Securing a future of financial stability and success often hinges on a strong understanding of financial planning. This comprehensive guide delves into the world of Financial Planning Certification, exploring the diverse pathways available to aspiring professionals. We’ll examine the various certification types, their associated career paths, educational prerequisites, and the crucial role of ongoing professional development. Understanding the ethical considerations and the impact of technology on the field are also key components of this exploration.

From entry-level qualifications to advanced certifications, we will analyze the curriculum requirements, examination processes, and salary expectations across different geographical regions. We will also highlight successful career trajectories and provide insights into the continuing education needed to maintain professional competence and stay abreast of industry advancements.

Types of Financial Planning Certifications

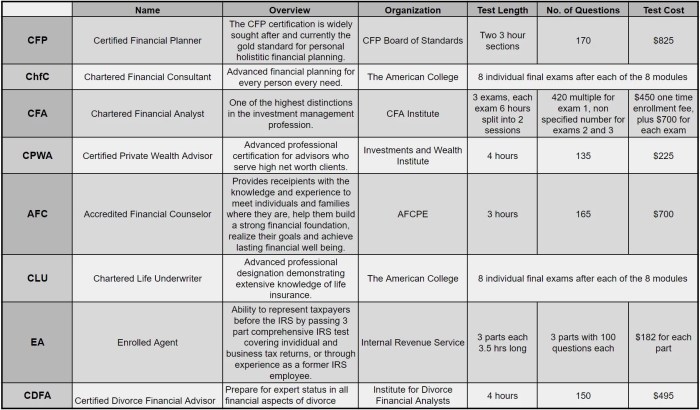

Choosing the right financial planning certification can significantly enhance your career prospects and credibility within the financial industry. The availability and recognition of certifications vary globally, reflecting differing regulatory environments and professional standards. This section Artikels several prominent certifications, comparing their requirements and examination processes.

Globally Recognized Financial Planning Certifications

A range of certifications cater to different experience levels and career goals. These certifications demonstrate a commitment to professional development and adherence to ethical standards within the financial planning field. Below is a categorization of some prominent certifications, although this is not an exhaustive list and the specific availability of each certification will depend on geographic location.

| Certification Name | Awarding Body | Level | Required Qualifications |

|---|---|---|---|

| Certified Financial Planner (CFP) | Financial Planning Standards Board (FPSB) – varies by country | Advanced | Bachelor’s degree, specified education requirements, examination, experience requirements, ethical commitment |

| Chartered Financial Analyst (CFA) | CFA Institute | Advanced | Bachelor’s degree (or equivalent), three levels of rigorous exams, work experience |

| Certified Public Accountant (CPA) | Various state boards of accountancy (USA) or equivalent bodies in other countries | Advanced | Bachelor’s degree in accounting or related field, examination, experience requirements, continuing professional education |

| Certified Financial Education Instructor (CFEI) | Financial Planning Association (FPA) | Entry-level/Intermediate | Specified education requirements and exam |

Curriculum Comparison: CFP, CFA, and CPA

The CFP, CFA, and CPA certifications, while all demanding, focus on different aspects of finance. The CFP curriculum emphasizes financial planning for individuals and families, encompassing retirement planning, investment management, tax planning, and estate planning. The CFA program focuses heavily on investment management, portfolio construction, and financial modeling. The CPA curriculum, while relevant to financial planning, centers on accounting principles, auditing, and tax preparation. All three require rigorous examinations, though the content and format differ significantly.

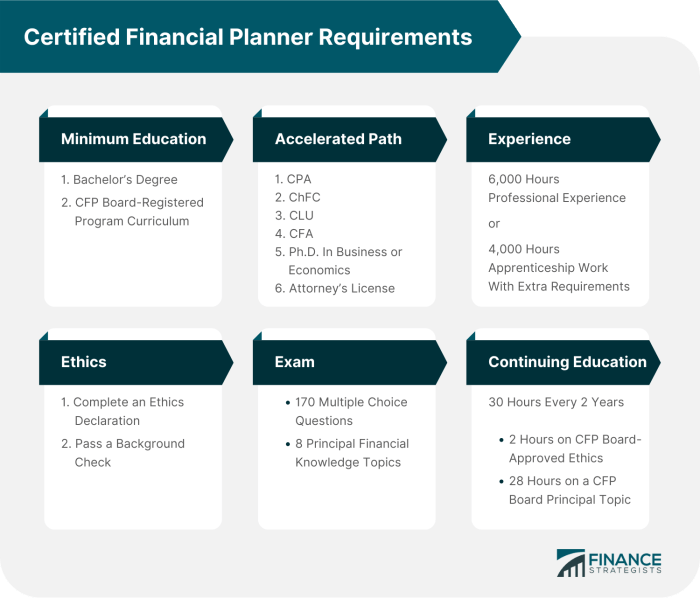

CFP Examination Process

The CFP certification process involves multiple steps. Candidates must meet education requirements, complete a specified curriculum, pass a comprehensive examination, and fulfill experience requirements. The exam itself is typically a computer-based test, assessing knowledge across various financial planning domains. The exam covers topics such as financial planning process, education planning, risk management, insurance planning, investment planning, tax planning, and retirement planning. Passing all sections demonstrates a high level of competency in comprehensive financial planning.

Career Paths with Financial Planning Certifications

Financial planning certifications open doors to a diverse range of career opportunities, offering varying levels of responsibility, compensation, and job satisfaction. The specific path a certified professional takes often depends on their prior experience, educational background, and personal career goals. This section explores various career paths accessible with different financial planning certifications, illustrating potential career progressions and providing insights into salary expectations and job outlook.

Career Paths Based on Certification Level

The type of financial planning certification significantly influences the career options available. For instance, a Certified Financial Planner (CFP) designation typically opens doors to more senior roles than a less comprehensive certification. The following illustrates this relationship.

- Entry-Level Positions (with Associate’s Degree/Relevant Experience): Financial Analyst, Paraplanner, Junior Financial Advisor. These roles often require foundational knowledge and assist senior professionals. A person with a relevant associate’s degree and a basic financial planning certificate might start here.

- Mid-Level Positions (with Bachelor’s Degree and Specific Certifications): Financial Advisor, Investment Advisor Representative, Retirement Planner. These positions require more advanced knowledge and independent work. A CFP professional might start at this level or progress here from entry-level roles.

- Senior-Level Positions (with Advanced Degrees and Extensive Experience): Senior Financial Advisor, Wealth Manager, Financial Planning Director, Chief Financial Officer (CFO). These roles demand extensive experience, leadership skills, and often a higher-level certification like a Chartered Financial Analyst (CFA) in addition to CFP.

Career Progression Flowchart

A simplified flowchart depicting potential career progression could look like this:

(Imagine a flowchart here. The flowchart would begin with “Entry-Level Position (e.g., Paraplanner)” branching to “Mid-Level Position (e.g., Financial Advisor)” via the acquisition of relevant certifications and experience. This would then branch to “Senior-Level Position (e.g., Wealth Manager)” through further certifications, advanced education, and accumulated experience. Each stage would show potential certifications earned, such as a basic financial planning certificate, then a CFP, potentially followed by a CFA.)

Salary Expectations and Job Outlook

Salary expectations and job outlook vary significantly depending on the certification, experience level, location, and employer. Generally, CFP professionals command higher salaries than those with less comprehensive certifications.

| Certification | Geographic Region | Average Salary (USD) (Approximate) | Job Outlook (General Trend) |

|---|---|---|---|

| CFP | United States | $80,000 – $150,000+ | Strong, growing demand |

| CFP | Canada | $60,000 – $120,000+ | Positive growth, competitive market |

| Other Financial Planning Certifications | United States | $50,000 – $100,000+ | Moderate growth, dependent on specialization |

Note: These salary ranges are approximate and can vary widely based on factors mentioned above. Data should be verified with up-to-date salary surveys and job market analyses.

Examples of Successful Career Trajectories

Many successful financial planners leverage their certifications to build impressive careers. One example might be an individual who started as a paraplanner, obtained their CFP certification, and subsequently progressed to become a senior financial advisor at a large wealth management firm, eventually leading a team. Another example could be someone who built a successful independent financial planning practice after gaining several years of experience and obtaining their CFP designation. These trajectories highlight the potential for career advancement with dedicated effort and relevant certifications.

Educational Requirements and Prerequisites

Pursuing a financial planning certification requires meeting specific educational and experience prerequisites, which vary depending on the certifying body and the specific credential sought. These requirements are designed to ensure candidates possess the necessary knowledge and skills to provide competent financial advice. Understanding these prerequisites is crucial for prospective candidates to plan their educational journey effectively.

The educational path to becoming a certified financial planner is multifaceted. Different certifications have varying requirements, and some allow for a combination of education and experience to meet eligibility. Choosing the right path depends on an individual’s existing qualifications and career goals.

Educational Pathways to Financial Planning Certification

Several common educational pathways can lead to eligibility for various financial planning certification programs. These pathways often involve a combination of formal education and practical experience. The specific requirements, however, can significantly differ.

- A bachelor’s degree in finance, accounting, economics, or a related field, coupled with relevant work experience.

- A master’s degree in financial planning, personal financial planning, or a similar field, which often fulfills educational requirements directly.

- Completion of a specific coursework curriculum approved by the certifying body, often combined with supervised practical experience.

- A combination of relevant work experience and continuing education courses that satisfy the educational requirements set by the certifying body.

Comparison of Application Processes for Different Certification Programs

The application processes for different financial planning certifications vary in their specifics, but generally involve submitting an application, providing transcripts and proof of experience, and passing examinations. Let’s compare three prominent examples: the Certified Financial Planner (CFP) certification, the Chartered Financial Analyst (CFA) charter, and the Personal Financial Specialist (PFS) credential.

- CFP Certification: The CFP Board’s application process involves meeting education requirements, completing the CFP Board’s education program, passing six exams, and accumulating the required experience. A rigorous background check is also a component.

- CFA Charter: The CFA Institute’s process is known for its challenging exams. Candidates must register, pay fees, and successfully complete three rigorous levels of exams. Professional work experience is also a requirement, accumulated concurrently with the exam process.

- PFS Credential: Awarded by the American Institute of CPAs (AICPA), the PFS credential requires CPA licensure, completion of specific education requirements, and an examination. This path is specifically tailored to CPAs who want to specialize in personal financial planning.

Duration and Cost of Obtaining Financial Planning Certifications

The time and financial investment required to obtain a financial planning certification can vary considerably. The duration depends on factors such as existing qualifications, learning pace, and the chosen certification program. Costs include exam fees, education program fees, and study materials.

- CFP Certification: The CFP certification process can typically take 2-4 years to complete, depending on prior education and experience. Costs can range from several thousand dollars to upwards of $10,000, including exam fees, education programs, and study materials.

- CFA Charter: Achieving the CFA charter typically takes 3-5 years, given the difficulty of the exams and the requirement for concurrent work experience. Costs can exceed $10,000, including exam fees and study materials.

- PFS Credential: The PFS credential requires less time than the CFP or CFA, potentially taking 1-2 years to obtain after fulfilling the prerequisite of CPA licensure. The cost varies depending on the specific education requirements and exam fees.

Continuing Education and Professional Development

Maintaining a high level of competence and staying current with industry best practices are crucial for financial planning professionals. Continuous learning isn’t just beneficial; it’s often a requirement for maintaining many financial planning certifications. This commitment to ongoing professional development ensures that clients receive the most up-to-date and effective financial advice.

Continuing education requirements vary depending on the specific certification held. Some organizations mandate a certain number of continuing education credits (CECs) annually or over a specific period. These credits are typically earned through participation in approved courses, workshops, conferences, or by completing self-study programs. Failure to meet these requirements can result in suspension or revocation of the certification. It’s vital for professionals to understand and adhere to the specific requirements Artikeld by their certifying body.

Continuing Education Requirements for Maintaining Certification

The specific continuing education requirements differ widely among certifying bodies. For instance, the Certified Financial Planner (CFP) certification requires a significant number of continuing education hours each year to maintain the credential. These hours must be earned through approved programs covering topics relevant to financial planning. Other certifications, such as the Chartered Financial Analyst (CFA) designation, also have their own continuing education stipulations, often focusing on professional ethics and updated investment strategies. It is imperative to consult the individual certification body’s website for the most accurate and up-to-date requirements.

Examples of Professional Development Opportunities

Numerous opportunities exist for financial planning professionals to enhance their skills and knowledge. These range from formal educational programs to informal networking events. Examples include attending specialized workshops on advanced tax planning strategies, participating in webinars on behavioral finance, or completing online courses in investment management techniques. Conferences focused on specific areas of financial planning, such as retirement planning or estate planning, offer opportunities to learn from leading experts and network with peers. Many organizations offer professional development programs specifically tailored to financial planners, encompassing both technical and soft skills.

Benefits of Ongoing Professional Development

Ongoing professional development offers several key benefits. Firstly, it ensures that financial planners remain current with changes in regulations, market trends, and technological advancements. This ensures they can provide the best possible advice to their clients. Secondly, continuous learning enhances a professional’s credibility and competitiveness in the job market. Thirdly, engaging in professional development opportunities expands one’s network, facilitating collaboration and knowledge sharing. Finally, this commitment to ongoing learning can lead to greater job satisfaction and career advancement opportunities.

Resources for Continuing Education

Staying informed is critical for success in financial planning. Accessing a variety of resources is crucial for ongoing professional development.

- Books: Many publishers release updated editions of financial planning textbooks and specialized guides annually. Examples include books on investment strategies, tax planning, and retirement planning.

- Journals: Professional journals, such as the Journal of Financial Planning, publish articles on current research and best practices in the field.

- Conferences: Major industry conferences, such as those hosted by the Financial Planning Association (FPA) or the Certified Financial Planner Board of Standards (CFP Board), offer valuable opportunities for learning and networking.

- Webinars and Online Courses: Numerous online platforms offer webinars and courses on various aspects of financial planning, allowing for flexible and convenient learning.

Ethical Considerations and Professional Standards

Maintaining ethical conduct is paramount in financial planning. The profession relies heavily on trust, and adherence to strict ethical codes is crucial for maintaining client confidence and the integrity of the industry. Breaches of these standards can lead to severe consequences, including disciplinary action and reputational damage.

Ethical codes of conduct vary slightly depending on the specific certifying body, but common themes include fiduciary duty, confidentiality, competence, and objectivity. Organizations like the Certified Financial Planner Board of Standards (CFP Board) in the US and similar bodies internationally have detailed codes outlining expected behavior and professional responsibilities. These codes often address issues such as conflicts of interest, suitability of recommendations, and the proper handling of client information. They emphasize the importance of acting in the best interests of the client, placing their needs above personal gain.

Ethical Dilemmas and Potential Solutions

Financial planners frequently encounter ethical dilemmas. One common example involves a client who is nearing retirement and wants to invest heavily in high-risk, high-reward ventures. While the planner might personally believe this is unwise, ethically they must consider the client’s risk tolerance and financial goals, ensuring full disclosure of the risks involved. A potential solution would involve presenting a range of options, clearly explaining the potential downsides of the high-risk strategy while also acknowledging the client’s desire for potentially higher returns. Another example could involve a conflict of interest, such as receiving a commission for recommending a specific product. Transparency and disclosure are key here; the planner should inform the client of any potential conflicts and explain how this might influence their recommendations.

Disciplinary Procedures for Ethical Breaches

The consequences of violating ethical standards are serious. Most certifying bodies have established disciplinary procedures that range from reprimands and fines to suspension or revocation of certification. Investigations are typically conducted following complaints from clients or other professionals. The process usually involves a review of the alleged violation, an opportunity for the planner to respond, and a determination of guilt or innocence. Penalties are determined based on the severity of the infraction. These disciplinary actions serve as a deterrent and protect the public from unethical practices.

Importance of Adhering to Professional Standards

Adherence to professional standards is fundamental to building and maintaining trust with clients. Clients entrust financial planners with significant personal information and their financial well-being. Demonstrating ethical conduct through transparency, competence, and a commitment to acting in the client’s best interests fosters strong relationships and ensures the long-term success of the financial planning practice. A reputation for ethical behavior is invaluable and contributes significantly to a planner’s credibility and success in the field.

Impact of Technology on Financial Planning Certifications

The financial planning profession is undergoing a rapid transformation driven by technological advancements. Fintech innovations and the rise of artificial intelligence (AI) are reshaping how financial advisors interact with clients, manage portfolios, and comply with regulations. This necessitates a corresponding evolution in financial planning certifications to equip professionals with the necessary skills and knowledge to navigate this new landscape.

The integration of technology into financial planning is not merely an add-on; it’s a fundamental shift that requires a re-evaluation of traditional practices and the development of new competencies. Certifications are responding by incorporating technological proficiency into their curricula, ensuring graduates are prepared for the demands of a digitally-driven industry.

Adaptation of Certification Curricula to Technological Changes

Many financial planning certification programs are now integrating modules focused on fintech applications, data analytics, and AI-powered tools. For instance, courses might cover robo-advisors, algorithmic trading, cybersecurity best practices for client data, and the ethical implications of using AI in financial advice. These additions reflect the growing importance of technological literacy within the profession. The Certified Financial Planner (CFP) board, for example, continually updates its curriculum to reflect the evolving technological landscape. This ensures that CFP professionals remain at the forefront of industry best practices and technological advancements.

Emerging Technologies Impacting Future Financial Planning Certifications

Several emerging technologies are poised to significantly impact the financial planning profession and, consequently, the content of future certifications. Blockchain technology, for example, has the potential to revolutionize record-keeping and enhance security in wealth management. Advanced AI algorithms could personalize financial advice at scale, while big data analytics can improve risk management and investment strategies. Therefore, future certifications will likely incorporate training on these technologies, equipping professionals to leverage them effectively and responsibly. We can expect to see a greater emphasis on data interpretation, cybersecurity expertise, and the ethical considerations surrounding the use of increasingly sophisticated AI tools.

Technological Impact on Various Aspects of Financial Planning

| Aspect of Financial Planning | Technological Impact | Examples | Implications for Certification |

|---|---|---|---|

| Client Communication | Increased use of digital platforms, video conferencing, and automated communication tools. | Use of client portals for document sharing, video consultations, automated email updates. | Certifications will need to incorporate training on effective digital communication strategies and client relationship management software. |

| Portfolio Management | Automation of investment processes, algorithmic trading, and use of robo-advisors. | Algorithmic portfolio rebalancing, automated trading platforms, robo-advisor integration. | Certifications will need to cover the principles of algorithmic trading, portfolio optimization techniques, and the ethical considerations of using automated systems. |

| Regulatory Compliance | Increased use of data analytics for compliance monitoring, automated reporting tools, and blockchain for enhanced transparency. | Automated regulatory reporting, blockchain-based record-keeping for improved audit trails. | Certifications will need to incorporate training on relevant regulations, data security, and the use of compliance technologies. |

| Financial Modeling & Analysis | Advanced analytics and machine learning for improved forecasting and risk assessment. | Sophisticated financial models incorporating market sentiment analysis and predictive algorithms. | Certifications should integrate training on advanced data analysis techniques, financial modeling software, and interpretation of complex data sets. |

Closing Summary

Ultimately, achieving Financial Planning Certification demonstrates a commitment to professional excellence and ethical conduct within the financial industry. This guide provides a roadmap for individuals seeking to enhance their expertise and build successful careers in financial planning. By understanding the different certification options, career paths, and ongoing professional development requirements, aspiring financial planners can make informed decisions that align with their goals and contribute to the financial well-being of their clients.

FAQ Guide

What is the average cost of obtaining a financial planning certification?

Costs vary significantly depending on the specific certification and provider, ranging from a few hundred to several thousand dollars, including exam fees, study materials, and potential course costs.

How long does it typically take to obtain a financial planning certification?

The time commitment depends on the chosen certification and the individual’s prior experience and educational background. It can range from several months to a couple of years.

Are there any age restrictions for obtaining financial planning certifications?

Generally, there are no specific age restrictions. However, certain certifications might require a minimum level of work experience, which could indirectly affect younger applicants.

What are the renewal requirements for financial planning certifications?

Most certifications necessitate continuing education credits and adherence to ethical standards to maintain their validity. Specific requirements vary by certification provider.