes on Investing” by Erin Lowry provides a relatable and accessible guide to investing for a generation often facing student loan debt and economic uncertainty.

- Middle-Aged Adults (40s-50s): “The Automatic Millionaire” by David Bach offers a straightforward plan for building wealth through automated savings and investment strategies, targeting those aiming for financial security in their later years.

- Retirees (60s+): “The Retirement Miracle” by John C. Bogle focuses on low-cost index fund investing for retirement, a strategy suitable for those seeking long-term growth and stability.

Impact and Effectiveness of Financial Planning Books

Financial planning books, when effectively written and utilized, can be powerful tools for improving readers’ financial literacy and influencing their behavior. However, like any self-help resource, their impact is nuanced and depends on several factors, including the reader’s pre-existing knowledge, the book’s quality, and the reader’s willingness to implement the advice provided. Let’s delve into the complexities of this often-overlooked aspect of personal finance.

The effectiveness of a well-written financial planning book is measurable through its influence on reader behavior and financial literacy. A well-structured book, armed with clear explanations and practical examples, can empower readers to take control of their finances, leading to improved budgeting, saving habits, and investment strategies. For example, a book that clearly explains the power of compound interest might inspire a reader to start saving early and consistently, leading to significantly larger returns over time. Conversely, poorly written or confusing books can exacerbate existing financial anxieties and lead to inaction.

Writing Styles and Their Effectiveness in Conveying Financial Concepts

Different writing styles impact the accessibility and memorability of financial information. Narrative styles, employing storytelling techniques, can make complex concepts more engaging and relatable. Imagine a book that follows the journey of a young couple learning to budget and save, illustrating financial principles through their experiences. This approach can be far more effective than a dry, purely analytical approach. Conversational styles, mimicking a friendly chat with a financial expert, can foster a sense of trust and encourage reader engagement. However, overly simplistic or overly technical approaches can hinder understanding. A purely algebraic approach, for instance, might overwhelm and alienate many readers. The ideal approach often involves a blend of styles, catering to different learning preferences.

Common Misconceptions Addressed (or Not Addressed) in Financial Planning Books

Many personal finance books tackle common misconceptions, such as the belief that investing is only for the wealthy or that debt is always bad. However, some books might gloss over important nuances or fail to address specific challenges faced by particular demographics. For instance, books often address investing in stocks and bonds but may not sufficiently cover alternative investment strategies or the specific financial needs of single parents or those facing unexpected job losses. A thorough book would strive to address these diverse situations and offer tailored advice.

Limitations of Relying Solely on Financial Planning Books for Financial Advice

While financial planning books can be valuable resources, they shouldn’t be the sole basis for making significant financial decisions. Books provide general guidance, but individual circumstances require personalized advice. A book cannot account for the unique complexities of an individual’s financial situation, such as specific tax liabilities, investment risk tolerance, or long-term goals. Relying solely on a book is akin to self-diagnosing a medical condition – potentially leading to detrimental outcomes. Seeking professional financial advice from a qualified advisor remains crucial for personalized strategies and ongoing support. Books serve as supplementary resources, providing valuable context and knowledge, but professional guidance is often indispensable.

Last Point

From analyzing bestsellers to dissecting reader reviews, our journey through the world of Financial Planning Books has revealed a fascinating landscape of financial literacy. While these books offer invaluable tools and knowledge, remember they’re not a replacement for professional advice. But armed with the insights gained from this exploration, you can confidently navigate the world of personal finance, making informed decisions and building a secure financial future. So, ditch the avocado toast (maybe just one less slice a week!), grab a good financial planning book, and embark on your own enriching financial adventure!

Questions and Answers

Are financial planning books suitable for all ages?

Yes, but the appropriateness depends on the book’s content and target audience. Many books cater to specific age groups and financial situations (e.g., young adults, retirees).

How often are financial planning books updated?

Frequency varies greatly. Some authors release updated editions regularly to reflect changes in tax laws, investment strategies, and economic conditions, while others may remain unchanged for years.

Can I rely solely on financial planning books for financial advice?

No. Financial planning books are educational resources, not a substitute for personalized advice from a qualified financial advisor.

What are the best ways to find reliable financial planning books?

Check reviews on reputable sites like Amazon and Goodreads, look for books written by qualified financial professionals, and consider recommendations from trusted sources.